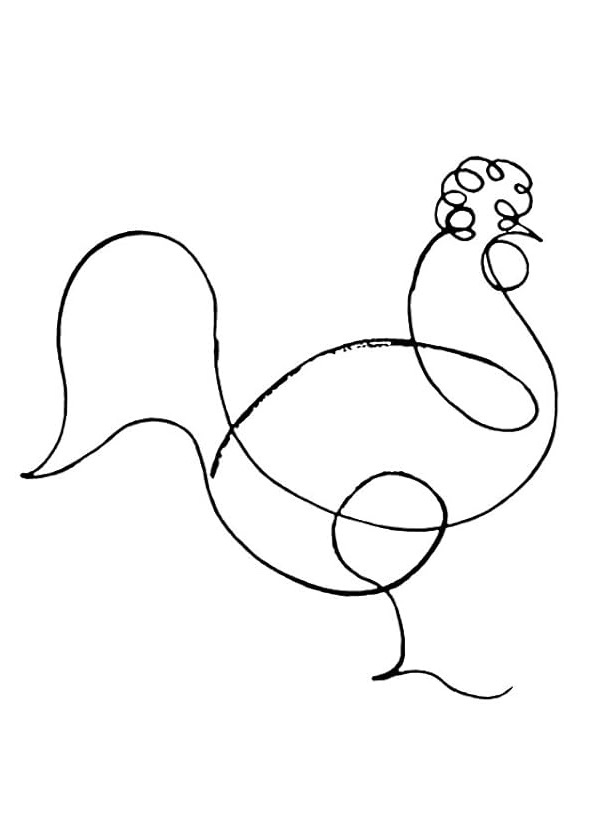

Pablo Picasso The Rooster 1918

Jon Stewart

Ok y'all…

I'm not saying that the planets are aligned or anything but…

-Trump wins at SCOTUS 9-0 yesterday.

-Trump's gonna win 15-0 today.

-Biden Admin ADMITS it secretly flew 320k illegals into the US

AND….

-The Daily Show absolutely MOCKS the Democrats and IS ACTUALLY… pic.twitter.com/XtTYOpHWGn— SaltyGoat (@SaltyGoat17) March 5, 2024

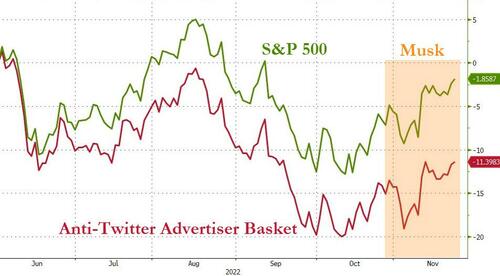

Trump Elon

https://twitter.com/i/status/1765180141259641194

Trump

Trump calls out dirty DAs like Fani Willis and coordinated Democrat Plot to eliminate him via lawfare:

"These people are bad people. They were set out to do a number on me to damage me, so that Biden could beat me. Because that's the only way he can beat anybody because he's… pic.twitter.com/QFlwrxOAIb

— Benny Johnson (@bennyjohnson) March 5, 2024

This freight train’s coming

Trump puts Regime ON NOTICE with chilling Super Tuesday message:

"We want to be too big to rig… Because we want to send a signal that we're coming. This freight train's coming." pic.twitter.com/7upuWFFyyv

— Benny Johnson (@bennyjohnson) March 5, 2024

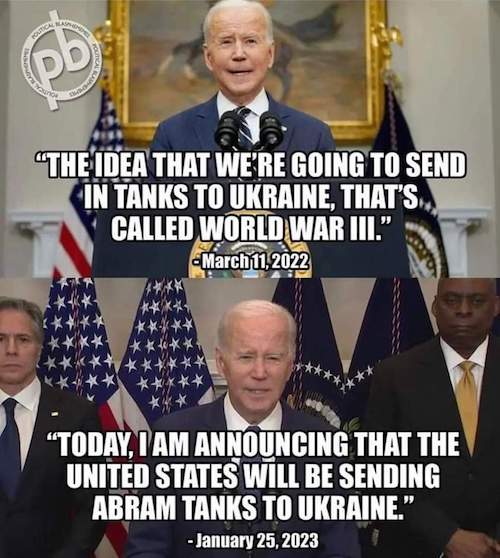

Bannon Nuland

Bannon: "Victoria Nuland, preserve your documents. Lawyer up because we are coming for you. You are the fountain head of everything about this Ukraine situation." pic.twitter.com/89NV1W95tb

— Real Mac Report (@RealMacReport) March 5, 2024

Tucker Ablow

Ep. 79 Dr Keith Ablow is a psychiatrist who spent years on Fox News. He also treated Hunter Biden. Armed agents raided his office, took his patient records as well as Hunter's laptop, and never charged him with a crime. What was this about? He talks about it for the first time. pic.twitter.com/qltqW0ITTv

— Tucker Carlson (@TuckerCarlson) March 5, 2024

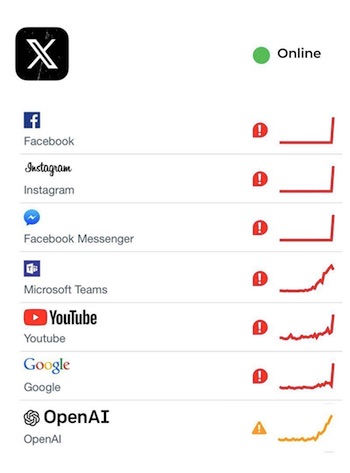

Lots of outages on Super Tuesday..

@ SteveLovesAmmo:

I honestly don’t know how Donald Trump does it. He has been relentlessly attacked by the mainstream media since 2015. He has been arrested 4 times with 91 charges and is facing 700 years in prison over political persecution. He lost over 46% of his net worth since his Presidency, while the establishment continues to rake in and fatten their pocketbooks. He flies to numerous cities and states to greet his supporters in between court cases.

He could have thrown in the towel at any point and continued his lavish lifestyle but continues to fight daily for the American people. His home and his wife and sons possessions were violated by the FBI. That’s a man that has been battle tested and worthy of being President of the United States of America. Not some corrupt politician that has been milking the system for over 50 years. Donald Trump is a true American patriot and hero. No one can change my mind.

