Banksy Monkey Parliament 2009

Finland wants to join NATO.

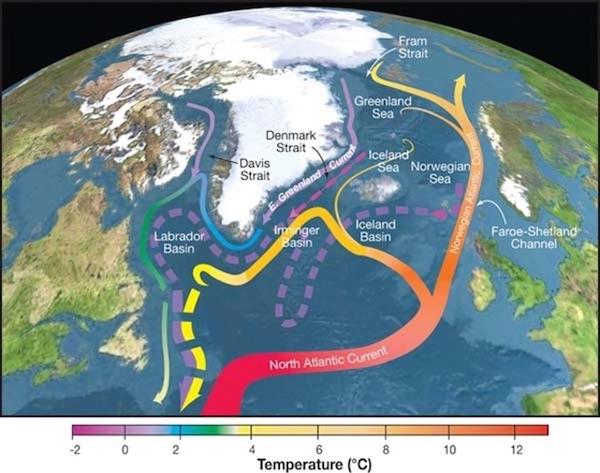

Russia says NATO missiles in Ukraine would be too close to Moscow. Check the distance from the Ukraine border to Moscow. Then from the Finland border to St. Petersburg.

Tulsi armageddon

Tulsi Gabbard: The path the Biden admin has us on will lead to nuclear armageddon pic.twitter.com/hdxroVGeLk

— Wittgenstein (@backtolife_2022) May 11, 2022

Zero covid

China's zero-COVID strategy unsustainable, says WHO

euronews pic.twitter.com/KxHU0r8SHR— Wittgenstein (@backtolife_2022) May 11, 2022

“Finland shares a 830-mile border with Russia..”

When NATO was founded, they did’t even dare.

• Finland Announces Plans To Join NATO In Historic Move (CNBC)

Finland’s President Sauli Niinisto and Prime Minister Sanna Marin said Thursday that the country should apply to join NATO “without delay.” Finland has had a decades-long policy of military neutrality that would come to an end if it becomes a full member of the military alliance. Thursday’s announcement is the strongest sign yet that Finland will make a formal application to join NATO. The government will debate the issue over the weekend and the Finnish parliament is expected to give its final approval to the application as early as Monday. At the same time, there is a risk the move from Helsinki could spark aggression from Russia, where President Vladimir Putin has expressed his opposition against NATO’s enlargement.

Finland shares a 830-mile border with Russia; if it joins the military alliance, the land border that Russia shares with NATO territories would roughly double (Russia has land borders with 14 countries and five of them are NATO members: Latvia, Estonia, Lithuania, Poland and Norway). Finland has been reviewing its security policy in the wake of Russia’s invasion of Ukraine, which showed the Kremlin is willing attack a neighboring nation. Finland has been invaded in the past — in 1939, the Soviet Union attacked Finland in what became known as the Winter War.

Ukraine will become a landlocked “country”.

• Nothing to Celebrate? (Tweedie)

On May 8, when Victory in Europe (VE) Day is celebrated in the West, US Ambassador to the United Nations Linda Thomas-Greenfield told CNN that Russia had “nothing to celebrate” on its own Victory Day on May 9. Her reasoning, faithfully transcribed on the US mission’s website, was that “They have not succeeded in defeating the Ukrainians.” Given that Victory Day and VE Day both specifically commemorate the allied defeat of Nazi Germany in 1945, Thomas-Greenfield’s comments were like saying the US, Britain and France had nothing to celebrate this year because they got chased out of Afghanistan by the Taliban last August. The ambassador is either an apologist for Nazism or merely too ignorant to do her job. She should at least read some objective reports about the conflict in the Ukraine.

In fact Russians had two immediate military victories to celebrate that Monday. Russian and Lugansk People’s Republic troops captured the town of Popasna, a lynchpin in the Ukrainian army’s defensive line that it had held for eight years. Meanwhile Kiev, apparently desperate for a victory of its own to rain on the parade through Moscow’s Red Square, launched an airborne and marine assault on the now-famous Zmeinyy (Snake) Island off the coast of Odessa oblast. Some sources say the Russians withdrew their small force holding the island as bait for a trap, but either way it went horribly wrong for the Ukrainians. They lost four jet fighters and strike aircraft, up to 10 helicopters, a corvette and three infantry landing craft. More than 60 of their personnel were killed, of which 27 were abandoned on the island.

The Ukraine is like a bull elephant that has been shot right in the heart in mid-charge. The beast keeps on bellowing and rampaging around, not yet realising that it’s already dead. It becomes clearer by the day that the Ukrainian army attempting to occupy the remains of the Donbass republics, newly recognised by Russia just as the West ‘recognised’ its creations of Kosovo and South Sudan, is dead on its feet. Its navy, air force, artillery, tanks and transportation are almost destroyed. Its casualties are replaced with boys and old men press-ganged off the streets of Kiev and Lvov, some without proper boots. Its senior officers are fled or dead.

