MC Escher Relativity 1953

“Back in Washington, they’ve found a company to crucify who turned out to be even bigger hypocrites than they are. Quite the bi-partisan cause!”

• Is Robinhood The Devil in Sheep’s Clothing? (Neville)

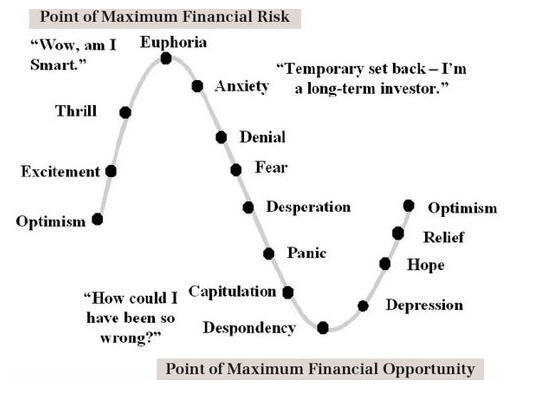

Robinhood fancies themselves as commission free trading which is giving normal people free access to the stock market. They are the Facebook of the financial world. You think it’s free, but your data ends up being sold to another big business who profits off of it more than you do. For Zuckerberg, he sells all your data to businesses across the world. For Robinhood, they sell your data to Ken Griffin and other High Frequency Trading shops. You could write a book on the nuances of it, but let’s leave it there for now. As Facebook and (anti)social media grew too large, it has created mass hysterias. Neuroscientist and philosopher, Sam Harris, speaks on his podcast about humans losing sense of their rationality. Because of the constant propaganda being thrown on social media, humans are having a hard time deciphering truths and often create false realities.

Humans end up giving their attention to the most extreme personalities (watch the Tekashi69 Documentary on HBO) and the values of balance and a middle class lifestyle go out the door. In the same way that Facebook has distorted human perception, Robinhood is doing this to capital markets, which might be even scarier. If no one knows the value of things, then how do we attempt to live in a civilized society and trade value for value? Stan Druckenmiller has said that there should be some sort of hurdle rate for investment into the market. Perhaps this is what he saw coming? One of the words that I am shorting over the next five years is ‘scale’. One of the words that will likely replace it is ‘balance’. With balance, you get real growth and real innovation. You accept the fact you are human and fallible while constantly trying to learn from your failures. With scale, you just want to control things as fast as you can at the expense of the herd.

I worked as a trader for 12 years before tapping out and realizing my job was getting eaten alive by algorithms & high-frequency-trading. I tried to out-hustle it, but the incentive to make things cheaper for the end consumer to buy stocks inevitably won. As a free market capitalist, I have to give passive investment, HFT & Robinhood some major props. What they did was brilliant, but I can’t help but ask myself whether we’ve sacrificed social stability in that pursuit of scale. Behind closed doors, I know they are concerned and they can’t unwind what they’ve built. I get messages from Wall Street friends everyday now who can’t openly speak about it, but know how messed up the capital markets are.

With retail equity and call buying at all time records, liquidity could get funky if pay-for-order flow providers pull back at all. CEO’s at Schwab, TD and Virtu will likely try to distance themselves from that model. In the interim, Robinhood will likely do a nice round of mea-culpas with the best PR firms on the market and apologize to everyone about the GameStop situation. The big VC’s on Robinhood’s cap table who are obsessed with scale will make their calls into Washington. Back in Washington, they’ve found a company to crucify who turned out to be even bigger hypocrites than they are. Quite the bi-partisan cause!

What will be the new normal? Can’t imagine it will be like the old one.

