Harris&Ewing Agriculture Department, Cow jumps over moon 1920

It’s taken a while, but Nicole Foss is now coming back to the Automatic Earth for real. Here’s her take on Greece and everything that bubbles under its surface:

Nicole Foss: The project of European Union, and its single currency experiment, were politically an attempt to unite fractious nations in order to put an end to a history of horribly destructive conflict. Economically, the goals were to scale up governance in Europe, to transition from the national to the transnational level in order to wield more power as a larger trading block. As such it was very much in line with the global trend of the last thirty years towards scaling up almost everything. However, as we have observed before, such expansions are inherently fragile and self-limiting:

This in-built need to expand, sometimes to the scale of an imperium in the search for new territory, means that the process is grounded in ponzi dynamics. Expansion stops when no new territories can be subsumed, and contraction will follow as the society consumes its internal natural capital….

….A foundational ingredient in determining effective organizational scale is trust – the glue holding societies together. At small scale, trust is personal, and group acceptance is limited to those who are known well enough to be trusted. For societies to scale up, trust must transcend the personal and be grounded instead in an institutional framework governing interactions between individuals, between the people and different polities, between different layers of governance (municipal, provincial, regional, national), and between states on the international stage.

This institutional framework takes time to scale up and relies on public trust for its political legitimacy. That trust depends on the general perception that the function of the governing institutions serves the public good, and that the rules are sufficiently transparent and predictably applied to all. This is the definition of the rule of law. Of course the ideal does not exist, but better and worse approximations do at each scale in question.

Over time, the trust horizon has waxed and waned in tandem with large cycles of socioeconomic advance and retreat. Trust builds during expansionary times, conferring political legitimacy on larger scale forms of organization. Trust takes a long time to build, however, and much less time to destroy. The retreat of the trust horizon in contractionary times can be very rapid, and as trust is withdrawn from governing institutions, so is political legitimacy.

This is the predicament facing what is essentially a European imperium today – the twin threats of financial crisis and concommittant loss of trust and political legitimacy. In an awkwardly-amalgamated collective polity with a thousand year history of conflict, the risks associated with the transition from expansion to contraction are legion. We warned in 2010 of the toxic dynamic underlying European unification, and that the political fallout from what we regarded, and still regard, as the inevitable failure of that imperial structure, would be potentially catastrophic:

All aggregate human structures at all degrees of scale are essentially predatory. They all convey wealth from a necessarily expanding periphery towards the centre, where wealth is concentrated. The periphery may be either forced or enticed to join the larger structure, but that does not affect the outcome….The European periphery was sold an impossible dream – that they could by fiat have the same living standards as northern Europe. Perhaps the architects of the project believed that equalization by fiat would work, but whether their intentions were honourable or not is immaterial to the outcome….

…A credit expansion requires two sides – a predatory lending structure at the centre and and gullibility and greed in the periphery. They are mutually responsible for the outcome. In a collapse, the centre attempts to blame the periphery and impose all the consequences upon it, while holding on to all the perceived wealth. This is toxic to the larger structure. The socioeconomic disparities created in the attempt to contain the consequences in the periphery will be politically impossible to sustain…The extent to which the attempt to do this will inflame destructive old hatreds is very much larger than people currently suppose…Collective memory is long.

Union?

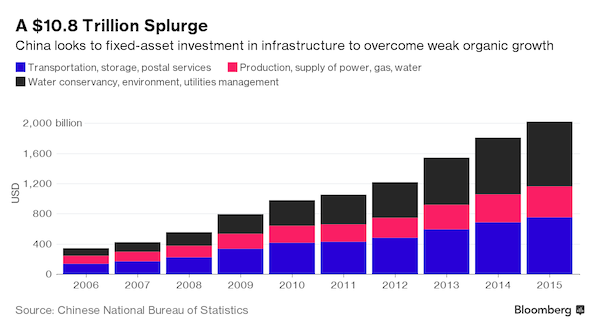

During our decades of economic expansion in the era of globalization, effective organizational scale has become larger and larger, undercutting the ability of smaller entities to compete, and thereby forcing them to amalgamate. Europe has been attempting to create a political entity comparable to the United States, but without the benefit of a common language, culture, identity, freedom of movement, system of transfer payments, financial regulatory regime etc. In doing so, it has created a fatally flawed entity which is nakedly predator, rather than tempered with integrative redistribution mechanisms.

The degree of true integration in Europe is a fraction of what it is in the USA, hence that integration is far more fragile:

Large, economically diverse areas can successfully share a single currency if they have deep economic links that make it possible for troubled regions to ride out crises. That means shared bank regulation and deposit insurance, so banks don’t face regional panics; a labor market that lets people move from places without jobs to places with them; and a fiscal union, which allows the government to collect taxes wherever there is money and spend it wherever there are needs….

…The European Union’s centralized budget equals only about 1% of Europe’s G.D.P., compared with more than 20% for the American federal government. A much more centralized E.U. budget, with much more money flowing through Brussels the way it flows through Washington, could provide similar macroeconomic stability to Europe by creating a fiscal union…

…An economic union can promote economic stability only if it is politically stable, so market participants can have confidence that fiscal transfers and bank guarantees will remain in place.

The price for the necessary integration is far higher than sovereign European countries have been prepared to pay. Without substantial transfer payments to blunt the disparities, the imperial structure of the eurozone acts as a mechanism to convey wealth from the periphery to the financial centre:

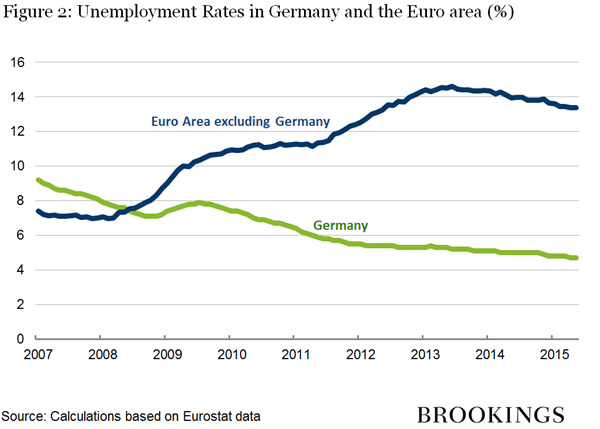

The core issue: Although the European Union can handle economies of widely varying types and levels of development, the euro area cannot. Greece’s gross domestic product per person was about half of Germany’s when it joined the euro in 2001. Since then, Greece’s competitiveness relative to Germany’s has slid by about 40%.

For a currency union to handle widely divergent economies, they must be deeply integrated across multiple dimensions. In the U.S., the average citizen of Mississippi makes just $20,618 a year, compared with $37,892 in Connecticut — almost as big a gap as between Greece and Germany. Yet the U.S. doesn’t worry about a “Missexit,” because the country has various mechanisms for smoothing over differences among its states….

….The mechanisms include large fiscal transfers– by necessity currency unions are transfer unions. Last year, 28 U.S. states sent the equivalent of 2.3% of their gross domestic product through the federal budget to the other 22 states. The biggest donor, Delaware, gave 21%. The biggest recipient, North Dakota, got 90%. By contrast, in 2011 Germany made a net contribution of 0.2% of its GDP to the EU budget, while Greece received 0.2%. Would German voters really support a tenfold jump in their contributions from 210 euros to 2,100 euros per person?

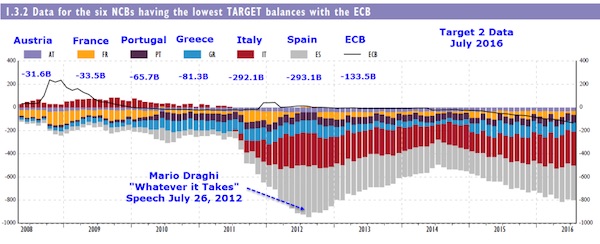

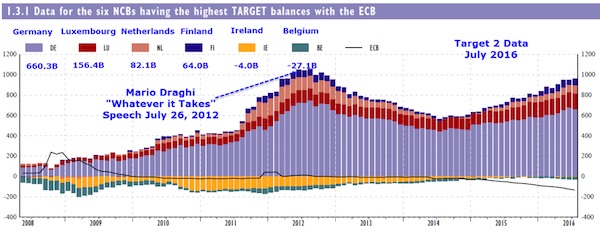

Large-scale fiscal transfers are not the only mechanism needed. Mississippi has probably run the equivalent of a current account deficit with New York ever since the Civil War. Every April, the banks in the Federal Reserve system reallocate assets and smooth over such regional imbalances. By contrast, when Greece runs a deficit with Germany — for example, due to trade with Germany or capital flight from Greece — its central bank accumulates debts to the Bundesbank indefinitely. The Bundesbank currently holds more than 500 billion euros in credits against other euro zone central banks. Again, would German taxpayers be willing to see the Bundesbank regularly write off some portion of those liabilities?