@jason_meister

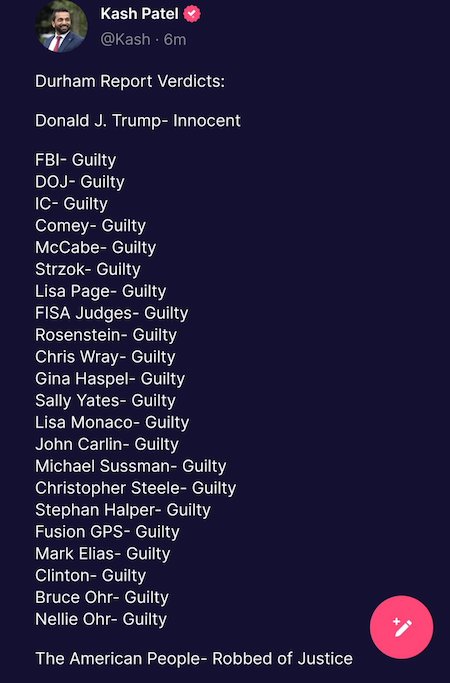

Democrats illegally spied on Trump’s transition team, framed a three-star-general, sabotaged an administration, undermined a sitting US president, banned him from social media, impeached him 2X, arrested him 4X, charged him 91X, indicted him 4X, jailed his supporters, and raided his private residence. When all of that failed they attempted to remove him from ballots. And they go on national television to talk about how we need to vote for Democrats to save democracy.

“I mean, that’s a mercenary army by definition.” “Of course,” Macgregor replied, “And mercenaries fight for money. They fight for the people that pay them.”

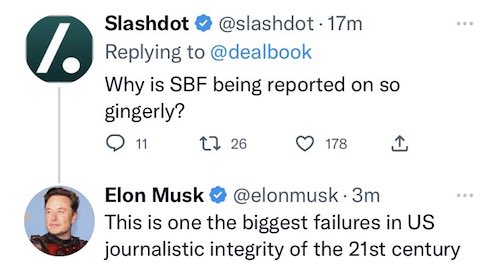

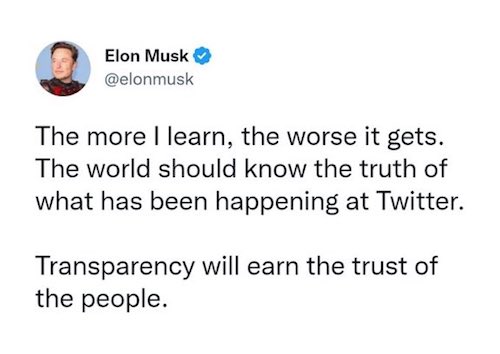

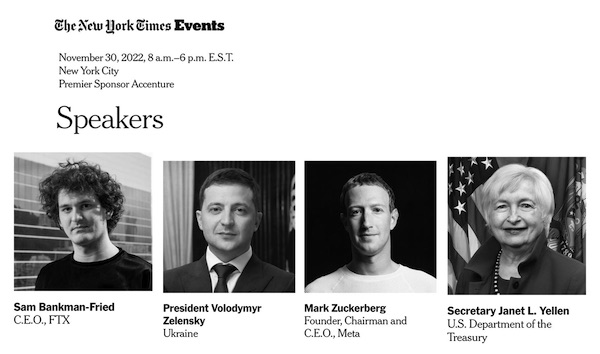

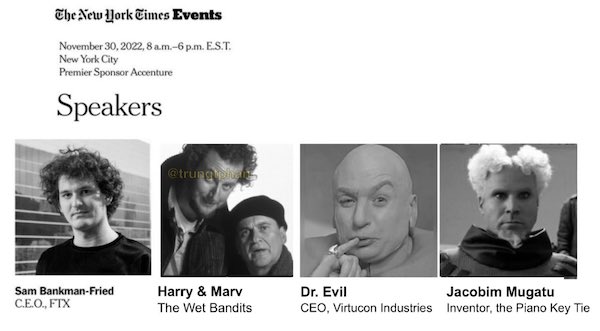

• Elon Musk Exposes the Democrats’ Secret Game Plan to Win Every Election (VN)

Following Biden’s COVID-19 “vaccine” mandates and the war on middle America, the U.S. military is facing recruiting shortfalls. As a response to this challenge, Democrats are proposing illegal immigrants sign up for the armed forces, as a potential path to citizenship. One of the biggest proponents of this proposal is Senate Majority Whip Dick Durbin (D-IL). Not too long ago on the Senator floor, he said, “… if you are an undocumented person in this country and you can pass the physical and the required background test the like, you can serve in our military. And if you do it honorably, we will make you citizens of the United States. Do we need that? You know what the recruiting numbers are.” On Tucker Carlson Uncensored Monday evening, the conservative journalist asked retired Army Colonel Douglas Macgregor if Congress would be stupid enough to pass a law granting citizenship to illegal aliens who enlist in the military — to which Macgregor answered, “YES.”

“The problem is Washington is donor-occupied. Donor occupied. The donors own the political figure. So what do the donors want?” he asked. So, if the donor class wants illegal immigrants in the U.S. military, Macgregor thinks they have a high probability of getting their way. Macgregor also remarked: “I think the largest problem is that Washington is this ideological bubble. And everyone decides that anyone who doesn’t agree with them, that the world has to be refashioned in some new image that exists only in their minds, and that anybody who disagrees with them is by definition a criminal and has to be treated as such. What better solution than finding people who have no connection to the American people, arming them, and then sending them out to oppress us? Sounds like a great solution.” Carlson responded, “I mean, that’s a mercenary army by definition.” “Of course,” Macgregor replied, “And mercenaries fight for money. They fight for the people that pay them.”

This administration is both importing voters and creating a national security threat from unvetted illegal immigrants.

It is highly probable that the groundwork is being laid for something far worse than 9/11. Just a matter of time. pic.twitter.com/kuilPxAvv3

— Elon Musk (@elonmusk) March 5, 2024

On X, formerly known as Twitter, Elon Musk responded to a post by political commentator Ashley St. Clair. She said, “I was called a racist for saying this last year,” featuring a screenshot of a Daily Mail article that reads, “Biden administration ADMITS flying 320,000 migrants secretly into the U.S. to reduce the number of crossings at the border has national security ‘vulnerabilities.’” Musk replied: “It is obvious to anyone who is not a fool that this administration is deliberately importing vast numbers of illegals. “No grand conspiracy theory is needed to explain this, just simple incentives: they are far more likely to vote Democrat than Republican. “This is why Dems are constantly pushing to legalize illegals and won’t deport them, even when they are arrested for crime, which otherwise seem … I dunno … like an opportune time (shrug emoji). “If illegals can beat up American police on camera in Times Square, be released without bail, and get rewarded with free tickets to California, what more do you need to know?”

Is Musk being sensational? Take a listen to Senator Chris Murphy’s (D-Connecticut) words last month. He admitted to MSBNC host Chris Hayes that “the people we care about most” are “the undocumented Americans that are in this country.” TRANSLATION: “We want their votes!”

Hochul

BREAKING NOW: New York State now removing red tape to ALLOW ILLEGAL MIGRANTS the ability to obtain state jobs.

