Dorothea Lange “Men on ‘Skid Row’, Modesto, California” 1937

WIll there be a Shanghai Accord at the Feb 26-27 G20 summit?

• Barclays Says Sharp Yuan Devaluation Needed (BBG)

A sharp, one-off devaluation of the yuan is among options China’s central bank might consider to stem capital outflows and shift market psychology to appreciation from depreciation, according to Barclays. The risk of such a move, which Barclays says would need to be in the region of 25% to alter perceptions, is rising as China’s foreign-exchange reserves plunge, analysts Ajay Rajadhyaksha and Jian Chang wrote in a report. Based on the current pace of decline in those holdings, there’s a six- to 12-month window before they drop to uncomfortable levels and measures such as capital controls or monetary tightening may also have to be looked at to curb the exodus of money, they said. All those options carry elements of danger.

Another rapid yuan depreciation could spook investors just as concern about the state of the global economy is growing and other central banks would likely follow, countering the beneficial impact on Chinese exports, the analysts said. Strict capital controls won’t work in an export-driven economy, while a move to policy tightening could slow growth and cause credit defaults, they said. “A devaluation of this magnitude seems impossible to ‘sell’ to the rest of the world,” according to the analysts at Barclays, the world’s third-biggest currency trader. “The People’s Bank of China will probably have to take more aggressive measures to stem outflows,” said head of macro research Rajadhyaksha in New York and Hong Kong-based chief China economist Chang.

[..] Chinese policy makers are trying to counter record outflows and prop up the yuan, while opening up the capital account and keeping borrowing costs low to revive growth in the world’s second-biggest economy. The balancing act challenges Nobel-winning economist Robert Mundell’s “impossible trinity” principle, which stipulates a country can’t maintain independent monetary policy, a fixed exchange rate and free capital borders all at the same time.

Not peanuts.

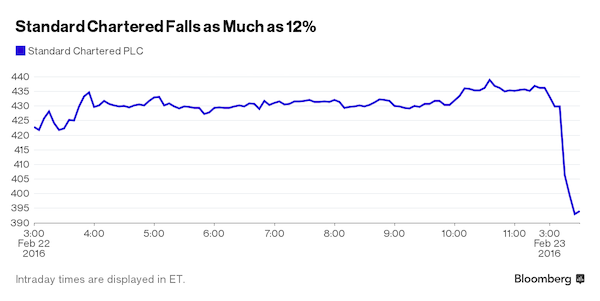

• Standard Chartered Plunges 12% On Annual Loss, Loan Impairments (BBG)

Standard Chartered dropped the most in more than three years after reporting a surprise full-year loss, as revenue missed estimates and loan impairments almost doubled to the highest in the bank’s history. The stock dropped as much as 12% as the London-based bank said its pretax loss was $1.5 billion in 2015, down from profit of $4.2 billion a year earlier. Excluding some one-time items, pretax profit was $834 million. CEO Bill Winters is attempting to unwind the damage caused by predecessor Peter Sands’ revenue-led expansion across emerging markets, which left the bank riddled with bad loans when the commodity market crashed and growth stalled from China to India.

Since June, Winters has raised $5.1 billion from investors, scrapped the dividend and announced plans to cut 15,000 jobs to help save $2.9 billion by 2018, while seeking to restructure or exit $100 billion of risky assets. “While our 2015 financial results were poor, they are set against a backdrop of continuing geo-political and economic headwinds and volatility across many of our markets,” Winters said in the statement. “We expect the financial performance of the group to remain subdued during 2016.”

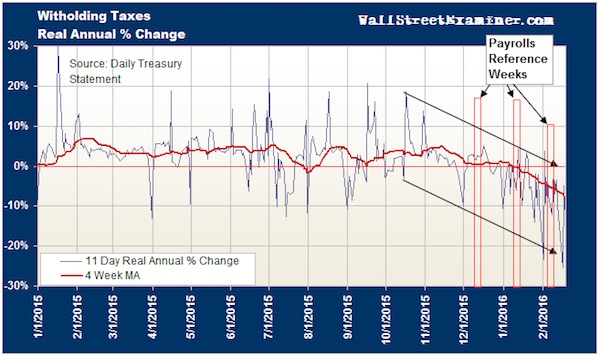

The decline in withholding taxes is significant.

• Financial Time Bombs Hiding In Plain Sight (David Stockman)

[..] Implicit in the whole misbegotten wealth effects doctrine is the spurious presumption that the Wall Street gambling apparatus can be rented for a spell by the central bank. So doing, our monetary central planners believe themselves to be unleashing a virtuous circle of increased spending, income and output, and then more rounds of the same. At length, according to these pettifoggers, production, income and profits catch-up with the levitated prices of financial assets. Accordingly, there are no bubbles; and, instead, societal wealth continues to rise happily ever after. Not exactly. Central bank stimulated financial asset bubbles crash. Every time.

