Dorothea Lange Country store, Person County, NC Jul 1939

120 is the alleged big breaking point. We’re getting close and moving fast.

• Dollar-Yen Breaks Above 115, What Next? (CNBC)

The dollar-yen broke above the 115 level for the first time in seven years on Thursday. Active U.S. dollar buying pushed the pair as high as 115.40 in the Asian trading session, according to market participants. The Bank of Japan’s (BoJ) second round of monetary easing, announced last Friday, has ignited a powerful rally in dollar-yen, which is up over 9% year to date. Despite the rapid rise, analysts believe the rally is far from over. “The fact that the easing move on Friday was a surprise provides the market with some scope to ‘chase’ as USD/JPY rises to reflect the policy surprise, and any pull-back is likely to be shallow as market participants use the opportunity to ‘buy the dip’,” Fiona Lake strategist at Goldman Sachs wrote in a note late Wednesday. The bank, which has a target of 125 by end-2016, expects the yen will continue to weaken against the greenback as a function of diverging monetary policies and likely deterioration in Japan’s external balance as the Government Pension Investment Fund (GPIF) buys more external assets.

GPIF, the world’s largest pension fund, last week announced new asset allocation targets. Under the new allocation guidelines, Japanese stocks and foreign stocks will account for 25% of the fund’s holdings, up from 12% each previously. The fund will put 35% of its money in domestic bonds, down from 60%, while the ratio for overseas bonds will rise to 15% from 11%. Nomura expects swifter gains in the dollar-yen, forecasting 121 by end-June 2015 and 125 by end-December. “USD/JPY has already reacted very positively to the two policy announcements, but we still see upside risks for USD/JPY, both in the short and medium term,” Yujiro Goto, foreign-exchange strategist at Nomura wrote in a note this week.

It’s like cosmic background radiation: The world looks the same wherever you look.

• BoJ’s Surprise Easing Showers Wealth On Japan’s Top Billionaires (Bloomberg)

The Bank of Japan’s unexpected stimulus has already made the country’s richest even wealthier, adding more than $3 billion to the four top billionaires’ net worth. Fast Retailing Co. Chairman Tadashi Yanai, Japan’s richest person, saw his fortune grow by about $2 billion in the three trading days since the central bank’s Oct. 31 announcement that sparked a plunge in the yen and a rally in stocks. While billionaires such as Yanai gained, the central bank’s unprecedented asset purchases to support economic growth have yet to show evidence of spreading beyond Japan’s wealthiest people and corporations. Toyota, the country’s biggest company, yesterday cited the weaker yen in raising its annual profit forecast to a record 2 trillion yen ($17 billion). “The top 10% or 20% are getting richer, on the other hand the bottom 20% to 30% are becoming poorer,” said Tatsushi Maeno, head of Japanese equities at Pinebridge Investments Japan Co. “The equity market rally could accelerate this trend.”

Masayoshi Son, founder of SoftBank Corp. and Japan’s second-richest person, is up by $182 million since the BOJ decision, according to the Bloomberg Billionaires Index. Keyence Corp. Chairman Takemitsu Takizaki, the country’s No. 3 billionaire, added $434 million to his fortune and Rakuten Inc. President Hiroshi Mikitani, the next richest, saw an extra $393 million, based on closing prices yesterday. Estimates of billionaires’ net worths were compiled based on the billionaires’ shareholdings and other assets, and the yen’s value versus the dollar as of yesterday. Stocks also rallied after Japan’s $1.1 trillion Government Pension Investment Fund said it would buy more local shares. “The short-term result is good for everybody,” said Masayuki Kubota, chief strategist at Rakuten Securities Economic Research Institute. “It’s the government directly intervening in the Japanese equity market.”

Looks like Draghi’s in a bind from many different sides. When’s he going to pick up the message and go away?

• Kuroda Has Draghi in a Bind as Euro Soars Against Yen (Bloomberg)

Mario Draghi has something new to worry about as he prepares for tomorrow’s European Central Bank policy meeting: the euro-yen exchange rate. The yen approached a six-year low versus the shared European currency after Bank of Japan Governor Haruhiko Kuroda surprised investors late last week by extending his record stimulus program. Kuroda’s actions jeopardize the weaker euro that analysts say Draghi needs to reflate the economy, heaping pressure on him to come up with a policy response. “Kuroda has thrown down the gauntlet to Draghi,” Robert Rennie, the head of currency and commodity strategy at Westpac Banking Corp., said yesterday by phone from Sydney. “Whether Draghi will, or can, accept the challenge remains to be seen.”

