Arthur Rothstein Mooo, Ropesville Farms, Texas April 1936

We’re going into another weekend, and this one’s Memorial. It may also be memorable, since there are elections in both the EU and Ukraine. And fireworks may well be part of both, during and after. In the Netherlands, where they were early, just 35% of people voted, which makes you want to look up the word democracy in the thesaurus, while in also-early-ran Britain UKIP won big. Nobody cares about Europe, or let’s say the only ones who care do so for strictly personal reasons, not for some grand ideal. The ideal is dead, the only thing left is “the EU gives us jobs and profits”, even as both claims are entirely unprovable for lack of things to compare them to. The Ukraine elections are a whole lot more serious. Willy Wonka is set to be the next president, but only part of the population will accept him, and the rest have plenty guns to prove they don’t.

The chance that Ukraine survives as a nation is about the same as the global economy, or the US economy, being in recovery. Slim in a late phase anorexic sense. New home sales were announced up. But are they?

New Home Sales Post Tepid April Bounce As Average, Median Home Price Drops

Last month’s dramatic miss of expectations for a modest post-weather pop in new home sales (having dropped 14.5% month-over-month) so it was inevitable that there would be a bounce. Modestly beating expectations, 433k annualized new home sales in April was only a 6.4% gain MoM thanks to the upward revision of the big miss in March. This ‘recovery’ remains well below the peak see in January – right in the middle of the worst weather impacted time in US history if one is to believe what the media is spewing. Before the ‘housing recovery is back on track’ meme gets going though, there is the fact that homes sold in the Northeast fell to the lowest since June 2012 … as the average home price fell to $320,100 – the lowest since August 2013.

A scratch below the surface shows that the April jump was all region, and driven by the Mideast where New Homes sold were up a whopping 47.4% (35.5% Y/Y) in April to 84K. Contrast that with the Northeast which was down -26.7% (-31.3% Y/Y) to 22K. And perhaps the most interesting fact: both the median and average home prices were down Y/Y, by 1.3% and 5.0% respectively. Further, the average new home price of $320,100 was the lowest since August 2013.

Some of the big boys think not:

Big Investors Are Betting Against US Housing Market (MarketWatch)

• DoubleLine Capital founder Jeffrey Gundlach took to the podium at a highly watched investment conference to suggest shorting the popular SPDR S&P Homebuilders exchange traded fund . He pointed to a concern, cited by others, that would-be young buyers are shunning mortgages . BlackRock CEO Laurence Fink said Tuesday that the housing market is “ structurally more unsound ” …

• Real-estate investor Sam Zell says he expects the Homeownership rate to drop as low as 55% as more people delay marriages.

• Charles Plosser, president of the Fed Bank of Philadelphia says housing fundamentals “remain sound” on Tuesday, while New York Fed Bank President Charles Dudley said later that day he believes there’s a “deep and protracted” housing downturn.

According to Jeff Cox at CNBC, the Fed is awfully bad in its history of predictions:

Everything The Fed Thinks It Knows May Be Wrong (CNBC)

At the core of the Federal Reserve’s credibility is its insistence that it can hold interest rates low enough for long enough to ensure a complete economic recovery. The reality may prove quite a bit different, particularly if current trends hold up. Those low yields are critical for both the public and private sector – financing upwards of a trillion dollars a year in corporate borrowing as well as helping to contain financing costs for the government’s $17.5 trillion debt. …

“It’s not that I don’t have faith in the Fed or think these are not some of the smartest economists out there. This is unprecedented territory,” said Lindsey M. Piegza, chief economist at Sterne Agee. “It’s going to be very difficult to understand those unintended consequences on the back end of these policies. …That confusion of how to unwind these unprecedented policies says to me there’s going to be a lot of volatility, a lot of missteps.”

It’s the rates, guys, they’ll make you poor(er) and save the economy at the same time, so your kids may not have to be chained down for their entire lives. See, in the end it all works out.

