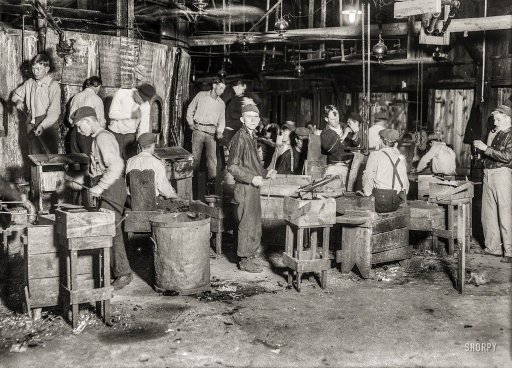

Lewis Wickes Hine Night scene in Cumberland Glass Works, Bridgeton, NJ 1909

Flowing to America.

• Investors Yank $9.3 Billion From Emerging Markets, Most in 7 Years (WSJ)

Emerging markets are out of favor. Global investors have yanked $9.3 billion from stocks in developing countries in the week to Wednesday, the most since the depths of the global financial crisis in 2008. Asia has been particularly vulnerable with $7.9 billion pulled out of the region’s equity markets, the most in almost 15 years, according to data provider EPFR Global. Financial markets in emerging markets have been grinding weaker with currencies trading at their weakest levels in years, and bonds have been caught in the riptide too. Including bonds, investors have pulled out the most money since 2013’s “taper tantrum.” The dangers of emerging markets are well-known to investors and analysts, but the magnitude of this selloff has caught many by surprise.

It follows a selloff in Treasurys and German bunds that has rocked global sentiment, and comes ahead of the U.S. Federal Reserve raising interest rates later this year that is likely to send money back to developed markets. “Money is gradually leaving emerging markets, including Asia,” said Paul Chan at Invesco. “It’s a repeat of 2013, but this time we are slowly pricing in the eventual rate hike.” Mr. Chan’s fund has been cutting its investments in Southeast Asia but adding in South Korea this year. It has been overweight on China and India in recent years. Analysts say emerging-market equity-fund managers are increasingly feeling the pain of plummeting currencies in the region, which cuts into investors’ returns in stocks and bonds. “Currency is a major culprit,” Goldman Sachs analysts said. The U.S. bank forecasts another 4% drop in emerging-market currencies against the U.S. dollar over the next year.

“..a “margin call” on $9 trillion of off-shore dollar debt, a figure that has exploded from $2 trillion fifteen years ago. ”

• Fed Tantrum Sets Off Biggest Exodus From Emerging Markets Since 2008 (AEP)

Investors are withdrawing money from emerging markets at the fastest rate since the global financial crisis, raising the risk of a ‘sudden stop’ in capital flows as the US Federal Reserve prepares to turn off the spigot of cheap dollar liquidity. Data from the tracking agency EPFR show that equity funds in Asia, Latin America, and the emerging world bled $9.27bn in the week up to June 10, surpassing the exodus in the ‘taper tantrum’ in mid-2013 when the Fed first began to hint at monetary tightening. Jonathan Garner from Morgan Stanley said outflows from onshore-listed equity funds in China reached $7.12bn, the highest ever recorded in a single week. Brazil and Korea also saw large losses. The pace has quickened dramatically as the US economy gathers steam after a growth scare earlier this year.

Signs of incipient wage inflation bring forward the long-feared inflexion point when the Fed finally raises rates for the first time in eight years. Morgan Stanley said its US tracking indicator for GDP growth in the second quarter has jumped from 1.5pc to 2.7pc over the last week and a half alone as a blizzard of strong figures changes the outlook entirely. The University of Michigan’s index of consumer sentiment roared back to life in June, jumping from 90.7 to 94.6. It follows news of a surge in US retail sales in May. Small investors have been pulling funds out of emerging markets for several months but the big pension funds and institutions have until now held firm. There is a danger that these giants could suddenly start for rushing for narrow exits at the same time.

