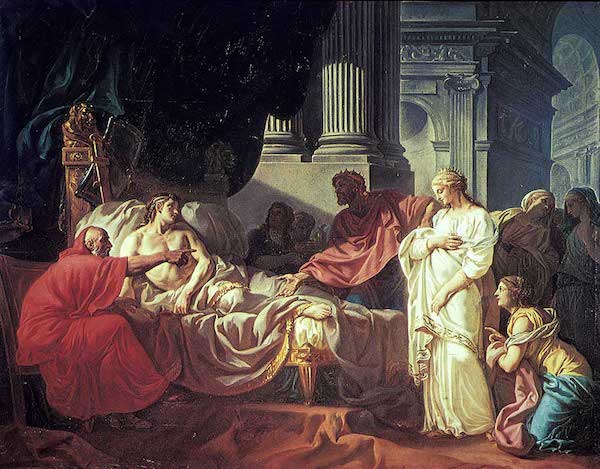

Jacques-Louis David Erasistratus Discovering the Cause of Antiochus’ Disease 1774

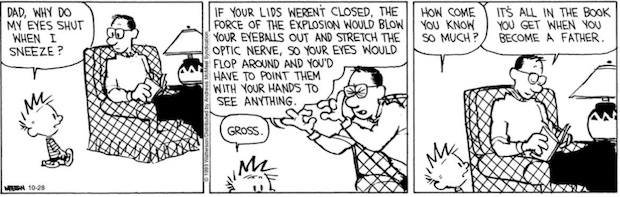

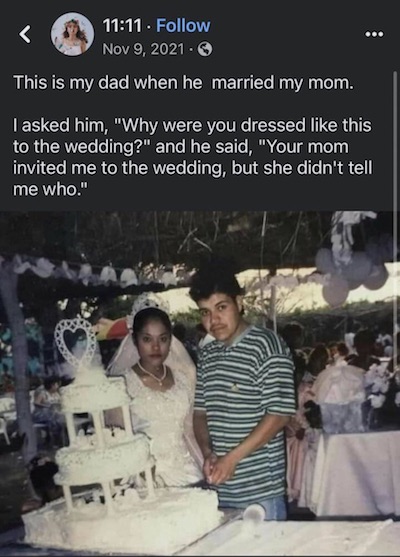

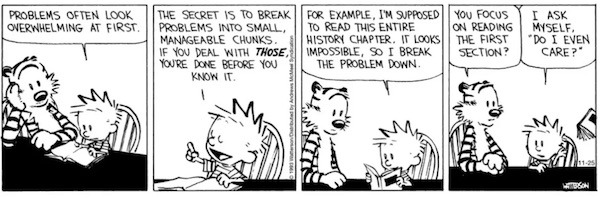

Tuberville

Tuberville: “Chuck Schumer, Nancy Pelosi and Obama have been running the country… they’ve had total control. Not the president."

— Paul A. Szypula 🇺🇸 (@Bubblebathgirl) July 7, 2024

Biden chip

I was just watching this clip over again and while I keyed in on his NATO comments on first listen, upon second hearing, he takes credit for inventing the computer chip

He even repeats it at the end pic.twitter.com/BhgXV2Es5q

— Jack Poso 🇺🇸 (@JackPosobiec) July 6, 2024

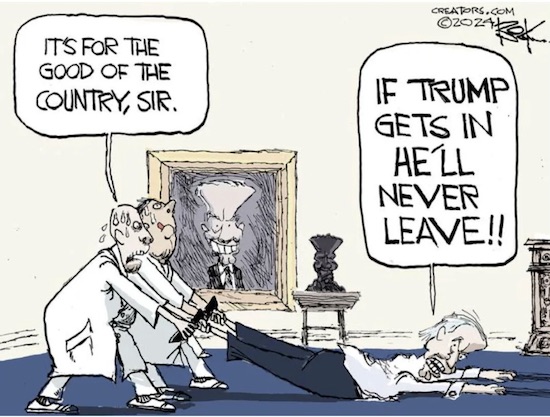

Megyn

NEW: Megyn Kelly appears to stop short of calling First Lady Jill Biden a "power-hungry b**ch" for keeping her husband in office despite his clear mental decline.

Kelly accused the renowned Doctor of using her husband to fulfill her desire for power.

"She has been exposed as a… pic.twitter.com/qrcpkElTBb

— Collin Rugg (@CollinRugg) July 7, 2024

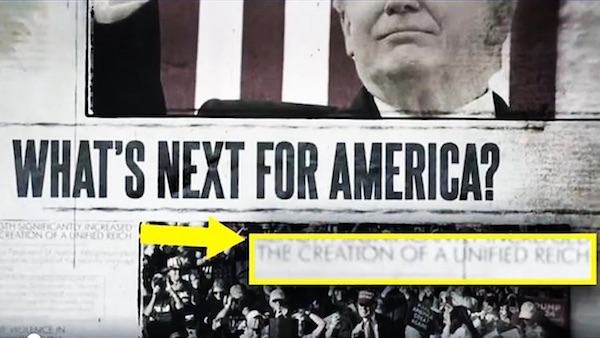

Obamagate

Twitter, under Jack Dorsey, took this video down, which chronicles the unmasking of General Flynn by the Obama FBI and the attempted coup on a duly elected president

— @Community Notes (@MoreXProtection) July 6, 2024

Pope

Archbishop Carlo Maria Viganò, excommunicated from the Church by order of Pope Francis, issued a grave warning, alleging that the pope is an enthusiastic collaborator in the Great Reset.

He claims that the pope's goal is to dismantle the Church and replace it with an… pic.twitter.com/u5wM9hIC8D

— Shadow of Ezra (@ShadowofEzra) July 6, 2024

Biden ABC full interview

“..a lot of people don’t understand is that Barack Obama and the Clintons and Biden don’t have a great relationship..”

