Pablo Picasso Femme nue couchée (Marie-Thérèse Walter) 1932

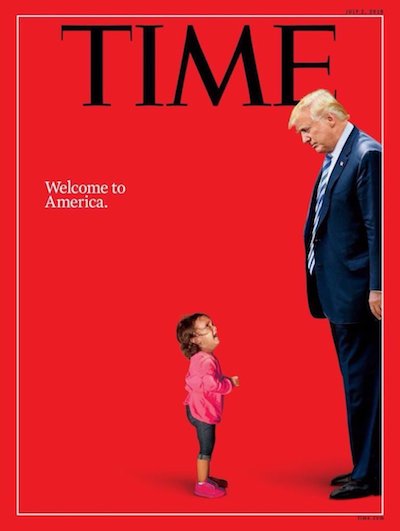

Disinformation

Freshman Christopher Phillips CALLS OUT Brian Stelter and CNN for being a "purveyor of disinformation." He points to the Russian collusion hoax, Jussie Smollett, the smears of Justice Kavanaugh and Nick Sandmann, and their dismissal of Hunter Biden's laptop. pic.twitter.com/eHxqAWqVSC

— Nicholas Fondacaro (@NickFondacaro) April 7, 2022

Wow, this sounds stupid

US official: "It doesn't have to be solid intelligence when we talk. It's more important to get out ahead of them – #Putin specifically – before they do something. It's preventative." pic.twitter.com/RKaVefXItx

— In Context (@incontextmedia) April 7, 2022

“The more weapons we get and the sooner they arrive in Ukraine, the more human lives will be saved.”

Uh, no.

• Ukraine Foreign Minister Demands More “Weapons, Weapons, Weapons” From NATO (ZH)

“Weapons, weapons, weapons” is what Ukraine’s government is still demanding of NATO countries, even after the Biden-approved $800 million package last month. Foreign Minister Dmytro Kuleba issued the plea after meeting with NATO Secretary-General Jens Stoltenberg in Brussels, stating on Twitter that the “three most important things” for Ukrainians are “weapons, weapons, weapons.” “Met with Secretary General Jens Stoltenberg at NATO HQ in Brussels. I came here today to discuss three most important things: weapons, weapons, and weapons,” Kuleba wrote. “Ukraine’s urgent needs, the sustainability of supplies, and long-term solutions which will help Ukraine to prevail,” he added.

Already the Pentagon has agreed to send more Javelin anti-armor systems, also as Stinger anti-aircraft missiles are being supplied, which Moscow sees as a huge provocation, with the war entering its sixth week. During a press conference in Brussels, Kuleba said his agenda in meeting with NATO leaders remains “simple”… “We know how to fight. We know how to win. But without sustainable and sufficient supplies requested by Ukraine, these wins will be accompanied by enormous sacrifices,” Kuleba said. “The more weapons we get and the sooner they arrive in Ukraine, the more human lives will be saved.”

Previously, CNN had documented that Kiev is increasingly pushing Washington for more advanced battlefield weapons, especially to take out Russia’s superior tanks and aircraft: The Defense Department plans to accelerate production of Stinger anti-aircraft missiles and Javelin anti-tank missiles so it can refill its own depleted stocks as it continues to send the vital systems to Ukrainian forces fighting the Russian invasion, according to defense officials. Ukraine wants 500 Javelin anti-tank missiles and 500 Stinger anti-aircraft missiles delivered from the US daily, according to a recent military assistance wish list. CNN viewed the document that details the items Ukraine believes it needs from the US.

“Russia needs to flush the EU down her “mental toilet” and only deal with sovereign countries which have retained enough agency to defend their own interests.”

• The True Importance Of The Bucha False Flag (Saker)

[..] the leaders of the Empire of Hate and Lies have fully opened the “Hate and Lies” valve and it appears that they are seriously “losing it”. Remember how in the Skripal and MH-17 cases EU countries joined in the sanctions out of “solidarity”? I personally would call that cowardice and submissiveness, but “solidarity” works too. Well, the Eurolemmings have solidarized themselves into their own grave and now there is no undoing what they did to themselves. From the Russian point of view, it is rather straightforward: Russia tried to encourage EU countries to use their own judgment and act in their own interests.

It is now quite clear that as long as they get to brown-nose Uncle Shmuel the Eurolemmings are quite content with their fate. Russia needs to flush the EU down her “mental toilet” and only deal with sovereign countries which have retained enough agency to defend their own interests. In the EU that means Hungary and, to a much lesser degree, Serbia (not the people, of course, but the government which remains subservient to the Eurolemmings). The Bucha massacre itself will go down Zone A’s collective memory hole, that’s where all the previous false flags of the Empire of Hate and Lies have gone. Once a demonization operation has served its use, it can be forgotten.

