DPC H.A. Testard Bicycles & Automobiles, New Orleans 1910

Bloomberg attempts to blame Europe’s troubles on Putin. Unbelievable. Have you no shame? How about journalistic standards?

• EU Dream Unravels 25 Years After The Wall Came Down (Bloomberg)

Europe’s post-Cold War order is fraying and there’s no consensus over how to stitch it back together. Some blame the European debt crisis for exposing the folly of the drive for economic unification. Some point to Vladimir Putin for redrawing the map by force and sending his warplanes to buzz NATO borders. For others, the vision of a peaceful, post-national Europe died off with the World War II generation. The makers of European memory will ponder those questions this weekend, marking on Sunday the anniversary of the fall of the Berlin Wall in 1989 and the ensuing euro-euphoria. The lessons of the intervening quarter-century are more sobering. “The easy assumption was that the international liberal order was prevailing,” said Nick Witney, a former head of the European Defence Agency, who is now with the European Council on Foreign Relations in London. “The fact is that those who don’t share those values are coming back. We’re not somehow riding the wheel of history any more than communism was.”

A few of the original builders of the post-Cold War European Union and euro are still at it. The European Commission’s new president, Jean-Claude Juncker of Luxembourg, traces his career back past the 1991 negotiations in Maastricht, the Netherlands that paved the way to the single currency. Juncker’s mission as the EU’s top civil servant is primarily defensive. The turn-of-the-century notion that Europe could export its economic model to places like China, India and Latin America has given way to renewed global power politics with Europe’s heft much diminished. The EU’s stuttering recovery from the debt crisis underlines that weakness. The euro economy will muster 0.8% growth in 2014 after two years of contraction, the commission said this week. It last outperformed the U.S. in 2008 at the start of the financial crisis.

[..] there’s more than enough nationalism to go around in the European heartland. Parties with grievances against immigration, the euro, the EU and a sense of lost identity have made electoral inroads in Britain, France, Greece, Denmark, the Netherlands, Finland, Austria – and even Germany, long seen as immune to bouts of populism. As a result, the map is in flux. While Scotland voted to stay part of the U.K. in a September referendum, all British citizens will have the opportunity to vote themselves out of the EU in 2017 if Prime Minister David Cameron is re-elected next year. Spain is nagged by a separatist movement in Catalonia, its largest regional economy. “This is the worst possible time for geopolitical risk to be hitting the European continent,” Ian Bremmer, head of Eurasia Group, a New York-based risk consultancy, said this week on “Bloomberg Surveillance.” “On the one hand, you have an external environment that is much worse for the Europeans than anyone else. On the other hand, you have internal populism that’s going to make the Europeans grow farther apart.”

The limited utility of QE outside the US.

• Not All QE Is Created Equal as US Outpunches ECB And BOJ (Bloomberg)

It turns out not all quantitative easing is created equal. New stimulus measures at the Bank of Japan and European Central Bank may lack the global punch of the U.S. Federal Reserve, which last week ended its third round of quantitative easing. So investors should pay more attention to the source of the extra cash sloshing around the financial system than to the amounts. “It is unlikely that increased asset purchases by the BOJ and the ECB will be able to provide a full offset to the end of Fed purchases,” says David Woo, head of global rates and currencies at Bank of America Merrill Lynch in New York. His calculations, contained in a Nov. 3 report, show the Bank of Japan’s surprise decision last week to boost its monetary base faster than previously planned will help add another $730 billion to its balance sheet in the next year. Meantime, the ECB’s buying of asset-backed securities and covered bonds should add $410 billion to its accounts annually.

So even with the Fed no longer buying $85 billion a month of assets, the aggregate liquidity provided each month by the three major central banks will next year return to this year’s peak of a little more than $150 billion. That may help cap any climb in market interest rates in 2015, yet won’t be enough to fully soothe markets as when Fed Chair Janet Yellen and colleagues were writing the checks, according to Woo. Woo argues that the Fed’s influence lies in the benchmark role of the dollar and U.S. Treasuries. Secondly, the Bank of Japan’s latest salvo is more about domestic issues such as reforms of the Government Pension Investment Fund than a signal that it wants to make up for U.S. withdrawal. Finally, Japanese and German bond yields are already so close to zero that the effect of purchases by their central banks will be limited. The upshot is that even with the ECB and BOJ spending, investors will probably now treat bad U.S. data such as a weak jobs report more harshly than when they thought economic deterioration spelled more monetary stimulus.