The International Monetary Fund warned in its Global Financial Stability Report in April that the asset management industry now has $76 trillion worth of investments, equal 100pc of world GDP. These funds are prone to “herding” behaviour, and have vastly increased their holdings of emerging market bonds and equities The IMF fears a “liquidity storm” once the Fed starts to tighten, causing them to pull out en masse. It has repeatedly called on EM economies to beef up their defences and curb ballooning credit before it is too late. The great worry is what will happen if Fed action causes the dollar to spike dramatically and drives up global borrowing costs, transmitting a double shock through the international financial system.

This would amount to a “margin call” on $9 trillion of off-shore dollar debt, a figure that has exploded from $2 trillion fifteen years ago. The Bank for International Settlements estimates that emerging markets now account for €4.5 trillion of this dollar debt, an unprecedented sum that escaped control over the last seven years as cheap liquidity from zero rates and quantitative easing in the West spilled into Asia, Latin America, and the rest of the EM nexus. Many of these countries were unable to defend themselves against a flood of capital, much of it on offer at a real rates of just 1pc, far too low for conditions in fast-growing countries that were then overheating. The inflows set off credit booms that are now unwinding painfully.

And to think Deutsche was bailed out at the expense of the Greek people…

• Is Deutsche Bank The Next Lehman? (NotQuant.com)

Looking back at the Lehman Brothers collapse of 2008, it’s amazing how quickly it all happened. In hindsight there were a few early-warning signs, but the true scale of the disaster publicly unfolded only in the final moments before it became apparent that Lehman was doomed. First, for purposes of drawing a parallel, let’s re-cap the events of 2007-2008: There were few early indicators of Lehman’s plight. Insiders however, were well aware: In late 2007, Goldman Sachs placed a massive proprietary bet against Lehman which would be known internally as the “Big Short”. (It’s a bet that would later profit from during the crisis). In the summer 2007 subprime loans were beginning to perform poorly in the marketplace.

By August of 2007, the commercial paper market saw liquidity evaporating quickly and funding for all types of asset-backed security was drying up. But still – even in late 2007, there was little public indication that Lehman was circling the drain. Probably the first public indication that things were heading downhill for Lehman wasn’t until June 9th, 2008, when Fitch Ratings cut Lehman’s rating to AA-minus, outlook negative (ironically, 7 years to the day before S&P would cut DB). The “negative outlook” indicates that another further downgrade is likely. In this particular case, it was the understatement of all time. A mere 3 months later, in the course of just one week, Lehman would announce a major loss and file for bankruptcy. And the rest is history.

Could this happen to Deutsche Bank? First, we must state the obvious: if Deutsche Bank is the next Lehman, we will not know until events are moving at an uncontrollable and accelerating speed. The nature of all fractional-reserve banks — who are by definition bankrupt at all times – is to project an aura of stability until that illusion has already begun to implode. By the time we are aware of a crisis – if one is in the offing — it will already be a roaring blaze by the time it is known publicly. It is by now well-established that truth is the first casualty of all banking crises. There will be little in the way of early warnings. [..]

How exposed is Deutsche Bank? The trouble for Deutsche Bank is that its conventional retail banking operations are not a significant profit center. To maintain margins, Deutsche Bank has been forced into riskier asset classes than its peers. Deutsche Bank is sitting on more than $75 Trillion in derivatives bets — an amount that is twenty times greater than German GDP. Their derivatives exposure dwarfs even JP Morgan’s exposure – by a staggering $5 trillion. With that kind of exposure, relatively small moves can precipitate catastrophic losses. Again, we must note that Greece just missed it’s payment to the IMF – and further defaults are most certainly not beyond the realm of possibility.

Not a lot of love lost there.

• Obama Suffers Stunning Loss As Democrats Defeat Trade Bill (LA Times)

President Obama’s ambitious trade agenda unraveled Friday in a stunning setback delivered by his own party as the House rejected an important piece of a package aimed at fast-tracking a controversial trade pact he is pursuing with 11 other Pacific Rim nations. Hoping to salvage what could be a key part of his legacy, Obama dashed to Capitol Hill before the vote Friday for a rare early morning meeting with Democrats. But amid fears that a trade deal would hurt American workers, even Obama’s dramatic personal intervention failed to generate the Democratic votes needed to bolster his unusual alliance with pro-trade Republicans.

