DPC Broadway at night from Times Square 1911

“A report in the U.S. showed manufacturing contracted at the fastest pace in more than six years..”

• The $289 Billion Wipeout That Blindsided US Bulls (BBG)

As losses snowballed in U.S. stocks around midday, the best thing U.S. bulls had to say about the worst start to a year since 2001 was that there are 248 more trading days to make it up. “My entire screen is blood red – there’s nothing good to talk about,” Phil Orlando at Federated Investors said around noon in New York, as losses in the Dow Jones Industrial Average approached 500 points. “On days like today you need to take a step back, take a deep breath and let the rubble fall.” Taking a break and breathing helped: the Dow added almost 150 points in the last 30 minutes to pare its loss to 276 points.

Still, investors returning to work from holidays were greeted by the sixth-worst start to a year since 1927 for the Standard & Poor’s 500 Index, which plunged 1.5% to erase $289 billion in market value as weak Chinese manufacturing data unnerved equity markets. The selloff started in China and persisted thanks to a flareup in tension between Saudi Arabia and Iran. A report in the U.S. showed manufacturing contracted at the fastest pace in more than six years added to concerns that growth is slowing.

50% seems mild.

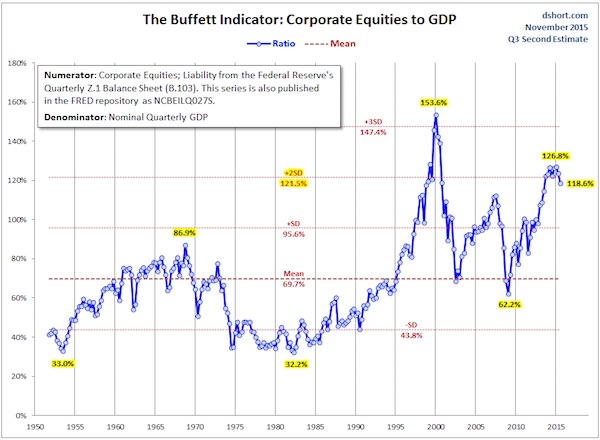

• A Stock Market Crash Of 50%+ Would Not Be A Surprise (BI)

By many, many historically predictive valuation meassures, stocks are overvalued to the tune of 75%-100%. In the past, when stocks have been this overvalued, they have often “corrected” by crashing (1929, 1987, 2000, 2007, for example) . They have also sometimes corrected by moving sideways and down for a long, long time (1901-1920, 1966-1982, for example). After long eras of over-valuation, like the period we have been in since the late 1990s (with the notable exceptions of the lows after the 2000 and 2007 crashes), stocks have also often transitioned into an era of undervaluation, often one that lasts for a decade or more. In short, stocks are so expensive on historically predictive measures that the annual returns over the next decade are likely to net out to about 0% per year.

How we get there is anyone’s guess. But… A stock-market crash of ~50% from the peak would not be a surprise. It would also not be the “worst-case scenario,” by any means. The “worst-case scenario,” which has actually been a common scenario over history, is that stocks would drop by, say 75% peak to trough. Those are the facts. Why isn’t anyone talking about those facts? Three reasons: First, as mentioned, no one in the financial community likes to hear bad news or to be the bearer of bad news when it comes to stock prices. It’s bad for business. Second, valuation is nearly useless as a market-timing indicator. Third, yes, there is a (probably small) chance that it’s “different this time,” and all the historically predictive valuation measures are out-dated and no longer predictive. The third reason is the one that everyone who is bullish about stocks these days is implicitly or explicitly relying on: “It’s different this time.”

At least I’m not alone in my assessment of China.

• Bank of America Thinks The Probability Of A Chinese Crisis Is 100% (ZH)

Some sobering words about China’s imminent crisis, not from your friendly neighborhood doom and gloom village drunk, but from BofA’s China strategist David Cui. Excerpted from “2016 Year-Ahead: what may trigger financial instability”, a must-read report for anyone interested in learning how China’s epic stock market experiment ends.

