NPC Fire at Thomas Somerville plant, Washington DC 1926

I’m thinking 2008 will turn out to have nothing on the present crash.

• Commodities Are Crashing Like It’s 2008 All Over Again (Bloomberg)

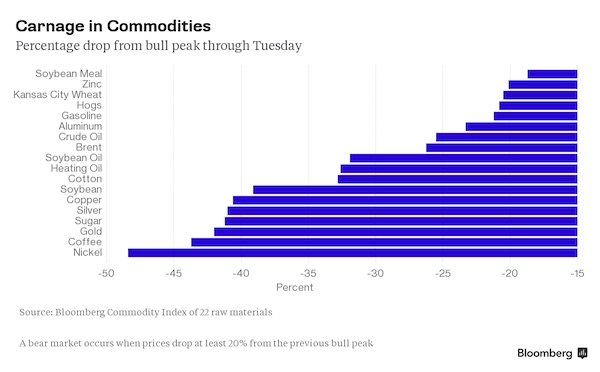

Attention commodities investors: Welcome back to 2008! The meltdown has pushed as many commodities into bear markets as there were in the month after the collapse of Lehman Brothers Holdings Inc., which spurred the worst financial crisis seven years ago since the Great Depression. Eighteen of the 22 components in the Bloomberg Commodity Index have dropped at least 20% from recent closing highs, meeting the common definition of a bear market. That’s the same number as at the end of October 2008, when deepening financial turmoil sent global markets into a swoon.

A stronger U.S. dollar and China’s cooling economy are adding to pressure on raw materials. Two of the index’s top three weightings – gold and crude oil – are in bear markets. The gauge itself has bounced off 13-year lows for the past month. Four commodities – corn, natural gas, wheat and cattle – have managed to stay out of bear markets, due to bad weather and supply issues. Hedge funds are growing more pessimistic as the year has gone on. Money managers have slashed bets on higher commodity prices by half this year, anticipating lower oil and gold prices.

Everything shrinks.

• Lost Decade in Emerging Markets: Investors Already Halfway There (Bloomberg)

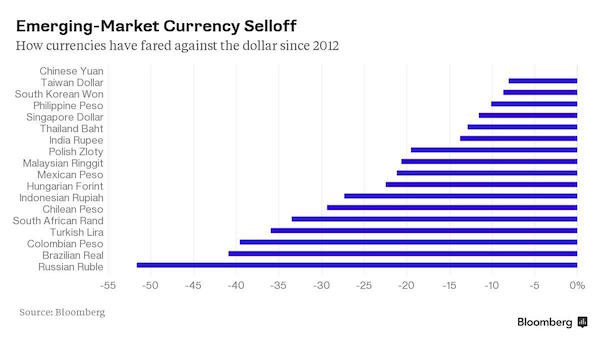

Just 14 years ago Wall Street fell in love with the BRICs, the tidy acronym for four major emerging economies that, to many, looked like sure winners. Today, after heady runs and abrupt reversals, most of the BRICs – in fact, most developing nations – look like big-time losers. The history of emerging markets is a history of booms and busts, but the immediate future may hold something more prosaic: malaise. Investors today confront what could turn out to be a lost decade of returns, with four or five more meager years ahead. “These are very much the lean years after the bonanza decade,” said Harvard Kennedy School economist Carmen Reinhart, one of the world’s top experts on financial crises and developing economies.

Not long ago the BRICs – Brazil, Russia, India and China – were celebrated as engines of global growth. Now Brazil and Russia face deep recessions brought on by the collapse in global commodities, while China is slowing and struggling to prop up its fast-sinking stock market. The prospect of higher U.S. interest rates only adds to the gloom. Currencies from the South African rand to the Malaysian ringgit fell anew on Wednesday amid worries the U.S. Federal Reserve might move as early as September. To Ruchir Sharma, the turnabout suggests the outsize investment returns of the early 2000s – the MSCI Emerging Markets Index nearly quadrupled between 2002 and 2010 – now look like an anomaly.

“Very few emerging markets historically have ever been able to make it to the developed countries,” said Sharma, head of emerging markets at Morgan Stanley. “This is a return to normalcy.” The numbers are certainly sobering. All told, developing-nation currencies have fallen to their lowest levels since 1999, and bonds denominated in those currencies have wiped out five years’ worth of gains.

“Shanghai looks bad and the global cycle is starting to look a little weaker, and that should pressure these things.”

