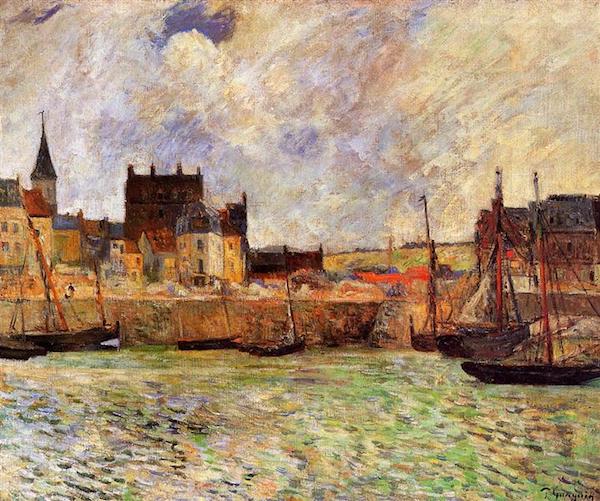

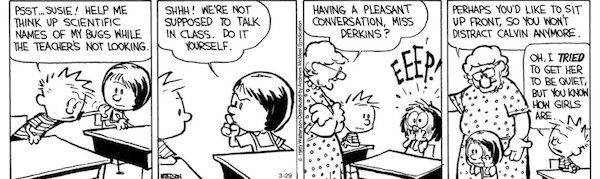

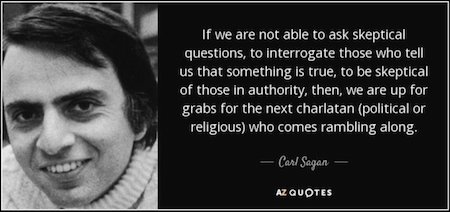

Henri Matisse Window at Tangiers 1912

Anti-Trump rally in New York City, June 3, 2017 © AFP / Eduardo Munoz Alvarez

Trump Kamala

There’s something GLORIOUS about watching CNN read this Trump quote live on air.

CNN viewers just got a truth bomb, and it is hilarious.

“Whatever else can be said about crooked Joe Biden, you have to give him credit for one brilliant decision: picking Kamala Harris as his vice… pic.twitter.com/7g2lw33lK5

— The Vigilant Fox 🦊 (@VigilantFox) July 10, 2024

Buffett

Here's the Warren Buffet clip

“I could end the deficit in 5 minutes.

You just pass a law that says any time there's a deficit of more than 3% of GDP, all sitting members of Congress are ineligible for re-election.

Now you've got the incentives in the right place.” pic.twitter.com/2SpW4vqpa7

— ALEX (@ajtourville) July 9, 2024

“..Hungary’s leader does not speak for the European Union, even if his country holds the rotating presidency of the Council of the EU. That is true, but to be frank, uninteresting. What is intriguing instead is the compulsive need to keep saying it.”

• Orban Is What Zelensky Should Have Been (Amar)

When your enfant terrible is also (almost) the only adult in the room, then something is very wrong with your room. For “the room” read the EU – and the West more broadly – and, for both the enfant terrible and the adult in the room, Viktor Orbán, prime minister of Hungary, and there you have it: the shortest possible description of what the big brouhaha about his recent trips to first Kiev, then Moscow and Beijing is really all about. The EU, in reality, has no policy worthy of the name to address the single most urgent issue in Europe at this point, namely, how to end the war in and over Ukraine. As Orbán himself has correctly pointed out in an interview with the German newspaper Die Welt, all the EU does is copy America’s “policy of war.” In other words, Brussels, like Washington, has ruled out diplomacy and compromise to end the war.

Indeed, if the US and EU had engaged in genuine diplomacy, then the war could have been prevented or ended quickly, in spring 2022. Orbán may be putting too much weight on – and too much trust in – a single Western leader, but that is his larger point when he claims that the large-scale war would not have happened if Angela Merkel had still been in office as chancellor of Germany. Against this backdrop of EU non- or, really – anti-diplomacy, Orbán has dared stand out by going on what, using social media to great effect, he has loudly announced as his “peace mission.” That appeal to public opinion has, of course, angered his detractors even more: Not only has he dared speak to “the autocrats” out there, he has also addressed the masses at home in the West. Perish the “populism”!

Yet it is a traditional and legitimate move among politicians worth their salt: Before practicing the art of – back then – radio reach-out to perfection in World War II, no lesser a leader than young Charles de Gaulle, in his ‘The Edge of the Sword’, recognized the absolute need to “dominate opinion,” since “nothing is possible” without that true “sovereign.” Yet Orbán’s “populism” is not even the main problem this time. That rather has to do with the fact that he has turned his own initiative into a foil against which the EU’s mainstream’s lack of imagination, rigidity, and, last but not least, complete subservience to the US are glaringly obvious. In the EU it is now going “rogue” to do what is not only obvious but reasonable and urgently needed: seek at least dialogue instead of stonewalling. That reflects badly on the EU.

So does the fact that the Hungarian leader has a habit of realism where the EU establishment prefers fictions maintained by – aggressively enforced – group think. Orbán has no time for the silly idea that Russia is a threat to European states inside NATO, he observes – rightly – that Russian policy is rational, and he recognizes the fact that Russia cannot be defeated in Ukraine. All of this is true, and all of it is taboo in Brussels. To complete his register of sin and heresy, the Hungarian prime minister also has the temerity to cultivate a memory and a sense of history. In a Newsweek editorial, he has just reminded NATO of two essential facts: that the alliance was founded for defensive purposes (to which it has badly failed to stick) and that the recent habit of treating a future war with “the world’s other geopolitical power centers,” that is, Russia and China, as de facto inevitable can turn into a “self-fulfilling prophecy.”