Thailand, Malaysia, Indonesia: the emerging markets eaten alive by the taper. It’s all going according to plan.

• Asian Currencies Set For A Beating (CNBC)

Currencies across Asia are set for a beating, buffeted by a combination of the G3 central banks, a stronger U.S. dollar and newly volatile Chinese yuan, HSBC said. “It will be slim pickings in terms of which Asian currencies to like next year. Even the yuan will be predisposed to bouts of higher volatility, which could further upset the region’s currencies,” HSBC said in a note Thursday. “While we had expected most Asian currencies to trade on the back foot against the U.S. dollar, some are now even starting to underperform the euro.” Many of Asia’s currencies have had a tough week since the Bank of Japan (BOJ) announced a fresh batch of stimulus, with the Singapore dollar shedding 1.5% against the U.S. dollar, the Thai baht losing 1.1%, the Malaysian ringgit dropping 2.2% and Indonesia’s rupiah slipping 0.7%.

Currencies with sound external balances, such as the yuan, Korean won, Taiwan dollar and Singapore dollar, were expected to hold up better against the Federal Reserve’s tapering of its asset purchases this year, HSBC said. But it added, “It has become steadily clearer that Asian currencies are held hostage to more than just the Fed. The ECB has become increasingly important and suddenly so too has the Bank of Japan.” ECB President Mario Draghi this week indicated the central bank may take further aggressive stimulus measures, with many analysts expecting a quantitative easing program, including bond-buying, is in the works. The ECB is already buying asset-backed securities.

Draghi’s comments followed the Bank of Japan’s surprise move last Friday to expand an already large stimulus program by increasing asset purchases. It plans to increase purchases of Japanese government bonds (JGBs) to 80 trillion yen annually from the current 50 trillion yen as well as tripling purchases of exchange-traded funds (ETFs) to 3 trillion yen and tripling Japanese real-estate investment trust (REIT) purchases to 90 billion yen. “This muddies the picture as to which Asian currencies should outperform,” HSBC said. “It only fuels a stronger U.S. dollar and even those Asian currencies with sound external balances (the Korean won, the Singapore dollar and the Taiwan dollar) cannot ride out the storm. It is all proving to be a nasty combination for many Asian currencies.”

The rally will end anyway, independent of dollar levels.

• Could A Strong Dollar Derail Wall Street’s Rally? (CNBC)

A stronger greenback will ultimately hinder the U.S. stock market’s performance as domestic exporters receive less cash for their products abroad, according to Capital Economics. The U.S. dollar hit multi-year highs against several currencies this week, including a seven-year high against the Japanese yen, after Republicans gained control over both chambers of Congress for the first time since 2006, raising hopes of more pro-business policies. At the same time, U.S. stocks have been powering higher. The S&P 500 and Dow Jones hit record highs on Thursday, and are up 9.48% and 5.48% year to date, respectively. “Although the U.S. stock market has rebounded in recent weeks, its upside could by limited if, as we forecast, the rally in the dollar continues,” Capital Economics analysts said.

A stronger greenback means U.S. exporters will be faced with a conundrum: cut profit margins by keeping the foreign currency price of its exports unchanged or risk losing market share by hiking prices abroad. Either way, the dollar’s rise will prove a hindrance, Capital Economics said. Companies selling goods at home, that compete with imports from foreign countries, will also lose out, Capital Economics said. Foreign companies can cut the dollar price of their exports without hurting the value of profits in their home currency, putting them at an advantage and increasing their market share. “Finally, fluctuations in the dollar’s value also affect the earnings of U.S. companies’ foreign affiliates, which are very sizeable… As the dollar rises, those overseas earnings are worth less in U.S. currency,” the analysts added.

PR to make people buy gold, fearing it will go up in price?

