William Henry Jackson Eureka, Colorado 1900

Not all numbers lie.

• Contracting US Industrial Output Associated With Onset Of A Recession (WSJ)

When the Federal Reserve announced in mid-December that it would begin raising short-term interest rates, Fed officials characterized domestic spending as “solid” and the risks to economic growth as “balanced.” They also said they were “reasonably confident” that inflation would move back up to the Fed’s 2% target over the next several years. Data released the past few weeks, however, underscore concerns about the economic outlook that were apparent even before the Fed’s announcement.

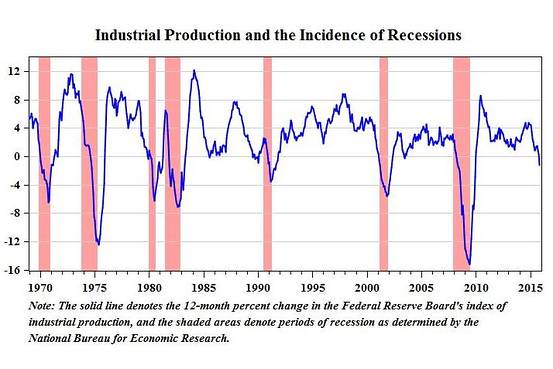

The same day it announced its monetary policy decision, the Federal Reserve released its latest measure of industrial production. As the chart below shows, the industrial sector contracted 1.2% in November from a year earlier. That contraction was initially played down as largely reflecting the effects of warm weather on utility production. But subsequent data point to a broader and more persistent contraction. In the manufacturing survey published Monday by the Institute of Supply Managers, the index of business conditions declined further in December; this index stands at its lowest level since 2009.

Turning to domestic spending, the term “solid” implies substantial strength and resilience. Yet recent indicators paint a gloomier picture. Shipments of core capital goods (that is, nondefense items excluding aircraft) contracted at an annual rate of nearly 2% over the three months ending in November. Private non-residential construction contracted about 4%. Meanwhile, growth in real personal consumption expenditures dropped from 4% last spring to 3% over the summer and slowed further, to around 2%, over the three months ending in November. In light of those readings, the Atlanta Fed’s current “now-cast” analysis indicates that real GDP barely increased during the fourth quarter of 2015.

These data reinforce the view that the U.S. economy may be operating at stall speed. Consequently, the possibility of falling into recession poses a much more significant risk than the prospect of economic overheating. As the first chart shows, every episode of contracting industrial output since 1970 has been associated with the onset of a recession. These downside risks make a compelling case for Fed officials to refrain from further monetary tightening and, instead, refocus on contingency planning for scenarios in which such risks materialize.

A strange confession.

• “We Frontloaded A Tremendous Market Rally” Former Fed President Admits (ZH)

In perhaps the most shocking of mea culpas seen in modern financial history, former Dallas Fed head Richard Fisher unleashed some seriously uncomfortable truthiness during a 5-minute confessional interview on CNBC. While talking heads attempt to blame China for recent US market volatility, Fisher explains “It is not China,” it is The Fed that is at fault: “What The Fed did, and I was part of it, was front-loaded an enormous rally market rally in order to create a wealth effect… and an uncomfortable digestive period is likely now.” Simply put he concludes, there can’t be much more accomodation, “The Fed is a giant weapon that has no ammunition left.”

Must watch!!! A shocked Simon Hobbs (at 5:10) is a must-see… “Will The Fed come on and say ‘we’re sorry, we over-inflated the market’ when it crashes?” Fisher appears to be undertaking a major “cover-your-ass” episosde, proclaiming that he was against QE3 which is what has forced “valuations to be very richly priced.” “In my tenure at The Fed, every market participant was demanding we do more… “It was The Fed, The Fed, The Fed… in my opinion they got lazy.. and it is time to go back to fundamental analysis… and not just expect the tide to lift all boats… and as [The Fed] tide recedes we are going to see who is wearing a bathing suit and who is not”

European markets now falling 3rd day in a row.

• “It’s A Really Messy Start To The Year” For Markets (BBG)

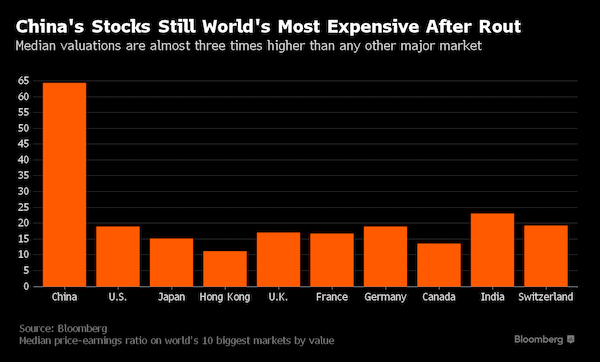

Stocks declined around the world for a second day and the yen advanced after China’s efforts to prop up its stock market failed to quell investor misgivings over the strength of the global economy. Investor optimism in Europe proved short-lived as shares in the region erased an advance of more than 1%, while U.S. equity-index futures pointed to further declines after the Standard & Poor’s 500 Index posted its sixth-worst start to a year in data compiled by Bloomberg going back to 1927. The yen strengthened against all its major counterparts on demand for the safest assets and gold gained a second day. Industrial metals advanced after China’s authorities succeeded in stabilizing that nation’s equities.