The White House dismissed the vote as a “procedural snafu” and vowed to salvage the trade legislation when the House votes again next week. But the unusual defeat at the hands of the increasingly defiant liberal wing of the Democratic Party was seen as a sign of Obama’s waning influence as he approaches his final two years in office. “This is not about the president,” said Rep. Rosa DeLauro (D-Conn.), the liberal stalwart who led the opposition. “It really is all about what [lawmakers] heard from their own people, what they thought was the right thing to do.”

It could threaten all these criminal trade deals.

• Trade Bill Defeat Casts Doubt On EU-US Deal (Politico)

Japan, the European Union and other countries have been waiting years for a clear signal that President Barack Obama had the political muscle to get trade deals through Congress. They got the opposite on Friday, when Obama trekked up to Capitol Hill to plead for his trade agenda and got smacked down by fellow Democrats. That spells trouble for the proposed Trans-Pacific Partnership, a massive pact covering about 40% of world economic output. The failure of the trade bill also casts doubt on the sprawling European trade negotiations, and will make other nations less likely to trust the Obama administration’s ability to negotiate everything from auto tariffs to currency rules around the world.

Unless Obama gets the “fast track” trade promotion authority bill, there’s no end in sight for the Asia-Pacific talks between the United States, Japan, Vietnam and nine other countries, U.S. Trade Representative Michael Froman acknowledged earlier this week. Canada hasn’t even made an agricultural offer in the TPP talks and isn’t likely to do that anytime soon if Obama doesn’t get fast track. “None of the countries are willing to come to the table, have another meeting and put their final offers on the table, until they see us having TPA,” the top U.S. trade official told the President’s Export Council. “They’ve made that clear, and you can understand why. All these final issues require very difficult decisions in their own systems, and they’re only willing to do that if they feel like we have the political support here to move this forward.”

“The euro will not survive as a prison – if not a torture chamber.”

• The Euro Won’t Survive Unless The EU Ends Greece’s Humanitarian Crisis (Bibow)

It would be unfortunate for the IMF to be the party to pull the trigger in the ongoing Greek drama, just as it would be wrong for the ECB to find itself in that position. It is for no one else but Europe’s democratically elected governments to accept their shared responsibility for past mistakes – and embark on a path that promises a better future for all involved. The Greek people acknowledge that their current predicament is partly due to their society’s own failings. Even after overcoming military dictatorship and joining the EU, Greek governments generally prioritized securing the wealth and power of a small oligarchy through favoritism and corruption. This includes previous Greek governments that the “troika” chose to cooperate with in the past five years, which made no real effort to break with the past of pervasive corruption and tax evasion, and were not required to do so, either, as long as they collaborated in imposing austerity and arranging for fire sales of Greek assets.

The Syriza government has committed to reforming Greece and the ways in which it governs itself. Greece will need the support of its euro partners to erase corruption and tax evasion, for instance. The conditionality of loans should focus on what are the true structural problems of the Greek economy. And external help may well need to encompass administrative support and effective surveillance in these critical areas. But Greece does not need pressure for even deeper cuts in pensions and wages when almost half of its pensioners are already living below the poverty line, and wage cuts in the order of 20% or more have not boosted employment but propelled unemployment into inhumane territory instead.

By contrast, creditor countries, foremost Germany, have yet to acknowledge that they and their preferred austerity policies share part of the “schuld” (German for guilt) and hence should also shoulder part of the “schulden” (German for debt) that continue to suffocate Greece, preventing its renaissance and holding its people hostage in what has become Europe’s euro disgrace. German Chancellor Angela Merkel will finally need to explain to the German people what really went wrong with the euro and that the matter is truly one of shared responsibility. Failure to end Europe’s euro disgrace, the ongoing humanitarian crisis in Greece, is bound to turn the euro itself into Europe’s disgrace. The euro will not survive as a prison – if not a torture chamber. Rather, it must be a means to shared prosperity.