READ THAT TWICE…pic.twitter.com/euFyoizxTd

— Chuck Callesto (@ChuckCallesto) March 5, 2024

“It is the political version of the Big Gulp law, voters like consumers have to be protected against their own unhealthy choices..”

• Democrats Prepare to Resume Disqualification Efforts in Congress (Turley)

Calling it “one on a huge list of priorities,” Rep. Jamie Raskin (D., Md.) announced that he will be reintroducing a prior bill with Reps. Debbie Wasserman Schultz and Eric Swalwell to disqualify not just Trump but a large number of Republicans from taking office. The alternative, it appears, is unthinkable: allowing the public to choose their next president and representatives in Congress. It appears that the last thing Democrats want is for the unanimous decision to actually lead to an outbreak of democracy. Where the Court expressly warned of “chaos” in elections, Raskin and others appear eager to be agents of chaos in Congress. Soon after the decision, Raskin went on the air at CNN to assure people that he and his colleagues would not stand by and allow the right to vote be restored to citizens in the upcoming election.

He pledged to offer a prior bill that would declare Jan. 6 an “insurrection” and that those involved “engaged in insurrection.” I previously wrote about these “ballot cleansing” efforts because it would not just disqualify Trump but potentially dozens of sitting Republican members of Congress. Rep. Bill Pascrell (D-NJ) sought to bar 126 members of Congress under the same theory. Similar legislation offered by Rep. Cori Bush (D-Mo.) to disqualify members got 63 co-sponsors, all Democrats. Raskin’s participation in this effort is crushingly ironic. In 2016, he sought to block certification of the 2016 election under the very same law as violent protests were occurring before the inauguration. The prior bills were sweeping and included members who did not engage in any violent acts (no member has been charged with such violence or even incitement) but merely opposed certification.

Raskin recently offered a particularly Orwellian argument for the disqualification of Trump and his colleagues in Congress: “If you think about it, of all of the forms of disqualification that we have, the one that disqualifies people for engaging in insurrection is the most democratic because it’s the one where people choose themselves to be disqualified.” In other words, preventing voters from voting is “the most democratic” because these people choose to oppose certification . . . as he did in 2016. After the ruling, Raskin added the curious claim that the justices “didn’t exactly disagree with [the disqualification theory]. They just said that they’re not the ones to figure it out. It’s not going to be a matter for judicial resolution under Section 3 of the 14th Amendment, but it’s up to Congress to enforce it.”

That was sharply different from the pre-decision Raskin who insisted that there was no real question legally and that the case before the justices was “their opportunity to behave like real Supreme Court justices.” Well, they did act as “real Supreme Court justices” by unanimously opposing what the Court described as the “chaos” that would unfold with such state disqualification efforts. Raskin, however, is seeking a new avenue for chaos through Congress. Raskin’s statement is also bizarre in claiming that somehow the justices agreed with him and the others pushing disqualification. No one, not even the Trump team, questioned that Congress could act to bar people from office. It is expressly stated in the Constitution. It is not an “argument” but a fact. Of course, the Democrats would need to craft the legislation correctly to satisfy the standard and secure the support of both houses. Neither appears likely at this point.

However, Raskin is succeeding in one respect. He and his colleagues have bulldozed any moral high ground after January 6th. Most of us condemned the riot on that day as a desecration of our constitutional process. Yet, the Democrats have responded with the most anti-democratic efforts to prevent voters from exercising their rights in the upcoming election. For these members, citizens cannot be trusted with this power as Trump tops national polls as the leading choice for the presidency. It is the political version of the Big Gulp law, voters like consumers have to be protected against their own unhealthy choices.

“Russophobia, proposed by Victoria Nuland as the main foreign policy concept of the United States, is dragging the Democrats to the bottom like a stone..”

US Deputy Secretary of State Victoria Nuland is poised to leave her post soon, Secretary of State Antony Blinken has announced. The senior official, widely regarded as a foreign policy hawk, played a key role in the Western-backed coup in Kiev in 2014. In a statement on Tuesday, Blinken noted that his friend “Toria” has held most of the jobs at the State Department, from a consular officer to ambassador and deputy secretary, over her 35-year career. Her most recent posting was as undersecretary for political affairs. She was also Blinken’s acting deputy after the July 2023 retirement of Wendy Sherman, until Kurt Campbell was confirmed to the post last month. “What makes Toria truly exceptional is the fierce passion she brings to fighting for what she believes in most: freedom, democracy, human rights, and America’s enduring capacity to inspire and promote those values around the world,” Blinken said.

He also noted that her “leadership on Ukraine” will be the subject of study “for years to come” by diplomats and students of foreign policy. Nuland was directly involved in the Maidan uprising and the subsequent coup in Kiev. In December 2013, she visited Ukraine to hand out pastries to the armed protesters in Kiev’s central square. She was then recorded discussing how to “midwife this thing” with then-US ambassador to Kiev, Geoffrey Pyatt, just days before the February 2014 coup. She resigned from the State Department during the Trump administration, taking the helm of the Center for a New American Security (CNAS) think-tank before joining the Albright Stonebridge Group and the board of the National Endowment for Democracy (NED). She rejoined the government after President Joe Biden’s inauguration in 2021.

In that capacity, she has worked on arming Ukraine and assembling a Western coalition that would supply Kiev with weapons and ammunition for the conflict with Russia. Last month, she pleaded to Congress to approve $61 billion in funding to Ukraine, arguing that most of it would be “going right back into the US economy,” to create jobs in the weapons industry. Her most recent trip to Kiev involved intervening with President Vladimir Zelensky on behalf of General Valery Zaluzhny, though to no avail. Zaluzhny was subsequently fired. In a CNN interview at the end of February, Nuland admitted the defeat of US policy towards Moscow, describing today’s Russia as “not the Russia that, frankly, we wanted.”

Russian Foreign Ministry Spokeswoman Maria Zakharova attributed Nuland’s exit to “the failure of the anti-Russian course of the Biden administration.” “Russophobia, proposed by Victoria Nuland as the main foreign policy concept of the United States, is dragging the Democrats to the bottom like a stone,” Zakharova said. Posting a photo of Nuland taken at an Orthodox church at some point, she said that if the US politician wanted to “go to a monastery to atone for your sins, we can put in a good word.” Nuland is married to neoconservative stalwart Robert Kagan. Her sister-in-law Kimberley Kagan, married to Robert’s brother Fred, runs the Institute for the Study of War. Her temporary replacement at the State Department will be Under Secretary for Management John Bass.

https://twitter.com/i/status/1765092971001848154

“At 50, everyone has the face he (or she) deserves.” – George Orwell https://t.co/PobdM2u80x pic.twitter.com/UtSgPouYwl

— Martyr Made (@martyrmade) March 5, 2024

“With four more years of Biden, the hordes of illegal aliens stampeding across our borders will exceed 40 to 50 million people,” Trump claimed, saying healthcare, education, and social security will collapse under the pressure.”