“It’s a really messy start to the year – everyone is really on edge,” said William Hobbs at Barclays’ wealth-management unit in London. “Not much is expected of the world in terms of growth, risk appetite is biased to the downside and weak data from China to the U.S. hasn’t helped at all. Plenty of people out there believe that the next global recession is imminent.” The declines come even after China moved to support its stock market with state-controlled funds buying equities and regulators signaling a selling ban on major investors will remain beyond this week’s expiration date, according to people familiar with the matter. A 7% slump in mainland China shares on Monday triggered a trading halt, and the rout spread throughout Asia, Europe and the U.S. as a report showing the fastest contraction in U.S. manufacturing in six years.

In more ways than one: “The Saudis are preparing for Iran’s return..”

• Saudis Slash European Oil Prices as Middle East Tensions Grow (WSJ)

Saudi Arabia on Tuesday sharply cut the prices it charges for crude oil in Europe, a move that could undercut Iran as sectarian tensions escalate between the rival Middle Eastern nations. The Saudi move appears to pave the way for a competition over European oil markets later this year when Iran is expected to increase its exports after the expected end of western sanctions over its nuclear program. Italy and Spain relied on Iran for 13% and 16% of their oil imports before the European Union banned such purchases under sanctions related to its nuclear program in 2012. Although the country was replaced in the market by Saudi Arabia and other countries such as Russia, Tehran is counting on rekindling those ties when it resumes exports.

The price cut comes after a diplomatic chasm opened this week between Saudi Arabia and Iran, and by extension, the Sunni and Shiite Muslim worlds. Riyadh and a number of Sunni Muslim capitals have severed or downgraded diplomatic ties with Iran after the Saudi embassy was set on fire in Tehran following the execution in Saudi Arabia of Shiite cleric Nemer al-Nemer. Iran and Saudi Arabia are at odds elsewhere in the Middle East. In Yemen, Iran has supported militants fighting a Saudi-backed regime. In Syria, Saudi Arabia is supporting rebel groups trying to topple Iranian-backed President Bashar al-Assad. Saudi Aramco, the kingdom’s state-owned oil company, didn’t mention the conflict in its news release about the price cuts.

Aramco prices are set every month at a discount or premium to various regional benchmark prices, which go up and down based on supply, demand and other factors considered by the market. On Tuesday, Aramco said it was deepening the discount for its light crude by $0.60 a barrel to Northwest Europe and by $0.20 a barrel in the Mediterranean for February delivery. Iranian oil professionals interpreted the move as a way to compete with Iran returning to the oil markets. The European Union is set to lift an embargo on Tehran as soon as next month. “The Saudis are preparing for Iran’s return,” said Mohamed Sadegh Memarian, who recently retired as the head of petroleum market analysis at Iran’s oil ministry..

Slash Europe prices, cut perks at home. Doesn’t even look like a short-term strategy.

• Saudi Arabia Hikes Domestic Gas Prices By 50% Amid Budget Cuts (CNN)

While the world’s attention is focused on Saudi Arabia’s latest flare up with Iran, many Saudis are concerned about the “economic bomb” at home. The government is slashing a plethora of perks for its citizens. The cash crunch is so dire that the Saudi government just hiked the price of gasoline by 50%. Saudis lined up at gas stations Monday to fill up before the higher prices kicked in. “They have announced cutbacks in subsidies that will hurt every single Saudi in their pocketbook,” says Robert Jordan, a former U.S. ambassador to Saudi Arabia and author of “Desert Diplomat: Inside Saudi Arabia Following 9/11.” Gas used to cost a mere 16 cents a liter in Saudi Arabia, one of the cheapest prices in the world. Many Saudis drive large SUVs and “have no concept of saving gas,” says Jordan.

The gas hike is just the beginning. Water and electricity prices are also going up, and the government is scaling back spending on roads, buildings and other infrastructure. Those cuts might sound normal for any government that is running low on cash. But it’s especially problematic in Saudi Arabia because the vast majority of Saudis work in the public sector. About 75% of the Saudi government’s budget comes from oil. The price of oil has crashed from over $100 a barrel in 2014 to around $36 currently. Most experts don’t expect a rebound anytime soon. The Saudi government used its vast oil wealth to provide generous benefits to its citizens. When the Arab Spring rocked the Middle East in 2011, the Saudi king spent even more in an effort to subdue any discontent in the country.