• Analyst Who Called Top of China Stock Rally Sees Rout Worsening (Bloomberg)

More than two decades’ experience poring over stock charts helped Thomas Schroeder lock in profits in April before Chinese companies in Hong Kong went into freefall. Now he’s bearish again, betting the slump in Chinese shares won’t stop anytime soon. The Shanghai Composite Index will decline to as low as 3,100 in two months, Schroeder said, 16% below the closing level Wednesday, despite intermittent rallies as the government steps up efforts to stabilize the market. The Hang Seng China Enterprises Index of mainland shares traded in Hong Kong will drop about 10%, he said. To Schroeder, slowing Chinese economic growth and collapsing commodities prices are heightening the chance that the indexes will fall below key equity market support levels.

These are lines on charts that technical analysts say typically mark a floor for prices. Technical analysts use past patterns to try to predict future movements. “For now, we’re in the bear camp,” Schroeder, founder and managing director at Chart Partners, a provider of trading strategies linked to technical analysis, said by phone from Bangkok. “You’re not going to get to it right away. I’m sure the Chinese government will continue to come in and try to support the market in Shanghai. But in the next two months, you’re going to be” reaching these levels.

The former global head of technical research for SG Securities and Asian technical analysis chief at UBS is watching the 3,400 level on the Shanghai Composite. He expects the gauge to fall further if that’s breached. It closed Wednesday at 3,694.57. The H-share measure had jumped 37% from a low in October when Schroeder made his call. Though it edged up a further 5.8% to a peak on May 26, it then slumped more than 25%, while a 32% rout in Shanghai shares helped destroy about $4 trillion in mainland market value. [..] “There are some big moves coming,” said Schroeder. “Shanghai looks bad and the global cycle is starting to look a little weaker, and that should pressure these things.”

“Regulations have chased the ‘carry trades’ from the banking system into the shadow banking system where officials can’t see or measure the risk.”

• The Fed Is Cornered And There Are Visible Market Stresses Everywhere (Haselmann)

Part One, China An economic slowdown is underway in China. This is reflected in the steep drop in the commodity complex and in the currencies of emerging market countries. Large imbalances are being worked off as Beijing attempts to shift the composition of its growth. Policy decision are not always economic. New sources of growth are being sought by Beijing as deleveraging occurs. Since officials care foremost about social stability, they try to preserve as many current jobs as possible during their attempt at economic transformation. During this period, banks might be averse to calling in loans. State owned enterprises (SOEs) are pressured to keep producing, so that workers can continue to receive a pay check. The result is over-production and downward pressure on prices.

Part Two, The Seven Year Fed Subsidy The Fed’s zero interest rate policy has provided a subsidy to investors for the past 7 years. The lure of easy profits from cheap money was wildly attractive and readily accepted by investors. The Fed “put” gave investors great confidence that they could outperform their exceptionally low cost of capital. These implicit promises by central banks encouraged trillions of dollars into ‘carry trades’ and various forms of market speculation. Complacent investors maintain these trades, despite the Fed’s warning of a looming reduction in the subsidy, and despite a balance sheet expected to shrink in 2016. It has been a risk-chasing ‘game of chicken’ that is coming to an end. Changing conditions have skewed risk/reward to the downside. This is particularly true because financial assets prices are exceptionally expensive.

Maybe investors do not believe ‘lift-off’ looms, because the Fed has changed its guidance so many times. Or maybe, investors are interpreting plummeting commodity prices and the steep fall in global trade as warning signs that global growth and inflation are under pressure. Is this why the US 30 year has rallied 40 basis points in the past 3 weeks? (see my July 17th note, “Bonds are Back”) Either scenario creates a paradox for risk-seeking investors. If the US economy continues on its current slow progress pace, then the Fed will act on its warning and hike rates in September. However, if the Fed does not hike in September it is likely because problems from China, commodities, Greece, or emerging markets (etc) cause the global outlook to deteriorate further. Neither scenario should be good for risk assets.

Part Three, “Carry Trade” During the 2008 crisis, Special Investment Vehicles (SIVs) were primarily responsible for freezing the interbank lending market. SIVs were separate entities set up primarily to earn the ‘carry’ differential between short-dated loans and longer-dated assets purchased with the proceeds of the loans. This legal structure allowed banks to own billions of dollars of securities (CDOs and such) off of their balance sheets. Since the entities were wholly-owned with liquidity guarantees, the vehicles received the same attractive funding rates as the parent banks. When the housing crisis (and Lehman collapse) spurred loan delinquencies, banks had to place all of these hidden securities onto their balance sheets.