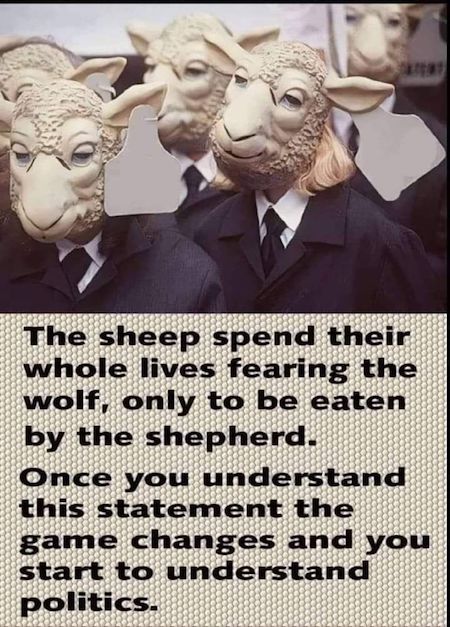

“..the Russian Federation is a very unequal and corrupt society because of these oligarchs, who simply repeat the Western oligarch model..”

Russia before 1917 was rotten from the inside, a house of cards. The whole ‘Revolution’ was a story of the treachery of the elite, the aristocrats, including many Romanovs, the politicians, the generals and the new bourgeoisie. Having lost their faith, they replaced all loyalty to the Faith, the Tsar and Home with pure greed. The same thing happened with the USSR. A generation after the people’s war won by those trained in the Tsar’s Army, the Soviet Union turned into a State in whose official Communist ideology nobody believed any more. The elite had lost faith in it and so the USSR also fell. After 1991 the Russian Federation was handed over to the future oligarchs, the new aristocrats, just as before the Revolution the Russian Empire had been far too much in the hands of the past oligarchs, the old aristocrats.

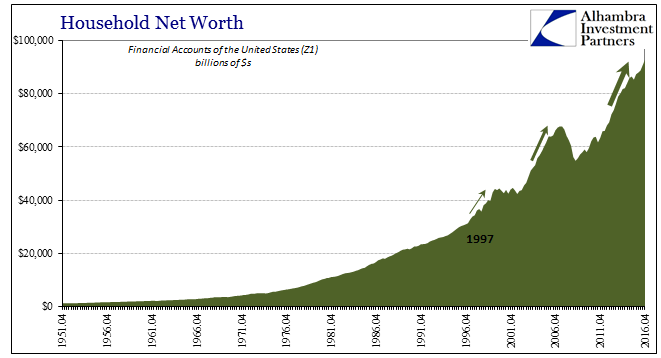

Whoever says oligarchs automatically says corruption. And when the rich have enough riches, they next want power and betray to get it. Like the rest of the world, the Russian Federation is a very unequal and corrupt society because of these oligarchs, who simply repeat the Western oligarch model. Have no illusions: Oligarchs rule the Western world. It is illusory to think otherwise. In France Pompidou was and Macron is a Rothschild banker (the ones who own The Economist and much of the rest of the media). French conglomerates stand beside them. In Germany banks and huge automobile and chemical industries put up their political candidates. In the UK all candidates are vetted by the financial sharks of the City. As for the USA, think of Trump or Hoover, and all is clear. Follow the money.

“He stressed it would be “up to local residents” and that the process would be “absolutely clear and legitimate”

• Russian-Captured Ukrainian Territories Will Soon Ask To ‘Join Russia’ (ZH)

Russia’s state-run RIA Novosti news agency is reporting for the first time Wednesday that the Russian military occupied southern Ukrainian city of Kherson will soon petition the Kremlin to become part of the Russian Federation. It was in late April that a pro-Moscow “military-civilian administration” was installed after Kherson fell to the invading forces, complete with a local transition to the Russian ruble. While the news hasn’t been officially confirmed by the Kremlin, it’s significant that the report surfaced through RIA and not Ukrainian or opposition sources, suggesting such referendums or even simple declared annexations in captured regions could be imminent.

Kremlin spokesman Dmitry Peskov has in his latest statements invoked Crimea – which came under Russian control due to a Kremlin-backed ‘popular referendum’ in 2014 – as a model for what could happen regarding Kherson’s political future. He stressed it would be “up to local residents” and that the process would be “absolutely clear and legitimate”. Additionally, according to The Moscow Times, “Occupied Kherson, as well as the Pryazovske region on the Sea of Azov, reportedly began trading with Crimea shortly after Russian forces installed pro-Moscow administrations in the area.”