• Miners Facing ‘Bloodbath’ If Gold Sinks To $1,000 (Telegraph)

The boss of the largest London-listed gold miner said his industry is suffering and is facing a “bloodbath” if the price of the precious metal sinks to $1,000 an ounce. Mark Bristow, chief executive of Randgold Rresources, said: “The [gold mining] industry is clearly stuffed at $1,140 and it will be a bloodbath at $1,000.” The price of gold is testing four-year lows. It fell again today – down 0.4pc to $1,142.8 per ounce at midday. Mr Bristow, who was speaking at his company’s third quarter results presentation in London, said demand for gold is as strong as ever. However, he beleives that the industry has failed to learn the lessons from a cyclical market and is “pumping out” unprofitable gold into the market after years of expansion.

He believes that the business plans of many companies are based on the price of gold being around $1,300 per ounce. This did not look outlandish when the price hit $1,900 in 2011 but is making things difficult now. Mr Bristow said he doesn’t expect the price of gold to recover any time soon: “Gold at $1,300 is history and big players wil struggle to repay their debts at current prices.” Randgold Resources said third-quarter pre-tax profits were down to $79.6m from $126.6m in the same period last year. The company’s own cash costs for gold production were $692 per ounce during the period, one of the lowest in the industry. “Our business is designed to make profits at $1,000 per ounce, not just survive,” Mr Bristow said.

“..three quarters of gold mining companies burn cash at spot prices just below $1,200 on an all-in cost basis.”

• Gold Firms Plan Drastic Cuts As Bullion Sinks (Reuters)

Struggling gold producers plan increasingly drastic measures such as scrapping dividends, cutting jobs, halting projects and shutting mines to survive the latest price plunge, but not all of them will make it. Gold tumbled to a more than four-year low of $1,137.40 an ounce this week, rekindling memories of last year’s 28% drop to $1,196. That fall put an abrupt end to years of over-spending on expansion projects and forced producers to cut costs. Gold prices recovered early in 2014, but the slide in the past three months to new lows will force companies to step up their efforts to cope. According to Citi analysts, about three quarters of gold mining companies burn cash at spot prices just below $1,200 on an all-in cost basis, which includes head office, interest, permitting and exploration costs. Buenaventura, Medusa and Iamgold are among the highest-cost producers with all-in costs well above $1,300, a Citi note to investors said.

“Everyone has started now to appreciate that the music has stopped and there are only so many chairs,” Mark Bristow, chief executive of gold miner Randgold, said in an interview. He said he was frustrated that not much high-cost production had been shut down so far. “It is questionable whether, without injection of liquidity, the leading companies in our industry can manage their businesses going forward. Everyone is trying to survive in hope that the gold price will go up.” Unlike prices for most other commodities, the gold price does not hinge mostly on demand and supply fundamentals. Instead, it is tied more to global economic factors such as interest rates and inflation and is more subject to investor sentiment, which make its moves more difficult to predict. And gold equities are historically even more volatile than the metal. After outperforming the bullion price for most of this year, gold mining shares have given up all gains to sink much deeper than gold itself.

It works!

• Abenomics Pushes Japan Corporate Earnings Toward Record (Bloomberg)

Japanese companies are headed toward their highest profits ever, as the falling yen boosts exporters from Toyota to Uniqlo-operator Fast Retailing. Aggregate net income at 195 of the largest listed companies will expand 10% to a record 17.5 trillion yen ($153 billion) this fiscal year, based on analyst estimates compiled by Bloomberg. Executives are catching up to such lofty expectations, with Toyota this week raising its profit forecast to an unprecedented 2 trillion yen.

As the earnings season winds down in Japan — almost all companies will have reported results by next week — exporters are emerging as one of the biggest beneficiaries of Prime Minister Shinzo Abe’s economic policies. For investors, the weaker currency is outweighing slumps in wages and local consumption, prompting them to push up the Nikkei 225 Stock Average to levels last seen seven years ago. “Profits were pushed up somewhat surprisingly by the exchange rate recently,” said Tomohiro Okawa, a Japan equities strategist at UBS AG in Tokyo. “Still, there’s not much more that monetary policies can do, and structurally, nothing has changed for these companies.”