The Fed and other practitioners of wealth effects policy do not rent the gambling apparatus of the financial markets. They become hostage to it, and eventually become loathe to curtail it for fear of an open-ended hissy fit in the casino. Bernanke found that out in the spring of 2013, and Yellen three times now – in October 2014, August 2015 and January-February 2016. But unlike the last two bubble cycles, where our monetary central planners did manage to ratchet the money market rate back up to the 6% and 5% range, by 2000 and 2007, respectively, this time an even more obtuse posse of Keynesian true believers rode the zero bound right to the end of capitalism’s natural recovery cycle.

Accordingly, the casinos are populated with financial time bombs like never before. Worse still, the central bankers are now so utterly lost and confused that they are all thronging toward the one thing that will ignite these time bombs in a fiery denouement. That is, negative interest rates. This travesty reflects sheer irrational desperation among central bankers and their fellow travelers, and will soon illicit a fire storm of political revolt, currency hoarding and revulsion among even the gamblers inside the casino. Besides that, they are crushing bank net interest margins, thereby imperiling the solvency of the very banking system that the central banks claim to have rescued and fixed.

We will treat with some of the time bombs set to explode in the sections below, but first it needs to be emphasized that the third bubble collapse of this century is imminent. That’s because both the global and domestic economy is cooling rapidly, meaning that recession is just around the corner. Based on the common sense proposition that the nation’s 16 million employers send payroll tax withholding monies to the IRS based on actual labor hours utilized – and without any regard for phantom jobs embedded in such BLS fantasies as birth/death adjustments and seasonal adjustments – my colleague Lee Adler reports that inflation-adjusted collections have dropped by 7-8% from prior year in the most recent four-week rolling average.

“..what is dressed up as a carefully calibrated policy response is really just blundering around in the dark..”

• Central Bankers On The Defensive As Weird Policy Becomes Even Weirder (G.)

As far as the OECD is concerned, monetary policy is being forced to take too much of the strain. Its chief economist Catherine Mann made the point that lasting recovery required three things: stimulative monetary policy; activist fiscal policy; and structural reform. The OECD wants the second of these ingredients to be added to the recipe in the form of increased spending on public infrastructure, something it says would more than pay for itself at a time when governments can borrow so cheaply.

The Paris-based thinktank says collective action by the world’s leading economies is needed because a go-it-alone approach will result in the effects of stronger demand being blunted by higher imports. It will make the case for higher investment spending at this week’s meeting of the G20 in Shanghai, almost certainly to little effect. Central banks will argue that they still have plenty of ammunition left, even though as the years tick by it becomes more and more apparent that relying solely on monetary policy is the equivalent of pushing on a piece of string. Central banks now have one last chance to live up to their exalted reputations. A prolonged period of low but positive interest rates carries the risk that it will create the conditions for asset price bubbles. That risk is amplified by quantitative easing.

All the dangers associated with low but positive borrowing costs apply to negative interest rates – but with some added complications. One is that it affects the profitability of banks, by squeezing lending spreads, at a time when many of them have yet to make a full recovery from the last crisis. Another is that central banks will overcook things and that the deeper into negative territory interest rates go now the higher they will have to go later. Perhaps though the biggest danger is to the reputation of central banks. Throughout the crisis, the assumption has been that the Federal Reserve, the Bank of England, the ECB, the Bank of Japan and all the other central banks are in control of a tricky situation. Central bankers give the impression that they can model the impact of interest rates and QE on growth and inflation; that is part of their mystique.

Now, it may be that it is simply taking time for central banks to get to grips with a protracted and complex crisis. Everything may work out well in the end, with inflation returning to target and interest rates back to more normal levels. The absence of supportive fiscal policy could be making an already tough job that much tougher. But the longer this goes on the more the suspicion grows that central bankers aren’t quite so clever as they think they are, and that what is dressed up as a carefully calibrated policy response is really just blundering around in the dark. Central banks have been conducting a gigantic experiment over the past seven years and Tyrie will want to know from Carney whether he actually knows what he is doing. It is a perfectly fair question.

Come home to daddy…

• Foreign Central Banks Dump Dollars At Federal Reserve (Reuters)

China, Japan and other overseas central banks are leaving more of their dollars with the U.S. Federal Reserve as they have liquidated their U.S. Treasuries holdings to raise cash in an effort to stabilize their currencies, government data show. Foreign central banks’ reduced ownership of U.S. government debt, especially older issues, have bloated the bond inventories of U.S. primary dealers and kept U.S. money market rates elevated in recent months, analysts said. Primary dealers, or the top 22 Wall Street firms that do business directly with the Fed, held $113.5 billion worth of Treasuries in the week ended Feb. 10, the most since October 2013. As Wall Street holds more Treasuries, foreign central banks have piled more money into the Fed’s reverse purchase program where they earn interest income.

