Paul Gauguin Huts under trees 1887

Europe has wintertime, the US does not. I’m in Europe, 70% of readers are in US. Great. Screws me up every single time. Failproof.

“Life really does begin at forty. Up until then, you are just doing research.”

~ Carl Jung

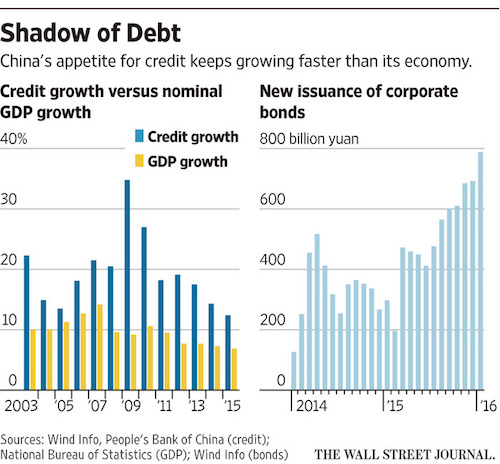

Kerry

John Kerry says he wants the U.S. to spend trillions of dollars to transition the economies of countries all over the world to green energy. pic.twitter.com/Oa4v5dyMsv

— Greg Price (@greg_price11) October 31, 2022

Safe and effective

https://twitter.com/i/status/1581321573646372864

US. Zelensky cannot speak for himself.

• Kremlin Outlines Why Solo Negotiations With Ukraine Are ‘Impossible’ (RT)

Russia is open to negotiations over Ukraine, but any agreement with Kiev would have little credibility because it could be rescinded by the West, Kremlin Press Secretary Dmitry Peskov said on Sunday. This means that any possible settlement should be primarily discussed with the US, he added. Any unilateral diplomatic engagement with Ukraine is unlikely to succeed because “the deciding vote rests with Washington,” the spokesman told Rossiya-1 TV channel. “It’s just impossible to discuss something, for example, with Kiev,” he stated. According to Peskov, while Russia could try to reach some agreements with Ukrainian President Vladimir Zelensky, “based on what happened in March, these agreements are worthless, because they can be instantly canceled upon orders” from outside actors.

The Kremlin press secretary was referring to several rounds of talks that took place in late February and March after Russia launched its military operation against the neighboring state. At the time, these diplomatic efforts failed to cease hostilities. Meanwhile, Peskov signaled that Russian President Vladimir Putin is ready for talks over Ukraine. “The president has repeatedly said he is open to the negotiation process… Whether they are ready or not, but the West should know and hear this,”Peskov reiterated. The official also suggested that Putin and US President Joe Biden could hold negotiations if Washington is willing to take heed of Moscow’s security concerns that were outlined by the Russian Foreign Ministry in the draft documents on security guarantees released in mid-December last year prior to the Ukraine conflict.

Earlier this month, Zelensky signed a decree on Ukraine officially rejecting peace talks with the Russian president. The move came just hours after Putin signed agreements on the Donetsk and Lugansk People’s Republics, as well as Kherson and Zaporozhye Regions joining Russia following referendums that saw overwhelming public support for the move. At the time, Moscow maintained that it is still ready to look for a negotiated solution to the conflict, adding, however, that “it takes two parties to negotiate.”

Moscow’s security concerns. Which were completely ignored a year ago. What are the odds that now they will not be?

• Kremlin Reveals Possible Basis For Putin-Biden Talks (RT)

Potential talks between Russian President Vladimir Putin and his US counterpart Joe Biden would depend on Washington’s willingness to hear Moscow’s security concerns, the Kremlin press secretary said on Sunday. Speaking to the Rossiya-1 TV channel, Dmitry Peskov said high-level re-engagement could happen if the United States “pays heed to our concerns.” It would be contingent on “the US desire to go back to the state of things as of December-January and ask the question: what the Russians are offering may not suit all of us, but maybe we should still sit down with them at the negotiating table?” The spokesman explained that he was referring to the draft documents on security guarantees that Moscow submitted to both Brussels and Washington before the Ukraine conflict broke out in late February. In mid-December last year, the Russian Foreign Ministry published the drafts of two treaties – one with the US and one with NATO – with a list of Moscow’s security demands, in a bid to lower tensions in Europe.