Forget it.

• Draghi Stokes Speculation ECB Set to Intensify Stimulus (Bloomberg)

Mario Draghi is stoking investor bets that he’ll intensify stimulus for the euro area after indicating he has the backing of policy makers to do so. With the European Central Bank president yesterday downplaying dissent within his 24-member Governing Council, new preparations for more-expansive action and a €1 trillion ($1.2 trillion) target for boosting the institution’s balance sheet suggest momentum is shifting toward a proposal for broader bond-buying, perhaps in December. The euro fell and southern European bonds rose as Draghi said policy makers are united in trying to revive inflation and highlighted how they’re stepping up their efforts as the U.S. Federal Reserve pulls back. Corporate bonds could be the next target before more-controversial sovereign debt, economists said. “Draghi signaled that additional monetary easing was in the pipeline,” said Nick Kounis, head of macro and financial markets research at ABN Amro Bank in Amsterdam. “Further action could be announced as soon as next month’s meeting.”

The euro area’s central bankers met yesterday in Frankfurt amid claims that Draghi often acts without the backing of them all, and just days after the Bank of Japan ramped up its own stimulus campaign. The question from investors is how much more he can do to boost an economy that risks sliding into its third recession in six years and where inflation is close to becoming deflation. Having already cut interest rates to record lows and saying they can go no lower, Draghi is now focused on boosting the ECB’s balance sheet. He told reporters that he expects to increase assets back toward March 2012 levels, a clearer commitment than previously. That means a goal of €3 trillion, or about €1 trillion more than the current level. The ECB has issued long-term loans to banks and started buying covered bonds in the hope of flooding the economy with enough liquidity to ease credit constraints. Purchases of asset-backed securities are due to start this month.

Accurate contrarian indicator.

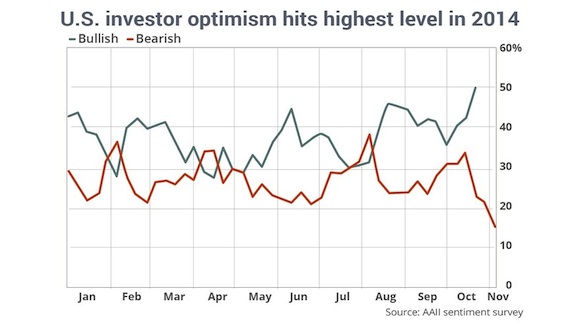

• US Investor Sentiment At Highest Level Of 2014 (MarketWatch)

A scary selloff in U.S. stocks that gripped markets last month may seem like a gauzy memory, by now. Major U.S. stock benchmarks are hurtling to new heights. So, have the halcyon days for stocks returned? At first glance, the answer appears to be, yes. Eyeballing the most recent investor-sentiment survey from The American Association of Individual Investors indicates that optimism is at its highest level since Dec. 26, 2013, while pessimism fell to a nine-year low. More than half of people surveyed are optimistic that markets will rise over the next six months, while only 15% expect markets to fall, as the chart included shows.

It’s important to note that many market watchers use the AAII survey as a contrarian indicator. Meaning high optimism can signal that it’s not the best time to be a buyer because the markets are hopped up on a major dose of irrational exuberance. After all, if everyone is already bullish, who’s left to buy? At current levels, optimism is unusually high and pessimism is unusually low, AAII wrote, in a report accompanying its survey results, adding that “historically, such occurrences have been followed by lower-than-average levels of market gains.” The number of people feeling bullish has been rising for the past five weeks, according AAII survey. That’s despite the nasty selloff last month, which reached its nadir in the middle of October. Fueling some of this newfound euphoria has been the cessation of the Federal Reserve’s bond-purchasing program and solid corporate earnings. However, investors may be too late to the stock party, if the AAII survey is an accurate contrarian indicator.

How to keep home prices at elevated levels.