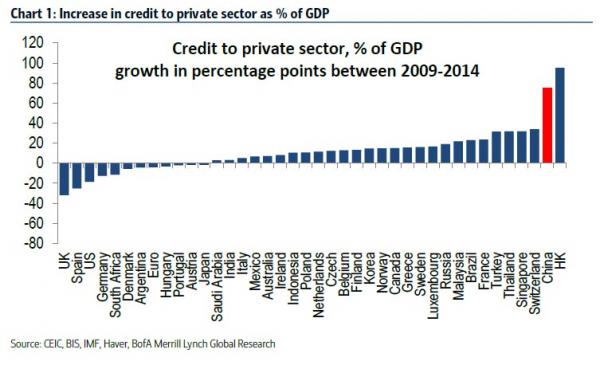

A case for financial instability – It’s widely accepted that the best leading indicator of financial instability is rapid debt to GDP growth over a period of several years as it’s a strong sign of significant malinvestment. Based on Bank of International Settlement’s (BIS) private debt data and the financial instability episodes identified in “This time is different”, a book by Reinhart & Rogoff, we estimate that once a country grows its private debt to GDP ratio by over 40% within a period of four years, there is a 90% chance that it may run into financial system trouble. The disturbance can be in the form of banking sector re-cap (with or without a credit crunch), sharp currency devaluation, high inflation, sovereign debt default or a combination of a few of these. As Chart 1 demonstrates, China’s private debt to GDP ratio rose by 75% between 2009 and 2014 (i.e., since the Rmb4tr stimulus), by far the highest in the world (we suspect a significant portion of the debt growth in HK went to China). At the peak speed, over four years from 2009 to 2012, the ratio in China rose by 49%.

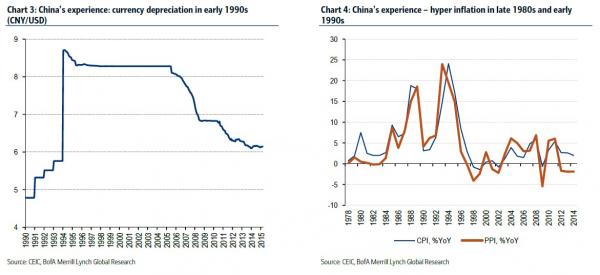

Other than sovereign debt default, China has experienced all the other forms of financial instability since the open-door reform started in late 1970s, including a sharp currency devaluation in the early 1990s (Chart 3) and hyper-inflation in the late 1980s and early 1990s (Chart 4). China also needed to write-off bad debt and recap its banks every decade or so. Banking sector NPL reached some 40% in the late 1990s and early 2000s and the government had to strip off some 20% of GDP equivalent of bad debt from the banking system between 1999 and 2005.

When the debt problem gets too severe, a country can only solve it by devaluation (via the export channel), inflation (to make local currency debt worth less in real terms), writeoff/re-cap or default. We judge that China’s debt situation has probably passed the point of no-return and it will be difficult to grow out of the problem, particularly if the growth continues to be driven by debt-fueled investment in a weak-demand environment. We consider the most likely forms of financial instability that China may experience will be a combination of RMB devaluation, debt write-off and banking sector re-cap and possibly high inflation. Given the sizeable and unstable shadow banking sector in China and the potential of capital flight, we also think the risk of a credit crunch developing in China is high. In our mind, the only uncertainty is timing and potential triggers of such instabilities.

“The economy is poor, stock valuation is still high, and the yuan keeps sliding. The market drop is overdue.”

• China Injects $20 Billion Into Markets, Hints At Curbs On Share Sales (Reuters)

The Chinese authorities were battling to prop up the country’s stock markets on Tuesday after a surprise cash injection from the central bank failed to calm jitters among investors. The unexpected 130 billion yuan ($19.94 billion) injection by the central bank – the largest such move to encourage more borrowing since September – came after a 7% crash on Monday triggered a “circuit-breaker” mechanism to suspend trading for the day. The measures initially helped Chinese mainland indexes recover quickly from a steep initial fall but the selling gained the upper hand in the afternoon to leave the Shanghai Composite index down 2.16% at 5.30am GMT. Elsewhere in Asia Pacific, Japanese stocks fell for a second day in choppy trade to their lowest point since October. In Australia the ASX/S&P200 closed down 1.6% as the outlook for China continued to drag on the country’s resource-heavy market.

However, markets in Europe and the US were expected to open higher on Tuesday, according to futures trading. Beijing’s intervention on Tuesday appeared timed to reassure Chinese retail investors, who are always sensitive to liquidity signals, that the bank would support the market with cash. The People’s Bank of China offered the liquidity in the form of what are known as seven-day reverse repos at an interest rate of 2.25%, according to the statement. China’s securities regulator said it was studying rules to regulate share sales by major shareholders and senior executives in listed companies. This would address concerns that the end of a six-month lockup on share sales by major institutional investors timed for this Friday – and scheduled to free up an estimated 1.2 trillion yuan worth of shares for sale next Monday – would result in a massive institutional evacuation from stocks.

The PBOC also published nine new financial service standards that will come into effect on 1 June, to protect consumers. The China securities regulatory commission also defended the functioning of the new “circuit breaker” policy that caused Chinese stock markets to suspend trade on Monday, triggering the mechanism on the very first day it came into effect. While some analysts criticised the design of the circuit breaker, saying it inadvertently encouraged bearish sentiment, the regulator said the mechanism had helped calm markets and protect investors – although it said the mechanism needed to be further improved. Analysts and investors warned that the success of the interventions was not assured. Repeated and often heavy handed interventions by Beijing have kept stock valuations at what many consider excessively high given the slowing economy and falling corporate profits.