• Tucker Carlson Compares US to Roman Empire (RT)

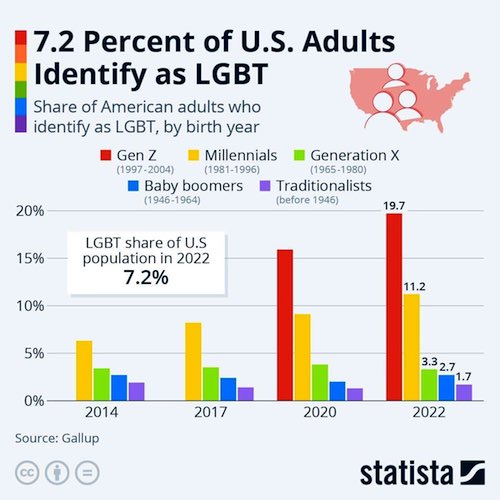

Allowing illegal migrants into the US military as a means of granting them citizenship will lead the country towards inevitable collapse, former Fox News host Tucker Carlson said in a video posted on X (formerly Twitter) on Tuesday. In the clip, Carlson recalled the fall of the Roman Empire, stating that while historians have long debated the reasons for the collapse of one of history’s most powerful empires, one fact has been “pretty obvious.” “The roman military, its legions, became dominated by non-citizens, who in the end, because they weren’t loyal to Rome, turned against Rome’s citizens,” he explained. Carlson went on to say that this course of events was similar to what is currently happening in the US, which has been “flooded” with illegal aliens – over 7.2 million since President Joe Biden entered office, according to the White House’s official estimates.

“That number is greater than the population of 32 states,” he noted. But the main issue, according to the former Fox News host, is that instead of deporting these people, Congress is entertaining the idea of enlisting them into the US military. One such proposal is the Courage to Serve Act introduced by Pat Ryan, a Democratic congressman from New York. The bill would offer “qualified and vetted migrants” an expedited path towards citizenship if they serve in the military, Ryan said, noting that the US military missed its recruiting goals by around 41,000 in 2023. Carlson, however, vehemently rejected the idea, arguing that the military’s struggle to meet recruiting goals is the result of intentionally alienating white American men who have always made up the majority of the country’s fighting force.

But instead of addressing these issues and figuring out why young Americans don’t want to join the armed forces, Calrson claimed that Congress has decided to “allow an invasion of the country, not use the military to stop it, and then populate the military with people who are invading the country and hope for the best.” Former US President Donald Trump warned last month that America would collapse if Joe Biden remains in office following this year’s presidential election, suggesting that the country will have over 18 million illegal migrants by the end of the year. “With four more years of Biden, the hordes of illegal aliens stampeding across our borders will exceed 40 to 50 million people,” Trump claimed, saying healthcare, education, and social security will collapse under the pressure.

X thread.

“There’s no NATOstan plan B. So back to Plan A: Forever Wars. Bring it on. Russia is ready.”

• It Has Been NATO Vs. Russia All Along (Pepe Escobar)

The – gray – cat is finally out of the bag, appropriately via weapons peddler Lloyd Raytheon: “If Ukraine is defeated, NATO will be at war with Russia.” Sideshows: The freakout by Le Petit Warmonger Roi – and his wet dreams of a pink can can Moulin Rouge army parading in the steppes of Novorossiya. Bundeswehr clowns dreaming of blowing up the Crimean bridge. Not to mention the astonishing abjectness 24/7 of the Liverwurst Reichskanzler – the one who betrayed his nation by duly accepting the Nord Streams bombing. The incoming, cosmic humiliation of NATO is one for the ages. And that inevitably extrapolates to the politico-economic sphere – where the strategic autonomy of the EU, the P.R. arm of NATO, is less than zero.

Enter psycho lowly functionaries of the Janet Yellen type dreaming of stealing Russian assets for good – a sort of financial bombing of the Crimean bridge. They actually believe the current free lunch system allows for sovereign assets to be simply stolen by the “rules-based international order” – and still they can get away with it because the US dollar won’t be toppled. It will. It’s just a matter of time. And they know it. De-dollarization is the economic arm of NATO’s cosmic humiliation, with Russia destroying Project Ukraine in the black soil of Novorossiya. There’s no NATOstan plan B. So back to Plan A: Forever Wars. Bring it on. Russia is ready.

“What is not at all reported, even alluded to, is the racket being run by senior army officers close to him who are drawing the salaries of dead soldiers..”

“..Recently the EU agreed to send to Kiev 12.5 billion euros a year in cash for public sector salaries. Given the racket going on over dead soldiers salaries, this makes Brussels complicit in money laundering..”

• NATO’s Role in Ukraine Is as Sleazy as the EU’s (Jay)

Did Jens Stoltenberg really say that he had recently given “permission” to Ukraine to use F-16 fighter jets there in the war against Russia? If so, we can add it to the list of bumbling, buffoonish Freudian slips that he has chalked up himself while in office. But it does at least give us a glimpse of how western elites are no longer bothering to even cover up the fact that the war in Ukraine has, in reality, very little to do with Ukraine but rather is a much bigger war fought by the West against Russia. Yet the whole issue about F-16s in Ukraine will be shrouded in lies, doublespeak and fake news. The real story of these outdated fighter jets from the Netherlands – some might call a bribe to Biden to secure the Dutch prime minister as next NATO boss – will probably never be known. Journalists who even want to ask who will really fly these planes – Ukrainians or U.S. pilots – will never get a straight answer but be fobbed off with the normal NATO ‘secrets and lies’ which are what we have all come to understand is the normal modus operandi for this so-called defence organisation.

Timing is critical. Does Ukraine have the 6 months minimum time that Ukrainian pilots will need just to fly them, following intensive training? It’s a good bet that we will see them operational by the end of the summer with contracted, retired U.S. air force pilots flying them though – probably not in dogfight scenarios as they are no match for the newer Su-35s which Russia has – used in air to ground attacks. Of course, such a shift in strategy will lead Russia to target Ukrainian airfields, which some analysts are reporting is already happening but in reality, like so many decisions taken by NATO, this latest is just the latest in a long line of miscalculations. These 20-year old planes are going to be a real prize for Russia to shoot out of the skies like ducks on a Sunday afternoon. Pity the pilots who will be in their cockpits as they are on a suicide mission. The truth though will be very hard to get to with the F-16s. NATO will have already its fake news ready for the suppliant journalists ready to oblige.