So what are the purposes of the Bucha false flag: • Change the narrative from the (non-existing) Ukronazi “victories” to “stop the Russian atrocities” • Obfuscate the DELUGE of evidence (witnesses and forensic) showing that it was the Ukronazis who engaged in mass atrocities in Mariupol. Remember – Ukrainian victims are sacred, Russian victims are simply irrelevant. In fact, a Russian CAN NOT be a victim unless he is anti-Putin, then it’s okay. • To condition (I mean that in the psychological sense) the TV watching serfs of the Empire of Lies and Hate to hate anything Russian with a searing, explosive, hated. • Declare that Putin is now the “New Hitler” (though Putin has been Hitler pretty much since 2000, it’s just that now he is even MORE Hitler than before) and Russia some kind of broken, poor, and otherwise horrible Mordor.

• Use this pretext to try to eject Russia and Russians from as many locations and organizations on the planet as possible. That means all of Zone A for sure, but also plenty of locations and organizations in Zone B where the comprador ruling set the tone and don’t give a damn about their own people and country. • Try to scare Putin with the same fate as Gaddafi, Milosevic, and Hussein who were all demonized and later murdered. • If you think about it, I think that it is fair to say that these are all clear signs that the Empire of Hate and Lies has now declared total war on Russia, just short of overtly actually attacking Russian forces or Russia, of course. In fact, Russia and the Empire of Hate and Lies have been at war since at least 2013..

“Serious politicians, especially at such a high level as Minister Lapid, have no right to talk idly..”

• Israel, Russia Clash Over Ukraine (Lauria)

From the start of Russia’s invasion of Ukraine Israel has refused to join the West’s economic war against Moscow, maintaining a neutral stance that as positioned it as a possible broker to end the conflict. But all that appears to have changed with remarks by Israel’s foreign minister in a Twitter post on Sunday, the day the massacre at Bucha was revealed and before any investigation could be conducted. Foreign Minister Yair Lapid wrote: “It is impossible to remain indifferent in the face of the horrific images from the city of Bucha near Kyiv, from after the Russian army left. Intentionally harming a civilian population is a war crime and I strongly condemn it.” Israel’s ambassador to Ukraine also implied that Russia had committed a war crime. “Deeply shocked by the photos from #Bucha. Killing of civilians is a war crime and cannot be justified,” Ambassador Michael Brodsky tweeted on Sunday.

Earlier, on March 13, during a visit to Romania, Lapid had tweeted: “… like Romania, Israel condemns the Russian invasion of Ukraine. It’s without justification, and we call on Russia to stop its firing and attacks, and to resolve this conflict around the negotiating table.” The Israeli foreign ministry tried to distance itself from the ambassador’s remarks. Haaretz reported: “Asked if the Foreign Ministry’s official position was that Russia had committed war crimes in Ukraine, a spokesman replied: ‘No. It’s a tweet by the ambassador regarding the photos. He didn’t blame Russia.’” Prime Minister Naftali Bennett, who flew to Moscow on March 5 to meet with President Vladimir Putin (and was condemned for it), has made no comment about the Bucha incident.

Israel is trying to maintain a balancing act between Moscow and Washington, which cannot be pleased with Israel not joining the economic war. Russia and Israel have long maintained good relations, with Moscow even allowing Israel to conduct bombing raids on Syria. But years of goodwill have now been put on the line with Foreign Minister Lapid’s remarks. And now Russia has struck back. Sergey Ivanov, head of the department of diplomacy and consular service at the Foreign Ministry’s Diplomatic Academy, wrote a scathing critique of Israel on Wednesday, posted on the ministry’s Telegram page. It holds nothing back, openly condemning Israel for a variety of sins, including its treatment of the Palestinians.

Ivanov wrote that many Western journalists and political analysts have opportunistically become overnight “Ukraine experts” just as Western politicians, such as Lapid, are making rash statements to boost their popularity. “Serious politicians, especially at such a high level as Minister Lapid, have no right to talk idly,” Ivanov warned. “They should be aware of the possible consequences of what they say, including with regard to relations with Russia.”

Bring your nazi to work. Just how stupid are these people?

“Ukraine’s Zelensky faces criticism in Greece after bringing a Neo Nazi member of the Azov battalion alongside him during his address to the Greek Parliament.”

• Azov Fighter Video Overshadows Zelenskyy’s Address To Greek Lawmakers (R.)

Ukrainian President Volodomyr Zelenskyy’s address to the Greek parliament on Thursday caused an outrage from opposition parties after a man who identified himself as an ethnic Greek member of Ukraine’s ultranationalist Azov battalion appeared on a video. Zelenskyy spoke about the destruction of the Russian-besieged Ukrainian port of Mariupol – home to thousands of ethnic Greeks – and appealed to Athens for help. During his speech he showed a video with a message by a man who identified himself as a member of the Azov battalion, a far-right militia now part of Ukraine’s National Guard. “I address you, as a Greek by origin. I am Mikhail, my grandfather fought against the Nazis… I participate in the defence of Ukraine through the Azov Battalion,” he said.

Zelenskyy, who was invited to address the Greek parliament by conservative Prime Minister Kyriakos Mitsotakis, received a standing ovation from lawmakers present in the room. But the video caused a backlash on social media and an angry reaction from leftist parties. Shortly after the speech, the head of the leftist SYRIZA party Alexis Tsipras said the incident was a provocation. “Solidarity with the Ukrainian people is a given. But the Nazis can not have a say in parliament,” he tweeted. A Greek government spokesman responded that the message of a member of the Azov Battalion was “mistaken and inappropriate.”