“We’ve been waiting for a market drop like this for a long time,” said Samuel Chien, a partner of Shanghai-based hedge fund manager BoomTrend Investment Management. “The economy is poor, stock valuation is still high, and the yuan keeps sliding. The market drop is overdue.”

XI didn’t sleep well last night.

• China Said to Intervene in Stock Market After $590 Billion Rout (BBG)

China moved to support its sinking stock market as state-controlled funds bought equities and the securities regulator signaled a selling ban on major investors will remain beyond this week’s expiration date, according to people familiar with the matter. Government funds purchased local stocks on Tuesday after a 7% tumble in the CSI 300 Index on Monday triggered a market-wide trading halt, said the people, who asked not to be identified because the buying wasn’t publicly disclosed. The China Securities Regulatory Commission asked bourses verbally to tell listed companies that the six-month sales ban on major stockholders will remain valid beyond Jan. 8, the people said.

The moves suggest that policy makers, who took unprecedented measures to prop up stocks during a mid-year rout, are stepping in once again to end a selloff that erased $590 billion of value in the worst-ever start to a year for the Chinese market. Authorities are trying to prevent volatility in financial markets from eroding confidence in an economy set to grow at its weakest annual pace since 1990. The sales ban on major holders, introduced in July near the height of a $5 trillion crash, will stay in effect until the introduction of a new rule restricting sales, the people said. Listed companies were encouraged to issue statements saying they’re willing to halt such sales, they said.

Was already down 4.7% in 2014. Also: “The country’s top economic planner said last month that November rail freight volumes fell 15.6% from a year earlier.”

• China Rail Freight Down 10.5% In 2015, Biggest Ever Annual Fall (Reuters)

The total volume of goods transported by China’s national railway dropped by a tenth last year, its biggest ever annual decline, business magazine Caixin reported on Tuesday, a figure likely to fan concerns over how sharply the economy is really slowing. Citing sources from railway operator National Railway Administration, Caixin said rail freight volumes declined 10.5% year-on-year to 3.4 billion tonnes in 2015. In comparison, volumes fell 4.7% in 2014. The amount of cargo moved by railways around China is seen as an indicator of domestic economic activity. The country’s top economic planner said last month that November rail freight volumes fell 15.6% from a year earlier.

Weighed down by weak demand at home and abroad, factory overcapacity and cooling investment, China is expected to post its weakest economic growth in 25 years in 2015, with growth seen cooling to around 7% from 7.3% in 2014. But some China watchers believe real economic growth is already much weaker than official data suggest, pointing to falling freight volumes and weak electricity consumption among other measures. Power consumption in November inched up only 0.6% from a year earlier. A private survey published on Monday showed that the factory activity contracted for the 10th straight month in December and at a sharper pace than in November, suggesting a continued gradual loss of momentum in the world’s second-largest economy.

If this is only halfway true, Obstfeld just labeled himself, and the IMF, grossly incompetent: “Global spillovers from China’s slowdown have been “much larger than we could have anticipated..”

• China Could ‘Spook’ Global Markets Again in 2016: IMF Chief Economist (BBG)

China could once again “spook” global financial markets in 2016, the IMF’s chief economist warned. Global spillovers from China’s slowdown have been “much larger than we could have anticipated,” affecting the global economy through reduced imports and weaker demand for commodities, IMF Economic Counselor Maurice Obstfeld said in an interview posted on the fund’s website. After a year in which China’s efforts to contain a stock-market plunge and make its exchange rate more market-based roiled markets, the health of the world’s second-biggest economy will again be a key issue to watch in 2016, Obstfeld said. “Growth below the authorities’ official targets could again spook global financial markets,” he said as global equities on Monday got off to a rough start to the year.

“Serious challenges to restructuring remain in terms of state-owned enterprise balance-sheet weaknesses, the financial markets, and the general flexibility and rationality of resource allocation.” Obstfeld, who took over as chief economist at the International Monetary Fund in September, said emerging markets will also be “center stage” this year. Currency depreciation has “proved so far to be an extremely useful buffer for a range of economic shocks,” he said. “Sharp further falls in commodity prices, including energy, however, would lead to even more problems for exporters, including sharper currency depreciations that potentially trigger still-hidden balance sheet vulnerabilities or spark inflation,” he said. With emerging-market risks rising, it will be critical for the U.S. Federal Reserve to manage interest-rate increases after lifting its benchmark rate in December for the first time since 2006, Obstfeld said.

Q: who suffers the losses on the investments?