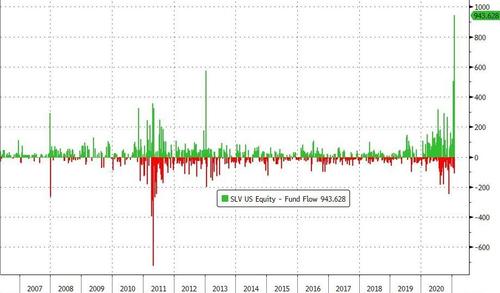

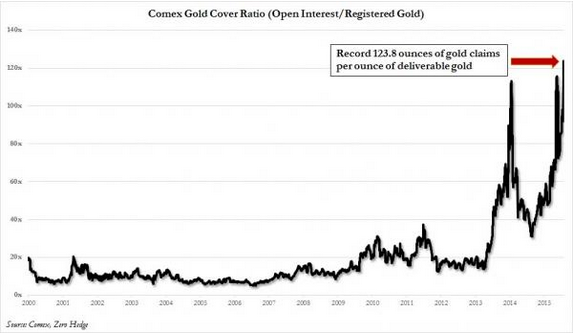

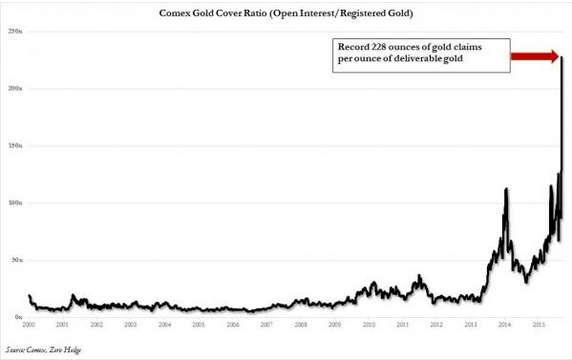

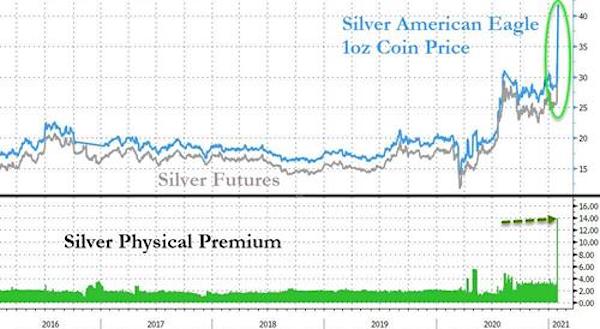

• Physical Premium To Paper Hits Record As Silver Market Tears In Two (ZH)

APMEX Statement On Current Market Conditions:

In the last week, we have seen a dramatic shift in Silver demand from our customers. For example, the ratio of ounces sold per day was running about two times earlier in the week and closer to four times the average demand by the end of the week. Once markets closed on Friday, we saw demand hit as much as six times a typical business day and more than 12 times a normal weekend day. Combined with the extremely high demand levels, we are also seeing a surge in new customers. On Saturday alone, we added as many new customers as we usually add in a week.

Any Precious Metal dealer will take a long position in the futures market to protect against spot price exposure when the markets open. We do this because it is our goal not to take a speculative position on metal. The weekends are unique as we are not able to real-time hedge our position. We took an aggressive position this weekend, but clearly could not have predicted the volumes that were seen. We have partnerships around to world that allowed us to cover these long positions, but only to a point. Once we exceeded our comfort levels, we had little choice but to stop the sale of Silver on our website. This was a difficult decision to make and unprecedented in our history.

As we evaluate the markets, it is difficult to know where Silver’s price and demand will go in the coming day and weeks. APMEX is highly capitalized and has more than $150 million in inventory to support demand. We have made strategic decisions to procure additional metal, locking up any metal we can find in the market place. We suspect premiums will rise and rise quickly, as we are seeing significant increases in our costs, when we can even locate the metal. It is also highly likely that we will need an additional day or two to fill orders based on current order counts. The one guarantee we can make to our customers is that you will only be sold metal that is on-site, or we have procured the metal with a firm commitment date from our partners. In markets like this, we feel this is the best approach a retailer can take, as no one can predict product availability.

“The new wealth comes from a cartel capitalism far more concentrated and far more criminal than any of the cartels built by the old robber barons of the 19th century.”

• Papering Over the Rot (Chris Hedges)

The death spiral of the American Empire will not be halted with civility. It will not be halted with the 42 executive orders signed by President Joe Biden, however welcome many are, especially since they can, with a new chief executive, be immediately revoked. It will not be halted by removing Donald Trump, and the crackpot conspiracy theorists, Christian fascists and racists who support him, from social media. It will not be halted by locking up the Proud Boys and the clueless protestors who stormed the Congress on Jan. 6. and took selfies in Vice President Mike Pence’s Senate chair. It will not be halted by restoring the frayed alliances with our European allies or rejoining the World Health Organization or the Paris Climate Agreement.

Mr. Fish

All of these measures are window dressing, masking the root cause of the demise of America — unchecked oligarchic power and greed. The longer wealth is funneled upwards into the hands of a tiny, oligarchic cabal, who put Biden into office and whose interests he assiduously serves, we are doomed. Once an oligarchy seizes power, deforming governing institutions to exclusively serve their narrow interests and turning the citizenry into serfs, there are only two options, as Aristotle pointed out — tyranny or revolution. The staggering concentration of wealth and obscene avarice of the very rich now dwarfs the hedonism and excesses of the world’s most heinous despots and wealthiest capitalists of the past.

In 2015, shortly before he died, Forbes estimated David Rockefeller’s net worth was $3 billion. The Shah of Iran looted an estimated $1 billion from his country. Ferdinand and Imelda Marcos amassed between $5 and $10 billion. And the former Zimbabwean President Robert Mugabe was worth about a billion. Jeff Bezos and Elon Musk are each at $180 billion. The new wealth comes from a cartel capitalism far more concentrated and far more criminal than any of the cartels built by the old robber barons of the 19th century.

It was made possible by Presidents Ronald Reagan and Bill Clinton who, in exchange for corporate money to fund their campaigns and later Clinton’s foundation and post-presidency opulent lifestyle, abolished the regulations that once protected the citizenry from the worst forms of monopoly exploitation. The demolishing of regulations made possible the largest upwards transference of wealth in American history. Whatever you say about Trump, he at least initiated moves to break up Facebook, Google, Amazon and the other Silicon Valley monopolists, none of which will happen under Biden, whose campaign these corporations bankrolled. And that has to be one of the reasons these digital platforms disappeared Trump from social media.

