Gordon Parks Harlem, New York 1943

Well, new…

• Fantasy and Magic: A New Central Bank Approach (WSJ)

“You may call it ‘nonsense’ if you like, but I’ve heard nonsense, compared with which that would be as sensible as a dictionary,” says the Red Queen in “Through The Looking-Glass.” Central banks have gone down the rabbit hole. Starting with record low interest rates, then purchases of government bonds and mortgage bonds, ultra-accommodative policy progressed in Japan to buying real-estate investment trusts and equity funds. With negative rates, central bankers have now managed what was believed all but impossible: breaching the “zero lower bound.” In the looking-glass world of modern central banking, almost nothing is taboo, with even the abolition of cash discussed seriously by top monetary wonks.

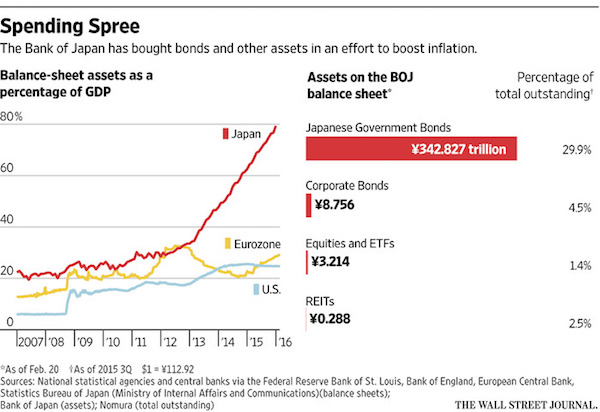

One idea not yet considered: the Bank of Japan should print money to buy oil. It sounds beyond nonsense. But with central bankers believing six impossible things before breakfast, it no longer seems inconceivable, which is informative in itself. Consider the BOJ’s problem. The central bank is creating ¥80 trillion ($700 billion) a year to buy mainly government bonds, one of the biggest programs of money printing in history. It already owns almost a third of the bond market, nearly 2% of equities and about half of exchange-traded funds by value. Nonetheless, Japanese inflation remains quiescent. The yen has been strengthening despite the negative rates introduced last month, making it even harder to push prices up toward the BOJ’s 2% target.

There have been hints that the BOJ will do more next month, although Gov. Haruhiko Kuroda on Tuesday cast doubt on whether printing money alone would achieve the goal. The obvious alternative is to take rates much more negative, possibly in conjunction with more asset purchases and higher government spending. Yet, negative rates have unpleasant side-effects, hurting banks, while bond supply may be limited. Nomura estimates that over the next three years only ¥236 trillion of bonds could be available to buy because banks and insurance companies are reluctant to sell many of their holdings—making it hard to ramp up purchases further. HSBC says that in a worst-case scenario the BOJ would have trouble filling its monthly purchases later on this year.

These estimates may be overly pessimistic. If not, the obvious alternative of buying foreign assets is challenging. Direct currency manipulation is a diplomatic no-no nowadays for such a big country as Japan, so buying U.S. Treasurys—similar to Swiss purchases of European bonds—is not realistic. There are more extreme options, such as direct financing of government spending, or abolishing bank notes so interest rates can go deeply negative. None is politically palatable. Compared with these, creating money to buy oil has several big advantages.

More magic.

• Draghi Has Two Weeks To Pull Another Rabbit Out Of The Bag (BBG)

Mario Draghi has two weeks left to decide how to ramp up stimulus in a way that doesn’t upset either his colleagues or investors. When ECB policy makers meet in Frankfurt from March 9-10, they’ll consider whether negative interest rates and 60 billion euros ($67 billion) a month of debt purchases is enough to revive consumer prices. With another rate cut priced in by markets, the biggest question mark hangs over how to customize quantitative easing. The ECB president has said there are no limits to how far policy makers will go within their mandate, yet sub-zero rates carry risks and expanding QE is easier said than done.

He’ll walk a fine line between convincing investors he can overcome the hurdles and avoiding the market disappointment that greeted the last adjustment in December. “It’ll be very challenging” to increase QE, said James Nixon at Oxford Economics, who doesn’t expect such a move just yet. “You’d have to sort of throw the rule book out. It might be quite interesting to see whether Draghi, as he tends to do when he’s confronted by these situations, pulls another rabbit out of the bag.”

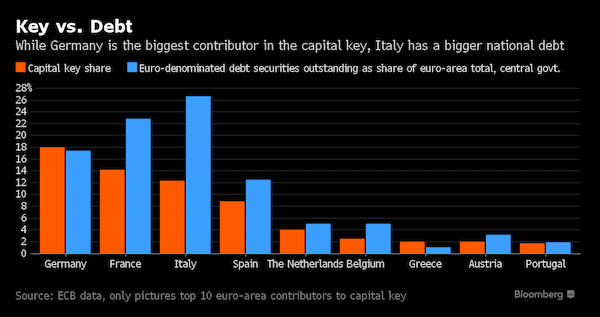

[..] To ease the reliance on German debt, the ECB could eliminate the capital key that links buying to economic size. That would allow other countries with more outstanding debt, such as Italy, to buy a greater share. That strategy might make it look like the ECB is supporting nations that pursued riskier fiscal policies. Worse, it could draw accusations of monetary financing, which is banned under European Union law. “They chose the capital key for a reason,” said Peter Schaffrik at Royal Bank of Canada in London. “Do I think it would make sense to change that from a macroeconomic point of view? Absolutely. Do I think that’s the preferred measure and most easily adoptable within the council? I’m not so convinced.”