• Democratic Party ‘Clans Clash’ in Wake of Biden’s Debate Performance (Sp.)

A Wall Street Journal poll conducted in the wake of Joe Biden’s debate against Trump – his first of the 2024 election cycle – showed that 80 percent of the nation’s voters think the Democrat is too old to run for a second term. Fissures are growing within the Democratic Party’s three leading clans as Joe Biden refuses to give in to demands to drop out of the 2024 race, the Financial Times has reported. An “already-fractured” Democratic Party is reportedly trying desperately to carry out damage control in the wake of the 81-year-old president’s debate against Trump. But the “historic crisis” that has led to increasing questions regarding his mental acuity has opened up “old wounds and rivalries,” noted the FT. The Democratic Party is described as witnessing a raging battle between “three leading clans,” while the Republican Party “has appeared ever more uniform” under Trump.

Some Democrats are ostensibly hoping Biden’s once boss, ex-president Barack Obama, could “usher Biden aside.” However, the outlet cites those from the inner Biden circle as warning that such a step would be “counterproductive.” The reason is that there is supposedly a lingering bitterness among the Bidens after Obama backed Hillary Clinton, and not vice-president Biden to be his successor in 2015. Clinton went on to lose that presidential bid to Trump in 2016. “I think the thing that a lot of people don’t understand is that Barack Obama and the Clintons and Biden don’t have a great relationship,” one Democratic lobbyist was cited as saying. As for Obama himself, during his debut stint as senator representing Illinois from 2005 to 2008 he inflamed the Clintons after he “had the audacity” to challenge Hillary Clinton for the party’s 2008 nomination, reminded the outlet. “There is no unity among Democrats because, basically, the Democratic coalition’s pieces do not share the same values,” party strategist Hank Sheinkopf was cited as saying.

The various degrees of resentment nursed overtly by the Bidens, Obamas and the Clintons come amid a flurry of Democratic politicians, donors, and other supporters calling for the removal of Biden as candidate. Biden – appearing to be confused and incoherent throughout his debate with the Republican frontrunner last Thursday – reinforced ongoing concerns about his cognitive abilities. The president has taken a defiant stance, claiming his debate performance was just a “bad episode.” But 80 percent of the nation’s voters insist that the Democrat is too old to run for a second term, according to a Wall Street Journal poll released on Wednesday. Amid a flurry of reports attempting to suggest possible replacements for Biden, a new campaign has been imploring him to “Pass the Torch.” Hours before Biden was interviewed by ABC News anchor George Stephanopoulos, where he insisted that he will stay in the race, Democratic activists launched a grassroots campaign begging the president to step aside.

They urged him to act on a 2020 pledge to be a “transition” president. “Democrats need the strongest possible ticket to maximize our chances of winning in November. It has become very clear, based on both long-term polling and the recent debate, that Democrats’ current ticket is not the strongest one we can put forward,” said the campaign.

“In a blink, he has gone from “the best Biden ever” to a type of “comatose but comfortable” defense. It is the political version of going from blue chip to junk bond status in a week.”

• Get a Dog: The Political and Media Establishment Turns on Biden (Turley)

Fox host Shannon Bream reported this morning that her staff tried for an entire week to get a single Democrat to go on the show to defend President Joe Biden as the party’s nominee. Not a single Democrat was willing to do so. In the meantime, the New York Times is reporting that a senior White House official is calling for Biden to step down as the nominee due to his declining physical and mental condition. The media, which has long attacked those questioning Biden’s fitness, is now on board with the Democratic establishment in pushing the President to withdraw. The one constant in this ever-changing city is that self-interest alone drives policies and alliances. If you endanger the meal ticket of members of Congress, you are immediately persona non grata. Biden is now threatening Democratic control of both the White House and the Congress. The word is out that Biden has to go so the media is suddenly noticing what it long refused to see.

That goes for staffers too. For years, the staff has engaged in a dishonest effort to shield Biden from questions and to carefully script and choreograph his appearances. Figures like Karine Jean-Pierre and close political allies knowingly misled the public as to the President’s deteriorating condition. Even after telling the public to watch the President in interviews, it was revealed this weekend that the White House was feeding pre-written questions to favorable hosts. Indeed, the media is actually blaming conservatives for failing to reveal the President’s condition due to their effort to frame the news. The truth is now unavoidable. The President has continued to struggle with clarity, as when he recently declared “by the way, I’m proud to be, as I said, the first vice president, first black woman… to serve with a black president.”

In the case of this high-level White House staffer, he or she also said nothing for months, even as the White House attacked Fox News and other outlets for showing the President’s confusion at public events. They were denounced as “cheap fakes.” This staffer reportedly worked with Biden during his presidency, vice presidency and 2020 campaign. As with the media, however, the staffer now seems to have the green light to kick the President to the curb to strengthen Democratic chances in the upcoming election. The staffer revealed that Biden has repeatedly become confused and weakened in the course of the day. Somehow this is being portrayed as courageous despite the fact that the staffer remained silent as others were attacked for raising these issues and the White House actively hid the President’s declining condition.

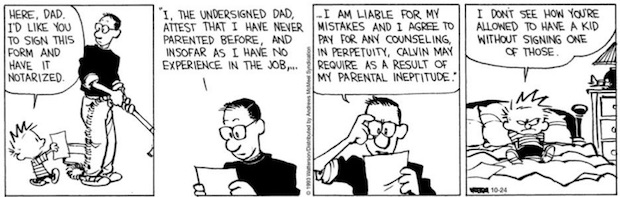

As is often the case, everyone in Washington is jumping ship as the rats run for the poop deck. No one will be held responsible for months and months of misleading the public about the condition of the man who holds the nuclear launch codes. Just weeks ago, the media was heralding the brilliance and sharpness of the President. On MSNBC, Joe Scarborough stated “start your tape right now because I’m about to tell you the truth. And F— you if you can’t handle the truth. This version of Biden intellectually, analytically, is the best Biden ever. Not a close second. And I have known him for years…If it weren’t the truth I wouldn’t say it.” Now, the best that Biden can muster is MSNBC’s Joy Reid who declared “If it’s Biden in a coma, I’m going to vote for Biden in a coma. I don’t even really, in particular, like the guy. A lot of his policies? Don’t like them, [but] he’s not Donald Trump, right?”