Western countries say Moscow’s invasion, the biggest assault on a European country since World War Two, was entirely unprovoked. Russia says it is carrying out a “special operation” to disarm and “denazify” its neighbors. Ukraine’s embassy in Athens said the Azov regiment, set up as a far right group in 2014, has been reformed and integrated into the National Guard of Ukraine. “For many years Russia tried to ‘plant’ into Greek minds the myth that “Azov” Regiment is a paramilitary independent unit operating in Mariupol,” it said.

Given the average age, no wonder that things move very slowly.

• Ukraine War Frenzy Proves: It’s Still John McCain’s GOP (Tracey)

“The senator from Kentucky is now working for Vladimir Putin,” fumed John McCain back in March 2017. His target: Rand Paul, who had committed the unforgivable offense of momentarily delaying the latest round of NATO expansion. Montenegro, a tiny country in southeastern Europe that most Americans have never heard of, was about to join the sprawling military alliance — and McCain was determined to see the final ratification ritual proceed with as little debate as possible. So he hurled the time-honored “working for Putin” accusation, and sure enough, Paul quickly withdrew his minor procedural objection. The glorious ascension of Montenegro to NATO membership status was thereby assured.

Since that episode, a lot has transpired regarding the public perception of McCain. He delighted liberals by feuding regularly with Donald Trump — even going so far as to denounce Trump for engaging in “disgraceful” and “pathetic” flattery of Putin. “No prior president has ever abased himself more abjectly before a tyrant,” McCain raged. He undermined Congressional Republicans’ legislative agenda during the brief window in Trump’s presidency when the party had unified control of government — famously delivering a dramatic thumbs-down gesture to derail GOP hopes of repealing Obamacare, as a chagrined Mitch McConnell watched powerlessly on.

McCain had returned to his most natural state. After annoying Democrats by running against Barack Obama in the 2008 election, and being surly about his defeat for some time afterwards, he had once again resumed playing the “maverick” role he so relished — reviled by “his own side,” and loved by the “other side.” His death in 2018 brought forth the most effusive display of state-sanctioned grief that any US political figure had received since Ronald Reagan died in 2004, with all the universal media adulation that entails. Trump’s exclusion from the funeral proceedings, at McCain’s posthumous direction, was just the icing on the cake. But nowadays, if you bring up McCain in certain GOP circles, it will often be claimed that his influence has mercifully dissipated. The Republican Party experienced a bonafide ideological upheaval under Trump, they’ll say, and the McCain worldview — defined mainly by his unwavering commitment to a hyper-interventionist US foreign policy — has since fallen starkly out of favor.

“Western countries have yet to field a hypersonic weapon while the old world order crumbles as a multipolar world emerges..”

• US Air Force Delays Hypersonic Missile Program Over “Flight Test Anomalies” (ZH)

While Russia launched hypersonic air-to-ground missiles during the invasion of Ukraine and China flew a hypersonic weapon around the world late last year, the US continues to fall behind the hypersonic curve as a new round of delays were announced by the US Air Force (USAF), according to Bloomberg. The AGM-183 Air-Launched Rapid Response Weapon (ARRW) was expected to be declared “early operational capability” by Sept. 30. However, according to a USAF statement, those timelines have been pushed back to the next fiscal year. ARRW, expected to be the Pentagon’s first hypersonic weapon, suffered three consecutive failed tests last year. ARRW’s latest hurdle was two upcoming ground-based booster motor tests by June 30.

But, it appears “due to recent flight test anomalies,” the missile test would be shifted out to as late as December with additional tests planned next fiscal year, according to the USAF statement. “The ARRW production decision remains event-driven and will occur after operational utility is demonstrated through successful system end-to-end flight tests,” the service continued. Lockheed-Martin’s ability to manufacture and deliver the new weapon appears to be a 2023 story. Western countries have yet to field a hypersonic weapon while the old world order crumbles as a multipolar world emerges, pushing Russia and China closer together. Perhaps that’s why President Biden is set to unveil a new trilateral security hypersonic pact with the UK and Australia to advance the development of hypersonic weapons.

On Wednesday, Republican Rep. Mike Rogers of Alabama sounded the alarm at the House Armed Services Committee hearing that China has “more troops, ships, and hypersonic missiles than the United States.” Republican Rep. Michael Turner of Ohio said the US needs to increase its hypersonic development.

“..why not simply throw in the financial towel and adopt the U.S. dollar, like Ecuador, Somalia and the Turks and Caicos Islands?”