Allowing central banks to buy other nations’ public debt would also be a hard sell. It’s unlikely a country such as Germany would find it acceptable to buy riskier bonds from elsewhere. “You’ve really got to sort of put that in print, write it down, to realize how completely unworkable politically that would be,” Nixon said. “It’s just a complete non-starter.”

“..China cannot simultaneously control its currency and its money supply growth and allow free flow of capital…”

• Investors Fear Central Bank Policy Errors (FT)

Do investors think central banks can restore calm or is negative rate policy an error? Bear markets thrive on fear and uncertainty. Until a few weeks ago, the list included a hard landing for China, plunging oil prices, problems for European banks and fears that even the US economy was rolling over. Now we worry that central bankers are not just behind the curve, to use that trite phrase, but have lost the plot. What is the current policy framework, let alone its efficacy? The first concern is China’s exchange rate policy; is it simply moving from a fixed dollar peg to a trade weighted basket? Is modest volatility required to justify the renminbi’s membership of the IMF’s SDR, the reserve asset, or a dramatic depreciation to prop up a rapidly slowing economy? The ‘unholy trinity’ remains very clear — that China cannot simultaneously control its currency and its money supply growth and allow free flow of capital.

A second policy error possibly took place when the Bank of Japan unexpectedly adopted negative interest rates, following in the footsteps of several European central banks. Just as with QE, there are several channels through which this new policy tool could affect the real economy. The standard argument is that in a world of low headline inflation the zero bound on nominal yields needs to give way to engineer negative real yields, encourage portfolio rebalancing and discourage savings. There are other rationales, though; the Swiss and Swedish central banks adopted negative rates to dissuade currency inflows which could destabilise their inflation targets. It is vital to recognise what works domestically need not work externally. Each central bank in turn argues that their currency is too high in relation to domestic conditions, and therefore action needs to be taken to make their exchange rate more competitive.

This argument might work in an environment of strong global GDP and trade growth but those days are long past. We are all familiar with the litany of headwinds which have brought global nominal GDP growth to its lowest since 2009. A zero sum game is threatening with no winners from ever more desperate efforts to bring currencies down. Negative rates are an especially large threat to commercial banks because they compress net interest margins and thus remove a key driver of profits. That may matter less in Sweden where banks can benefit from a range of other income sources. Rightly or wrongly, investors have assumed that Japan’s decision is more dangerous. Sure, the BoJ was aware of the risk and crafted a complicated three-tier mechanism, but negative rates were associated with a parallel shift down, rather than a steepening, in the yield curve. Over 70% of the JGB market now has negative yields — about 15% of Japanese bank assets are in bonds and bills. How can this help profits growth?

This is scary: “..45% of new debt is being used to pay interest on old debt..”

• China Adds To The World’s Most Dangerous Debt Pile (BBG)

China has two very good reasons to slow the gusher of cheap money that continues to flood its economy. The first, obviously, is to prevent the kind of financial implosion that’s struck down similarly debt-burdened countries. The second is just as important: to clear out the deadwood in the world’s second-largest economy. For Chinese leaders, the need to prop up faltering GDP growth outweighs fears about a rapid buildup in debt. In January alone, banks made a record $385 billion worth of new loans, more than 70% higher than the year before. Debt now tops 230% of GDP and could reach as high as 300% of GDP if current trends continue. Billionaire investor Bill Gross has joined the chorus of voices calling this trajectory “unsustainable.” Even the Bank for International Settlements, a body not known for hyperbole, has warned that Chinese debt is reaching levels that typically trigger financial crises.

The recent surge in credit is merely an extension of policies put into place after the global financial crisis. To fend off a downturn, China launched a massive 2009 fiscal stimulus package focused on infrastructure and investment spending. Simultaneously, policymakers ordered banks to open the credit spigot. Since January 2009, total loans in China have grown 202%, for an annualized growth rate of 34%. Local governments and businesses alike have been only too happy to partake in the largesse. The problem is that most of this money has gone into the least efficient, most saturated parts of the economy. Nomura estimates that 40% of bank loans to companies go to state-owned enterprises, although they account for barely 10% of China’s output. The money is being used to prop up companies that probably shouldn’t survive: One Chinese securities firm suggests 45% of new debt is being used to pay interest on old debt, like using a new credit card to pay off an old one.

Cheap money is also continuing to expand capacity in sectors that already have too much. There are currently about four-and-a-half years’ worth of residential real estate sales under construction. Coal plants, which are currently running at only 67% of capacity, are investing in an additional $9.4 billion worth of capacity in 2015, with a similar number expected in 2016. The government has pledged to slash capacity in the bloated steel sector by as much as 13% by 2020. But given that the industry is already losing about $25 for every ton of steel produced, those small cuts, even excluding capacity additions, are hardly going to solve the problem. The government isn’t blind to the dangers. Its 2016 economic plan lists “deleveraging” and capacity reduction as two major priorities for the year.