Since the magnitude of the SIV levered assets was unknown to others, bank solvency was questioned, and interbank lending froze. Many of these securities had to be sold at fire sale prices, i.e., prices well below their economic value. When the Fed begins to normalize rates, trillions in carry trades will likely begin to unwind. The similarity to 2008 is glaring, except that banks no longer own SIVs. Regulations have chased the ‘carry trades’ from the banking system into the shadow banking system where officials can’t see or measure the risk. The banking system today is, no doubt, far less exposed, but too many sellers could overwhelm the depth of the market, leading to asset price contagion that filters into the real economy.

Varoufakis proposed this in January.

• GDP Bonds Are Answer To Greek Debt Problem (FT)

It is clear that Greece cannot repay its sovereign debt as it is now structured, despite a generous dose of reprofiling, (extend and pretend), already granted by the country’s public sector creditors in the eurozone. The IMF has endorsed this view. But how can one lower the debt burden on Greece, and yet at the same time be fair to other eurozone countries with debt burdens enlarged by the global financial crisis, such as Ireland; and fair also to the taxpayers in creditor countries, some of which may well be still poorer than the Greeks? There is, I believe, a way to do so. This mechanism is to restructure most, or all, of such Greek debt into real GDP bonds.

These pay nothing so long as real per capita income is below its previous peak, but, as a quid pro quo, they pay a multiple, say twice, of any%age increase in real per capita income as it rises beyond its prior peak level. The maturity would be long, say 40 years, but there would have to be a fixed maturity, since otherwise, in a growing economy the burden could eventually become excessive. Such a switch would achieve several objectives simultaneously. First, creditors would get paid if, and only if, they helped Greece to start growing again. The present fixation with large primary surpluses and austerity would get replaced with a growth programme. So long as growth remained possible, as it surely must, nothing would have to be written off. The net present value of the debt would be a strongly positive function of future Greek growth rates.

Second, the interest/dividend repayments would become strongly contracyclical, with larger payouts in booms when tax payments are high, rather than (mildly) pro-cyclical as they are now. Nothing would be paid in a recession, such as exists at present. Third, exactly the same option, to switch existing debt into real GDP bonds, could also be offered to any other country that has had to accept a support programme, notably Ireland, Cyprus and Portugal. There is no need to give uniquely favourable terms to Greece among all those countries worst hit by the financial crisis. Countries without such a programme, such as Italy, would be allowed to switch existing debt into real GDP bonds, but only on terms agreed after negotiation with existing creditors.

Any country could, of course, issue real GDP bonds to finance current deficits. Real GDP bonds are, of course, a form of national equity. The world is currently drowning in debt, and this is but one way to move the debt/equity ratio back towards a safer and saner balance. Just as we require banks to hold a higher equity ratio, and for much the same reasons, so we should encourage countries, especially those with volatile economies, to shift from debt to equity finance.

A second proposal for GDP(-linked) bonds. COntagion?!

• Greece’s Debt Burden Can And Must Be Lightened Within The Euro (Bruegel)

Perhaps the greatest damage caused by the confrontation with Greece is a general loss of confidence. If we want to get Greece back to growth, people, companies and investors have to regain confidence in the viability of the country. For this to work, a legitimate and competent government as well as an efficient administration and judiciary are essential. Yet the issue of debt sustainability is still central, even if the debt servicing costs are negligible in the short term. No one doubts the IMF’s analysis that the sustainability of Greek government debt constitutes a key precondition for recovery. The third program, which is now being negotiated, aims to put Greece back where it stood at the end of last year: with growth expectations of almost 3%.

This third programme is intended to be the exact opposite of a transfer program. It aims to strengthen the Greek economy and thereby protect the loans and guarantees provided by the creditors. A large part of the disbursements will go into debt repayments to official creditors. This is important, but not enough. The current link between debt servicing and membership of the single currency leads to a vicious circle that increases uncertainty, weakens growth and makes full debt repayment less likely. There will be no confidence and no growth in Greece without a solution to the debt problem. We suggest breaking this vicious cycle by tying the interest rates on the loans to the growth rate of the Greek economy, together with a conditional debt moratorium.

A Greece without growth should not pay any interest or make any repayments. The stronger the growth rate, the higher the interest and repayments to European creditors. The debt moratorium would mean that Greece could push back the repayments if it has not reached a certain level of GDP by 2022, when it is scheduled to begin servicing its debts to the European creditors. Such a solution would end the uncertainty and recognise the fact that Greek growth is a joint European concern and a prerequisite for Greece to service its debts. Stability and confidence could return. Much of the cause for the current political confrontation would be gone. Meanwhile, such an approach would not reduce the incentives for reform.