Unless Draghi emulates the large-scale government-bond purchases, or quantitative easing, of his BOJ counterparts, money borrowed cheaply in Japan could increasingly flow into European assets, propping up the 18-nation currency, Rennie said. Most analysts expect policy makers to refrain from changes at tomorrow’s meeting, while they remain split over the odds of sovereign asset purchases. Some see a higher likelihood of additional easing at the December gathering. The BOJ got out ahead of many of its peers by announcing on Oct. 31 that it raised the annual target for enlarging its monetary base to 80 trillion yen ($704 billion) from 60 to 70 trillion yen previously.

Problem is, it’s all so destructive: going back to a normally functioning economy gets harder every day.

• Kuroda Stimulus Drives Government Borrowing Costs to Record Low (BW)

Bank of Japan Governor Haruhiko Kuroda’s unexpected expansion of stimulus last week has driven government borrowing costs to an unprecedented low. An auction of 10-year government debt today resulted in the lowest average yield on record at 0.439%, according to Ministry of Finance data. The previous low was 0.470% in June 2003. Last month, investors began paying the government to lend at sales of three-month debt for the first time ever, with average yields as low as minus 0.0041%. The BOJ surprised investors last week by raising the annual target for an increase in Japanese government bond holdings by 60%. Kuroda reiterated today the central bank will do “whatever it can” to end deflation, a pledge he has made since before embarking on quantitative easing in April last year, and driving yields to record lows.

“This isn’t quite a level where you can buy, but with the BOJ basically snapping up all new issuance, there’s no need to worry about the supply-demand balance,” said Takeo Okuhara, a senior fund manager in Tokyo at Daiwa SB Investments Ltd. The central bank’s expanded plan to buy 8 trillion yen to 12 trillion yen of JGBs per month gives Kuroda leeway to soak up all of the 10 trillion yen in new bonds that the Ministry of Finance sells in the market each month. The central bank is already the largest single holder of Japan’s bonds, topping insurers at the end of March for the first time ever. Japan’s 10-year borrowing costs rose 3 1/2 basis points to 0.475% at 2:51 p.m. in Tokyo from yesterday, when they reached 0.435% for a second day, the lowest since April 5 last year, when the record low of 0.315% was set, a day after Kuroda’s initial quantitative easing announcement.

The argument: it’s very selfish for the older people to want safe pensions, and the young can only get them if we go to the casino. I can see Japan go to war not too long from now, it’ll seem the only thing left.

• Japan Union Boss Criticises Pension Fund Strategy Shift (FT)

The head of Japan’s most powerful federation of labour unions has criticised the shake-up at the national pension fund, arguing that the world’s biggest institutional investor should have consulted workers before committing half of its Y127tn ($1.1tn) in assets to stocks. Last week the Government Pension Investment Fund (GPIF) surprised markets by saying it would more than double its allocation to domestic and foreign equities over the next few years, while cutting its target share of Japanese government bonds from 60% to 35%. The new mix was billed as a way to address rising payments to pensioners, while making the GPIF – which has long had a passive, conservative approach compared with similar bodies outside Japan – a more aggressive, returns-minded investor.

But Nobuaki Koga, the 62-year-old president of the federation known as Rengo, was unimpressed, describing the shift as a “big problem”. “Workers and management have had no say in the decision-making process, even though the money the GPIF is investing belongs to them,” Mr Koga told the Financial Times. “If there are big losses on the stock market, who will take responsibility?” The comments reflect concerns among some senior officials in Japan that the GPIF has been co-opted by the administration of Shinzo Abe in its attempt to haul the economy out of years of deflation. Higher stock prices are seen as a key part of that effort, prompting complaints that the prime minister is in effect gambling with the savings of millions of workers.

Friday’s announcement from the GPIF came within hours of another burst of monetary stimulus from the Bank of Japan and confirmation from the finance ministry that it was preparing a fiscal stimulus package. The measures combined to push up the Nikkei 225 stock average by about 8% in two days. Supporters of the GPIF’s move say criticism is to be expected, as people of Mr Koga’s generation have witnessed the Nikkei sink from a peak of almost 40,000 on the last business day of 1989 to a post-Lehman low of 7,054 in March 2009. “Stocks seem risky if you look at the volatility of month-to-month or year-to-year returns but this is a fund for the next 100 years. We can be patient,” said Takatoshi Ito, former chair of a committee advising on the portfolio reallocation and now deputy chair of a committee on reforming the GPIF’s governance. “Our view is that holding JGBs with coupons of 0.5% presents a significant risk in itself.”