“They have been selling their Treasuries holdings and using more the Fed’s reverse repo program,” Alex Roever, head of U.S. interest rate strategy at J.P. Morgan Securities in New York, said on Monday. On Monday, the New York Federal Reserve’s executive vice president Simon Potter said the Fed’s repo program for foreign central banks has increased because “the constraints imposed on customers’ ability to vary the size of their investments have been removed, the supply of balance sheet offered by the private sector to foreign central banks appears to have declined, and some central banks desire to maintain robust dollar liquidity buffers.” On Feb. 17, overseas central banks held $246.65 billion in reverse repos, up from $129.78 billion a year earlier, Fed data released last week showed.

The very suggestion is ludicrous. TBTF banks have gotten a lot bigger since 2007.

• Taxpayers Cannot Bank On An End To The Era Of Too Big To Fail (FT)

During Deutsche Bank’s share price meltdown a couple of weeks ago, Wolfgang Schäuble, the German finance minister, said he had “no concerns” about the health of Germany’s largest bank. But what could he actually do if he really were worried? Last year Mark Carney, governor of the Bank of England, proclaimed that the era of too-big-to-fail banks was over, meaning that politicians (via their taxpayers) will no longer be able to rescue banks. If Mr Carney is right about that, it would indeed be some achievement. It was in 1984 that Stewart McKinney, a US congressman, popularised the phrase “too big to fail” when he described the near collapse of Continental Illinois Bank, which at the time was the seventh-largest bank in the US. The issue came back to haunt policymakers in 2008 with the plethora of bank rescues.

But can taxpayers around the world really breathe a sigh of relief that next time it will not be down to them to pay for the bailout of their banks? Nobody knows. Indeed, just last week Neel Kashkari, one of the architects of the $700bn taxpayer bailout of US banks in 2008 and the head of the Minneapolis Federal Reserve, said that he thought “too big to fail” remained alive and well. We all know what the new rule book says; that when one of the world’s largest banks becomes close to going bust, then it is up to all of its debt and equity holders to pay for the rescue. That bit is clear. But financial history is littered with examples of rule books being ignored in the teeth of a crisis.

That is what happened in 2008, when governments trampled over rules that placed limits on deposit guarantees and refused to call on senior bondholders to suffer the losses that they were contractually expected to bear. Faced with contagion risk and fears of systemic failures, governments break rules. To some extent we can ask the markets to judge Mr Carney’s claim that “too big to fail” has really ended against Mr Kashkari’s scepticism. An April 2014 IMF report estimated that the too-big-to-fail subsidy — the lower funding costs enjoyed by the world’s largest banks — totalled up to $630bn per annum. If true, then removing that subsidy would destroy the profits of these big banks.

Yet the fact that share prices for most banks, whilst weak, have not totally collapsed suggests that markets, at least, either do not believe that the subsidy was ever that big, or that the age of “too big to fail” is still not over. There have always been two ways to address this too-big-to-fail challenge. One approach — the one which hitherto has been favoured by most regulators — is to place the cost of bailouts on the private sector and therefore to remove the cost of failure from taxpayers. Yet as Mr Kashkari makes clear, there remains considerable doubt over whether such a course of action will really work in practice. And until a major bank nears collapse, such doubts will inevitably remain.

The painful world of Oz.

• That’s Not A Housing Bubble, This Is A Housing Bubble (BBG)

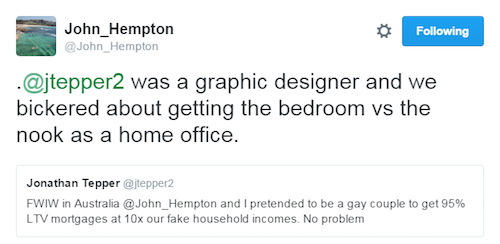

Insane. That’s how Jonathan Tepper, chief executive officer at research firm Variant Perception, described Australia’s housing sector in a word, painting the picture of a market that’s strikingly similar to that of the U.S. prior to the financial crisis. A local 60 Minutes segment that aired on Sunday titled “Home Groans” chronicled some of the eye-popping events in the nation’s real estate market, with amateurs owning (and under water on) multiple homes with no tenants, interest-only loans increasing in prominence, price-to-income ratios at elevated levels, and home auctions attended by the community and captured for the small screen.