And Reuters writes of more signs of annexation of the city coming soon as follows: “TASS cited the Russian-controlled administration as saying that pension bodies and a banking system would be created from scratch for the region, and that branches of a Russian bank could be open there before the end of May,” according to its report. However, some correspondents are saying there won’t be a referendum, or possibly just the appearance of one as a pretext…

Lavrov

“If you can’t sleep because of the Russian-Ukrainian conflict just imagine it’s in Africa or the Middle East”

– Lavrov

WESTERN HYPOCRITES ON LIFE SUPPORT pic.twitter.com/5QoU7Vrolh

— What's the media hiding? (@narrative_hole) May 9, 2022

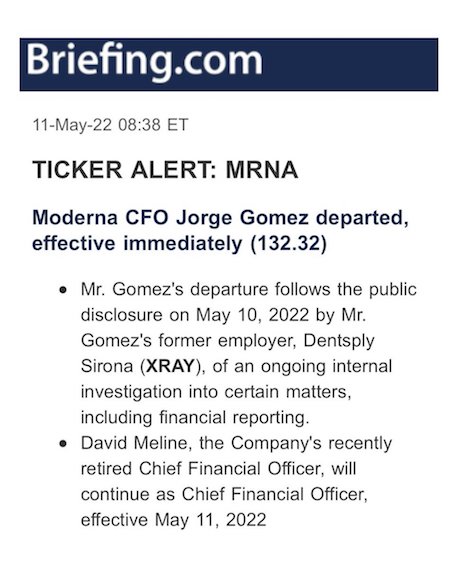

It’s not even a revolving door anymore.

• Blinken, Austin Past Ties to Investment Firms Forgotten by Media (Celente)

Top officials in the Biden administration who have been the most vocal backers of providing Ukraine with more arms than Kyiv knows what to do with have deep ties to consulting and investment firms that has raised concerns in the past about the government’s revolving door with the defense industry. The Presstitutes no longer discuss these ties because they are on the same team as the government when it comes to Ukraine. More weapons, more weapons, more weapons. Two of the biggest names in the Biden administration with these past ties are Secretary of Defense Lloyd Austin and Secretary of State Antony Blinken. They have been some of the top proponents of donating weapons to Ukrainians.

BLINKEN: “Russia is failing. Ukraine is succeeding. Russia has sought, as its principal aim, to totally subjugate Ukraine, to take away its sovereignty, to take away its independence. That has failed.” AUSTIN: “We want to see Russia weakened to the degree that it can’t do the kinds of things that it has done in invading Ukraine. It had already lost a lot of military capability and a lot of its troops, quite frankly, and we want to see them not have the capability to very quickly reproduce that capability.”

One of the names that kept popping up about a year or so ago was Blinken and Austin’s ties to a little-known investment firm called Pine Island Capital Partner. In December 2020, Pine Island Acquisition Corp., a special purpose acquisition company that claimed to have “unusual access to information” said in its SEC filings that it was “well-suited to take advantage of the current and future opportunities present in the aerospace, defense and government service industries.” (Austin also sat on the board of Raytheon Technologies in 2020, according to OpenSecrets.org. Forbes estimated that Austin’s net worth is about $7 million after serving on boards in retirement.)

From CNBC in December 2020: Pine Island’s team includes Tony Blinken, Biden’s choice to be secretary of State, and Ret. Gen. Lloyd Austin, his nominee for Defense secretary. Austin was listed on the original SPAC proposal, while Blinken was left off as he took a leave of absence from the firm when he joined the Biden campaign. Axios reported a month earlier that Pine Island was formed in 2018 by John Thain, the CEO who reportedly got his office renovated for $1 million while his Bank of America Merrill Lynch took a major loss in 2009; Phil Cooper, the former Goldman Sachs buyout big, and Clyde Tuggle, ex-Coca-Cola executive.

“So, I know that there’s an outrage right now, I guess, about protests that have been peaceful to date, and we certainly continue to encourage that outside of judges homes..”

• Garland Allowing ‘Mob Rule’ In US – GOP (Fox)

Nearly 50 House Republicans pressed Attorney General Merrick Garland Wednesday to prosecute those protesting outside the homes of Supreme Court justices over an anticipated ruling overturning Roe v. Wade. Led by Rep. Claudia Tenney, R-N.Y., the members of Congress cite a federal law that makes it illegal to “picket or parade” outside a courthouse or a judge’s home “with the intent of influencing … the discharge of his duty.” “We therefore ask a simple question: as Supreme Court Justices are being illegally targeted at their homes, do you intend to enforce the law?” the Republicans wrote. “Your failure to act is a shameless and implicit endorsement of mob rule in America.”

Forty-seven House Republicans signed the letter, including House Republican Conference Chair Elise Stefanik, R-N.Y.; GOP Conference Vice Chair Mike Johnson; and R-La., Byron Donalds, R-Fla. They join a chorus of voices, including Senate Minority Leader Mitch McConnell, R-Ky., and Judiciary Committee Ranking Member Chuck Grassley, R-Iowa, who are condemning the protests at the justices’ homes. Over the weekend, protesters picketed outside the homes of Justice Brett Kavanaugh and Chief Justice John Roberts. People protested outside of Justice Samuel Alito’s home Monday.