It’s a similar story with a recent statement by Zelensky himself who claimed that something like 30,000 Ukrainians so far had died in battle. Did he forget a zero there reading from his notes? Did too much cocaine affect his vision? Was it a joke? No, it was no joke. Just more fake news dutifully processed by corrupt western media who don’t have journalists among them even capable of questioning the statement. However, the reason why the numbers of dead Ukrainian soldiers is such a polemic is interesting. You might be forgiven for thinking that if the real figure of at least 300,000 dead Ukrainians were to be admitted, that this would have a political consequence for Zelensky himself. And this would be true within a democratic context. But Zelensky has shut down all media that doesn’t replicate his propaganda, eliminated all opposition parties so it’s hardly likely anyone is going to question this ludicrous figure of 30,000 or so. In reality there is a much more salacious, if not mercurial reason why he needs to stick to this work of fiction: graft.

What is not at all reported, even alluded to, is the racket being run by senior army officers close to him who are drawing the salaries of dead soldiers – and how the West turns a blind eye, once again, to this particular scam involving millions of dollars of western aid. Recently the EU agreed to send to Kiev 12.5 billion euros a year in cash for public sector salaries. Given the racket going on over dead soldiers salaries, this makes Brussels complicit in money laundering. Would it be far fetched to assume that senior EU officials are receiving kickbacks, in return? Given Ursula von der Leyen’s murky dealings with Pfizer and the recent news that she is to evade any scrutiny for another 5 years in office, assuming her corrupt friends in the EU support her second term, it becomes clear what the EU and NATO’s objectives are in Ukraine of late: just keep the machine turning over and Zelensky in power.

“With his plan for Gaza once military operations cease, Netanyahu has formally declared war on Biden and his campaign for re-election..”

• ‘Untenable Positions’ – Warning Signs Abound (Alastair Crooke)

Tuesday’s local elections were a flashing warning light for Israel. The ultra-Orthodox parties, the religious Zionist groups, and the far-right, racist parties – organized in a few communities and scored gains that are disproportionate to the true size of the groups they represent. Conversely, the democratic camp [largely secular liberal Ashkenazi], which for nearly a year turned out weekly for giant demonstrations on Tel Aviv’s Kaplan Street and dozens of locations around the country, failed in most cases to translate the anger into electoral gains in local governments”. “Another conclusion to draw from the elections” continues the Haaretz Editorial “is the growing similarity between the ruling Likud party and [Ben Gvir’s party] the far-right Otzma Yehudit (Jewish Supremacy). In Tel Aviv, the two parties ran together, in a move that was unimaginable in the pre-Benjamin Netanyahu Likud … We can learn from this that Likud is changing: Meir Kahane [a founder of the Jewish radical Right, and of Kach Party] defeated Ze’ev Jabotinsky; Jewish supremacy and forced population transfer replaced liberty”.

Put starkly, Israel is turning further to the Right. Another warning sign: In a (virtually) uncontested primary in the U.S., “a coalition of pro-Palestinian groups had set a modest target of 10,000 uncommitted votes—Trump’s margin of victory in Michigan in 2016—to send a message that voter frustration over Biden’s backing of Israel’s military campaign could cost him in November … ‘Uncommitted’ however, blew past the 10,000 target and clocked in at nearly 101,400 votes – about 13% of the tally. Biden earned more than 80% of the vote, yet the number of uncommitted votes were enough to send two ‘uncommitted’ delegates to the Democratic Party’s national convention in August”. “The biggest danger for the president here is not that too many people voted ‘uncommitted’”, said former Rep. Andy Levin (D., Mich.), who endorsed the effort. “The biggest danger is if he doesn’t get the message”.

A third warning sign: With his plan for Gaza once military operations cease, Netanyahu has formally declared war on Biden and his campaign for re-election: “Far from moving toward [the] two-state solution being promulgated by Biden, Netanyahu is calling for an increased and time-unlimited Israeli occupation not only of Gaza but also of the West Bank and all other areas of that which otherwise would constitute an independent Palestinian state. In effect, Netanyahu is calling for the total conquest by Israel of the remains of Palestine – the exact opposite of what Biden and the rest of the world are suggesting”. Put plainly: Netanyahu is putting Biden “between the devil and the deep blue sea”. The former knows that Biden is heavily dependent on not only the Jewish vote, but even more importantly, on Jewish money for his potential re-election.

Netanyahu seems to assess that he has the leeway safely to ignore Biden – and for the next eight months or so, to pursue his ambition unhindered: to seize control of ‘Greater Israel’ (up to the Litani River inside southern Lebanon) and to consolidate a Jewish Jerusalem. Even Tom Friedman at the New York Times is showing signs of panic: “It felt to me, at least, that the world was ready, initially, to accept that there were going to be significant civilian casualties if Israel was going to root out Hamas and recover its hostages … But now we have a toxic combination of thousands of civilian casualties and a Netanyahu peace plan that promises only endless occupation … So the whole Israel-Gaza operation is starting to look – to more and more people – like a human meat grinder whose only goal is to reduce the population so that Israel can control it more easily … And, I repeat, it is going to put the Biden administration in an increasingly untenable position”.

“These factors expand the system of military threats to Russia and require a new level of security, where aerospace forces play a key role..”

• Defense Ministry Reveals Possible Scenario of Attack on Russia (Sp.)

An air-ground or air-sea operation could be launched against Russia that would begin with a rapid global strike and several massive missile and air strikes at the same time, reads an article in Military Thought magazine, published by the Russian Defense Ministry. According to the article, foreign experts are considering the emergence of new military structures called “joint operational formations.” These should be compact, highly mobile, multi-sphere groups of troops capable of inflicting a comprehensive defeat on an enemy’s administrative, political, and military-industrial infrastructure in all fields: land, sea, air, space, and information.

“The most expected forms of application of joint operational formations are air-ground campaigns. They begin with air (from 2030 air-space) offensive operations consisting of a quick strike and several (from 2-3 to 5-7) massive missile and air strikes. In this case, aviation will be one of the first to enter combat operations as the most maneuverable and adaptable type of troops, possibly even before the deployment of the main grouping,” the article says. Before the active phase of the operation starts, the enemy’s operational formations will carry out provocative, demonstrative, informational, and other potentially aggressive actions in order to control the situation. The aggressor will intensify all types of reconnaissance, regular aircraft and drone flights near the country’s borders, including flights of strategic bombers. It is also possible that there will be exercises with aircraft carrier groups and ships with cruise missiles.

The article stipulates that the amount of personnel within enemy’s joint operational formations in peacetime may be 50-70% of the troops that would operate during a war. “These factors expand the system of military threats to Russia and require a new level of security, where aerospace forces play a key role,” the Russian Defense Ministry concludes. The utmost importance of the Russian Aerospace Forces in military conflicts raises the need to equip them with new modernized aircraft, including drones and weapon complexes, introduce advanced automated control systems, and improve intelligence support.