Now there’s a roaring endorsement. The comatose POTUS pitch. Rep. Dan Goldman (D., N.Y.) threw in his own damning defense by saying that the public should just look at the people around the President, a type of figurehead rationale for keeping a possibly infirm president. As usual, it is the public that has been played as chumps by the establishment and the media. The public is expected to forget the years of shielding Biden and the many public testimonials of his wickedly sharp acumen. In a blink, he has gone from “the best Biden ever” to a type of “comatose but comfortable” defense. It is the political version of going from blue chip to junk bond status in a week.

“..moderated by celebrities like Oprah Winfrey, Taylor Smith and Michelle Obama..”

“Democratic Party luminaries are likely to continue to stick with Biden, maintaining their influence within the organization even if it means defeat in November.”

• ‘Blitz Primary’ Proposed as Democratic Insiders Dissatisfied With Biden (Sp.)

Two Democratic insiders have proposed a novel idea to address the “malaise and crisis” within the party amid questions over US President Joe Biden’s age and mental acuity. Ted Dintersmith, a wealthy party donor, and Rosa Brooks, a law professor and veteran of former President Barack Obama’s Defense Department, have proposed a whirlwind “blitz primary” to rapidly choose a replacement for the elderly party leader. The plan suggests Democratic Party leaders could choose six candidates, who would run brief “positive-only” campaigns putting forward their case for why they should be the party’s nominee. Weekly events would be held where the candidates put forward their ideas and vision, moderated by celebrities like Oprah Winfrey, Taylor Smith and Michelle Obama in order to stir voter interest. After one month’s time the party leaders would vote to select a ticket from the group of contenders, making the decision before the start of the Democratic National Convention on August 19.

The insiders claim the ploy would reinvigorate interest in the party and revive its electoral chances, which suffered a steep decline after Biden’s widely-panned performance at June 27th’s televised debate. “We can limp to shameful, avoidable democracy-ending defeat,” Brooks and Dintersmith reason, “or Democrats can make this Our Finest Hour. While we hope for help from Lord Almighty, the Lord helps those who help themselves. We need to act. Now.” Observers suggest the idea is unlikely to gain traction as it would require the blessing of Biden, who has insisted he will continue his candidacy unless instructed otherwise by God himself. It would also require Kamala Harris to surrender her assumed right to top the ticket as the current Vice President. The appearance of the party passing over a Black and female presumptive nominee could cause lasting controversy among core Democratic Party constituencies, critics say.

What the plan has going for it, in the likely view of Democratic Party figures, is that it avoids the pesky issue of having to put the question to actual voters. Democratic Party delegates – the typically well-connected insiders chosen after state primaries or granted influence by virtue of their status in the party – would both choose the list of candidates and make the final decision once they are heard. Leaked emails published by Wikileaks after 2016’s contentious party primary revealed insiders intervened heavily to tilt the process in favor of former candidate Hillary Clinton and against Vermont Senator Bernie Sanders. In 2020, when Sanders again appeared to be in a strong position to win the party’s nomination, former President Barack Obama reportedly intervened behind the scenes to encourage multiple candidates to drop out and throw their support behind Biden instead.

The sudden surge of publicity for Biden, and stern warnings over the consequences of choosing Sanders, convinced voters to turn towards the former Obama vice president after Sanders’ victories in the first three state primaries had made his victory appear inevitable. The heavy hand of insiders in the candidate selection process – and series of highly questionable excuses offered to supporters for Biden’s disastrous debate performance – suggest the Democratic Party hardly lives up to its name. If some DNC figures remain concerned over the electoral chances of Joe Biden, they are terrified of losing control of the party to its voters, who may choose to back a forbidden candidate. All of which suggests Democratic Party luminaries are likely to continue to stick with Biden, maintaining their influence within the organization even if it means defeat in November.

“The US president’s team has claimed “it is not at all uncommon” for guests to share topics they would prefer to discuss with journalists..”

• Biden Campaign Fed Questions For ‘I’m A Black Woman’ Interview (RT)

The first journalists to interview US president Joe Biden after his disastrous performance in the June 27 debate against Donald Trump have said that they were given lists of approved questions by his campaign staff. Biden made appearances on radio shows with largely black audiences in Wisconsin and Pennsylvania on Thursday, a week after his face-off with Trump, in which the 81-year-old president appeared frail and lost his train of thought on multiple occasions. The interviews were used to show Biden’s doubters, especially in his own Democratic Party, that he is mentally and physically able for a reelection campaign and capable of discussing his record and answering questions coherently. However, the radio appearances were marred with more gaffes, with the president, among other things, describing himself as a “black woman.” “By the way, I’m proud to be, as I said, the first vice president, first black woman… to serve with a black president. Proud to be involved of the first black woman on the Supreme Court.

There’s so much that we can do because… look, we’re the United States of America,” Biden said on The Earl Ingram Show on Wisconsin’s CivicMedia. Host Earl told AP on Saturday that the Biden campaign gave him five “exact questions to ask” ahead of the interview. “There was no back and forth,” he added. “I probably would never have accepted, it but this was an opportunity to talk to the president of the United States,” Ingram explained. A few hours earlier, Andrea Lawful-Sanders, the host of The Source, a program on WURD in Pennsylvania, told CNN that “the questions were sent to me for approval; I approved of them” ahead of the interview with Biden. The Biden campaign’s spokeswoman, Lauren Hitt, confirmed the radio hosts’ claims, saying in a statement that “it is not at all an uncommon practice for interviewees to share topics they would prefer. These questions were relevant to news of the day.”