Much of the clip centers on the coal town of Moranbah, which the narrator deems to be a canary in the coal mine for the nation’s housing market as a whole, and the financial and emotional plight of those who got caught up in the boom. According to an owner, the value of one property in the Queensland town has declined by roughly 80%. Perhaps the juiciest tidbit, however, is a claim that John Hempton, a hedge fund manager at Bronte Capital and long-time Australian property bear, and Tepper—who’s called housing busts in the U.S., Spain, and Ireland—put on Twitter:

Tepper later added that this offer came from a “major brand lender.” While most discussions of frothy housing markets focus on the low cost of credit (and central banks’ role in that), the ability to access credit is arguably more important. A borrower may be willing to take on a dangerous amount of leverage to be part of a seemingly can’t-miss opportunity, but in the end, the bank still has the final say on whether to provide the funds. Australia hasn’t had a recession since the early 1990s, but it’s tough to see the nation avoiding one in the event that Tepper’s prophesied 30% to 50% crash in home values comes to pass. Of course, investors have also been warning of an Australian housing bubble for almost as long.

Bad money.

• The Fatal Flaw That Has Doomed Our Economy (Bonner)

We are searching for an insight. Each time we think we see it… like the shadow of a ghost in an old photo… it gets away from us. It concerns the real nature of our money system… and what’s wrong with it. Here… we bring new readers more fully into the picture… and try to spot the flaw that has doomed our economy. Let’s begin with a question. After the invention of the internal combustion engine, people in Europe… and then the Americas… got richer, almost every year. Earnings rose. Wealth increased. Then in the 1970s, after two centuries, American men ceased making progress. Despite more PhDs than ever… more scientists… more engineers… more capital… more knowledge… more Nobel Prizes… more college graduates… more machines… more factories… more patents… and the invention of the Internet… after adjusting for inflation, the typical American man earned no more in 2015 than he had 40 years before.

Why? What went wrong? No one knows. But we have a hypothesis. Not one person in 1,000 realizes it, but America’s money changed on August 15, 1971. After that, not even foreign governments could exchange their dollars for gold at a fixed rate. The dollar still looked the same. It still acted the same. It still could be used to buy booze and cigarettes. But it was flawed money. And it changed the whole world economy in a fundamental way… a way that is just now coming into focus. The Old Testament tells us that God chased Adam and Eve from the Garden of Eden with this curse: “By the sweat of your brow, you will earn your food until you return to the ground.” From then on, you worked… you earned money… you could buy bread. Or lend it out. Or invest it.

Dollars – or any form of real money – were compensation… for work, for risk taking, for accumulating knowledge and capital. Money is information. It tells us how much reward we’ve earned… how much things cost… how much profit, how much loss, how much something is worth… how much we’ve saved, how much we’ve spent, how much we need, and how much we’ve got. Ultimately, only a market-chosen money can be sound. The market chose gold as the most marketable commodity. There were no meetings or committees deciding on this, it happened spontaneously – governments simply usurped it. Money doesn’t have to be “hard” or “soft” or expensive or cheap. But it has to be honest. Otherwise, the whole system runs into a ditch. But the new money was a phony. It put the cart ahead of the horse.

This was money that no one ever had to break a sweat to get. It was based on credit – the anticipation of work, not work that had already been done. Money no longer represented wealth. It now represented anti-wealth: debt. So, the economy stopped producing real wealth. The Fed could create money that no one ever earned and no one ever saved. It was no longer the real thing, but a counterfeit. In this way, effort and reward were cut off from one another. The working man still had to labor. But it was the banker, gambler, speculator, lender, financier, investor, politician, or inside operator who made the money. And the nature of the economy changed. Instead of rewarding the productive Main Street economy, it rewarded insiders… and the financial sector.

Globalization is a huge failure.

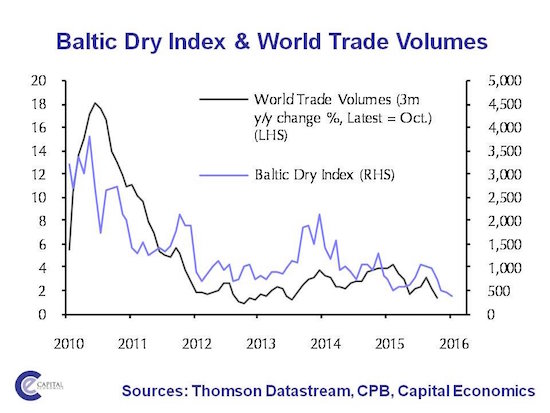

• Cargo Ships Are Being Scrapped Faster Than They Are Being Built (BI)

World trade is as bad as it has been at any point since the global financial crisis in 2008. The Baltic Dry Index, a measure of how much it costs to transport raw materials, in November dropped below 500 for the first time, and it has kept falling. The index was as high as 1,222 in August, and it has fallen 84% from a recent peak of 2,330 in late 2013. The index measures how much it costs to ship dry commodities, meaning raw materials like grain and steel, around the world. It is frequently used as a so-called canary in the coal mine for the state of the global economy and how well international trade is performing. If the price is low, it suggests trade is slowing.