• Congress Is In No Hurry To Wind Down Fannie And Freddie (MarketWatch)

Looking for a reason why U.S. lawmakers might not rush to push through an overhaul of the U.S. housing-finance system that would involve winding down Fannie Mae and Freddie Mac? You’re in luck: There are billions of reasons, according to the companies’ quarterly earnings reports released Thursday. By the end of 2014, the government-sponsored enterprises will have delivered $38 billion more in dividend payments to the U.S. Treasury than they received in bailout money. “The GSEs are a dedicated source of revenue for the federal government and that is unlikely to change anytime soon,” said Isaac Boltansky, an analyst at Compass Point Research & Trading, a Washington-based investment firm. Fannie and Freddie started taking federal bailout funds in 2008, and maxed out at a cumulative total of almost $190 billion several years ago. Due to a legal arrangement, the companies can’t narrow their debt to the government, but they do send periodic payments.

By the end of 2014 Fannie and Freddie will have sent the U.S. Treasury Department a cumulative total of about $225 billion in dividend payments. A strengthening housing market, large tax benefits and legal settlements in recent years have pumped up Fannie and Freddie’s earnings. Because of a controversial amendment to the government’s agreement to help the once-flailing companies, Fannie and Freddie are unable to build capital. Instead, they send their profits to the U.S. Treasury. While U.S. lawmakers may pay lip service to the idea of replacing the two mortgage-finance giants — together Fannie and Freddie back about half of new U.S. mortgages – Congress may dawdle when it comes to slaughtering the cash cows. “GSE earnings today could delay the debt ceiling deadline tomorrow,” Boltansky said.

They all think governments can make up for the decline in cosumer spending. Fatal flaw.

• Eurozone Governments Look for Spending Boost (Bloomberg)

Euro-area governments brainstormed over how to boost the bloc’s flagging recovery as European Central Bank President Mario Draghi urged countries to do more to make their economies more competitive. “The sense of urgency has to become a lot stronger,” Dutch Finance Minister Jeroen Dijsselbloem said at a conference in Brussels today before talks among his euro-area counterparts. “Politicians also have to shape up and get some of the tougher things done to really create an investment climate in Europe which we badly need.” Finance ministers from the 18-nation euro bloc are beginning to converge over the need to fire up investment as growth in the region’s largest countries stagnates and inflation is predicted to remain at less than half the ECB goal of just under 2% this year and next. Draghi today said he’ll be ready to provide more ECB stimulus, while pressuring member states to do their part.

While accommodative monetary policy, such as the unprecedented stimulus measures that the ECB has already pushed through, can help economic activity, “implementation of product and labor-market reforms, as well as actions to improve the business environment for firms, need to gain momentum in several countries,” Draghi told reporters at his monthly press conference after the ECB Governing Council met in Frankfurt today. “Insufficient progress in structural reforms in euro-area countries constitutes a key downward risk to the economic outlook.” Italy, the third-largest euro-area economy in its third recession in six years, is already taking steps to make its economy more competitive, Finance Minister Pier Carlo Padoan, said at the Brussels conference. “In order to have more investment and therefore more growth we need more resources,” he said. This needs “bringing into the field other investors alongside banks, institutional investors, pension funds, insurance companies and so forth, but also leveraging and making the most of the instruments we already have.”

Why not come clean?

• China Central Bank Pledges Policy Support As Risks To Growth Rise (Reuters)

China’s central bank pledged on Thursday to maintain modest policy support to help the world’s second-largest economy weather increasing headwinds in the near term but stressed that it will not flood markets with cash. Yet at the same time, the central bank also said publicly for the first time that it had pumped 769.5 billion yuan ($125.91 billion) worth of three-month loans into banks via a “medium-term lending facility” (MLF) to keep interest rates low. The disbursement of loans was slightly more than the 700 billion yuan expected by many in the market and underscored the risks faced by China’s economy, where third-quarter growth fell to a low not seen since the 2008/09 global financial crisis.

“During the process of economic adjustment, China will see rising downward pressure in its economy and increasing chances of exposure to potential risks in a certain period of time,” the People’s Bank of China said. It promised to stick to its “prudent” stance, fine-tune policy in a timely manner to support the economy, and maintain appropriate liquidity conditions to keep reasonable growth in credit and social financing. Indeed, to protect a wobbly economy from any painful rises in borrowing cost, the central bank said the 769.5 billion yuan worth of loans that were extended to banks in September and October were issued at an interest rate of 3.5%.