“We do not condition interviews on acceptance of these questions, and hosts are always free to ask the questions they think will best inform their listeners,” Hitt stressed. A source within Biden’s team told CBS News that it “will refrain from offering suggested questions” to journalists in his future interviews. A poll by Reuters/Ipsos revealed that one in three Democrats believes that Biden should quit the race after his debate performance, while some key donors have reportedly demanded that the president be replaced on the party’s ticket. In his interview with ABC News on Friday, Biden rejected the possibility of stepping down, insisting that he was “the most qualified person” to defeat Trump.

https://twitter.com/i/status/1809619673748529338

Everybody loves me!

• Biden Refuses To Believe Poll Numbers (RT)

US President Joe Biden said he does not accept polling data showing a slump in support, speaking in a televised interview on Friday. During the sit-down, ABC host George Stephanopoulos said: Mr. President, I’ve never seen a president with 36% approval get reelected.” Biden replied: “Well, I don’t believe that’s my approval rating. That’s not what our polls show,” without specifying which polling data he was relying on. A New York Times/Siena College poll released on Monday found that 36% of likely voters approve of the way Biden is handling his job as president. On voter intentions, the same survey showed Trump leading Biden with 49% to 43%, widening the gap from a 3-point lead before the debate.

“Look, you know polling better than anybody. Do you think polling data is as accurate as it used to be?” the US leader parried when Stephanopoulos insisted that Biden was close but still behind Trump even before going into the debate. Biden insisted that there’s nobody “more qualified to be president or win this race than me” and said he would not drop out, even if top Democratic leaders asked him to, claiming that only “the Lord Almighty” could convince him to step aside. Biden is struggling to dispel concerns over whether he is mentally and physically capable of leading the country for another four years following his halting performance in a televised debate against Republican rival Donald Trump.

The oldest US president in history appeared so frail and confused throughout the encounter last week that a survey conducted by CBS News/YouGov shortly afterwards found that 72% of registered voters do not believe Biden has the “mental and cognitive health necessary to serve as president.” A Suffolk University/USA TODAY poll published on Tuesday found Trump beating Biden by 3 percentage points, while a survey conducted for CNN by SSRS put Trump 6 points in the lead. A separate Bloomberg News/Morning Consult tracking poll showed Biden narrowing the gap over the past week and now losing “by only 2 percentage points” in the critical swing states needed to win the November election. Overall, less than one in five respondents in those states thought the 81-year-old was the “more coherent, mentally fit or dominant participant” of the debate.

“A president’s failure to use due care or be loyal is ground for impeachment..”

• President Biden Must Resign, or Be Impeached (Young)

President Biden’s duty to the American people is to “faithfully execute” his office. As a public trustee, Biden took an oath to do what is right. He is a trustee of powers bestowed upon him by the Constitution in return for his promise to be dutiful. Like every agent and trustee, Biden owes fiduciary duties to those who are served by his decisions. He owes them two duties: the duty of always acting with due care; and the duty of giving them his absolute loyalty, always putting their interests above his own. A president’s failure to use due care or be loyal is ground for impeachment. Under our Constitution, impeachment for “high crimes and misdemeanors” is not a criminal proceeding. Rather, it is a civil proceeding to discharge from office one who has failed in his or her trusteeship.

John Locke put it this way: “Who shall be judge, whether the prince or legislative act contrary to their trust? … To this I reply, The people shall be judge; for who shall be judge whether his trustee or deputy acts well, and according to the trust reposed in him, but he who deputes him, and must, by having deputed him, have still a power to discard him, when he fails in his trust? If this be reasonable in particular cases of private men, why should it be otherwise in that of the greatest moment, where the welfare of millions is concerned, and also where the evil, if not prevented, is greater, and the redress very difficult, dear, and dangerous?”

More than 50 years ago, when the impeachment of Richard Nixon was under consideration in the House of Representatives, I researched the English parliamentary practice of impeaching high officers for “high crimes and misdemeanors.” The lead special counsel in the impeachment proceeding, John Doar, incorporated my conclusions into the articles of impeachment of Richard Nixon in these words: In all of this, Richard M. Nixon has acted in a manner contrary to his trust as President and subversive of constitutional government, to the great prejudice of the cause of law and justice and to the manifest injury of the people of the United States. Wherefore Richard M. Nixon, by such conduct, warrants impeachment and trial, and removal from office.

The same standard of abuse of fiduciary duties was later included in the articles of impeachment of Donald Trump: “In all of this, President Trump has acted in a manner contrary to his trust as President and subversive of constitutional government, to the great prejudice of the cause of law and justice, and to the manifest injury of the people of the United States.” As we saw last Thursday, President Biden is no longer capable of acting with due care as steward of the best interest of the American people. He appeared physically and cognitively inept. His answers to simple questions were nonsensical. Even Nancy Pelosi wondered aloud, “Is this an episode or is this a condition?”

For Biden to remain in office, he will not be faithfully executing it. Rather, he will be using the powers of the office for self-serving ends, depriving the American people of a vigorous defender of our rights and privileges. If Biden does not resign immediately, he has committed an impeachable offense by causing “manifest injury of the people of the United States.” Should Biden attempt to have his cake and eat it too, he might withdraw his candidacy for this year’s presidential election but not resign as president. If he affirms that he would not be qualified to execute the office of president in January 2025, then why is he qualified to serve in that office today? To withdraw from the presidential race but continue in office would be a violation of his duty of loyalty to the American people. Joe Biden made a choice when he took the oath of office to serve as our president. If he can no longer be loyal or serve with due care, then he must resign his office or be impeached.

Very few saw that coming..