Here are some of the perks Saudis receive:

-Heavily subsidized gas (It used to be 16 cents a liter. Now it’s gone up to 24 cents.)

-Free health care

-Free schooling

-Subsidized water and electricity

-No income tax

-Public pensions

-Nearly 90% of Saudis are employed by the government

-Often higher pay for government jobs than private sector ones

-Unemployment benefits (started in 2011 in reaction to the Arab Spring)

-A “development fund” that provides interest-free loans to help families buy homes and start businesses.Now Saudi Arabia can’t pay for all those benefits. It ran a deficit of nearly $100 billion last year and expects something similar this year, if not worse. The IMF recently predicted that Saudi Arabia could run out of cash in five years or less if oil stays below $50 a barrel. “The Saudis have used their economic power to buy off their population,” says Jordan, who is currently serving as diplomat in residence at Southern Methodist University. He predicts Saudi Arabia may even have to start collecting an income tax or sales tax. “Part of the leverage the regime has had on their people is that they don’t impose taxes and therefore people don’t expect representation,” Jordan says. “But once they pay taxes, you’re likely to see an increase in political unrest.”

Money flowing out.

• Spread Between Onshore, Offshore Yuan Widest Since September 2011 (Reuters)

The spread between onshore and offshore yuan hit its widest level in more than four years on Tuesday after the central bank was suspected to have intervened in the onshore market to support the currency. The People’s Bank of China set the midpoint rate at 6.5169 per dollar prior to the market open, weaker than the previous fix of 6.5032 and the weakest level since April 2011. In the onshore spot market, the yuan strengthened immediately after the opening. The spot rate is allowed to trade with a range 2% above or below the official fixing on any given day. “It’s quite obvious that the central bank has intervened in the market via big Chinese banks in the morning and trading was very active,” said a trader at a Chinese bank in Shanghai. Despite the interventions, the trader said his strategy was to continue shorting the yuan given China’s weak economic fundamentals.

The trader expected the Chinese currency to fall to 6.6 per dollar by the end of the year. China struggled to shore up shaky sentiment on Tuesday a day after its stock indexes and yuan currency tumbled, rattling markets worldwide, but analysts warned investors to buckle up for more wild price swings in the months ahead. “State-owned banks were offering dollar liquidity around 6.52 per dollar,” said a Shanghai trader at a major European bank. “They were apparently trading on behalf of the PBOC to help control the pace of yuan depreciation.” In the offshore market, where the central bank usually takes a hands-off attitude, the yuan hit 6.6488 in late afternoon trade, the lowest in more than four years. It was 2% weaker than the onshore yuan midpoint. The spread between onshore and offshore yuan widened to more than 1,200 pips, the highest level since September 2011.

“China is going to have to dramatically devalue its currency..” Dramatically. 25% just for starters.

• Dow Futures Off 170 Points, Yuan Falls To 5-Year Low, PBOC Loses Control (ZH)

Dow futures are down over 170 points from the cash close, testing the lows of the day following carnage in the Chinese currency markets. Despite the biggest drop in onshore Yuan since August devaluation, Offshore Yuan has collapsed to its lowest since September 2010. What is more worrisome (or positive for Kyle Bass) is that the spread between onshore and offshore Yuan has blown out to 1250 pips – a record – indicating dramatic outflows and/or expectations of further devaluation to come.

Yuan is in free-fall… Offshore Yuan is down over 400 pips from intraday highs, testing 6.6800

CNH-CNY spread is now over 1320 pips – as it appears The PBOC is losing control.

And although Chinese stocks are "stable" thanks to some National Team play…

US equity futures are tumbling off the bounce close, trading back near the day's lows…

It appears Kyle Bass was right:

Given our views on credit contraction in Asia, and in China in particular, let's say they are going to go through a banking loss cycle like we went through during the Great Financial Crisis, there's one thing that is going to happen: China is going to have to dramatically devalue its currency."

And it is – sanctioned by The IMF…

Charts: Bloomberg

Chinese can’t short the markets. We can.

• China’s Terrible Start to 2016 Has Beijing Fighting Market Fires (BBG)

China has started 2016 in fire-fighting mode. After three months of relative calm in the nation’s $6.5 trillion stock market, a 7% rout to open the new year prompted government funds to prop up share prices on Tuesday, according to people familiar with the matter. The central bank injected the most cash since September into the financial system to keep a lid on borrowing costs, while the monetary authority was also said to intervene in the currency market to prevent excessive volatility. With Chinese shares and the yuan posting their worst starts to a year in at least two decades, the ruling Communist Party is being forced to scale back efforts to let markets have more sway in the world’s second-largest economy.

