Russell Lee Sign Along the Road Near Capulin New Mexico 1939

Shaky, but give it time before deciding.

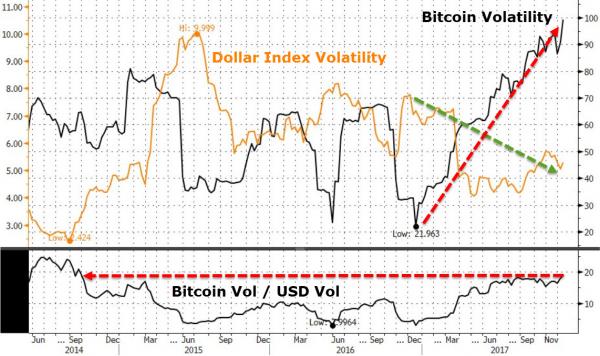

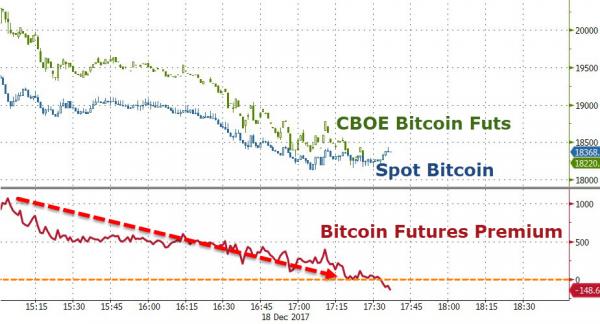

• Bitcoin Futures Crash Over $2000 From Open (ZH)

Update: Bitcoin and Bitcoin Futures have collapsed since the futures opened…

Dropping over $2200 to converge with spot…

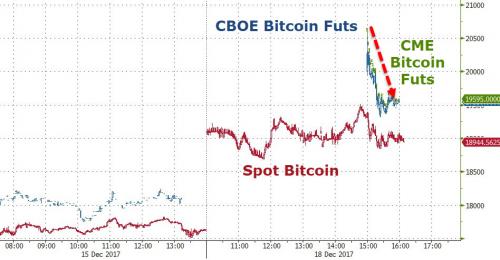

Both CME and CBOE Bitcoin Futures contracts opened above $20,000 this evening (with Bitcoin spot hovering around $19,000). However, as soon as trading started, Bitcoin futures got hammered lower.

Those expecting a surge in futs volumes on the CME vs the CBOE will be disappointed: In fact, spoting actual trades in the first few minutes of trading is not heavy to say the least. Obviously Jan is seeing all the volume… And March not so much… (let alone the $1200 bid-offer spread).

The lack of trading will likely be a surprise to those who were expecting a more “vigorous” futures launch on the CME, such as Brooks Dudley, vice president of risk in New York at ED&F Man Capital Markets who told Bloomberg that “CME’s bitcoin contract may not be first, but they are a larger futures clearinghouse and we are looking forward to our clients trading their product on Sunday evening. Not all market participants have been able to short the Cboe bitcoin futures. We have allowed our clients to go long or short to take advantage of dislocations between the futures and the underlying spot market.” For now, nobody appears to be taking advantage of anything.

This seems to be a reasonable fear.

• Bitcoin’s Illiquidity Is Going To Be A Huge Problem (BI)

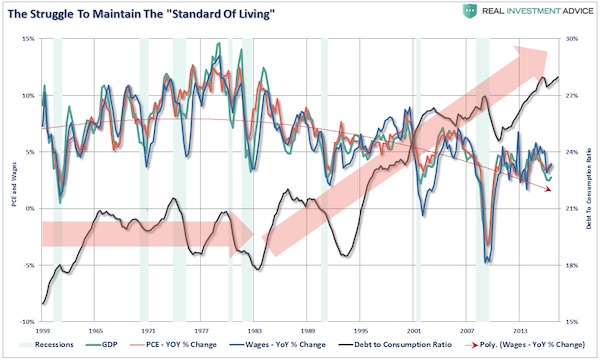

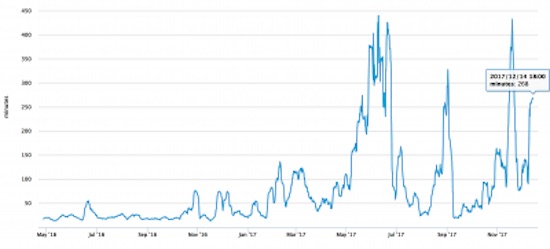

This chart shows a seven-day average of the total number of minutes it takes to confirm a bitcoin transaction, since May 2016. Like the price of bitcoin itself, transaction time has been rising as the months go by. At the time of writing, it took four-and-a-half hours to confirm a bitcoin trade, on average:

If you are holding bitcoin, and you’re worried that the price is a bubble – it cleared $17,000 last week – then bitcoin transaction times should really start to scare you. The price of bitcoin is shifting up and down by hundreds or thousands of dollars each day. No one knows what the price will be one hour from now, except that we know it will be very, very different. The schedule for the world’s largest ICO, the $500 million Dragon casino offering, has been pushed back two weeks, the company says, “due to the extreme congestion on both the Bitcoin and Ethereum Networks, [in which] ICO investors or contributors have faced significant challenges when transferring their Bitcoin and Ethereum to participate in the Dragon Pre-ICO.”

The transaction time is built into the system. Each transaction must be confirmed by six bitcoin miners, and that takes time. There is a finite number of miners, and the more transactions they have to confirm, the longer it takes as their network bandwidth gets filled. Worse, they charge for transactions and prioritise transactions based on price. Those who pay more get processed first. Imagine how bad this is going to get on the day some negative news hits the wires and the really significant holders of bitcoin decide, “I’ve had enough of this. I’ve made my money. I am bailing.” The majority of bitcoins are held by a tiny percentage of the market. 40% are held by 1,000 people. Those few major holders can crash the market whenever they want.

As anyone who remembers the market crashes of 2000 and 2008 knows, these things happen fast. Billions get wiped off the market in minutes. People who need to cash out now, but who are an hour or so behind the news, can lose their shirts. It is brutal. And blockchain just isn’t equipped to deal with it. Part of the increase in transaction time has, no doubt, been caused by the recent arrival of new, less knowledgeable investors who are coming into the market only because they have seen the headlines about the price of bitcoin going up, up, up. That gives us an idea of just how congested it will be on the way down. It will also be expensive. By some counts, transaction fees are doubling every three months. Ars Technica reported that fees reached $26 per trade recently.

Abe’s going to have to force his people to spend at gunpoint. And then find out they can’t.

• Japan Exports Boom, But Inflation Not Following Script (R.)

Japanese exports accelerated sharply in November, yet again pointing to growing momentum in the world’s third-biggest economy. There was just one catch: inflation remained stubbornly low and well off the central bank’s 2% target. The combination of steady growth and benign consumer prices mean the Bank of Japan will lag other major central banks in exiting crisis-era monetary stimulus, with analysts widely expecting BOJ Governor Haruhiko Kuroda to keep the liquidity tap wide open at a meeting later this week. “Inflation expectation is in a gradual recovery trend, but a gap between firm economic indicators and weak price indexes remains wide open,” said Yuichiro Nagai, economist at Barclays Securities.

Indeed, a BOJ survey on Monday showed companies’ inflation expectations heightened only a touch in December from three months ago, despite a tight labor market and business confidence at over a decade high. The persistently low inflation – with core prices running at an annual pace of 0.8% – was also hard to square off with the robust performance of Japan Inc., which has benefited from booming exports thanks to upbeat global demand. Separate data from the Ministry of Finance showed exports grew 16.2% in the year to November, beating a 14.6% gain expected by economists in a Reuters poll and accelerating from the prior month’s 14.0% increase, led by a stellar sales to China and Asia.

[..] “The BOJ will likely be forced into cutting its price projections once again in its quarterly outlook report in January. That will highlight a distance to an exit from the BOJ’s monetary stimulus,” said Barclays’ Nagai. The BOJ quarterly “tankan” survey on corporate inflation expectations survey showed companies expect consumer prices to rise 0.8% a year from now, slightly ahead of their projection for a 0.7% increase three months ago. The marginal nudge up in expectations underscored why inflation is still well off the BOJ’s target, with firms expecting consumer prices to rise an annual 1.1% three years from now and 1.1% five years ahead, unchanged from three months ago, the survey showed.