You think, gnome?

• Ben Bernanke: Quantitative Easing Will Be Difficult For The ECB (CNBC)

Former Federal Reserve Chairman Ben Bernanke predicted that the European Central Bank (ECB) would have a rough time implementing U.S-style monetary easing. Speaking Wednesday at the Schwab IMPACT conference, the ex-central bank chief said the ECB faces political barriers to enacting such an aggressive program. “The barriers to doing it are not really economic,” he said. “The legal and political barriers being thrown up are going to make it very difficult to do that.” Bernanke also fired back at critics of the Fed’s own easing programs, accusing them of “bad economics” for saying that QE, which has pushed the institution’s balance sheet past the $4.5 trillion mark, would lead to inflation. The easing program began in 2009 and has had two additional versions since, the latest of which the Janet Yellen-led Open Market Committee terminated last week.

“There never was any risk of inflation. The economy was in great slack. If anything we were worried about deflation,” Bernanke said of economic conditions when QE was first launched. “Four years later there’s not a sign of inflation. The dollar is strengthening. They’re saying, ‘Wait another five years, it’s going to happen.’ It’s not going to happen.” QE came into being after the economy fell into recession during the financial crisis. Bernanke and a team that included then-Treasury Secretary Hank Paulson and his eventual successor, Timothy Geithner, who at the time headed the New York Fed, devised a series of alphabet-soup programs that helped stabilize the financial system. Since the advent of the Troubled Asset Relief Program, QE and other initiatives, the stock market also has rebounded, gaining about 200% off its March 2009 lows.

The experts think they’re part of the plan.

• BOJ Runs Into Critical Analysts After Kuroda Easing Shock (Bloomberg)

Hours after the Bank of Japan caught central-bank watchers off guard by boosting stimulus, officials were fending off complaints about its communications. A meeting on Oct. 31 with about 50 analysts and economists on the BOJ’s new outlook ran on for two hours – twice the usual time – as the discussion turned to how well Governor Haruhiko Kuroda and other officials telegraphed their views before the decision, said people who were present. The questions came like a torrent, with some complaining about the BOJ’s bond purchase plan and its communications with the market, according to analysts who asked not to be named as the gathering was private.

While Kuroda said he didn’t intend to surprise anyone with the decision to bolster already-unprecedented easing, springing the news on the market added to the punch. The risk for Kuroda is that he may undermine the BOJ’s credibility with some people in the market who count on central bank officials for clear and timely communication. “We shouldn’t take Kuroda’s comments at face value,” said Noriatsu Tanji, chief rates strategist at RBS Securities in Tokyo. “He offered a completely different view from what he said just three days earlier. Instead of listening to Kuroda, we should look at prices and the distance to the BOJ’s inflation target.”

Go Mario, while you can with your face intact.

• Mario Draghi’s Efforts To Save EMU Have Hit The Berlin Wall (AEP)

Mario Draghi has finally overplayed his hand. He tried to bounce the European Central Bank into €1 trillion of stimulus without the acquiescence of Europe’s creditor bloc or the political assent of Germany. The counter-attack is in full swing. The Frankfurter Allgemeine talks of a “palace coup”, the German boulevard press of a “Putsch”. I write before knowing the outcome of the ECB’s pre-meeting dinner on Wednesday night, but a blizzard of leaks points to an ugly showdown between Mr Draghi and Bundesbank chief Jens Weidmann. They are at daggers drawn. Mr Draghi is accused of withholding key documents from the ECB’s two German members, lest they use them in their guerrilla campaign to head off quantitative easing. This includes Sabine Lautenschlager, Germany’s enforcer on the six-man executive board, and an open foe of QE.

The chemistry is unrecognisable from July 2012, when Mr Draghi was working hand-in-glove with Ms Lautenschlager’s predecessor, Jorg Asmussen, an Italian speaker and Left-leaning Social Democrat. Together they cooked up the “do-whatever-it-takes” rescue plan for Italy and Spain (OMT). That is why it worked. We now learn from a Reuters report that Mr Draghi defied an explicit order from the governing council when he seemingly promised to boost the ECB’s balance sheet by €1 trillion. He also jumped the gun with a speech in Jackson Hole, giving the very strong impression that the ECB was alarmed by the collapse of the so-called five-year/five-year swap rate and would therefore respond with overpowering force. He had no clearance for this. The governors of all northern and central EMU states – except Finland and Belgium – lean towards the Bundesbank view, foolishly in my view but that is irrelevant. The North-South split is out in the open, and it reflects the raw conflict of interest between the two halves.