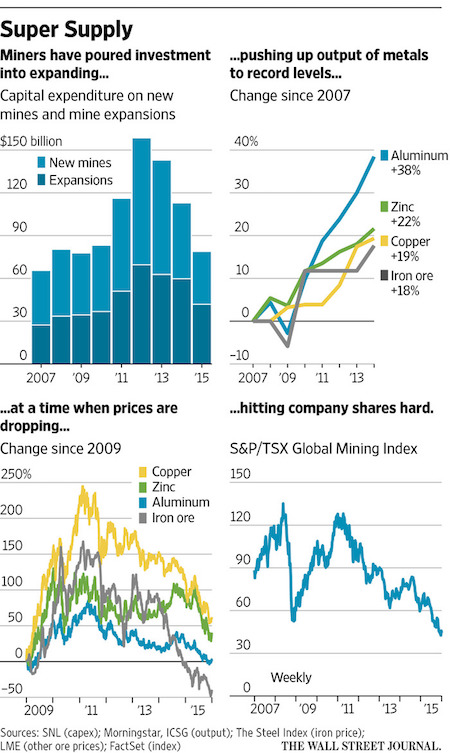

• Supermines Add to Supply Glut of Metals (WSJ)

Cerro Verde, Peru – In this volcanic desert, a dusty moonscape patrolled by bats, snakes and guanacos, America’s biggest miner is piling on to the new force in industrial resources: supermines. It’s a strategy that could be driving miners into the ground. Freeport-McMoRan is completing a yearslong $4.6 billion expansion that will triple production at its Cerro Verde copper mine, turning a once-tiny, unprofitable state mine into one of the world’s top five copper producers. As Cerro Verde’s towering concrete concentrators grind out copper to be made into pipes and wires in Asia, it will add to production coming from newly built giant mines around the world, in a wave of supply that is compounding the woes of the depressed mining sector.

Slowing growth in China and other emerging markets has dragged metals prices into a deep downturn, just a few years after mining companies and their investors bet billions on a so-called supercycle, the seemingly never-ending growth in demand for commodities. Back then, miners awash in cheap money set out to build the biggest mines in history, extracting iron ore in Australia, Brazil and West Africa, and copper from Chile, Peru, Indonesia, Arizona, Mongolia and the Democratic Republic of Congo. They also expanded production of minerals such as zinc, nickel and bauxite, which is mined to make aluminum. Those giant mines are now giving the industry an extra-bad hangover during the bust.

The big mines cost so much to build and extract minerals so efficiently that mothballing them is unthinkable—running them generates cash to pay down debts, and huge mines are expensive to simply maintain while idle. But as a result, their scale means they are helping miners dig themselves even deeper into the price trough by adding to a glut. The prolonged price slump has forced miners to make painful cuts. In December, Anglo American, which recently completed a supermine in Brazil that went over budget by $6 billion, announced 85,000 new job cuts, asset sales and a suspended dividend. On the same day, Rio Tinto, which has built supermines in Western Australia, cut spending plans, while in September, Glencore suspended its dividend and raised $2.5 billion in stock as part of a plan to cut debt.

Absolutely nuts.

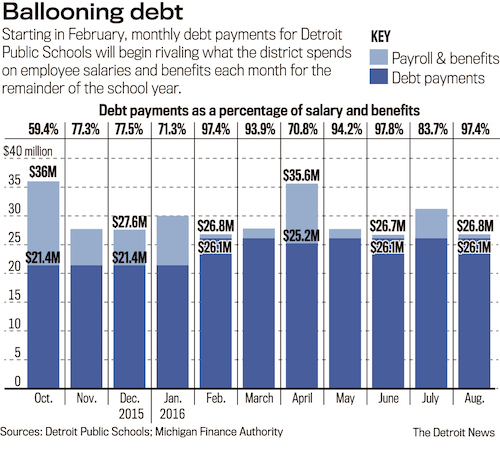

• Debt Payments Set To Balloon For Detroit Public Schools (DN)

The debt payments of Detroit Public Schools — already the highest of any school district in Michigan — are set to balloon in February to an amount nearly equal to the school district’s payroll and benefits as the city school system teeters on the edge of insolvency. Detroit Public Schools has to begin making monthly $26 million payments starting in less than a month to chip away at the $121 million borrowed this school year for cash flow purposes and $139.8 million for operating debts incurred in prior years. The city school system’s total debt payments are 74% higher from last school year. The debt costs continue to mount while Gov. Rick Snyder and the Legislature remain at odds over how to rescue Michigan’s largest school district.

A bankruptcy of the district could leave state taxpayers on the hook for at least $1.5 billion in DPS debt. The school district’s payroll and health care benefits are projected to cost $26.8 million in February — meaning the debt payments will be 97% of payroll. General fund operating debt payments that exceed 10% of payroll are “a major warning flag,” municipal bond analyst Matt Fabian said. “That’s extremely high,” said Fabian, managing director of Municipal Market Advisors in Concord, Massachusetts, who also followed the city of Detroit’s bankruptcy case. “That’s no longer, really, a normal school district. The school district has turned into a debt-servicing entity. It’s making its own mission impossible.” As a result, the Detroit district won’t have enough cash to pay any bills in four months.

As a result of holiday spending?