They’ll all go to the same places though.

• China Should Let Its Migrant Workers Roam Free (Pettis)

Over the past few weeks, people here in Beijing have been riveted by the so-called migrant “clean-out” – the government’s attempt to evict tens of thousands of migrant workers from their homes in the poorer parts of the city. What’s not being discussed, however, is how the crackdown could threaten one of the government’s other main priorities: managing debt. In China, mobility is legally restricted according to a household registration system, called the hukou. Chinese citizens receive an urban or rural hukou which officially identifies them as residents of a specific area and which allows them to live and work only in that area. Few if any of the migrant workers affected by the current sweep possess a Beijing hukou. Previously, this didn’t really matter.

For the past three decades, during the period of China’s furious economic growth, the country’s fastest-growing regions were desperate for cheap labor to fill factories and build infrastructure. With local government officials graded in large part on their ability to generate rapid growth, they largely ignored hukou restrictions and made migration into their cities easy. Hundreds of millions of workers traveled from their hukou areas to wherever there were jobs, in particular big cities such as Beijing, Shenzhen and Shanghai. The attitudes of local authorities may be changing now as the economy slows and officials become more concerned about unemployment and tensions over access to schools and other social services. One of the easiest tools the authorities have to manage both problems is to enforce the hukou rules that are already on the books.

In Beijing, the campaign is broadly popular among legal residents, who complain about overcrowding and rising rents. If it spreads, however, the crackdown could carry a significant macroeconomic cost. Enforcing the residency system nationally could severely limit labor mobility in China. This would in turn constrain monetary policy, which is critical to minimizing the cost to China of what’s likely to be a very difficult adjustment after decades of deeply unbalanced growth. How exactly would this happen? It’s important to remember that while China is a huge economy with a great deal of variety across different regions, it can nonetheless operate effectively with a single currency because it has most of the characteristics of an optimum currency area. In the 1960s, Columbia University’s Robert Mundell argued that four conditions were required to establish such an area.

They include high levels of labor mobility, high levels of capital mobility, a system of transfers that shares risks across the region, and coordinated business cycles. If labor mobility in China slows dramatically, growth rates in different parts of the country would diverge even more than they have already, rather than converge. As a result, monetary policies aimed at restraining credit growth overall might end up being too tight for some regions, leading to accelerating bankruptcies, and too loose for others, fueling out-of-control credit growth.

Inevitable.

• Desperate UK Homeowners Are Cutting Prices – Zoopla (G.)

Price cutting by homeowners desperate to shift their property in a slowing market has reached the highest levels in six years, according to an analysis by website Zoopla. Just over 35% of the homes marketed on the site have marked down their price in the hope of achieving a sale, with the biggest discounts in the London property market. The 35% figure compares with 29% just before the EU referendum in 2016, although it is below the levels recorded in the aftermath of the financial crisis. Sellers in Richmond and Kingston upon Thames in south-west London, both relatively prosperous areas, are among those to have made the deepest reductions in sale prices. Zoopla put the average mark-down by sellers in Kingston at £84,244.

It added that around half of all the properties for sale in Kingston and other nearby locations such as Mitcham and Camberley in Surrey have been reduced since their first listing, indicating that sellers are having to significantly readjust their hopes in the light of the Brexit vote. Lawrence Hall, at Zoopla, said it was good news for first-time buyers trying to get on the property ladder. “A slight rise in levels of discounting is to be expected at this time of year when house-hunters are likely to be delaying their property search until activity picks up in January,” Hall said. “Those on the look-out for a bargain should consider looking in Camberley or Kingston upon Thames in the south, or areas of the north-east – home to some of Britain’s biggest discounts.”

The average asking price reduction across the country currently stands at £25,562, according to Zoopla. The property website said towns in Scotland and northern England have proved more resilient to discounts. About 16% of homes in Edinburgh have been reduced in price, followed by 19% in Salford, 22% in Glasgow, and 25% in Manchester – all below the national average. In London, 39% of property listings have recorded a price reduction, up from 37% in July.

Banks want to be no. 1 consideration.