The North is competitive. The South is 20pc overvalued, caught in a debt-deflation vice. Data from the IMF show that Germany’s net foreign credit position (NIIP) has risen from 34pc to 48pc of GDP since 2009, Holland’s from 17pc to 46pc. The net debtors are sinking into deeper trouble, France from -9pc to -17pc, Italy from -27pc to -30pc and Spain from -94pc to -98pc. Claims that Spain is safely out of the woods ignore this festering problem.

The higher dollar is all it takes.

• It’s Now Total War Against The BRICS (Pepe Escobar)

Fasten your seat belts: the information war already unleashed against Russia is bound to expand to Brazil, India and China. Brazil, Russia, India and China, as it’s widely known, are the top four members of the BRICS group of emerging powers, which also includes South Africa and will incorporate other Global South nations in the near future. The BRICS immensely annoy Washington – and its Think Tankland – as they embody the concerted Global South push towards a multipolar world. Bottles of Crimean champagne could be bet that the US response to such a process couldn’t be but a sort of total information war – not dissimilar in spirit to the NSA’s deep state Total Information Awareness (TIA), a crucial element of the Pentagon’s Full Spectrum Dominance doctrine. The BRICS are seen as a major threat – so to counteract them implies domination of the information grid.

Vladimir Davydov, director of the Russian Academy of Sciences’ Institute of Latin America, was spot on when he remarked, “The current situation shows that there are attempts to suppress not only Russia but also the BRICS given that the global role of this association has only intensified.” Russia demonization has quickly escalated in the US from sanctions related to Ukraine to Putin as the “new Hitler” and the resurrection of the time-tested Cold War scare “The Russians are coming”. In the case of Brazil the information war already started way before the reelection of President Dilma Rousseff. As much as Wall Street and its local comprador elites were doing everything to tank what they define as a “statist” economy, Dilma was also personally demonized. Not so far-fetched steps in the near future might include sanctions on China because of its “aggressive” position in the South China Sea, or Hong Kong, or Tibet; sanctions on India because of Kashmir; sanctions on Brazil because of human rights violations or excess deforestation.

A world of hurt.

• ‘Devil’s Metal’ Burns Investors As Gold Melts Down (CNBC)

Gold and silver have been crushed this week, burned by the rising dollar and the outflow of money looking for a home in stocks and other investments. Some analysts said the metals look like they should be close to a floor, but they stop short of calling a bottom based on the factors that are driving prices lower, including ETF withdrawals. Even a rush of coin buying, causing the U.S. Mint to temporarily run out of silver American Eagle coins, hasn’t yet turned the tide, “I’ve been pretty morose on gold for quite some time. Maybe it’s a little bit lower than we would have thought. … We had a one-two punch and a knockout,” said Bart Melek, head of commodities strategy at TD Securities. He said the hawkish tone of the Fed last week helped send gold reeling, and any positive moves in the dollar add to its decline. “It’s not likely we’re going to see an outright rout at this point. We’re kind of holding on key support levels. I think it will very much depend on how equity markets do and how the economy looks.”

The December Gold contract fell below $1,150 an ounce, and is now off more than 6.5% in the past five days. Silver is even weaker, and Melek said it could fall into the $14.50 zone. Silver is down more than 10.5% in the same time, and the December futures contract was down 3.2% at $15.44 an ounce in afternoon trading Wednesday. “It’s even more slaughtered. Although the fundamentals of silver are much stronger than the fundamentals of gold, who cares? The only thing that matters is what the dollar is doing. Money still wants to flow to stocks and that’s what it will continue to do,” said Dennis Gartman, publisher of the Gartman Letter.

Silver is much more volatile than gold and can lead prices higher, but also lower as it is doing now. “It burns investors. That’s why they call it the devil’s metal,” said one analyst. Gold also has been selling off as the world appears to be more concerned about disinflation than inflation, with weaker economies and the drop in crude. The dollar index is up 1.7% in the past five days. “The strength in the dollar is so substantial. The crude market weakness is so substantial. Where else can it go? It will keep going until it stops. It’s a bull market for the dollar, and that trumps all other concerns,” said Gartman.

Brilliant.