At the time, Russia wanted the West to ban Ukraine from entering NATO and limit the deployment of troops and weapons on the bloc’s eastern flank. It also insisted that the military alliance retreat to its borders as of 1997, before it expanded eastwards. While neither the US nor NATO gave written responses to Russia’s proposals, they both rebuffed Moscow’s demand that Ukraine should be barred from the bloc. Earlier this month, Putin said he saw no need for talks with his US counterpart, explaining that “there is no platform for any negotiations yet.” The statement was echoed by the White House, which stated that Joe Biden does not plan to meet with the Russian leader at the G20 summit next month, despite earlier refusing to rule out the possibility. The last time the two leaders met in person was in June 2021 in Geneva, Switzerland. The talks were followed up by a virtual summit in December, with Ukraine being one of the topics on the agenda.

It was the grain corridor all along. And now: “The Coordination Center reported that Kiev, Ankara and the UN agreed on the movement of 14 vessels in the Black Sea tomorrow from Odessa as part of the “Black Sea initiative”, Russia was notified..”

Russia will demand to inspect all 14 vessels.

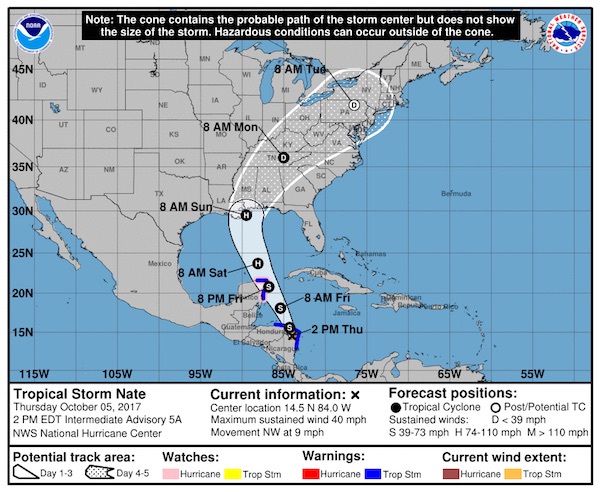

• New Details On Drone Attack In Crimea Emerge (RT)

Those behind a major drone attack on the Russian naval base in the Crimean port city of Sevastopol made active use of a UN-brokered Black Sea grain corridor, the Russian Defense Ministry said in a statement after studying the wreckage of the unmanned combat vehicles. The ministry’s specialists retrieved the navigational modules of the drones destroyed by the Russian warships and naval aviation, the statement said, adding that the Canadian-made devices stored data on the vehicles’ path to their target. Most of them were launched from the Ukrainian Black Sea coast, not far from the port city of Odessa, the Russian military said. “The naval drones were then moving within the security zone of the grain corridor before changing course and heading towards the Russian naval base in Sevastopol,” the statement said.

Navigational data from at least one naval drone shows that it was launched from a sea location within the grain corridor security zone, the ministry added. According to Russian specialists, it might have been launched from a civilian vessel chartered by Ukraine or its “western backers” to transport Ukrainian agricultural produce. Saturday’s assault, which involved nine aerial and seven naval drones, targeted vessels of the Russian Black Sea Fleet docked in Sevastopol. It was repelled, with just one ship suffering minor damage, according to the ministry. According to Moscow, the Russian ships that were targeted by the Ukrainian drones had been involved in providing security for the “grain corridor,” which was set up to allow exports of Ukrainian food products through the Black Sea as part of a deal negotiated in Istanbul between Moscow and Kiev with UN and Turkish mediation this summer.

The attack prompted Russia to indefinitely suspend its participation in the deal, a move that has sparked an angry reaction from the US. Russia blamed Kiev for the attack, which it claimed was “carried out under the supervision of British experts.” Kiev has been reluctant to claim responsibility for the assault. Andrey Yermak, the head of Ukrainian President Vladimir Zelensky’s office, took to Telegram to accuse Russia of “making up terrorist acts at its facilities.” On Sunday, the New York Times reported that it was Ukrainian forces that launched Saturday’s attack, citing an unnamed Ukrainian official.

“..this would inevitably lead to the “deindustrialization” of the EU which, in turn, will have “very, very deplorable consequences” for the bloc “over the next 10 to 20 years.”