We’re all hostages to these companies now. No-one talks about boosting your immune system, or getting fitter, natural defenses are not done.

• How To Redesign COVID Vaccines So They Protect Against Variants (Nature)

Labs worldwide are racing to understand the threat that emerging coronavirus variants pose for vaccines. But early insights from these studies are mixed and incomplete. A variant identified in late 2020 in South Africa, called 501Y.V2 (also known as variant B.1.351), is among the most worrying. Lab assays have found that it carries mutations that sap the potency of virus-inactivating ‘neutralizing antibodies’ that were made by people who received either the Pfizer or Moderna RNA vaccines. Whether these changes are enough to lower the effectiveness of those vaccines is not clear, says Subbarao. “That is the million-dollar question, because we don’t know how much antibody you need.” Other immune responses that vaccines prompt might help to protect against the effects of variants.

But on 28 January, biotech firm Novavax released data from clinical trials showing that its experimental vaccine, designed to combat the original virus, was about 85% effective against a variant identified in the United Kingdom — but less than 50% effective against 501Y.V2. That drop is concerning, say researchers, because it indicates that 501Y.V2 and other variants like it can cause a significant drop in vaccines’ effectiveness. “I think it’s inevitable for the vaccines to maintain tip-top efficacy, they will need to be updated. The only question is how often and when,” says Paul Bieniasz, a virologist at the Rockefeller University in New York City who co-led one of the neutralizing-antibody studies. Scientists, health officials and vaccine makers are starting to hash this out. Researchers are only beginning to learn how different mutations alter vaccine responses and how evolutionary forces can cause mutations to spread. “I certainly wouldn’t update them now,” says Bieniasz.

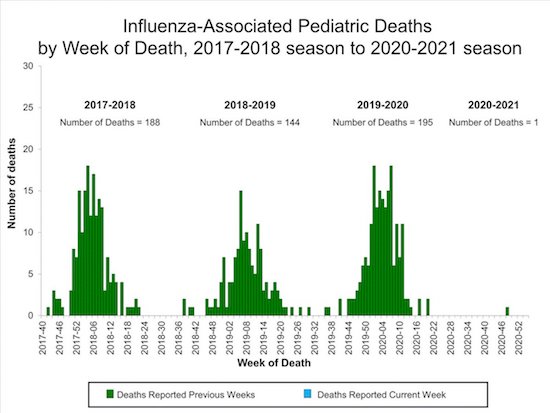

One model that COVID vaccine updates could follow is that of seasonal flu vaccines, says Subbarao, who directs the World Health Organization Collaborating Centre for Reference and Research on Influenza in Melbourne. Centres including hers monitor emerging flu strains for genetic changes that might influence vaccines’ effectiveness. Researchers use studies with ferret and human antibodies to determine whether a new flu strain is likely to evade a previous season’s vaccine, and therefore necessitate an update. These reviews are conducted annually for each hemisphere’s flu season, and changes are made only when a vaccine-evading strain is widespread, says Subbarao. “If it’s localized to one region, one country, we wouldn’t change the vaccine for the whole hemisphere.”

Drug pricing is not the scandal here.

• COVID19 Vaccine Developers Ask SEC to Help Keep Price Setting Secret (DP)

When the U.S. government awarded over $10 billion in contracts and advance- purchase commitments to drug companies working on COVID-19 vaccine and treatments, it did not require the recipients of government money to agree to offer their products at fair prices or share intellectual property rights to enable faster production. Now, two of the companies awarded those contracts—Pfizer and Johnson & Johnson—are trying to prevent shareholders from voting on resolutions to require the companies to disclose information about the impact of government funding on vaccine access. The U.S. government has purchased 200 million doses of the Pfizer vaccine and 100 million doses of the Johnson & Johnson vaccines, for about $20 and $10 per dose, respectively.

The shareholder resolutions, filed by members of the Interfaith Center on Corporate Responsibility (ICCR), a shareholder activism organization, ask those two companies to inform their shareholders how “receipt of public financial support for development and manufacture of products for COVID-19 is being, or will be, taken into account when making decisions that affect access to such products, such as setting prices.” Similar resolutions were also filed at Eli Lilly, Gilead, Merck, and Regeneron. Both Pfizer and Johnson & Johnson filed “no action requests” with the Securities and Exchange Commission (SEC) in December, asking the agency to rule that the companies can withhold the proposals from shareholders.

In nearly identical filings prepared by the same lawyer, both Pfizer and Johnson & Johnson argued that the proposals attempt to “micromanage” the companies “by requesting an intricately detailed report.” Meg Jones-Monteiro, ICCR’s health equity director, called the micromanaging claim “ludicrous.” The claim that investors are trying to “micromanage” the companies comes from an SEC precedent finding that certain “ordinary business operations” should not be subject to shareholder oversight. But Jones-Monteiro argues that the issue of vaccine pricing during pandemics doesn’t fall into this category.