“The right to peaceful assembly is among the most sacred rights we hold as Americans,” the GOP members wrote. “Yet our sacred right to peacefully assemble has never permitted Americans to intimidate judges, jurors or officers of the court. “We urge you to enforce the laws of the United States and stop the mob,” they added. “You should send the clear and unmistakable message to all Americans — regardless of party or political affiliation — that the intimidation of justices and the judicial process will not stand.”

The White House isn’t explicitly condemning protests outside the justices’ homes. But White House press secretary Jen Psaki said Monday intimidation is not acceptable. “@POTUS strongly believes in the Constitutional right to protest. But that should never include violence, threats, or vandalism,” Psaki tweeted. “Judges perform an incredibly important function in our society, and they must be able to do their jobs without concern for their personal safety.” “So, I know that there’s an outrage right now, I guess, about protests that have been peaceful to date, and we certainly continue to encourage that outside of judges homes,” Psaki elaborated Tuesday. “And that’s the president’s position.”

Filibuster had nothing to do with it.

• Efforts To Codify Roe vs Wade Fail In The Senate (ET)

The Senate voted on May 11 to filibuster the Democratic-sponsored Women’s Health Protection Act (WHPA), which would have codified the 1973 Roe v. Wade abortion ruling into federal law as the Supreme Court appears intent on striking down the precedent. The 51–49 procedural cloture motion vote was mostly party-line, with all Republicans and Sen. Joe Manchin (D-W.Va.) voting against the measure. The measure failed as expected because Democrats didn’t meet the 60-vote filibuster threshold needed to advance the legislation in the upper chamber. According to a draft opinion leaked to Politico and published on May 2—written by Justice Samuel Alito and confirmed as genuine by the court—a majority of the justices have agreed preliminarily to overturn Roe v. Wade.

The court hasn’t yet issued a final opinion. Under the 1973 standard, states are prohibited from imposing restrictions on abortion in the first trimester, during which SCOTUS ruled that the mother’s right to privacy outweighed state interest in protecting life. The move effectively overturned existing abortion laws in more than two dozen states, and since then, pro-life advocates have fought to return the power to regulate abortion to the states. Democrats decided immediately after the draft was leaked to try again on the WHPA, which the Senate failed to advance in February. A different version of the legislation was passed by the House of Representatives in September 2021 in a party-line vote, with Rep. Henry Cuellar (D-Texas), a pro-life Catholic, being the only Democrat to oppose it.

“..there was not an outbreak caused by products from the facility..”

• FDA Refuses To Reopen Biggest Baby Formula Plant in US (DM)

The biggest baby formula supplier in the U.S. has denied its Michigan plant is responsible for the deaths of two children despite the FDA closing it down. The plant was shutdown nearly three months ago after a bacterial infection caused the deaths and other serious illnesses. In mid-February Abbott Laboratories issued a nationwide baby formula recall and ceased operations at its plant in Sturgis, Michigan amid reports of babies contracting bacterial infections from its products. An Abbott spokesperson told DailyMail.com Tuesday that ‘thorough investigation’ by the U.S. Food and Drug Administration (FDA) and Abbott revealed ‘infant formula produced at our Sturgis facility is not the likely source of infection in the reported cases and that there was not an outbreak caused by products from the facility’.

However, despite the findings of the investigation, the plant remains shuttered nearly three months later, fueling the nationwide baby formula shortage. The FDA – which said it found food safety violations at the plant, as well as five strains of Cronobacter, a bacteria that can cause blood infections and meningitis – has refused to say when the plant can resume operations. Abbott claims they are ‘working closely with the FDA to restart operations’ at the plant, with the spokesperson noting: ‘We continue to make progress on corrective actions and will be implementing additional actions as we work toward addressing items related to the recent recall’. The FDA told DailyMail.com it was holding discussions with ‘Abbott and other manufacturers to increase production of different specialty and metabolic products’ but refused to say when the Sturgis plant could reopen.