• UK Banks Tell May: A Canada-Style Brexit Deal Is Not Good Enough (G.)

Britain’s banks have written to Theresa May and Philip Hammond warning that a Canada-style free trade agreement with the EU post-Brexit is not ambitious enough and that alignment with EU rules on finance is crucial. The open letter from UK Finance, which represents major banks and other financial institutions, said the government must place the City at the centre of Brexit trade talks or risk dealing a major blow to the economy. “Ceta [the Comprehensive and Economic Trade Agreement between the EU and Canada] is an interesting template, but given the UK and the EU 27 start from a position of regulatory convergence that the UK and Canada didn’t have, we should seek to be far more ambitious,” said the letter.

The banks congratulated May on successfully negotiating a move to the second phase of withdrawal negotiations with the EU, which it called the first substantive evidence that a final deal could be agreed. But the trade body called on the government to avoid a cliff-edge Brexit and broker a smooth transition by focusing on alignment with Europe. “Pragmatic decisions to align the two regimes from a regulatory perspective … should be seen not as concessions, but as mechanisms to maximise benefits and choice within a deep regional capital market for the benefit of citizens and our economies,” it said. The alternative is “an unnecessary loss” of GDP, it added.

“A high degree of mutual cross-border market access is fundamental to the continued success of our financial services sector – and to the success of the economies and citizens which our sector serves in the UK and the EU 27,” UK Finance wrote.

Stimulus instead of austerity.

• Why Business Could Prosper Under A Corbyn Government (Pettifor)

[..] polling shows that the British people are disillusioned with the privatisation of key sectors, and favour nationalisation. They seek protection from the impact of deregulated market forces on their lives and livelihoods and on their children’s prospects. Business leaders have been made aware – by the IMF, the OECD and the Bank for International Settlements – that the Conservatives’ dependence on what David Cameron called his government’s “monetary radicalism and fiscal conservatism” has gone too far. There is now real concern about the long-term impact of quantitative easing which, coupled with austerity, has led to rocketing asset prices, falling wages and rising inequality. Those with access to central bank largesse have been enriched as the prices of assets have risen; while those without assets and dependent on earnings have suffered as incomes have fallen in real terms.

Falling incomes and spare capacity have not been good for business. While the Treasury, the Office for Budget Responsibility, an independent watchdog, and the National Institute of Economic and Social Research, a thinktank, have obsessed over supply-side issues, politicians have been persuaded by economists to sit on their hands, as Britain’s economy falters under huge, unused capacity. Howard Bogod, who runs a business with a turnover of under £20m, wrote recently: “Economic models have failed to explain why wages have not increased as unemployment has fallen so low. These same models are incorrect in their conclusions about productivity growth – indeed these two failures are linked. My conclusion based on observing actual businesses is that if nominal demand were to continue to grow then both productivity and real wages would start to grow more quickly, and economists would again be left scratching their heads.”

There is, nevertheless, anxiety over the scale of Labour’s public investment plans and their impact on the UK’s credit rating. But Labour has a record, in key respects, of being more fiscally conservative than Conservatives. For example, a review by economists at Policy Research in Macroeconomics of current budget deficits or surpluses (that is, excluding public investment) for the whole period before the global financial crisis, from 1956 to 2008, reveals that Conservative governments had an average annual surplus of 0.3% of GDP, while Labour governments had an average annual surplus of 1.1%.

“Steve Keen, dressed in a monk’s habit and wielding a blow up hammer, could be found outside the London School of Economics last week. ..”

• Heretics Welcome! Economics Needs A New Reformation (G.)