“Anything related to drug pricing has been established as a social policy issue,” Jones-Monteiro told The Daily Poster, meaning it isn’t just ordinary business that doesn’t need any shareholder oversight. She noted that the proposals don’t ask about ordinary pricing decisions or ask for intricate details about pricing algorithms. “We are asking very generally: did you take government funding into account? And how did you take it into account?” Oxfam, an ICCR member who filed the proposed resolution with Johnson & Johnson, wrote in a supporting statement that “JNJ stated publicly that it will distribute a COVID-19 vaccine on a “nonprofit” basis,” adding: “JNJ has not clarified what ‘nonprofit’ means when the government funds a significant portion of the research and development cost.”

Pretty bad.

• The Brazil Variant Is Exposing the World’s Vulnerability (Atl.)

Even in a year of horrendous suffering, what is unfolding in Brazil stands out. In the rainforest city of Manaus, home to 2 million people, bodies are reportedly being dropped into mass graves as quickly as they can be dug. Hospitals have run out of oxygen, and people with potentially treatable cases of COVID-19 are dying of asphyxia. This nature and scale of mortality have not been seen since the first months of the pandemic. This is happening in a very unlikely place. Manaus saw a devastating outbreak last April that similarly overwhelmed systems, infecting the majority of the city. Because the morbidity was so ubiquitous, many scientists believed the population had since developed a high level of immunity that would preclude another devastating wave of infection.

On the whole, Brazil has already reported the second-highest death toll in the world (though half that of the United States). As the country headed into summer, the worst was thought to be behind it. Data seemed to support the idea that herd immunity in Manaus was near. In Science this month, researchers mapped the virus’s takeover last year: In April, blood tests found that 4.8 percent of the city’s population had antibodies to SARS-CoV-2. By June, the number was up to 52.5 percent. Since people who get infected do not always test positive for antibodies, the researchers estimated that by June about two-thirds of the city had been infected. By November, the estimate was about 76 percent. In The Lancet this week, a team of Brazilian researchers noted that even if these estimates were off by a large margin, infection on this scale “should confer important population immunity to avoid a larger outbreak.”

Indeed, it seemed to. The city was able to largely reopen and remain open throughout its winter with low levels of COVID-19 cases. Yet now, the nightmare scenario is happening a second time. The situation defies expert expectations about how immunity would help protect the hardest-hit populations. By estimates of leading infectious-disease specialists, such as Anthony Fauci, when roughly 70 to 75 percent of the population is immune, there can still be clusters of cases, but sustaining a large-scale outbreak becomes mathematically impossible. Still somehow, according to The Washington Post, hospitals in Manaus that had thought they were well prepared are now overwhelmed.

What a clown.

• Fauci 180º: Double Masking For Covid-19 Doesn’t ‘Make A Difference’ (JTN)

First he said don’t wear a mask. Then he said wear a mask. Then he said wear two masks. Then he said just wear one mask. Keeping up with Dr. Anthony Fauci’s mask-wearing recommendations is getting tough. Back in March, just as the COVID-19 pandemic was emerging, Fauci, the country’s top infectious disease expert, said, “There’s no reason to be walking around with a mask.” “When you’re in the middle of an outbreak, wearing a mask might make people feel a little bit better and it might even block a droplet, but it’s not providing the perfect protection that people think that it is,” the doctor said on CBS News. Of course, we didn’t know much back then, and how to slow the spread has since evolved.

Soon after Fauci made his comments, experts – including those in the Center for Disease Control and Prevention – said Americans should wear masks, citing estimates that 40% or more of those infected were asymptomatic but could still spread the virus. “We were not aware that 40% to 45% of people were asymptomatic, nor were we aware that a substantial proportion of people who get infected get infected from people who are without symptoms. That makes it overwhelmingly important for everyone to wear a mask,” Fauci said in September, noting that “the data now are very, very clear.”

Fauci, an immunologist and director of the National Institute of Allergy and Infectious Diseases who served on President Trump’s White House Coronavirus Task Force and is now President Biden’s chief medical adviser on COVID-19, said last month that wearing two masks is likely more effective than wearing one. “If you have a physical covering with one layer, you put another layer on it, just makes common sense that it likely would be more effective,” Fauci told NBC News. Then over the weekend, Fauci said: “There are many people who feel, you know, if you want to have an extra little bit of protection, maybe I should put two masks on. There’s nothing wrong with that, but there’s no data that indicates that that is going to make a difference and that’s the reason why the CDC has not changed the recommendation.”