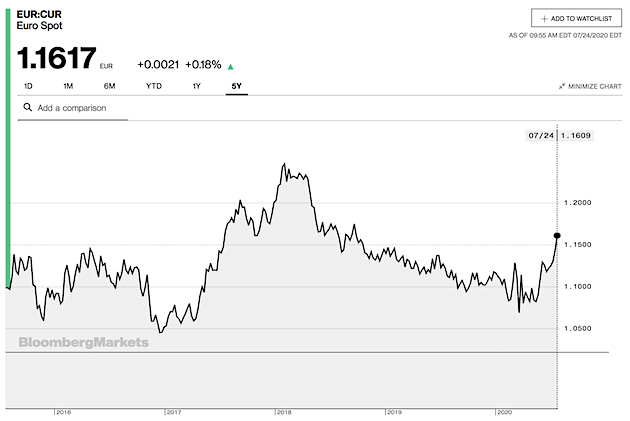

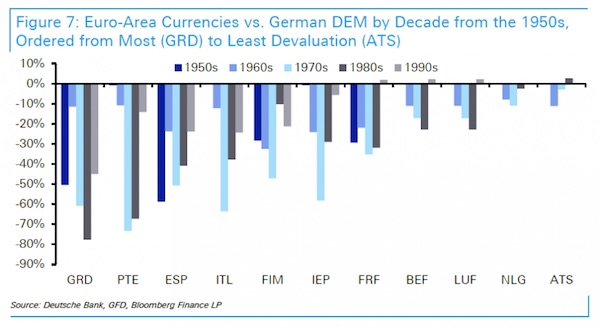

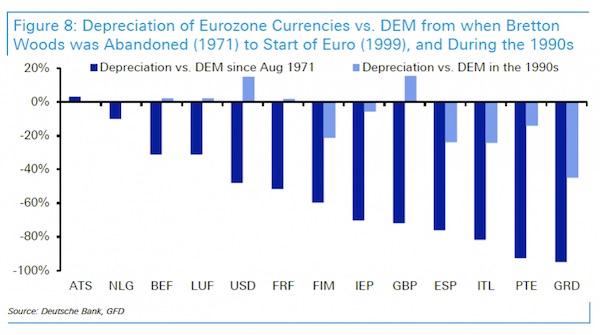

• The Dollar Devours the Euro (Michael Hudson)

European trade and investment prior to the War to Impose Sanctions had promised a rising mutual prosperity between Germany, France and other NATO countries vis-à-vis Russia and China. Russia was providing abundant energy at a competitive price, and this energy was to make a quantum leap with Nord Stream 2. Europe was to earn the foreign exchange to pay for this rising import trade by a combination of exporting more industrial manufactures to Russia and capital investment in developing the Russian economy, e.g. by German auto companies and financial investment. This bilateral trade and investment is now stopped – and will remain stopped for many, many years, given NATO’s confiscation of Russia’s foreign reserves kept in euros and British sterling, and the European Russophobia being fanned by U.S. propaganda media.

In its place, NATO countries will purchase U.S. LNG – but they will need to spend billions of dollars building sufficient port capacity, which may take until perhaps 2024. (Good luck until then.) The energy shortage will sharply raise the world price of gas and oil. NATO countries also will step up their purchases of arms from the U.S. military-industrial complex. The near-panic buying will also raise the price for arms. And food prices also will rise as a result of the desperate grain shortfalls resulting from a cessation of imports from Russia and Ukraine on the one hand, and the shortage of ammonia fertilizer made from gas. All three of these trade dynamics will strengthen the dollar vis-à-vis the euro. The question is, how will Europe balance its international payments with the United States?

What does it have to export that the U.S. economy will accept as its own protectionist interests gain influence, now that global free trade is dying quickly? The answer is, not much. So what will Europe do? I could make a modest proposal. Now that Europe has pretty much ceased to be a politically independent state, it is beginning to look more like Panama and Liberia – “flag of convenience” offshore banking centers that are not real “states” because they don’t issue their own currency, but use the U.S. dollar. Since the eurozone has been created with monetary handcuffs limiting its ability to create money to spend into the economy beyond the limit of 3 percent of GDP, why not simply throw in the financial towel and adopt the U.S. dollar, like Ecuador, Somalia and the Turks and Caicos Islands? That would give foreign investors security against currency depreciation in their rising trade with Europe and its export financing.

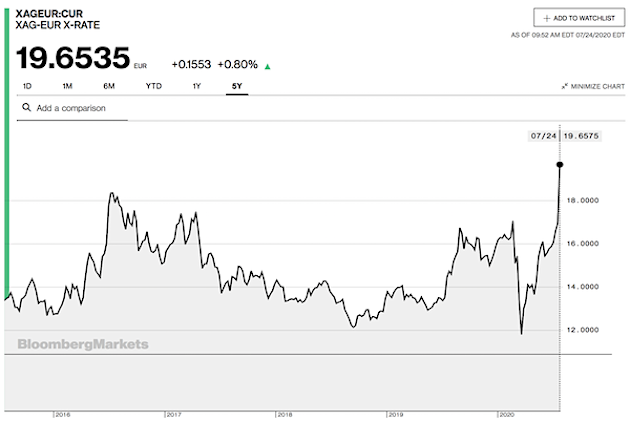

“The price of oil is going up and the ruble is worth just as much as it was before the war.”

