Paul Klee In the Houses of Saint Germain 1932

Emerging markets are already hurting. Watch Turkey.

• The Rising Dollar Will Trigger Next “Systemic Banking Crisis” – Napier (ZH)

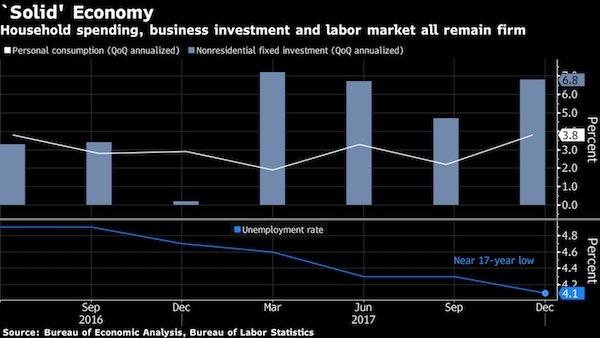

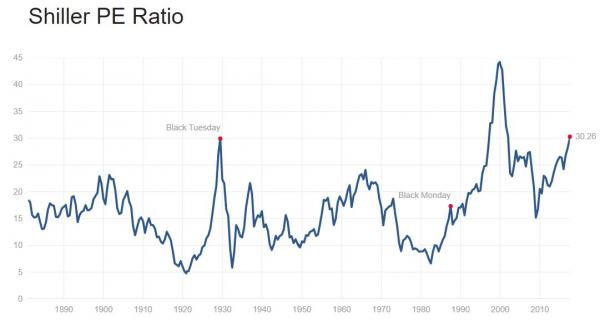

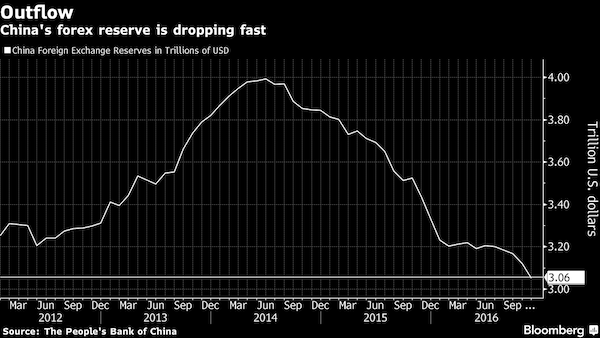

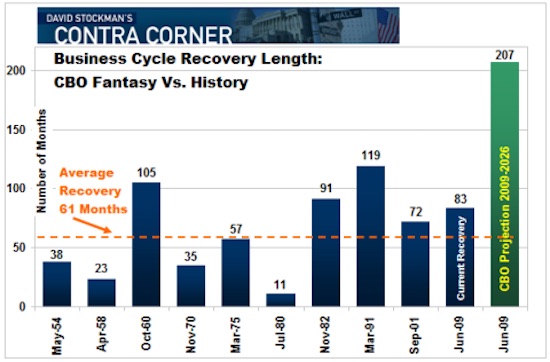

Fresh off his successful call earlier this year that the US dollar would strengthen in the coming months, macroeconomic strategist and market historian Russell Napier joined MacroVoices host Erik Townsend to discuss why he favors deflation and why he has such a bullish view on the US dollar. Echoing David Tepper’s concerns that the equity highs for the year might already be in, and that a 10-year yield above 3.25% could lead to market chaos, Napier said he sees interest rates rising sharply in the coming months as the dollar strengthens – a phenomenon that will push the US back into deflation.

Napier’s thesis relies on one simple fact: With the Fed and foreign buyers pulling back, who will step into the breach and buy Treasurys? The answer is – unfortunately for anybody who borrows in dollars – nobody. In fact, the Fed is expected to allow $228 billion in Treasury debt to roll off its balance sheet this year. This “net sell” will inevitably lead to higher interest rates in the US, as well as a stronger dollar. And once the 10-year yield reaches the 4% area, signs of stress that could be a lead up to a global “credit crisis” could start to appear.