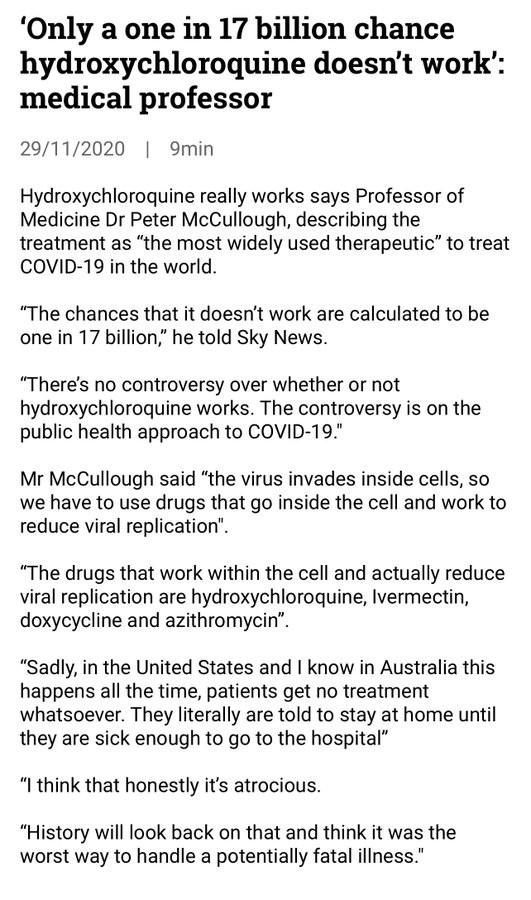

HCQ research has been dead since April, thanks to the Lancet. That’s also when the vaccine trials started.

• Oversight Board Reverses Facebook Removal Of HCQ Post (JTN)

Facebook’s independent Oversight Board has reversed the social media platform’s decision to remove an October 2020 post pertaining to the drug hydroxychloroquine in the treatment of COVID-19. “In October 2020, a user posted a video and accompanying text in French in a public Facebook group related to COVID-19,” the board explained on its website. “The post alleged a scandal at the Agence Nationale de Sécurité du Médicament (the French agency responsible for regulating health products), which refused to authorize hydroxychloroquine combined with azithromycin for use against COVID-19, but authorized and promoted remdesivir. The user criticized the lack of a health strategy in France and stated that “[Didier] Raoult’s cure” is being used elsewhere to save lives.

“The user’s post also questioned what society had to lose by allowing doctors to prescribe in an emergency a “harmless drug” when the first symptoms of COVID-19 appear.” While the person’s post pushed back against a government policy, it did not urge people to obtain or take medicine without a prescription, the board noted. “[The] user was opposing a governmental policy and aimed to change that policy,” the board said in explaining its ruling. “The combination of medicines that the post claims constitute a cure are not available without a prescription in France and the content does not encourage people to buy or take drugs without a prescription. Considering these and other contextual factors, the Board noted that Facebook had not demonstrated the post would rise to the level of imminent harm, as required by its own rule in the Community Standards.”

Facebook also failed to show why it did not opt for a less severe remedy than removing the post from the platform, the panel found. “Given that Facebook has a range of tools to deal with misinformation, such as providing users with additional context, the company failed to demonstrate why it did not choose a less intrusive option than removing the content,” the board explained. The board also determined that the social media giant’s misinformation and imminent harm rule is too vague and recommended that the platform consolidate and clarify its standards on health misinformation in one place.

“The Board also found Facebook’s misinformation and imminent harm rule, which this post is said to have violated, to be inappropriately vague and inconsistent with international human rights standards,” the panel said. “A patchwork of policies found on different parts of Facebook’s website make it difficult for users to understand what content is prohibited. Changes to Facebook’s COVID-19 policies announced in the company’s Newsroom have not always been reflected in its Community Standards, while some of these changes even appear to contradict them.”

“It looks like they mean bidness.”

• The Game is On (Jim Kunstler)