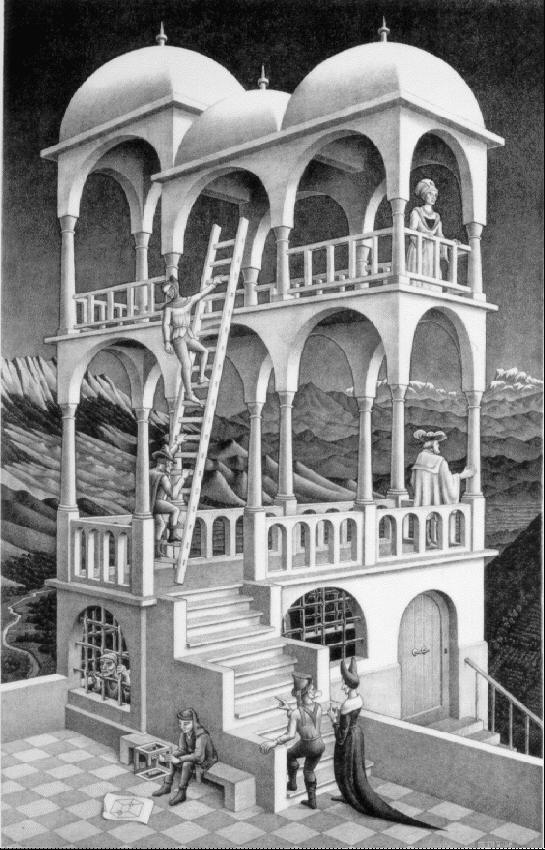

In October 1517, an unknown Augustinian monk by the name of Martin Luther changed the world when he grabbed a hammer and nailed his 95 theses to the door of the Castle Church in Wittenberg. The Reformation started there. The tale of how the 95 theses were posted is almost certainly false. Luther never mentioned the incident and the first account of it didn’t surface until after his death. But it makes a better story than Luther writing a letter (which is what probably happened), and that’s why the economist Steve Keen, dressed in a monk’s habit and wielding a blow up hammer, could be found outside the London School of Economics last week.

Keen and those supporting him (full disclosure: I was one of them) were making a simple point as he used Blu Tack to stick their 33 theses to one of the world’s leading universities: economics needs its own Reformation just as the Catholic church did 500 years ago. Like the mediaeval church, orthodox economics thinks it has all the answers. Complex mathematics is used to mystify economics, just as congregations in Luther’s time were deliberately left in the dark by services conducted in Latin. Neo-classical economics has become an unquestioned belief system and treats anybody who challenges the creed of self-righting markets and rational consumers as dangerous heretics. Keen was one of those heretics. He was one of the economists who knew there was big trouble brewing in the years leading up to the financial crisis of a decade ago but whose warnings were ignored.

The reason Keen was proved right was that he paid no heed to the equilibrium models favoured by mainstream economics. He looked at what was actually happening rather than having a preconceived view of what ought to be happening. Somewhat depressingly, nothing much has happened, even though it was a crisis neo-classical economics said could not happen. There was a brief dalliance with unorthodox remedies when things were really bleak in the winter of 2008-09, but by late 2009 and early 2010, there was a return to business as normal.

“.. invoking Article 7 will eventually allow the European Parliament to rescind all economic aid to Poland and its voting rights within the body.”

• Merkel’s Last Stand – Article 7 For Poland (Luongo)

As she fights for her political life Soon-to-be-ex-Chancellor of Germany Angela Merkel will go down swinging against her stiffest political opponents in the European Union, the Poles. Merkel and French President Emmanual Macron publicly agreed to back Article 7 proceedings against Poland for refusing to comply with EU immigration quotas and changes to its judicial system. Immigration quotas, I might add, that are becoming harder to defend as the war in Syria is mostly over and the flow of refugees from there has slowed to a trickle. But, those brought in and stranded in camps in Italy and Greece apparently need to go somewhere else. But, no one wants them. And the rest of the EU is trying to bully Poland and the rest of the Visigrad countries – Hungary, Czech Republic and Slovakia – into taking on their ‘fair share.’

The problem with this is that Merkel made this decision unilaterally and foisted it on the rest of the EU. And she is determined not to lose this fight to Poland, not because this is any kind of humanitarian issue at this point. No, this is about the primacy of EU diktats being enforced at the expense of logic and political cohesion. And, as I’ve been warning about all year, Merkel will put the EU before any practical consideration and bring Article 7 proceedings against Poland. Because she has to. Immigration and the destruction of individual European cultures is the guiding principle behind the EU’s biggest benefactors. This policy is part of the long-term strategic goals of the EU. It has created an army which will be used to quell secessionist movements in the name of ‘continental security.’ Because despite the fevered dreams of a few hundred Latvians, the Russians are not invading Europe anytime soon.