Another reason U.S. states don’t pop out of the dollar area is that they (with the exception of Vermont) have to balance their operating budgets. Only the federal government can run a long-term deficit. Again, Germany and other EU states have explicitly rejected any kind of euro-area sovereign-bond arrangement that would pool deficits. Finally, the U.S. has a deep single market for products, services and labor and a true national banking union, all of which in Europe are only partially completed projects. The lack of truly integrated markets allowed real interest rates and inflation to diverge across the euro zone, leading to a loss of competitiveness and a credit boom and bust in the south.

Thus, the euro area is stuck in a dysfunctional netherworld between a fully integrated union and a more flexible exchange rate mechanism. So Greece has to become a lot more like Germany (unlikely), the euro area needs to become a lot more like the U.S. (also unlikely), or we’ll have another crisis (very likely).

To Scale-Up or Scale-Down?

This is not, however, an argument for Europe to move now towards supranational statehood, even if such a thing were possible, which, in the absence of a common identity, is not realistic. Europe is not prepared for, nor suited for, that level of integration. As German finance minister Wolfgang Schäuble said:

“There can be no mutual liability in Europe. Providing debt relief and transfers won’t help any country. The problem of moral and political hazard in Europe isn’t some narrow-minded mantra,” he said.

Given that we stand on the brink of a major financial and economic contraction, further integration or aggregation would not be possible. The aggregation already achieved was a function of economic expansion, and entities which come together under such circumstances are fissile once expansion morphs into contraction. Trust determines effective organizational scale, and in the coming environment, effective organizational scale is going to get much smaller. Rather than trying to maintain an over-extended and fragile polity, Europe is going to have to rediscover small scale sovereignty.

The assumption in Europe was that regional diversity would be secondary to the unifying force of a single currency, and that a currency union could be expected to remain politically stable even in the absence of fundamental aspects of integration. This has proven over time to be disastrously incorrect. Identity remains at the national, not the supranational, level, meaning that trust has had great difficulty transcending this level in order for it to manifest in European institutions as opposed to national parliaments. True political legitimacy has therefore never been granted, and the democratic deficit in Europe has widened as a result, with supranational institutions insulating themselves from a European public increasingly at odds with its priorities.

This is where we found ourselves at the peak of expansion, under the best conditions for broad-based trust. Past that peak, with the trust horizon sharply contracting already, conditions are rapidly worsening. As we have observed before, expansions are relatively smooth progressions, but contractions are, in contrast, full of abrupt discontinuities:

As we scaled up we built structural dependencies on the range of affordable inputs available to us, on the physical infrastructure we built to exploit them, on the trading relationships formed through comparative advantage, and on the large scale institutional framework to manage it all. Scaling down will mean huge dislocation as these dependencies must give way. There is simply no smooth, managed way to achieve this.

The situation manifesting in Greece at the moment is a prime example of this dynamic. There is a desperate attempt to manage the unmanageable, on the grounds that failure to do so would have dire consequences:

Former Greek finance minister Yanis Varoufakis:”If the PM announced tonight an emergency bill for the introduction of a new currency, in 20 minutes all cash machines would be empty. There would be queues outside banks. The economy would collapse. The ECB would withdraw support for banks leading to their collapse. Until such time as the state printed a new currency, utter darkness would cover the country. 80% of households would become poverty-stricken. The vast-majority of people would rue the time and day this post-bailout default was announced. The exit from the euro for a deficit country would send us back to the neolithic period before we could even realise it.”

This is no doubt true, and the question therefore becomes whether or not this eventuality can be avoided by attempting to prop up the system in its current form in order to buy time to construct its replacement:

Yanis Varoufakis: “If my prognosis is correct, and we are not facing just another cyclical slump soon to be overcome, the question that arises for radicals is this: should we welcome this crisis of European capitalism as an opportunity to replace it with a better system? Or should we be so worried about it as to embark upon a campaign for stabilising European capitalism?

To me, the answer is clear. Europe’s crisis is far less likely to give birth to a better alternative to capitalism than it is to unleash dangerously regressive forces that have the capacity to cause a humanitarian bloodbath, while extinguishing the hope for any progressive moves for generations to come. For this view I have been accused, by well-meaning radical voices, of being “defeatist” and of trying to save an indefensible European socioeconomic system. This criticism, I confess, hurts. And it hurts because it contains more than a kernel of truth.

I share the view that this European Union is typified by a large democratic deficit that, in combination with the denial of the faulty architecture of its monetary union, has put Europe’s peoples on a path to permanent recession. And I also bow to the criticism that I have campaigned on an agenda founded on the assumption that the left was, and remains, squarely defeated. I confess I would much rather be promoting a radical agenda, the raison d’être of which is to replace European capitalism with a different system.

Yet my aim here is to offer a window into my view of a repugnant European capitalism whose implosion, despite its many ills, should be avoided at all costs. It is a confession intended to convince radicals that we have a contradictory mission: to arrest the freefall of European capitalism in order to buy the time we need to formulate its alternative.”

The Psychology of Contraction and the Politics of Division

I agree with Varoufakis that the failure of the current system is likely to unleash the dangerously regressive forces that he mentions. The psychology of contraction is fundamentally different from that of expansion, meaning that different – negative – forces gain the upper hand. I disagree, however, that attempting to maintain the current system can prevent this from happening. Desperately trying to sustain a credit bubble that has already consumed the substance on which it was built is not a viable strategy. It is not going to buy time to construct and implement an alternative system of governance. All it can to is to facilitate an even greater degree of self-consuming catabolism, thereby guaranteeing that the crunch, when it inevitably comes, will be worse. Crisis may be postponed, but at great cost. It cannot be prevented.

Once a credit bubble has been blown, it will eventually implode, as all structures grounded in ponzi dynamics do. When it does, as we have noted before, politics will get much uglier no matter which part of the political spectrum comes to power:

The psychology of contraction is not constructive, and leads in the direction of division and exclusion as trust evaporates. Unfortunately, trust – the glue of a functional society – takes a long time to build, but relatively little time to destroy….

….Whether the left or the right presides over contraction, we are most likely to see a much more pathological face emerge, and this will aggravate political crisis considerably. On the right this could be xenophobia, strict enforcement of tight and arbitrary norms dictated by the few, loss of civil rights, extreme poverty for most while a few live like kings, and fascism, perhaps grounded in theocracy.

On the left it could be forced collectivization, the elimination of property rights, confiscations, and a desire to punish anyone who appears to be doing relatively well, whether or not they achieved this legitimately through foresight, hard work and fiscal responsibility. In either case, liberty is likely to be an early casualty, and intolerance of differences is virtually guaranteed to increase.

We are already seeing the politics of division in Europe. Instead of defending a collective vision, European nation states are retreating into manifest self-interest and mutual recrimination:

Deeper fiscal integration in the eurozone is a “huge mistake” that could end up tearing the bloc apart, Sweden’s former finance minister has warned. Anders Borg said forcing countries to cede sovereignty could trigger a right-wing backlash across Europe, as he predicted that countries such as Sweden and Poland, which are obliged to join the euro, would not adopt the single currency for “decades”. “If you go for tighter co-operation that basically brings higher taxes to the north to subsidise the south, you build in a political divide that is not sustainable in the long term,” he said.

We are seeing divisions between the core nations of France and Germany, and an obvious failure of solidarity among the nations most likely to find themselves in the same position as Greece in the not too distant future.