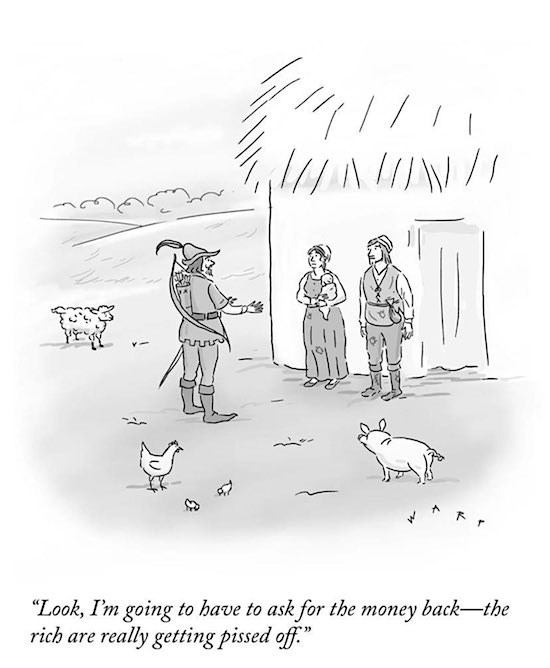

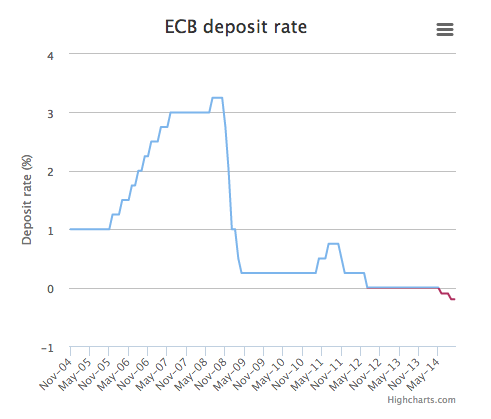

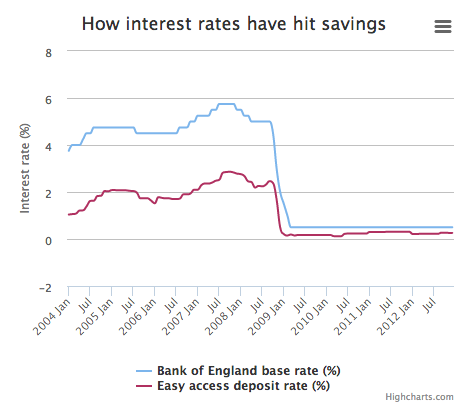

It’s been fifty years since precious metals enjoyed any official peg with the US dollar, but for five thousand years previously gold and silver were money itself and paper currencies became mere representations of that money. That relationship ended in 1971 when President Nixon closed the “window” that allowed foreign countries to redeem gold in exchange for dollars they accumulated from the commercial trade of goods — and, our dollar being the world’s supreme reserve currency, the rest of the world’s currencies followed.

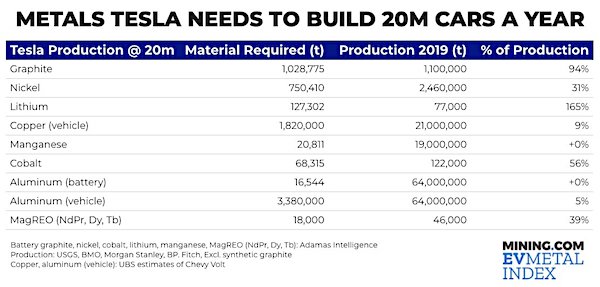

Despite all efforts since then by banking authorities to denigrate the value and the role of gold and silver in financial affairs, the “barbarous relics” retained a persistent influence in men’s minds because of their intrinsic qualities. These were: the vested energy they represented from mining and refining, their physical durability, portability, and divisibility, their freedom from counterparty obligations, and, especially in modern times, their vital usefulness in electronics and other industrial applications. The latter quality is greatly reinforced by the powerful wish to transition from a fossil fuel economy to an alt-energy economy of solar cells and wind turbines — a wish that probably won’t come true.

And so, as promised by the subreddit vigilantes, the silver price was up around $3 or ten percent in overnight trading going into the week’s Monday open. It looks like they mean bidness. And that could mean many things. The most obvious is a very conscious effort to punish the high hats of Wall Street for years of lawless game-playing that made them ultra-rich and left everybody else in the country impoverished. Some of the vigilantes frankly express the desire to wreck the degenerate banking system altogether, a great purge of evil to restore something like God-fearing accountability, moving toward a fresh and honest re-start of markets and banking. I’m not convinced that we would get any such orderly re-start in the sense that global banking could be reconstructed along pre-2020 lines.

Rather, wrecking the banks in a daisy-chain of shattered obligations would be an express ticket to the Palookaville of neo-medievalism I’ve been warning about, and probably in a sharp, disorderly, violent, and deadly episode of losing everything that has made us civilized. In any case, the country has already prepped itself for some kind of spectacular failure with all the social mind-fuckery of the past four years that eventuated with the empty shell of Joe Biden in the White House, and millions of his supporters swept into an epic hysteria of manufactured moral outrage over pseudo-realities initiated by academic racketeers and then weaponized by our politicians. But the game is on, whether you like it or not. This may be a last opportunity to get your minds right before you lose your country and your future.

There are hundreds of them.

• Figures Tied To Past Controversies Increasingly Land Jobs On Team Biden (JTN)

Jake Sullivan was one of the most prolific users of Hillary Clinton’s forbidden email server. Now he’s Joe Biden’s national security adviser. Undersecretary of State Victoria Nuland previously had ties to Christopher Steele in the Russia scandal. White House domestic adviser Susan Rice once falsely declared the Benghazi terror attack was provoked by an anti-Muslim video and later wrote the famously curious did-it-by-the-books email in the Russia scandal during her last minutes in he Obama administration. And top Securities and Exchange Commission enforcement official Melissa Hodgman is married to Peter Strzok, the fired FBI agent who supervised the discredited Crossfire Hurricane probe into Russia-Trump collusion. As Biden fills out his team, the list of people tied to past scandals and controversy keeps getting bigger.

And the pattern has some prominent Republicans taking note. “If you look at the larger picture, the Russia hoaxers, the people that were pushing this out from the very beginning and lying about it after the fact, they’re all at the top echelons of the Biden administration,” former House Intelligence Committee chairman Devin Nunes (R-Calif.) said Sunday. During an appearance on Fox News’ Sunday show hosted by Maria Bartiromo, Nunes took issue with Hodgman’s appointment as acting chief of the SEC enforcement division, saying while she “could be a great public servant,” it created the appearance of a Democratic payback to her husband for pursuing Trump. “Looks like Peter Strozk is actually going to get reimbursed for all of his troubles,” Nunes said. “The guy lost his job, but nothing’s happened to him at this point.”