Anyone else have the feeling that there are at least as many Americans who don’t register as unemployed any longer as those that are? So, you know, the real number should be north of 12%? Look, if Italy can include hookers and cocaine to boost its GDP numbers, why would you think Washington would not? Cause their nice and decent folk looking out for you? Come to think of it, what part of US GDP is blow and pussy? However that may be:

Nearly Half Of US Unemployed Have Given Up Looking For A Job

Nearly half of unemployed Americans are on the verge of completely giving up on looking for a job, but they remain optimistic they will find a job they really want within the next six months, a new survey found. The poll, commissioned by staffing firm Express Employment Professionals, found that 47% of the 1,500 respondents agreed to some extent that they have completely given up on looking for a job, but only 7% said they agree completely with that statement. “

And why is this all going to get worse? Again, it’s the rates, guys:

Forget ‘Taper Tantrum’, Here Comes ‘Rate Rage’

If you thought market nervousness over central bank policy decisions was largely over, you might be in for a shock. Despite global markets seemingly taking the Federal Reserve’s “tapering” in their stride it now appears there’s a new concern on the horizon. “Rate rage”, dubbed on Friday by Dario Perkins, an economist at Lombard Street Research, is a term used to describe the future market turmoil that could arise from the raising of benchmark interest rates by the Bank of England and the Federal Reserve. … “With central banks less able to provide clear guidance about the future, we are likely to see renewed market volatility as they start to raise interest rates in 2015. Some investors will again be anxious to sell their bonds, fearing significantly higher yields.”

And those rising rates will need to lead to what Marc Faber mistakenly labels asset deflation, which exists no more than cookie inflation, consumer inflation or any of those terms. What Faber has right is that a lot of money/credit, trillions ‘worth’ of it, will go Poof and will never be seen again. And that will have a major effect on the economy and everyone who’s part of it.

Marc Faber: ‘Brace For A “General Asset Deflation’

With global debts 30% higher than they were at the 2007 crisis peaks, enabled by the money printing of central banks, Marc Faber warns that the “asset inflation” of the last years is not reflective of the broad growth seen in the 70s. “The system is still very vulnerable,” he warned as investors are exuberant over “hot new issues” just as they were in 2000 and fears “excessive speculation” means investors should brace for a “general asset deflation.”

But we can still grow our way out of all the negatives, can’t we? You know, escape velocity! Well, sorry …

a target=”new” href=”https://www.marketwatch.com/story/world-trade-flows-drop-in-first-quarter-cpb-2014-05-23?”>World Trade Flows Drop In Q1 2014

World trade flows fell in the first three months of 2014, another indication that a sustained and broad-based pickup in global economic growth remains out of reach more than five years after the start of the financial crisis. The Netherlands Bureau for Economic Policy Analysis, also known as the CPB, Friday said the volume of world exports and imports in March was 0.5% lower than in February. For the first quarter as a whole, trade flows were down 0.8% on a quarterly basis, after a rise of 1.5% in the final three months of last year.

That’s not happening. Maybe there’s a pocket somewhere, China?

PBOC’s Zhou Says China May Have Housing Bubble in ‘Some Cities’ (Bloomberg)

China may have a housing bubble only in “some cities” … While 12 of 18 economists say China has some national oversupply of housing, only seven say the market is in a bubble countrywide, according to a Bloomberg News survey [..] Half see bubbles in some cities, and a majority say they expect restrictions on home purchases and loans to be loosened at a regional level. New construction in China has fallen 22% and sales have slumped 7.8% this year,

No salvation there either. We’re going into the Memorial weekend, and the elections that may tear the EU further apart and do g-d knows what damage in Ukraine, with an economic system that keeps on exhibiting sings of starvation and exhaustion more than recovery (for good reason, when you look at debt levels).

Things are not going well. At all. Perhaps, instead of clinging on to happy happy propaganda emanating from the politicians who screwed up and the media that are umbilically linked to them, it would be better if we acknowledge the failures of our economic and political systems, in order to be able to build new ones. What we have now is only going to schlepp us down ever more. Not unlike Ukraine perhaps.

Here’s your weekend song.