Quite different from the usual analysis.

• Greece: Default Ahead? (Jacques Sapir)

A Greek default would imply not only a radical devaluating of the Greek debts held bilaterally by various States of the Eurozone or held by the MES, but also the impossibility to use these titles as collateral within the mechanism of emergency liquidity assistance (ELA) created by the European Central Bank. The default would entail the immediate suspension of the ELA and would force the Greek government to use monetary instruments constituting a proto-currency and which, within weeks, would become an alternative currency. Let’s note that, in this scenario, the Greek government is compelled to create these instruments and that it can claim that it is doing so under duress, imposed by the attitude of the ECB.

Openly, the Greek government could continue to claim that it wants to stay within the Eurozone, while setting afoot the process which will in fact result in re-creating the Drachma. The Greek government could continue to claim that it did not want this default and this exit from the Euro, while preparing to cash in on the benefits from these events. And these benefits are far more considerable than what is being thought and said. The consequences of a default would be distinctly greater for the partners of Greece than for Greece itself. Considerable sums have left Greece since February. It is estimated at present that over €30 billion have left Greece since February, owned by Greek players, landing on foreign bank accounts.

Once the Drachma is created, these sums would return to Greece and, given the depreciation of the Drachma relatively to the Euro, the players (businesses and households) who had brought these liquidities out of the country, would gain in purchasing power in Greece. One can expect that the Greek government could then establish a control on exchange and skim off a small tax (5%) on these returns, which would allow households and businesses to legalize part of their assets, while giving the Greek government additional financial means to compensate that part of the population which has not been able to bring liquidities out of the country. This “return” of the money held abroad might well be the equivalent of what the Greek government asked of the European Union, that is, an investment plan.

Taking into account the amelioration in the competitiveness of Greek exports because of the depreciation of the Drachma, the positive effect of this mechanism might well be considerable. Of course, Greece will have to face an imported inflation shock. But, for a depreciation of 30% of the Drachma in relation to the Euro, this shock should not exceed 6% to 8% during the first year, and certainly less (4% to 6%) the second year. On the other hand, the positive effects on the economy (and on the sector of tourism particularly) might be quite extensive.

Merkel’s way late in confronting Schäuble.

• Brewing Conflict over Greece: Schäuble Mulls Taking on Merkel (Spiegel)

Schäuble is something of an éminence grise in the German government: He became a member of parliament in 1972, when Merkel was preparing to graduate from high school in Templin. In 1998, as head of the CDU/CSU parliamentary group in the Bundestag, he made Merkel his secretary general, but then became enmeshed in the CDU donations scandal. Merkel succeeded him in 2000. Although she’s the one in charge, he intermittently makes it clear that he remains his own man; that he doesn’t kowtow to anyone. Appointed finance minister in 2009, Schäuble remarked that Merkel likes to surround herself with people who were uncomplicated, but that he himself was not uncomplicated. He tends to be a little derisory about Merkel, admiring her hunger for power but deeming her too hesitant when the chips are down.

The euro crisis first drove a wedge between them in 2010, when they disagreed on the IMF’s contribution to the Greek rescue fund. Schäuble was against it, on the grounds that Europe should sort out its problems by itself. Merkel, however, was keen to enlist the help of a body that has clear criteria when it comes to offering aid, and which would therefore prevent the Europeans from making one concession after another. Merkel prevailed. But they’ve now traded positions. Schäuble believes that enough concessions have been made to Greece and he’s bolstered by the frustration currently rife in his parliamentary group over Merkel’s strategy. It will be hard for Merkel to secure majority support if he opposes her, so her fate is effectively in his hands.

Both of them understand the stakes, which is why they are both at pains to keep their disagreement under wraps. Whenever he’s asked if he has fallen out with Merkel, Schäuble likes to pull a shocked expression, respond with a barrage of insults and throw out terms such as “amateur economist” – although this isn’t necessarily as bad as it sounds, given that Schäuble describes himself as a “middling economist,” at least in comparison to the “great economist” Yanis Varoufakis. When it got out that Schäuble had not been invited to a recent summit at the Chancellery of the Troika, his spokesman Martin Jäger played down the snub. Government spokesman Steffen Seibert, meanwhile, insisted that “the Chancellor and the Finance Minister have an excellent working relationship that is both friendly and trusting.”