Incompetence as a strategic move.

• Why You Haven’t Seen A Sit-Down Biden Interview Yet (Pol.)

Joe Biden waited nearly four decades to become the most powerful man in the free world. Now that he is, he’s making himself scarce. Biden is leaning on doctors and health experts to publicly detail his Covid policy. He’s relying on his Cabinet, economic advisers and other high-ranking administration officials to help sell his nearly $2 trillion rescue package. Biden’s press team, meanwhile, is standing in for their boss by blanketing TV programs with pledges to tell the truth even when it’s inconvenient. It’s one of the more arresting shifts after four years of a president who delighted in torturing the media with sudden pronouncements that often surprised and befuddled his own advisers.

“He trusts them, and Americans will trust experts,” John Anzalone, a top Biden adviser and campaign pollster, said of the president’s approach to his team. “Plus,” he added, “Biden is dealing with multiple crises and is a good delegator.” White House aides describe the strategy not so much as delegation but as an concerted effort to restore confidence with a public battered by the contradictory messaging and scorched-earth politics of the Trump years. In just over a week, the White House has booked 80 TV and radio interviews with 20 senior administration officials, members of the Covid-19 response team and Cabinet secretary designates. They’ve had officials on each major network, booking them on every Sunday show in the first week.

And they worked with CNN to have three of the doctors in charge of its Covid-19 response take questions from the public during a coronavirus town hall, said Mariel Sáez, the White House director of broadcast media. Who’s not been booked for any sit-down interviews: Biden. But the president hasn’t exactly been absent either. He appeared for brief ceremonies where he signed executive orders and delivered mostly scripted remarks. He’s taken a handful of questions from the news media. And he’s expected to give a major foreign policy address on Monday amid a planned trip to the State Department, his first visit to a Cabinet agency.

As main protagonists go, Biden’s role has been comparatively limited — a startling contrast to the omnipresent president who preceded him. Donald Trump didn’t so much love the spotlight as he sought to totally consume it. Whether he was sending Twitter screeds at all hours or shouting answers over the ear-splitting blades of his presidential aircraft, Trump craved media attention like no American leader before him.

Who built the cages?

• Hundreds Deported Under Biden, Including Witness To Massacre (AP)

President Joe Biden’s administration has deported hundreds of immigrants in its early days despite his campaign pledge to stop removing most people in the U.S. illegally at the beginning of his term. A federal judge last week ordered the Biden administration not to enforce a 100-day moratorium on deportations, but the ruling did not require the government to schedule them. In recent days, U.S. Immigration and Customs Enforcement has deported immigrants to at least three countries: 15 people to Jamaica on Thursday and 269 people to Guatemala and Honduras on Friday. More deportation flights were scheduled Monday.

It’s unclear how many of those people are considered national security or public safety threats or had recently crossed the border illegally, the priority under new guidance that the Department of Homeland Security issued to enforcement agencies and that took effect Monday. Some of the people put on the flights may have been expelled — which is a quicker process than deportation — under a public health order that former President Donald Trump invoked during the coronavirus pandemic and that Biden has kept in place. In the border city of El Paso, Texas, immigration authorities on Friday deported a woman who witnessed the 2019 massacre at a Walmart that left 22 people dead.

She had agreed to be a witness against the gunman and has met with the local district attorney’s office, according to her lawyers. Rosa was pulled over Wednesday for a broken brake light, detained based on previous traffic warrants, then transferred to ICE, which deported her before she could reach her attorney, said Melissa Lopez, executive director of the nonprofit Diocesan Migrant & Refugee Services, which represents her.

They want him off the map.

• Biden Considers Revoking Trump’s Rights To Be Briefed On Secrets (DM)

The Biden administration is reviewing whether to take away the ability of former President Donald Trump to receive classified security briefings as the former president in the wake of the Capitol riot.White House spokeswoman Jen Psaki punted on the question when asked about a topic that also came up during the transition – but also confirmed Monday the administration was reviewing the matter. ‘This is a good question,’ said Psaki. ‘It’s something that’s obviously under review.’ The review comes as Trump critics demand he be forced to relinquish some of the perks of power that follow a president even after he leaves office. Former presidents get classified briefings by tradition – although not at the very highest levels reserved for the current officeholder.

In Trump’s case, the briefings would go to a former president who failed to attend the inauguration and spent months claiming that he had ‘won.’ Trump’s statement on his impeachment legal team over the weekend referred to him as the ’45th president of the United States.’ Trump has a small staff that has been running out of Mar-a-Lago. Former presidents get a substantial office stipend, and Secret Service protection costing up to $1 million per year. Even Trump’s adult children are getting Secret Service protection for the next six months, ABC News reported this month. If the Senate were to convict Trump of ‘incitement of insurrection’ following his impeachment trial, it could also vote to strip him of his ability to hold future office. It is unclear what current perks, if any, would go away if he were convicted.