France, which is itself teetering on the brink, fears German power, but is unwilling to challenge it to forcefully. Prior to the recent national humiliation of Greece, France was beginning to favour leniency:

The much more consequential U-turn is in Paris. Suddenly, Tsipras’s promises on fiscal policy are “serious, credible,” according to President Francois Hollande. In truth, of course, they are exactly as serious and credible as they have been for the past five months. Even if Tsipras becomes a born-again fiscal conservative and actually tries to keep these promises, he’ll fail — and everybody knows it. A tightening of fiscal policy as the economy falls further into recession is anti-growth and fiscally counterproductive. Those primary-surplus targets that the creditors want carved in stone are almost impossible to hit.

However, French representation in actual negotiations was apparently muted:

Yanis Varoufakis: “Only the French minister [Michel Sapin] made noises that were different from the German line, and those noises were very subtle. You could sense he had to use very judicious language, to be seen not to oppose. And in the final analysis, when Dr Schäuble responded and effectively determined the official line, the French minister would always fold.”

Other eurozone countries, many of which are poorer than Greece, resent the notion of Greek debt relief which they would be asked to help pay for:

The arguments of Greece’s creditors have a powerful political logic. No politician from a creditor country can be seen handing over cash to Greece without strict guarantees about how it will be spent. Such politicians note that even as Greece requests further bailouts, its pension system remains relatively generous, encouraging early retirement. The share of employed Greeks between the ages of 55 and 64 is nearly half that of Germany. In 2012, for example, Greece spent 17.5% of GDP on government pensions, compared with 12.3% in Germany. Such comparisons make European voters balk over further bailouts. Politicians in Slovakia and the Baltics, nations no richer than Greece, struggle to explain to constituents why their countries should help fund Greek pensions. Fix the holes in Greece’s perpetually leaky tax system first, many constituents contend.

In addition other indebted members states were concerned about the implications for their own internal politics in the event of Greece being granted a deal:

Varoufakis was reluctant to name individuals, but added that the governments that might have been expected to be the most sympathetic towards Greece were actually their “most energetic enemies”. He said that the “greatest nightmare” of those with large debts – the governments of countries like Portugal, Spain, Italy and Ireland – “was our success”. “Were we to succeed in negotiating a better deal, that would obliterate them politically: they would have to answer to their own people why they didn’t negotiate like we were doing.”

Nascent political movements comparable to Greece’s Syriza are considered a major threat in other affected countries, and a Syriza victory would be seen as empowering political discontent at home:

Michael Pettis: “Today’s Financial Times has a very worrying article explaining why Madrid wants to be seen among the hardliners in opposing a rational treatment for Greece: “when it comes to helping Greece, there will be no such thing as southern solidarity or peripheral patronage.” This is the reverse of what it should be doing. In an article for Politica Exterior in January 2012, I actually proposed, albeit without much hope, that Spain take the lead and organize the debtor countries to negotiate a sustainable agreement, but in its fear of Podemos, the Spanish equivalent of Syriza, and its determination to be one of the “virtuous” countries, it strikes me that Madrid is probably moving in the wrong direction economically. Ultimately, by tying itself even more tightly to the interests of the creditors, Rajoy and his associates are only making the electoral prospects for Podemos all the brighter.”

Meanwhile in the richer north, small political parties like the euroskeptic True Finns have a disproportionate amount of power over the fate of their southern neighbour, thanks to their role in the coalition government and the need for that government to approve a Greek deal. Although Finland could not block a bailout by itself, given the its share of the vote is determined by its contribution to the bailout fund, it could instigate a coalition of euroskeptics to derail and agreement. The issue is proving extremely divisive within Finnish domestic politics. When splinter groups in one member state have what is effectively the power of life death over people in another member state, anger and resentment are guaranteed:

The decision to push for a so-called “Grexit” came after the eurosceptic True Finns party, the second-largest in parliament, threatened to bring down the government if it backed another rescue deal for Greece….Finns party leader Timo Soini, who is also the country’s foreign minister, has repeatedly argued in favour a “Grexit”, saying it would be better for Greece to leave the euro. Finland is one of several EU countries whose national parliaments must sign off of any debt deal for Greece.

The European project, supposedly instituted to prevent future conflict, has increasingly become a potential cause of it:

Europe brings peace. Is that so? It is becoming obvious that you cannot have the economics of the Great Depression without having the politics of the Great Depression. Tsipras’s Greek Marxists and Marine le Pen’s French ‘post-fascists’ may seem moderate when set against the men and women who will come after them if this crisis does not end. Far from quelling nationalism, meanwhile, the Euro has incited it. People who were rubbing along perfectly well in the early 1990s, now look on each other with an emotion close to hatred. Greeks, Italians and Spaniards wonder why Germans, Finns and the Dutch insist that they must suffer. The Germans, Finns and Dutch wonder why southern Europeans expect to live off their taxes.

The politics of division have begun in earnest:

Yanis Varoufakis: Back in 1971 Nick Kaldor, the noted Cambridge economist, had warned that forging monetary union before a political union was possible would lead not only to a failed monetary union but also to the deconstruction of the European political project. Later on, in 1999, German-British sociologist Ralf Dahrendorf also warned that economic and monetary union would split rather than unite Europe. All these years I hoped that they were wrong. Now, the powers that be in Brussels, in Berlin and in Frankfurt have conspired to prove them right.

A Greek Deal That Pleases No One

The terms imposed upon Greece have been subjected to criticism from all sides. The deal has been described as a national humiliation, as a cruel forced-capitulation on the diplomatic rack, as a crucifixion of Greek leader Alexis Tsipras, as a coup d’etat, as a new Versailles treaty, and as the relegation of Greece to the status of a vassal state with an emasculated parliament. EMU inspectors will be able to veto Greek legislation. Greece must adopt drastic reforms, far more draconian than those they rejected in their recent referendum. They must streamline the pension system, boost tax revenue, liberalise the labour market, privatise the electricity network, extend commercial opening hours and place €50 billion worth of assets into a trust fund intended to generate privatisation revenues to pay creditors. All of this is merely to begin negotiations on a new bailout package, with no prospect of the debt relief that even the IMF insists is necessary.

The European Union does not suffer from a mere ‘democratic deficit’, as this exercise in naked monetary imperialism demonstrates:

Monday July 13 will go down in history as the day Greece lost its independence after 185 years of freedom, the day democracy died in the country that invented it and the day the European Union took a decisive step towards self-destruction. After almost 20 hours of of browbeating by EU leaders in Brussels – which one senior official compared to “mental waterboarding” – Greece was given a blunt choice: vote through a raft of draconian measures demanded by creditors or leave the Eurozone…

…Greece has essentially seen its independence eviscerated. A state whose motto is ‘Freedom or Death’ and whose national anthem is ‘Hymn to Liberty’ is now little more than a protectorate of the EU. Its parliament no longer has the power to make sovereign decisions about the issues that matter most to its citizens. Instead, it has two days to vote through a shopping-list of far-reaching reforms mandated by Brussels. Its administration is subordinate to a triumvirate of unelected officials from the European Commission, European Central Bank and IMF. And billions of euros of assets are to be stripped from the Greek state’s control and placed in a Luxembourg trust fund.

As the summit of Eurozone leaders limped to a conclusion Monday morning, some commentators compared the tortured talks to the Nice Treaty, thrashed out over four days in 2000. In fact, it more resembles the Versailles Treaty, whose punitive terms were imposed on Germany almost a century ago and poisoned international relations for decades after.

The wartime comparisons have been expressed by many commentators:

Yanis Varoufakis: “The recent Euro Summit is indeed nothing short of the culmination of a coup. In 1967 it was the tanks that foreign powers used to end Greek democracy. In my interview with Philip Adams, on ABC Radio National’s LNL, I claimed that in 2015 another coup was staged by foreign powers using, instead of tanks, Greece’s banks.”

The week’s events constitute power politics in their most unedifying form:

What we’ve learned these past couple of weeks is that being a member of the eurozone means that the creditors can destroy your economy if you step out of line. This has no bearing at all on the underlying economics of austerity. “This goes beyond harsh into pure vindictiveness, complete destruction of national sovereignty, and no hope of relief. It is, presumably, meant to be an offer Greece can’t accept; but even so, it’s a grotesque betrayal of everything the European project was supposed to stand for.