• Washington Seeking To Weaken EU – Moscow (RT)

The United States is aiming to weaken the EU, both militarily and economically, Russian Foreign Minister Sergey Lavrov has claimed. Europeans are already suffering from anti-Russia sanctions “many times more than the US,” he said in an interview published on Sunday. “There is a growing number of economists, not only in our country, but also in the West, who come to a conclusion that the US goal is to completely ‘bleed’ and deindustrialize the European economy,” he said. “It is also in Washington’s interests to weaken Europe militarily. To constantly keep it under pressure, to force it to pump weapons into Ukraine, and in return fill the EU countries’ arms depots with American supplies,” Lavrov said. In pursuing such a policy, Washington has been guided by “economic, purely selfish calculations, as well as by ideological complexes of superiority,” he suggested.

Earlier this month, Kremlin spokesman Dmitry Peskov said Americans were making “crazy money” by selling gas to European states at exorbitant prices against a backdrop of EU sanctions on Russian energy supplies. He said this would inevitably lead to the “deindustrialization” of the EU which, in turn, will have “very, very deplorable consequences” for the bloc “over the next 10 to 20 years.” In the wake of sweeping sanctions the EU imposed on Russia over its military operation in Ukraine, gas prices have surged. The bloc is now struggling with the prospect of energy shortages in winter and soaring inflation. Brussels has largely followed Washington’s stance of seeking to weaken Moscow by imposing sanctions, while supporting Kiev through weapons supplies and financial aid.

“Lula’s bench of leftwing allies will occupy less than about a quarter of seats in the lower house..”

• Left-Wing Lula Narrowly Wins Brazilian Presidency (ZH)

By an extremely narrow margin of less than two percentage points, Luiz Inácio Lula da Silva (Lula) has beaten incumbent Jair Bolsanaro to become Brazil’s next president. The tight result tops off a dramatic comeback for the 77 year-old opposition leader, who served two terms as president between 2003 and 2010 but subsequently was accused of corruption and served time in prison for graft before his convictions were annulled. This result is historic as it marks the first time a sitting president in Brazil has lost a re-election bid. Echoing the Biden administration’s narratives, Lula focused on the risks to democracy from Bolsonaro’s far-right movement, framing the election as a choice between “democracy and fascism, democracy and barbarism.”

Additionally, the far-left leader pledged to reduce inequality and protect the environment while preserving the country’s fiscal health (but caused consternation among some by offering few details on his broader economic agenda and refusing to nominate a finance minister). “Lula’s challenge of governing is bigger than that of winning the election. Brazilian society needs to be rebuilt in its institutional and fiscal basis,” said Carolina Botelho, a political scientist with the Institute of Advanced Studies at Sao Paulo University.“Lula will need to recover the internal and external trust of financial agents and civil society. ”Amid extremely high interest rates and inflation, his plan to move away from the free market vision of the Bolsonaro administration to a model that puts the state at the heart of the economy will be a key focus for investors globally. Crucially, as The FT reports, Lula remains a deeply polarising figure and is also likely to face obstacles in Congress, which is broadly right-leaning.

Lula’s bench of leftwing allies will occupy less than about a quarter of seats in the lower house, meaning he will need to make concessions to pursue his agenda. Bolsonaro allies will also occupy key governorships, including São Paulo – Brazil’s wealthiest and most populous state – which was won on Sunday by Tarcísio de Freitas of the rightwing Republican party.Finally, it took just minutes for President Biden to send his congratulations to the Workers’ Party leader on his success in “free, fair, and credible elections.” We wonder if the US president would have been so fast to congratulate Bolsonaro if the vote count was so close but the other way? (In the run-up to the election, Bolsonaro had persistently claimed Brazil’s electronic ballot machines were vulnerable to fraud, leading opponents to fear he was preparing a justification to reject a losing result.)

You need the BRICS and Saudi Arabia (OPEC+).

• Russia and China Can Shatter Dollar Dominance – Chinese Diplomat (RT)

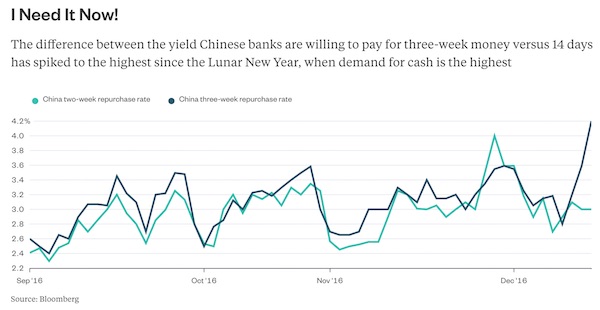

The transition to trade in national currencies between Russia and China will contribute to a global de-dollarization process, China’s Charge d’Affaires in Russia said this week at a conference on the matter. “The existing economic partnership between China and Russia and the long-term accumulated level of trade have laid a solid foundation for further deepening cooperation between our countries,” Sun Weidong said, noting that bilateral trade has risen dramatically, mostly on energy and agriculture supplies. “Energy cooperation continues to play an important role in relations between the two countries, in addition, agricultural products and seafood from Russia are increasingly entering the Chinese market,” the diplomat said.