It is in the self-interest of any Greek government to pursue growth-friendly reforms. Of course, it will be necessary to design the plan in such a way as to avoid moral hazard; yet this is possible and the conditions are favourable. Such a solution would also be advantageous for the creditors. Some form of debt relief is inevitable. The main advantage of our proposal is that creditors would benefit if growth resumes and thereby reclaim more of their loans than otherwise possible. At the same time, our proposal has only a negligible impact on the creditors’ current budgets and would thus have no meaningful consequences for the constitutional debt limits of member states.

Take the money and run.

• Tsipras: Greece On ‘Final Stretch’ Of Talks With Creditors (Guardian)

Greece is “in the final stretch” of talks with lenders on a multibillion-euro bailout, the country’s prime minister, Alexis Tsipras, has said, on a day when banks suffered more punishing losses on the Athens stock market. Greece and its creditors are racing to agree a complex, three-year deal worth up to €86bn by 20 August, when Athens must come up with €3.5bn to repay debts to the ECB. Both sides have said a deal is possible, although Tsipras struck the most optimistic note so far when he said on Wednesday that the deal could end the uncertainty over Greece’s place in the eurozone. He said: “We are in the final stretch. Despite the difficulties we are facing, we hope this agreement can end uncertainty on the future of Greece.”

The head of the European commission, Jean-Claude Juncker, said an agreement was likely this month. He told Agence France-Presse: “All the reports I am getting suggest an accord this month, preferably before the 20th.” Negotiations were proceeding in a satisfactory way, he said. Officials from the commission, the ECB and the IMF began meeting the Greek government in the final week of July. Experts from the European Stability Mechanism, the eurozone fund that is expected to provide €50bn towards the bailout, are also at the Athens talks, but do not have the same power as the troika of lenders to set the conditions attached to the loan. At stake is the small print on reforms Greece must carry out in order to qualify for the loan, including overhauling its pension system and introducing a sweeping privatisation programme.

[..] Failure to reach an agreement would leave officials scrambling to find another emergency bridging loan, to add to the €7bn Greece had from an EU-wide bailout fund in July. Eurozone officials are anxious to avoid another short-term loan, as the rules on using the EU-wide fund have since been tightened to placate non-euro states such as the UK that are wary of being dragged into the Greek debt crisis.

Why does Greece still have systemic lenders? Why does any country, for that matter?!

• Tests Start On Greece’s Systemic Lenders (Kathimerini)

European officials began on Wednesday the inspection that will eventually determine the extent of the recapitalization required by local banks, while the timetable is extremely tight, aiming to have the entire process to boost the lenders’ share capital completed well before the end of the year. Inspectors from the ECB and the European Stability Mechanism yesterday delved into the files of more than 4,000 corporate loans and 2,000 mortgages, as they began probing the loan portfolios of the country’s four systemic banks. The December deadline is meant to prevent the application of the new bail-in law – i.e. the haircut on deposits of more than €100,000 – which will otherwise come into force in January 2016.

The timetable is so restricted that it foresees the monitoring of the loan portfolios’ figures up to June 30 running alongside the stress tests that will examine banks’ possible responses to various economic scenarios in the next couple of years. That will bring the start of the stress tests a step closer, with the first data being drawn as soon as mid-August, so that the results of both procedures can be announced by the end of October. That will leave a period of two months for the completion of the recapitalization, which could be conducted in summary fashion at the banks’ general meetings. Bank managers are expressing concern about the size of the capital requirements, with current estimates putting the total amount between €10 and €15 billion.

However, the final amount will to a great extent depend on the macroeconomic scenarios, which will involve economic contractions and unemployment levels that will determine the capacity of households and corporations to meet their loan repayment obligations. Corporate loans will come under the scrutiny of the Asset Quality Review, with the European experts assessing a broad sample of some 1,000 loans per bank. They will also probe around 500 mortgage loans per lender, factoring in the drop in property values.

Ambrose loves the US almost as much as he does Yanis.

• Saudi Arabia May Go Broke Before The US Oil Industry Buckles (AEP)

If the oil futures market is correct, Saudi Arabia will start running into trouble within two years. It will be in existential crisis by the end of the decade. The contract price of US crude oil for delivery in December 2020 is currently $62.05, implying a drastic change in the economic landscape for the Middle East and the petro-rentier states. The Saudis took a huge gamble last November when they stopped supporting prices and opted instead to flood the market and drive out rivals, boosting their own output to 10.6m barrels a day (b/d) into the teeth of the downturn. Bank of America says OPEC is now “effectively dissolved”. The cartel might as well shut down its offices in Vienna to save money.