And I have to wonder who will staff this Grand Army of the Oligarchy? After impoverishing an entire generation of people thanks to a decade-long banking system bailout, you shouldn’t be expecting the crème de la crème of the vanishing European middle class. You can expect a number of these newly-integrated immigrants that Merkel invited at everyone else’s expense will be in their ranks. And only the most politically-acceptable members of the current armies of each country will be invited to positions of authority in this new EU army. Their loyalty will be to the EU first and their homes second. The very definition of a Vichy gendarme for the 21st century. Poland and the rest of the Visigrad Four – Hungary, Czech Republic and Slovakia – are headed for a collision course with the rest of Western Europe over this issue and many others.

And invoking Article 7 will eventually allow the European Parliament to rescind all economic aid to Poland and its voting rights within the body. While at that same time not allowing Poland free access to international trade because it will not be an independent nation at that point. Any move to extricate itself from the EU politically or practically will be met with the most strident opposition. Look no further than Brexit talks and the brutal put-down of Catalonia’s independence movement to see Poland’s future.

They have that in common with Germans.

• Cash Still King For The Majority Of Greek Consumers, Employers (K.)

Greeks love cash: Not only do they make most of their payments in cash – more than in any other eurozone country – but they also use it to pay their regular monthly obligations, such as utility bills, rent and even their taxes. The main reason for this proclivity for paper money is not an inherent aversion towards electronic payments, but that the vast majority of Greeks, far more than in other eurozone member states, still get paid in cash. This is evident in the recent European Central Bank survey on cash use in eurozone households, which showed that 57% of Greeks are paid in paper. Cyprus and Slovenia come a distant second, with a rate of 28%, while in the other eurozone countries the share of people getting paid “cash in hand” ranges between 5 and 20%.

Behind this particularly high rate of people paid in cash in Greece lies the large number of small or family owned enterprises and freelancers who work for cash. This also serves to illustrate the extensive tax evasion in this country, which tends to be focused on a series of professional categories, mainly among freelancers. The above figures concern 2016, while banks estimate that this picture has started changing considerably after the compulsory payment of salaried workers via a bank account from early 2017. The ECB figures show that the cash culture is not a strictly Greek phenomenon, as 79% of transactions in the eurozone – with great variations from country to country – are conducted with coins and banknotes.

Yet contrary to European habits, Greeks use cash for a series of transactions that are regular every month: 40% of Greeks pay their taxes in cash against just 9% in the eurozone, 50% use paper to pay for their insurance against 10% in the eurozone, and 70% pay for their medicines in cash against 31% in the eurozone. Similarly, electricity and phone bills are paid by 60% of Greeks in cash, compared to 16% in the eurozone, and 30% of rents are covered by cash against just 6% in the eurozone. ECB data also revealed that Greeks hold an average of 80 euros in cash on them, against the Spaniards’ 50 euros and the Italians’ 69 euros, while the Portuguese like to keep just 29 euros at hand.

In a system as overwhelmed as it is, this does not spell a lot of good.

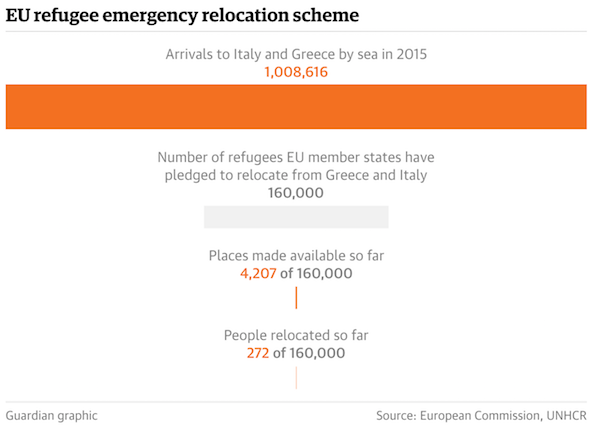

• Greece Drafts Law to Accelerate Migrant Asylum Applications And Returns (K.)