• Despite Sanctions The Ruble Is Stronger Than Before The War (OffG)

It’s official, as of right now the Russian ruble is worth more US dollars than before the invasion of Ukraine. On the 22nd of February this year, one US dollar would exchange for just over 79 rubles. As of the time of writing, it is now 78. The same is true of the British pound (around 108 rubles before, 102 now), and the Euro (88 rubles before, 84 now). Across the board, the ruble is stronger than before the war. So, how has this happened? Aren’t NATO, the EU and the rest of the “international community” meant to be crippling the Russian economy with biting sanctions? The media are claiming that the strength of the ruble “may be illusory” or that Russia has exploited a “loophole” in the sanctions and used “financial alchemy” to “rescue the ruble”.

Reminder: In 2014, when the west sanctioned Russia over the Crimean referendum, the ruble lost almost half its value. It recovered slightly in 2016, and has since stabilized, but has never come close to its pre-Crimean worth. So, presumably the earlier sanctions didn’t have a “loophole” in them, and/or the Russians either weren’t aware of this “financial alchemy” back then, or simply decided not to use it. Of course there is one key difference between 2014 and 2022 – the oil market. As we have written before, in 2014/15 the US and Saudi Arabia flooded the market with cheap oil and crashed the price. Russia (and Iran, and Venezuela) all suffered huge economic damage from this move.

But far from repeating this tactic, Saudi Arabia has increased their prices. The Western press claims that the US asked Saudi Arabia to increase oil production and they refused. They claim Saudi Arabia “sided with Russia”, and that they should be “punished”. Meanwhile, Turkey has just suspended the trial of the Saudi citizens alleged to have murdered journalist Jamal Khashoggi, a move that should please the Saudi government no end. The West seems as bad at “punishing” their misbehaved allies as they are at tanking the value of the Russia’s currency. To sum up – The price of oil is going up and the ruble is worth just as much as it was before the war.

“..next winter energy bills packing a mean punch; products disappearing from supermarkets; holiday bookings almost frozen; Le Petit Roi Macron in France – maybe up to a nasty electoral surprise – announcing “food stamps like in WWII are possible”.

• Sit Back And Watch Europe Commit Suicide (Escobar)

The stunning spectacle of the EU committing slow motion hara-kiri is something for the ages. Like a cheap Kurosawa remake the movie is actually about the Empire of Lies-detonated demolition of the EU, complete with subsequent rerouting of some key Russian commodities exports to the US at the expense of the Europeans. It helps to have a 5th columnist actress strategically placed, in this case astonishingly incompetent European Commission head Ursula von der Lugen, with a brand new vociferous announcement of an extra sanctions package: Russian ships banned from EU ports; road transportation companies from Russia and Belarus prohibited from entering the EU; no more coal imports (over 4.4 billion euros a year).

That translates in practice into the Empire of Lies shaking down its wealthiest – Western – clients/puppets. Russia of course is too powerful militarily. The Empire badly needs some of its key exports – especially minerals. Mission Accomplished in this case amounts to nudging the EU into imposing more and more sanctions and willfully collapsing their national economies, allowing the US to scoop everything up. Cue to the coming catastrophic economic consequences felt by Europeans in their daily life (but not by the wealthiest 5%): inflation devouring salaries and savings; next winter energy bills packing a mean punch; products disappearing from supermarkets; holiday bookings almost frozen; Le Petit Roi Macron in France – maybe up to a nasty electoral surprise – announcing “food stamps like in WWII are possible”.

We have Germany facing the returning ghost of Weimar hyperinflation; BlackRock President Rob Kapito saying, in Texas, “for the first time, this generation is going to go into a store and not be able to get what they want”; farmers in Africa not able to afford fertilizer at all this year, reducing agricultural production by an amount capable of feeding 100 million people. Zoltan Poszar, former NY Fed and US Treasury guru, current Credit Suisse grand vizir, has been on a streak, stressing how commodity reserves – and here Russia is unrivaled – will be an essential feature of what he calls Bretton Woods III (yet, in fact, what’s being designed by Russia, China, Iran and the Eurasia Economic Union is a post-Bretton Woods). Poszar remarks that wars, historically, are won by those who have more food and energy supplies, in the past to power horses and soldiers, today to feed soldiers and fuel tanks and fighter jets. China, incidentally, has amassed large stocks of virtually everything.

“..so that people can see the scale of depravity and Biden family corruption within the evidence..”

• Two-Star General Warns Hunter Biden Laptop Witness About His Safety (CTH)

Emerald Robinson has a great interview with Jack Maxey from Switzerland. Maxey was the first person to receive a full hard drive copy of the Hunter Biden laptop from Rudy Guliani. After media, Senate and U.S. government officials refused to take action, Maxey went to Switzerland in order to complete a full forensic audit of the laptop content in a neutral jurisdiction. Previously, Maxey outlined his intent to share the full contents of the original files, and all of the retrieved deleted files, with the public so that people can see the scale of depravity and Biden family corruption within the evidence. In this interview with Emerald Robinson, Maxey states the full and searchable email archive will likely be completed early next week.