The central bank has imposed limits on certain banks that had been a bit too liberal in their recent lending. But the fact remains that the state-owned giants drawing the bulk of new lending are also the most politically well-connected. Rather than shutting them down and throwing potentially millions of Chinese out of work, the government hopes to keep them afloat while they’re merged and overhauled. There’s little reason to think this plan can succeed. No country with a similarly rapid rise in debt levels has escaped either a financial crisis, or like Japan, a prolonged slowdown. Continuing to lend at this pace will only increase the ranks of zombie companies, alive because of government life support. Slowing lending will inevitably mean lower GDP growth, more corporate bankruptcies and higher unemployment. But it will also reduce the buildup of risks that are otherwise certain to come due.

Horse, cart. If you can’t see the cracks already, get better glasses.

• How Long Before The Cracks Show In China’s Great Currency Wall? (Reuters)

China still owns the world’s largest currency reserves, but it has been burning through them at such a pace that some think Beijing might soon have to allow a sharp fall in the yuan or back-pedal on liberalization and tighten its capital controls. Foreign exchange reserves in China declined $99.5 billion in January to $3.23 trillion, following a record fall the previous month, and have shrunk by $762 billion since mid-2014, more than the gross domestic product of Switzerland. That still leaves a mighty arsenal, and the People’s Bank of China says it is more than adequate, though it has not said what the minimum might be and did not return a request for comment. PBOC governor Zhou Xiaochuan told Caixin magazine a week ago that much of the outflow had been Chinese companies repaying dollar debt as the greenback rose, which would bottom out, or outbound investment, which was to be welcomed.

Most economists agree China has a way to go before running out of road, but some believe it will have to hit the brakes in months, not years. The pace of decline has accelerated as the PBOC fought to keep the yuan steady in the face of speculative selling offshore and capital flight at home, a task made harder by China’s slowest economic growth in 25 years and the bank’s own decision to guide the currency down in August and again in early January. Though it has huge reserves, an economy the size of China’s needs them to cover imports and foreign debts, and the less liquid assets in reserves can’t readily serve those purposes. Though the composition of China’s reserves is a state secret, officials also say the falling dollar value of other currencies it holds accounts for some of the fall.

Economists and foreign exchange professionals around the world are nevertheless asking how low can they go before Beijing is forced to choose between fresh capital controls or giving up selling dollars to defend the yuan. French bank Societe Generale says IMF guidelines put $2.8 trillion as the minimum prudent level for China, which is not far away if reserves keep falling at the current pace. “If that occurs in the next few months,” says SocGen, “expect to see a tidal wave of speculative selling, forcing the PBOC to throw in the towel and let the market decide the level of the renminbi exchange rate.” A G20 deputy central banker was considerably more sanguine. “Whatever number I would come up with, it would be a lot less than $2.8 trillion,” he said, adding that reserves could fall another trillion by year-end in conjunction with stability in the exchange rate.

But that doesn’t rhyme with their new IMF status.

• Capital Controls In China A Possibility (CNBC)

While markets are flirting with the idea that a big devaluation of the yuan could take China’s economic slowdown to a new and more dangerous place, economists and some money managers say it’s not at all likely. Over the past eight months, China’s central bank has spent billions of dollars to fend off speculators who think the yuan will fall as China looks to pump up exports. The currency fell to a five-year low of 6.51 against the dollar on Jan. 6 as weak economic data spooked investors. That’s one reason uber-bear fund manager Kyle Bass, founder of Hayman Capital Management, could shake markets with a prediction that China’s currency could lose 40% of its value in the next 18 months, thanks to the heavy debt load of state-backed Chinese enterprises.

Bass’ idea is that China’s banks are facing huge yet-undisclosed credit losses, largely on loans to manufacturers that, like the banks, are controlled by the government, and that the currency will fall as the government prints yuan to recapitalize the banks. Bass’ opinion remains, for now at least, a minority view. Other fund managers and economists argue that devaluation would do little to promote sales of Chinese exports that are already competitive, especially in the U.S., and that a sharp devaluation would backfire if countries like Australia, Malaysia and Indonesia were prodded to devalue their currencies in a bid to make sure they remain competitive with China.

Most of all, they said, a market-jolting move lower for the yuan would be at odds with a record of incrementalism that Beijing’s government has nurtured for years, and it would rock investors who have already pushed the Shanghai Composite Index down 43% to 2,927 since its peak last June. “They want a stable but gradually declining exchange rate if they can engineer it,” said Barry Eichengreen, an economist at the University of California-Berkeley and former senior policy advisor for the International Monetary Fund. “Stability is good for their image in the markets, and a gradual decline is good for their effort to maintain a growth rate of 6%.”

Missed opportunities?! A deal for a yuan devaluation at the summit means Beijing wouldn’t pick up the blame alone.

• World Bank’s Kim Sees Little Chance of G-20 Action (BBG)

The sluggish global economy has entered “unprecedented territory” as countries grapple with divergent difficulties, leaving little room for a coordinated policy response from the Group of 20 finance chiefs meeting this week, World Bank President Jim Yong Kim said in an interview. “There is a lot of uncertainty; there is a lot of instability and fluctuations in global markets,” he said. “But I don’t think we’re at a point where you are going to see some sort of concerted, focused action in one sector or another.” Global growth continues to lag even as advanced economies embrace “unorthodox” policies, Kim said. “We are now seeing negative interest rates in Japan, negative interest rates in Europe and even in the US, although they are not negative, the notion that that might be possible has been put on the table, so this is completely unprecedented territory.”