While they’re restructuring..

• Russian Armed Forces Continue to Push Ukrainian Troops Westward – Shoigu (Sp.)

The Russian armed forces did not allow Ukrainian troops who fled from the Avdeyevka strongpoint to gain a foothold on the new line and continue to push them westward, Russian Defense Minister Sergei Shoigu said on Tuesday. “After Ukrainian fighters fled from the Avdeyevka strongpoint, the Russian group of troops did not allow them to gain a foothold on the Stepovoe-Lastochkyno-Severnoe line and continues to push the enemy westward,” Shoigu told a meeting with senior military officials. Russia has created Leningrad and Moscow military districts due to NATO military buildup near the country’s borders, Shoigu said.

“Amid NATO’s military buildup near Russian borders … Two inter-specific strategic territorial units of the armed forces have been created — the Leningrad and Moscow military districts,” Shoigu told a meeting with senior military officials President Vladimir Putin’s decree has established the military-administrative division of Russian, which now incorporates new regions, Shoigu added. Russia plans to create a prototype of a new Il-212 light military transport aircraft with jet engines by the end of 2026, Shoigu said. “The United Aircraft Corporation has already begun developing the technical design of the aircraft. Production of the prototype is planned for the end of 2026,” Shoigu told a meeting with senior military officials.

“The hybrid war waged by the collective West against the Russian people is in full swing, Foreign Ministry spokeswoman Maria Zakharova said..”

• German Military Leak Becoming Massive Headache for West (Sp.)

An audio recording of a conversation between high-ranking German military officers on security topics concerning Russia and Ukraine was published by Russian media on Friday. The publication of German military officers’ conversations about possible strikes on the Crimean Bridge has hurt the position of German Chancellor Olaf Scholz, undermined Ukraine’s prospects of getting Taurus missiles, and showed the superiority of Russian President Vladimir Putin, according to a Politico article. “After so many years as Russia’s leader, Putin is still a master spy at heart. There is no greater pleasure than outwitting Russia’s adversaries,” the article said. “Nothing on the tape is manipulation. That’s why it’s so powerful: it’s not disinformation, it’s just information revealed,” the article summarized. The leaked recording revealed “the institutional frustration of the German military.”

Opposition politicians may launch an investigation into why Scholz doesn’t intend to send Taurus missiles to Ukraine, but it could take months to finish. This makes it even more unlikely that Kiev will get these weapons, the article concludes. Margarita Simonyan, editor-in-chief of RT and Rossiya Segodnya, Sputnik’s parent media group, published a recording of the February 19 conversation between four German military officers on Friday. German news agency DPA reported earlier that the leaked audio recording was authentic. On Saturday, German Chancellor Olaf Scholz, who has repeatedly ruled out the possibility of supplying Ukraine with Taurus missiles, said that the government was investigating the leak. The Russian Foreign Ministry has requested an explanation from German Ambassador to Moscow Alexander Graf Lambsdorff. The hybrid war waged by the collective West against the Russian people is in full swing, Foreign Ministry spokeswoman Maria Zakharova said.

“The situation is simply not good and does not match the threat map..”

• Israel’s Manpower Crisis Worsens As Wave Of Resignations Hits Army (Cradle)

The Israeli Army Spokesperson’s Unit, led by Lt Col Daniel Hagari, has witnessed a large wave of resignations. Among those who resigned are Hagari’s second in command, Colonel Butbol, as well Colonel Moran Katz and the army’s International Spokesman Lieutenant Richard Hecht. “A large number of officers recently announced their retirement from the unit responsible for the military’s information system,” Hebrew news outlet Channel 14 reported on 3 March. A number of female officers were also among those who resigned. The resignations came “after things did not work out ‘professionally and personally,’” Channel 14 correspondent Tamir Morg said. Several officers have reportedly complained about not moving up in the ranks, the Hebrew outlet explained.

“The picture is complex, since it is a military system and sometimes people reach retirement age and leave for no particular reason, but despite this, the number of people who retire at once during a war is unusual,” the correspondent said. The Israeli military has not responded to requests for comment. The resignations come as significant tension has overtaken Israel’s military establishment. Israeli Defense Minister Yoav Gallant has been calling for an end to draft exemptions for Israel’s ultra-Orthodox community, citing a severe manpower crisis in the army. Gallant said he would only support legislation to settle the issue if certain members of the ruling coalition backed it.

“The army is in need of manpower now. It’s not a matter of politics, it’s a matter of mathematics,” the defense minister said on Sunday. Gallant’s position is causing tension with ultra-Orthodox parties in the coalition, viewed as integral to the current government’s survival, according to Hebrew media. Israel is taking severe losses from its genocidal war in Gaza and its attempt to eradicate the Palestinian resistance. While Israel claims that Gaza’s southernmost city of Rafah is the final Hamas stronghold, the group’s military wing, along with several other factions, continue to fiercely confront Israeli troops across the strip. “The situation is simply not good and does not match the threat map,” Ynet reported on 1 March.

“Galloway received 12,335 votes – over 40% of the votes cast – while the Conservatives gained 3,731 votes, and Labour, 2,402..”

• George Galloway Is Not A Threat To Democracy (Hryce)

Last week’s exchange of insults between newly elected MP George Galloway and Prime Minister Rishi Sunak highlighted the festering political divisions that have recently emerged in Western democracies over the ongoing conflict in Gaza. Their vituperative exchange also made clear that rational debate over Gaza is virtually impossible in those Western nations in which both major political parties uncritically support America’s pro-Israel foreign policy in Gaza. Debates over domestic culture war issues in the West have for decades been characterized by irrationality, demonization of opponents, the abolition of history, and the refusal to acknowledge the right to express a view contrary to dominant woke ideologies. Within such a neo-totalitarian intellectual culture, it would be foolish to expect that a debate over a historically contentious issue like Gaza could be conducted rationally. Nevertheless, last week, Galloway won a by-election in Rochdale, a poor Midlands electorate in the UK formerly held by the Labour Party.

It was an astounding and comprehensive victory. Galloway received 12,335 votes – over 40% of the votes cast – while the Conservatives gained 3,731 votes, and Labour, 2,402. Galloway labeled his win as “a thumping victory” over both major parties – and he described Keir Starmer and Sunak, in characteristically provocative fashion, as “two cheeks of the same backside” that he had just “spanked.” Galloway is a controversial and charismatic political figure. He is a former Labour and Independent MP who courageously opposed Tony Blair and George Bush’s war against Iraq, and he has been a trenchant defender of the Palestinian cause for decades. In the Rochdale by-election – an electorate with a Muslim population of around 30% – Galloway focused his campaign on calling for an immediate ceasefire in Gaza. In the UK, the Gaza conflict has become a deeply divisive political issue over the past six months. During that time, more than 30,000 people have been killed by the Israeli military, most of them civilians and many of them women and children.