When you are thin on substance, rely instead on formalities and, if need be, legalism. Much of the EU elites’ response to Orbán’s initiatives has taken that self-revealing form. As soon as Orbán dared go to Moscow, leading EU cadres, such as Josep Borrell, Ursula von der Leyen, and Charles Michel could hardly stop falling over themselves with denunciations and reminders that Hungary’s leader does not speak for the European Union, even if his country holds the rotating presidency of the Council of the EU. That is true, but to be frank, uninteresting. What is intriguing instead is the compulsive need to keep saying it.

Likely.

• Merkel Would Have Prevented Ukraine Conflict – Orban (RT)

The Ukraine conflict would not have escalated into an “international war” if former German Chancellor Angela Merkel were still in power, according to Hungarian Prime Minister Viktor Orban. He accused current EU leaders of lacking vision in an interview with Die Welt published on Monday. A vocal proponent of a diplomatic solution for Ukraine, Orban last week embarked on a “peace mission” to some of the countries he says are the “five main actors” to the conflict – Ukraine, Russia, China, the EU, and the US.Orban’s first stop was Germany, where he spoke to Chancellor Olaf Scholz. The Hungarian leader said “there was hardly any agreement” between the pair regarding the resolution of the conflict, noting that he “always” misses Scholz’s predecessor, Merkel, due to her practical approach. According to Orban, if Merkel were still in power, the Russia-Ukraine conflict in its current form “would never have happened.”

“She had the ability, the understanding and the skills to isolate the conflicts that are bad for Europe. We made the mistake of allowing there to be a conflict, of allowing there to be a war. And instead of isolating it, we escalated it and made it international,” he stated. Orban recalled the failed Minsk peace accords, brokered by France and Germany, which ostensibly sought to resolve the dispute in Donbass in 2014 that preceded the current conflict. The path to peace would be much easier for all parties today if similar agreements were in place, the Hungarian prime minister argued. “If you believe that a political agreement like Minsk can solve all problems, then Minsk is of course a failure. But if you see that there is a situation that is bad and needs to be resolved somehow, then the only relevant reference point is not how can it be made better, but how it can be prevented from getting even worse,” Orban stated.

“Peace does not come by itself,” he added, stating that it has to be brokered by global leaders who want it, and claiming that “unfortunately we lack those.” Orban has often criticized the West’s approach to the Ukraine conflict, calling for a diplomatic settlement through negotiations. However, his ceasefire overture to Ukraine’s Vladimir Zelensky earlier this month was rejected, while his EU peers criticized him for his later visit to Russia. Several diplomatic sources told Politico earlier this week that the bloc could even revoke Hungary’s rotating EU presidency, which it assumed last month.

“Trump said he wanted to give Biden a “chance to redeem himself.”

• Trump Issues Fresh Challenge To Biden (RT)

Former US President Donald Trump has challenged Joe Biden to a “no-holds-barred” debate and an 18-hole game of golf so that the incumbent leader can prove he is still fit for office. The 81-year-old Biden is facing growing calls from his fellow Democrats to drop out of the 2024 presidential race over concerns about his mental health, following his disastrous performance during a debate with Trump last month. Speaking at a rally in Miami on Tuesday, Trump said he wanted to give Biden a “chance to redeem himself.” “Let’s do another debate this week so ‘Sleepy’ Joe Biden can prove to everyone all over the world that he has what it takes to be president. But this time it will be man to man, no moderators, no holds barred,” Trump said, calling on Biden to “name the place, anytime, anywhere.”

Trump also recalled that during their CNN-hosted debate, Biden had declared that he would be willing to test his skills and stamina against his rival on the golf course. “Can you believe this? Did you ever see him swing?” Trump told his supporters, announcing that he is “officially challenging ‘Crooked Joe’ to an 18-hole golf match right here.” The presumptive Republican candidate promised that if Biden won, he would donate $1 million to any charity of his opponent’s choice. However, Trump doubted that Biden would accept his challenge “because he is all talk.” Biden campaign spokesman James Singer responded to the challenge on Wednesday by claiming that the US president “doesn’t have time for Donald Trump’s weird antics – he’s busy leading America and defending the free world.” He also dismissed Trump as a “liar, a convict, and a fraud only out for himself.”

Biden himself has unequivocally stressed that he is “firmly committed” to staying in the presidential race, while White House press secretary Karine Jean-Pierre has insisted that the incumbent is determined to serve out his full second term in office if reelected. At the same time, calls for Biden to drop out of the election have continued to grow, with many senior Democrats and party donors urging him to “do the right thing” and quit, fearing he would not be able to beat Trump. A survey conducted by CBS News/YouGov in the wake of last month’s presidential debate also found that 72% of registered voters do not believe that Biden has the “mental and cognitive health necessary to serve as president.”

“The White House, in the time since that disastrous debate, I think, has done nothing to really demonstrate that they have a plan to win this election..”

• Dem Senator Says Trump Could Beat Biden In “Landslide” (ZH)

Sen. Michael Bennett (D-CO) on Tuesday became the first Democratic senator to publicly cast doubt on President Joe Biden’s chances against Donald Trump in November. “Donald Trump is on track, I think, to win this election, and maybe win it by a landslide, and take with him the Senate and the House,” Bennett told CNN’s Kaitlan Collins on Tuesday – after telling colleagues the same in private. “So for me, this isn’t a question about polling. It’s not a question about politics. It’s a moral question about the future of our country.” “The White House, in the time since that disastrous debate, I think, has done nothing to really demonstrate that they have a plan to win this election,” he continued.