What we have all seen with great clarity is that the EMU creditor powers can subjugate an unruly state – provided it is small – by shutting down its banking system. We have seen too that a small country has no defences whatsoever. This is monetary power run amok.

Phillippe Legrain, former head of the analysis team at the Bureau of European Policy Advisers and principal adviser to the president of the European Commission, has been particularly scathing in his criticism:

When finalizing my book European Spring last year, I hesitated before describing the Eurozone as a “glorified debtors’ prison.” After this weekend’s brutal, vindictive, and short-sighted exercise of German power against Greece, backed up by the Frankfurt-based European Central Bank’s (ECB) illegal threat to pull the plug on the entire Greek banking system, I take it back. There is nothing glorious about the Eurozone: it is a monstrous, undemocratic creditors’ racket.

Greece’s submission to the conditions that Germany demanded, merely to start negotiations about further funding to refinance its unsustainable debts, may stave off the prospect of imminent bank collapse and Greece’s exit from the Eurozone. But far from solving the Greek problem, doubling down on the creditors’ disastrous strategy of the past five years will only further depress the economy, increase the unbearable debt burden, and trample on democracy. Even Deutsche Bank, one of the German banks bailed out by European taxpayers’ forced loans to the Greek government in 2010, says Greece is now tantamount to a vassal state….

….That’s the point of brutalizing Greece: to deter anyone else from getting out of line. Why vote for parties that challenge the Berlin Consensus if they will be beaten into submission, too? Created to bring Europeans closer together, the Eurozone is now held together by little except fear.

Even former staunch europhiles on the political left are increasingly seeing the European project in a very different light:

At first, only a few dipped their toes in the water; then others, hesitantly, followed their lead, all the time looking at each other for reassurance. As austerity-ravaged Greece was placed under what Yanis Varoufakis terms a “postmodern occupation”, its sovereignty overturned and compelled to implement more of the policies that have achieved nothing but economic ruin, Britain’s left is turning against the European Union, and fast.

“Everything good about the EU is in retreat; everything bad is on the rampage,” writes George Monbiot, explaining his about-turn. “All my life I’ve been pro-Europe,” says Caitlin Moran, “but seeing how Germany is treating Greece, I am finding it increasingly distasteful.” Nick Cohen believes the EU is being portrayed “with some truth, as a cruel, fanatical and stupid institution”. “How can the left support what is being done?” asks Suzanne Moore. “The European ‘Union’. Not in my name.”

Many commentators feel that critical lines were crossed and the damage to the European Union could ultimately prove to be fatal:

George Friedmann: Germany could not accept the Greek demand. It could not risk a Greek exit from the European Union. It could not appear to be frightened by an exit, and it could not be flexible. During the week, the Germans floated the idea of a temporary Greek exit from the euro. Greece owes a huge debt and needs to build its economy. What all this has to do with being in the euro or using the drachma is not clear. It is certainly not clear how it would have helped Europe or solved the immediate banking problem. The Greeks are broke, and don’t have the euros to pay back loans or liquefy the banking system. The same would have been true if they left the European Union. Suggesting a temporary Grexit was a fairly meaningless act — a bravura performance by the Germans. When you desperately fear something in a negotiation, there is no better strategy than to demand that it happen….

…Germany crossed two lines. The lesser line was that France and Germany were not linked on dealing with Greece, though they were not so far apart as to be even close to a breach. The second, and more serious, line was that the final negotiation was an exercise of unilateral German power. Several nations supported the German position from the beginning — particularly the Eastern European nations that, in addition to opposing Greece soaking up European money, do not trust Greece’s relationship with Russia. Germany had allies. But it also had major powers as opponents, and these were brushed aside.

These powerful opponents were brushed aside particularly on two issues. One was any temporary infusion of cash into Greek banks. The other was the German demand, in a more extreme way than ever before, that the Greeks cede fundamental sovereignty over their national economy and, in effect, over Greece itself. Germany demanded that Greece place itself under the supervision of a foreign EU monitoring force that, as Germany demonstrated in these negotiations, ultimately would be under German control….

…The situation in Greece is desperate because of the condition of the banking system. It was the pressure point that the Germans used to force Greek capitulation. But Greece is now facing not only austerity, but also foreign governance. The Germans’ position is they do not trust the Greeks. They do not mean the government now, but the Greek electorate. Therefore, they want monitoring and controls. This is reasonable from the German point of view, but it will be explosive to the Greeks.

In World War II, the Germans occupied Greece. As in much of the rest of Europe, the memory of that occupation is now in the country’s DNA. This will be seen as the return of German occupation, and opponents of the deal will certainly use that argument. The manner in which the deal was made and extended by the Germans to provide outside control will resurrect historical memories of German occupation. It has already started.

Friedmann’s point about not trusting the Greek electorate is an important one. This is not the first time in Europe in recent years that electorates have been sidestepped or subverted for having inconvenient collective opinions. Elections themselves could become increasingly problematic:

Varoufakis said that Schäuble, Germany’s finance minister and the architect of the deals Greece signed in 2010 and 2012, was “consistent throughout”. “His view was ‘I’m not discussing the programme – this was accepted by the previous [Greek] government and we can’t possibly allow an election to change anything.

“So at that point I said ‘Well perhaps we should simply not hold elections anymore for indebted countries’, and there was no answer. The only interpretation I can give [of their view] is, ‘Yes, that would be a good idea, but it would be difficult. So you either sign on the dotted line or you are out.’”

Interestingly, much angst over the deal can also be found domestically in Germany, where there is considerable concern over the country’s reputation in Europe. The Greek debacle is being referred to as a diplomatic disaster:

Chancellor Angela Merkel may appear to be the victor in the Greek bailout standoff but many Germans looked on in dismay at the heavy cost to the country’s image. Merkel and her hardline finance minister, Wolfgang Schäuble, drove a tough bargain at the marathon negotiations, in line with Berlin’s stated goal of defending the cause of fiscal rectitude. But while Merkel, often called Europe’s de facto leader, has grown used to Nazi caricatures on the streets of Athens, a backlash appeared to be mounting this time at home too. Commentators of all political stripes said they feared that Berlin’s “bad cop” stance in Brussels had brought back “ugly German” stereotypes of rigid, brutal rule enforcers.

“The German government destroyed seven decades of post-war diplomacy on a single weekend,” news website Spiegel Online said. “There is a fine line between saving and punishing Greece. This night the line has disappeared,” tweeted Mathias Mueller von Blumencron of the conservative standard-bearer Frankfurter Allgemeine Zeitung as the details of the German-brokered austerity-for-aid deal emerged. “Merkel managed to revive the image of the ugly, hard-hearted and stingy German that had just begun to fade,” the centre-left daily Sueddeutsche Zeitung wrote. “Every cent of aid to Greece that the Germans tried to save will have to be spent two and three times over in the coming years to polish that image again.”

It is difficult to see how this situation could be described as other than the worst way for the European project to proceed:

Greece’s economy is in tatters, its creditors are fuming and Europe’s institutions are in despair. Much to Britain’s disgust even non-euro countries have been sucked into the nightmare: a bridge loan designed to keep Greece afloat while the bail-out talks proceed looks set to tap a fund to which all EU countries have contributed.

But wasn’t this week’s agreement a triumph for the shock troops of austerity? Hardly. Finland’s coalition, formed only two months ago, tottered at the prospect of funding a third Greek bail-out. The Dutch prime minister, Mark Rutte, has admitted that it would violate an election pledge he made in 2012. One euro-zone diplomat says that 99% of her compatriots would say “no” to the bail-out if offered a Greece-style referendum. Even Angela Merkel, Germany’s chancellor and Mr Tsipras’s chief tormentor, is damaged. The deal, crafted largely by Mrs Merkel, Mr Tsipras and François Hollande, France’s president, has exposed the German chancellor to competing charges: of cruelty abroad and of leniency at home, notably among Germany’s increasingly irritable parliamentarians, who must vote twice on the Greek package.

Europe’s single currency, designed to foster unity and ease trade between its members, has thus become a ruthless generator of misery for almost all of them.