Private data this week showed the nation’s manufacturing sector ended last year with a 10th straight month of contraction, amplifying concern that the weakest economic growth in 25 years will fuel capital outflows. “There’s no doubt China wants to liberalize markets, but it’s happening at such a time that it’s very difficult to do in an orderly manner,” said Ken Peng at Citigroup in Hong Kong. While Chinese policy makers have said freer markets are integral to their plans to make the country’s economic expansion more sustainable, authorities are also concerned that sinking asset prices will weigh on business and consumer confidence. Capital outflows from China swelled to an estimated $367 billion in the three months ended November, according to data compiled by Bloomberg.

The stock market’s selloff on Monday was triggered by this week’s disappointing manufacturing data, along with investor worries that an expiring ban on stake sales by major shareholders would unleash a flood of sell orders at the end of this week. Those concerns eased on Tuesday as people familiar with the matter said regulators plan to keep the restrictions in place beyond Jan. 8. To support share prices, government funds targeted companies in the finance and steel sectors, among others, said the people, who asked not to be identified because the buying wasn’t publicly disclosed. The plunge on Monday triggered the nation’s circuit breakers on their first day, dealing a blow to regulatory efforts to restore calm to a market where individuals drive more than 80% of trading.

They don’t understand. They can’t afford to buy enough copper to stabilize prices.

• China’s Strategic Reserve Board Is Buying Up More Copper

China’s State Reserve Bureau is seeking as much as 150,000 metric tons of domestically produced refined copper for its stockpiles amid a collapse in prices to six-year lows, according to people with knowledge of the situation. The state agency issued the tender, which closes Jan. 10, to multiple sellers including smelters at a meeting in Beijing on Tuesday, the people said, asking not to be identified because the information is private. The tender was reported late Tuesday by FastMarkets.com. Smelters in China, the world’s largest producer and consumer of metals, are contending with a collapse in prices as the nation’s growth slows to its weakest in a quarter century.

The SRB’s move to soak up excess supply follows industry pledges in December to cut output and sales, and lobbying of the government to step in to support the market. China’s refined copper surplus was forecast to narrow last year to 1.14 million tons as imports fell, according to state-run researcher Beijing Antaike Information Development Co. in October. At the same time, Antaike projected that domestic production would grow 7.7% to 7.42 million tons.

Curious idea.

• Foreign Banks In China Could Face Curbs If They Snub Gold Benchmark (Reuters)

China has warned foreign banks it could curb their operations in the world’s biggest bullion market if they refuse to participate in the planned launch of a yuan-denominated benchmark price for the metal, sources said. The world’s top producer and consumer of gold has been pushing to be a price-setter for bullion as part of a broader drive to boost its influence on global markets. Derived from a contract to be traded on the state-run Shanghai Gold Exchange, the Chinese benchmark is set to launch in April, potentially denting the relevance of the current global standard, the U.S. dollar-denominated London price. China needs the support of foreign banks, especially those who import gold into the mainland, but they could be wary given the global scrutiny on benchmarks following the manipulation of Libor rates in the foreign exchange market.

Banks with import licenses will face “some action” if they do not participate in the benchmark, said a source who did not want to be named as he was not authorized to speak to media. “Maybe China won’t cancel the license but we won’t give them the import quota or will reduce the amount under the quota,” the source said. Banks with licenses must apply to regulators for annual import quotas. Banks had been told China would take “some measures” if they did not participate in the fix, a banking source said. “They passed on the impression that ‘maybe your quota will be limited or you cannot be a market maker for swaps or forwards’,” he said.

It’s a death trap, it’s a suicide rap, we gotta get out while we’re young…

• UK Consumer Lending Growing At Fastest Rate In A Decade (Ind.)

Near-zero inflation and Black Friday discounts helped trigger the biggest pre-Christmas spending spree for nearly a decade in November, Bank of England figures showed yesterday. The Bank’s data showed consumer lending through personal loans and credit card debts up 8.3% year on year over the month – the fastest pace of growth since February 2006, back in the pre-credit crunch era. But along with another big surge in mortgage lending in November and more evidence of waning momentum among manufacturing companies, the figures fuelled concerns over the unbalanced nature of the UK recovery. In cash terms, £1.48bn in consumer credit was advanced, the most for a single month since February 2008. The data included both the Black Friday and Cyber Monday events, which ushered in a six-week price-cutting drive among retailers.