Senator Michael Bennet (D-CO) got outed by the media for saying privately that Biden is on track to lose badly to Donald Trump. He went on CNN to own his comments publicly. Respect. This is an absolutely brutal clip if you're inside the Biden White House right now. pic.twitter.com/oS7BWdkHJF

— Charlie Kirk (@charliekirk11) July 10, 2024

Bennet’s comments echo those of a growing number of congressional Democrats who say Biden’s reelection bid could hurt the entire party in down-ballot races this fall. As CNN reports, “Democrats, including those inside the administration, view this week as critical to Biden’s political survival, and lawmakers on Capitol Hill gathered privately for their weekly meetings on Tuesday.” “The stakes could not be higher,” said Bennett, who says his voters have “deep concerns” over whether Biden can win. Punchbowl News had a sobering take on the state of affairs for Democrats in their Wednesday AM newsletter, saying Biden has “made a mess of the Democratic party.” Senate Democrats were far from united about whether Biden is the best person to defeat Trump. Sen. Richard Blumenthal (D-Conn.) told us that Biden needs to “continue to aggressively make his case” to his fellow Democratic senators in order to “earn full support.”

New Jersey Democratic Rep. Mikie Sherrill issued a statement Tuesday afternoon calling on Biden to step aside in favor of another Democratic candidate. “[B]ecause I know President Biden cares deeply about the future of our country, I am asking that he declare that he won’t run for reelection and will help lead us through a process toward a new nominee.” Fellow New Jersey Democratic Rep. Andy Kim — who’s running for Senate — walked right up the line of whether Biden should get out. “What steps can we actually take right now [to replace Biden.] That’s where some of the confusion is. Especially with all the talk of what are the actual deadlines. It’s hard to kind of make a decision without fully understanding that. We need to get a better grasp on it,” said Kim.

Meanwhile, House Democratic leaders met privately on Tuesday morning with some of their most vulnerable members, for a conversation that was “honest, brutal and intense,” and left some members crying, according to sources with knowledge of the meeting. ABC News anchor George Stephanopoulos, meanwhile, told TMZ that he doesn’t think Biden can serve another four years. The 63-year-old Stephanopoulos sat down for a closely-watched interview with Biden last week following the president’s disastrous debate performance last month against Donald Trump. “Do you think Biden should step down?” the TMZ journalist asked the “Good Morning America” co-host and moderator of “This Week.” “I don’t think he can serve four more years,” replied Stephanopoulos after a pause.

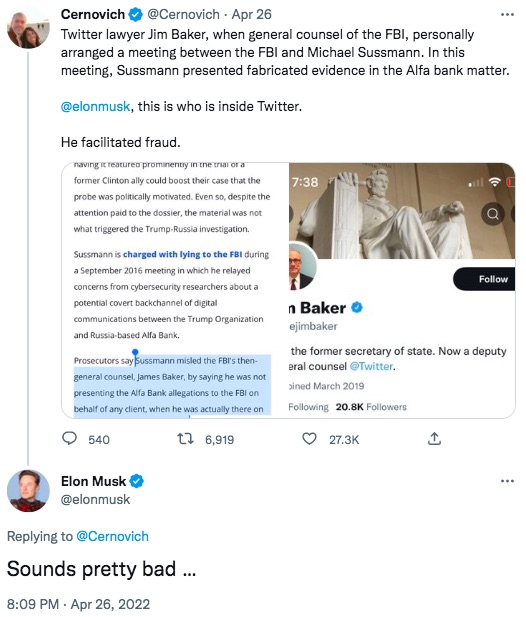

Russiagate 3.0.

• MSM Launches ‘Muh Russia’ Election Narrative (ZH)

While the Democratic party melts down over Joe Biden’s cognitive decline – an obvious risk to US national security, the 2024 election wouldn’t be complete without a Trump-Russia narrative. To that end, the Wall Street Journal reports that the Russian government has launched a ‘whole-of-government” effort to influence the US presidential election in favor of Donald Trump – who, for some reason, Russia held off on invading Ukraine while he was president (and ostensibly wouldn’t have sent $175 billion and counting in US aid to combat). Citing unnamed ‘senior US intelligence officials,’ the Journal writes: The officials didn’t mention Trump by name, but said that Russia’s current activity—described as covert social-media use and other online propaganda efforts—mirrored the 2020 and 2016 election cycles, when Moscow also favored Trump and sought to undermine Democratic candidates, according to U.S. intelligence agencies.

Of course, Russia’s 2016 ‘influence campaign’ amounted to roughly $100,000 in Facebook ads, which “didn’t reference any specific presidential candidate, or even the election itself,” largely targeting BLM members and ‘Pokemon Go’ aficionados. Insidious. That said, the officials say that the activity witnessed so far this election cycle “isn’t on the scale or scope seen in 2016, when Russia’s actions included a hack-and-leak of Democratic Party emails, rudimentary cyber-probing of some state election systems and other actions intended to undermine Democratic nominee Hillary Clinton’s campaign.” Hacked emails, you say? Edit: And as ZeroHedge reader ‘The Wolverine’ notes in the comments below: ‘Remember that time Adam Schiff interviewed the President of CrowdStrike and refused to release the transcript for months and months?’