• Big Investors Are Betting Against US Housing Market (MarketWatch)

Some of Wall Street’s most vocal investors are betting against housing, saying the recovery has fizzled out. Earlier this month, DoubleLine Capital founder Jeffrey Gundlach took to the podium at a highly watched investment conference to suggest shorting the popular SPDR S&P Homebuilders exchange traded fund . He pointed to a concern, cited by others, that would-be young buyers are shunning mortgages . BlackRock CEO Laurence Fink said Tuesday that the housing market is “ structurally more unsound ” than prior to the financial crisis due to its reliance on Fannie Mae and Freddie Mac , according to news reports. He did sound a more optimistic note on Homeownership reviving.

Real-estate investor Sam Zell says he expects the Homeownership rate to drop as low as 55% as more people delay marriages. But there are also some long bets out there. Former Legg Mason Chief Bill Miller, a housing bull, said last week that the bearish positions of Gundlach and Zell are wrong . He expects continued strong demand for housing, and said he’s betting on mortgage insurers, home builders and subprime servicers, according to Bloomberg News. And Pershing Square Capital Management’s Bill Ackman recently trotted out a 110-slide presentation on the value of mortgage finance giants Fannie Mae and Freddie Mac, saying he’s ready to sit down with the government to work out a deal.

As investors take sides, Federal Reserve officials are doing so too . Charles Plosser, president of the Fed Bank of Philadelphia says housing fundamentals “remain sound” on Tuesday, while New York Fed Bank President Charles Dudley said later that day he believes there’s a “deep and protracted” housing downturn. For market participants, the current time period reflects uncertainty — and a touch of fear — about whether the housing market is improving fast enough to push broader U.S. economic growth toward liftoff. Investors are taking the pulse of business conditions after a cold winter to gauge when and how the Fed will normalize its monetary policies, in turn guiding the future of the five-year-old bull market in stocks and the direction of bond yields. That’s making housing a key factor that could aid or stifle growth.

• Everything The Fed Thinks It Knows May Be Wrong (CNBC)

At the core of the Federal Reserve’s credibility is its insistence that it can hold interest rates low enough for long enough to ensure a complete economic recovery. The reality may prove quite a bit different, particularly if current trends hold up. Those low yields are critical for both the public and private sector – financing upwards of a trillion dollars a year in corporate borrowing as well as helping to contain financing costs for the government’s $17.5 trillion debt. But after nearly five months of a decline in yields that caught market participants almost completely off guard, talk is increasing that inflationary pressures are building and that yields may begin to rise in a way that could put the Fed behind the curve of market forces.

That could help undermine the position of a central bank that badly needs the market’s confidence if it is to have any chance to unwind a nearly $4.4 trillion balance sheet and a historically lengthy time period of basement-level interest rates. “It’s not that I don’t have faith in the Fed or think these are not some of the smartest economists out there. This is unprecedented territory,” said Lindsey M. Piegza, chief economist at Sterne Agee. “It’s going to be very difficult to understand those unintended consequences on the back end of these policies. …That confusion of how to unwind these unprecedented policies says to me there’s going to be a lot of volatility, a lot of missteps.” Others in the market share the sentiment that while the Fed may not be driving blind, it doesn’t have a particularly clear road map, either. One worry is that a combined heat-up in the economy will combine with inflation to force the Fed to raise rates before it would like.

• Forget ‘Taper Tantrum’, Here Comes ‘Rate Rage’ (CNBC)

If you thought market nervousness over central bank policy decisions was largely over, you might be in for a shock. Despite global markets seemingly taking the Federal Reserve’s “tapering” in their stride it now appears there’s a new concern on the horizon. “Rate rage”, dubbed on Friday by Dario Perkins, an economist at independent U.K.-based research firm Lombard Street Research, is a term used to describe the future market turmoil that could arise from the raising of benchmark interest rates by the Bank of England and the Federal Reserve.

“Just as markets suffered a ‘taper tantrum in 2013’, a ‘rate rage’ is possible,” he said in the research note. “With central banks less able to provide clear guidance about the future, we are likely to see renewed market volatility as they start to raise interest rates in 2015. Some investors will again be anxious to sell their bonds, fearing significantly higher yields.” On May 22, 2013, the Federal Reserve’s policy minutes sparked fears the central bank could start tapering off its $85 billion-a-month bond purchasing program. This came to be known as the “taper tantrum”, with emerging market (EM) currencies tumbling as investors started to bring their dollars back to the U.S. in anticipation of higher interest rates.