Shoppers are benefiting from cheap food and petrol, with the cost of living at just 0.1%. But recent real-terms pay increases have been largely fuelled by tumbling inflation rather than improved productivity, while the Bank has also voiced fears over the vulnerability of indebted households to an interest rate rise. The IMF has also highlighted the risk of deeply indebted people succumbing to “income and interest rate shocks”, with household debt still standing at around 144% of incomes. The pick-up in unsecured loans follows recent data from the Office for National Statistics showing that the household savings ratio dipped to 4.4% in the third quarter of 2015, equalling the lowest rate since 1963. “Consumers are borrowing more and saving less to finance their spending, which is likely a consequence of relatively high consumer confidence and extended low interest rates,” Howard Archer of IHS Global Insight said. Consumer credit lending has now topped £1bn for nine months in a row.

Sounds noble…

• Sanders Vows To Break Up Banks During First Year In Office (AP)

Characterizing Wall Street as an industry run on “greed, fraud, dishonesty and arrogance,” Democratic presidential candidate Bernie Sanders pledged to break up the country’s biggest financial firms within a year and limit banking fees placed on consumers, should he become president, in a fiery speech on Tuesday. He coupled that promise, delivered in front of a raucous crowd just a few subway stops from Wall Street, with a series of attacks on rival Hillary Clinton, arguing her personal and political ties make her unable to truly take on the financial industry. “To those on Wall Street who may be listening today, let me be very clear: Greed is not good,” said Sanders, in a reference to Oliver Stone’s 1980s film, “Wall Street.” “If Wall Street does not end its greed, we will end it for them,” he said, as a cheering audience jumped to its feet.

Sanders has made regulating Wall Street a focus of his primary bid, with calls to curb the political influence of “millionaires and billionaires” at the core of his message. But the attacks on Clinton marked an escalation in his offensive against the Democratic front-runner. Clinton’s policies, he said, would do little more than “impose a few more fees and regulations.” “My opponent says that, as a senator, she told bankers to ‘cut it out’ and end their destructive behavior,” he said, to laughter. “But, in my view, establishment politicians are the ones who need to cut it out,” he said. Clinton responded at a campaign event in Sioux City, Iowa, on Tuesday evening, saying her policies would take on a wide range of financial actors, including insurance companies and investment houses that helped spark the 2008 recession. “I have a broader, more comprehensive set of policies about everything including taking on Wall Street,” she said. “I want to go after everybody who poses a risk to our financial system.”

[..] Sanders vowed to create a “too-big-to-fail” list of companies within the first 100 days of his administration whose failure would pose a grave risk to the U.S. economy without a taxpayer bailout. Those firms would be forced to reorganize within a year. Sanders also said he wants to cap ATM fees at two dollars and cap interest rates on credit cards and consumer loans at 15%. He also promised to take a tougher tact against industry abuses, noting that major financial institutions have been fined only $204 billion since 2009. And he promised to restructure credit rating agencies and the Federal Reserve, so bankers cannot serve on the body’s board. “The reality is that fraud is the business model on Wall Street,” he said. “It is not the exception to the rule. It is the rule.”

…but does Bernie really get it?

• Note To Sanders: Forget The Octopus Arms…Go For The Head (Rossini)

Bernie Sanders is attacking Wall Street. He’s campaigning to break up the “too big to fail” banks. It’s easy to see why such an idea would get some fanfare. After all, there are many Americans that remember the great $700 billion heist during the George W. Bush administration…the one that bailed out the most-favored banking cronies. Sanders says: “We need a movement which tells Wall Street that when a bank is too big to fail, it is too big to exist.” Again, superficially, it makes sense as to why people would hitch their wagons onto such an idea. Sadly though, Sanders is taking a swing that can only end up as a major whiff. The American banking system is like an octopus. The head of the octopus is the central bank, known as The Federal Reserve. That is where the source of our problems originate.

It all starts and ends with The Fed. The banks are nothing but appendages. They’re like the Fed’s octopus arms. Sanders wants to attack the arms. That’s a poor strategy, and the results would be fruitless. The size of a bank doesn’t matter. In fact, how does Sanders know what the “right” size would be? At what point is a bank no longer “too big”? How can he know such a thing? The truth is, he can’t, and like most government decisions, such a move would be totally arbitrary. Even if Sanders were to succeed in breaking up the big banks, were the Federal Reserve to still exist, those new banks would retain their “lender of last resort”. The banks would still operate in an environment drowning in moral hazard. They would still have a call option on our purchasing power and would continue to loot us via inflation.

They would still be The Fed’s instruments in creating the illusionary booms that are followed by the bone-crushing busts. That’s why they call it The Federal Reserve “System”. It’s a “system” of enriching the few at the expense of the many. Sanders isn’t going to touch the “system”. In fact, with all the free stuff and new “rights” that he’s concocted, Bernie’s going to need The Federal Reserve around to finance them. Bottom line? Tangling with the Fed’s octopus arms would accomplish virtually nothing. The only change that must occur is to End The Fed. The Eccles Building needs to be turned into a museum where future generations can walk through and learn about one of the biggest mistakes that was ever made in America. Will Sanders call for an end to The Fed? Don’t count on it.