“We know what the Federal Reserve plans to sell this calendar year, $228 billion. We know what the rise in global foreign reserves is, and about 64% of that will flow into the United States’ assets. Slightly less of that will flow into Treasuries. $228 billion, at the current rate at which foreign reserves are accumulating, we are not going to see foreign central bankers offsetting the sales from the Fed. So that’s a net sell. We don’t know what that net sale will be, but it’s a net sale from central bankers at a time when the Congressional Budget Office forecasts a roughly $1 trillion fiscal deficit. This is the first time in my investment career that savers will have to fund the whole lot. And it’s perfectly normal that real rates of interest have to go higher to attract those savings.

$1 trillion is still a large amount of money. It can come from anywhere in the world. It can come from outside the United States. It can come from inside the United States. But it’s a liquidation of other assets or a rise in the savings rate, which is necessary to fund this. Either of these things is positive for the dollar.”

“It essentially will not deliver anything other than supposed scarcity..”

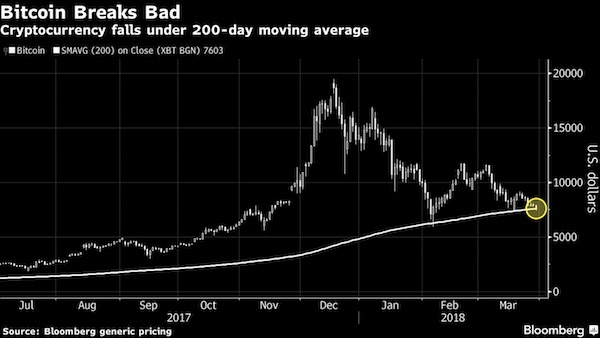

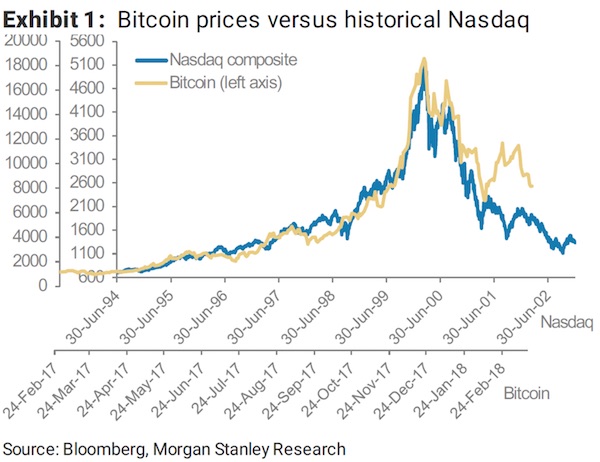

• Warren Buffett Compares Bitcoin To ‘Rat Poison Squared’ (Ind.)

Mega-investor Warren Buffett still is not buying into the crypto-currency craze, likening Bitcoin to “rat poison squared”. “Cryptocurrencies will come to a bad ending”, Mr Buffett told shareholders at a retreat in Omaha, Nebraska, according to the Associated Press, adding that crypto currencies have no intrinsic value. “It essentially will not deliver anything other than supposed scarcity”, added Mr Buffett, who has earned the nickname the “Oracle of Omaha” for his prescient investment decisions. The Berkshire Hathaway CEO maintained his sceptical stance even as the alternate currency’s soaring value set off a scramble last year.

In an interview with CNBC last year, he said his company did not own any cryptocurrency and was avoiding taking a position in them. “What’s going on definitely will come to a bad ending,” Mr Buffett said at the time. Other prominent economists and investors have echoed those warnings, cautioning that the frenzied speculation around crypto-currencies had the makings of a bubble. Turning to politics, Mr Buffett downplayed the risks of a trade war breaking out as a result of Donald Trump imposing tariffs on steel and aluminum, which sparked Chinese retaliation. He said it was unlikely that the two countries would “dig themselves into” a “real trade war”, suggesting the broad appeal of trade would prevent conflict.