• Marc Faber: ‘Brace For A “General Asset Deflation’ (Zero Hedge)

With global debts 30% higher than they were at the 2007 crisis peaks, enabled by the money printing of central banks, Marc Faber warns that the “asset inflation” of the last years is not reflective of the broad growth seen in the 70s. “The system is still very vulnerable,” he warned as investors are exuberant over “hot new issues” just as they were in 2000 and fears “excessive speculation” means investors should brace for a “general asset deflation.”

Emerging markets are relatively cheap to the US and Europe, he notes, but it is too early; there is nothing to like about low treasury yields but they are good to offset risk. As the market soared recently, fewer and fewer stocks are making new highs and this internal weakness (lack of breadth) and the breakdown in so many ‘loved’ stocks says the drop is coming sooner rather than later…

• World Trade Flows Drop In Q1 2014 (WSJ)

World trade flows fell in the first three months of 2014, another indication that a sustained and broad-based pickup in global economic growth remains out of reach more than five years after the start of the financial crisis. The Netherlands Bureau for Economic Policy Analysis, also known as the CPB, Friday said the volume of world exports and imports in March was 0.5% lower than in February. For the first quarter as a whole, trade flows were down 0.8% on a quarterly basis, after a rise of 1.5% in the final three months of last year. Each month, the CPB aggregates measures of imports and exports for 96 countries around the world, plus sub-Saharan Africa. It provides the most up-to-date measure of trade flows available, which has a close correlation with global economic growth.

During the first quarter, exports from developing economies in Asia recorded the largest decline, a drop of 4.5%. Central and Eastern Europe was the only region to record a rise in exports. Asian developing economies also recorded the largest drop in imports, while Japan recorded what the CPB termed “a remarkable increase,” or a jump of 4.5%. That was likely linked to high levels of consumer spending ahead of an April increase in the country’s sales tax, which also boosted economic growth during the period. According to the CPB, exports from and imports to the U.S. also fell during the quarter, while trade flows to and from the euro zone were little changed. The decline in trade flows is consistent with other evidence that suggests the global economy got off to a weak start this year.

• PBOC’s Zhou Says China May Have Housing Bubble in ‘Some Cities’ (Bloomberg)

China may have a housing bubble only in “some cities,” a issue that’s difficult to resolve with a single nationwide policy, the nation’s central bank Governor Zhou Xiaochuan said. China is a big country with multiple housing markets, many of which are still drawing new inhabitants from the countryside, Zhou said yesterday in an interview in Kigali, Rwanda, where he was attending the African Development Bank’s annual meeting. “China is still in the process of urbanization, so there may be some kind of volatility in the supply-demand relationship,” Zhou said. “But if you look at the medium-term of urbanization, I think we still have a very good market for home sectors.”

While 12 of 18 economists say China has some national oversupply of housing, only seven say the market is in a bubble countrywide, according to a Bloomberg News survey conducted from May 15 to May 20. Half see bubbles in some cities, and a majority say they expect restrictions on home purchases and loans to be loosened at a regional level. New construction in China has fallen 22% and sales have slumped 7.8% this year, testing the government’s four-year commitment to curbs that aim to make homes more affordable, and its reluctance to enact broader economic stimulus. The slowdown’s depth will have implications for everything from demand for Australian iron ore to land sales that help local governments repay their $3 trillion of debt.