Goldman estimates they’ll end up paying just half a billion?!

• Volkswagen Struggling To Agree On Fix For US Test Cheating Cars (Reuters)

Volkswagen is struggling to agree with U.S. authorities a fix for vehicles capable of cheating emissions tests, a VW source said on Tuesday, showing how relations between the two sides remain strained four months after the cheating came to light. The source said the German carmaker would hold further talks with the Californian Air Resources Board this week and with the U.S. Environmental Protection Authority (EPA) next week, and still hoped to reach a solution by a mid-January deadline. But finding a fix was proving more difficult than expected, in part because this involved producing new components which then required testing, said the person, who declined to be named as the talks are confidential.

The difficulties highlight the lack of progress VW has made in winning back the confidence of U.S. regulators and drivers almost four months after it admitted to cheating diesel emissions tests and promised to turn over a new leaf. On Monday, the U.S. Justice Department said it was suing Europe’s biggest carmaker for up to $90 billion for allegedly violating environmental law – five times the initial estimate of regulators. The move threw VW’s U.S. problems back into focus after it seemed to be recovering ground in Europe, sending its shares down more than 8% to a six-week low on Tuesday. “The announcement serves as a reminder/reality check of VW’s still unresolved emissions issues,” Goldman Sachs analysts said of the lawsuit.

VW Chief Executive Matthias Mueller is expected to meet EPA representatives and politicians in Washington next week after visiting the Detroit Auto Show, the VW source said, on what will be Mueller’s first trip to the United States since the scandal broke in September. VW declined to comment on the progress of talks with the EPA, on whose behalf the U.S. Justice Department filed the lawsuit, or on Mueller’s plans. The lawsuit claim of up to $90 billion is based on fines of as much as $37,500 per vehicle for each of four violations of the law, with illegal devices installed in nearly 600,000 vehicles in the United States, according to the complaint. U.S. lawsuits are typically settled at a fraction of the theoretical maximum. Goldman has estimated the likely costs at $534 million.

“VW cannot afford to lose more time in the United States. It needs to ditch the ill-fated plan to repair the 580,000 U.S. vehicles. A swift buyback of all these would be far more effective, as it would end the extra air pollution at once.”

• Volkswagen’s American Nightmare (BV)

The United States is reversing Volkswagen’s recent progress in tackling its emissions scandal. The U.S. Department of Justice on Jan. 4 issued a strongly worded lawsuit against the German carmaker, upending a six-week rally in VW shares. Wolfsburg needs something big to stop American lawmakers wielding a scarily large stick. Last year ended on a relatively positive note for the battered company. German regulators rubberstamped an inexpensive and simple fix for the majority of the 11 million vehicles sold in the European Union. Suspected manipulation of fuel efficiency data uncovered by VW’s internal investigation turned out to be much less widespread and severe than initially feared.

Yet both precedent and the lawsuit’s content suggest the United States will be tougher. The Department of Justice accuses Volkswagen of four different violations of the Clean Air Act. Most strikingly, VW’s theoretical maximum fine if found guilty has more than quadrupled to $90 billion – almost 125% of its market capitalisation. Moreover, Volkswagen has done little to win the goodwill of U.S. authorities. It admitted wrongdoing in September 2015 only after months of stonewalling. The company still lacks a technical fix to lower toxic emissions of its affected U.S. diesels to pass the country’s more demanding emission regimes and effectively reduce exhaust fumes. And the complaint filed on Jan. 4 also accuses VW of continuing to impede and obstruct its investigations “by material omissions and misleading information” after the September confession.

VW cannot afford to lose more time in the United States. It needs to ditch the ill-fated plan to repair the 580,000 U.S. vehicles. A swift buyback of all these would be far more effective, as it would end the extra air pollution at once. These benefits would by far outweigh the initial costs Evercore ISI analysts see at €5.8 billion. More sweeping changes in Volkswagen’s governance are also important. Chairman Hans Dieter Poetsch should go. The former finance director was one of Volkswagen’s most senior managers during the emissions cheating era. A credible outsider, who is unburdened by the past and embodies a new culture, could then set about trying to limit the fallout across the Atlantic.

Do read.

• My Financial Road Map For 2016 (Nomi Prins)

As a writer and journalist covering the ebbs and flows of government, elite individual, central bank and private industry power, actions, co-dependencies, and impacts on populations and markets worldwide, I often find myself reacting too quickly to information. As I embark upon extensive research for my new book, Artisans of Money, my resolution for the book – and the year – is to more carefully consider small details in the context of the broader perspective. My travels will take me to Brazil, Mexico, China, Japan, Germany, Spain, Greece and more. My intent is to converse with people in their respective locales; those formulating (or trying to formulate) monetary, economic and financial policy, and those affected by it.