According to the new report, Russia is seeking to influence specific voting groups, including those in swing states, and promote divisive narratives while denigrating specific politicians, the anonymous US intelligence officials told reporters, without mentioning the specific voters or politicians who have been allegedly targeted. But wait, there’s more! The Kremlin “is also working to influence members of Congress and is broadly seeking to undermine U.S. support for Ukraine in its war with Russia,” according to the anonymous officials – one of whom said that Russia was the “pre-eminent threat” to the election, while Iran was a ‘lesser threat at the moment,’ and aims to be a ‘chaos agent’ by exacerbating social tensions. “We have observed actors tied to Iran’s government posing as activists online, seeking to encourage protests, and even providing financial support to protesters,” said Avril Haines, the director of national intelligence, in a separate Tuesday statement.

Neverending. And we are all hostages.

• NATO Preparing For ‘Protracted Wars’ – Pentagon (RT)

The US and its allies are planning to continue ramping up defense spending, which will ensure long-term demand for weapons, US Deputy Defense Secretary Kathleen Hicks told a gathering of arms manufacturers during a NATO event on Tuesday. Speaking at the NATO Summit Defense Industry Forum, the official praised NATO members for boosting their military budgets since the initial flare-up of the Ukraine conflict in 2014, and particularly after the open hostilities between Ukraine and Russia erupted in 2022. Over the past decade, the average annual increase in spending was 72%, adjusted for inflation, she said. That reversed a period when “defense industries across the Atlantic were affected by decades of inconsistent funding and blinkered demand signals,” she said. She said the current thinking is: “Production matters. Production is deterrence.”

Western arms manufacturers have the ability “not just to compete, but to out-compete and prevail” over Russia and other nations that the US considers its rivals, including China, North Korea and Iran. “That includes ensuring we are prepared for the possibility of protracted war, which every ally must be prepared for – and not just in Europe, either,” Hicks warned. Developing the manufacturing base on both sides of the Atlantic in a way that combines “information-age ingenuity and industrial-era capacity” will benefit US allies in the Pacific, such as Australia, Japan and South Korea, the official said. She claimed that Western political systems are inherently beneficial for building “arsenals of democracy,” since they foster innovation and transnational cooperation. On the other hand, “autocracies,” according to her reasoning, can’t move beyond “just landing at each other’s airfields, or sailing ships alongside each other for a few days at a time.”

The Pentagon is looking for ways “to be a better customer,” Hicks said, by streamlining its internal processes, delivering targeted investments in the defense sector, and providing security services to weapons businesses. Russian officials have described NATO as a tool of US geopolitical ambition and a way to secure a permanent market for American weapons in Europe. Moscow has cited Washington’s pledge that Ukraine will eventually join the bloc together with NATO’s increased presence in Ukraine since 2014 as among the key triggers of the ongoing conflict. Beijing has accused the US of being stuck in a “Cold War mentality” and playing “zero-sum games” with non-Western nations, including China.

Yay!

• EU Members Up Defense Spending by 30% Over Last 3 Years – Borrell (Sp.)

EU member states have increased their joint defense spending by 30% in the last three years, while in 2024, the bloc’s defense spending is expected to reach approximately 2% of GDP, EU foreign policy chief Josep Borrell said on Wednesday. “In the last three years, the total expenditure [in the defense sector] in Europe … has increased by 30% and this year we will be reaching almost an average all together of 2% [of GDP], it is not enough, but is much better and it is growing,” the high-ranked EU official said during his speech at the 75th NATO Anniversary Summit in Washington. The NATO summit kicked off in Washington on Tuesday and will run through July 11. In late June, European Commission President Ursula von der Leyen said the European Union needed to invest 500 billion euros ($535 billion) in defense in the next 10 years.

The European Union “regrets” that people are dying in Ukraine, but it will continue to supply weapons to Kiev to counter Russia’s actions, EU foreign policy chief Josep Borrell said on Wednesday. “We certainly regret that people are dying, but Ukrainian soldiers are fighting and dying because they are defending their country,” Borrell said during a speech at the fifth NATO Anniversary Summit in Washington. The EU will continue to support Ukraine, Borrell added. “I am happy to have heard [US] President Biden a moment ago to say that Russia cannot prevail, for that we have to increase our [military] industrial capacity, putting more money on the table, more technological development,” Borrell said.

“..not prepared to fight in an armed conflict of “any scale” and would run out of ammunition rapidly..”

• New UK Prime Minister Pledges Sharp Rise In Military Spending (RT)

The UK is set to boost its military capabilities and plans to gradually increase defense spending to 2.5% of its GDP, new Prime Minister Keir Starmer said on Tuesday as he departed for a NATO summit in Washington. Starmer has pledged to publish a roadmap for defense expenditure following calls from both the UK military and NATO states to clarify his policy, his office has said. “I am committed to that 2.5% [of gross domestic product] within our fiscal rules, but that strategic review needs to come first,” he told Reuters ahead of the NATO summit. His predecessor Rishi Sunak had promised earlier this year that London would reach this target by 2030. According to Starmer’s office, the government will launch a strategic review next week to “determine the future defense posture” of the UK and the military capabilities it needs. The timeline for the review or when the spending goal might be achieved has not been specified, however.

Many NATO states have for years struggled to reach an agreed threshold of 2% of GDP for defense spending, but the push has gained momentum since the start of the Ukraine crisis in 2014 and especially after the launch of Russia’s military operation in 2022. Starmer, who became the UK prime minister after his party’s landslide victory in the general election last week, reiterated that London’s commitment to Kiev remains unchanged. Britain has been one of Ukraine’s biggest backers in the conflict with Russia, pledging £12.5 billion (around $16 billion) in support for Kiev, including £7.6 billion (around $9.7 billion) in military aid, since February 2022. Meanwhile, recent military research revealed that Britain’s armed forces are in such a poor state that they are barely able to defend the country, with deficiencies spread across its various branches. Rob Johnson, director of the Oxford Changing Character of War Center, told the FT last week that the UK was not prepared to fight in an armed conflict of “any scale” and would run out of ammunition rapidly.