If the Fed raises rates, can BoE remain behind?

• UK Rates Will Stay Low For A Very Long Time (G.)

Bank of England governor Mark Carney has already faced accusations of behaving like the Grand old Duke of York and he will probably do so again should Britain’s central bank opt to keep interest rates on hold. Since he joined the Bank in 2013, he has marched borrowers and savers up the hill with heavy hints about the imminent prospect of a rate rise, only to march them back down again. Last November’s restoration of 2016’s emergency rate cut hardly qualified as a major move, whatever the Bank said about its significance. Until an interview with the BBC during the IMF spring meetings a fortnight ago, it seemed to be a racing cert that the Bank was finally ready to begin the long journey back to 3% and push the base rate from 0.5% to 0.75%.

The markets were guided to expect action at a meeting of the monetary policy committee on Thursday. And it wasn’t just Carney dropping hints. Almost every member of the committee who had previously blocked a rise had gone on the record arguing that the time for a rate increase was near at hand. Speeches by external member Jan Vlieghe constituted the most startling intervention. During 2016 and much of 2017, the former hedge fund economist turned interest-rate setter was one of the most vociferous opponents of a rise. His former brethren in the Square Mile considered him an arch dove who might never vote to increase rates, such was his downbeat view of the economy’s growth potential.

Yet, towards the end of last year, he was one of the most optimistic proponents of the economy’s resilience and the likelihood of a rate rise. Just as before, a moment of central bank exuberance looks like becoming a non-event – which is strange given Vlieghe’s reasoning for backing an increase last year. Then, he said that ultra-low unemployment, steady growth and the probable end to a long period of declining real wages was enough to justify tighter monetary policy.

Ha!

• Trump White House Accuses China Of ‘Orwellian Nonsense’ (G.)

The White House on Saturday condemned Chinese efforts to control how US airlines refer to Taiwan, Hong Kong and Macao as “Orwellian nonsense”. The harshly worded statement came as a high-level trade delegation led by the Treasury secretary Steven Mnuchin returned from negotiations in China. The carriers were told to remove references on their websites or in other material that suggests Taiwan, Hong Kong and Macau are part of countries independent from China, US and airline officials said. Taiwan is China’s most sensitive territorial issue. Beijing considers the self-ruled, democratic island a wayward province. Hong Kong and Macau are former European colonies that are now part of China but run largely autonomously.

A spokesman for Airlines for America, a trade group representing United Airlines, American Airlines and other major carriers, said the group was “continuing to work with US government officials as we determine next steps”. In January, Delta Air Lines, following a demand from China over listing Taiwan and Tibet as countries on its website, apologized for making “an inadvertent error with no business or political intention” and said it had taken steps to resolve the issue. Also in January, China suspended Marriott International’s Chinese website for a week, punishing the world’s biggest hotel chain for listing Tibet, Taiwan, Hong Kong and Macau as separate countries in a customer questionnaire.

On Saturday, White House press secretary Sarah Sanders said in a statement that Donald Trump “ran against political correctness in the United States” and as president would “stand up for Americans resisting efforts by the Chinese Communist Party to impose Chinese political correctness on American companies and citizens”.

What will Germany do?

• US Prosecutors Allege Ex-CEO of VW Knew All About Diesel Cheating (BBC)

It was an “appalling” fraud that went to the very top of the company. That is the striking allegation made by US prosecutors looking into the emissions-cheating scandal at the Volkswagen Group. The indictment unsealed on Thursday claims that former CEO Martin Winterkorn was not only fully briefed about what his engineers were up to, he also authorised a continuing cover-up. These allegations have yet to be tested in a court of law. But if true, they paint a picture of extraordinary executive wrongdoing at one of the titans of German industry. Dr Winterkorn himself is unlikely ever to face trial in the US. But he remains under investigation in Germany on suspicion of deceiving investors.