“We have cooperation on major projects in the field of nuclear energy, aircraft construction, rocket engines, satellite navigation… In addition, payments are constantly being made in local currencies.” Russia and its trading partners have been expanding the share of national currencies in mutual settlements in an attempt to move away from the US dollar and the euro. In recent years, Moscow has been steadily following a policy of de-dollarization of foreign trade, particularly expanding the use of Chinese currency for buying financial products denominated in yuan, and using it as a reserve currency. Trade between the two nations hit $136 billion in the first nine months of this year, jumping by over 30% in annual terms, according to the National Bureau of Statistics of China. Moscow and Beijing aim to increase bilateral trade to a $200 billion target this year.

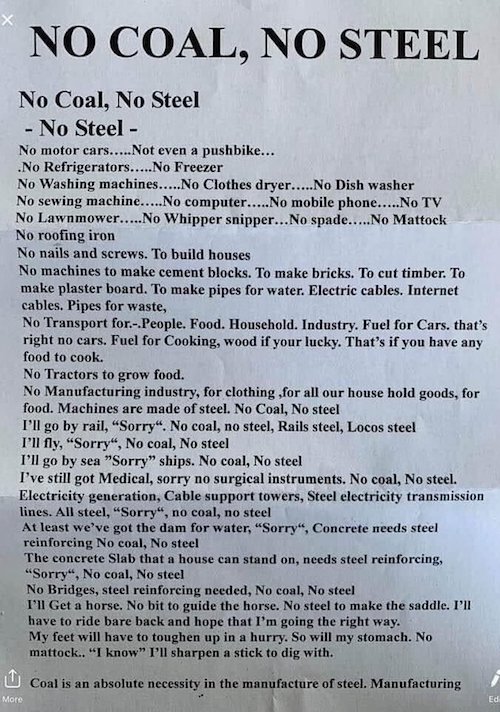

“Every advancement in human history over the last couple of hundred years rests on the exploitation of carbon-based energy..”

• Bad Economics Leads To Bad Outcomes (Denninger)

Now how about NY? A court there ruled that all of the fired employees who refused to take the jab must be reinstated and are entitled to all back pay and benefits for the time they were out. This applies to about 1,200 people. Again, this decision took over a year from when the mandates were put in place and in this case while money damages are certainly a “fix” for the terminated employees how about those who took the jab under duress and got screwed, such as having heart damage which we now know happens in some degree to everyone who takes it or worse, had a heart attack, stroke or even died? Obviously money damages do not fix any of that, especially the last one. Yet it was clear that the original mandate was predicated on fraud.

The CEOs of the companies who make the stuff have so-admitted in that they have now stated they knew the original trials back in the fall of 2020 did not demonstrate, and were not designed to demonstrate, that the jab actually would or could protect anyone other than the person who got it. Deborah Birx has admitted this as well and that she, and thus the entire Covid response force in the Federal Government, knew this before the shots began. Again, irrespective of whether you believe a state, locality, or the Federal Government has the power to issue such a mandate in the general case in this case all involved parties deliberately lied about the predicate requirements for such a mandate. Specifically all power of quarantine and related police power, whether at a local, state or federal level, is inherently about protecting other people and rests on that premise.

If no protection of others is possible then no mandate stands on a Constitutional basis. You can no more mandate that I take care of my health with a jab than you can mandate how many calories or what sort of calories I consume. This was done intentionally, with knowledge that it was unconstitutional, and there is no recourse in the law after the fact for those who were materially harmed or killed as a consequence. The same is true for DACA. Obama admitted this at the time and now it has been so-ruled because it was not created through Congressional action as is required, but rather by Obama’s “pen.” There is nothing to defend because legally it is constitutional infirm and thus never occurred but, so far, the courts have recognized that by requiring as long as it did to get heard and ruled this way, now several times in fact including during Trump’s Presidency, ten years from when Obama did so it has created a set of circumstances that they’ve been unwilling to unwind. Thus an illegal order stands today despite being acknowledged by the government itself as illegal.