If the aim was to choke the US shale industry, the Saudis have misjudged badly, just as they misjudged the growing shale threat at every stage for eight years. “It is becoming apparent that non-OPEC producers are not as responsive to low oil prices as had been thought, at least in the short-run,” said the Saudi central bank in its latest stability report. “The main impact has been to cut back on developmental drilling of new oil wells, rather than slowing the flow of oil from existing wells. This requires more patience,” it said. One Saudi expert was blunter. “The policy hasn’t worked and it will never work,” he said. By causing the oil price to crash, the Saudis and their Gulf allies have certainly killed off prospects for a raft of high-cost ventures in the Russian Arctic, the Gulf of Mexico, the deep waters of the mid-Atlantic, and the Canadian tar sands.

Consultants Wood Mackenzie say the major oil and gas companies have shelved 46 large projects, deferring $200bn of investments. The problem for the Saudis is that US shale frackers are not high-cost. They are mostly mid-cost, and as I reported from the CERAWeek energy forum in Houston, experts at IHS think shale companies may be able to shave those costs by 45pc this year – and not only by switching tactically to high-yielding wells. Advanced pad drilling techniques allow frackers to launch five or ten wells in different directions from the same site. Smart drill-bits with computer chips can seek out cracks in the rock. New dissolvable plugs promise to save $300,000 a well. “We’ve driven down drilling costs by 50pc, and we can see another 30pc ahead,” said John Hess, head of the Hess Corporation.

It was the same story from Scott Sheffield, head of Pioneer Natural Resources. “We have just drilled an 18,000 ft well in 16 days in the Permian Basin. Last year it took 30 days,” he said. The North American rig-count has dropped to 664 from 1,608 in October but output still rose to a 43-year high of 9.6m b/d June. It has only just begun to roll over. “The freight train of North American tight oil has kept on coming,” said Rex Tillerson, head of Exxon Mobil. He said the resilience of the sister industry of shale gas should be a cautionary warning to those reading too much into the rig-count. Gas prices have collapsed from $8 to $2.78 since 2009, and the number of gas rigs has dropped 1,200 to 209. Yet output has risen by 30pc over that period.

What a surprise…

• ECB Paper: Banks That Lobby More Likely To Get Favourable Treatment (Reuters)

Banks that spend money on lobbying or hire former regulators are more likely to get favourable treatment from their watchdog agency, according to a ECB paper published today. While lobbying in the United States has been subject to extensive disclosure for years, European authorities only started to tighten the rules in recent months. Companies that want to meet with officials are now obliged to join a register and their meetings are logged. The ECB paper, based on data from about 780 US banks, found that lenders which have lobbied, hired a former regulator or government official, or are otherwise close to the authorities are less likely to face additional sanctions if their capital ratios fall below the minimum threshold.

They also tend to have higher Fitch Bank Support Ratings, meaning they are considered more likely to receive public-sector help if they are at risk of default, the paper found. “Increasing lobbying expenditures raise the probability of preferential regulatory treatment, but even small lobbying expenditures prove to be effective,” authors Magdalena Ignatowski, Charlotte Werger and Josef Korte wrote in the paper. “Lobbying becomes more effective by involving former politicians as lobbyists,” the paper said. “The effectiveness of proximity to the relevant legislative committee increases with the amount of campaign contributions from the financial industry that elected legislators receive.”

But lobbying and other sources of political influence cease to be effective when a bank finds itself in deep financial distress and faces being closed, the paper found. The ECB research did not account for undeclared or indirect lobbying, such as that carried out by an association of banks, which means the real effect of lobbying might be even stronger, the authors wrote. “Our evidence indicates that expenditures on lobbying are on the rise, and that banks are increasing their influence activities,” the authors of the paper wrote. “It is important to be aware that regulatory treatment is not immune to the influence of banks, and that we might expect this influence to further increase.”

And that’s NOT a surprise.

• Eurozone Retail Sales Fall Sharply in June (WSJ)

Retail sales in the eurozone fell more sharply than expected in June, a fresh sign that the currency area’s economic recovery remains too weak to quickly bring down very high rates of unemployment, or raise inflation to the ECB’s target. Separately, the final results of surveys of purchasing managers at businesses around the eurozone recorded a slowdown in activity during July, although it was less marked than first estimated. And in Italy, the eurozone’s third largest member, figures showed industrial production fell by 1.1% on the month in June, a sign that the recovery from the country’s worst postwar recession is still fragile. The EU’s statistics agency said Wednesday retail sales in the 19 countries that use the euro fell 0.6% in June from May, but were up 1.2% from the same month last year.

It was the largest month-to-month fall since September 2014. Economists surveyed by The WSJ had estimated sales fell 0.2%, having seen figures from Germany that recorded a large drop. Eurostat said sales in Germany were down 2.3% from May. That is a blow to hopes that low unemployment and rising wages in its largest member would boost the recovery in the eurozone as whole, as Germans purchased more goods and services from weaker parts of the currency area. But the weakness in retail sales wasn’t confined to Germany, and is also a setback to the ECB’s goal of raising the annual rate of inflation to its target of just under 2%.