Liquidity Crunch and a Cash-Only Economy

As we have consistently maintained at TAE, cash is king in a period of deflation, and the conversion to a cash-only economy can unfold very rapidly once credit instruments cease to be regarded as credible promises to repay. Like Cyprus in March 2013, the Greek economy is rapidly transitioning to cash-only as the liquidity crunch, or liquidity asphyxiation, to use Yanis Varoufakis’ term, deepens. The banks are on the verge of collapse. Capital controls allow for withdrawals of only €60 per day, and pensioners are only able to access €120 per week [update: that changed today]. Tourists are finding they cannot change foreign currency for scarce euros. People fear bank account haircuts. Medicines, particularly insulin, and access to medical care are very limited as the healthcare system has converted to pay-as-you-go, in cash. The power system struggles to cope as consumers cannot pay their bills. Purchases cannot be made outside the country, so vital imports are not possible, meaning that stocks of raw materials are being run down. Operations may shortly cease for many businesses:

Constantine Michalos, head of the Hellenic Chambers of Commerce and a food importer, said the economy has reached near paralysis. “There is no system in place for Greek companies to transfer money about. Our life-blood has been shut off,” he said. “People are depleting their stocks. We are going to start seeing shortages of meat by the end of the week.”

The network of chambers in the Greek islands reports that the local payments system is breaking down since nobody wants to accept transfers into backing accounts that could be seized at any moment. “The ferry operators are demanding cash up front to bring in fuel and supplies,” he said. “The whole is economy shifting to cash. You can’t really import anything, and 40pc of Greek GDP is based on imports,” said Haris Makryniotis, who helps small businesses for Endeavor Greece.

Businesses have little remaining room for manoeuver :

Whereas individuals may be able to survive off €60 a day, at least for a while, businesses cannot. One particular problem is that Greek businesses rely heavily on imports (especially of raw materials) which they can no longer access easily; this means that, for example, a lightbulb factory reliant on copper from Chile can only make lightbulbs as long as its existing inventory holds out. Exports also fall; Greek manufacturers have already had to cancel orders from buyers abroad and more will follow soon. Domestic suppliers have begun to insist on up-front cash payments (those that didn’t already, at least). This causes similar supply-chain problems; as drivers and petrol stations demand payment in cash, which isn’t readily available, delivery delays grow, occasionally leading fruit and vegetables to go off. Redundancies are already starting to happen as businesses slim down to counter losses.

Whereas some of the bigger businesses with bank accounts abroad or foreign income streams are able to circumvent some of these controls by using their foreign bank accounts to pay suppliers, most family-run businesses and smaller firms—the backbone of the Greek economy—are not so lucky. In theory, they can apply to a special bank committee that assesses applications; in practice this is proving wholly insufficient….

…Greece is a more cash-reliant economy than other European countries and small businesses in particular pay both suppliers and employees in cash. Capital controls have quickly thrown normal pay arrangements into chaos, and businesses are increasingly resorting to delayed payments, forced holiday for employees, and layoffs.

Companies with large cash flows, such as supermarkets, have stopped putting all their cash earnings back into banks and are holding on to over 50% of it, according to one senior Greek banker. Those who still use banks for deposits say they do so in order to pay staff electronically. Cash-heavy businesses that have stopped paying into banks have started to pay staff directly in cash.

Greece’s slow slide into a cash-only economy has significant repercussions for the state—including a smaller tax take as cash transactions and payments reduce the (already low) share of exchanges reported to the Greek government.

This is what a liquidity crunch looks like in practice, and very much what we have been warning about at TAE since its inception. Finance is the operating system, and when the operating system crashes, nothing moves. In a complex system, that translates rapidly into cascading system failure. Without liquidity to act as the lubricant in the engine of the economy, it is not longer possible to connect buyers and sellers, or producers and consumers. In a cash-only economy, where credit instruments have ceased to be viable, there is very little cash available, and of what little there is, people hold on to as much as they can because they are unsure when they may come by any more of it. This means the velocity of money – the prime determinant of the level of economic activity that can be supported – remains extremely low. As we have said before:

2008 did not demonstrate what a liquidity crunch really means, but this time we are going to find out. As with many aspects of financial crisis, Greece is the canary in the coalmine….For a long time, money will be the limiting factor, and finance will be the key driver to the downside, just as was the case in the Great Depression of the 1930s. Resources will remain available, at least initially, but no one will have the means to pay for them during a period of economic seizure.

As we have discussed at TAE before, prices diverge under conditions of liquidity crunch. As a much larger percentage of a much smaller money supply starts competing for the essentials, they receive relative price support. In contrast domestic good of little immediate essential value become virtually worthless very quickly:

Some Greeks of means are reportedly going on spending binges, buying expensive goods in order to empty their bank accounts. When the rumour of a haircut to deposits over €8000 surfaced earlier this week, people apparently tried to find ways to bring their accounts below that level (by buying things on their debit cards or transferring money to friends with a lower balance).

Most Greeks are living off meagre salaries, have little money in their accounts and are prioritising the basics. Food and petrol sellers have been the big winners, so to speak, of the past week as people hoard dry foods and fill up on petrol to prepare for potential severe shortages in future. For most other businesses, selling less-essential goods and services, business is very bad. Many report drops in sales of 25%-50%. Demand for non-essential food items, for example, is reportedly down around 30%. Domestic production is falling as a consequence, which suggests that a sharp rise in unemployment may soon follow.

To the extent that they can, people are hoarding cash (and have been in modest amounts since January, when Syriza came to power). Around €45 billion is estimated to be stuffed in sock-drawers, under mattresses and in safes in people’s homes. These hoards will support some segments of the Greek population well if the crisis continues, but the cashpiles seem to be distributed in highly uneven fashion.

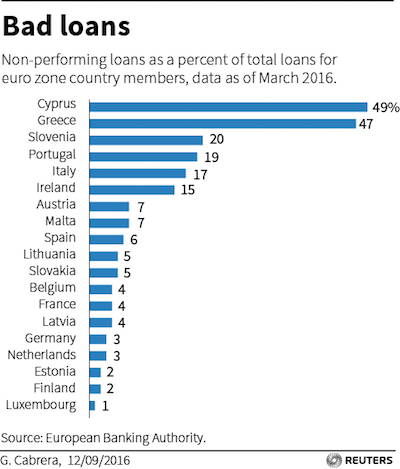

Debt to GDP is past the point of no return in Greece, meaning that default is inevitable. Austerity is merely frog-marching the country in that direction even more quickly, as it suppresses economic growth. With the rate of growth less than the rate of interest paid on debt, Greece is in an exploding debt scenario. The greater the extent to which austerity forces economic contraction, the larger the debt will loom in comparison to falling GDP. Debt relief is not on offer, maturity extensions will make little difference, and assets set aside to cover debt from privatization revenues are not going to attract the expected valuations under conditions of distressed assets prices. Their contribution to debt repayment is therefore being grossly overestimated in the Troika’s calculations:

“It’s just a continuation of failed policy packages, and if anything it’s worse,” says Charles Wyplosz, professor of economics at the Graduate Institute of International Studies, Geneva. “It hasn’t worked, it won’t work.”…

….Greece’s paralyzed banks could prove the biggest brake on such an economic bounce, however. The banks, which have suffered from deteriorating asset quality and massive deposit flight, need a faster and bolder recapitalization than Europe is currently offering, Mr. Gros says. “Creditors will have to deliver here. They will sabotage their own program if they don’t,” he says….