The Washington-based development bank lowered its global forecast for 2016 growth to 2.9%, from a 3.3% projection in June, according to a report it released last month. The world economy advanced 2.4% last year, lower than the 2.8% growth forecast. China’s hosting of the G-20 forum this year in Shanghai culminates in a leaders’ summit in September, and officials are pushing a detailed and diverse platform that covers everything from bolstering investment in infrastructure to climate-friendly financing. The weakening outlook for global growth and how policy makers should respond will dominate the agenda when the G-20 central bank governors and finance ministers gather. China faces calls to make its currency and macroeconomic policies clearer at the meeting.

The economic woes afflicting individual countries are so varied that it’s unlikely a consensus on a policy response will be reached, Kim said. The G-20 provides “an environment in which we can put difficult issues on the table and talk them through,” he said. “But it’s difficult to imagine that everyone would take a particular action around fiscal, monetary or other kinds of policies because you have oil producers and oil importers, you have commodity exporters and commodity importers — there’s such a difference in economic models.”

Looks pretty dark.

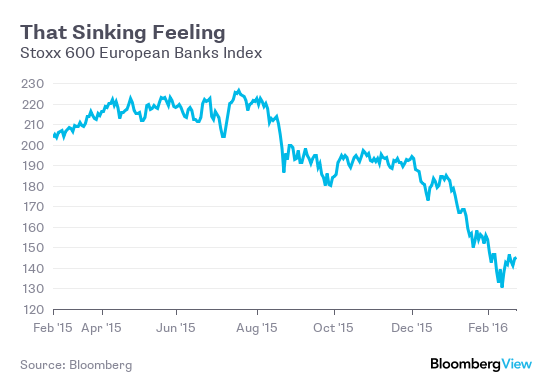

• Europe’s Banking Model Is Still Broken (BBG)

Call it the new normal for European bank earnings. Standard Chartered shares plunged by the most in more than three years on Tuesday after the bank posted a “surprise” 2015 pretax loss of $1.5 billion, somewhat different from the $1.37 billion average profit estimate from 20 analysts. On Monday, HSBC delivered a “surprise” fourth-quarter pretax loss of $858 million, rather than the expected profit of $1.95 billion. On Jan. 28, Deutsche Bank “surprised” bond investors with a fourth-quarter net loss of $2.3 billion, less than two weeks after tapping them for $1.75 billion of funds. As the saying goes, fool me once, shame on you; fool me twice, shame on me. But fool me three times and maybe I should just resign myself to being a fool, at least where European banks are concerned.

The unpalatable truth is that the banking model is broken. The days of generating gobs of cash from “socially useless” financial engineering, as Adair Turner put it in 2009 when he chaired the U.K. Financial Services Authority, are over. Because banks have to hold more capital for a rainy day, they have less money to play with in financial markets. And they’re still shrinking their trading desks, further curbing their ability to make money from markets. Important aspects of Europe’s regulatory backdrop remain foggy at best; the European Union’s Markets in Financial Instruments Directive, new rules covering a multitude of markets from derivatives to bonds, has been delayed by a year to 2018. But it’s clear that the EU is seeking to keep financial institutions from so-called casino banking as much as possible.

Provisions for European bank loans to oil and gas companies are likely to climb – HSBC took a $400 million hit on those loans this week – further crimping profit. And there seems to be no end to the fines being paid for rigging markets, with settlements for faking prices for gold, silver, platinum, palladium and derivative-market benchmarks still looming. As another saying goes, a billion here and a billion there and pretty soon you’re talking about real money. So it’s little wonder that Europe’s banks have lost about 30% of their value in the past year [..] Central bank interest rates at near or below zero deliver cheap money. But longer-term rates also at record lows and in many cases below zero (five-year German government bonds yield -0.33%) mean banks can’t borrow cheaply and profit from lending to their customers at inflated rates.

You mean they haven’t done that yet?

• US Banks To Cut Credit Lines For Energy Firms (Reuters)

Cash-strapped energy firms are coming under increasing pressure from U.S. bank lenders and, on average, could see a 15% to 20% cut in their credit lines, the head of JP Morgan’s commercial bank told investors on Tuesday. Until now, banks could be more lenient with their energy clients despite a prolonged slump in the price of oil, but Doug Petno, the head of JP Morgan’s commercial bank, said that is changing. Moves, disclosed in securities filings, by oil and gas companies such as Linn Energy and SandRidge Energy to max out revolving credit lines – designed to cover short-term funding gaps – have prompted banks to take action. Petno said JP Morgan was not waiting for April, when banks traditionally reassess the value of oil reserves underpinning energy loans – a process known as redetermination – to reassess its exposure.

“We are not waiting for the spring redetermination to discuss this with our clients,” he said during a presentation at JP Morgan’s annual investor day in New York. Petno said JP Morgan had been working closely with its energy customers through the current price rout. The biggest U.S. bank by assets plans to increase provisions for expected losses on bad energy loans by more than 60% in the first quarter. Petno said he expected credit lines, on average, would shrink by 15% to 20% across the industry, but there would be wide variations depending on the health of the borrower. “Some borrowing bases may by go up. Some may go down by 50%,” he said. A lurch in the price of oil below $30 a barrel last month has forced companies to offload assets and cut staff to survive.