“According to Reuters, Biden delivered his remarks without a teleprompter in an explicit and clear-cut manner..”

• ‘Russia Will Not Prevail’ – Biden to NATO (RT)

US President Joe Biden has delivered a forceful speech to NATO members in a bid to reassure them that Ukraine can still prevail in its conflict against Russia. However, several Western diplomats told Reuters that the US leader’s better-than-expected stage performance failed to make up for his disastrous debate with Republican presidential frontrunner Donald Trump. In the keynote speech at the opening of the NATO summit in Washington on Tuesday, Biden touted the bloc as “the bulwark of global security” and reiterated its intention to support Ukraine with military aid, including new deliveries of air defense systems. “We know [Russian President Vladimir] Putin won’t stop at Ukraine. But make no mistake, Ukraine can and will stop Putin… When this senseless war began, Ukraine was a free country. Today, it is still a free country, and the war will end with Ukraine remaining a free and independent country,” he declared. “Russia will not prevail. Ukraine will prevail.”

Russia has repeatedly condemned Western arms shipments to Ukraine, arguing they only prolong the conflict. It has also called NATO a “hostile” bloc directly involved in the conflict between Kiev and Moscow. According to Reuters, Biden delivered his remarks without a teleprompter in an explicit and clear-cut manner, in sharp contrast to his performance at the debate with Republican rival Trump last month. The 81-year-old president’s performance was described as “fumbling” and “incoherent,” with numerous media reports claiming that the debate disaster led to prominent Democrats urging him to drop out of the race. Several unnamed Western diplomats told Reuters that Biden’s NATO speech failed to erase the damage to his public image done by the recent debacle. “We don’t see how he can come back after the debate,” one European diplomat noted, adding that the president’s remarks were scripted and could not be seen as evidence of his endurance.

“I can’t imagine him being at helm of the US and NATO for four more years,” he remarked. Meanwhile, Biden has insisted he is “not going anywhere” and intends to beat Trump in the November election. On Tuesday, the GOP candidate challenged his rival to another face-off, calling it a “chance [for Biden] to redeem himself in front of the entire world,” and suggesting that the debate should be held without moderators. Biden and Trump are already scheduled to hold another debate, which will be moderated by ABC, on September 10.

So why give him any?

• Kiev Can ‘Never’ Get Enough Weapons – Zelensky (RT)

Virtually no quantity of weapons that the US and its allies supply to Kiev for its fight with Russia will be enough, Ukraine’s Vladimir Zelensky has said. The Ukrainian leader is visiting the US this week as the heads of NATO states hold a summit in Washington DC. Zelensky called for more arms deliveries at the Ronald Reagan Institute on Tuesday, where he participated in an event alongside US Senator Mitch McConnell. While he highlighted his determination to continue hostilities with Russia, he stressed on several occasions the disparity in military strength between the two sides in the conflict. ”It’s not enough. It’s never enough,” he said, referring to the five additional Patriot missile systems, which US President Joe Biden pledged the same day to Kiev on behalf of his nation, Germany, Romania and others.

Asked about the fate of the 31 Abrams main battle tanks supplied by the US last year, Zelensky said the number was too low to “change the situation on the battlefield.”He went on to say the number of F-16 fighter jets pledged by Western donors has been insufficient. Russia uses some 300 jets in the Ukraine conflict, while Kiev would only be able to field 10 to 20 F-16s anytime soon, he said. ”Even if we will have 50 it’s nothing. They have 300,” Zelensky said. Being on the defense, Ukraine would need a fleet of 128 F-16s for parity with Russia, he stated.

Zelensky urged the US to lift all restrictions on using American-provided weapons against targets deep inside Russia and to provide Kiev with better long-range strike capability. In late May, the Biden administration revised its policy restricting the use of American weapons inside what the US recognizes as Russian territory, but would not allow long-range strikes, according to media reports and statements by officials. Russian President Vladimir Putin has warned that his country may supply weapons similar to those that Ukraine gets from the West to parties hostile to the donors elsewhere in the world in case of further escalation. Moscow has described the Ukraine conflict as part of a US-led proxy war against Russia, in which NATO members take part in virtually every aspect except by sending their own troops to the battlefield.

“Should Moscow conclude that it is now Washington policy to fight Russia, not just to the last Ukrainian, but to the last American?”

• US Bodycount 35 KIA After Russian Missile Strike (Helmer)

The latest Russian Defense Ministry daily bulletin was issued on Tuesday afternoon, July 9. Since then the Pentagon and the White House have been as silent as the tomb. Make that thirty-five American tombs. “During the day [July 9],” said the Defense Ministry briefer in Moscow, “the Armed Forces of the Russian Federation carried out a group strike with high-precision weapons on American HIMARS multiple launch rocket systems prepared for strikes on the territory of Crimea, as well as the venue of an official meeting of the AFU [Armed Forces of the Ukraine] command staff. The objectives of the strike have been achieved. Four US-made HIMARS MLRS launchers were destroyed, as well as up to 35 foreign specialists who serviced them.” Several hours later, the Pentagon briefer, Major General Pat Ryder, announced “a great kickoff to NATO summit events this week.”