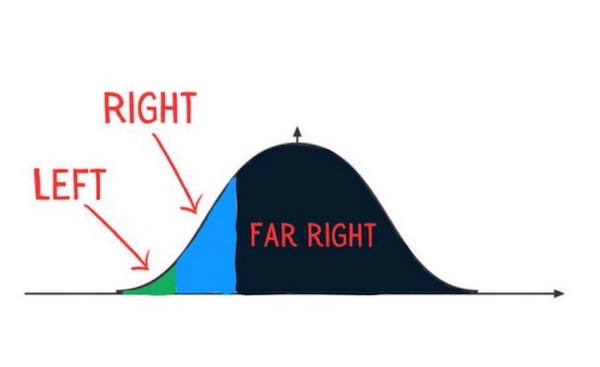

• Leftist Coalition Set For Shock Victory In French Election (ZH)

Well, no one saw that coming… The last-minute-arranged broad left-wing coalition known as The New Popular Front (NFP), was leading a tight French legislative election Sunday, ahead of both President Emmanuel Macron’s centrists and Le Pen’s rightists, projections showed. Provisional estimates from four pollsters suggest the following seat projections: • Left Alliance Set for 170-215 Seats • Macron’s Group Set for 150-182 Seats • Le Pen’s Group Set for 110-158 Seats. It looks like the anti-National Rally front worked better than anyone expected, catching the polling companies by surprise. The projected results suggest that the co-ordinated anti-RN strategy, under which the left and center tactically withdrew their candidates from run-offs, had paid off. If confirmed in final voting tallies, the projections suggest that none of the three main blocs will be able easily to command a governing majority, potentially leaving France in a period of political gridlock.

There are some big barriers to that given that Macron himself has called France Unbowed – a big part of the left’s New Popular Front – an extremist party and some of his supports have called against voting for its candidates. AP reports that the French leftist leader,Jean-Luc Melenchon says elections are an “immense relief for a majority of people,” demands prime minister resign. Melenchon says the New Popular Front government would apply its program and nothing but the program as he refuses any negotiation with Macron’s party or any combination. As Bloomberg reports, that theoretically would mean some disruptive changes of economic policy, and by decree according to Melenchon: • Undoing the pension reform; • raising the minimum wage; • a 90% top marginal tax rate; • and freezing prices of some consumer staples. Not a pretty picture for French bonds either way.

Andrea Tueni, head of sales trading at Saxo Banque France: “This is a big surprise, it’s a real blow for the RN. That being said, it’s not necessarily good for markets: The Nouveau Front Populaire taking the lead could generate concerns due to their program which was the most poorly perceived by the markets.” French National Rally Leader Jordan Bardella warns this vote “has thrown France into the arms of the far-Left.” As @RUNews posted on X: “Macron now faces a total mess. He aimed to stop ‘Hitler’ party and mobilized Lenin (Mélenchon), but now he has both Lenin and Hitler, leaving him stuck in the middle.” Presumably all the globalist fear mongering over the so-called ‘Hitler-ite’ Le Pen pushed the French people back into the immigrant-loving arms of the Left? Or something else went down?

If there is a coalition at all..

• New French Governing Coalition Will Likely Be ‘Fragile’ (Sp.)

Assessing the results of the second round of the snap parliamentary elections in France, it can be assumed that the outcome will create a serious governance problem in the country. The future governing coalition will likely be fragile and society will be characterized by greater political polarization, chairman of Rome-based think tank Vision and Global Trends Tiberio Graziani told Sputnik. “Economic problems will worsen. It will be three years of political crisis,” he said. France is already going through a political crisis, both internally and within Europe. The elections show that the country is facing political, economic and social crises.

The same can be said about other European nations, like Germany, the expert added. Jean-Luc Melanchon’s left-wing New Popular Front coalition won the parliamentary elections, securing 182 seats (out of 577) in the French parliament. President Emmanuel Macron’s bloc gained 168 seats. Marine Le Pen and Jordan Bardelle’s National Rally got 143 parliamentary seats.

And then she loses…

• How ‘Putin Endorsed Le Pen’: Russiagate Comes To France (Amar)

It is perfectly predictable and yet a sorry spectacle every time it happens: the great big bad Russia panic whenever, and that’s frequently nowadays, Western liberals and Centrists are losing their grip. This time it’s the turn of France. With the far-right/right-populist National Rally (RN) under Marine Le Pen and Jordan Bardella succeeding at the polls as never before, French and other Western mainstream media are serving up the same stale old dish of fearmongering and, most importantly, blame shifting.Russiagate, or really Russia Rage (as in Road Rage), and its many copies, have been with us since Hillary Clinton and her cult were incapable of facing the fact that she lost the 2016 US presidential election because she is a dreadful person with no redeeming graces – and unlike her naturally gifted if shifty and immoral husband, a catastrophically incompetent politician.

And like every good form of insanity, Russia Rage is absolutely immune to both falsification and its own record of failure, even as a piece of demagoguery. We know that the only real scandal about “Russiagate” was that it was a hoax, the result of massive exaggeration, outright lying, and all-round manipulation by Democratic party operatives and their media allies. We also know that it did not even work on its own dishonest terms. Russia Rage was, in American journalist Matt Taibbi’s words, an “epic disaster.” Indeed, if it had any political effect, then to ultimately help – not damage – its target, Donald Trump: Almost a decade after the inception of the “Russiagate” hoax, Trump is back, stronger than ever and set to capture the American presidency again. And this time, his organization and plans are much more elaborate and ambitious, and, just now, obliging conservative judges at the Supreme Court have also equipped him with almost perfect legal immunity.

The other thing that Russia Rage did accomplish is, of course, to massively damage the credibility of US mainstream media. Not that they ever deserved any (ask the Iraqis, for instance, owners of non-existent WMDs and victims of an absolutely illegal and devastating war of aggression based on a big fat lie eagerly supported by those media). But Russia Rage brought the lying home in a way that woke up many Americans. By 2022, US media credibility was the lowest “among 46 nations, according to a study by the Reuters Institute for the Study of Journalism.” One year before, “83 percent of Americans saw ‘fake news’ as a ‘problem,’ and 56 percent – mostly Republicans and independents – agreed that the media were “truly the enemy of the American people.”