Plenty of dreams.

• A Prescription for Peace and Prosperity (Paul Craig Roberts)

For the United States to return to a prosperous road, the middle class must be restored and the ladders of upward mobility put back in place. The middle class served domestic political stability by being a buffer between rich and poor. Ladders of upward mobility are a relief valve that permit determined folk to rise from poverty to success. Rising incomes throughout society provide the consumer demand that drives an economy. This is the way the US economy worked in the post-WWII period. To reestablish the middle class the offshored jobs have to be brought home, monopolies broken up, regulation restored, and the central bank put under accountable control or abolished. Jobs offshoring enriched owners and managers of capital at the expense of the middle class.

Well paid manufacturing and industrial workers lost their livelihoods as did university graduates trained for tradable professional service jobs such as software engineering and information technology. No comparable wages and salaries could be found in the economy where the remaining jobs consist of domestic service employment, such as retail clerks, hospital orderlies, waitresses and bartenders. The current income loss is compounded by the loss of medical benefits and private pensions that supplemented Social Security retirement. Thus, jobs offshoring reduced both current and future consumer income. America’s middle class jobs can be brought home by changing the way corporations are taxed. Corporate income could be taxed on the basis of whether corporations add value to their product sold in US markets domestically or offshore.

Domestic production would have a lower tax rate. Offshored production would be taxed at a higher rate. The tax rate could be set to cancel out the cost savings of producing offshore. Under long-term attack by free market economists, the Sherman Antitrust Act has become a dead-letter law. Free market economists argue that markets are self-correcting and that anti-monopoly legislation is unnecessary and serves mainly to protect inefficiency. A large array of traditionally small business activities have been monopolized by franchises and “big box” stores. Family owned auto parts stores, hardware stores, restaurants, men’s clothing stores, and dress shops, have been crowded out. Walmart’s destructive impact on Main Street businesses is legendary. National corporations have pushed local businesses into the trash bin.

How is it possible that people like Osborne get to make these decisions?

• Osborne, In Big Banks’ Pockets, Faces Wrath Of Challengers (Guardian)

George Osborne has cut state support for Britain’s working families and imposed a pay freeze on public sector workers. But when it comes to Britain’s big banks, the chancellor has proved himself to be a pushover. That much was evident from the strong hints by Standard Chartered that it was no longer thinking of removing its head office from the UK and relocating to east Asia. Why? Because Osborne kindly did what was asked of him and announced deep cuts in the government’s bank levy that will halve the tax take for the exchequer by the early 2020s. Rarely has the lobbying power of the established banks been more obvious. In the runup to the election, HSBC said it was reviewing whether to keep its HQ in London.

Standard Chartered let it be known that it, too, was so unhappy about the bank levy that it might up sticks. The result was that Osborne beat a hasty retreat in his summer budget. He announced changes to the taxation of banks, cutting the bank levy while at the same time announcing an additional corporation tax of 8% for those banks making profits of more than £25m. This had the effect of shifting the tax burden from global UK-domiciled banks like HSBC, Barclays and Standard Chartered to the smaller challenger banks, because the levy was related to the size of a bank’s balance sheet, not just in Britain but anywhere in the world. Smaller banks such as Metro, Tesco and Aldermore were not big enough to pay. Despite the cave-in, this is not mission accomplished for the chancellor.

He has solved one problem – the risk that London’s reputation as a global banking hub might be damaged by the departure of HSBC or Standard Chartered – but created another. The challenger banks are now faced with paying higher corporation tax in order to keep HSBC and Standard Chartered sweet. Predictably, they are furious about it and are lobbying Osborne to raise the profits threshold for paying the supplementary corporation tax to £250m. More competition in high street banking is a good idea. It is forcing the established players to treat their customers with a bit more respect. Osborne wants HSBC and Standard Chartered to stay in the UK but not at the expense of the challenger banks. It won’t be long before a second climbdown is announced.

That would be very good news.

• The Economist: The TPP is Dead (Naked Capitalism)

Leith van Onselen at MacroBusiness tells us:

The chief economist of The Economist magazine, Simon Baptist, believes that the Trans-Pacific Partnership (TPP) trade deal is dead following the failure of final round negotiations in Hawaii last week. Here’s Baptist’s latest commentary on the TPP from his latest email newsletter:

The latest talks on the Trans-Pacific Partnership (TPP) did not end well and election timetables in Canada and the US mean that the prospect of a deal being ratified before the end of 2016 (at the earliest) is remote. The usual problem of agricultural markets was prominent, headlined by Canada’s refusal to open its dairy sector. For New Zealand—one of the four founder countries of the TPP, along with Brunei, Chile and Singapore—this was a non-negotiable issue.