In a bid to ease growing pressure on overcrowded refugee camps on Greece’s eastern Aegean islands, the government is drafting a law to accelerate the process of granting asylum to refugees with a bill expected to go to Parliament as early as this week. Arrivals of migrants from Turkey radically dropped after Ankara signed an agreement with the European Union to crack down on human smuggling over the Aegean. But the influx has picked up in recent months. Also the process of returning migrants to Turkey, as foreseen by the pact, is very slow, partly due to the influence of critics of the deal within leftist SYRIZA. “The only way to deal with the problem on the Greek islands is for the EU-Turkey agreement to be effectively enforced and for there to be a significant number of returns to Turkey,” an official at the Citizens’ Protection Ministry told Kathimerini.

Since the deal was signed in March 2016, around 48,600 migrants have arrived on the Greek islands, according to the United Nations refugee agency. During that time only some 1, 500 people have been returned to Turkey. Thousands of asylum applications are pending, chiefly because migrants generally appeal rejected claims. At a summit of EU leaders last week, German Chancellor Angela Merkel and European Commission President Jean-Claude Juncker pledged to bolster Greek efforts to accelerate the asylum process and to help increase the presence of Frontex, the EU’s border monitoring agency, at the country’s frontiers with Turkey and Bulgaria, Greek officials said. Meanwhile, there are concerns that a decision by the government to move migrants from cramped island camps to the mainland could encourage smugglers to bring more migrants to Greece.

“There’s something wrong with a valuing system that doesn’t recognize healthy humans, or the redistribution of goods, or the disappearing of problems forever.”

• If Money Rewarded Hard Work, Moms Would Be The Billionaires (CJ)

Ask a woman right now how her Christmas is going and she will almost certainly unfurl her to-do list before your eyes, from the turkey to the costumes for the kids’ concerts. They should call it the Season of To-dos. For women, anyway. Christmas is the one time of the year when the gender pay gap is an open festering wound. Most of women’s work goes unvalued, unpaid, unseen by the patriarchal valuing system we call money. It’s invisible to money but it’s also pretty invisible even to ourselves. For a woman, it’s just what you do. For men, it’s stuff that just… happens. Don’t get me wrong, I don’t want to give up being Santa. I love it, I’m good at it, and I still do it for my kids even though they’re way past believing. That doesn’t mean it’s not work and it’s not worth something. People love their work and still get money for it.

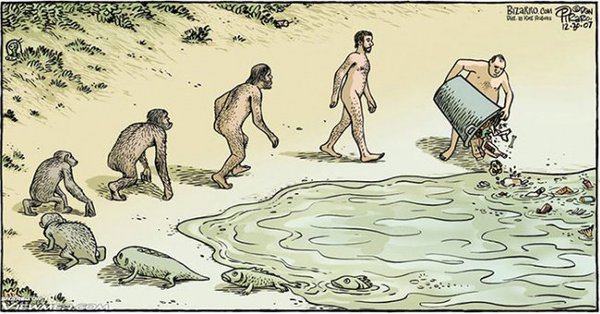

(A little aside: isn’t it interesting that the man behind Santa is almost never a man? It’s almost like the patriarchy wants to take the credit for all of women’s work at Christmas time.) But whoever coined the term “holiday season” was clearly a bloke. It ain’t no holiday. For women, it’s the busiest time of the year. There’s something really broken about a valuing system that doesn’t recognize how much important work goes into bringing up children, socially integrating the tribe, bonding with each other and appreciating the beauty of each individual in the family and all the gifts they bring. A valuing system that doesn’t recognize the gains of having good-natured humans brought up in solid, loving environments that are closely networked in the goodwill economy. A family that will look after each other.

There’s something wrong with a valuing system that doesn’t recognize healthy humans, or the redistribution of goods, or the disappearing of problems forever. There’s something deeply sick about a valuing system that only knows how to pay people to make more problems, more sickness, more work for themselves. Invent a problem, and then sell your “solution” to it. That’s pretty much every business model ever. Libertarians will tell you earnestly that all our valuing decisions should be left up to “the markets.” If left to its own devices, the intelligence of money is meant to somehow create a handsome retirement savings package for a hardworking single mom of six. It’s somehow going to pay people to reuse and redistribute goods that they don’t need and fill all the unused houses with house-less people. It’s going to reward leaving minerals in the ground and pay for people to be healthy and live simply and for the environment to flourish and sustain life.