Dozens of companies have already hit the wall and a third of oil producers and service firms, or 175 companies, are at high risk of slipping into bankruptcy this year, according to a study by Deloitte. “Most of these clients are working with their banks way in advance of redeterminations, so it is compelling M&A, it is compelling asset sales, it is compelling discussions with private equity. But there is a lot of leverage,” said Petno. “The most distressed clients know when they are going to be pinched… and are taking the steps to deal with it,” he added. “There will be a meaningful number of these players who have no options. I think we have only begun to see the range of bankruptcies in oil and gas.”

You can’t be the EU’s financial center if you’re not in the EU.

• Banks Have More to Fear Than Boris (BBG)

Boris Johnson’s backing of Brexit has heightened anxiety in the City of London. But Europe’s dominant financial center faces bigger threats to its future than whether or not the Brits listen to their capital’s mayor and quit the EU. A vote to leave in June’s referendum certainly wouldn’t help London’s financiers. Take this from Deutsche Bank analysts led by Barbara Boettcher:”An EU exit would mean uncertainty for the ability to use the U.K. as a hub to provide banking services into Europe. This has implications not just for the EU operations of U.K. financial institutions (which have actually reduced significantly post-crisis), but also for the U.K. and European operations of banks globally. “Some banks might move their headquarters to continental Europe or shift jobs, Deutsche Bank said, something senior executives have warned about in private over the past year.

HSBC chief Stuart Gulliver broke cover on Monday and said his bank could shift about 1,000 U.K. jobs to Paris in the event of an exit.But despite the veiled (and not so veiled) threats, the City of London is already under pressure on jobs and to defend its pre-eminence in Europe – even before a decision on the EU. For starters, many roles that were traditionally strong in London have been in the firing line since the financial crisis. In particular, big banks are shrinking fixed income and commodities trading desks in response to regulations that make these businesses more capital intensive and less profitable. At the top global investment banks, fixed income revenues and staffing levels fell about a third between 2010 and 2015, according to Coalition research. More broadly, weak revenue growth across banking puts more emphasis on costs as the best way to lift profit.

Investment-banking revenue has dipped 15% since 2010 but costs have remained stubbornly high despite layoffs. That suggests more cuts will come.Meanwhile, the soaring cost of employing staff in London makes it harder to keep large swathes of workers there when other locations will do. London has by far the most expensive office space in Europe – annual leasing costs run to $122 per square foot on average, compared to just $56.75 in Paris or $53.25 in Frankfurt. Surging accommodation costs are pushing up the cost of living too. The median house price in London climbed about 13% in December from a year earlier to $615,931. Already, many global investment banks have shifted jobs to smaller U.K. cities such as Bournemouth, Birmingham and Manchester and to offshore sites, and more plans are afoot.

Oh boy…

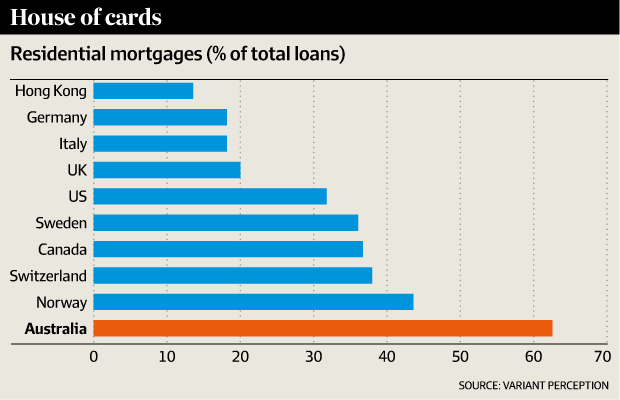

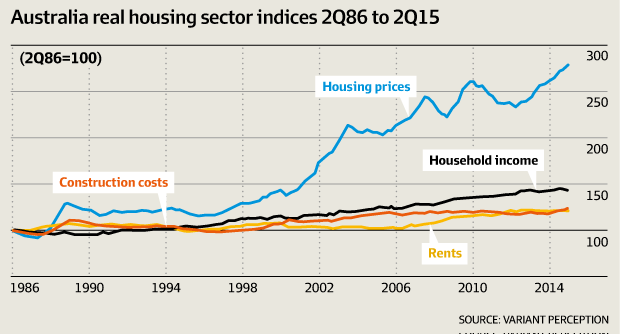

• The Australian Housing Bubble Is Out Of Control (SMH)

Jonathan Tepper, a UK based economist and founder of research house Variant Perception, is convinced Australia is in the midst of “one of the biggest housing bubbles in history”. The Australian Financial Review reports about how he and local hedge fund manager John Hempton scoped out the apparent epicenter of this bubble, Sydney’s western suburbs, and walked away thinking it was even worse than they’d originally thought. It’s a fascinating story. In a subsequent report to clients, obtained by Fairfax Media, Tepper uses the following charts to support his thesis.

‘Australia is simply in a league of its own when it comes to mortgage lending.’