Dairy was not the only problem. As usual, Japan was worried about cars and rice, and the US about patent protection for its pharma companies. The TPP was probably doomed when the US joined, and certainly when Japan did. It then became more of a political project than an economic one. Big trade agreements had hitherto focused on physical goods, while the TPP had an aim of forging rules of trade beyond this in intellectual property, investment and services.

China was a notable absence, and the US and Japan, in particular, were keen to set these rules with enough of the global economy behind them such that China would be forced into line later on. For now, the shape of international standards in these areas remains up for grabs. The next step for the TPP, if anything, is whether a smaller group—such as the founding four —will break away and go ahead on their own, with a much smaller share of global GDP involved, and in the hope that others will join later.

Yves here. This conclusion is even more deadly than it seems, particularly coming from a neoliberal organ like the Economist. I have to confess to not reading the Economist much on this topic, precisely because the articles I did see hewed so tightly to party line: that the TPP and its ugly sister, the Transatlantic Trade and Investment Partnership, were “free trade” deals and therefore of course should be passed, since more “free trade” was always and ever a good thing. In fact, trade is already substantially liberalized, and the further GDP gains that economists could gin up using their models (which have overstated results) were so pathetically small as to amount to rounding error. Accordingly, contacts in DC told us that the business community was not pushing the deal hard: “Multinationals don’t see much benefit to be had from being able to sue Malaysia over environmental regulations.” The corporate support for the TPP in the US was thus much narrower than the cheerleading in the press would have you believe.

Not everyone seems to agree yet, but it’s there.

• Canada Is On The Verge Of A Recession (CNN)

The latest economic data from Canada shows that it is inching toward recession, after its economy posted its fifth straight month of contraction. Statistics Canada revealed on July 31 that the Canadian economy shrank by 0.2% on an annualized basis in May, perhaps pushing the country over the edge into recessionary territory for the first half of 2015. “There is no sugar-coating this one,” Douglas Porter, BMO chief economist, wrote in a client note. “It’s a sour result.” The poor showing surprised economists, who predicted GDP to remain flat, but it the result followed a contraction in the first quarter at an annual rate of 0.6%. Canada’s economy may or may not have technically dipped into recession this year – defined as two consecutive quarters of negative GDP growth – but it is surely facing some serious headwinds.

Attempts to rebound: Canada’s central bank slashed interest rates in July to 0.50%, the second cut this year, but that may not be enough to goose the economy. With rates already so low, there comes a point when interest rate cuts have diminishing returns. Consumer confidence in Canada is at a two-year low. There are other fault lines in the Canadian economy. Fears over a housing bubble in key metro areas such as Toronto and Vancouver are rising. “In light of its hotter price performance over the past three to five years and greater supply risk, this vulnerability appears to be comparatively high in the Toronto market,” the deputy chief economist of TD Bank wrote in a new report. A run up in housing prices, along with overbuilding units that haven’t been sold, and a high home price-to-income ratio has TD Bank predicting a “medium-to-moderate” chance of a “painful price adjustment.”

In other words, the bubble could deflate. Housing markets in the oil patch have already started losing value. The Calgary Real Estate Board predicts that the resale value of homes will fall by 0.2% by the end of the year. And total home sales could fall by 22% in 2015. That is a dramatic downward revision from the group’s prediction in January that home sales would rise by 1.6%. It’s all about oil: But that’s because the economic situation is much worse in the oil patch than many had predicted six months ago. And oil prices have crashed again, a detail not yet captured by the disappointing GDP figures. Crude oil (WTI) is now below $50 per barrel, and Canada’s heavy oil trades at a discount to even that low figure due to pipeline constraints and lower quality.

The Pope and The Donald.

• Pope Francis’ ‘Attendance’ At GOP Debate Will Help Sink The Party (Farrell)

We know this activist pope just won’t stop — he keeps ramping up his attack, hammering away at capitalism’s war against the poor and the environment: “In this third world war, waged piecemeal, which we are now experiencing, a form of genocide is taking place, and it must end.” Get it? In Pope Francis’ world view, WWIII has already begun, is raging, here, now, today. So no surprise that his relentless anticapitalism attacks are driving conservative critics crazy. A RawStory.com headline captured the voice of the party: “Rush Limbaugh goes bonkers because Pope Francis called out-of-control capitalism the dung of the devil.” Yes, the pope said that capitalism is the “dung of the devil.”