Analysts at Deutsche Bank led by Amit Mehrotra have been watching the fall closely. The drop has been so bad that ships are being scrapped faster than they are being built. Here are the main points in a recent note:

• Total dry bulk capacity declined by almost 1M tons (net) last week as the pace of deliveries slowed and scrapping remained elevated.

• Around 16 ships were sold for scrap last week totaling 1.6M tons. This more than offset 9 new deliveries, translating to a net reduction of 7 vessels.

• Last week’s scrapping would represent an annualized pace of 11% of installed capacity, which is almost double the all-time high of 6.3% set in 1986.

• Year-to-date scrapping is up 80% versus same time last year.It’s bad news, as it means that ship owners expect demand for cargo transport to remain weak long into the future. And they’re generally very good at predicting trends in global trade. This graph from Capital Economics shows just how closely the Baltic Dry index tracks world trade volumes.

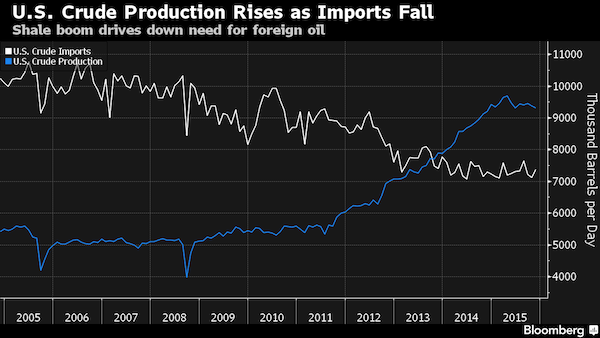

OPEC’s main problem is a collapsing world economy, not shale.

• OPEC Doesn’t Know How To ‘Live Together’ With Shale Oil (BBG)

OPEC and U.S. shale may need a relationship counselor. After first ignoring it, later worrying about it and ultimately launching a price war against it, OPEC has now concluded it doesn’t know how to coexist with the U.S. shale oil industry. “Shale oil in the United States, I don’t know how we are going to live together,” Abdalla Salem El-Badri, OPEC secretary-general, told a packed room of industry executives from Texas and North Dakota at the annual IHS CERAWeek meeting in Houston. OPEC, which controls about 40% of global oil production, has never had to deal with an oil supply source that can respond as rapidly to price changes as U.S. shale, El-Badri said. That complicates the cartel’s ability to prop up prices by reducing output.

“Any increase in price, shale will come immediately and cover any reduction,” he said. The International Energy Agency earlier on Monday gave OPEC reason to worry about shale oil, saying that total U.S. crude output, most of it from shale basins, will increase by 1.3 million barrels a day from 2015 to 2021 despite low prices. While U.S. production from shale is projected to retreat by 600,000 barrels a day this year and a further 200,000 in 2017, it will grow again from 2018 onward, the IEA said. “Anybody who believes that we have seen the last of rising” U.S. shale oil production “should think again,” the IEA said in its medium-term report.

More to come.

• S&P Cuts Rating On BP, Total And Statoil (Reuters)

Standard & Poor’s cut its corporate credit ratings on BP, Total SA and Statoil ASA , citing the Europe-based oil and gas companies’ persistent weak debt coverage measures over 2015-2017. The ratings agency on Monday cut the long- and short-term corporate credit ratings on BP Plc to ‘A minus/A-2’ from ‘A/A-1’ with a stable outlook. S&P lowered the long- and short-term corporate credit ratings on Total S.A. to ‘A plus/A-1’ from ‘AA-/A-1 plus’ and assigned a negative outlook. The ratings agency also cut the long- and short-term corporate credit ratings on Statoil ASA to ‘A plus/A-1’ from ‘AA minus/A-1 plus’ and assigned a stable outlook. Standard and Poor’s had lowered its ratings on some U.S. exploration & production companies after price assumption revisions earlier this month.

“The U.S. remains a net importer, but its demand for foreign oil has fallen by 32% since its peak in 2005.” A third in 10 years. That’s a lot. But it’s not only because of shale.

• The Trickle of US Oil Exports Is Already Shifting Global Power (BBG)

The sea stretched toward the horizon last New Year’s Eve as the Theo T, a red-and-white tug at her side, slipped quietly beneath the Corpus Christi Harbor Bridge in Texas. Few Americans knew she was sailing into history. Inside the Panamax oil tanker was a cargo that some on Capitol Hill had dubbed “Liquid American Freedom” – the first U.S. crude bound for overseas markets after Congress lifted the 40-year export ban. It was a landmark moment for the beleaguered energy industry and one heavy with both symbolism and economic implications. The Theo T was ushering in a new era as it left the U.S. Gulf coast bound for France.