• Luxembourg Rubber-Stamps Tax Avoidance On Industrial Scale (Guardian)

An unprecedented international investigation into tax deals struck with Luxembourg has uncovered the multi-billion dollar tax secrets of some of the world’s largest multinational corporations. A cache of almost 28,000 pages of leaked tax agreements, returns and other sensitive papers relating to over 1,000 businesses paints a damning picture of an EU state which is quietly rubber-stamping tax avoidance on an industrial scale. The documents show that major companies — including drugs group Shire, City trading firm Icap and vacuum cleaner firm Dyson, who are headquartered in the UK or Ireland — have used complex webs of internal loans and interest payments which have slashed the companies’ tax bills. These arrangements, signed off by the Grand Duchy, are perfectly legal.

The documents also show how some 340 companies from around the world arranged specially-designed corporate structures with the Luxembourg authorities. The businesses include corporations such as Pepsi, Ikea, Accenture, Burberry, Procter & Gamble, Heinz, JP Morgan and FedEx. Leaked papers relating to the Coach handbag firm, drugs group Abbott Laboratories, Amazon, Deutsche Bank and Australian financial group Macquarie are also included. [.] Stephen Shay, a Harvard Law School professor who has held senior tax roles in the US Treasury and who last year gave expert testimony on Apple’s tax avoidance structures in a Senate investigation, said: “Clearly the database is evidencing a pervasive enabling by Luxembourg of multinationals’ avoidance of taxes [around the world].” He described the Grand Duchy as being “like a magical fairyland.”

We live in a distorted world.

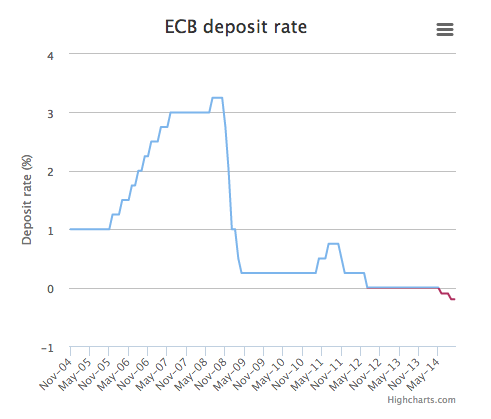

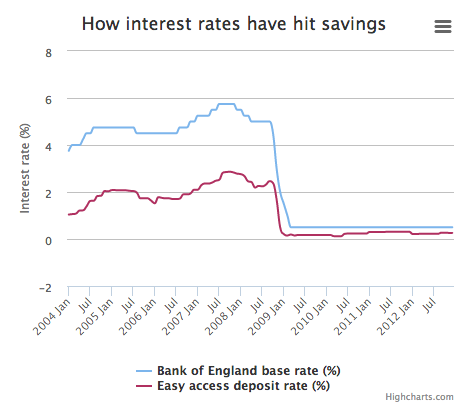

• Interest Rates Are So Low Germans Pay To Keep Money In Banks (Telegraph)

Record low interest rates around the world have been hitting savers’ holdings for years, but things have become even worse in Germany. Deutsche Skatbank, a medium-sized co-operative based in Altenburg, East Germany, has introduced an interest rate of -0.25pc for certain clients, blaming the European Central Bank’s negative rates. The ECB cut one of its three key rates to less than zero in June and has since reduced them further in a desperate attempt to ward off deflation. “We can no longer offer cover costs due to the current interest rate environment,” the bank said. “The lowering of the interest rate for certain deposits with Deutsche Skatbank [is due to] the negative results from the analogous changes in interest rates, both at the ECB and in the interbank market.” Those with deposits of more than €500,000 (£393,000), will, rather than receiving interest on their deposits, have an interest rate of -0.25pc per annum. However, the bank said it would only actually apply this if balances went above €3m.

To put it another way, certain depositors are better off putting their money under the mattress. Because of the threshold, it only applies to very rich savers and institutions, but further ECB attempts to boost growth may have see this trend continue. The ECB is under pressure to introduce quantitative easing in a last-ditch attempt to boost growth, and has already started a version dubbed “QE-lite”. In June, when the ECB introduced negative rates, it said: “There will be no direct impact on your savings. Only banks that deposit money in certain accounts at the ECB have to pay.” However, it added: “Commercial banks may of course choose to lower interest rates for savers.” Low interest rates and quantitative easing have hit savers’ returns since the financial crisis.Additionally, banks’ extremely low funding costs due to the Funding for Lending Scheme and low market rates supported by implict government subsidies, have meant they do not have to attract savers to raise funds. There is a very direct correlation between interest rates and savings rates, which have been below inflation for years.