The Volkswagen scandal erupted in September 2015, when the company admitted that nearly 600,000 cars sold in the US were fitted with “defeat devices” designed to circumvent emissions tests. Shortly afterwards the then head of its US operations, Michael Horn, told a congressional committee that the deception was the work of “a couple of software engineers”. We know that was far from the truth. Volkswagen has already admitted as much in an agreed “statement of facts” published last year as part of a settlement with the US Department of Justice. That document set out how Volkswagen engineers struggled to make a diesel engine which would both perform well and be capable of meeting stringent US emissions standards.

It explained how instead they designed a system to switch on emissions controls when the cars were being tested, and turn them off during normal driving. It also described how managers repeatedly sanctioned the use of this system despite objections from some employees, and encouraged engineers to hide what they were up to. The indictment against Dr Winterkorn goes considerably further – suggesting that the CEO himself was made well aware of what the engineers were doing and authorised a continued cover-up. It claims that in early 2014, engineers heard about a study commissioned by the International Council on Clean Transport, which showed that VW diesels were producing far higher emissions on the road than in official lab tests.

It says that senior managers were informed, and warned that the study might result in VW’s deception being uncovered. A memorandum was written for Dr Winterkorn explaining that the company would be unable to explain the test results to the authorities.

No, CBS, you can’t sing the praises of these people without looking behind them.

• US Freezes Funding For Syria’s “White Helmets” (CBS)

Less than two months ago the State Department hosted members of the White Helmets at Foggy Bottom. At the time, the humanitarian group was showered with praise for saving lives in Syria. “Our meetings in March were very positive. There were even remarks from senior officials about long-term commitments even into 2020. There were no suggestions whatsoever about stopping support,” Raed Saleh, the group’s leader, told CBS News. Now they are not getting any U.S funding as the State Department says the support is “under active review.” The U.S had accounted for about a third of the group’s overall funding. “This is a very worrisome development,” said an official from the White Helmets. “Ultimately, this will negatively impact the humanitarian workers ability to save lives.”

The White Helmets, formally known as the Syrian Civil Defense, are a group of 3,000 volunteer rescuers that have saved thousands of lives since the Syrian civil war began in 2011. A makeshift 911, they have run into the collapsing buildings to pull children, men and women out of danger’s way. They say they have saved more than 70,000 lives. Having not received U.S. funding in recent weeks, White Helmets are questioning what this means for the future. They have received no formal declaration from the U.S. government that the monetary assistance has come to a full halt, but the group’s people on the ground in Syria report that their funds have been cut off.

“..gold is actually what kept the Federal Reserve solvent in 2008.”

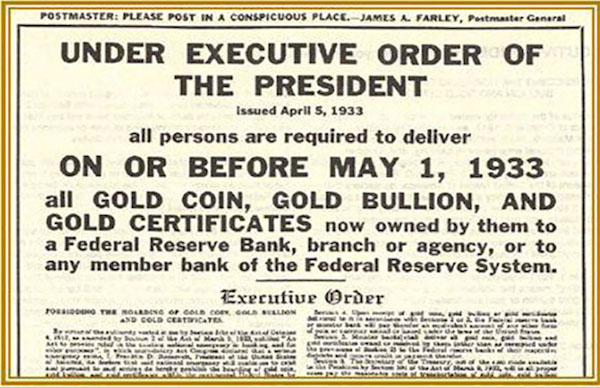

• The U.S Government Can Still Confiscate Gold (GT)

By the 1930s, the US government was facing its most severe financial crisis, and it needed gold (something of value), to stimulate the economy that was running on the fumes of fiat currency. So, it took people’s gold. It was as simple as that. Non-compliance was threatened with severe punishment. We may be facing another financial crisis, and it might be best to avoid the role of fugitive “gold hoarder.” At this point, it doesn’t make sense for the government to confiscate private gold, as a cashless society will indirectly control peoples finances. Why would the government seize gold? In 1933, under the 1913 Federal Reserve Act, the dollar had to be backed by 40 percent gold.