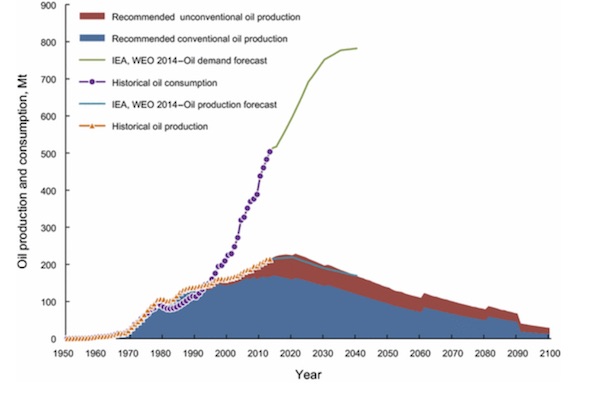

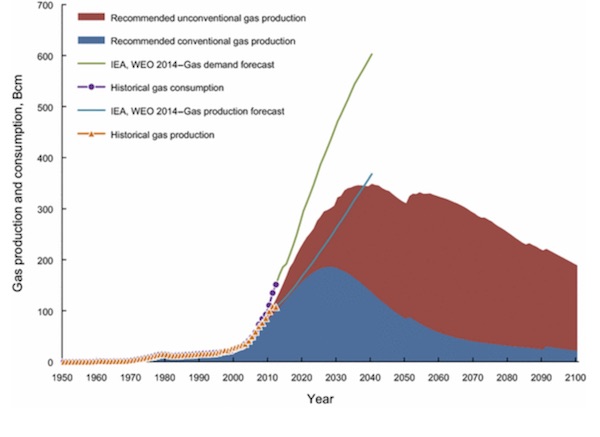

How about the CDC and their “rent moratorium”? Same deal. Yet the small landlord was screwed and, quite possibly, has no legitimate recourse, particularly if he or she was forced out of business or forced to sell in the interim. Money does not make them whole. We’re headed for another one, much worse, with carbon-based fuels. As I pointed out repeatedly no CEO will invest in something that they have been told by the government will be made worthless before it can return a profit. In fact to so-invest would be fraud upon the shareholders and, to the extent money was borrowed, upon the lenders as well. This is now confirmed; the refineries that were shut down will not be restarted. Is that action by the Executive legal? No, it is not. And while it might be Constitutional if initiated by Congress through formal legislation that’s not what’s happened here in the main.

Let me be clear: This last example has the potential to return the American people to a lifestyle akin to that of the 1700s if not before. That’s not hyperbole or a joke — its real, and those who poo-poo it are wrong. Every advancement in human history over the last couple of hundred years rests on the exploitation of carbon-based energy and there is no evidence of any kind that it can be successfully replaced. Even my preferred path forward for energy, which involves nuclear power, still exploits carbon-based fuels because in order for society to continue to function you have to. Simply put the Laws of Thermodynamics are not suggestions and cannot be repealed or circumvented; they are facts.

Fracking in Germany just so you can send weapons to Ukraine? What’s next?

• German Official Offers Controversial Solution To Gas Crisis (RT)

Germany should study the issue of producing domestic shale gas using fracking, which is currently prohibited in the country, Finance Minister Christian Lindner said in an interview with the Funke media group, as quoted by TASS. The technology allows oil and gas to be extracted from shale rock by breaking it up with pressurized liquid, including water and chemicals. The technique has been used in Germany since the 1960s to extract natural gas from conventional reserves, including sandstone and carbonate stones. About one third of the natural gas produced in the country comes from reserves tapped by fracking. However, “unconventional fracking” in shale and coal seams, which uses horizontal drilling techniques, was placed under moratorium in 2011, and then largely banned in Germany due to environmental risks such as water pollution, or even earthquakes.

“We have significant gas deposits in Germany that can be extracted without endangering drinking water,” Lindner said. “It would be rather irresponsible to refrain from fracking because of ideological commitments.” According to the official, production is possible “at several” fields, with Germany able to meet relatively large needs from its own sources, which would be useful in light of the situation across the world. The call comes amid an unprecedented energy crisis resulting from a reduction in energy imports from Russia, formerly the bloc’s biggest supplier. The conflict in Ukraine has resulted in an all-out sanctions war against Moscow, targeting commodities including oil and gas, and contributing to soaring energy prices in the EU and worldwide.