And yet, here we go again. In best Russia Rage style, the Washington Post, relying unquestioningly on French intelligence services and, of course, anonymous “sources,” is mapping out a whole “ecosystem” of Russian influence campaigns targeting, it maintains, the French election as well as the Olympics. And not only now but for about a year already. One wonders how those wicked Russians foresaw Macron’s bizarre decision to cap his EU Parliament election failure with a snap legislative election at home to make the fiasco complete. Or, perhaps, must we now assume that Macron is working for Russia as well? Who knows? The French paper of record Le Monde has been keeping up a steady, ominous drumbeat for months already, keeping its readers on edge with tales of Russian subversion and, always, of course, the National Rally as its tool. Perish the thought that this could have anything to do with the RN being the most popular and most dangerous challenger to the Macronist regime of extreme Centrism.

” Idealists who seek to transcend power politics and create a more benign world thus find themselves intensifying the security competition and instigating wars.”

• A Nation In Pain: How Political Idealism Destroyed Ukraine (Glenn Diesen)

Political realism is commonly and mistakenly portrayed as immoral because its principal focus is on an inescapable security competition, and it thus rejects idealist efforts to transcend power politics. Because states canot break away from security competition, morality for the realist entails acting in accordance with the balance of power logic as the foundation for stability and peace. Idealist efforts to break with power politics can then be defined as immoral, as they undermine the management of the security competition as the foundation of peace. As Raymond Aron expressed in 1966: “The idealist, believing he has broken with power politics exaggerates its crimes.”The most appealing and dangerous idealist argument that destroyed Ukraine is that it has the right to join any military alliance it desires.

It is a very attractive statement that can easily win support from the public, as it affirms the freedom and sovereignty of Ukraine, and the alternative is seemingly that Russia should be allowed to dictate Ukraine’s policies. However, arguing that Ukraine should be allowed to join any military alliance is an idealist argument, as it appeals to how we would like the world to be, not how the world actually works. The principle that peace is derived from the expansion of military alliances without taking into account the security interests of other great powers has never existed. States such as Ukraine that border a great power have every reason to express legitimate security concerns, but inviting a rival great power such as the US into its territory intensifies the security competition. Is it moral to insist on how the world ought to be when war is the consequence of ignoring how the world actually works? The alternative to expanding NATO is not to accept a Russian sphere of influence, which denotes a zone of exclusive influence.

Peace is derived from recognizing a Russian sphere of interests, which is an area where Russian security interests must be recognized and incorporated rather than excluded. It did not use to be controversial to argue that Russian security interests must be taken into account when operating on its borders. This is why Europe had a belt of neutral states as a buffer between East and West during the Cold War to mitigate the security competition. Mexico has plenty of freedoms in the international system, but it does not have the freedom to join a Chinese-led military alliance or to host Chinese military bases. The idealist argument that Mexico can do as it pleases implies ignoring US security concerns, and the result would likely be the US destruction of Mexico. If Scotland secedes from the UK and then joins a Russian-led military alliance and hosts Russian missiles, would the English still champion the principle of consent?

When we live in a realist world and recognize that security competition must be mitigated for peace, then we accept a security system based on mutual constraints. When we live in the idealist world of good states versus evil states, then the force for good should not be constrained. Peace is then ensured when good defeats evil, and compromise is mere appeasement. Idealists who seek to transcend power politics and create a more benign world thus find themselves intensifying the security competition and instigating wars.

“Hungarian FM Warns EU Politicians Will Have to ‘Buckle Up”

• Orban’s Peace Mission Continues (Sp.)

Hungarian Foreign Minister Peter Szijjarto on Sunday suggested that European politicians “buckle up” ahead of Hungary’s further actions aimed at promoting peace. Hungarian Prime Minister Viktor Orban visited Russia on Friday to hold talks with Russian President Vladimir Putin. Orban described his visit as a continuation of his “peace mission” after a visit to Kiev, which took place on Tuesday. He has also announced more surprising meetings next week. Orban’s activity, however, sparked criticism from the EU authorities. “We are not deterred or discouraged by these attacks [by the EU officials]. The peace mission continues and even intensifies, so I suggest that European pro-war politicians buckle up and follow closely next week as well,” Szijjarto said in a video address on his social media.

The criticism Hungary faced during this week showed that the crisis in the European Union is being fueled by politicians who are supplying Ukraine with weapons, mulling sending troops there, and talking about nuclear weapons, he added. Hungary’s six-month presidency of the EU Council, which started on July 1, will be dedicated to the country’s peace mission, the top Hungarian diplomat said. Budapest will do everything it can to put an end to the Ukrainian conflict and to get Europe out of its “suffocating military crisis,” he added.

Orban behaves like a true EU leader.

• Xi Jinping Welcomes Viktor Orban To Beijing (RT)

Chinese President Xi Jinping has held a meeting with Hungarian Prime Minister Viktor Orban, who is in Beijing on what he has dubbed a “peacekeeping mission,” Xinhua reported on Monday morning. “China is a key power in creating the conditions for peace in the Russia-Ukraine war. This is why I came to meet with President Xi in Beijing, just two months after his official visit to Budapest,” Orban wrote in a post on X (formerly Twitter). Details of the meeting have yet to be revealed, but it follows Orban’s trips to Kiev and Moscow last week. The Hungarian prime minister called the Beijing trip a “peace mission 3.0” upon his arrival.