Trump caused an uproar during his 2017 meeting with Russian Foreign Minister Sergei Lavrov and former ambassador to the U.S. Sergei Kislyak after it was reported he revealed highly classified information about ISIS in Syria to the U.S. adversary. He gave up highly sensitive information from a U.S. ally, reported to be Israel, that resulted in the U.S. having to extract a top-level source inside the Russian government. Trump also once tweeted out what appeared to be a classified photo of an Iranian nuclear installation. Trump said he had the power to declassify material. All that preceded the Capitol riots, which followed Trump telling his supporters to ‘fight’ on the day Congress was counting the Electoral College vote.

“Green” has more than one meaning. It’s what the Paris accord is based on.

• Kerry Gifts Wall Street the Green New Deal (Pettifor)

Last week the Biden team delivered their first press conference on the Democrat’s much-anticipated Climate Plan. The good news is that Climate Envoy, John Kerry and Advisor, Gina McCarthy are talking about the Climate Plan delivering “Good paying Union Jobs”. All hail to that ambition. The bad news is that this ain’t no Rooseveltian New Deal. Roosevelt confronted Wall St from the get go. His administration systematically drained the Street of power, and made it servant to the economy and ecosystem. Henry Morgenthau, Roosevelt’s Treasury Secretary could rightly boast: “We moved the financial capital from London and Wall Street right to my desk at the Treasury. (Rauchway, 2017, p. 227)”

John Kerry on behalf of President Biden did the reverse. With breath-taking haste he genuflected to Wall St. by paying homage to the CEO of Blackrock, and then implied the mighty United States government was dependent on Wall St titans to deliver those “Good paying Union Jobs”. Kerry began the press conference by welcoming CEO Larry Fink’s recent letter and “the new awareness among asset managers about the need to be putting resources into this endeavour.” Remember readers, that Larry Fink presides over assets valued at $8.6 trillion. Blackrock’s clients include pension funds, insurance companies, charities, endowment funds and central banks. Tucked into that basket are your pensions, your insurance, your charitable donations – and your taxpayer-backed central bank.

And just this weekend, Gillian Tett of the Financial Times reminded us, in an article titled – Wall St.’s New Mantra: Green is Good – that Blackrock “Exploded in size and power this century by amassing exchange traded funds and “passive’ strategies that automatically track mainstream indices, such as the S&P 500 – which include fossil fuels… to which Blackrock is heavily exposed…” In other words, this private company uses the world’s savings to make massive capital gains from ‘passive’ almost effortless investment strategies. Worse they use their power to accelerate the climate crisis by investing “heavily” in fossil fuels. All that is bad enough. But Blackrock is able to amass their vast, global power because economists and politicians (including ‘the Left’ of the political spectrum) have conceded that power to them.

John Kerry is our witness. After paying homage to CEO Fink, Kerry placed the United States government in the role of humble supplicant – and effectively begged Wall St. to come to the rescue of the Biden Climate Plan. He could not have addressed the Street more plainly: “What the financiers, the big banks, the asset managers, private investors, venture capital, are all discovering is that there is a lot of money to be made in the jobs to be created in these sectors…” Gina McCarthy, National Climate Advisor, drove home the point: “The question won’t be, will the private sector buy into it? The private sector is going to drive it…”

“Twitter has silenced JCN and the 30 million small business owners it represents..”

• Twitter Suspends Account of Group That Called For Regulating Big Tech (JTN)

Twitter has suspended the account of the Job Creators Network, a nonpartisan group that advocates for small businesses and policies that protect Main Street jobs. According to the group, the social media giant sent them a message late last week saying JCN had violated Twitter’s “rules against platform manipulation and spam.” Company President and CEO Alfredo Ortiz rejects that claim, saying the deplatforming effort is retaliation against JCN for implying that Twitter should be regulated as a utility. “Twitter has silenced JCN and the 30 million small business owners it represents after JCN implied that the tech giant should be regulated as a utility,” Ortiz said in a statement. “Given that JCN’s internal review demonstrates we did not violate Twitter’s terms and conditions, the tech giant’s bold move is likely pure retaliation against us for our position on tech regulations.”

Twitter on Monday did not respond immediately to several attempts to contact the company to learn why JCN, which advocates for lower taxes and progressive policies, had been removed from the site. Last month, Ortiz wrote an op-ed published by RealClearPolitics titled, “Big Tech’s Conservative Purge Changes the Free Speech Debate.” JCN Chief Communications Officer Elaine Parker on Monday told the “John Solomon Reports” podcast the op-ed argued for Washington to begin regulating social media platforms and other tech giants as utilities. “The reason behind that is because it would it would preclude them from excluding services based on political beliefs and ideology,” Parker told host John Solomon. “I mean, when when you’re getting your phone service through AT&T, they don’t care who you vote for, or who you support or what your political background is. They just want to sell you a service … right?”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

“It is my great hope someday, to see science and decision makers rediscover what the ancients have always known. Namely that our highest currency is respect.”

– Nassim Nicholas Taleb

“Strap yourself to a tree with roots.”

– Bob Dylan

This So Real

This So Real pic.twitter.com/6UiPiJ74Nw

— Rising Morning Star IAM LIT MASTER BUILDER (@LReasonings) January 31, 2021

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.