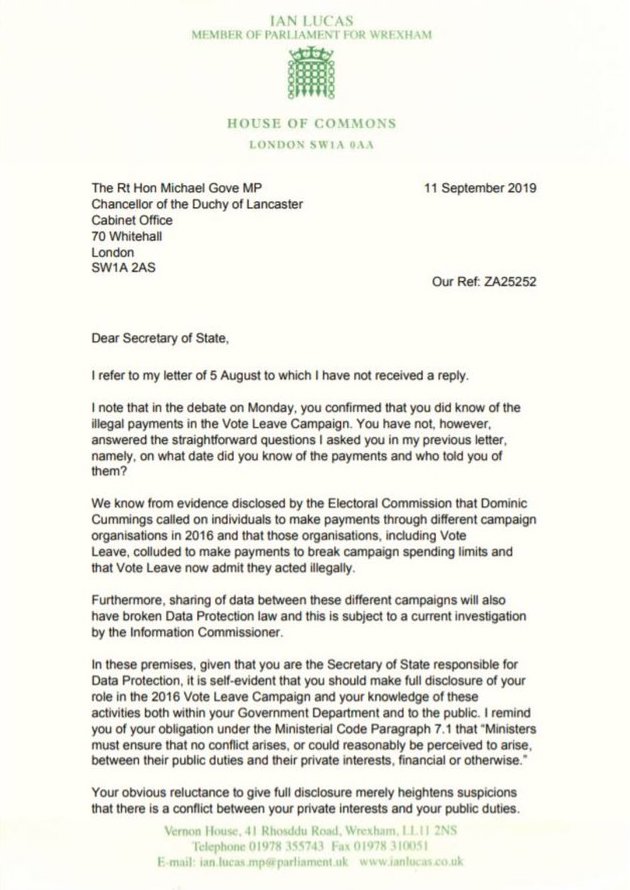

“..he conceded that they don’t look ethical..”

Well, no. 1, they were secret. Isn’t that enough?

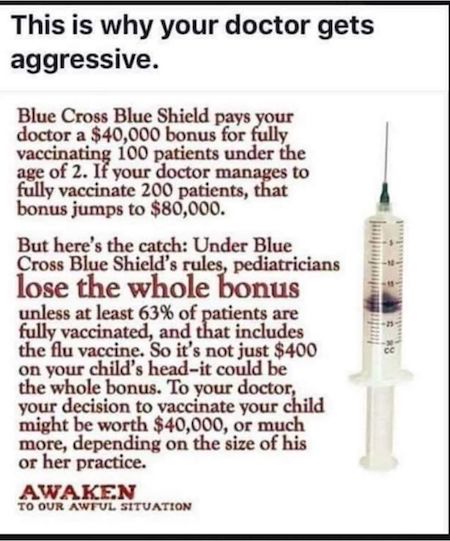

• Acting NIH Director Admits Appearance of Conflict of Interest in Payments (ET)

Undisclosed royalty payments estimated at $350 million from pharmaceutical and other firms to Dr. Anthony Fauci and hundreds of National Institutes of Health (NIH) scientists do present “an appearance of a conflict of interest,” according to the agency’s acting director. Dr. Lawrence Tabak, who took over as NIH director following the December 2021 resignation of the agency’s long-time leader, Dr. Francis Collins, told a House Appropriations Committee subcommittee that federal law allows the royalty payments, but he conceded that they don’t look ethical. “Right now, I think the NIH has a credibility problem and this only feeds into this, and I’m only just learning about this,” Rep. John Moolenaar (R-Mich.) told Tabak.

“People in my district say, ‘Well, so-and-so has a financial interest,’ or they don’t like ivermectin because they aren’t benefitting from that royalty. “You may have very sound scientific reasons for recommending a medicine or not, but the idea that people get a financial benefit from certain research that’s been done and grants that were awarded, that is, to me, the height of the appearance of a conflict of interest.” In response, Tabak said NIH doesn’t endorse particular medicines. “We support the science that validates whether an invention is or is not efficacious, we don’t say this is good or this is bad. … I certainly can understand that it might seem as a conflict of interest,” he said. Moolenaar seemed taken aback by Tabak’s response and, while pointing to Fauci, who was also testifying, said that “truthfully, I would say you’ve had leaders of NIH saying certain medicines are not good.”

Tabak said such statements by NIH are based on clinical trials that are supported by the agency. Moolenaar then asked Tabak, “But if the agency is awarding who is the beneficiary of the grant, who is doing the trial, and there is somehow finances involved, that there is a financial benefit that could be accrued if someone’s patent or invention is considered validated, do you not see that as a conflict or at least the appearance of a conflict of interest?” After conceding that there’s an appearance of a conflict of interest, Tabak suggested to Moolenaar that “maybe this is the sort of thing that we can work together on so that we can explain to you the firewalls that we do have because they are substantial and significant.”

[..] The $350 million in royalty payments were made between 2010 and 2020, according to Open the Books, the nonprofit that took the NIH to court when it refused to acknowledge the group’s FOIA request for documents. Collins received 14 payments, Fauci received 23 payments, and his deputy, Clifford Lane, received eight payments, according to Open the Books. Adam Andrzejewski, founder and president of Open the Books, told The Epoch Times on May 11 that NIH continues to withhold important information about the royalty payments, including the names of particular payers and the specific amounts paid to individuals at NIH.

Glenn Beck

Glenn Beck – alarming… pic.twitter.com/gWqzrvhEa7

— Wittgenstein (@backtolife_2022) May 11, 2022

And got a fine reward.