The implications – both financial and political – for energy behemoths such as Saudi Arabia and Russia are staggering, according to Mark Mills, a senior fellow at the Manhattan Institute think tank and a former venture capitalist. “It’s a game changer,” he said. For the Saudis and their OPEC cohorts, who collectively control 40% of the globe’s oil supply, the specter of U.S. crude landing at European and Asian refineries further weakens their grip on world petroleum prices at a time they are already suffering from lower prices and stiffened competition. With Russia also seeing its influence over European energy buyers lessened, the two crude superpowers last week tentatively agreed to freeze oil output at near-record levels, the first such coordination in a decade and a half.

The political effects need not wait until U.S. shipments become more plentiful, Mills said. “In geopolitics, psychology matters as much as actual transactions,” he said. Meanwhile, the U.S. is also poised to make its first shipments of liquefied natural gas, or LNG, from shale onto world markets within weeks, about two months later than scheduled. Cheniere Energy Iexpects to have about 9 million metric tons a year of LNG available for its own portfolio from nine liquefaction trains being developed at two complexes in Texas. That’s enough to power Norway and Denmark combined for a year.

[..] Beyond corporations, the Dec. 18 lifting of the export ban by Congress and President Barack Obama created geopolitical winners and losers, too. The U.S., awash in shale oil, has gained while powerful exporters like Russia and Saudi Arabia, for whom oil represents not just profits but also power, find themselves on the downswing. The U.S. remains a net importer, but its demand for foreign oil has fallen by 32% since its peak in 2005. Meanwhile, plummeting oil and gas prices, driven in part by the U.S. shale revolution, have already eroded OPEC and Russia’s abilities to use natural resources as foreign policy cudgels. They are also squeezing petroleum-rich economies from Venezuela to Nigeria that rely heavily on crude receipts to fund everything from military budgets to fuel subsidies.

Oh well, it’s only the IEA.

• Crude Glut Could Take Years to Disappear: IEA (WSJ)

Oil prices are unlikely to significantly rebound for at least a few years, the International Energy Agency projected on Monday, as a top official with the Organization of the Petroleum Exporting Countries said he wouldn’t rule out taking additional steps to stabilize the market. The new IEA projections and the statements by OPEC’s secretary-general, which came as oil ministers, executives and analysts gathered for the annual IHS CERAWeek conference in Houston made one point abundantly clear: No one is immediately coming to the rescue for struggling oil producers. Oil rallied Monday following the IEA’s projection that shale production is poised to fall this year by about 600,000 barrels a day, and by 200,000 barrels a day in 2017.

But Fatih Birol, the executive director of the IEA, which tracks the global oil trade on behalf of industrialized nations, and OPEC’s Abdalla el-Badri, who represents the cartel of major exporters, both agreed that market signals continue to point to depressed prices. “Everybody is suffering,” said Mr. el-Badri, noting that the rapid fall in crude had caught many member nations by surprise. “This is historical,” said Mr. Birol. “In the last 30 years, we have never seen oil investment decline two-consecutive years.” A preliminary agreement between Saudi Arabia and Russia to freeze output at January levels was a “first step” toward creating market stability, he said. Iran, whose oil exports have only recently been freed from Western sanctions, has yet to agree. “If this is successful, maybe we can take other steps in the future,” Mr. Birol said, declining to specify what those could be. He also asserted OPEC’s continued relevance on the world scale. “We are not dead. We are alive and alive and alive. You will see us for many years.”

Asking for more government support.

• North Sea Oil Investment To Slump 90% This Year As Losses Mount (Tel.)

Investment in the UK’s embattled oil and gas industry is expected to fall by almost 90pc this year, raising urgent industry calls for the Government to reform its North Sea tax regime to safeguard the industry’s future. Oil firms have been forced to dramatically slash costs in order to survive a 70pc cut in oil prices since mid-2014, but the severe drop in investment threatens thousands of North Sea jobs, said Oil and Gas UK (OGUK). The trade group says that firms have forced down the cost of oil production from $29.30 a barrel in 2014 to just under $21 a barrel in 2015. But despite improving efficiency and cutting operating costs almost half of the UK’s oilfields will struggle to make a profit if oil prices remain at $30-a-barrel levels for the rest of the year.

The financial risk means many have axed or delayed investment decisions, and OGUK said that investment in new projects could fall as low as £1bn this year, compared with a typical average of £8bn a year. OGUK boss Deidre Mitchell said: “This drop in activity is being felt right across the supply chain, which contracted by a quarter in the last year and is expected to fall further in the coming year as current projects near completion. “With demand for goods and services falling, ongoing job losses are the personal cost to individuals and families across the UK.” North Sea job losses could reach a total of 23,000, and Aberdeen is expected to take the brunt of the economic hit. Securing the future of the region has already climbed the political agenda this year with both the Scottish and Westminster governments pledging hundreds of millions of pounds in support.

Justin inherited a poisoned chalice. Didn’t he know?