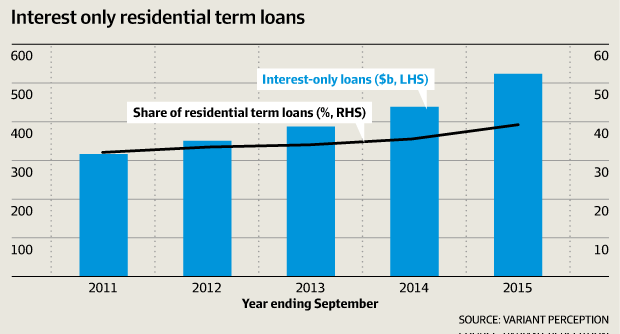

And a rising share of these mortgages are ‘interest only’ loans

“The Australian housing bubble could not have become as ridiculous as it is without the help of easy financing,” he writes. “Over the past few years, over 40% of all new mortgages originated have been interest-only mortgages. “This is truly Ponzi financing, where home buyers only make money if their houses keep rising in value,” he writes, later describing interest only loans as a “disaster waiting to happen.”

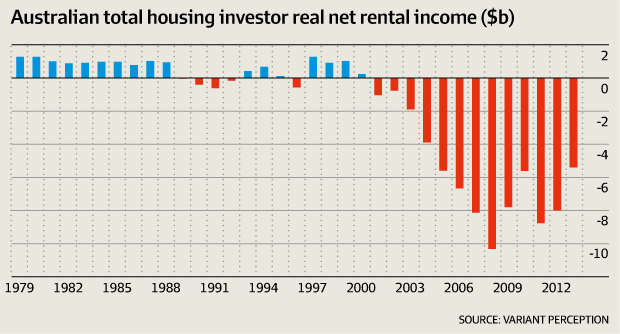

The negative gearing effect…

It is one of the most contentious issues in the national political discourse at the moment. Tepper likens negative gearing – the ability to claim losses on leveraged investment properties as a tax deduction – to startups during the dot com bubble burning through their cash. “Only in a bubble could losing money on housing be viewed as positive,” he writes.

Housing prices are totally out of whack with…everything

Schäuble will come and get them.

• Portugal Adopts Anti-Austerity Budget Despite Concerns (AFP-PTI)

Portugal’s Socialist-led lawmakers have approved a 2016 budget that pledges to reverse unpopular austerity measures but is seen as high-risk by critics and investors, with Lisbon under EU pressure to stay on a disciplined path. “This budget proves it is possible to live a better life in Portugal,” socialist Prime Minister Antonio Costa said yesterday. The vote came a few weeks after the European Commission approved Portugal’s draft, but warned that more efforts would be needed by the government to avoid a breach of EU rules on spending. In response, Portugal cut its budget deficit target for 2016 to 2.2% of GDP from a previously announced target of 2.6%. Last year, Portugal’s budget deficit came in at 4.3%, well above the EU’s 3.0% limit.

The conservative opposition lashed out at the new budget yesterday, branding it “unrealistic and populist”. “It is a poisoned gift for the Portuguese,” said former prime minister Pedro Passos Coelho. Portugal received a massive international debt bailout in 2011 that saved it from defaulting, but in return the country had to introduce a string of austerity measures. In four years, over 78,000 public sector jobs were cut – more than 10% of the total – alongside other steps the creditors said were needed to return the public finances to balance and put the economy back on track.

Portugal’s public debt is forecast to hit 130% of GDP. True to the socialists’ campaign promises that brought them to power in November, Costa’s budget restores civil servants’ salaries, eases a surtax tax on employees’ incomes, and breathes new life into the welfare system. However, in a bid to appease Brussels’ demands, the government also announced a hike in taxes on fuel, vehicles and tobacco. Analysts were sceptical however that the plan would actually work. “The budget seeks an impossible balance. It is doomed. It will neither put an end to austerity, nor will it meet the deficit objectives,” said Joao Cesar das Neves, an economics professor.

Czexit.

• Czech Republic ‘Will Follow Britain Out Of EU’ (Telegraph)

The Czech Republic may choose to follow Britain out of the EU, the country’s prime minister said, amid growing fears in Brussels of a “contagion”. Bohuslav Sobotka said that a “Czexit” may take place. The Czech Republic only joined the EU in 2004 and has been the beneficiary of billions in development funds, but has some of the most hostile public opinion. A Brussels decision to force the country to take in a quota of migrants caused fury. Three-fifths of Czechs said they were unhappy with EU membership and 62% said they would vote against it in a referendum, according to an October 2015 poll by the STEM agency. “If Britain leaves the EU, we can expect debates about leaving the EU in a few years too,” said Mr Sobotka, who led eastern European states in opposition to David Cameron’s plans to curb benefits.

“The impact may be really huge,” he said, adding that a “Czexit” could trigger an economic and security downturn and a return to the Russian sphere of influence. Such a move “would be an absolute negation of the developments after 1989”, he said, referring to the revolution of Czechoslovakia that threw off Soviet rule. There are fears in Brussels that the multiple crises of Brexit, migration and the euro mean that 2016 will prove to be the high-water mark of the European project, in which it becomes plain that the vision of a fully federalised EU state will never be reached. And leaders fear that Mr Cameron will trigger a string of copy-cat referendums from ambitious leaders who want to extract special concessions from Brussels, pulling the bloc to pieces.