Orban embarked on an unannounced trip to Kiev last Tuesday, where he proposed a “quick ceasefire” to Ukrainian leader Vladimir Zelensky. Orban then traveled to Moscow to discuss the “shortest way out” of the conflict with Russian President Vladimir Putin. Moscow’s and Kiev’s positions remain very “far apart,” according to the Hungarian leader, who noted that Zelensky “didn’t like” his proposals. Meanwhile, Putin reiterated Moscow’s readiness to resolve the hostilities through negotiations, but said the Ukrainian leadership appears committed to waging war “until the end.” Orban’s meeting with Putin angered some fellow EU leaders, while Kiev expressed fury that the Hungarian leader had traveled to Russia “without approval or coordination with Ukraine.”

Hannibal.

• Israel Deliberately Killed Own Citizens on October 7 – Report (Sp.)

A report in the Israeli newspaper Haaretz has claimed the IDF invoked the controversial Hannibal directive during Hamas’ October 7 attack last year, deliberately killing Israelis to prevent them from being taken hostage by Palestinian fighters. “Documents and testimonies obtained by Haaretz reveal the Hannibal operational order, which directs the use of force to prevent soldiers being taken into captivity, was employed at three army facilities infiltrated by Hamas, potentially endangering civilians as well,” read an article in the liberal paper’s Sunday edition. “‘Not a single vehicle can return to Gaza’ was the order,” writes journalist Yaniv Kubovich. “At this point, the IDF was not aware of the extent of kidnapping along the Gaza border, but it did know that many people were involved. Thus, it was entirely clear what that message meant, and what the fate of some of the kidnapped people would be.”

The newspaper notes the exact number of Israelis killed by IDF fire is unknown. The report cites testimony from servicemembers up and down the IDF chain of command, including soldiers and mid- and senior-level officers. Highly controversial within and outside of Israel, the so-called Hannibal directive was devised in response to the threat of armed groups gaining leverage over the Israeli state through the taking of hostages. Palestinian forces took several Israelis captive during the 1970s and 80s, successfully negotiating the release of Palestinian prisoners in return. The notion Israelis were “better dead than abducted” led to the creation of the protocol, which allowed the use of deadly force. Claims of the invocation of the Hannibal directive on October 7 were made months ago when it was revealed an IDF brigadier general instructed a tank to shell a house in Kibbutz Be’eri with a number of Israelis and Hamas fighters inside, killing 13 Israeli captives.

But Sunday’s report is the most complete accounting to date of accusations of friendly fire. The allegations add to claims Israeli Prime Minister Benjamin Netanyahu has deliberately placed Israeli citizens in harm’s way in order to pursue the Likud party’s vision of territorial maximalism. The response to Hamas’ October 7 attack was reportedly delayed for hours because Netanyahu had redeployed soldiers to support Jewish settlers in the occupied West Bank. Netanyahu’s government received urgent warnings from Egyptian authorities in the months leading up to Hamas’ attack that the Palestinian group was likely planning a significant armed operation, it has been revealed. Israeli reconnaissance of the Gaza Strip, broadly considered “one of the most heavily surveilled places in the world,” showed Palestinian fighters were training in the use of hang gliders that were used to breach the enclave’s border fence.

And perhaps a currency.

• BRICS To Launch Independent Financial System – Moscow (RT)

Countries of the BRICS economic bloc are currently working on the launch of a financial system that would be independent of the dominance of third parties, according to the Russian Ambassador to China Igor Morgulov. The volume of Russia’s transactions in national currencies with fellow BRICS nations is constantly growing, the envoy said on Saturday in Beijing, speaking at the 12th World Peace Forum (WPF). Morgulov highlighted that Russia-China trade turnover had reached $240 billion and that 92% of settlements were being conducted in rubles and yuans. “We are leaving the dollar-dominated space and developing the mechanism and tools for a truly independent financial system,” the ambassador said, as cited by RIA Novosti.

Morgulov also said that introducing a new single currency is still some way off but stressed that the group – which recently expanded and now comprises Brazil, Russia, India, China, South Africa, Ethiopia, Iran and Egypt – is “moving in this direction.” Last month, Russia’s Deputy Finance Minister Ivan Chebeskov told media that Russia was working on creating a settlement-and-payment infrastructure together with BRICS member states’ central banks. The senior state official specified that the economic bloc was working on launching the BRICS Bridge platform for settlements in national currencies. In addition, Russian Finance Minister Anton Siluanov told Russian daily Vedomosti that BRICS Bridge could provide member states an opportunity to make settlements using digital assets of central banks linked to national currencies

Russia has been promoting its own domestic payment system as a reliable alternative to SWIFT, after many of the country’s financial institutions were cut off from the Western financial network in 2022. The Russian SPFS interbank messaging system ensures the secure transfer of financial messages between banks both inside and outside the country. Moscow has also accelerated efforts to move away from SWIFT by trading with international partners using their respective national currencies. The trend has been increasingly supported by members of the BRICS group, which have shifted from using the dollar and euro for trade settlements. The share of national currencies in Russia’s settlements with BRICS countries jumped to 85% at the end of 2023, up from 26% two years ago.

“WhatsApp exports your user data every night. Some people still think it is secure..”

• Elon Musk Issues WhatsApp Safety Warning (RT)

Elon Musk, owner of X (formerly Twitter), has again attacked WhatsApp over its handling of personal data. On Saturday, Musk commented on a post on X; one of the users had asked: “If WhatsApp messages are end-to-end encrypted, why do we see ads related to the things we discussed in our chats?” The entrepreneur offered a short answer to the question, saying: “WhatsApp is not secure at all.” Musk had already engaged in an online spat with WhatsApp, which is owned by Mark Zuckerberg’s Meta conglomerate, this May. At the time, he responded to another post on X, which claimed that “WhatsApp exports user data nightly, which is analyzed and used for targeted advertising, making users the product, not the customer.” “WhatsApp exports your user data every night. Some people still think it is secure,” the Tesla and SpaceX CEO said, referring to longstanding concerns about data sharing between WhatsApp and Meta’s other platform, Facebook.