• Top US Scientist Warned Chinese Of US Investigations Into Wuhan Lab (DC)

The head of a U.S. national laboratory in Texas accepted a position at a Chinese university roughly one year after warning Chinese scientists about potential congressional investigations into COVID-19’s origins, according to emails obtained by Judicial Watch. In an April 2020 email chain, Dr. James W. Le Duc, director of the Galveston National Laboratory (GNL), warned top science officials in China, including a director at the Wuhan Institute of Virology (WIV), about Florida Republican Sen. Marco Rubio’s interest in investigating the pandemic’s origins. In April 2021, emails show Le Duc accepted a position on the “Biosafety Advisory Committee” at China’s Westlake University, a private research university with ties to the Chinese Communist Party (CCP).

“These startling documents show that China had partners here in the United States willing to go to bat for them on the Wuhan lab controversy,” Tom Fitton, president of Judicial Watch, said in a statement. Judicial Watch obtained Le Duc’s emails through a public records request to the University of Texas Medical Branch. Judicial Watch’s investigation follows years of mystery surrounding COVID-19’s origins. Early on, the theory that COVID leaked from the WIV was roundly dismissed by government officials and prominent scientists; at one point a New York Times reporter even claimed the Wuhan-origin theory had “racist roots.” However, scientists and experts increasingly consider it the “most likely” origin for the virus, and Kentucky Republican Sen. Rand Paul has even accused Dr. Anthony Fauci of the National Institutes of Health and other top U.S. scientists of covering-up their own culpability in a possible Wuhan lab leak.

Le Duc first sent his warning to Shi, whose controversial research is at the center of the COVID origins debate, and other Chinese scientists in a series of emails beginning in April 2020. “I wonder if you would have time for a phone call sometime soon… The email below is relevant,” Le Duc wrote to Shi on April 16, 2020. Le Duc’s email linked to a Forbes report on Sen. Rubio’s interest in investigating COVID’s origins. Le Duc’s email also included a message he’d received from a former commander at the U.S. Army Medical Research Institute of Infectious Diseases, warning that Rubio was pushing for a Wuhan lab investigation.

“The controversial WEF has received renewed attention in the Conservative leadership race after candidate and MP Pierre Poilievre committed to boycotting the organization.”

• Trudeau Government Gave $3 Million To WEF And $1.6 Billion To UN In 2021 (TNC)

The Liberal government funnelled more than a billion-and-a-half taxpayer dollars into various United Nations bodies, and millions into the World Economic Forum (WEF) last year, public accounts data shows. According to the transfer payments section of the 2020-2021 Public Accounts of Canada, the WEF received $2,915,095 from Canadian taxpayers in the form of grants and contributions. Funding was provided by two departments – the Department of Environment and the Department of Foreign Affairs, Trade and Development. The largest of the transfer payments to WEF was a $1,141,851 contribution from the International Development Assistance for Multilateral Programming. WEF also received another $1 million grant under the same program. Other payments were cited as “contributions in support of conserving nature” and for the “establishment and management of conservation measures.”

The Trudeau government also generously funded the UN to the tune of $1.576 billion in the form of financial support, contributions and grants. Funding came primarily from Global Affairs, although other departments including Immigration, Refugees and Citizenship also gave the UN money. Six UN-affiliated organizations received transfer payments worth more than $100 million each. The largest payment was given to the United Nations Children’s Fund, totalling $543 million. Meanwhile UN peacekeeping operations saw contributions worth $235 million, while the UN High Commissioner for Refugees received $139 million. Other large recipients include the UN Population Fund and the United Nations Organizations.

[..] According to Federal Director of the Canadian Taxpayers Federation Franco Terrazzano, the Trudeau government needs to do a better job accounting for its funding of international organizations like the WEF, while Canada deals with a debt of over $1 trillion. “That’s a lot of money, and we can’t just keep sending a ton of tax dollars to international organizations because we’ve been doing it for years,” Terrazzano told True North. “The feds are more than $1 trillion in debt, so it’s on the government to make a clear case for every cent it sends to international organizations, and if it can’t make the case then we need to see reductions.” The controversial WEF has received renewed attention in the Conservative leadership race after candidate and MP Pierre Poilievre committed to boycotting the organization.