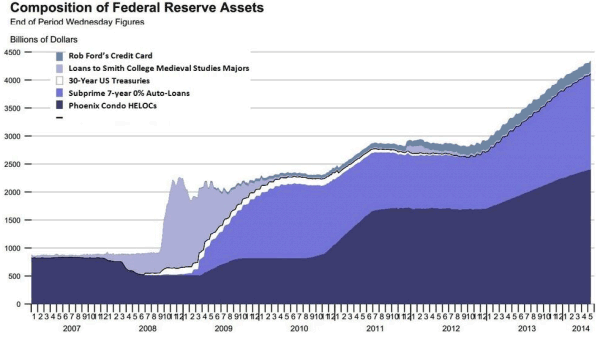

• A Look Inside The Real Fed Balance Sheet (Zero Hedge)

Sometimes one just needs a little translation to see the big picture for the trees…

• Toxic Reputations Are A Time Bomb For Banks (CNBC)

More than five years after the 2008 economic crisis, banks still have an awful reputation. And the hits keeps coming with this this week’s announcement from Credit Suisse that it’s pleading guilty to helping Americans evade taxes. In fact, Attorney General Eric Holder recently said that no bank is “too big to jail,” as his Justice Department pursues criminal charges against a number of financial institutions. Does it really matter? You could be forgiven for thinking it doesn’t. After all, a historically bad reputation hasn’t stopped banks from delivering historically good returns. Bank profits reached an all-time high in 2013 and large U.S. bank stocks have outperformed the S&P 500 for two years running for the first time since 2003.

If a half-decade of public outrage and Occupy Wall Street isn’t enough of a reputational blow to knock banks off their stride, it’s fair to wonder what is. But the toxic reputation of banks is still a huge problem — a time bomb that could soon extract a significant toll on their bottom lines. It may seem an odd argument to make at a time when banks are so profitable and influential. But though banks have won a few short-term battles in Washington, they’re losing the long-term war for public opinion. Public confidence in banks has marginally improved but is still well below pre-recession levels, and the consequences are showing up in the broader political and regulatory debate. Last year, a bipartisan group of senators introduced a bill that would have effectively reinstated the Glass-Steagall regulations that separated commercial and investment-banking activities.

And as jockeying for the 2016 presidential race starts, commentators have noted a rising populism on both the left and right, with Republican contender Rand Paul recently saying that the GOP “cannot be the party of fat cats, rich people and Wall Street.” This may all amount to nothing. But it’s instructive to remember that Congress passed two major batches of financial regulation in response to the Great Depression, one in 1933-1934 and another in 1940. There’s no reason Congress couldn’t revisit or expand upon the Dodd-Frank legislation in the coming years. If they do, the prevailing public opinion of banks will help determine if any legislation is constructive or punitive for the industry. Even without new legislation, public opinion will undoubtedly influence the aggressiveness of regulatory bodies like the Consumer Financial Protection Bureau.

• Nearly Half Of US Unemployed Have Given Up Looking For A Job (RT)

Nearly half of unemployed Americans are on the verge of completely giving up on looking for a job, but they remain optimistic they will find a job they really want within the next six months, a new survey found. The poll, commissioned by staffing firm Express Employment Professionals, found that 47% of the 1,500 respondents agreed to some extent that they have completely given up on looking for a job, but only 7% said they agree completely with that statement. “The study offers several surprising and sometimes troubling insights into how unemployed Americans are faring and what they’re doing, and not doing, to get jobs,” Bob Funk, CEO of Express and a former Chairman of the Federal Reserve Bank of Kansas City, said in a statement. “It also demonstrates why the labor force participation rate is so low – many people have given up looking for a job.”

Over the past 12 months, the number of long-term unemployed (those unemployed for 27 weeks or more) has decreased by 908,000, according to the Bureau of Labor Statistics. The civilian labor force dropped by 806,000 in April, following an increase of 503,000 in March. The labor force participation rate fell by 0.4 percentage point to 62.8% in April. The jobless rate nationwide dropped to 6.3% last month — the lowest level since 2008 — as the nation added 288,000 jobs, according to the government. “Though the unemployment rate fell in March and April, both drops reflected fewer people looking for work, not more employment,” Nigel Gault, chief U.S. economist for the forecasting firm IHS Global Insight, said in a written assessment of the job market, according to NPR. “After searching for four years and being unsuccessful, I am tired of trying,” said one Express survey respondent.

But many jobless Americans are reluctant to make significant changes to boost their chances of landing a job. Only 13% of the survey’s respondents have actively pursued more education. And they are unwilling to relocate: 44% of respondents said they are unwilling to relocate to a new town, while 60% said are unwilling to move to a new state. These numbers include 57% and 72%, respectively, of those unemployed two years or longer.