This would give the Federal Reserve room to print new money when needed. What’s a government to do when it needs to print money, but doesn’t have the gold reserves needed to back it up? It passes an Executive Order making gold ownership illegal but buys up the illegal gold itself. That’s what Roosevelt did. When the government continued to print more money, it declared ownership of silver illegal a year later. Soon after the government confiscated all gold, the price rose by 40 percent. As if by magic, the US government had a lot more funds than it had before. What happens is that the government buys your gold with cash, then devalues the cash and raises the value of the gold. It wins, you lose.

While the government attributes artificial value to money, it can do and does the same to the value of gold. The government currently holds 261 million ounces of gold in reserve at marked on its book at $42.22 per ounce. That’s a total value of $11 billion. Or is it? The fair market value of gold today is around $1,300 per ounce. As Jim Rickards pointed out in the New Case For Gold, gold is actually what kept the Federal Reserve solvent in 2008.

Third world.

• Shock Figures From Top Thinktank Reveal Extent Of NHS Crisis (G.)

The NHS has among the lowest per capita numbers of doctors, nurses and hospital beds in the western world, a new study of international health spending has revealed. The stark findings come from a new King’s Fund analysis of health data from 21 countries, collected by the Organisation for Economic Cooperation and Development. They reveal that only Poland has fewer doctors and nurses than the UK, while only Canada, Denmark and Sweden have fewer hospital beds, and that Britain also falls short when it comes to scanners. “If the 21 countries were a football league then the UK would be in the relegation zone in terms of the resources we put into our healthcare system, as measured by staff, equipment and beds in which to care for patients,” said Siva Anandaciva, the King’s Fund’s chief analyst.

“If you look across all these indicators – beds, staffing, scanners – the UK is consistently below the average in the resources we give the NHS relative to countries such as France and Germany. Overall, the NHS does not have the level of resources it needs to do the job we all expect it to do, given our ageing and growing population, and the OECD data confirms that,” he added. The report concludes that, given the dramatic differences between Britain and other countries: “A general picture emerges that suggests the NHS is under-resourced.”

The thinktank’s research found that the UK has the third-lowest number of doctors among the 21 nations, with just 2.8 per 1,000 people, barely half the number in Austria, which has 5.1 doctors per 1,000 of population. Similarly, the UK has the sixth-smallest number of nurses for its population: just 7.9 per 1,000 people – way behind Switzerland, which has the most: 18 nurses, more than twice as many. With hospital beds, the UK has just 2.6 for every 1,000 people, just over a third of the number in Germany, which has the most – 8.1 beds – and which places the UK 18th overall out of the 21 countries which the OECD gathered figures for. The number of hospital beds in England has halved over the last 30 years and now stands at about 100,000 ..

How wrong can this go?

• Earthquakes, Lava Fissures Could Last For Months On Hawaii (R.)

More homes on Hawaii’s Big Island were destroyed on Saturday as eruptions linked to the Kilauea volcano increased, spewing lava into residential areas and forcing nearly 2,000 people to evacuate, officials said. Scientists forecast more eruptions and more earthquakes, perhaps for months to come, after the southeast corner of the island was rocked by a 6.9 tremor on Friday, the strongest on the island since 1975. The U.S. Geological Survey (USGS) said on Saturday that several new lava fissures had opened in the Leilani Estates subdivision of Puna District, about a dozen miles (19 km) from the volcano. Not all the fissures were still active, it added.

The Hawaiian Volcano Observatory said at midday local time on Saturday that “eruptive activity is increasing and is expected to continue.” Janet Babb, a spokeswoman for the observatory, said by telephone that the eruptions could carry on “for weeks or months.” Babb said the activity since Thursday is beginning to show similarities to another event in the area in 1955 that lasted for 88 days, when far fewer people lived near the volcano.

Rebalancing carbon: there’s too much inside the planet.

• CO2 Levels In Earth’s Atmosphere ‘Highest In 800,000 Years’ (Ind.)