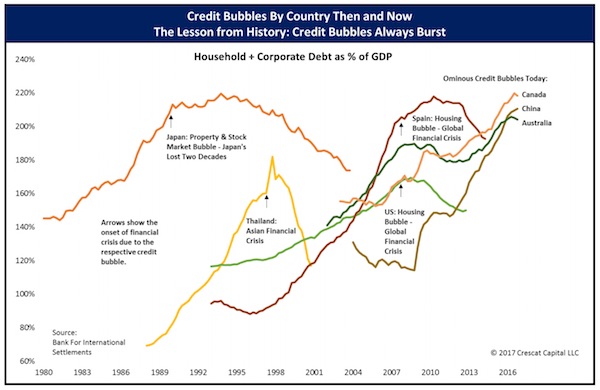

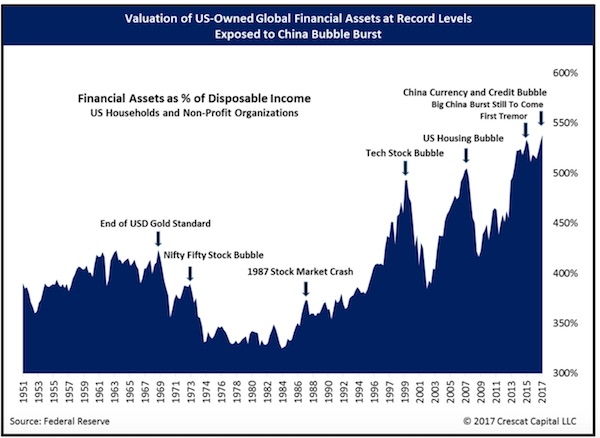

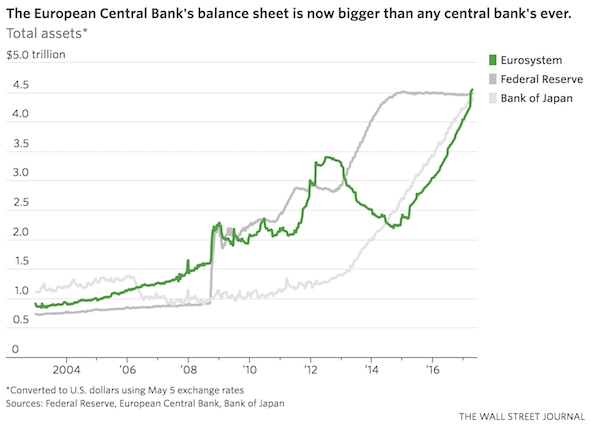

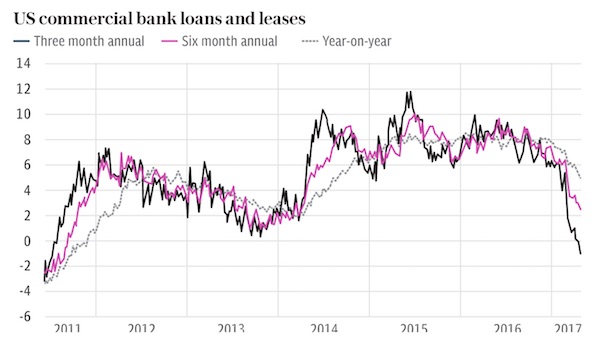

Money flees..

• Prepare For More Chinese Capital Controls As Exodus Worsens (BBG)

Strict capital controls made it impossible for several European companies to send dividends abroad and a Japanese beverage maker could not get paid due to “tougher restrictions on cross-border wire transactions.” This is not Russia in 2022, but China in late 2016 and early 2017, when the yuan plunged toward 7 per dollar. Those types of curbs could soon be brought back as part of Beijing’s arsenal to manage currency depreciation, especially in a context similar to 2016-17: Once again, the Fed hikes and capital flees. Besides the headline exchange rate, how much and how quickly money can leave China will become equally, if not more, important. Global portfolio managers, foreign businesses and the local rich are either leaving China or bringing much less capital onshore.

The nation suffered an unprecedented outflow from bond and stock investors in March and net selling continued into April, according to estimates from the International Institute of Finance. Total capital outflows, including errors and omissions, may surge to about $300b this year from $129b in 2021, IIF said in a report last week. While that figure is well below $725b, IIF’s estimate for 2016, Beijing’s options for combating it are much narrower this time around. Trade wars, Covid and supply-chain disruptions were not on the minds of foreign executives back then. In 2022, however, 52% of 121 companies polled by the American Chamber of Commerce in China have either cut or delayed investments. With only 1% planning to increase local investment, authorities have a daunting task to boost foreign direct investment as long as China sticks to its Covid Zero strategy.

What a stupid story this has become.

• Oath Keepers Rescued 16 Police Officers On Jan 6 (ET)

Video footage widely circulated in 2021 that shows a Capitol Police lieutenant asking members of the Oath Keepers for rescue help at the U.S. Capitol blows a hole in the seditious conspiracy charges brought against the group by federal prosecutors, two defense attorneys say. In the footage, Lt. Tarik Khalid Johnson asks a group of men to help him get more than a dozen trapped Capitol Police officers out of the Capitol and through a tightly packed crowd of protesters on the building’s east steps. It was widely reported in January 2021 that Johnson wore a red Make America Great Again cap on Jan. 6 as a ruse to “trick” supporters of President Donald Trump into helping him rescue fellow officers from the Capitol.

He was later suspended for wearing the MAGA cap. Johnson is a registered Democrat, according to online records. The men who answered the call to help were members of the Oath Keepers, a nationwide group of current and former military, law enforcement, and first responders who have been targeted by federal prosecutors for allegedly conspiring to attack the Capitol on Jan. 6, 2021. The video is at least the second example showing the Oath Keepers coming to the aid of Capitol Police inside the building that day. Would a group of men seditiously plotting an attack on the Capitol, allegedly to prevent certification of Electoral College votes, rush into the building to extract police trapped inside—all while being followed by a filmmaker?