Bad Worse Worstest.

• New Jersey Economic Comeback? Fuhgeddaboudit! (Reuters)

When New Jersey Governor Chris Christie on Tuesday unveiled a massive budget shortfall, he pointed the finger at a steep and unexpected drop in income taxes. But Christie’s lowered revenue projections – $2.75 billion through the end of fiscal 2015 – highlight a deeper problem: While its neighbors and the rest of the nation have slowly but steadily recovered from the Great Recession, New Jersey has flatlined. The data paint a bleak picture. Through March, New Jersey had recovered less than 40% of the jobs it lost during the recession, while the United States overall has recovered 99% of the jobs lost, according to data from the U.S. Labor Department.

In the high-paying manufacturing sector, for instance, nearly 650,000 new jobs have been created nationally since Christie took office in early 2010. Over that same time, New Jersey’s manufacturing employment has declined by nearly 18,000 jobs. In housing, too, New Jersey is weakening while other areas improve. In the first quarter of 2014, it was the only state to see an increase in foreclosure rates. At 8%, its foreclosure rate is now the highest in the country, according to the Mortgage Bankers Association. And while most states have begun rebuilding their reserve funds, New Jersey’s has continued to shrink and is now at its lowest level in a decade, according to Moody’s Investors Service. New Jersey’s economy grew by 2% over the 12 months through the end of April. But neighbors Pennsylvania and Delaware grew by 4.2% and 3.9%, respectively, according to a Federal Reserve Bank of Philadelphia index that combines four economic factors. The U.S. economy expanded by 3% using the same measure.

Greenwald said the revelation would lead to deaths. Really? More than there already are since we invaded?

• WikiLeaks: NSA Records ‘Nearly All’ Phone Calls In Afghanistan (RT)

The NSA records almost all domestic and international phone calls in Afghanistan, similar to what it does in the Bahamas, WikiLeaks’ Julian Assange said. Reports in the Washington Post and the Intercept had previously reported that domestic and international phone calls from two or more target states had been recorded and stored in mass as of 2013. Both publications censored the name of one victim country at the request of the US government, which the Intercept referred to as ‘Country X’. Assange says he cannot disclose how WikiLeaks confirmed the identity of the victim state for the sake of source protection, though the claim can be “independently verified” via means of “forensic scrutiny of imperfectly applied censorship on related documents released to date and correlations with other NSA programs.”

The Intercept, which Glenn Greenwald, who first broke the Edward Snowden revelations helped to found, had earlier named the Bahamas as having their mobile calls recorded and stored by a powerful National Security Agency (NSA) program called SOMALGET. WikiLeaks initially opted not to reveal the name of ‘Country X’ as they were led to believe it could “lead to deaths” by Greenwald. WikiLeaks later accused The Intercept and its parent company First Look Media of censorship, saying they would go ahead and publish the name of the NSA-targeted country. “We do not believe it is the place of media to ‘aid and abet’ a state in escaping detection and prosecution for a serious crime against a population,” Assange said in the statement. “By denying an entire population the knowledge of its own victimization, this act of censorship denies each individual in that country the opportunity to seek an effective remedy, whether in international courts, or elsewhere,” he said.

Well, that is, there is no proof.

• Pentagon: Scope Of Intelligence Compromised By Snowden ‘Staggering’ (Guardian)

The classified damage assessment was first cited in a news report published by Foreign Policy on January 9. The Foreign Policy report attributed details of the DIA assessment to House intelligence committee chairman Mike Rogers and its ranking Democrat Dutch Ruppersberger. The lawmakers said the White House had authorized them to discuss the document in order to undercut the narrative of Snowden being portrayed as a heroic whistleblower. The DIA report has been cited numerous times by Rogers and Rusppersberger and other lawmakers who claimed Snowden’s leaks have put US personnel at risk. In January, Rogers asserted that the report concluded that most of the documents Snowden took “concern vital operations of the US Army, Navy, Marine Corps and Air Force”.