Duh!

• Crisis Changes Greeks’ Consumer Behavior (Kathimerini)

Once-profligate Greeks have radically changed their consumer habits since the start of the crisis, becoming more frugal in their purchases, even when it comes to basic necessities, and it appears that what started as a response to straitened times may become entrenched in a more permanent pattern. Indeed, as the crisis drags on, the number of Greeks who are more cautious with their purchases is on the rise, not just as a result of the toll the crisis has taken on their budgets but also to a great degree because they are starting to develop a more mature consumer conscience – albeit as a result of the violent adjustment to austerity.

The data in the latest study of consumer behavior by the Marketing Laboratory of the Athens University of Economics and Business (AUEB) are revealing. The study period began in November 2014 and ended on January 31, 2014, and was based on phone interviews with 1,437 consumers. According to the findings, seven in 10 consumers now restrict their purchases to the bare necessities, slightly more than two years ago, when the figure was six in 10. This trend has had a significant impact on the sales of products that fall into the “spontaneous purchases” category, such as sweets, snacks and chewing gum. Also 74% said they purchase fewer items.[..]

On the subject of supermarkets, the study found that poorer households with a monthly income of €1,000 or less spend more than a quarter of their income on supermarket purchases, explaining the overall change in consumer behavior noted over the past few years. The reason is simple: While prices have gone down, they have done so at a much smaller rate than incomes. [..] “What the data suggest is that the high prices at supermarkets are a much bigger social problem than high prices in other sectors of the economy as purchases there concern basic goods and the burden is heavier on the poorest households,” notes Giorgos Baltas, the coordinator of the study and director of the university’s postgraduate marketing and communication program.

“Western capitalism is a looting mechanism. Greece is being looted as was Ireland, and Italy and Spain will not escape looting unless they renege on their debts and leave the EU.”

• Happy Birthday Magna Carta (Paul Craig Roberts)

Monday, June 15, 2015, is the 800th anniversary of Magna Carta.[..] Beginning with the Clinton Administration and rapidly accelerating with the George W. Bush and Obama regimes and Tony Blair in England, the US and UK governments have run roughshod over their accountability to law. Both the US and UK in the 21st century have gone to numerous wars illegally under the Nuremberg Standard established by the US and UK following Germany’s defeat in WWII and used to execute Germans for war crimes. The US and UK claim that unlike Germany they are immune to the very international law that they themselves established in order to punish the defeated Germans. Washington and London can bomb and murder at will, but not Germany.

Both governments illegally and unconstitutionally (the UK Constitution is unwritten) spy on their citizens, and the Bush and Obama executive branches have eviscerated, with the complicity of Congress and the federal courts, the entirely of the US Constitution except for the Second Amendment, which is protected by the strong lobby of the National Rifle Association. If the gun control “progressives” have their way, nothing will be left of the US Constitution. Washington and its European satellites have subordinated law to a political and economic hegemonic agenda. Just as under the heyday of colonialism when the West looted the non-white world, today the West loots its own. Greece is being looted as was Ireland, and Italy and Spain will not escape looting unless they renege on their debts and leave the EU.

Western capitalism is a looting mechanism. It loots labor. It loots the environment, and with the transpacific and transatlantic “partnerships” it will loot the sovereign law of countries. For example, France’s laws against GMOs become “restraints on trade” and subjects France to punitive law suits by Monsanto. A new slave existence is being created in front of our eyes as law ceases to be a shield of peoples and becomes a weapon in the hands of government. Eight hundred years of reform is being overturned as Washington and its vassals invade, bomb, and overthrow governments that are out of step with Washington’s agenda. Formerly self-sufficient agricultural communities are becoming wage slaves for international agribusiness corporations. Everywhere privilege is rising above law and justice is being lost.

Because the media tell us to.