Additionally, in this interview Maxey goes into greater detail about the larger issues surrounding impediments to the release of information, including how the laptop contained access certificates to enter the Defense Department database. Maxey tried to get the DoD to address the issue without success, until he found a direct conduit to a two-star general who took the certificate codes, deactivated the access and thanked him for his diligence. Unfortunately, that same general then told Maxey he needed to focus on securing the safety of himself and his family, as the full weight of the U.S. interests, including the intelligence apparatus and defense apparatus, will likely target him. In my opinion, it is Maxey’s forensic review of the data and statements about making it all public, that triggered/pressured the collective western media to begin admitting the laptop issues were real and start covering the details.

What an insane story.

• BLMs LA Mansion Bought For 3.1M Sold 6 Days Later For 5.8M (DM)

A Los Angeles mansion frequented by Marilyn Monroe and Humphrey Bogart was bought by a real estate developer working for BLM founder Patrisse Cullors and her partner for $3.1 million, and then purchased by BLM’s foundation just six days later for $5.8 million in cash, it has emerged. The rapid price inflation ‘raises serious questions,’ ethics experts said. The purchase of the 6,500 square-foot, six-bedroom property in Studio City was first revealed on Monday by New York Magazine, amid growing questions about BLM’s finances. The organization in February 2021 said it had taken in more than $90 million in 2020 and still had $60 million on hand, but it remains unclear how that money is being managed or even where it is.

Cullors, the co-founder of the organization, resigned in May 2021 as director of the Black Lives Matter Global Network Foundation (BLMGNF), amid scrutiny of her property empire. She has written best-selling books, and has a contract with Warner Brothers to produce content. On Wednesday, Cullors, 38, angrily hit back at the questions over cash purchase of the Studio City mansion, describing the criticism as ‘racist and sexist’. She insisted that the expansive property was bought as a ‘safe space’ for black creatives, activists and thought leaders, and its purchase was never disclosed because it needed renovating. Cullors called the New York Magazine investigation ‘a despicable abuse of a platform that’s intended to provide truthful information to the public’, and said that the author had ‘a proven and very public bias against me and other Black leaders’. She did not address the discrepancy in the home’s cost.

The property was purchased on October 21, 2020 by Dyane Pascall, a real estate developer who worked for the firm run by Cullors and her partner, Janaya and Patrisse Consulting. Pascall is president of Conscious Capital Investment Enterprises, according to LinkedIn, which describes it as ‘Real Estate Investment company in South LA that provides affordable housing in low income communities in the face of rapid gentrification.’