In April, German Vice-Chancellor and Energy Minister Robert Habeck rejected the idea of extracting shale gas in Germany by fracking due to environmental concerns. He stressed that it would take years before it would be possible to obtain the necessary permits and establish production using the method.

This is getting serious…

• Chip Shortage Drives Toyota Back To Basics (RT)

Toyota customers in Japan will get a mechanical key instead of a “smart” one when they get their new vehicle, Reuters reported on Thursday. One of the two electronic “smart” keys will be replaced with a basic one, the agency explained, quoting the carmaker’s statement. “As the shortage of semiconductors continues, this is a provisional measure aimed at delivering cars to customers as quickly as possible,” Toyota said. A second smart key will be handed over “as soon as it is ready,” the statement adds. The global chip shortage that started during the Covid-19 pandemic has caused severe supply issues and delays with the automotive and other industries.

“The offloading of the asset has further raised investor concerns about the bank’s financial health.”

• Credit Suisse To Axe Thousands Of Jobs (RT)

Swiss banking giant Credit Suisse on Thursday announced plans to slash 9,000 jobs and sell off its deal-making unit. The announcement follows a series of scandals and billions in losses. According to the bank, it is cutting 2,700 jobs in the final quarter of 2022 and will reduce employee numbers by 9,000 by the end of 2025. This is around 17% of the company’s workforce of 52,000. The bank will raise around $4 billion in fresh capital to fund the overhaul. Credit Suisse will also revive its First Boston name — the US-based investment bank it acquired in 1990 — as it separates its deal-making unit from the rest of the investment bank.

The overhaul is an urgent attempt to restore credibility at Credit Suisse. The bank racked up billions of dollars in losses from the 2021 collapse of hedge fund Archegos and financial services firm Greensill. This, along with the bank’s management chaos, shattered its status as one of Europe’s most prestigious lenders. Credit Suisse has since reshuffled its management team, suspended share buybacks and cut dividend payments. Earlier this month, the embattled lender said it was selling the landmark five-star Savoy Hotel in Zurich’s financial district for as much as 400 million Swiss francs ($404 million). The offloading of the asset has further raised investor concerns about the bank’s financial health.

Interesting that his views are quite moderate.

• Medical Boards Strip Dr. Peter McCullough’s Medical Credentials (GP)

One of the most respected doctors in the world and top cardiologists and epidemiologist in the country had his license revoked for speaking the truth about the danger of COVID vaccines. Dr. McCullough is an Internist, Cardiologist, and Epidemiologist who testified to the Senate Committee on Homeland Security and Governmental Affairs in November 2020. Dr. McCullough is a cardiologist and was vice chief of internal medicine at Baylor University Medical Center and a professor at Texas A&M University. McCullough is editor-in-chief of the journals Reviews in Cardiovascular Medicine and Cardiorenal Medicine. He was and is an advocate for early COVID-19 treatment that included hydroxychloroquine. He’s been right about everything throughout the pandemic.

He is one of the first doctors who sounded the alarm on the Covid-19 vaccines and explained how they all make the dangerous Wuhan spike protein.“It’s alarming right now – we have had over 4400 deaths and 14,000 hospitalizations….That is probably only the tip of the iceberg,” Dr. McCullough said in an interview with Rose Unplugged on 1320 AM WJAS. He said pregnant women, women of child-bearing years, children or healthy people under 50 should not get the Covid jab. Dr. McCullough explained how all Covid-19 vaccines produce the dangerous Wuhan spike protein and what that does to a person’s body. He added that Covid-19 vaccines have become a social menace and explained how it has been “socially weaponized.”

According to McCullough, the Covid-19 pandemic was premeditated by public health officials working in tandem with medical elites, and the evidence for this had been made clear well before the first reports of a Covid outbreak in late 2019, during an interview with Joe Rogan. In order to promote mass adoption of the experimental vaccine, McCullough says health officials purposefully suppressed treatments and refrained from compiling a treatment protocol to combat the virus, in hopes that people would be so afraid that they would just take the jab.

[..]”I was terminated as the Editor-In-Chief of Cardiorenal Medicine and Reviews in Cardiovascular Medicine after years of service and rising impact factors. There was no phone call, no board meeting, no due process. Just e-mails or certified letters. Powerful dark forces are working in academic medicine to expunge any resistance to the vax. Yesterday I was stripped of my board certifications in Internal Medicine and Cardiology after decades of perfect clinical performance, board scores, and hundreds of peer reviewed publications. None of this will stop until there is a “needle in every arm.”