Many citizens in the West – to their credit – have refused to turn a blind eye to the distinction between terrorists and civilians, and the humanitarian crisis that America’s continuing support for the Netanyahu government has created in Gaza. It cannot be disputed that America’s persistent refusal to support a ceasefire in Gaza has resulted in the deaths of thousands of innocent Palestinian civilians. In the UK and Australia, the governments and major opposition parties have, up until now, resolutely supported America’s stance and refused to call for an immediate ceasefire. In these countries, it has fallen to minor left-wing parties to oppose America’s position – in the UK, it has been Galloway’ Workers Party, and in Australia, it has been the Greens. But principled opposition to America’s Gaza policy does not end there.

Deep-seated divisions have emerged within the Democratic Party in America, the Labour Party in the UK, and the Labor government in Australia – as a result of significant segments of these parties strongly opposing the stance on Gaza taken by US President Joe Biden, UK Labour leader Keir Starmer, and Australian Prime Minister Anthony Albanese. The British parliament recently descended into complete chaos when Starmer pressured the speaker of the House of Commons to breach parliamentary convention and prevent debate over a Scottish National Party (SNP) motion calling for an immediate ceasefire in Gaza.

“I give interviews to everybody. I’m a free man, I’m an elected free man. I have the right to speak and I will go on speaking to whomsoever wants to hear me..”

• Galloway Explains Why RT Was Banned: ‘Too many people watched’ (RT)

Fresh from his election to parliament to the British parliament, MP George Galloway spoke with RT on Tuesday about the state of media freedom in Britain and London’s disastrous policies in the Middle East and Ukraine. Galloway trounced both Tory and Labour candidates in last week’s Rochdale by-election, winning twice as many votes than both major parties combined. PM Rishi Sunak denounced the result as “beyond alarming” and a threat to “our democracy itself.” As Galloway pointed out, however, he has been elected to Parliament a total of seven times – far more than Sunak or Labour leader Keir Starmer. “These people are hypocrites. Things like democracy, human rights, rule of law, rules-based international order, it’s just lipstick on a pig. They wipe the lipstick off whenever they no longer feel the need to look prettier,” he claimed.

“As Sunak’s speech outside Number 10 [Downing Street] on Friday about my election makes clear, it’s not beyond them even to cancel elections,” he added. British authorities have banned RT and the Iranian PressTV outright, refused to renew the license of China’s CGTN, and blocked outlets like Venezuela’s TeleSur. “The reason is pretty simple if you think about it: Too many people were watching these TV channels. Too many people were watching RT. Not just in Britain, but even more so in Germany. That is why RT was closed down. Because too many of the public were watching it. How’s that for freedom?” said Galloway. The best illustration of press freedom in the UK is that “a good friend of mine is lying in the dungeon of Belmarsh top security prison,” Galloway said. “His name is Julian Assange He is convicted of no crime. And yet he is being held with mass murderers and terrorists in the worst prison for the worst people in England. And for what? For telling the truth as a publisher.”

He admitted the government might retaliate against him for speaking to RT, but said, “I don’t care.” “I give interviews to everybody. I’m a free man, I’m an elected free man. I have the right to speak and I will go on speaking to whomsoever wants to hear me. Nothing is solved by covering things up. Nothing is solved by denying people access to a different point of view,” Galloway said, recalling RT’s long-time slogan, “Question More.” Galloway is no stranger to RT. He has written many op-eds for the outlet and hosted his own TV show called ‘Sputnik Orbiting the World’ during his hiatus from Parliament.