….Like the previous bailout programs, the aim is to put Greece’s debt on a downward trajectory as a proportion of its GDP. But the math looks strained: Greek debt avoids skyrocketing only because lenders say Greece will raise €50 billion from privatizing public assets, the proceeds of which would mostly go toward paying down debt. Previous bailout plans also assumed large privatization revenues. Only a fraction have materialized. The problem was and remains that Greece doesn’t have assets that it can sell for such high prices in the foreseeable future

The dismal prospect for Greece under this agreement is a downward spiral of self-fulfilling prophecy, as the shift from to the psychology of expansion to the psychology of contraction has cascading impacts:

Value-added tax rates — your basic regressive sales tax — will jump by ten percentage points or more, to 23%, including for hotels and restaurants and including on the Greek islands. This will divert tourists to Turkey and elsewhere, damping Greece’s largest industry. Also, it will drive small businesses even further to cash and tax evasion. This means other tax revenues will also fall. Tax revenues will rise at first, but then they will fall short of targets, both because economic activity falls and evasion rises. As this happens, the new program requires that public spending be cut automatically. Since most public spending goes for pensions and wages, this means that pensions and wages will be cut. Since pensioners and civil servants live on these payments, they will cut their spending — and tax revenues will fall further. In the labor market, extreme deregulation will proceed. Collective bargaining will be suppressed; wages will therefore fall. As a result, wage labor will go off-the-books, into cash, even more than it already has, and pension contributions will decline again. The resulting tax losses will feed back into pension cuts.

Privatization will work through a required new fund that will, supposedly, hold €50 billion in Greek assets to be sold off (notwithstanding the difficulty that, according to the economy minister, public assets on that scale do not exist). Anyhow the state electricity company will be sold, and electric rates will rise. As all this happens, even more people will default on their mortgages. The judicial code will be rewritten to facilitate mass foreclosures, so far held in abeyance. The non-performing-loans of the banking system will then go from disastrous to catastrophic. Now then, under these conditions, what do you think will happen to the banks.

It is possible that a surge of “confidence” will now bring cash deposits back to the banks, new inter-bank loans from North Europe, new lending to small businesses, new jobs and economic growth. Possible, but not likely. Much more likely, with every increase of the ceiling on Emergency Liquidity Assistance (ELA), and every relaxation of capital controls, people in Greece will line up to pull cash from the banking system. They will do this because they have to, in order to live. They will do this because cash avoids taxes. They will do it because any fool can see that the banks are doomed. So deposits will go down, the ELA will go up, still more loans will go bad, and the banks will continue as zombies until — at some point — the European Central Bank gives up and closes them down, this time for good. Greek depositors will then lose what little remains.

Single Currency or Glorified Exchange-Rate Mechanism?

The single currency was intended to transcend the difficulties of the European Exchange Rate Mechanism which preceded it, becoming an irreversible unifying force for its member states. Currency pegs are notorious for providing a field day for speculators, as Britain discovered to its cost the day sterling was driven from the ERM, despite the government raising interest rates by 5% in a single day. A single currency, in contrast, is indivisible, providing no cracks within which wedges may be driven in order to profit from exploiting economic disparities.

Europe wished to convince the financial world of its new-found seamlessness by ‘graduating’ from ERM to single currency, but irreversibility and seamlessness are in the eye of the beholder. They depend on confidence, as does every facet of the financial world. Where there is a clear disparity between the level of primary loyalty (to the nation state) and the scale at which the currency operates (Europe-wide), there is clearly a problem. Allowing currency notes to be distinguished on the basis of country of issue (by serial number) creates another potentially exploitable weakness. Nevertheless, the eurozone was presenting a united front until the specter of Grexit emerged.

The negotiating position recently presented by German finance minister Wolfgang Schäuble, suggesting a temporary ‘time-out’ of the single currency for Greece, has opened Pandora’s box with a vengeance:

For its entire life, the euro was conceived as a currency from which there could be no exit. This was not accidental: the disasters that befell the Exchange Rate Mechanism in the early 1990s convinced European leaders that the only way to create a lasting single currency was never, ever, to countenance anyone leaving it. The euro was “irreversible”, to use the word Mario Draghi has frequently used.

Except, tonight in Brussels it transpired that it is far from irreversible. That euro finance ministers are now actively discussing giving Greece a “time-out” from the currency.

Now, one should insert a major note of caution at this stage. The clause quoted above was not agreed by all the euro members here in Brussels. It was put into square brackets, meaning it is yet to be agreed by all member states. It may well be excised by the time the leaders have honed the draft document away to produce their final statement.

Nonetheless, it was on the table. And that means that to some extent, the genie is now out of the bottle. Brussels is officially discussing how to engineer Greece’s departure. The euro is not irreversible.

The significance of this move was noted immediately:

Yanis Varoufakis: “Anyone who toys with the idea of cutting off bits of the euro zone hoping the rest will survive is playing with fire. Some claim that the rest of Europe has been ring-fenced from Greece and that the ECB has tools at its disposal to amputate Greece, if need be, cauterize the wound and allow the rest of euro zone to carry on. I very much doubt that that is the case. Not just because of Greece but for any part of the union. Once the idea enters peoples’ minds that monetary union is not forever, speculation begins … who’s next? That question is the solvent of any monetary union. Sooner or later it’s going to start raising interest rates, political tensions, capital flight.”

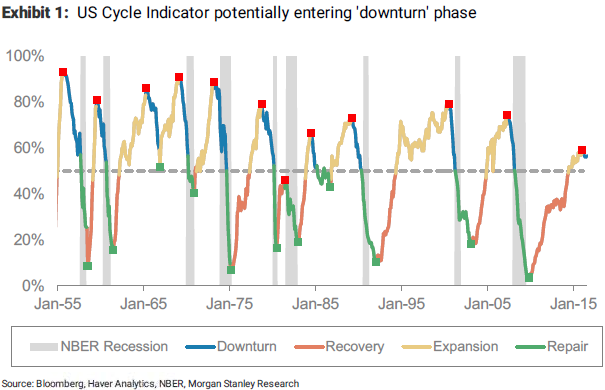

Varoufakis is right. The risk distinctions might not begin immediately, but they will happen, and speculation will exploit them by exert huge pressure on credit spreads. Interest rates are a risk premium, and raising or lowering them creates self-fulfilling prophecies. The perception that a country represents a greater risk of default results in higher interest rates, which in turn increase the debt burden and raise the actual risk of default. similarly, the perception that a country represents a relative safe haven creates circumstances of greater actual safety as interest rates fall and lower the debt burden. Safe become safer, while the riskier are marched over a cliff. In expansionary times, investors largely ignore risk and credit spreads narrow. In contractionary ones, we can expect spreads to blow out to record levels as risk aversion suddenly increases. The effect will be to pick off countries one by one, beginning with the one perceived to be weakest. Reality is less important than perception in driving this dynamic. As the psychological shift occurs, the impact cascades as a positive feedback loop to the downside.

Varoufakis’ description of the long negotiation process is interesting. It seems clear from his account that the German negotiating team was determined to achieve a Grexit:

The reason five months of negotiations between Greece and Europe led to impasse is that Dr Schäuble was determined that they would. By the time I attended my first Brussels meetings in early February, a powerful majority within the Eurogroup had already formed. Revolving around the earnest figure of Germany’s Minister of Finance, its mission was to block any deal building on the common ground between our freshly elected government and the rest of the Eurozone.

Thus five months of intense negotiations never had a chance. Condemned to lead to impasse, their purpose was to pave the ground for what Dr Schäuble had decided was ‘optimal’ well before our government was even elected: That Greece should be eased out of the Eurozone in order to discipline member-states resisting his very specific plan for re-structuring the Eurozone. This is no theory of mine. How do I know Grexit is an important part of Dr Schäuble’s plan for Europe? Because he told me so!

Germany had, after all, not been keen on allowing broad-based European participation in the eurozone from the beginning:

There were bitter fights between France and Germany in the run-up to the launch of the euro. Germany’s desire to limit the euro to a small club consisting of itself, France and some like-minded fiscally austere allies, such as the Netherlands, conflicted with France’s desire for a broader euro.

France, seeking to end the ability of Spain and Italy to competitively devalue at the expense of French exporters, wanted those southern European countries inside the euro. Germany’s efforts were undercut when a slowdown ensured it missed some of the stringent criteria it had insisted be a test for euro membership. With Germany and France both fudging their way in, there was no way to keep the so-called Club Med countries out.

The desire to squeeze Greece out of the euro might arguably be seen as an attempted kindness:

On July 14th, one day after the euro summit, Wolfgang Schäuble, Germany’s bristly finance chief, declared that many of his colleagues in Berlin thought Greece would be better off leaving the euro than submitting to its demands. (He did not need to add that he shares that belief.)