“Retailers are unwilling to pay a premium for Scottish produce as shoppers target bargains during the cost-of-living squeeze..”

• Scottish Blueberry Farmer Donates ‘Unviable’ Crop To Charity (Y!)

A Scottish farmer is giving away his entire crop of blueberries, worth £2 million, to charity, saying cheap imports and high labour costs have made harvesting the fruit economically unviable. Peter Thomson has been growing blueberries at his farm in Blairgowrie, northeast Scotland, for more than four decades, producing 300 tonnes of fruit per year. But now, he said, growers in Peru and South Africa can sell their berries in the UK at a far lower price, while a shortage of pickers caused by Brexit has made the harvest unviable. “They’ve started planting huge areas of blueberries in the subtropics like Peru and South Africa,” said Thomson, who started growing blueberries in 1976. “Their costs of production are so low that we can’t compete.”

Normally, said Thomson, 200 workers would have picked around 300 tonnes of blueberries this year with 50 more working in the packhouse. In 2014, the price paid to Scottish farmers for blueberries was £17.50 per kilo, he said. Today however, supermarkets pay less than £7. Labour costs meanwhile have risen from £7 an hour five years ago to £10.10 today, even before state pension contributions and holiday pay are taken into account. This meant that the value of crop of berries, which would once have been worth £3 million or more, fell to £2 million this year. Retailers are unwilling to pay a premium for Scottish produce as shoppers target bargains during the cost-of-living squeeze, Thomson said.

YIKES!: “..6 out of every 10 adults have at least one chronic health condition and 4 out of every 10 have two or more…”

• Common Medications You Shouldn’t Be On For Long (Mercola)

Global pharmaceutical sales rose from $780 billion in 2010 to $1.186 trillion in 2021.(1) In that same period, the U.S. market increased from $315 billion to $555 billion. In other words, the U.S. market was nearly 50 percent of world market sales. When drug sales were compared, the leading pharmaceutical product in 2021 was the COVID-19 vaccine, which generated $37 billion in revenue. When compared to other large companies, the profitability of the pharmaceutical industry is significantly greater than other public companies.(2) In other words, the pharmaceutical industry is big business. They make money when you buy medication and stay on it for the long term. However, there are several drugs that were designed to be taken short-term, but have become long-term staples in the medicine cabinet.

Research published in July 2022 revealed a dramatic rise in adverse drug reactions in the U.K.(3) Many of these were related to the high number of medications prescribed to the participants. Overprescribing is known as “polypharmacy,” which has been a growing problem over the last decade as the pharmaceutical industry develops new drugs with the inferred intent of lengthening life through chemistry. However, as is seen in revenue reports and research into the negative consequences, it appears the goal is growing revenue. If it were better health, the first recommendation would be lifestyle changes in collaboration with established support systems to help you make those changes. Instead, the first step is often a simple prescription, which may come with complicated side effects.

Growing Problem With Polypharmacy. Data (4,5) demonstrate that between 80 percent and 89 percent of adults aged 65 and older take at least one prescribed medication and 54 percent take four or more. Adverse effects are common and often drive patients to seek other drugs to control the side effects of the first drug. Polypharmacy, or using multiple medications, is more common in older adults who have several risk factors and chronic health conditions that can lead to overprescribing. According to the Centers for Disease Control and Prevention,(6) 6 out of every 10 adults have at least one chronic health condition and 4 out of every 10 have two or more.

Prescription medications are not the only type of drug that can cause challenges with polypharmacy. Over-the-counter (OTC) drugs are those you can buy without a prescription. Drugstore shelves are lined with pain medications, allergy relief, cold preparations, and remedies for gastrointestinal issues. While you can purchase them without a prescription, OTC drugs can have the same types of drug interactions with prescriptions or other OTC medications. As you consider whether you are taking too many drugs, it is also important to remember that some medications were designed to be taken for the short term and long-term use can lead to their own set of problems.

The Americans Are ITCHING To Fight The Russians

Why NATO Attacked Crimea (hint, the G20 Summit)

Quokka

Halloween Cat on the Prowl, Strasbourg, France

Can’t always

oh to be an audience member at the rolling stones rock and roll circus pic.twitter.com/rzSSDWGV4Y

— robert (@robertt) October 31, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.