General Ryder wasn’t referring to the largest number of US battlefield deaths ever recorded under hostile Russian fire. He had nothing to say about the Ukraine battlefield action, and the reporters attending failed to ask him about it. At the White House briefing which followed the Pentagon, the lead announcement was President Joseph Biden’s telephone calls to officials in Texas dealing with Hurricane Beryl; his plan to meet on Thursday with Vladimir Zelensky; and an assurance that “Russia’s aggression against Ukraine poses a threat to transatlantic security. That’s what it does. And it shows how critical the NATO Alliance is and how important it is to continue to make sure that it is strong, and that’s what the president has been able to do.” Reporters did not ask about US combat deaths in the Ukraine.

The New York Times also blacked out the report of the Russian strike on the HIMARS batteries, focusing instead on the Kiev targets of the day, and on claims by anonymous US intelligence and other officials that “Russia is unlikely to make significant territorial gains in Ukraine in the coming months as its poorly trained forces struggle to break through Ukrainian defenses that are now reinforced with Western munitions.” “You’d think in an election year,” comments a NATO veteran with Afghanistan war service, “that dead American ‘specialists’ would be an issue. This tells that they [the Biden Administration] are as committed to ‘victory’, or hiding an American defeat, as their [Trump campaign] opponents are. They are also loath to get into the role they played in getting things to this point.” That said, what interpretation can President Vladimir Putin and the Russian General Staff give after the 35 US battlefield deaths have been concealed by US officials? Should Moscow conclude that it is now Washington policy to fight Russia, not just to the last Ukrainian, but to the last American?

“..if a Russian missile had struck the hospital, there would be “nothing left of the building”

• Ukraine Timing Tragedies To Coincide With Important Events – Kremlin (RT)

Kiev is deliberately using tragedies for publicity ahead of important international events, such as this week’s NATO summit in Washington, so that Vladimir Zelensky can push for more support from the West, Kremlin spokesman Dmitry Peskov has claimed. In an interview with journalist Pavel Zarubin, Peskov suggested that Ukrainian authorities are effectively organizing PR campaigns “on blood,” referring to Monday’s deadly tragedy at the Okhmatdet children’s hospital in Kiev, where a missile killed two people and injured dozens more. Kiev and its backers have blamed Russia for the incident. Moscow has denied the allegations, insisting that it has never targeted civilian facilities. Instead, it claims that the hospital was struck by a Ukrainian air-defense missile. Peskov claimed that such tragedies in Ukraine often occur right before international events that are important for relations between Kiev and the West.

“I believe that there are no coincidences in this regard,” the spokesman said, suggesting that the Okhmatdet incident had been another “PR operation.” “This is truly a tragedy, but it is being deliberately used to create a backdrop that would accompany Zelensky’s participation in the NATO summit,” Peskov said, adding that Kiev’s methodology is “quite unclean, jesuitical, well-known, and has been repeated many times.” The Kremlin spokesman also noted that it was “very difficult” for Russia to get its point across to Western audiences regarding such incidents. “They do not want to hear anything,” Peskov said, adding that the “hysteria” in Western newspapers and TV channels “is likely due to the monopolistic dominance of Anglo-Saxon media there.” Nevertheless, Peskov said Russia would continue to “tell the truth about what has happened, both domestically and in countries where the audience is ready to hear us and where we have technical means to reach them.”

Meanwhile, Russia’s permanent representative to the UN, Vasily Nebenzia, has also insisted that Moscow had no involvement in the Okmatdet incident. Speaking at the UN Security Council on Tuesday, he suggested that if a Russian missile had struck the hospital, there would be “nothing left of the building” and that “children and adults would have died rather than being injured.” Nebenzia explained that Russia had, in fact, been targeting the Artemov missile plant in Kiev, which is located approximately 2km from the Okhmatdet hospital. “There is every reason to believe that the Ukrainian air-defense missile that hit it was intended for a Russian missile that hit the plant,” he said, noting that the tragedy could have been avoided if Ukraine hadn’t deployed air defense in residential areas.

“..Russian pilots and air defense personnel “will have new stars on their fuselages and new medals on their chests.”

• West to Supply Ukraine With ‘Squadrons’ of F-16 Fighter Jets (Sp.)

Western allies intend to supply Ukraine with entire “squadrons” of modern American-made F-16 fighter jets, according to a joint statement from the leaders of the US, Netherlands, and Denmark. They announced that the transfer of the first of these aircraft has already begun, allowing Ukrainian forces to start using them this summer. “We are committed to further enhancing Ukraine’s air capabilities, which will include squadrons of modern fourth generation F-16 multi-role aircraft,” US President Joe Biden said in a joint statement with Dutch Prime Minister Dick Schoof and Danish Prime Minister Mette Frederiksen at the NATO summit in Washington. The coalition, according to the leaders, intends to assist with the maintenance, armament, and pilot training for these jets. US Secretary of State Antony Blinken, in turn, announced that a transfer of F-16 fighter jets was currently underway from Europe to Ukraine.

“I’m also pleased to announce that as we speak, the transfer of F-16 jets is underway, coming from Denmark, coming from the Netherlands, and those jets will be flying in the skies of Ukraine this summer to make sure that Ukraine can continue to effectively defend itself against the Russian aggression,” Blinken said at the NATO Public Forum. Commenting on the development, Andrey Kartapolov, head of the State Duma Defense Committee told Sputnik that the transfer of F-16 fighter jets to Ukraine will not affect the course of the special operation and will change nothing. “We have known for a long time that they would give them something by the end of the summer; they have nothing else left but the F-16. Now they will be giving them, perhaps a dozen or so, but it will not change anything at all. We have been expecting them for a long time, and we have been preparing. It will not affect the course of the special operation,” said Kartapolov. He noted that after the transfer of F-16s to Ukraine, Russian pilots and air defense personnel “will have new stars on their fuselages and new medals on their chests.”

“The Russians have gotten really, really good” at interfering with guided munitions..”