Wonder what their true numbers are, their derivatives portfolio’s etc.

• French Banks Warn On Country’s ‘Difficult’, ‘Incoherent’ Economy (CNBC)

French lender Societe Generale posted a 56% rise in third quarter net profit on Thursday, to €836 million ($1.04 billion), in spite of what the bank’s deputy chief executive described as a “difficult environment.” This sentiment was backed by the CEO of rival Credit Agricole who criticized a “lack of coherence” in French economic policy. SocGen’s net profit figures beat estimates from analysts polled by Reuters of €794 million. However, revenues slipped in the same period, down 1.8% at €5.9 billion, slightly above analysts’ forecasts. Deputy chief executive Severin Cabannes gave three reasons why the group saw such a rise in profit. “Firstly, we had a good commercial dynamic across all our businesses, secondly we had a strict control of all our costs which decreased in absolute terms compared to last year and third, we had a sharp drop in the cost of risk as anticipated.” Loan loss provisions were down by 41% and provisions for litigation remained at €900 million.

The latest figures come after the lender, which is France’s second-largest by market value, reported a 7.8% rise in net profits, to €1.030 billion ($1.38 billion) in the second quarter, and increased its litigation provisions. Elsewhere Thursday, French bank Credit Agricole also reported an increase in third-quarter net profit to €758 million, up 4.1% year on year. Revenues rose 4.0% year-on-year in the same period to €4.0 billion. The bank said there was good business momentum and a continued fall in the cost of risk “despite a challenging economic, regulatory and fiscal environment,” chief executive Jean-Paul Chifflet said in an earning’s statement. However, Chifflet added that a weakness in the French economy weighed on the business and criticized a “lack of coherence” in French economic policy. Speaking to reporters in a conference call, Chifflet said “signs of recovery are proving elusive, unemployment is high, the real estate market is in correction, the public deficit continues to overshoot amid insufficient spending cuts,” Reuters reported.

So can we shut up now about that great economy?

• Pace Of UK Economic Growth Expected To Halve As Service Sector Slows (Guardian)

The pace of Britain’s recovery is expected to almost halve by the end of the year after a survey showed the service sector expanded at the slowest pace in almost 18 months in October. In the first quarter of the year, the UK registered a rise in GDP of 0.9%, but analysts said the slowdown since the summer meant the final quarter was likely to see growth fall to 0.5%, taking pressure off the Bank of England to raise interest rates. Echoing similar trends in manufacturing and construction, the Markit/CIPS services purchasing managers’ index (PMI) fell from 58.7 in September to 56.2, the lowest level of expansion since April 2013. Britain’s rate of growth still continues to outstrip that of the eurozone, with businesses reporting and businesses reported that they intend to hire more staff. Robert Wood, chief UK economist at Berenberg bank, said the latest figures revealed that growth rates had returned to “more reasonable levels” and showed that Britain would continue to grow strongly. “Keep some perspective, the PMI is still strong and the sharp slowdown may be a flash in the pan,” he said.

“New business flows remain very strong and firms are sufficiently enamoured with the UK’s prospects that they are still hiring strongly.” Markit said new business growth was the main prop to higher levels of activity. In its monthly report, the financial data provider said: “October’s data indicated the 22nd successive monthly increase in incoming new work, and respondents commented on success in securing new work via higher marketing and improved client engagement.” Reflecting the weaker outlook, sterling sank to a one-year low of $1.59. In July, the currency topped $1.70 but has fallen back as the prospect of interest rate rises began to wane. Warning signs of a sharper than expected deceleration towards the end of the year was reflected in comments about the uncertainty for exports. While the US remains a strong export market for the UK businesses, the eurozone has entered a period of contraction, with several countries falling back into a third recession since the 2008 banking crash.

This is what I find a disgrace.

• 300,000 More British Live In Dire Poverty Than Already Thought (Guardian)

The number of people living in dire poverty in Britain is 300,000 more than previously thought due to poorer households facing a higher cost of living than the well off, according to a study released on Wednesday. A report produced by the Institute for Fiscal Studies found that soaring prices for food and fuel over the past decade have had a bigger impact on struggling families who spend more of their budgets on staple goods. By contrast, richer households had been the beneficiaries of the drop in mortgage rates and lower motoring costs. The study by the IFS for the Joseph Rowntree Foundation said the government method for calculating absolute poverty – the number of people living below a breadline that rises each year in line with the cost of living – assumed that all households faced the same inflation rate. But in the six years from early 2008 to early 2014, the cost of energy had risen by 67% and the cost of food by 32%. Over the same period the retail prices index – a measure of the cost of a basket of goods and services – had gone up by 22%.