“This report confirms my greatest fears — Snowden’s real acts of betrayal place America’s military men and women at greater risk. Snowden’s actions are likely to have lethal consequences for our troops in the field,” Rogers said in a statement at the time. But details to back up Rogers’ claims are not included in the declassified material released to the Guardian. Neither he nor any other lawmaker has disclosed specific details from the DIA report but they have continued to push the “damage” narrative in interviews with journalists and during appearances on Sunday talk shows.

The declassified portion of the report obtained by the Guardian says only that DIA “assesses with high confidence that the information compromise by a former NSA contractor [redacted] and will have a GRAVE impact on US national defense”. The declassified material does not state the number of documents Snowden is alleged to have taken, which Rogers and Ruppersberger have claimed, again citing the DIA’s assessment, was 1.7m. Nor does the declassified portion of the report identify Snowden by name. “[Redacted] a former NSA contractor compromised [redacted] from NSA Net and the Joint Worldwide Intelligence Communications System (JWICS),” the report says. “On 6 June 2013, media groups published the first stories based on this material, and on 9 June 2013 they identified the source as an NSA contractor who had worked in Hawaii.”

• Putin: Sanctions Will Have ‘Boomerang Effect’ (CNBC)

Russian President Vladimir Putin has criticized Western powers and the Ukrainian interim government, as he announced plans for a new Eurasian union. He argued that the current stand-off with Ukraine is “not due to Russia but to the situation in the Ukraine, which abuses its position” in a speech at the St Petersburg Economic Forum, Russia’s answer to Davos. “We have gathered here for economic discussions, but we cannot erase political discussions,” Putin said, as he slammed the use of sanctions against Russian businesses and individuals as having a “boomerang effect” on the West. “Economic sanctions as a tool of political pressure are eventually going to attack the economy of the countries who have initiated the sanctions,” he said.

• West’s Eastward Expansion Ruins Historic Chance At Unification – Lavrov (RT)

The Ukrainian crisis is a natural result of the West’s expansion of its influence eastwards at the expense of Russian interests, Foreign Minister Sergey Lavrov said. This stance ruins a historic chance for a unified continent. The turbulence in Ukraine is reminiscent of the violence and bloodshed that Europe experienced in the 20th century, Lavrov told a security conference in Moscow. “The European continent, which brought two global military catastrophes in the last century, is not demonstrating an example to the world of peaceful development and broad cooperation,” he said, adding that the situation wasn’t accidental, but rather “a natural result of the developments over the past quarter of a century.” “Our Western partners rejected a truly historic chance to build a greater Europe in favor of border lines and the habitual logic of expanding the geopolitical space under their control to the East,” Lavrov stressed.

“This is de facto a continuation of a policy of containing Russia in a softer wrapping.” The West ignored Russia’s calls for cooperation and would not pursuit a challenge of bringing together different integration projects in Eurasia. Instead it was forcing nations historically close to Russia to choose between the East and the West.“With Ukraine’s fragile political situation, this pressure was enough to trigger a massive crisis of statehood,” Lavrov pointed out. But Ukraine is just one example of the destructive results that Western foreign policies bring, Lavrov said. “The operations to change regimes in sovereign states and the foreign-orchestrated ‘color revolutions’ of different brands produce obvious damage to the international stability. The attempts to impose one’s own designs for internal reforms on other peoples, which don’t take into account national characteristics, to ‘export democracy’, impact destructively international relations and multiplies the number of flashpoints on the world map,” he continued.

“Schemes based on advocating one’s exceptionalism, the use of double standards, pursuit of unilateral geopolitical outcomes in crisis situation, are widely used not only in Europe, but also in other regions,” the minister said. “This undermines crisis mediation efforts.” The problems in Ukraine, Syria, Afghanistan and many other countries can only be solved through collective effort, and Russia stands for joining forces in tackling issues. A collective effort resulted in resent advances on the Iranian nuclear program and launched the dismantling of the Syrian chemical arsenal, Lavrov said. Meanwhile unilateral attempts to resolve the Arab-Palestinian conflict proved to be deficient.

Anything goes.