• High-Tech Western Weapons ‘Useless’ In Ukraine Conflict – WSJ (RT)

Russia’s electronic warfare capabilities have rendered precision-guided Western munitions “useless” in the Ukraine conflict, the Wall Street Journal reported on Wednesday. With their guidance systems scrambled, some of these weapons have reportedly been retired within weeks of hitting the battlefield. When the US announced the delivery of GPS-guided Excalibur artillery shells to Ukraine in 2022, pro-Kiev outlets predicted that the $100,000-per-shot projectiles would make “Ukrainian artillery a whole lot more accurate” and “cause Russia a world of pain.” However, the Russian military adapted within weeks, Ukrainian commanders told the Wall Street Journal. Russian signal-jamming equipment was used to feed false coordinates to the shells and interfere with their fuses, causing them to veer off course or fall to the ground as duds.

“By the middle of last year, the M982 Excalibur munitions, developed by RTX and BAE Systems, became essentially useless and are no longer employed,” the newspaper stated, paraphrasing the Ukrainian commanders. The Soviet Union invested heavily in electronic warfare (EW) during the 1980s, viewing jamming technology as a crucial bulwark against the guided missiles and shells that the US was beginning to develop at the time. While weapons such as the 1990s-era Excalibur shells were used by the US to devastating effect in Iraq and Afghanistan, officials and analysts in Washington have since concluded that they are far less effective against a peer-level opponent like Russia. “The Russians have gotten really, really good” at interfering with guided munitions, US Deputy Secretary of Defense for Acquisition and Sustainment William LaPlante told the WSJ.

Retired US General Ben Hodges, who once predicted that Western weapons would help Ukraine seize Crimea by last winter, told the newspaper that “we probably made some bad assumptions because over the last 20 years we were launching precision weapons against people that could not do anything about it… and Russia and China do have these capabilities.” Some of NATO’s most advanced weapons systems have met a similar fate in Ukraine. The newly-developed Ground-Launched Small Diameter Bomb (GLSDB), a joint project of Boeing in the US and Saab in Sweden, was given to Ukraine earlier this year, with Kiev’s troops firing these GPS-guided munitions before their American counterparts. However, it has since been pulled from the battlefield after it proved completely ineffective against Russian EW.

Likewise, Russian EW has significantly blunted the accuracy of Ukraine’s Western-provided GMLRS missiles, which are fired from the HIMARS multiple-launch rocket system, Ukrainian soldiers told the WSJ. As with the Excalibur shells, GMLRS missiles were once described by pro-Kiev pundits and analysts as a “game changer” that would swing the conflict in Ukraine’s favor. Russia has long insisted that no amount of Western weapons systems will prevent it from achieving victory. Supplying these weapons is a “futile project” that will only encourage Kiev to “commit new crimes,” Moscow’s ambassador to Washington, Anatoly Antonov, warned last week.

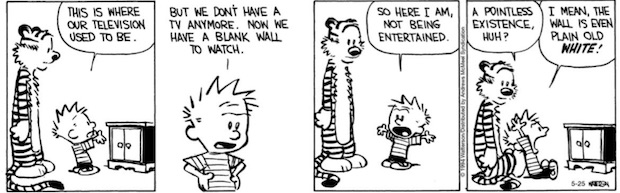

“Unelected advisers, party hacks, scheming family members and random hangers-on make the critical daily decisions..”

• We Were “Deceived & Gaslit For Years” (Alastair Crooke)

Emmanuel Todd, the French anthropological historian, examines the longer dynamics to events unfolding in the present: The prime agent of change leading to the Decline of the West (La Défaite de l’Occident), he argues, was the implosion of ‘Anglo’ Protestantism in the U.S. (and England), with its entailed habits of work, individualism and industry – a creed whose qualities were held then to reflect God’s grace through material success, and, above all, to confirm membership of the divine ‘Elect’. Whereas traditional liberalism had its mores, the decline of traditional values triggered the slide towards managerial technocracy, and to nihilism. Religion lingers on in the West, though in a ‘zombie’ state, Todd avers. Such societies, he argues, flounder – absent some guiding metaphysical sphere that provides people with non-material sustenance.

However, the incoming doctrine that only a wealthy financial élite, tech experts, leaders of multinational corporations and banks possess the required foresight and technological understanding to manipulate a complex and increasingly controlled system changed politics completely. Mores were gone – and so was empathy. Many experienced the disconnect and the disregard of cold technocracy. So when a senior WSJ editor tells us that the ‘deception and ‘gaslighting’ collapsed with the CNN Biden-Trump debate, we should surely pay attention; He is saying the scales finally fell from peoples’ eyes. What was being gaslighted was the fiction of democracy and also that of America declaring itself – in its own scripture – to be the trailblazer and pathfinder of humanity: America as the exceptional nation: the singular, the pure-of-heart, the baptizer, and redeemer of all peoples despised and downtrodden; the “last, best hope of earth”.

The reality was very different. Of course, states can ‘live a lie’ for a long period. The underlying problem – the point Todd makes so compellingly – is that you can be successful in deceiving and manipulating public perceptions, but only up to a point. The reality was, it simply was not working. The same is true of ‘Europe’. The EU’s aspiration to become a global geo-political actor too, was contingent on gaslighting the public that France, Italy and Germany et al could continue to be real national entities – even as the EU scooped up all national decision-making prerogatives, by deceit. The mutiny at the recent European elections reflected this discontent. Of course, Biden’s condition has been long known. So who then has been running affairs; making critical daily decisions about war, peace, the composition of the judiciary and the boundaries of state authority? The WSJ piece gives one answer: “Unelected advisers, party hacks, scheming family members and random hangers-on make the critical daily decisions” on these issues.