Needless to say, it was not perceived this way, and even if it was meant to be of benefit to Greece, the threat to the eurozone through the questioning of irreversibility is still huge:

In an odd way, the only European politician who was really offering Greece a way out of the impasse was Wolfgang Schäuble, the German finance minister, even if his offer was made in a graceless fashion, almost in the form of diktat. His plan for a five-year velvet withdrawal from EMU – a euphemism, since he really meant Grexit – with Paris Club debt relief, humanitarian help, and a package of growth measures, might allow Greece to regain competitiveness under the drachma in an orderly way. Such a formula would imply intervention by the ECB to stabilise the drachma, preventing an overshoot and dangerous downward spiral. It would certainly have been better than the atrocious document that Mr Tsipras must now take back to Athens….

…For the eurozone this “deal” is the worst of all worlds. They have solved nothing. Germany and its allies have for the first time attempted to eject a country from the euro, and by doing so have violated the sanctity of monetary union. Rather than go forward in times of deep crisis to fiscal and political union to hold the euro together – as the architects of EMU always anticipated – they have instead gone backwards. They have at a single stroke converted the eurozone into a hard-peg currency bloc, a renewed Exchange Rate Mechanism that is inherently unstable, at the whim and mercy of populist politicians playing to the gallery at home. The markets are already starting to call it ERM3.

The risk of Grexit still exists, since no one seriously believes that Tsipras and Syriza can deliver on all the promises required of them. Even the attempt is likely to amount to political suicide. There could be a parliamentary revolt. With confidence so shaken, reopening the banks could yet result in a major bank run. Cash is king and, given the opportunity, people will likely be determined to get their hands on as much of it as they can. Debt to GDP is past the point of no return and everyone knows it. In the absence of very substantial debt relief, this agreement is nothing more than an attempt to kick the can further down the road, with no Plan B should that fail. And the can kickers are almost out of road.

The clear risk is contagion, with speculators picking off one country at a time. Dr Schäuble appears to believe that contagion is not a risk, as the Greek economy is relatively small:

“If you look at Greece, it’s not a major part of the economy of the eurozone as a whole. Most participants of financial markets are telling us that markets have already priced in whatever will happen. You can’t see any contagion.”

However, relative size is not the issue:

The warnings were echoed by Eric Rosengren, head of the Boston Federal Reserve, who said Europe risks sitting off uncontrollable contagion if it mishandles the Greek crisis, even though Greece may look too small to matter.

“I would say to some European analysts who assume that a Greek exit would not be a problem, people thought that Lehman wouldn’t be a problem. If you measured the size of Lehman relative to the size of the US economy it was quite small,” he told a group at Chatham House.

Economies do run run mechanically in accordance with the law of physics. They are not machines where action and reaction are proportionate. Economies operate in psychological space, as they are composed of people. Financial and economic outcomes represent the sum of millions and millions of short term, self-interested decisions made by market participants. Psychological shifts can have very rapid and apparently disproportionate effects. As the psychology of contraction takes hold, contagion is virtually guaranteed.

Dr Schäuble’s anti-democratic proposal for a European budget commissioner, with veto powers over national budgets, would neither have prevented the current crisis, nor addressed its aftermath, as it rests on a fatally flawed mechanistic model of financial systems that completely fails to incorporate vital aspects of the eurozone reality:

Yanis Varoufakis: “Before the crisis, had Dr Schäuble’s fiscal overlord existed, she or he might have been able to veto the Greek government’s profligacy but would be in no position to do anything regarding the tsunami of loans flowing from the private banks of Frankfurt and Paris to the Periphery’s private banks. Those capital outflows underpinned unsustainable debt that, unavoidably, got transferred back onto the public’s shoulders the moment financial markets imploded. Post-crisis, Dr Schäuble’s budget Leviathan would also be powerless, in the face of potential insolvency of several states caused by their bailing out (directly or indirectly) the private banks. In short, the new high office envisioned by the Schäuble-Lamers Plan would have been impotent to prevent the causes of the crisis and to deal with its repercussions.”

Governments are not in a position to control credit expansions, as so much of the process happens privately, particularly in the shadow banking system. Credit expansions are possible even under a gold standards, as we saw in the Roaring 20s, prior to The Great Depression. As we have discussed before, credit expansions have characterized bubbles throughout history and governments have been powerless to prevent them:

Neglecting the vital role of ephemeral credit in the composition of the effective money supply in manic times is a major omission, as it is the virtual nature of credit that defines such periods, and its abrupt loss that leads to the severity of the depression conditions that inevitably follow.

Corporatocracy

The eurozone crisis is typically cast as a geopolitical clash of nations:

Countries that don’t play ball with Germany will see their banking system used against their democratically elected politicians. The banking system is the soft underbelly and the Germans are prepared to orchestrate bank runs in member states to get their way. This is not only new, it is outrageous.

This is overly simplistic, however, as the centre of the imperial structure is not in this case a state – Germany – but the private financial system itself, which has been heavily involved in orchestrating the circumstances leading to the current crisis and arranging to benefit fro the inevitable fallout:

The crisis was exacerbated years ago by a deal with Goldman Sachs, engineered by Goldman’s current CEO, Lloyd Blankfein. Blankfein and his Goldman team helped Greece hide the true extent of its debt, and in the process almost doubled it. And just as with the American subprime crisis, and the current plight of many American cities, Wall Street’s predatory lending played an important although little-recognized role.

In 2001, Greece was looking for ways to disguise its mounting financial troubles. The Maastricht Treaty required all eurozone member states to show improvement in their public finances, but Greece was heading in the wrong direction. Then Goldman Sachs came to the rescue, arranging a secret loan of 2.8 billion euros for Greece, disguised as an off-the-books “cross-currency swap”—a complicated transaction in which Greece’s foreign-currency debt was converted into a domestic-currency obligation using a fictitious market exchange rate.

As a result, about 2% of Greece’s debt magically disappeared from its national accounts. Christoforos Sardelis, then head of Greece’s Public Debt Management Agency, later described the deal to Bloomberg Business as “a very sexy story between two sinners.” For its services, Goldman received a whopping 600 million euros ($793 million), according to Spyros Papanicolaou, who took over from Sardelis in 2005. That came to about 12% of Goldman’s revenue from its giant trading and principal-investments unit in 2001—which posted record sales that year. The unit was run by Blankfein.

Then the deal turned sour. After the 9/11 attacks, bond yields plunged, resulting in a big loss for Greece because of the formula Goldman had used to compute the country’s debt repayments under the swap. By 2005, Greece owed almost double what it had put into the deal, pushing its off-the-books debt from 2.8 billion euros to 5.1 billion. In 2005, the deal was restructured and that 5.1 billion euros in debt locked in. Perhaps not incidentally, Mario Draghi, now head of the European Central Bank and a major player in the current Greek drama, was then managing director of Goldman’s international division.

….Goldman was the biggest enabler. Undoubtedly, Greece suffers from years of corruption and tax avoidance by its wealthy. But Goldman wasn’t an innocent bystander: It padded its profits by leveraging Greece to the hilt—along with much of the rest of the global economy. Other Wall Street banks did the same.

This is essentially the private equity model that has been employed against many companies, where a company is acquired (in a leveraged deal that costs the purchaser almost none of their own money) then asset-stripped, saddled with and sold back to the public as a worthless shell. Wall Street and its European counterparts do not only assets strip companies, they asset strip countries, and in the process shift the burdens onto the citizenry:

Michael Hudson: “It’s not so much Germany versus Greece, as the papers say. It’s really the war of the banks against labor. And it’s a continuation of Thatcherism and neoliberalism. The problem isn’t simply that the troika wants Greece to balance the budget; it wanted Greece to balance the budget by lowering wages and by imposing austerity on the labor force. But instead, the terms in which Varoufakis has suggested balancing the budget are to impose austerity on the financial class, on the tycoons, on the tax dodgers.

And he said, okay, instead of lowering pensions to the workers, instead of shrinking the domestic market, instead of pursuing a self-defeating austerity, we’re going to raise two and a half billion from the powerful Greek tycoons. We’re going to collect the back taxes that they have. We’re going to crack down on illegal smuggling of oil and the other networks and on the real estate owners that have been avoiding taxes, because the Greek upper classes have become notorious for tax dodging.