$126 billion in two months.That just go ‘poof’.

• China Central Bank Confirms New Liquidity Tool as It Holds Off Easing (Bloomberg)

China’s central bank has published details on its latest tool to provide liquidity as it refrains from across-the-board cuts to benchmark interest rates. The People’s Bank of China confirmed it pumped 769.5 billion yuan ($126 billion) into the country’s lenders in the last two months through a newly-created Medium-term Lending Facility. The PBOC injected 500 billion yuan in September and another 269.5 billion yuan in October via the facility — all termed at three months with an interest rate of 3.5%. The announcement, included in the PBOC’s quarterly monetary policy statement, is the first official confirmation of earlier reports on the injections. Goldman Sachs Group Inc. said every 500 billion yuan in funds from the central bank is similar to a 50-basis-point cut in the required reserve ratio.

“It shows the central bank is very reluctant to loosen monetary policy, but it has to reduce financing costs for end borrowers,” said Guan Qingyou, chief macro-economic researcher with Minsheng Securities Co. in Beijing. “It doesn’t mean the new tools can replace traditional tools forever.” The operations “affected mid-term interest rates while providing liquidity to guide commercial banks to lower their lending rates and overall social-financing costs,” the central bank said in the report published yesterday. “As liquidity generated from capital inflows eases, MLF has played a role of covering the liquidity gap and maintaining a neutral and appropriate liquidity situation.”

Time to lose the dollar peg?

• Yuan Bears Say Record Chinese Dollar Debt to Fuel Decline (Bloomberg)

Yuan bears have added Chinese companies’ record dollar borrowings to the list of reasons why the currency may weaken. Chinese firms raised $196 billion from loans and bonds this year, 11 times more than the $17.7 billion of 2008, data compiled by Bloomberg show. Societe General SA, Daiwa Capital Markets and Royal Bank of Canada predict the yuan, which is headed for its first annual decline in five years, will drop further in coming months as the outlook for rising U.S. interest rates and a weakening Chinese economy exposes the risk of overseas liabilities. The People’s Bank of China engineered a 2.6% decline in the yuan in the first quarter to cut one-way bets on the currency and prepare companies for the risk of exchange-rate weakness.

Daiwa Capital Markets estimates that, in addition to foreign-currency borrowing, $1 trillion of hot money has flooded into China since the Federal Reserve started quantitative easing in 2008, including through shadow-banking channels such as export financing and metals purchases. “Leverage does place China in the higher risk category in the Asian region,” Sue Trinh, a senior currency strategist at Royal Bank of Canada in Hong Kong, said by phone yesterday. “China is making continued progress in reducing reliance on credit and in particular the shadow-banking sector,” she said, adding that the effort “will likely limit the extent to which the yuan will be able to gain.”

Remnants of times long gone.

• Europe’s Shrinking Conglomerates (Bloomberg)

Europe’s biggest conglomerates are slimming down, discarding units that either don’t make enough money or don’t fit with how they see the future. It makes sense to concentrate on fewer industries: There’s no obvious synergy between building power stations and selling hearing aids, or between engineering more fertile seeds and making polycarbonate car parts. It just might herald the start of a second European industrial revolution. It’s certainly set off a massive mergers-and-acquisitions wave. Germany’s Siemens is leading the charge. It has discarded at least five businesses this year to focus on what it calls “electrification, automation and digitalization.” And that’s after more divestments last year than any European industrial company, according to Bloomberg Intelligence. Both Germany’s Bayer and Royal Philips of the Netherlands are abandoning their century-old business roots in a burst of Schumpeterian creative destruction.

Siemens is allowing partner Robert Bosch to take over its appliance business by selling Bosch a 50% stake for €3 billion ($3.75 billion). Siemens is also selling a health data unit for $1.3 billion, a clinical microbiology division for an undisclosed sum, an alarms-and-video surveillance maker, and a hearing-aids business for €2.2 billion. On the acquisitions side, Siemens is muscling up in the markets on which it wants to focus. It paid $7.6 billion for Dresser-Rand Inc. in September to bolster the oil-field equipment division, and $1.3 billion in May for a unit making gas turbines and compressors from Rolls-Royce Holdings. It missed out on the energy assets of France’s Alstom SA, beaten by U.S. giant General Electric’s $17 billion bid. (GE is also slimming down by offloading a consumer appliance business to Sweden’s Electrolux for $3.3 billion earlier this year.)