We are currently in a transitional phase of geo-political-monetary power struggles, capital flow decisions, and fundamental economic choices. This remains a period of artisanal (central bank fabricated) money, high volatility, low growth, excessive wealth inequality, extreme speculation, and policies that preserve the appearance of big bank liquidity and concentration at the expense of long-term stability. The potential for chaotic fluctuations in any element of the capital markets is greater than ever. The butterfly effect – the flutter of a wing in one part of the planet altering the course of seemingly unrelated events in another part – is on center stage. There is much information to process. So, I’d like to share with you – not my financial predictions for 2016 exactly – – but some of the items that I will be examining from a geographical, political and financial perspective as the year unfolds.

Wow! Beating ‘wetness’ records in Britain is quite the achievement. Britons might as well start walking around in wetsuits all day now.

• December 2015 Was Wettest Month Ever Recorded In UK (Guardian)

December was the wettest month ever recorded in the UK, with almost double the rain falling than average, according to data released by the Met Office on Tuesday. Last month saw widespread flooding which continued into the new year, with 21 flood alerts in England and Wales and four in Scotland in force on Tuesday morning. The record for the warmest December in the UK was also smashed last month, with an average temperature of 7.9C, 4.1C higher than the long-term average. Climate change has fundamentally changed the UK weather, said Prof Myles Allen, at the University of Oxford: “Normal weather, unchanged over generations, is a thing of the past. You are not meant to beat records by those margins and if you do so, just like in athletics, it is a sign something has changed.”

The Met Office records stretch back to 1910 and, while December saw a record downpour particularly affecting the north of England, Scotland and Wales, 2015 overall was only the sixth wettest year on record. The high temperatures in December would normally be expected in April or May and there was an almost complete lack of air frost across much of England. The average from 1981-2010 was for 11 days of air frost in December, but last month there were just three days. Across 2015, the average UK temperature was lower than in 2014, though globally 2015 was the hottest year on record. Allen said it has been predicted as far back as 1990 that global warming would mean warmer, wetter winters for the UK, with more intense rainstorms.

What happens when the -overly- well funded EU, UNHCR and Red Cross don’t do what they’re supposed to.

• Refugees In Lesbos: Are There Too Many NGOs On The Island? (Guardian)

Moria refugee camp, on the Greek island of Lesbos, is full of volunteers who have come from all over the world to help displaced people. Burly Dutch men carry huge water tanks, Cypriot doctors erect a new medical tent at the foot of Afghan Hill and major organisations such as Médecins Sans Frontières and Action Aid make their presence felt. But locals are anxious – they’re worried this huge influx of international volunteers is creating more chaos on their small island rather than a coordinated response, resulting in refugees being given bad information and the Greek community’s needs going ignored. At last count there were 81 NGOs operating on the island, and local media say that just 30 have registered with the local authorities.

The island has a population of about 90,000, yet saw almost 450,000 refugees pass through during 2015. The mayor of Lesbos, Spyros Galinos, says he is heartened by the outpouring of generosity but the presence of NGOs and volunteers doesn’t always have a positive effect. “I am grateful to the ones that immediately responded to our first call for help addressed to the international community to help us cope with refugee crisis,” Galinos has said. “However, more recently I have seen many NGOs and individuals coming without official registration and showing no cooperation with our municipality. This causes everyone upset and these NGOs arouse doubt and mistrust among the residents of Lesbos. I would say their presence is disruptive rather than useful.”

One local fixer says that it’s “like a party for the NGOs”: some are working closely with the municipality, but many others “have no idea and are just doing their own thing”. Hotel owner Aphroditi Vati is one resident who has witnessed first-hand the recent spike in volunteers on the ground. Refugee boats have been landing on the beach right outside her hotel in Molyvos, in the north of the island, since April, and she says it was only in mid-September that more people who wanted to help started arriving. There were often seven boats arriving each day and while the hotel was in desperate need of the assistance, she says the NGOs brought their own problems, too.

“We had all these other people speeding onto the property, not respecting where they were, not respecting that they were in a business location, parking their cars wherever they wanted – reporters and photographers, yes, but mainly a lot of volunteers and NGOs,” she says. Vati says that the newcomers would rush into the water and try to pull refugees off the boats in a way that frightened the already distressed travellers. “You would have all this commotion that was not necessary, and we had people giving out wrong information, saying there were no buses when there were and telling refugees to walk [to the registration point],” she says.

Europe’s politicians do not care.