The IFS report said the poorest 20% of households spent 8% of their budgets on energy and 20% on food, while the richest 20% spent 4% on energy and 11% on food. Poorer households allocated 3% of their budgets to mortgage interest payments, which have fallen by 40% since 2008 due to the cut in official interest from 5% to 0.5%. Richer households spend 8% of their budgets on servicing home loans. As a result, the IFS concluded that since 2008-09 the annual inflation rate faced by the poorest 20% had been higher than it was for the richest 20% of households. That meant the official measure of absolute poverty understated the figure by 0.5% – or 300,000. The report said, however, that poverty had not been systematically understated, and that in earlier years absolute poverty would have been lower using its new definition based on the different inflation rates facing rich and poor.

Word.

• The Trouble With Mass Delusions (Paul Singer)

The trouble with mass delusions is that they are recognized as such only when they are over – when the dazzling absurdity of certain widely held beliefs is unmasked by subsequent events. Interestingly, many delusions relate to war. At the beginning of World War I, there was a widespread misconception that the war would be over in months. In hindsight, this delusion was fueled by a deep misunderstanding, among citizens and military experts alike, of the impact that evolving technology would have on modern warfare. Parenthetically, we would argue that the current drawdown of military capability throughout the developed world is based on a delusion that ignores thousands of years of immutable, or at least always repeating, human history of almost continuous (in the grand scheme of things) warfare. Economics also provides its share of delusions, including the debt-fueled bubbles of both the 1920s stock market and the first dotcom boom.

The real estate boom of the 2000s was another one, as excess demand was fueled by the combination of near-free money, the most marginal financial products ever invented, and the frenetic selling of houses to people who could not afford them and did not actually own them in any meaningful sense of the word. These examples are easy, because they were mass beliefs that were unreasonable in the extreme at the time they were held. Of course, at the time not everyone held the same deluded views, but the disbelievers were (and always are) discredited, demoralized and ignored while the delusions were alive. The problem is that while the delusions remain intact there is no proof available to convince the believers of their folly. Simply repeating that a mass belief is crazy does not make it so (nor convince anyone else that it is nuts). Furthermore, the amount of time necessary to reveal the truth is sometimes too long for nonbelievers to bear, so they just stop trying.

There is a current set of delusions that is powerful and dangerous: that monetary debasement can be infinitely pursued without negative consequences; that the financial system is now solid and sound; that the low volatility and high prices of stocks, high-end real estate and bonds are real; that bonds are a safe haven; and that large financial institutions which get into trouble in the future can be unwound in a much safer way than they could be in 2008 We have discussed each of these elements in the pages of this report and previous ones in an attempt to reveal the fallacy and unsustainability of such beliefs. But, as stated above, they will only enter the history books as mass delusions if they are unmasked in the future as unjustifiable and erroneous beliefs at the time they were held. We think that test will be met, perhaps soon.

Yeah, we reallly need to prepare for more transport and bigger ships and more trade and what not, in the face of peak oil. We are so smart it hurts. But the techno happy majority among us will not be stopped by anything but harsh reality.

• Uncertainties Surround Nicaragua’s New Panama Canal Competitor (Spiegel)

Wearing orange overalls and sun hats, the Chinese arrived in Río Brito by helicopter before being escorted by soldiers to the river bank – right to the spot where José Enot Solís always throws out his fishing net. The Chinese drilled a hole into the ground, then another and another. “They punched holes all over the shore,” the fisherman says. He points to a grapefruit-sized opening in the mud, over one meter deep. Next to it lie bits of paper bearing Chinese writing. Aside from that, though, there isn’t much else to see of the monumental and controversial project that is to be built here: The Interoceanic Grand Canal, a second shipping channel between the Atlantic and Pacific. The waterway is to stretch from Río Brito on the Pacific coast to the mouth of the Punta Gorda river on the Caribbean coast. Beyond that, though, curiously little is known about the details of the project.

Only Nicaraguan President Daniel Ortega and his closest advisors know how much money has already been invested, what will happen with the people living along the route and when the first construction workers from China arrive. Studies regarding the environmental and social impact of the undertaking don’t exist. The timeline is tight. The first ship is scheduled to sail into Río Brito, which will become part of the canal, in just five years. When completed, the waterway will be 278 kilometers (173 miles) long, 230 meters (755 feet) wide and up to 30 meters (100 feet) deep, much larger than the Panama Canal to the south. A 500-meter wide security zone is planned for both sides of the waterway. And it will be able to handle enormous vessels belonging to the post-panamax category, some of which can carry more than 18,000 containers.