Time to lie, Jean-Claude.

• Luxembourg And Juncker Under Pressure Over Tax Avoidance Deals (Guardian)

French, German and Dutch finance ministers have rounded on Luxembourg for allowing multinational companies to create complicated structures to avoid billions of dollars of tax. Pressure is also mounting on Jean-Claude Juncker, the new president of the European commission and former long-serving prime minister of Luxembourg, who oversaw the introduction of laws that helped turn the tiny European country into a magnet for multinationals who are seeking to reduce their tax bills. The calls for Luxembourg to stop arranging special deals that help corporations avoid tax came after a vast cache of 28,000 leaked tax papers from the Grand Duchy revealed the country had been rubber-stamping tax avoidance on an industrial scale. Details of the documents were revealed by 80 journalists in 26 countries working with the International Consortium of Investigative Journalists (ICIJ), including the Guardian.

Wolfgang Schäuble, Germany’s finance minister, said the revelations about Luxembourg’s secret tax deals showed that the Grand Duchy had “a lot to do” to meet global standards. The French finance minister, Michel Sapin, said such deals were “no longer acceptable for any country”. He added: “I wish that in a few years we never have to talk about something like this again.” The Netherlands finance minister, Jeroen Dijsselbloem, who is also chair of the Eurogroup of all 18 finance ministers in the eurozone, said that Luxembourg was breaching international tax standards. “Many countries make agreements with companies to provide security. But these agreements need to comply with international standards. We still have some work here.” At Westminster, Margaret Hodge, chair of the Commons public accounts committee, said: “[Juncker has] just taken over the European commission, [yet] he’s presided over the biggest exploitation of European nations in his own little country for decades.”

Despite the criticism, Juncker was said to be “very serene” and “cool”. Juncker, who took over as president of the commission on Saturday after serving 19 years as premier of Luxembourg, was scheduled to take part in a public debate on Thursday in Brussels. But he pulled out on Wednesday night as news organisations prepared to publish the leaked tax documents. Many of the tax deals – secured for companies including Ikea, Pepsi, Burberry, FedEx and Procter & Gamble – were aided by laws written during Juncker’s term of office. The Danish tax minister, Benny Engelbrecht, said the revelations were “shocking”. “Tax payments are down to%ages that are so crazy that you can almost not even describe the challenges that they create for other countries,” Engelbrecht told the Danish paper Politiken.

“… the Brussels accounts have not been given the all clear for 19 years running.” How insane would you like it?

• EU Auditors Refuse To Sign Off Over £100 Billion Of Its Own Spending (Telegraph)

The European Union is accused of “breathtaking hypocrisy” for continuing to demand that David Cameron pays a £1.7 billion bill despite its own auditors failing to give a clean bill of health to more than £100 billion of spending by Brussels According to the annual report of the European Court of Auditors, seen by The Telegraph, £5.5 billion of the EU budget last year was misspent because of controls on spending that were deemed to be only “partially effective” by experts. The audit found that £109 billion out of a total of £117 billion spent by the EU in 2013 was “affected by material error”. It means that the Brussels accounts have not been given the all clear for 19 years running. Treasury sources said that the disclosure shows why the EU needs “urgent reform”. Mr Cameron has said he will refuse to pay “anything like” the £1.7 billion on December 1, despite being threatened with fines by the EU.

The damning finding by the auditors emerged as senior figures in Brussels criticised Mr Cameron for refusing to pay the bill, which was demanded because of the success of Britain’s economy. The audit concluded that the European budget needed better management at a time of “continuing pressure on EU and national finances”. “More can and should be done to ensure money is spent according to rules,” it said. Among the examples of misspent money was funding used to buy helicopters to help Spain defend Europe’s borders against entry by illegal immigrants. “[Auditors] examined a project in Spain which consisted of the purchase of four helicopters, to be used 75% of their operating time for EU border surveillance and control. However, the ECA found the helicopters were only used 25% of the time for this purpose,” said the report. In another case, the commission handed out £1.4 million in funding for social development in Moldova “for which no underlying expenditure had been incurred”.