• Canada PM Trudeau Drops Campaign Promises and Goes All In With Deficits (BBG)

In for a penny, in for a pound. With falling oil prices eroding Canada’s revenue base, newly elected Prime Minister Justin Trudeau is fully embracing deficits, with his finance minister hinting Monday the country will run a deficit of about C$30 billion ($22 billion) in the fiscal year that starts April 1. It’s one of the biggest fiscal swings in the country’s history that, in just four months since the Oct. 19 election, has cut loose all the fiscal anchors Trudeau pledged to abide by even as he runs deficits. The government’s bet is that appetite for more infrastructure spending and a post-election political honeymoon will trump criticism over borrowing and unmet campaign promises. “It looks like the Liberals want to front load as much bad news as possible in the hope when the election occurs in four years things will be better,” said Nik Nanos, an Ottawa-based pollster.

Trudeau swept to power in part by promising to put an end to an era of fiscal consolidation the Liberals claimed was undermining Canada’s growth, which has been lackluster since the recession in 2009. Still, he has tried to temper worries by laying out three main fiscal promises: annual deficits of no more than C$10 billion, balancing the budget in four years and reducing the debt-to-GDP ratio every year. On Monday, Finance Minister Bill Morneau indicated none of those three promises will be met. A fiscal update – released a month before the government’s first budget is due – showed Canada’s deficit in the year that begins April 1 is on pace to be C$18.4 billion, even before the bulk of the government’s C$11 billion in spending promises and any other stimulus measures are accounted for. The same document shows the nation’s debt-to-GDP ratio will be rising in the coming fiscal year, not falling. Morneau also reiterated that balancing the budget in the near term would be “difficult.”

2800 more arrivals in Athens overnight.

“It’s not refugees that are the problem. The problem is bombs falling on their houses”- Spiros Galinos, Mayor Lesvos

• Number Of Refugees Trapped At Border, Piraeus Builds Up (Kath.)

Thousands of refugees and migrants gathered at Greece’s border with the Former Yugoslav Republic of Macedonia (FYROM) on Monday, heightening concern that they will become trapped over the coming days. Some 4,000 people were estimated to have congregated at the Idomeni border crossing after FYROM refused to allow any Afghans at all or Iraqis and Syrians who did not have passports to cross from Greece. Athens said it had launched diplomatic efforts to convince Skopje to allow the Afghans, who make up around a third of arrivals, through. But the FYROM government said its decision was triggered by actions to its north. Austria, which is not accepting more than 80 refugees a day has called a summit with Albania, Bosnia, Bulgaria, Croatia, Montenegro, FYROM, Serbia, Slovenia and Kosovo tomorrow to attempt to coordinate their reaction to the refugee crisis.

Slovakia’s Prime Minister Robert Fico expressed doubts about whether the EU’s plans to reach a deal with Turkey next month on limiting the flow of migrants and refugees would be effective. “If that does not work, and I am very pessimistic, and all of us in Europe will insist on proper protection of external borders, there will be nothing left but protecting the border on the line of Greece-Macedonia and Greece-Bulgaria,” he said. FYROM’s action on its border was already having a knock-on effect in other parts of Greece yesterday. Thousands of migrants arriving at Piraeus from the Aegean islands, where almost 8,000 people arrived between Friday and Sunday, were held back at the port to avoid further overcrowding at Idomeni. Some were taken to the new transit center at Schisto.

“Our biggest fear is that the 4,000 migrants who are in Athens head up here and the place will become overcrowded,” Antonis Rigas, a coordinator of the medical relief charity Doctors Without Borders, told Reuters. Despite the rise in arrivals over the weekend, bad weather cut the number of refugees and migrants arriving in Greece by 40% last month compared to December, the European Union’s border agency Frontex said. But the number was still nearly 40 times higher than a year before. Frontex said most of the 68,000 people that reached Greece last month were Syrians, Iraqis and Afghans.

The lack of leadership in Europe is embarrassing. Why maintain a union at all?

• Greece Implores Macedonia To Reopen Border To Refugees (Guardian)

Greece has been making frantic appeals to Macedonia to open its frontier after a snap decision to tighten border controls by the Balkan state left thousands of people stranded. By midday on Monday up to 10,000 men, women and children had been trapped in Greece, with most marooned in the north. Another 4,000, newly arrived from islands off Turkey’s Aegean coast, were stuck in Athens’s port of Piraeus. The backlog came after Macedonia refused entry to Afghan refugees, claiming it was reacting to a similar move by Serbia. Amid rising tension and fears of the collapse of the passport-free Schengen zone,Greece lambasted the policies being pursued by countries to its north.