“The prosecutors’ narrative has more holes than Swiss cheese, but it [the video footage] does directly refute their claim,” said Jonathon Moseley, who previously represented Florida Oath Keepers leader Kelly Meggs. Prosecutors “just keep ignoring the self-contradictions in their stories.” The video footage was shot by part-time filmmaker Rico La Starza. One of several versions of the video footage posted online includes an introduction by La Starza. He said the video shows “me helping a group of Oath Keepers help Capitol Police get out. They looked scared and tired.”

Just trying to scare him.

• Feds Open Investigation Into Elon Musk (DW)

The U.S. government has reportedly opened an investigation into Elon Musk’s business dealings surrounding his recent $44 billion purchase of Twitter. “The Securities and Exchange Commission is probing Mr. Musk’s tardy submission of a public form that investors must file when they buy more than 5% of a company’s shares,” The Wall Street Journal reported. “The disclosure functions as an early sign to shareholders and companies that a significant investor could seek to control or influence a company.” The report said that Musk’s April 4 disclosure filing was at least 10 days late, a move that is believed to have saved him more than $140 million because share prices could have been higher if the public knew about his ownership of 5% of the company.

“The case is easy. It’s straightforward,” Daniel Taylor, a University of Pennsylvania accounting professor, said. “But whether they’re going to pick that battle with Elon is another question.” The report noted that a lawsuit against Musk from the SEC would likely not stop him from taking over Twitter since the company’s board of director’s unanimously approved to be acquired by Musk and the SEC may lack the power to do so. Musk’s purchase of Twitter is also reportedly being reviewed by the Federal Trade Commission (FTC). Musk said this week that he will reverse Twitter’s permanent ban on former President Donald Trump if and when the sale is finalized.

“I think that was a mistake because it alienated a large part of the country, and did not ultimately result in Donald Trump not having a voice,” Musk said, adding that the decision was “morally bad.” “That doesn’t mean that someone gets to say whatever they want to say,” Musk said. “If they say something that is illegal or destructive to the world, then there should be perhaps a timeout, temporary suspension or that particular tweet should be made invisible or have very little traction.” “I would reverse the permanent ban,” Musk added.

Murdering American citizens in broad daylight. Try that in Kiev.

• Al Jazeera Accuses Israel of Killing -American- Journalist (CD)

The media outlet Al Jazeera accused Israeli forces of “deliberately targeting and killing our colleague” on Wednesday after journalist Shireen Abu Akleh was shot in the face while covering a raid on the Jenin refugee camp in the occupied West Bank. In a statement, the Al Jazeera Media Network said that Abu Akleh — who worked as the publication’s Palestine correspondent — was wearing a press jacket that clearly identified her as a journalist when Israeli forces shot her “with live fire.” Al Jazeera, which is based in Qatar, called the attack “a blatant murder,” saying Abu Akleh, 51, was “assassinated in cold blood.” The statement continued:

“Al Jazeera Media Network condemns this heinous crime, which intends to only prevent the media from conducting their duty. Al Jazeera holds the Israeli government and the occupation forces responsible for the killing of Shireen. It also calls on the international community to condemn and hold the Israeli occupation forces accountable for their intentional targeting and killing of Shireen. The Israeli authorities are also responsible for the targeting of Al Jazeera producer Ali al-Samudi, who was also shot in the back while covering the same event, and he is currently undergoing treatment. Al Jazeera extends its sincere condolences to the family of Shireen in Palestine, and to her extended family around the world, and we pledge to prosecute the perpetrators legally, no matter how hard they try to cover up their crime, and bring them to justice.”

The Israeli government initially denied responsibility for killing Abu Akleh and wounding al-Samudi, claiming that they may have been shot by “Palestinian gunmen.” “There is a considerable chance that armed Palestinians, who fired wildly, were the ones who brought about the journalist’s unfortunate death,” said Israeli Prime Minister Naftali Bennett. But al-Samudi, speaking to the Associated Press following the incident, dismissed the Israeli government’s narrative as a “complete lie.” “He said they were all wearing protective gear that clearly marked them as reporters, and they passed by Israeli troops so the soldiers would know that they were there,” AP reported. “He said a first shot missed them, then a second struck him, and a third killed Abu Akleh. He said there were no militants or other civilians in the area — only the reporters and the army.”

Shireen Abu Akleh

This journalist was standing right next to Shireen Abu Akleh when she was killed.

Hear her account of what happened. pic.twitter.com/E3UvLWFUSA

— AJ+ (@ajplus) May 11, 2022

Fazer

https://twitter.com/i/status/1524553912463806464

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.