• New Year Brings Financial Headache For Millions Of British Families (Guardian)

More than 2.5 million families in England are being forced to cut back on essentials such as heating and clothing this winter to pay their rent or mortgage, according to housing charity Shelter. Its research also found that one in 10 parents were worried about whether they would be able to afford to meet their housing payments this month. The charity’s findings coincided with separate research from National Debtline showing that more than 5.5 million Britons said they were likely to fall behind with their finances in January as a result of Christmas spending. The two surveys underline the strain that many individuals and families are under as the new year begins, with some so worried about their situation that they sought online advice on Boxing Day.

As part of the Shelter research, YouGov questioned more than 4,500 adults during November, including around 850 parents with children aged 18 and under. It found that 27% of parents – the equivalent of almost 2.7 million people in England – said they had already cut back on either using energy to heat their home or buying warm clothing to help meet their rent or mortgage payments this winter. Around 10% of parents said they were worried about being able to afford to pay their monthly rent or mortgage, while 15% told the researchers they were already planning to cut back on buying festive food, or had used savings meant for Christmas presents to help meet their housing costs this winter. Shelter said a shortage of affordable homes had left many families struggling with “sky-high” housing costs, and was part of the reason why more than 100,000 people had sought advice on housing debt from its online, phone-based and face-to-face services in the past year.

When will Brazil blow up? How on earth can the country host the Olympics?

• Brazil Heads for Worst Recession Since 1901 (BBG)

Brazil’s economy will contract more than previously forecast and is heading for the deepest recession since at least 1901 as economic activity and confidence sink amid a political crisis, a survey of analysts showed. Latin America’s largest economy will shrink 2.95% this year, according to the weekly central bank poll of about 100 economists, versus a prior estimate of a 2.81% contraction. Analysts lowered their 2016 growth forecast for 13 straight weeks and estimate the economy contracted 3.71% last year. Brazil’s policy makers are struggling to control the fastest inflation in 12 years without further hamstringing a weak economy.

Finance Minister Nelson Barbosa, who took the job in December, has faced renewed pressure to moderate austerity proposals aimed at bolstering public accounts and avoiding further credit downgrades. Impeachment proceedings and an expanding corruption scandal have also been hindering approval of economic policies in Congress. “We’re now taking into account a very depressed scenario,” Flavio Serrano, senior economist at Haitong in Sao Paulo, said by phone. Central bank director Altamir Lopes said on Dec. 23 the institution will adopt necessary policies to bring inflation to its 4.5% target in 2017.

Less than a week later, the head of President Dilma Rousseff’s Workers’ Party, Rui Falcao, said Brazil should refrain from cutting investments and consider raising its inflation target to avoid higher borrowing costs. Consumer confidence as measured by the Getulio Vargas Foundation in December reached a record low. Business confidence as measured by the National Industry Confederation fell throughout most of last year, rebounding slightly from a record low in October. The last time Brazil had back-to-back years of recession was 1930 and 1931, and has never had one as deep as that forecast for 2015 and 2016 combined, according to data from national economic research institute IPEA that dates back to 1901.

“..the automaker will seek to negotiate a lower penalty by arguing that the maximum would be “crippling to the company and lead to massive layoffs..”

• Volkswagen Faces Billions In Fines As US Sues In Emissions Scandal (Reuters)

The U.S. Justice Department on Monday filed a civil lawsuit against Volkswagen for allegedly violating the Clean Air Act by installing illegal devices to impair emission control systems in nearly 600,000 vehicles. The allegations against Volkswagen, along with its Audi and Porsche units, carry penalties that could cost the automaker billions of dollars, a senior Justice Department official said. VW could face fines in theory exceeding $90 billion – or as much as $37,500 per vehicle per violation of the law, based on the complaint. In September, government regulators initially said VW could face fines in excess of $18 billion. “The United States will pursue all appropriate remedies against Volkswagen to redress the violations of our nation’s clean air laws,” said Assistant Attorney General John Cruden, head of the departments environment and natural resources division.

The Justice Department lawsuit, filed on behalf of the Environmental Protection Agency, accuses Volkswagen of four counts of violating the U.S. Clean Air Act, including tampering with the emissions control system and failing to report violations. The lawsuit is being filed in the Eastern District of Michigan and then transferred to Northern California, where class-action lawsuits against Volkswagen are pending. “We’re alleging that they knew what they were doing, they intentionally violated the law and that the consequences were significant to health,” the senior Justice Department official said. The Justice Department has also been investigating criminal fraud allegations against Volkswagen for misleading U.S. consumers and regulators. Criminal charges would require a higher burden of proof than the civil lawsuit.