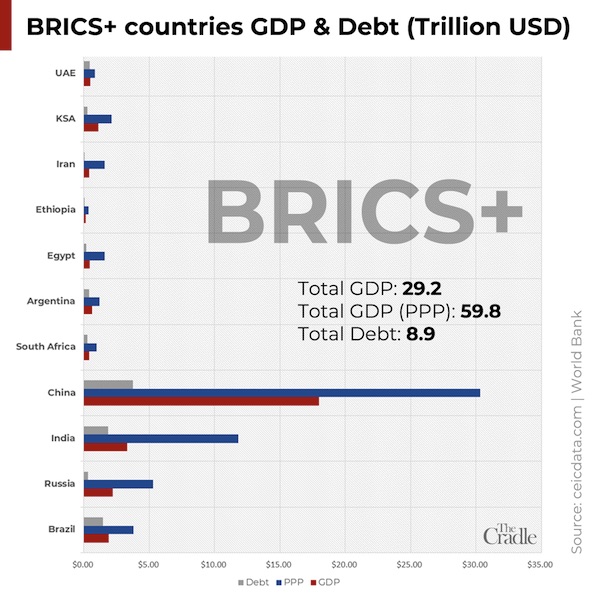

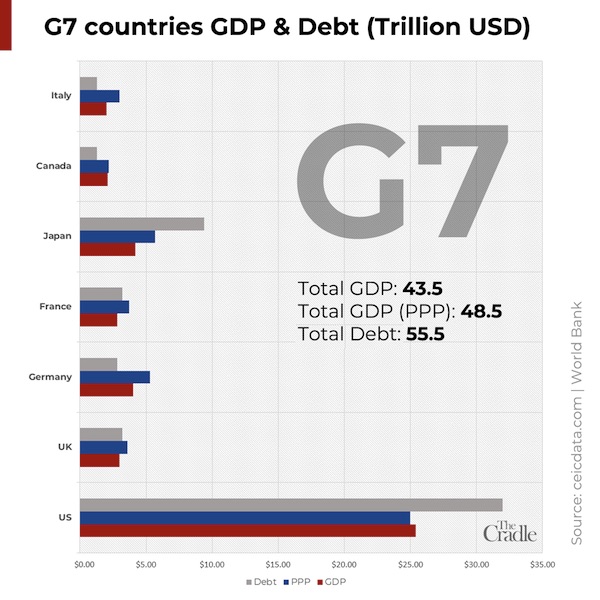

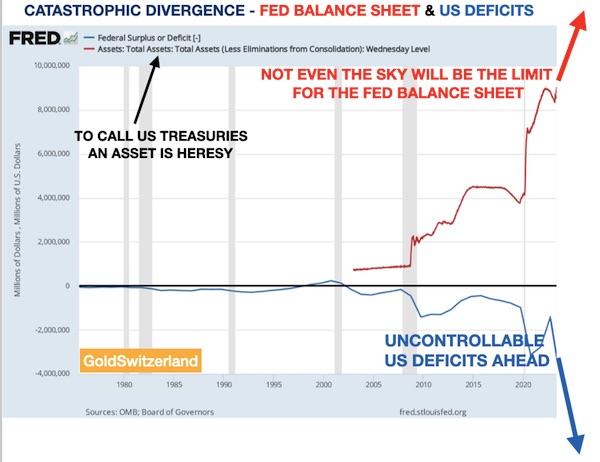

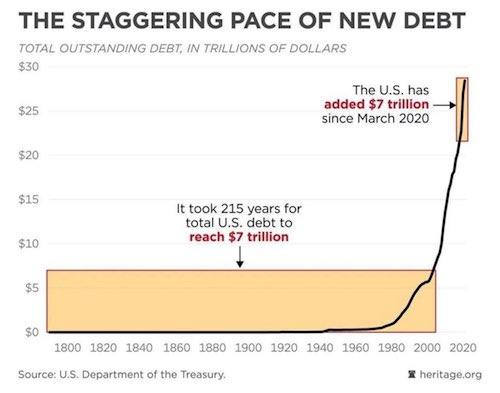

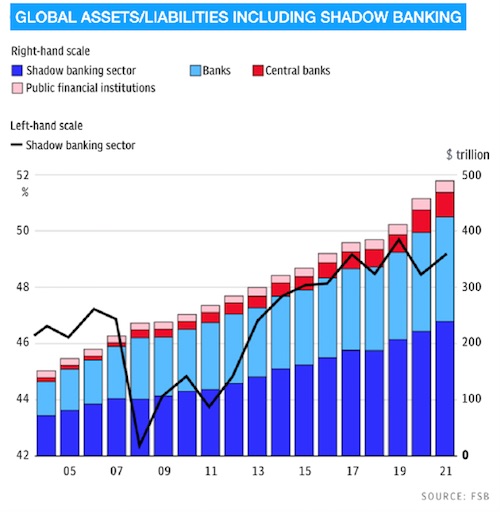

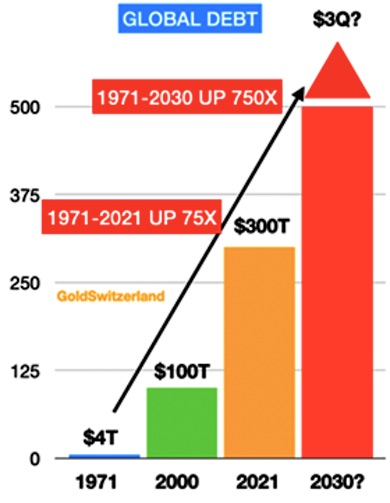

“..if we include off balance sheet assets including the shadow banking system and derivatives, we are looking at assets (which will become liabilities) in excess of $2 quadrillion..”

• Gold – We Have Liftoff! (Egon von Greyerz)

All Empires die without fail, so do all Fiat currencies. But gold has been shining for 5000 years and as I explain in this article, Gold is likely to outshine virtually all assets in the next 5-10 years. In early 2002 we made major investments in physical gold for our investors and ourselves. At the time gold was around $300. Our primary objective was wealth preservation. The Nasdaq had already crashed 67% but before the bottom was reached, it lost another 50%. The total loss was 80% with many companies going bankrupt. In 2006, just over 4 years later, the Great Financial Crisis started. In 2008, the financial system was minutes from imploding. Banks like JP Morgan, Morgan Stanley and many others were bankrupt – BANCA ROTTA – Virtually unlimited money printing postponed the collapse and since 2008 US total debt has almost doubled to $100 trillion. Gold backing of a currency doesn’t always solve a debt problem but it certainly makes it more difficult for the government to cook the books which they do without fail.

So tricky Dick (Nixon) couldn’t make ends meet in the late 1960s – early 70s partly due to the Vietnam war. Thus in 1971 Nixon, by closing the Gold window, started the most spectacular bonfire of the US government budget books. How wonderful, no more accountability, no more shackles and no more gold deliveries to de Gaulle in France who was clever to ask for gold instead of dollars in debt settlement from the US. So from August 1971, the US embarked on a money printing and credit expansion bonanza never seen before in history. Total US debt went from $2 trillion in 1971 to $200 trillion today – up 100X! Since most major currencies were linked to the dollar under the Bretton Woods system, the closing of the gold window started a global free for all with the printing press (including bank credit) replacing REAL MONEY i.e. GOLD.

The consequences of this “temporary” move by Nixon is that all Fiat or paper money has declined by 97-99% since 1971. The price of assets have obviously inflated correspondingly. In 1971 total US financial assets were $2 trillion. Today they are $130 trillion, up 65X. And if we include off balance sheet assets including the shadow banking system and derivatives, we are looking at assets (which will become liabilities) in excess of $2 quadrillion. I forecast the derivative bubble and demise of Credit Suisse in this article (Archegos & Credit Suisse – Tip of the Iceberg) and also in this one (The $2.3 Quadrillion Global Debt Time Bomb). Luke Gromen in his Tree Rings report puts forward two options for the world economy which can be summarised as follows:

1. Dedollarisation continues, the Petrodollar dies and gold gradually replaces the dollar as a global commodity trading currency especially in the commodity rich BRICS countries. This would allow commodity prices to stay low as gold rises and drives a virtuous circle of global trade. If the above option sounds too good to be true especially bearing in mind the bankrupt status of the global financial system, Luke puts forward a much less pleasant outcome. And in my view, Luke’s alternative outcome is sadly more likely, namely:

2. “China, the US Treasury market, and the global economy implode spectacularly, sending the world into a new Great Depression, political instability, and possibly WW3…in which case, gold probably rises spectacularly all the same, as bonds and then equities scramble for one of the only assets with no counterparty risk – gold. (BTC is another.)”

Yes, Bitcoin could go to $1 million as I have often said but it could also go to Zero if it is banned. Too binary for me and not a good wealth preservation risk in any case. As Gromen says, there is a virtuous case and there is a vicious case for the world economy. But above both cases shines GOLD! So why hold the worthless paper money or bubble assets when you can protect yourself with Gold!

Plastic roads

https://twitter.com/i/status/1764876916194959761

Baby peacock

Never thought about what a baby peacock looked like and they don't disappoint pic.twitter.com/EhZJBBERdi

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 4, 2024

Hippo

Hippo laughing at young lions pic.twitter.com/oTcrgU1cVN

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 6, 2024

Big Cats

Big cats.. pic.twitter.com/pTyMySc27s

— Buitengebieden (@buitengebieden) March 5, 2024

Mutualism

The interaction among organisms within or between overlapping niches can be characterized into five types of relationships: competition, predation, commensalism, mutualism and parasitism

Yet, sometimes it's simply curiosity (even if not always mutual)pic.twitter.com/CJ5atIs1xn

— Massimo (@Rainmaker1973) March 5, 2024

Trunk

https://twitter.com/i/status/1764757944799727681

Puppies

https://twitter.com/i/status/1765103517000143069

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.