Maybe we have to reconcile to the fact that Biden is an angry, senile man who yells at his staff: “During meetings with aides who are putting together formal briefings, some senior officials have at times gone to great lengths to curate the information in an effort to avoid provoking a negative reaction”.“It’s like, ‘You can’t include that, that will set him off’ or ‘Put that in, he likes that,’” said one senior administration official. “It’s very difficult and people are scared sh*tless of him.” The official added, “He doesn’t take advice from anyone other than those few top aides, and it becomes a perfect storm because he just gets more and more isolated from their efforts to control it”. Seymour Hersh, the well-known investigative journalist reports: “Biden’s drift into blankness has been ongoing for months, as he and his foreign policy aides have been urging a ceasefire that will not happen in Gaza whilst continuing to supply the weapons that make a ceasefire less likely.

There’s a similar paradox in Ukraine, where Biden has been financing a war that cannot be won – yet refusing to participate in negotiations that could end the slaughter”. “The reality behind all of this, as I’ve been told for months, is that Biden is simply ‘no longer there’ – in terms of understanding the contradictions of the policies he and his foreign policy advisers have been carrying out”. On the one hand, Politico tells us: “Biden’s insular senior team are well acquainted with the longtime aides who continue to have the president’s ear: Mike Donilon, Steve Ricchetti and Bruce Reed, as well as Ted Kaufman and Klain on the outside”. “It’s the same people — he has not changed those people for 40 years … The number of people who have access to the president has gotten smaller and smaller and smaller. They’ve been digging deeper into the bunker for months now.” And, the strategist said, “the more you get into the bunker, the less you listen to anyone”. In Todd’s words then, decisions are made by a small ‘Washington village’.

“Democrats are seeking to bar third-party candidates from the general election . . . all in the name of perfecting democracy.”

• NC Democrats Vote to Block 3rd-Party Candidates from Ballots (Turley)

Months ago, I wrote a column about how Democrats have continued to try to block voters from being able to vote for candidates while claiming the mantle of the defenders of Democracy. This effort not only included Democratic Secretaries of State attempting to remove former president Donald Trump from the ballots, but efforts in the primary from the ballot. Many of these Democrats now calling for a “blitz primary” previously said nothing as voters were barred from having a choice in the primary. Now, in North Carolina, Democrats are seeking to bar third-party candidates from the general election . . . all in the name of perfecting democracy. The Democratically controlled North Carolina’s Board of Elections voted against giving ballot access to new parties supporting presidential candidates Robert F. Kennedy Jr. and Cornel West. All three Democrats (Alan Hirsch, Jefferson Carmon, and Siobhan Millen) voted to prevent voters from being able to vote for Kennedy and West, though the decision will have to be reconsidered.

Yet, even if reversed, they are preserving uncertainty as to whether they will be viable candidates in the minds of voters. The excuses for this action are superficial and manufactured. Chairman Alan Hirsch insisted that their organizations were “problematic” in how they gathered signatures and how Republicans may be supporting their efforts to allegedly “take away votes from Joe Biden.” They also said that they were concerned that the third-party candidates were using the new party rules to gain an easier path to ballots. That is a bizarre objection. They are opting for the best approach under the existing rules. It seems openly partisan for these three Democrats to suddenly raise concerns over the existing rules when it could harm Joe Biden or the Democratic Party. Yet, Democratic commissioner Siobhan Millen worked hard to rationalize what is a raw political muscle play to prevent voters from having a choice:

“If this board keeps rubber-stamping thinly veiled so-called parties, national operatives are going to continue to come in and keep manipulating our system. Allowing unaffiliated candidates to follow the more lenient new-party rules is allowing a blind eye to partisan mischief, potentially.” If Millen wants to see partisan mischief, she does not have to look far. She and her colleagues are engaging in precisely such mischief to deny voters choices this election to try to bolster the chances of Biden in a swing state. Democrats continue to claim to defend Democracy while resisting democratic choice and abusing the legal process. This glaring disconnect was evident when President Joe Biden spoke on the top of the Point-du-Hoc in Normandy on the 80th anniversary of D-Day. Biden again used the event to suggest that democracy was in danger in the United States with the upcoming election.

Yet, Biden has overseen widespread government censorship with federal agencies targeting those with opposing views on everything from elections and climate change to COVID-19 and transgender policies. As Democratic secretaries of state sought to bar Trump from ballots, Biden refused to oppose the efforts. When liberal law professors and members demanded to pack the Supreme Court to guarantee a liberal majority, Biden refused to denounce it during the last campaign. This is why some in the country may view Biden and the Democrats as existential threats not just to Democracy, but to themselves. They see a party that is engaged in efforts to cleanse ballots (of Republicans), censor dissenting voices and prosecute political opponents. The effort in North Carolina continues this hypocritical and cynical narrative. These three Democratic board members just voted to prevent their fellow citizens from being able to cast votes for third-party candidates who are attracting increasing support among disgruntled voters.

Dog stairs

Dog Walks Up Stairs Like Human pic.twitter.com/lwV4JoWe3t

— B&S (@_B___S) July 9, 2024

Malinois

https://twitter.com/i/status/1810787853091115082

Whales

One of the most fascinating facts about the ocean, is that there are whales alive today who were born before Moby Dick was written.

Some of the bowhead whales in the icy waters off of Alaska today are over 200 years old.pic.twitter.com/o7a78hCAq4

— Massimo (@Rainmaker1973) July 10, 2024

Dance

https://twitter.com/i/status/1810755264343106007

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.