Gorbachev was never a big fan of Putin’s. But he knows the US “.. have different plans, they need a different situation, one that would allow them to meddle everywhere.”

• Gorbachev: Putin Protects Russia’s Interests Better Than Anyone Else (DW)

Former Soviet leader Mikhail Gorbachev said he will defend Russia’s policy in Ukraine and President Vladimir Putin when he meets with top German officials this week, for the festivities marking the 25th anniversary of the fall of the Berlin Wall. “I am absolutely convinced that Putin protects Russia’s interests better than anyone else,” Gorbachev said. The last leader of the USSR is set to meet German Chancellor Angela Merkel and President Joachim Gauck during the ceremony, which comes at a time of bitter confrontation between Russia and the West. Gorbachev also said that the current Ukraine crisis provided an “excuse” for the United States to pick on Russia.

“Russia agreed to new relations, [and] created new cooperation structures. And everything would be great but not everyone in the United States liked it,” he said in an interview with the Interfax news agency on Thursday. “They have different plans, they need a different situation, one that would allow them to meddle everywhere. Whether it will be good or bad, they don’t care,” Gorbachev said, referring to Washington. The 83-year-old is widely praised for his decision not to use force to stop the wave of changes in Eastern Europe during the final years of the Cold War. He is also credited for the reforms of glasnost (openness) and perestroika (restructuring) after coming to power in 1985, and allowing the Wall to fall in 1989, thus effectively ending the Cold War. He has often criticized Vladimir Putin for his authoritarian style of government. A quarter century after the fall of the Iron Curtain, many former Soviet officials say they feel betrayed by the West.

Several politicians from that era have told the AFP news agency that the reunification of Germany was allowed only under the condition that NATO would not expand to the east, into an area traditionally considered a Russian sphere of influence. Former Gorbachev advisor Anatoly Chernyaev swears that he personally witnessed a pledge from Washington to the Soviet leader not to enlarge NATO. “With my own ears, I heard Secretary of State James Baker promise Gorbachev on February 9, 1990 in the Kremlin’s Catherine the Great hall that NATO would not extend ‘even an inch’ to the east if we accepted the entry of a unified Germany into the alliance,” he said. Western leaders from the same period have rejected claims that such a deal with the Kremlin ever existed.

The west is not interested in peace.

• Ukraine Lurches Back Toward Open War on East Fighting (Bloomberg)

Ukraine’s east lurched back toward open war as the government in Kiev and pro-Russian rebels accused each other of starting major offensives in the region. The Ukrainian government said there were 26 outbreaks of fighting yesterday between its forces and separatists in the east, while the rebels said the Kiev government’s troops had gone on a large-scale military push there. The standoff is coming to a head after Ukraine and its allies accused separatists of undermining peace efforts with Nov. 2 elections in Donetsk and Luhansk. Russian President Vladimir Putin said Nov. 5 that Ukraine’s “civil war” isn’t subsiding as cities continue to come under shelling and the civilian death toll rises.

“Both Ukrainian government and separatist forces must immediately stop carrying out indiscriminate attacks in violation of the laws of war,” said John Dalhuisen, Europe and Central Asia director of Amnesty International in a report posted on the human rights group’s website yesterday. “They have killed and injured civilians, and destroyed civilian homes, and there would appear to be little impetus on both sides to end these violations.” Ukrainian troops are sticking to the cease-fire worked out two months ago and are “staying at their previous positions,” the military press office said in a statement on its Facebook page. It said three Ukrainian servicemen were killed yesterday. Russia’s RIA Novosti state news agency quoted Andrei Purgin, deputy premier of the self-proclaimed Donetsk People’s Republic, as saying that Ukraine had begun a large-scale offensive against the separatists in the east. Purgin said he sees “all-out war” and claimed Ukrainian forces had broken the Sept. 5 truce, according to RIA.

Home › Forums › Debt Rattle November 7 2014