Meanwhile, Aleksander Vucic, the Serbian Prime Minister said that EU membership is no longer the “big dream it was in the past” for Balkan states.. “The EU that all of us are aspiring to, it has lost its magic power,” Mr Vucic told a conference at the European Bank for Reconstruction and Development (EBRD) in London. “Yes we all want to join, but it is no longer the big dream it was in the past.” “When you see that in Britain at least 50% of the people say they want to leave that has an effect on the public,” he said. Seven states are in the queue to join the EU under a new wave of enlargement, that will not take place before 2019: Serbia, Montenegro, Kosovo, Bosnia-Herzegovina, Albania, Turkey and Macedonia. Membership could take years for some, as they are gripped by corruption, cronyism and sky-high unemployment, according to the EU’s own assessment reports.

Not to take lightly: Turkey links the refugee crisis to its land-grabbing Kurds-killing ambitions in Syria.

• NATO’s New Migrant Mission In The Aegean Is A Victory For Turkey (EI)

The recent Nato agreement to create a mission to tackle the migration crisis in the Aegean has been presented as a major new development. But its impact on migrant flows will in reality be limited. Its shape and scope for action is a reflection of Turkey’s priorities in the region rather than European needs. The creation of the Nato mission showcases the EU’s strategic irrelevance and highlights Turkey’s desire to entangle Europeans in its adventurist endeavours in Syria. The Nato mission will conduct monitoring, surveillance and reconnaissance in the Aegean in order to deter and contain the activities of human traffickers. Nato forces will not push back boats, except when rescuing migrants from drowning who will be returned to Turkey. The task of deterring smugglers will be performed by the Greek and Turkish coastguards.

But assistance from Nato will not make much of a difference if the key actor in the crisis, Turkey, does not act decisively. The stemming of migration flows still hinges on Turkish will to patrol its coasts. In previous months, Turkey had been under pressure to patrol its coasts more effectively. But it refrained from acting because the cost of accepting back or keeping in Turkish territory large numbers of migrants was considered much higher than whatever rewards the EU had promised. Caving in to external pressure would also be infuriating for domestic public opinion. A Nato mission allows Turkey to give in to some EU demands while circumventing these problems. As the mission covers Turkish as well as Greek territory, Turkey can deflect part of the European pressure for control of migrant flows back on its neighbour.

Turkey has also ensured that its actions will be scrutinised by an organisation in which it has a strong say. The migration issue forms only one aspect of a complex geopolitical game that Turkey is involved in now in Syria. Turkey’s relationship with Russia has deteriorated rapidly. Moscow’s clients in Syria have made significant inroads against Turkey’s allies, threatening it with both a collapse of its support and the arrival of new waves of refugees to its borders. Turkey’s position is further complicated by the assertiveness of Syria’s Kurds, whom Turkey’s Western allies consider a valuable ally against Islamic State. Turkey is now pushing for stronger support from Nato for its activities in Syria. A first step was taken in the same meeting that authorised the migrant mission in the Aegean. There,

Nato also decided to step up its participation in the fight against Islamic State, initially by deploying AWACS planes in the region. Involving Nato in the management of the migration crisis is part of a broader strategy by Turkey to align Europeans with its goals in the region. Any signs of Turkey becoming more cooperative on migration in the following weeks must be seen through the prism of its interests in Syria and its expectation that Europe will support it there in return.

The end of the EU is near.

• Refugee Flows To Europe Already Top 110,000 So Far In 2016 (Reuters)

More than 110,000 migrants and refugees have arrived in Greece and Italy already this year, a sharp increase on 2015, the International Organization for Migration (IOM) said on Tuesday. They include around at least 102,500 landing on Greek islands including Samos, Kos and Lesbos, and 7,500 in Italy, the IOM said. “Over 410 migrants and refugees have also lost their lives during the same period, with the eastern Mediterranean route between Turkey and Greece continuing to be the deadliest, accounting for 321 deaths,” the IOM said. Last year, the figure of 100,000 refugees and migrants was not reached until the end of June, according to IOM figures. Spokesman Itayi Viriri noted that the figure of 100,000 had already been exceeded this year despite rough sea conditions in recent days on the route from Libya to Italy. Migrants arriving in Italy are often in “very bad condition, having been subjected to violence by smugglers in Libya”, the IOM said, adding that women were subjected to human trafficking.

Mankind’s new normal: “More than 400 migrants have died in the Mediterranean this year..”

• Italy’s Navy Rescues 700 Refugees From Six Boats, 4 Found Dead (Reuters)

More than 700 migrants were rescued from six leaky boats in the sea between Tunisia and Sicily on Tuesday and four were found dead, the Italian navy said. More than 400 migrants have died in the Mediterranean this year, as people continue to try to cross into Europe despite bad winter weather in the second year of Europe’s biggest migration crisis since World War II. More than 110,000 people, many fleeing poverty and war in Africa and the Middle East, have arrived in Greece and Italy this year, a sharp increase on 2015, according to the International Organization for Migration (IOM). The navy said one of its ships went to help three boats, recovering 403 survivors and the four bodies. Another ship rescued 219 people from two vessels and a third coordinated the rescue of 105 migrants from their sinking boat.