• Why Do We Celebrate Rising Home Prices? (Mises Inst.)

In recent years, home price indices have seemed to proliferate. Case-Shiller, of course, has been around for a long time, but over the past decade, additional measures have been marketed aggressively by Trulia, CoreLogic, and Zillow, just to name a few. Measuring home prices has taken on an urgency beyond the real estate industry because for many, home price growth has become something of an indicator of the economy as a whole. If home prices are going up, it is assumed, “the economy” must be doing well. Indeed, we are encouraged to relax when home prices are increasing or holding steady, and we’re supposed to become concerned if home prices are going down. This is a rather odd way of looking at the price of a basic necessity.

If the price of food were going upward at the rate of 7 or 8% each year (as has been the case with houses in many markets in recent years) would we all be patting ourselves on the back and telling ourselves how wonderful economic conditions are? Or would we be rightly concerned if incomes were not also going up at a similar rate? Would we do the same with shoes and clothing? How about with education? With housing, though, increases in prices are to be lauded, we are told, even if they outpace wage growth. But in today’s economy, if home prices are outpacing wage growth, then housing is becoming less affordable. This is grudgingly admitted even by the supporters of ginning up home prices, but the affordability of housing takes a back seat to the insistence that home prices be preserved at all costs.

Behind all of this is the philosophy that even if the home-price/household-income relationship gets out of whack, most problems will nevertheless be solved if we can just get people into a house. Once someone becomes a homeowner, the theory goes, he’ll be sitting on a huge asset that (almost) always goes up in price, meaning that any homeowner will increase in net worth as the equity in his home increases. Then, the homeowner can use that equity to buy furniture, appliances, and a host of other consumer goods. With all that consumer spending, the economy takes off and we all win. Rising home prices are just a bump in the road, we are told, because if we can just ge everyone into a home, the overall benefit to the economy will be immense.

Not surprisingly, we find a sort of crude Keynesianism behind this philosophy. In this way of thinking, the point of homeownership is not to have shelter, but to acquire something that will encourage more consumer spending. In other words, the purpose of homeownership is to increase aggregate demand. The fact that you can live in the house is just a fringe benefit. This macro-obsession is part of the reason why the government has pushed homeownership so aggressively in recent decades. The fly in the ointment, of course, is if home prices keep going up faster than wages -ceteris paribus- fewer people will be able to save enough money to come up with either the full amount or even a sizable down payment on a loan.

Excellent.

• Trapped In A Bubble (Golem XIV)

Caterpillar (CAT) had been using more and more of its cash to buy back its own shares inflating the apparent demand for them and therefore their price. It’s not illegal, but what does it do for the idea that share price indicates what a company is worth? And where was CAT getting the money with which to buy those shares? I doubt it was from profits given the long cumulative decline in sales. More likely it was from selling bonds i.e. using borrowed money. And indeed that seems to be the case. In May of 2014 CAT sold $2 billion of debt some of it dated as long as 50 years. So let’s take a look at what we have. In May of 2014, despite having already suffered a year of declining sales, CAT shares were the second best performing shares on the Dow Jones.

Who was so keen to buy all their shares? Who knows. But CAT itself had just spent $175 million in buying their own shares in the first quarter (when it was the second best performing share on the DOW) and in the last quarter of the year went on to buy another 250 million dollars worth. In fact, and perhaps most critically, in January the CAT board had authorized $12 billion for buy-back. So the market know that a lot of shares were going to be bought up…by CAT. And not at bargain basement price either. Take a look at the record of their share price above and you’ll see that the board had authorized using borrowed money to buy their shares at around the highest price they had ever been.

Hmm. Did buying all those shares encourage others to do likewise, especially knowing that CAT had a war chest of $12 billion earmarked for buying shares? Any ‘investor’ would know there was a buyer in the market who would be ready and willing to buy them back from him. The upshot would be a guaranteed buoyant market in CAT shares at a time when without such a buoyant demand a year of declining sales might just possibly have led to a steep decline in share price. Of course the official rationale for taking on debt to buy back shares is that debt costs are now low so its a good time to do it. The problem is that while in the short term it improves the look of the company’s share price and things like return on equity, it locks CAT, and any company that does the same, in to paying out interest on debt over the long term.