• Cocaine Sales, Hookers to Boost Italian GDP in Boon for Budget (Bloomberg)

Italy will include prostitution and illegal drug sales in the gross domestic product calculation this year, a boost for its chronically stagnant economy and Prime Minister Matteo Renzi’s effort to meet deficit targets. Drugs, prostitution and smuggling will be part of GDP as of 2014 and prior-year figures will be adjusted to reflect the change in methodology, the Istat national statistics office said today. The revision was made to comply with European Union rules, it said.

Renzi, 39, is committed to narrowing Italy’s deficit to 2.6% of GDP this year, a task that’s easier if output is boosted by portions of the underground economy that previously went uncounted. Four recessions in the last 13 years left Italy’s GDP at 1.56 trillion euros ($2.13 trillion) last year, 2% lower than in 2001 after adjusting for inflation. “Even if the impact is hard to quantify, it’s obvious it will have a positive impact on GDP,” said Giuseppe Di Taranto, economist and professor of financial history at Rome’s Luiss University. “Therefore Renzi will have a greater margin this year to spend” without breaching the deficit limit, he said.

If God would want to stop us from destroying his creation, he would, right? Since he made us (or is that just me?) in his own image, whatever we do, he does, and he wants that too.

• Climate Science Is A Hoax: Big Oil, The GOP And God Say So (Paul B. Farrell)

Let’s all get dancing and look around us while we do! That should help.

• Dancing Honeybees Assess The Health Of The Environment (New Scientist)

Eavesdropping may be rude, but snooping on honeybee conversations could reveal a lot about the environment. Their unique mode of communication, the waggle dance, contains clues about the health of the landscape they live in. In effect, the bees are giving a thumbs-up or thumbs-down to different methods of conservation. A worker honeybee performs the waggle dance to tell her hive mates where the best food is located. That suggests the dance can indicate areas of the landscape that are healthy, at least in terms of food for pollinators.

To test this, Margaret Couvillon and her colleagues from the University of Sussex in Brighton, UK, videoed and decoded 5484 waggle dances from three laboratory-maintained honeybee colonies living in 94 square kilometres of rural and urban landscapes. They divided the area into various conservation schemes, regulated by the UK government, and mapped which areas were most frequented by the bees over two years. “Using honeybee colonies as biomonitors for environmental health is an idea that researchers have been interested in,” says James Nieh from the University of California, San Diego. “However, this study uses a far larger sample size and examines the data in a more sophisticated way.”

Darn!

• US House: Pentagon Can’t Treat Climate Change As Security Threat (RT)

The US House has voted to deny the Pentagon funding to combat impacts of climate change and its own heavy dependence on fossil fuels. The Department has long acknowledged the realities of global warming amid political wrangling over its effects. The House voted, mostly along party lines, to pass an amendment to the National Defense Authorization Act (NDAA) that aims to prevent the Pentagon from using appropriated funding to address the myriad national security concerns the Department of Defense (DOD) has said climate change poses to American interests.

The amendment to the NDAA, which sets the terms of the DOD budget, was sponsored by Rep. David McKinley (R), whose home state of West Virginia is deeply invested in coal development. The full text of the amendment reads: “None of the funds authorized to be appropriated or otherwise made available by this Act may be used to implement the U.S. Global Change Research Program National Climate Assessment, the Intergovernmental Panel on Climate Change’s Fifth Assessment Report, the United Nation’s Agenda 21 sustainable development plan, or the May 2013 Technical Update of the Social Cost of Carbon for Regulatory Impact Analysis Under Executive Order.”

In response, Democratic Reps. Henry Waxman and Bobby Rush said the “McKinley amendment would require the Defense Department to assume that the cost of carbon pollution is zero,” in a letter to House colleagues before Thursday’s vote. “That’s science denial at its worst and it fails our moral obligation to our children and grandchildren.” The amendment specifically targets the findings and recommendations of the recent National Climate Assessment (NCA) and the latest yearly climate report from the United Nations-sponsored Intergovernmental Panel on Climate Change (IPCC).

Home › Forums › Debt Rattle 23 2014: See The Lonely Boy Out On The Weekend