Well, this has infuriated the banks, because it turns out the finance ministers of Europe are not all in favor of balancing the budget if it has to be balanced by taxing the rich, because the banks know that whatever taxes the rich are able to avoid ends up being paid to the banks. So now the gloves are off and the class war is sort of back. Originally, Varoufakis thought he was negotiating with the troika, that is, with the IMF, the ECB, and the Euro Council.

But instead they said, no, no, you’re negotiating with the finance ministers. And the finance ministers in Europe are very much like Tim Geithner in the United States. They’re lobbyists for the big banks. And the finance minister said, how can we screw up this and make sure that we treat Greece as an object lesson, pretty much like America treated Cuba in 1960?”

Big Capital controls state machinery for its own benefit, writing the rules by which it is regulated and subverting the political process away from the common good. While it is tempting to view Germany as rich, in control and acting as the eurozone enforcer, Germans have not generally benefitted from their position at the centre of the European project. In fact ordinary Germans, as with the middle class everywhere, have seen their living standards eroded considerably:

German workers have barely seen wages rise for the 14-year stretch. In the short life of the euro, working Germans have fared worse than the French, Austrians, Italians and many across southern Europe. Yes, we’re talking about the same Germany: the mightiest economy on the continent, the one even David Cameron regards with envy. Yet the people working there and making the country more prosperous have seen barely any reward for their efforts. And this is the model for a continent….

….What the single currency has done is make Germany’s low-wage problems the ruin of an entire continent. Workers in France, Italy, Spain and the rest of the eurozone are now being undercut by the epic wage freeze going on in the giant country in the middle. Flassbeck and Lapavitsas describe this as Germany’s “beggar thy neighbour” policy – “but only after beggaring its own people”.

Greek debt resulted not only from problems within Greece itself (corruption, non-payments of taxes etc), but from profligate and predatory lending by private banks with no regard for creditworthiness. When these loans went bad, along with hedge fund bets on national solvency, the financial institutions were bailed out and made whole by taxpayers, who were then saddled with even more unrepayable debt in a huge transfer of public wealth into private hands. Wealth conveyance from the periphery to the centre has accelerated enormously all over the world in the era of globalization, and the eurozone has reflected that dynamic. The global financial elite has seen their share expand exponentially:

While Germany has played a major role it in the subjugation of Greece it is worth asking who truly benefits from economic negotiations that have stopped making economic sense. Could it be the large banks who, following a similar model imposed on countries in Latin America, Southeast Asia and Africa since the 1970’s, continue to extract wealth from the poorest people on earth? Has not almost every development in the EU in the past ten years served to consolidate the power of financial institutions at the expense of the citizenry?

The regulatory framework developed after the Great Depression has been progressively dismantled, opening the doors again to the ruthless exploitation typical of periods of economic laissez faire, while protecting the financial elite from the consequences of reckless gambling with other people’s money:

The 1930s regulation that made capitalism a functioning economic system has been repealed. Today in the Western world capitalism is a looting mechanism. Capitalism not only loots labor, capitalism loots entire countries, such as Greece which is being forced by the EU to sell of Greece’s national assets to foreign purchasers….

….Even the language used in the West is deceptive. The Greek “bailout” does not bail out Greece. The bailout bails out the holders of Greek debt. Many of these holders are not Greece’s original creditors. What the “bailout” does is to make the New York hedge funds’ bet on the Greek debt pay off for the hedge funds. The bailout money goes not to Greece but to those who speculated on the debt being paid. According to news reports, Quantitative Easing by the ECB has been used to purchase Greek debt from the troubled banks that made the loans, so the debt issue is no longer a creditor issue.

The corporatocracy has been taking shape for over thirty years, widening inequality both within and between states as wealth is accumulated at the top of the financial food chain:

The Greeks and the U.S. working poor endure the same deprivations because they are being assaulted by the same system—corporate capitalism. There are no internal constraints on corporate capitalism. And the few external constraints that existed have been removed. Corporate capitalism, manipulating the world’s most powerful financial institutions, including the Eurogroup, the World Bank, the International Monetary Fund and the Federal Reserve, does what it is designed to do: It turns everything, including human beings and the natural world, into commodities to be exploited until exhaustion or collapse. In the extraction process, labor unions are broken, regulatory agencies are gutted, laws are written by corporate lobbyists to legalize fraud and empower global monopolies, and public utilities are privatized…

…The Greek government kneels before the bankers of Europe begging for mercy because it knows that if it leaves the eurozone, the international banking system will do to Greece what it did to the socialist government of Salvador Allende in 1973 in Chile; it will, as Richard Nixon promised to do in Chile, “make the economy scream.” The bankers will destroy Greece. If this means the Greeks can no longer get medicine—Greece owes European drug makers 1 billion euros—so be it. If this means food shortages—Greece imports thousands of tons of food from Europe a year—so be it. If this means oil and gas shortages—Greece imports 99% of its oil and gas—so be it. The bankers will carry out economic warfare until the current Greek government is ousted and corporate political puppets are back in control.

Human life is of no concern to corporate capitalists. The suffering of the Greeks, like the suffering of ordinary Americans, is very good for the profit margins of financial institutions such as Goldman Sachs. It was, after all, Goldman Sachs—which shoved subprime mortgages down the throats of families it knew could never pay the loans back, sold the subprime mortgages as investments to pension funds and then bet against them—that orchestrated complex financial agreements with Greece, many of them secret. These agreements doubled the debt Greece owes under derivative deals and allowed the old Greek government to mask its real debt to keep borrowing. And when Greece imploded, Goldman Sachs headed out the door with suitcases full of cash.

I am very much in agreement with John Perkins, author of Confessions of an Economic Hitman, when he observes that the interests of the elite do not align with the interests of states or their inhabitants, particularly in relation to the European project. Differences can be exploited though arbitrage, but harmonisation would have removed many of these differences. Whereas a single currency is useful for the purpose of efficiently transferring profits, true European integration would have removed opportunities to play on side against another:

That’s part of the game: convince people that they’re wrong, that they’re inferior. The corporatocracy is incredibly good at that…It’s a policy of them versus us: We are good. We are right. We do everything right. You’re wrong. And in this case, all of this energy has been directed at the Greek people to say “you’re lazy; you didn’t do the right thing; you didn’t follow the right policies,” when in actuality, an awful lot of the blame needs to be laid on the financial community that encouraged Greece to go down this route….

…What I didn’t realize during any of this period was how much corporatocracy does not want a united Europe. We need to understand this. They may be happy enough with the euro, with one currency – they are happy to a certain degree by having it united enough that markets are open – but they do not want standardized rules and regulations. Let’s face it, big corporations, the corporatocracy, take advantage of the fact that some countries in Europe have much more lenient tax laws, some have much more lenient environmental and social laws, and they can pit them against each other.

What would it be like for big corporations if they didn’t have their tax havens in places like Malta or other places? I think we need to recognize that what the corporatocracy saw at first, the solid euro, a European union seemed like a very good thing, but as it moved forward, they could see that what was going to happen was that social and environmental laws and regulations were going to be standardized. They didn’t want that, so to a certain degree what’s been going on in Europe has been because the corporatocracy wants Europe to fail, at least on a certain level.

The corporatocracy makes little attempt to disguise its power grabs these days, being secure enough in its consolidation of power to feel that no longer necessary. However, the greater the extent to which the citizenry recognizes the underlying dynamic, the angrier and more alienated they become. They are becoming increasingly opposed to the entire project of European Union, seeing it as a facilitation of exploitation. Euroskepticism in on the rise all over the continent, and that has the potential to damage the fabric of European society as it leads in the direction of increasing distrust of neighbouring countries:

As I watch what is happening in Greece, I feel myself to be increasingly Eurosceptic and wondering too if Eurosceptism is not code for the anti-German sentiment that currently abounds. If the European project that once seemed so noble now comes down to the European Central Bank, which is not in any way independent but acts as a thuggish bailiff to further impoverish Greece, what actually is it? If Germans believe they should not have to pay for the mistakes of Greek governments, then they do not see the crisis of Greece for what it is: a crisis of all Europe. Bailouts have been funded for the financial sector since 2008. To simply blame Greece is unsustainable.