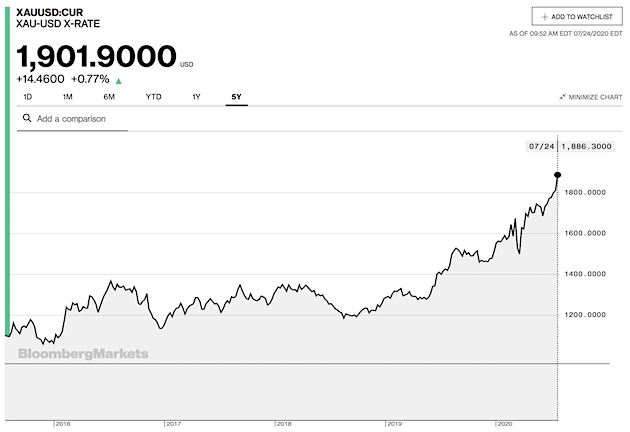

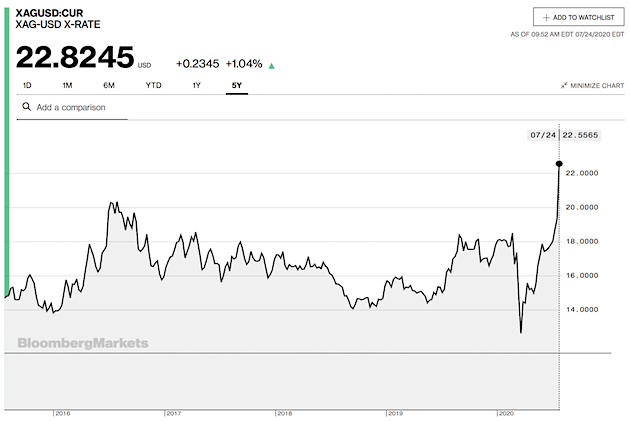

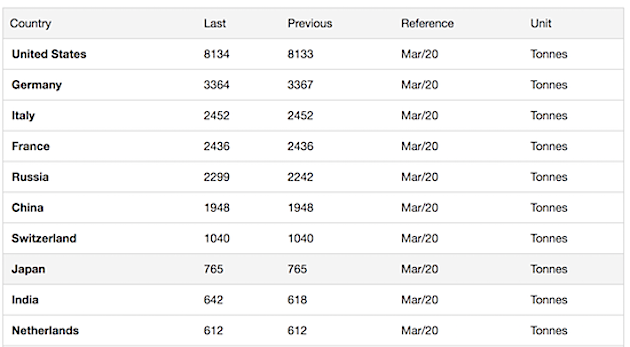

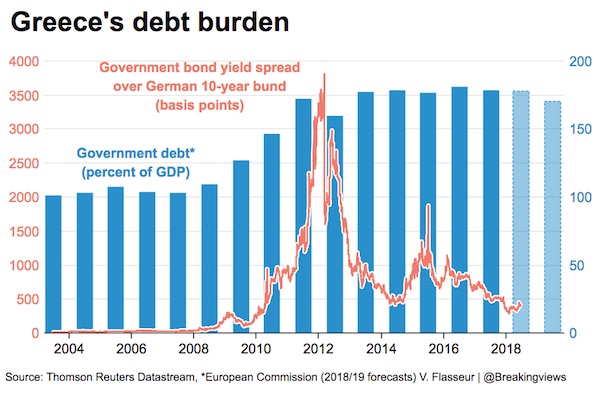

“today all the gold in the world is worth $12 trillion, while global equities are worth $115 trillion. In 1980, the ratio was one-to-one..”

• Peter Thiel Blasts Buffett, Dimon, & Fink As “Finance Gerontocracy” (ZH)

At Bitcoin 2022, Thiel started his speech with a video from him in the past, talking about the future of digital infrastructure. His predictions regarding cell phone usage, which may have sounded odd at the time, were quite accurate. He also mentioned the dollar hegemony and even the potential for digitalization of the dollar, all of which we are seeing today. The speech that followed was, in the words of Bitcoin Mag, “quite incredible” – he started by pulling out a wad of $100 bills, and presenting them to the crowd. He said, “It’s a mysterious thing, what is money?” He followed by offering the money to a random person in the crowd, a gesture to which many people responded. “It’s kind of crazy that this still works,” Thiel said. While he is a billionaire, he had a point.

He went on about how PayPal began, bitcoin’s placement in terms of velocity and more — and then he began talking about enemies of Bitcoin. “If bitcoin is going to replace gold, the question is, why is it so undervalued?” he said. “Bitcoin is always the most honest market in the world, the most efficient market and it was the canary in the coal mine.” Thiel went on to point out that “today all the gold in the world is worth $12 trillion, while global equities are worth $115 trillion. In 1980, the ratio was one-to-one, with all the gold in the world and global equities having the same value of $2.5 trillion.” And so, while in the 1970s, equities were a bad investment, the great moderation that started in 1980 after Volcker killed galloping inflation, made equities the best investment of the past 40 years.

However, now that inflation is as high as it was in the late 1970s, equities are the enemy and bitcoin is the right investment, according to Thiel. Concluding his musing on valuation, Thiel says that the competitor for bitcoin is not ethereum which is a payment system, nor gold, but equities and asks why shouldn’t there be parity between the $115 trillion value of global equities and the ~$830BN value of bitcoin. “I am still hopeful that bitcoin goes up by a factor of 100x” he said. The Paypal founder then also makes a mockery of all those who say that bitcoin is not an inflation hedge with just one chart – the chart showing how anyone who had a sense of the inflationary tsunami that is coming, made a killing in early 2020 when the could have bought bitcoin at a far lower price.

Saying that it’s hard to know where Bitcoin goes from here, the billionaire said that Bitcoin is the most honest and most efficient market: “Bitcoin is the canary in the coalmine, it was telling us that inflation is coming; it is telling us that central banks are bankrupt; it is telling us that we are at the end of the fiat money regime.” [..] His conclusion: the Financial Gerontocracy has declared war on Bitcoin as a revolutionary youth movement for good reason. It is this time the revolutionary youth should understand their enemies and return fire.

Thiel

Peter Thiel at @TheBitcoinConf: "Bitcoin is the most honest and most efficient market in the world." pic.twitter.com/P2QnjBS1ga

— BUILD OR DIE (@buildordie_) April 7, 2022

It’s everywhere.

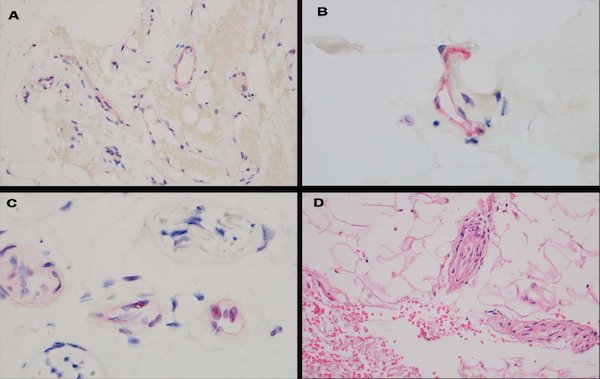

• The Spike Protein Is The “Amyloid” Being Deposited (Chesnut)

The spike protein is the “amyloid” being deposited and inducing amyloidoses: a major finding missed severe covid may be due to the added deposition of complement with the spike. The paper “The histologic and molecular correlates of COVID-19 vaccine-induced changes in the skin” made a case for the immune response to the Spike Protein causing self-limited hypersensitivity reactions to the vaccine. However, if you study the paper carefully, you notice that the authors have missed a far more important finding.