To paraphrase Steve Keen: Osborne’s understanding of economics is at a kindergarten level.

• Academics Attack George Osborne Budget Surplus Proposal (Guardian)

George Osborne’s plan to enshrine permanent budget surpluses in law is a political gimmick that ignores “basic economics”, a group of academic economists has warned. Responding to the chancellor’s Mansion House speech earlier this week, they said a law forcing the government to cut spending or raise taxes every year to generate a budget surplus, characterised as Micawber economics, would suck the economy dry and within a few years could trigger another credit crunch. In a letter to the Guardian, coordinated by the Centre for Labour and Social Studies, 77 of the best-known academic economists, including French economist Thomas Piketty and Cambridge professor Ha-Joon Chang, said the chancellor was turning a blind eye to the complexities of a 21st-century economy that demanded governments remain flexible and responsive to changing global events.

Piketty signed the letter alongside eminent economics professors from many of Britain’s top universities. Other signatories of the letter include former Bank of England monetary policy committee member David Blanchflower, Diane Elson, emeritus professor of economics at the University of Essex and chair of UK Women’s Budget Group alongside professors of economics from Oxford, Leeds and London universities. In a swipe at what they said was a “risky experiment with the economy in order to score political points”, they argued Osborne was guilty of adopting a gimmick designed to outmanoeuvre his opponents. The tough message follows the chancellor’s annual Mansion House speech in the City, during which he said the government should be forced by law to bring down the UK’s debt mountain to protect the economy against future shocks.

The academics said Osborne was shifting the burden of debt from the government to ordinary households because “surpluses and debts must arithmetically balance out in monetary terms”. “The government’s budget position is not independent of the rest of the economy and if it chooses to try to inflexibly run surpluses, and therefore no longer borrow, the knock-on effect to the rest of the economy will be significant,” they said. “Households, consumers and businesses may have to borrow more overall, and the risk of a personal debt crisis to rival 2008 could be very real indeed.”

“..but the US is probably a bit worse that we are.”

• Australian Workers ‘Stressed And Fat’ (BBC)

Australia’s workforce is affected “in a major way” by poor mental health, stress and obesity, a new study has found. The average Australian employee is stressed and overweight – about half the 30,000 employees surveyed were physically inactive, the report found. The study, by the University of Wollongong in partnership with Workplace Health Association Australia (WHAA), spans 10 years of data. Workers also showed other risk factors. The report found that 65.1% of the employees had reported “moderate to high stress levels” and that 41% had psychological distress levels considered to be “at risk”. The WHAA said that trends around employee health had been examined over a 5-to-10-year period and that the industries covered included banking and finance, legal, transport and storage, in both metropolitan and rural areas.

The study said its objectives were to present an analysis of employee health data from the five organisations, all members of the WHAA, who participated in the project. Dr John Lang, WHAA’s chief executive, told the BBC that the average employee “was seeing a 2.4% reduction in productivity, on average, per risk factor”. Risk factors listed in the study include high blood pressure, high cholesterol, physical inactivity, psychological distress, smoking and obesity. “So if the average employee has four risk factors – that’s four times a 2.4% reduction in productivity,” Dr Lang said. “And this means our workforce is being impacted in a major way by their poor lifestyle and physical health. It’s a global problem in the Western world, but the US is probably a bit worse that we are.”

Early Days.

• California Moves To Restrict Water Pumping By Pre-1914 Rights Holders (LA Times)

For the first time in nearly 40 years, state regulators are telling more than 100 growers and irrigation districts with some of the oldest water rights in California that they have to stop drawing supplies from drought-starved rivers and streams in the Central Valley. The curtailment order, issued Friday by the State Water Resources Control Board, has been expected for weeks. Earlier this spring, the board halted diversions under some 8,700 junior rights. With snowmelt reduced to a trickle this year, there simply isn’t enough water flowing in rivers to meet the demand of all those with even older rights predating 1914. And as flows continue to decline this summer, board officials said, they expect to issue more curtailments, stopping river pumping by more senior diverters.