The navy did not say what nationality the migrants were nor did it give any other information about their identities. Bad weather cut the number of people arriving last month in Greece, the main gateway to Europe for migrants, but the number was still nearly 40 times higher than in the previous January, European Union border agency Frontex says. Most of those were from Syria, Iraq and Afghanistan, while most of those who entered Europe via Italy were Nigerian, according to Frontex. Italy called on Monday for shared funding, including through issuing EU bonds, for a common policy to manage external borders and cope with the migration crisis.

This can get fully out of hand in mere weeks.

• Refugee Pressure Piles Up On Greece (Kath.)

More than 12,000 refugees and migrants found themselves trapped in Greece on Tuesday as Athens took diplomatic action to counter the border restrictions to its north that are causing the buildup. The Greek government issued a demarche to Austria over its decision to limit the number of asylum seekers it will accept, as well as the number of migrants that can pass through its territory in transit. Vienna is also hosting a conference on Wednesday to discuss the refugee crisis. A number of Western Balkan countries will attend but Greece had not been invited, prompting Athens to accuse the Central European country of making a “unilateral” move. “The exclusion of our country at this meeting is seen as a non-friendly act since it gives the impression that some, in our absence, are expediting decisions which directly concern us,” said Foreign Minister Nikos Kotzias.

Prime Minister Alexis Tsipras also called his Dutch counterpart Mark Rutte to discuss Athens’s grievances as the Netherlands currently holds the six-month rotating EU presidency. Athens feels that there was an agreement at last week’s leaders’ summit in Brussels that none of the Union’s members should take any unilateral actions concerning refugees until the planned meeting with Turkey takes place on March 6. The limitations put in place by Austria have had a knock-on effect along the rest of the so-called Balkan Route for migrants, particularly on Greece’s border with the Former Yugoslav Republic of Macedonia (FYROM), where only a few dozen people were allowed to cross on Tuesday.

FYROM border guards refused to allow Afghans to cross, leading to the Greek government hiring 21 coaches to transport the migrants back to Athens, where some were taken to the former Olympic Games site at Elliniko and others to the transit center at Schisto. Last night there was a total of around 2,500 people at the two sites. The rise in the number of arrivals also means there is a greater number of refugees and migrants on the Greek islands. Almost 1,400 people were rescued by the coast guard on Lesvos, some 1,200 people were at the hot spot on Chios and more than 1,300 had arrived on passengers ferries at Piraeus.

The Balkanization of Europe.

• Greek Migration Crisis Enters Worst-Case Scenario (EUO)

The European Commission and the Dutch EU presidency warned on Tuesday (23 February) of a humanitarian crisis in the Western Balkans and “especially in Greece,” adding that preparation for “contingency plans” was under way. The warning comes after border controls along the Western Balkan migration route were tightened in recent days in Austria and Macedonia. It is the realisation of a worst-case scenario becoming reality for EU authorities, in which Greece would be in effect cut off from the Schengen area and left to cope with hundreds of thousands of stranded refugees, while still being itself in the middle of an economic and social crisis. On Monday, Macedonia decided to deny entry to Afghan migrants and restricted access to Syrians and Iraqis.

The move followed last week’s decision by Austria to cap to 80 the number of daily asylum applications and to 3,200 the number of entries, also under the condition that the people go to another country to apply for asylum. The situation illustrates the growing rift between the actions of some EU and Balkan states and the common policies the European Commission and Germany have tried to put in place since the start of the migrant crisis last summer. The result is growing and potentially dramatic pressure on Greece, where 2,000 to 4,000 migrants arrive on the islands each day. On Tuesday alone, 1,130 refugees arrived at Athens Piraeus port, where they will have to be taken care of. “We are concerned about the developments along the Balkan route and the humanitarian crisis that might unfold in certain countries especially in Greece,” EU migration commissioner Dimitri Avramopoulos and Dutch minister for migration Klaas Dijkhoff said in a joint statement.

They called on “all countries and actors along the route to prepare the necessary contingency planning to be able to address humanitarian needs, including reception capacities”. “In parallel,” they said, “the commission is coordinating a contingency planning effort, to offer support in case of a humanitarian crisis both outside and within the EU, as well as to further coordinate border management.” Commission experts are already in Greece to assess the needs and what could be done in cooperation with the UN. Faced with the new developments, the commission seems to be more helpless than ever. “There is a clear risk of a fragmentation of the [Balkan] route,” an EU official said, with countries deviating from previously agreed plans. “We are concerned by the fact that member states are acting outside of the agreed framework,” commission spokeswoman Natasha Bertaud told journalists on Tuesday.

[..] This is the scenario that is now unfolding with the Austrian-Balkan initiative, one that the commission, together with Germany and some other EU countries, had wished to avoid. “We cannot let Greece become an open air detention camp,” a senior EU diplomat said, adding that “preserving the integrity of Schengen” was crucial for the EU. Financial and geopolitical concerns also come under consideration as Greece is engaged in an €85 billion bailout programme. “We do not want 500,000 migrants to destabilise the Greek government and Greece itself,” a source from another influential country said. “We would not see our money back and the whole EU would dismantle.”

Home › Forums › Debt Rattle February 24 2016