The biopsy specimens of normal skin post vaccine and of skin affected by the post-vaccine eruption showed rare deep microvessels positive for spike glycoprotein with no complement deposition contrasting with greater vascular deposition of spike protein and complement in skin biopsies from patients experiencing severe coronavirus disease 2019 (COVID-19). The histology exactly recapitulated perniosis including COVID-19–associated perniosis, which provides evidence that the Spike Protein alone induces COVID-19 pathology. More importantly, the fact that IN NORMAL SKIN, the Spike Protein was found to be deposited in DEEP VESSELS, MICROVESSELS, BLOOD VESSELS AND DEEP ENDOTHELIAL CELLS. Why would one assume that this deposition is only occurring in NORMAL SKIN TISSUE? I believe it is most certainly occurring in NORMAL TISSUE. PERIOD.

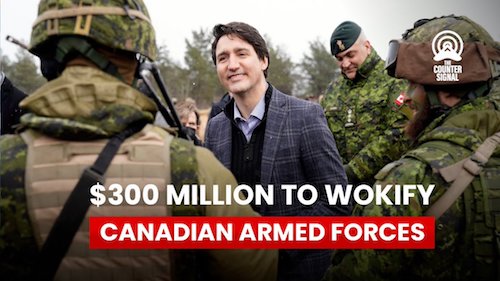

Think they’ll give their lives for him?

• Nearly $300 Million To Wokify The Canadian Military (CS)

Nestled deep within the Liberal government’s new 2022 budget is a whopping $100.5 million in taxpayer funding for “gender identity” culture change and training in the Canadian Armed Forces. The sum is part of Prime Minister Justin Trudeau’s new $58 billion spending bonanza and nested in their $8 billion defence spending boost over the next five years. “Budget 2022 proposes to provide $100.5 million over six years, starting in 2021-22, with $1.7 million in remaining amortization, and $16.8 million ongoing,” the budget report reads. These funds will be put towards “undertaking engagement and consultations on culture change” as it relates to gender identity or sexual orientation discrimination. The Liberal budget also mentions “coaching services.”

Under Trudeau’s watch, Canada’s military has been hit with sex scandals and harassment controversies. Instead of addressing the root causes of the problem and removing bad apples, the Liberals have used the issue as an opportunity to make the military more woke. Another gender-related spending in the defence budget included $144.3 million over five years and an additional $31.6 million ongoing to expand health services and physical fitness programs to “be more responsive to women and gender-diverse military personnel.” “This builds on funding from Budget 2021 of $236.2 million over five years, starting in 2021-22, and $33.5 million ongoing for the Department of National Defence and Veterans Affairs Canada to support efforts to eliminate sexual misconduct and gender-based violence in the military and support survivors,” the budget claims.

One big vicious circle.

• Priti Patel Part Of CIA-linked Lobby Group With Husband Of Assange Judge (DUK)

Priti Patel sat on the Henry Jackson Society’s (HJS) advisory council from around 2013-16, although the exact dates are unclear as neither the HJS nor Patel responded to Declassified’s requests for clarification. She has also received funds from the HJS, and was paid £2,500 by the group to visit Washington in March 2013 to attend a “security” programme in the US Congress. Patel, who became an MP in 2010 and was appointed Home Secretary in 2019, also hosted an HJS event in parliament soon after she returned from Washington. After the UK Supreme Court said this month it was refusing to hear Assange’s appeal of a High Court decision against him, the WikiLeaks founder’s fate now lies in Patel’s hands. He faces life in prison in the US.

The HJS, which was founded in 2005 and does not disclose its funders, has links to the CIA, the intelligence agency behind the prosecution of Assange and which reportedly developed plans to assassinate him. One of the HJS’s international patrons is James Woolsey, CIA director from 1993-95, who was in this role throughout the period Patel was advising the group. Woolsey’s affiliation to the HJS goes back to at least 2006, soon after it was founded. In 2014, the group hosted General David Petraeus, CIA director from 2011-12, at a UK parliament meeting from which all media were barred. Three years later, in 2017, the HJS organised another event at parliament with General Michael Hayden, CIA director from 2006-9, to “discuss the current state of the American Intelligence Community and its relationships with foreign partners.”

Hayden described “the relationship within the Five Eyes community as strong as ever, despite potential concerns over recent intelligence leaks between members.” Five Eyes is an intelligence alliance comprising Australia, Canada, New Zealand, the UK, and the US. During a visit to the UK in July 2020, then US Secretary of State Mike Pompeo spoke at a roundtable hosted by the HJS with what the Washington Post referred to as a group of “hawkish” members of the Conservative Party. As director of the CIA in 2017, Pompeo had launched a blistering attack on WikiLeaks calling the media organisation a “hostile intelligence service” that makes “common cause with dictators”. Pompeo did not provide evidence but added a threat: “To give them the space to crush us with misappropriated secrets is a perversion of what our great Constitution stands for. It ends now.”

Biden family

Corporate Media is ready to BURY the Biden Crime Family— Joe did NOT see this one coming… pic.twitter.com/gFE57c34sN

— Benny (@bennyjohnson) April 7, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.