• Refugees: EU Resettles Just 0.17% Of Pledged Target In Four Months (Guardian)

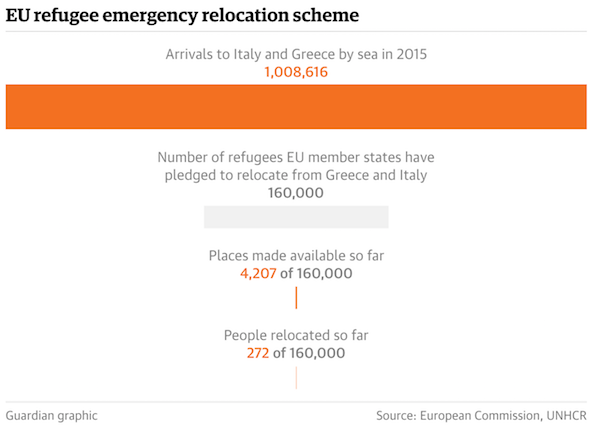

European countries have resettled just 0.17% of the asylum seekers they promised to welcome four months ago, it has emerged, in a revelation that campaigners say is the latest failure of Europe’s confused response to the continent’s refugee crisis. EU officials announced this week that just 272 Syrians and Eritreans have been formally transferred (pdf) from the countries on the frontline of the migration crisis, Greece and Italy, to countries elsewhere in the continent. It constitutes 0.17% of the 160,000 refugees that EU members pledged to share at a summit in September, and 0.03% of the 1,008,616 asylum seekers who arrived by sea in 2015. Europe’s slow response stands in sharp contrast to the accelerating nature of the crisis, with the daily arrival rate to Greece now 11 times higher than it was in January 2015.

On Tuesday, at least 34 people died in the Aegean sea between Greece and Turkey in the first such shipwrecks of 2016. Many of those who do reach Greece are nominally supposed to be shared between other countries in the EU, under the terms of the September agreement. But according to figures released this week, 19 EU countries have not relieved Greece and Italy of any asylum seekers, while those that have are largely the countries that are already bearing a significant share of the continent’s refugee burden, such as Sweden and Germany. European countries have also failed to provide the full quota of border guards they pledged to send to Greece and Italy in September – with just 447 guards provided out of a promised 775. Hungary, one of the loudest proponents of a more heavily fortified European border, has seconded just four guards to border duty in Greece and Italy.

I have no more tears. How about you, Barack?

• Turkish Authorities Find Bodies Of 34 Refugees, Search For Survivors (Reuters)

Turkish authorities said they found the bodies of 34 migrants, at least three of them children, at two locations on the Aegean coast on Tuesday after they apparently tried to cross to the Greek island of Lesvos. The flow of mostly Syrian refugees and migrants braving the seas to seek sanctuary in Europe dipped towards the end of last year with the colder weather, but the total still reached 1 million last year, nearly five times more than in 2014. The migrants died after their boat or boats apparently capsized in rough seas. It was not known how many vessels were involved or how many people were on board. Twenty-four of the bodies were discovered on the shoreline in the district of Ayvalik, the Turkish coast guard command told Reuters. Ten others were found in the district of Dikili, a gendarmerie official in the local headquarters said.

Reuters TV footage showed a body in an orange life jacket lying at the grey water’s edge in Ayvalik, lapped by waves. The nationalities of those drowned were not immediately clear. “We heard a boat sank and hit the rocks. I surmise these people died when they were trying to swim from the rocks. We came here to help as citizens,” an unnamed eyewitness said. Increased policing on Turkey’s shores and colder weather conditions have not deterred refugees and migrants from the Middle East, Asia and Africa from embarking on the perilous journey in small, flimsy boats. “Migrants and refugees continue to enter Greece at a rate of over 2,500 a day from Turkey, which is very close to the average through December,” International Organization for Migration (IOM) spokesman Joel Millman told reporters in Geneva. “So we see the migrant flows are continuing through the winter and obviously the fatalities are continuing as well.”

IOM said 3,771 migrants died trying to cross the Mediterranean to reach Europe last year, compared with 3,279 recorded deaths in 2014. The coast guard and gendarmerie rescued 12 people from the sea and the rocks on the Ayvalik coastline. A coast guard official said three boats and a helicopter were searching for any survivors. In a deal struck at the end of November, Turkey promised to help stem the flow of migrants to Europe in return for cash, visas and renewed talks on joining the EU. Turkey is host to 2.2 million Syrians and has spent around $8.5 billion on feeding and housing them since the start of the civil war nearly five years ago. But it has faced criticism for lacking a longer term integration strategy to give Syrians a future there. Almost all of the refugees have no legal work status and the majority of children do not go to school.

This little girl is one the 34 drowned refugees washed ashore on the Turkish Aegean coast. RIP sweetheart.

Home › Forums › Debt Rattle January 6 2016