The civil lawsuit reflects the expanding number of allegations against Volkswagen since the company first admitted in September to installing cheat devices in several of its 2.0 liter diesel vehicle models. The U.S. lawsuit also alleges that Volkswagen gamed emissions controls in many of its 3.0 liter diesel models, including the Audi Q7, and the Porsche Cayenne. Volkswagen’s earlier admissions eliminate almost any possibility that the automaker could defend itself in court, Daniel Riesel of Sive, Paget & Riesel P.C, who defends companies accused of environmental crimes, said. To win the civil case, the government does not need to prove the degree of intentional deception at Volkswagen – just that the cheating occurred, Riesel said. “I don’t think there is any defense in a civil suit,” he said. Instead, the automaker will seek to negotiate a lower penalty by arguing that the maximum would be “crippling to the company and lead to massive layoffs,” Riesel said.

This can -re: will- happen all over the EU.

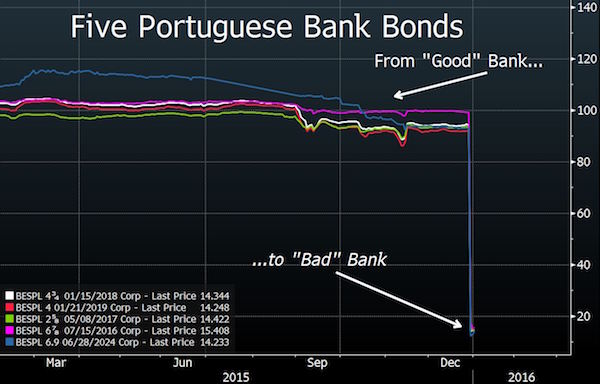

• Portugal’s Bank Bail-In Sets a Dangerous Precedent (BBG)

As Europe belatedly gets around to repairing its weakest banks, investors who have lent to financial institutions by buying bonds face a brave new world. Their money can effectively be confiscated to plug balance-sheet holes. Recent events in Portugal suggest that the authorities should be wary of treating bondholders as piggybanks, or risk destroying a key source of future funds for the finance industry. Let’s begin with the “what” before we get to the “why.” Here’s what happened to the prices of five Portuguese bank bonds in the past few days: Picture the scene. You left the office on Dec. 29 owning Portuguese bank debt that was trading at about 94% of face value. In less than 24 hours, you lost 80% of your money. So what happened? Last year, Portugal divided Banco Espirito Santo, previously the nation’s largest lender, into a “good” bank and a “bad” bank.

If you owned any of those five bonds on Tuesday, you were owed money by Novo Banco, the good bank. On Wednesday, you were told that your bonds had been transferred to BES, the bad bank. The Portuguese central bank selected five of Novo Banco’s 52 senior bonds, worth about €1.95 billion, and reassigned them – thus backfilling a €1.4 billion hole in the “good” bank’s balance sheet that had been revealed in November by the ECB’s stress tests of the institution. At the time of those tests, the value of Novo Banco bonds rose because the capital shortfall was lower than some investors had feared, and the good bank was widely expected to be able to mend the deficit by selling assets. Instead, the Dec. 30 switcheroo means selected bondholders are footing that bill.

Here is where the shoe pinches. The documentation for senior debt typically stipulates that all such debt is what’s called “pari passu”; that is, all securities rank equally, and none should get preferential treatment. But by moving just five bonds off the healthy bank’s balance sheet, Portugal has destroyed the principle of equality between debt securities. There’s nothing inherently wrong with “bailing in” bondholders who’ve lent to a failing institution. It’s certainly preferable to the old solution of using taxpayers’ money to shore up failed banks, and it’s enshrined in the EU’s new Bank Resolution and Recovery Directive, which came into effect on Jan. 1. But the principle of equal treatment for ostensibly identical securities is a key feature of the bond market. If investors fear they’re at the mercy of capricious regulatory decisions in a restructuring, they’ll think more than twice before lending to banks.

China’s take on Russia’s strategy document.

• Russia Stands Up To Western Threats, Pivots To East (Xinhua)

Russia has updated a bunch of strategies to fight against threats to its national security, as demonstrated by the document “About the Strategy of National Security of the Russian Federation,” which President Vladimir Putin signed on New Year’s Eve. Amid ongoing clashes with the West over Ukraine and other fronts, leaders of the country have chosen to stand up to Western threats, while attaching growing importance to security cooperation across the Asia-Pacific. On the one hand, the West has shown substantial willingness, following visits to Moscow by leaders or senior representatives of major Western powers, to work with the Kremlin on a global anti-terror campaign and a political settlement of the protracted conflict in Syria.

On the other hand, one can hardly deny new friction and tensions would arise during this engagement, considering the fact that the West remains vigilant about a Russia that aspires to regain its global stature. Taking into account the enormous changes in the geopolitical, military and economic situation, the document, a revised version of the 2009 one, calls for the consolidation of “Russia’s status of a leading world power.” Russia believes it is now confronted with a host of threats, both traditional and new, such as the expansion of NATO, military build-up and deployment in its neighboring countries, a new arms race with the United States, as well as attempts to undermine the Moscow regime and to incite a “color revolution” in the country. Last year has witnessed repeated saber-rattling between Russia and NATO.