Thus far, only a few dozen Chinese experts are in Nicaragua and have been carrying out test drilling at the mouth of the river since the end of last year. They are measuring the speed at which the river flows, groundwater levels and soil properties. Not long ago, police established a checkpoint at the site and it is possible that the entire area will ultimately be closed off. For now, though, the region remains a paradise for natural scientists and surfers. Sea turtles lay their eggs on the beach and a tropical dry forest stretches out behind it to the south, reaching far beyond the border into Costa Rica. But if the river here is dredged and straightened out as planned, the village on Río Brito will cease to exist.

” .. only 11 countries in the world are not involved in any conflict – despite this being “the most peaceful century in human history.”

• What’s The Environmental Impact Of Modern Warfare? (Guardian)

UN secretary general Ban Ki-moon has called on nations to do more to protect the environment from the devastation wrought by warfare. “The environment has long been a silent casualty of war and armed conflict. From the contamination of land and the destruction of forests to the plunder of natural resources and the collapse of management systems, the environmental consequences of war are often widespread and devastating,” said Ban in a statement for the UN’s International Day for Preventing the Exploitation of the Environment in War and Armed Conflict on Thursday. “Let us reaffirm our commitment to protect the environment from the impacts of war, and to prevent future conflicts over natural resources.” War changes our parameters. In the face of actual or perceived threat, acts that would normally be abhorrent become acceptable and even routine. One of the first of our sensibilities to be discarded is the protection of the environment, says Catherine Lutz, a professor on war and its impacts at the Watson Institute for International Studies.

“There is this notion that it is life or death for a nation so you don’t worry about niceties. We have this idea that human beings are separate from their environment and that you could save a human life through military means and military preparation and then worry about these secondary things later,” she says. According to the Institute for Economics and Peace, only 11 countries in the world are not involved in any conflict – despite this being “the most peaceful century in human history”. In war, the environment suffers from neglect, exploitation, human desperation and deliberate abuse. But even in relatively peaceful countries the forces assembled to maintain security consume vast resources with relative impunity. During the first Gulf War, the US bombed Iraq with 340 tonnes of missiles containing depleted uranium. Mac Skelton, a researcher at Johns Hopkins University, has conducted extensive field work in Iraq on the increased rate of radiation-related cancers, which has been linked to the shells used by the US and UK militaries.

Skelton and others suggest the radiation from these weapons has poisoned the soil and water of Iraq, making the environment carcinogenic. The UK government says these accusations are false. No comprehensive study has been done to establish or disprove the link between cancer and depleted uranium weapons.

“The town is probably the most heavily fracked in the country.”

• Texas Oil Town Makes History As Residents Say No To Fracking (Guardian)

The Texas town where America’s oil and natural gas boom began has voted to ban fracking, in a stunning rebuke to the industry. Denton, a college town on the edge of the Barnett Shale, voted by 59% to ban fracking inside the city limits, a first for any locality in Texas. Organisers said they hoped it would give a boost to anti-fracking activists in other states. More than 15 million Americans now live within a mile of an oil or gas well. “It should send a signal to industry that if the people in Texas – where fracking was invented – can’t live with it, nobody can,” said Sharon Wilson, the Texas organiser for EarthWorks, who lives in Denton. An energy group on Wednesday asked for an immediate injunction to keep the ban from being enforced. Tom Phillips, an attorney for the Texas Oil and Gas association, told the Associated Press the courts must “give a prompt and authoritative answer” on whether the ban violates the Texas state constitution.

Athens in Ohio and San Benito and Mendocino counties in California also voted to ban fracking on Tuesday. Similar measures were defeated in Gates Mills, Kent and Youngstown, Ohio, as well as Santa Barbara, California. Denton remains a solidly Republican town, and oil companies reportedly spent $700,000 to defeat the ban, according to the Denton Record-Chronicle – nearly $6 for every resident. “It was more like David and Godzilla then David and Goliath,” Wilson said. But she said residents were fed up with the noise and disruption of fracking, and the constant traffic and fumes from wells and trucks operating in residential neighbourhoods. The town is probably the most heavily fracked in the country.

Home › Forums › Debt Rattle November 6 2014