The effect of the curtailments, which affect water users with rights dating to 1903, will vary. Many have water in storage that they can continue to use. Utilities can keep using flows for hydropower production as long as the water is returned to the rivers. Some growers and ranchers also have groundwater supplies that are unaffected by the order. A few communities, including Chico and Nevada City, have to stop river withdrawals under the order. But Thomas Howard, the state board’s executive director, said they have alternative supplies. “Each water-right holder has different options available to them,” he added. Still, the fact that the state is reaching back more than a century in the hierarchy of California water rights highlights the withering hold of a drought that has also led to the state’s first mandatory cuts in urban use.

Being semi-Canadian, this sort of nonsense amuses me to no end.

• Canada, Tomorrow’s Superpower (Bloomberg)

With a population of only 31.5 million (in 2013), a famously frigid climate and a below-replacement fertility rate, Canada would seem an unlikely candidate to become a superpower. But Canada has three huge, fundamental strengths that will almost certainly be telling in the long run. These are natural resources, good government and an almost unbelievably tolerant and open culture. In terms of natural resources, Canada is almost unmatched. In terms of renewable freshwater – the best candidate for the essential scarce resource of the next two centuries – Canada is exceeded only by the U.S. and Brazil. Its %age of arable land, at 4.6%, is relatively small, but this probably will increase as climate change proceeds and the glaciers retreat.

Basically, there is room for a lot more people in Canada. Good government is another hallmark of Canadian strength. Canada regularly ranks in the top 10 least-corrupt countries in the world, according to Transparency International. The U.S., in comparison, only makes it to the lower reaches of the top 20. That’s especially impressive given Canada’s rich endowment of fossil fuels, which usually causes countries to become more corrupt – a phenomenon known as the Resource Curse. Canada’s institutions, derived from the very best of the U.K., are rock solid. It is probably because of these high-quality institutions that Canada was able to implement universal health care.

Whatever you think of the merits of universal health care, it definitely requires that citizens trust their government. In a country as spread-out and diverse as Canada, attaining a level of public trust equivalent to that received by the ethnically homogeneous countries of Europe is quite a feat. And Canada’s strong institutions have allowed it to implement less controversial economic policies, such as a low corporate tax rate (15%, compared with the U. S.’s 35%). Basically, Canada can usually get things done a lot better than the U.S.

Presumably includes former presidents.

• US Will Call All Chimps ‘Endangered’ (NY Times)

All chimpanzees will be designated as endangered under the Endangered Species Act, the United States Fish and Wildlife Service announced Friday. The move follows a petition filed in 2010 by Jane Goodall, The Humane Society of the United States and other groups to eliminate a longstanding distinction between the legal status of captive chimpanzees, which were previously listed as “threatened,” and their wild counterparts, which have been deemed “endangered” for decades. With the new designations, chimpanzees held in captivity in the United States will receive the same protections as wild chimps under the Endangered Species Act. Biomedical research, interstate trade, and export and import of captive chimpanzees will now require permits issued by the Fish and Wildlife Service. The new rules will become official on June 16 and will go into effect after a 90-day grace period on Sept. 14.

The regulations do not require that people who privately own chimpanzees obtain a permit to keep them, nor do they require permits to use chimpanzees in the entertainment industry, according to Dan Ashe, the United States Fish and Wildlife Service’s director. He said that the previous distinctions sent a mixed signal to the public and created the impression that chimpanzees were not in dire need of help. “At the time we thought it was important to encourage breeding of captive chimps to expand their numbers,” said Mr. Ashe. “But we expanded a culture of treating these animals as a commodity for research, sale, import and export, and entertainment. That has undermined the conservation of chimpanzees in the wild.” Chimpanzees once numbered about a million in the early 1900s, but widespread habitat loss and poaching have caused their numbers to decline. Currently, there are estimated to be between 172,000 and 300,000 worldwide, according to the Jane Goodall Institute.

Home › Forums › Debt Rattle June 13 2015