The expansion of the alliance, which saw a need to adapt to long-term security challenges with special interests in deploying heavy weapons in Eastern Europe and the Baltic countries, was blamed for the current military situation in the region and its cooling relationship with Moscow that has warned it would respond to any military build-up near Russian borders. At the same time, sanctions imposed by the United States and its allies over Moscow’s takeover of the Black Sea peninsula Crimea and its alleged role in the Ukraine crisis, together with the ongoing fall in oil prices, have once again drawn attention to Russia’s over-reliance on exports of raw materials and high vulnerability to the fluctuations in foreign markets, which the new document described as “main strategic threats to national security in the economy.”

Moreover, the daunting provocation and infiltration of the Islamic State terrorist group have just made Russia’s security concerns even graver. Domestically, Moscow has tightened security measures since Islamic extremists threatened attacks and bloodshed in the country. Globally, it has long been calling for a unified coalition, including collaboration with the United States, to double down on the anti-terror battle. As antagonism between Russia and the West currently shows little signs of receding, Moscow has begun to turn eastward, a strategic transition that is reflected by the national security blueprint. Mentioning specific relations with foreign countries, the document noted firstly that the strategic partnership of coordination with China is a key force to uphold global and regional stability. It then mentioned the country’s “privileged strategic partnership” with India.

Can’t really discuss this without involving Russia.

• Will US Fall For Saudi’s Provocation In Killing Of Shia Cleric? (Reuters)

There should be little doubt that Saudi Arabia wanted to escalate regional tensions into a crisis by executing Shi’ite cleric Nimr al-Nimr. On the same day, Riyadh also unilaterally withdrew from the ceasefire agreement in Yemen. By allowing protestors to torch the Saudi embassy in Tehran in response, Iran seems to have walked right into the Saudi trap. If Saudi Arabia succeeds in forcing the US into the conflict by siding with the kingdom, then its objectives will have been met. It is difficult to see that Saudi Arabia did not know that its decision to execute Nimr would cause uproar in the region and put additional strains on its already tense relations with Iran. The inexcusable torching of the Saudi embassy in Iran -Iranian President Hassan Rouhani condemned it and called it “totally unjustifiable,” though footage shows that Iranian security forces did little to prevent the attack- in turn provided Riyadh with the perfect pretext to cut diplomatic ties with Tehran.

With that, Riyadh significantly undermined U.S.-led regional diplomacy on both Syria and Yemen. Saudi Arabia has long opposed diplomatic initiatives that Iran participated in– be it in Syria or on the nuclear issue — and that risked normalizing Tehran’s regional role and influence. Earlier, Riyadh had successfully ensured Iran’s exclusion from Syria talks in Geneva by threatening to boycott them if Iran was present, U.S. officials have told me. In fact, according to White House sources, President Barack Obama had to personally call King Salman bin Abdulaziz Al Saud to force the Saudis to take part in the Vienna talks on Syria this past fall. Now, by having cut its diplomatic relations with Iran, the Saudis have the perfect excuse to slow down, undermine and possibly completely scuttle these U.S.-led negotiations, if they should choose to do so.

From the Saudi perspective, geopolitical trends in the region have gone against its interests for more than a decade now. The rise of Iran – and Washington’s decision to negotiate and compromise with Tehran over its nuclear program – has only added to the Saudi panic. To follow through on this way of thinking, Riyadh’s calculation with the deliberate provocation of executing Nimr may have been to manufacture a crisis — perhaps even war — that it hopes can change the geopolitical trajectory of the region back to the Saudi’s advantage. The prize would be to force the United States to side with Saudi Arabia and thwart its slow but critical warm-up in relations with Tehran. As a person close to the Saudi government told the Wall Street Journal: “At some point, the U.S. may be forced to take sides [between Saudi Arabia and Iran]… This could potentially threaten the nuclear deal.”

“The coming crackup will re-set the terms of civilized life to levels largely pre-techno-industrial.”

• Pretend to the Bitter End (Jim Kunstler)

Forecast 2016 There’s really one supreme element of this story that you must keep in view at all times: a society (i.e. an economy + a polity = a political economy) based on debt that will never be paid back is certain to crack up. Its institutions will stop functioning. Its business activities will seize up. Its leaders will be demoralized. Its denizens will act up and act out. Its wealth will evaporate. Given where we are in human history — the moment of techno-industrial over-reach — this crackup will not be easy to recover from; not like, say, the rapid recoveries of Japan and Germany after the brutal fiasco of World War Two. Things have gone too far in too many ways. The coming crackup will re-set the terms of civilized life to levels largely pre-techno-industrial. How far backward remains to be seen.