The exchange was noticed by WhatsApp’s head, Will Cathcart, who tried to defend his platform’s conduct. “Many have said this already, but worth repeating: this is not correct. We take security seriously and that’s why we end-to-end encrypt your messages. They don’t get sent to us every night or exported to us,” Cathcart said in his post on X. However, security researcher Tommy Mysk, who also joined the debate, clarified that while messages on WhatsApp might be end-to-end encrypted, “user data is not only about messages.” “The metadata such as user location, which contacts the user is communicating with, the patterns of when the user is online, etc. This metadata according to your privacy policy is indeed used for targeted ads across Meta services,” he said. “So, Elon Musk is right,” Mysk, who had previously uncovered data vulnerabilities in TikTok, Facebook and Apple’s products, wrote.

In 2022, when he was still in the process of purchasing Twitter, Musk argued that Zuckerberg had too much control over social media due to Meta owning Facebook, Instagram and WhatsApp. He called Meta’s CEO “Mark Zuckerberg XIV” in reference to France’s “Sun King” Louis XIV, who apocryphally claimed to be the state itself and was known for his wealth and authoritarian power. In 2023, the two tech billionaires were on the verge of holding a cage match against each other, but the bout never happened. Relations between Musk and Zuckerberg deteriorated even further after Meta launched Threads last summer, with the platform, which offers a space for real-time online conversations, being seen as a direct competitor to Twitter. Threads garnered 100 million users in the first days after launch, but the public’s interest in the app quickly subsided.

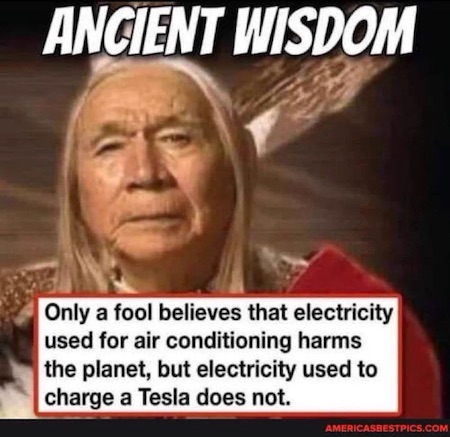

Woody

He’s right. 🎯pic.twitter.com/Fw0DZu0Tt9

— James Melville 🚜 (@JamesMelville) July 7, 2024

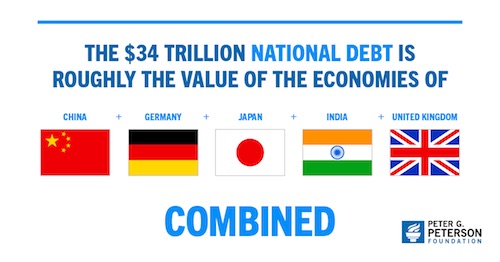

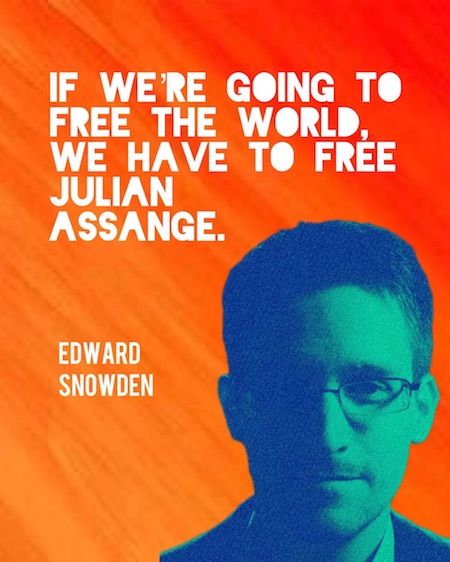

Guns

Absolutely true pic.twitter.com/L1kVp4Wgu4

— Wall Street Silver (@WallStreetSilv) July 7, 2024

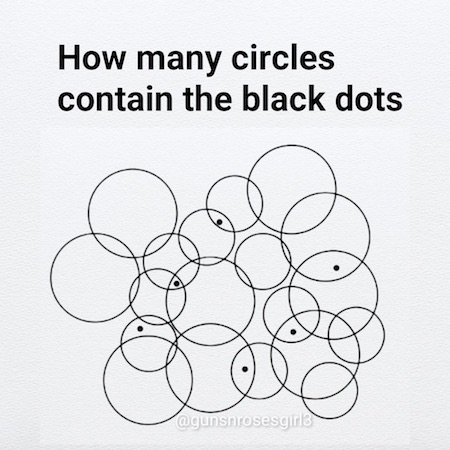

Rescue

This is the moment a surfer is rescued from a colossal wave in Nazare, Portugal

Ramon Laureano on the jet ski races against the crashing wave to safety, both reaching the shore unscathed in one of the most dramatic rescues on film

📹Pedro Miranda

— Science girl (@gunsnrosesgirl3) July 5, 2024

Koala

Mother’s love.. 😊 pic.twitter.com/TEUOYfal7H

— Buitengebieden (@buitengebieden) July 7, 2024

Dick Van Duijn captured the exact moment a squirrel stopped to smell a flower

Dog angry

How dare you! 😂😂 pic.twitter.com/0IaSWUJXD6

— Figen (@TheFigen_) July 7, 2024

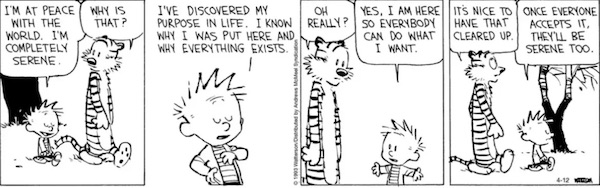

The best

Dogs are the best.. 😊 pic.twitter.com/RNprxwpF7a

— Buitengebieden (@buitengebieden) July 7, 2024

Alpaca

Alpaca without its wool

— Science girl (@gunsnrosesgirl3) July 7, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.