It’s so easy to imagine what he’ll say live to 300 GOP members of Congress next month when he appears before a join session of Congress. Pope Francis’s blunt delivery reminds us of a construction worker operating a loud jackhammer, hell-bent on dismantling the massive concrete edifice of American capitalism with deep, biting attacks like: “Men and women are sacrificed to the idols of profit and consumption: it is the ‘culture of waste.’ If a computer breaks it is a tragedy, but poverty, the needs and dramas of so many people end up being considered normal.” Warning, he’s now their champion inciting the rebellion.

Yes, Pope Francis will actually hear every dismissal voiced by GOP debaters, about how they’re ignoring what the pope says in matters of economics, social policy, global-warming science. Big mistake guys. The GOP’s days of playing deaf are over, the elephant on the 2015-16 political stage is the big guy in the white suit with the engaging smile. Dismissing him won’t work this election, he’s got an army of billions on his side.

Most Americans are right on at least something.

• Most Americans Say Their Children Will Be Worse Off (MarketWatch)

The next generation of Americans will be healthier, their parents say, all except for their finances. Barely more than one in 10 (13%) American adults believe their children will be better off financially than they were when their career reached its peak and just over half (52%) believe their children will have less disposable income than they did in the future, according to a survey of more than 1,100 American adults released Wednesday by life insurer Haven Life and research firm YouGov. What’s more, just 20% of Americans believe their children will have a better quality of life when they reach their age. “For the baby boomer generation, pocket money from mom and dad was only part of their early childhood,” says Yaron Ben-Zvi, CEO of Haven Life.

“Today’s parents are increasingly prepared to worry about and provide for their children’s financial well-being well far into their adulthoods.” (In fact, 40% of millennials say they get some kind of financial help from their parents, according to an April 2015 Bank of America/USA Today survey of 1,000 kids and 1,000 parents.) Why do parents believe that their children are faced with bigger financial challenges? They are saddled with more student loan debt than previous generations. The number of borrowers who default (those who are at least nine months past due) rose to 1.2 million annually in 2012 from around 500,000 per year a decade ago, according to the New York Fed. And many young people – especially those living in big cities – are still priced out of the housing market.

Studies also show that the better start children have in life in terms of financial support and education, the more likely they are to surpass their parents’ earnings. Children raised in low-income American families are more likely to have very low incomes as adults, while children raised in high-income families can anticipate a much bigger jump in income, according to a report – “Economic Mobility in the United States” – released last month by researchers at Stanford University. Their future is brighter in one way, parents say. Two thirds (66%) believe their kids will be as healthy or have a healthier lifestyle and, as such, will have a higher quality of life, the Haven Life/YouGov survey also found. Some 81% of millennials exercise regularly versus 61% of baby boomers, and millennials take more fitness classes, according to research group Nielsen. Unlike many of their parents, they’re also growing up in a country where smoking is banned by 36 states in workplaces, restaurants and bars.

Curious juxtaposition. Misery and holidays.

• Refugee Crisis on the Beach in Greece (NY Times)

Refugee camps are always sad, desperate places. I saw a lot of them when I was covering southern Africa for four years. But most were in desolate, poor places, not vacation islands like Lesbos, Greece, where thousands of refugees have been arriving in small inflatable boats, as upscale tourists do their best to unwind. The strangest part about covering this story was the constant juxtaposition of the European good life and the misery of people who, fleeing war and violence, now found themselves sitting among piles of garbage as they waited for their papers to be processed. My Greek colleague, Nikolas Leontopoulos, and I would meet with officials in the town of Mytilene, passing tourists who were busy picking out their favorite suntan lotion, and then an hour later we were in the back hills, where families had not eaten and the stench of clogged toilets was overwhelming.

At one point, we went to visit a good-hearted hotel owner who, driving along on a scorching hot day, came across a group of refugees walking the 30 miles to the processing station. She picked them up only to find herself arrested for “aiding smugglers.” But now she was a world away, supervising an evening of salsa for her guests. German mothers in skimpy dresses danced with their young children. Fathers watched with ice-cold beers in their hands. The sea just beyond the patio lapped gently on the shores. In the north, the beaches were littered with pools of black plastic — the boats the refugees arrived in and then punctured for fear they would be sent back. Nearby there was always a neat pile of abandoned life jackets and other flotation devices, many of them ridiculously flimsy — inflatable tubes decorated with fish — which would have done little good if the boats had capsized. There were also toothbrushes and abandoned backpacks and toys, too. People’s lives scattered around.

Home › Forums › Debt Rattle August 6 2015