Speaking on state-run ERT television, the Greek migration minister, Yiannis Mouzalas, said: “Once again the European Union voted for something, it reached an agreement, but a number of countries lacking the culture of the European Union, including Austria, unfortunately violated this deal barely 10 hours after it had been reached.” Neighbouring countries along the Balkan corridor had in turn become enmeshed in “an outburst of scaremongering”. “The Visegrád countries have not only not accepted even one refugee; they have not sent even a blanket for a refugee,” he added, referring to the Czech Republic, Poland, Hungary and Slovakia. “Or a policeman to reinforce [EU border agency] Frontex.” Skopje said on Monday it had tightened restrictions after Austria imposed a cap on transit and asylum applications, triggering a domino effect down the migrant trail.

As officials scrambled to find accommodation for the newcomers, Athens’s leftist-led government was engaged in desperate diplomatic efforts to ease the border controls. Greece has become Europe’s main entry point for the vast numbers fleeing war and destitution in the Middle East, Africa and Asia. Last year, more than 800,000 people – the majority from Syria – passed through the country en route to Germany and other more prosperous EU member states. With the pace of arrivals showing no sign of abating – a record 11,000 people were registered on Aegean islands in the space of three days last week – Athens has been in a race against the clock to improve hosting facilities including ‘hot spot’ screening centres and camps.

Mounting questions over Turkey’s desire to stem the flow, and Greece’s ability to handle it, have fuelled fears that if nations take unilateral action to seal frontiers, hundreds of thousands will end up trapped in Europe’s most chaotic state. Battling its worst economic crisis in modern times, Athens is ill-equipped to deal with the emergency.

There’s no place on the border.

• Greek Police Start Removing Refugees From Macedonian Border (Reuters)

Greek police started removing migrants from the Greek-Macedonian border on Tuesday after additional passage restrictions imposed by Macedonian authorities left hundreds of them stranded, sources said. The migrants had squatted on rail lines in the Idomeni area on Monday after attempting to push through the border to Macedonia, angry at delays and additional restrictions in crossing. Greek police and empty buses had entered the area before dawn, a Reuters witness said. In one area seen from the Macedonian side of the border, about 600 people had been surrounded by Greek police, the witness said. There were an estimated 1,200 people at Idomeni, in their vast majority Afghans or individuals without proper travel documents.

A crush developed there on Monday after Macedonian authorities demanded additional travel documentation, including passports, for people crossing into the territory. Some countries used by migrants as a corridor into wealthier northern Europe are imposing restrictions on passage, prompting those further down the chain to impose similar restrictions for fear of a bottleneck in their own country. But there are concerns at what may happen in Greece, where a influx continues unabated to its islands daily from Turkey. On Tuesday morning, a further 1,250 migrants arrived in Athens by ferry from three Greek islands. Some of them had bus tickets to Idomeni, but it was unclear if they would be permitted to travel north from Athens.

Good description of what Greece finds itself in.

Thessaloniki Mayor Yiannis Boutaris is absolutely right: “Refugees don’t eat people.” We are not sure if the reverse is true, as current events do not allow for any kind of certainty in the matter. For many leaders and citizens in a number of countries, refugees have already proved expendable, ready for sacrifice. A mass whose feelings don’t count, whose hopes for a better life bring laughter to those already enjoying it. This mass only acquires any significance when incorporated into the strategies of geopolitical players. In order for these strategies to succeed, it is no longer necessary to sacrifice parts of the cronies’ powers, in other words the unknown soldiers, as is usually the case when it comes to typical confrontations between countries. Being foreign and often of a different religion, the refugees are a great substitute and are inexpensive.

They constitute hundreds of thousands of pawns being moved on the map by chess-playing marshals constantly launching threats and blackmailing each other. We see this happening in bilateral and multilateral summit meetings in Brussels, London, Geneva, Vienna and Ankara, where talks focus on reaching a truce in the Syrian conflict, the allocation of refugees in European states and Turkey’s obligations, not to mention the precise rewards for fulfilling these obligations. A crucial element is that one of the biggest taboos of the post-Nazi era, threatening references to a Third World War, are forfeited during these meetings. Greece is not among the big players. It never has been. It is nowhere near Turkey in terms of size, population figures or diplomatic cynicism, which during Recep Tayyip Erdogan’s dominance has increasingly acquired delusions of grandeur.

When it comes to the refugee-migrant issue, Greece is just a pipeline, in between two taps over which it has no control. In the east, the entry tap can be opened and closed as the Turkish government pleases, depending on what suits its interests at the time: from showing a bit of good behavior through a partial containment of flows to playing the tough guy, by turning a blind eye to the smuggling rings. At the same time, Greece has very little influence over the exit tap at the Former Yugoslav Republic of Macedonia border. The neighboring country appears to be treating the current situation as a major opportunity to promote its broader interests, hence offering its services to the so-called Visegrad Four and Western Balkan countries.

No matter what else is going on, Greece must continue to honor its agreements, making the absence of morals and justice in the international political arena even more painfully clear.

Home › Forums › Debt Rattle February 23 2016