The concentration of carbon dioxide in the atmosphere has reached its highest level in at least 800,000 years, according to scientists. In April, CO2 concentration in the atmosphere exceeded an average of 410 parts per million (ppm) across the entire month, according to readings from the Mauna Loa Observatory in Hawaii. This is the first time in the history of the observatory’s readings that a monthly average has exceeded that level. The Scripps Institution of Oceanography said that before the Industrial Revolution, carbon dioxide levels did not exceed 300ppm in the last 800,000 years.

The Keeling Curve, which plots the concentration of carbon dioxide in the atmosphere, shows a steady rise in CO2 levels in the atmosphere for decades. Scientists have warned levels of carbon dioxide are crossing a threshold which could lead to global warming beyond the “safe” level identified by the international community, fuelling a rise in sea levels. The latest reading shows a 30 per cent increase in carbon dioxide concentration in the global atmosphere since recording began in 1958. The first measurement was recorded as 315ppm. Carbon dioxide concentration exceeded 400ppm for the first time in 2013. Prior to 1800, atmospheric CO2 averaged about 280ppm, which demonstrates the effect of manmade emissions since the industrial revolution.

“By 1935, with as few as 60 breeding individuals left, the situation was so dire that the right whale became the first cetacean to be protected by law.”

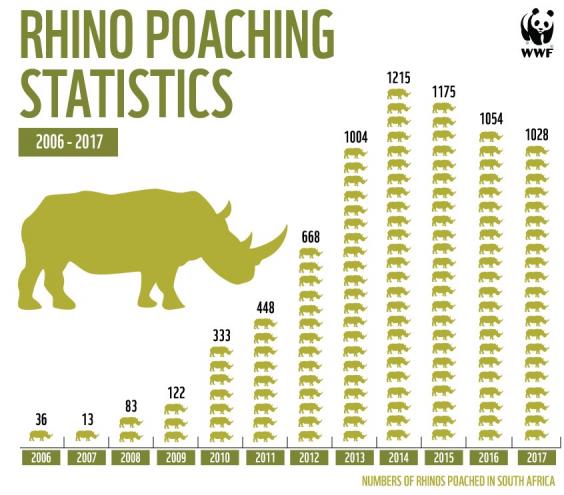

• Facing Extinction, The North Atlantic Right Whale Cannot Adapt. Can We? (G.)

As if to confound everyone, this past week Dr Charles “Stormy” Mayo and his team from the Provincetown Center for Coastal Studies reported seeing up to 150 right whales in Cape Cod Bay. Dr Mayo – who has been studying these animals for 40 years and has a scientist’s aversion to exaggeration – is stunned. “It is amazing for such a rare and utterly odd creature,” he tells me. All the more amazing since he knows this great gathering could be a final flourish. By 2040, the North Atlantic right whale may be gone. He hesitates, then uses the e-word: extinction. How can such a huge mammal simply disappear within reach of the richest and most powerful nation on earth?

Shifting food sources – due to climate change – are leading whales to areas where maritime industries are unused to them. In the past 12 months, 18 rights have died after ship strikes or entanglement in fishing gear. With as few as 430 animals left, 100 of them breeding females in a reduced gene pool, the species is unsustainable. The right whale may be the strangest beast in the ocean. Vast and rotund, its gigantic mouth is fringed with two-metre strips of baleen, once “harvested” by humans to furnish Venetian blinds and corset stays but used by the whale to strain its diet of rice-sized zooplankton from the sea.

These bizarre animals are not easily known or imagined. They live far longer than us – like its Arctic cousin, the bowhead, the right whale may reach 200, perhaps more. Individuals could be older than constitutional America. They exist beyond us in time, dimension and experience. If we lose the right whale, we lose part of our planet’s biological history. [..] By 1935, with as few as 60 breeding individuals left, the situation was so dire that the right whale became the first cetacean to be protected by law. But by the start of this century, the numbers seemed to recover. Shipping lanes were shifted and fishing industries took on board the whale’s protected status. It even got its own air exclusion zone. “Like a Hollywood star,” as John Waters quipped to me.

Eubalaena glacialis with calf