Those terms might be somewhat negotiable if we could accept the reality of this re-set and prepare for it. But, alas, most of the people capable of thought these days prefer wishful techno-narcissistic woolgathering to a reality-based assessment of where things stand — passively awaiting technological rescue remedies (“they” will “come up with something”) that will enable all the current rackets to continue. Thus, electric cars will allow suburban sprawl to function as the preferred everyday environment; molecular medicine will eliminate the role of death in human affairs; as-yet-undiscovered energy modalities will keep all the familiar comforts and conveniences running; and financial legerdemain will marshal the capital to make it all happen.

Oh, by the way, here’s a second element of the story to stay alert to: that most of the activities on-going in the USA today have taken on the qualities of rackets, that is, dishonest schemes for money-grubbing. This is most vividly and nauseatingly on display lately in the fields of medicine and education — two realms of action that formerly embodied in their basic operating systems the most sacred virtues developed in the fairly short history of civilized human endeavor: duty, diligence, etc. I’ve offered predictions for many a year that this consortium of rackets would enter failure mode, and so far that has seemed to not have happened, at least not to the catastrophic degree, yet.

I’ve also maintained that of all the complex systems we depend on for contemporary life, finance is the most abstracted from reality and therefore the one most likely to show the earliest strains of crackup. The outstanding feature of recent times has been the ability of the banking hierarchies to employ accounting fraud to forestall any reckoning over the majestic sums of unpayable debt. The lesson for those who cheerlead the triumph of fraud is that lying works and that it can continue indefinitely — or at least until they are clear of culpability for it, either retired, dead, or safe beyond the statute of limitations for their particular crime.

The same people who criticized Balkan countries for doing the same.

• Fortress Scandinavia Sinks Into Blame Game Over Refugee Crisis (BBG)

Gliding high above the Baltic Sea under pylons that stretch 669-feet into the air, the daily commute across Europe’s longest rail and road link was once a symbol of integration in the region. But for many of the 15,000 people who commute daily across the Oeresund Bridge between Malmoe, Sweden’s third-largest city, and Copenhagen, the trip to work and back just became a lot more difficult. On Monday, Sweden imposed identification checks on people seeking to enter by road, rail or ferry after the country was overwhelmed by a record influx of refugees. The development “doesn’t fit with anyone’s vision for the Oeresund region,” Ole Stavad, a former Social Democrat minister once in charge of Nordic cooperation, said in an interview. “This isn’t just about Oeresund, Copenhagen, Malmoe or Scania. It’s about all of Sweden and Denmark.”

He predicts economic pain for both countries “unless this issue is resolved.” If not even Sweden and Denmark can get along, that doesn’t bode well for the rest of Europe, which is now grappling with the ever-present threat of terrorism, a groundswell in nationalism and sclerotic economic growth. And the ripple effects are already starting. Twelve hours after the Swedish controls came into force, Denmark introduced spot checks on its border with Germany, threatening the passport-free travel zone known as Schengen. The move, which has yet to be approved by Schengen’s guardian, the EU, has not pleased Berlin. And mutual recriminations are flying in Scandinavia. The Danes say they were forced to impose their measures after Sweden enforced its controls.

The Swedes blame the Danes for not sharing the burden of absorbing refugees. Sweden received around 163,000 asylum applications in 2015, compared with Denmark’s 18,500. The controls are placing an unexpected burden on workers who had bought into the idea of an international business area of 3.7 million inhabitants. The Malmoe-based Oeresund Institute, a think-tank, estimates the daily cost of checks on commuters alone are 1.3 million kroner ($190,000). Denmark’s DSB railway says it costs it 1 million kroner in lost ticket sales and expenses for travel across a stretch made famous by the popular Scandinavian crime series “The Bridge.”

“..in an advanced state of decomposition..” Makes you wonder what the real death toll is, as opposed to the official one.

• Bodies Of Four Migrants Found In Eastern Aegean (Kath.)

Greek coast guard officers found the bodies of four people, thought to be migrants, in the sea near the islands of Fournoi in the eastern Aegean. The bodies, of three men and one woman, were found on Sunday in an advanced state of decomposition, according to authorities. The coast guard also rescued 160 migrants and arrested two traffickers off Samos on Sunday.

And on and on.

• Nine Drowned Refugees Wash Up On Turkish Beach (AP)

A Turkish news agency says the bodies of nine drowned migrants, including children, have washed up on a beach on Turkey’s Aegean coast after their boat capsized in rough seas. The Dogan news agency says the bodies were discovered early on Tuesday in the resort town of Ayvalik, from where migrants set off on boats to reach the Greek island of Lesvos. Turkish coasts guards were dispatched to search for possible survivors. Eight migrants were rescued. Dogan video footage showed a body, still wearing a life jacket, being pulled from the sea onto the sandy beach. There was no immediate information on the migrants’ nationalities.

Home › Forums › Debt Rattle January 5 2016