Wyland Stanley Golden Gate Bridge under construction 1935

See under ‘Recovery’ in your dictionary.

• US Braces for Worst Earnings Season Since 2009 (BBG)

U.S. corporate profits are expected to drop the most in 6 1/2 years in the first quarter, led by a wipeout in the embattled energy sector. Earnings for companies in the Standard & Poor’s 500 Index will fall 9.8% year-over-year, which would be the sharpest decline since the third quarter of 2009 and a fourth consecutive quarter of contraction, according to Bloomberg data. Results will be insufficient to justify current stock valuations, says Alex Bellefleur, head of global macro strategy and research at Pavilion Global Markets.

“The US is in for a full-blown end to the economic cycle.”

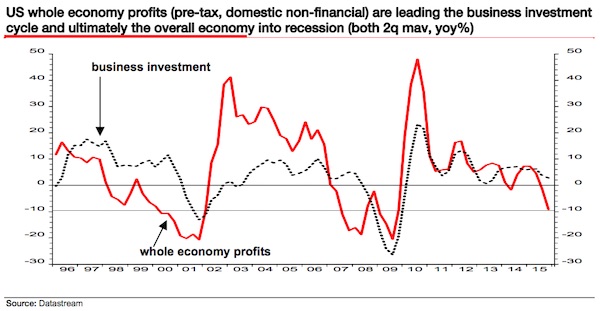

• Albert Edwards: Coming ‘Tidal Wave’ Will Throw The US Into Recession (BI)

A tidal wave is coming to the US economy, according to Albert Edwards, and when it crashes it’s going to throw the economy into recession. The Societe Generale economist, and noted perma-bear, believes that the profit recession facing American corporations is going to lead to a collapse in corporate credit. “Despite risk assets enjoying a few weeks in the sun our fail-safe recession indicator has stopped flashing amber and turned to red,” wrote Edwards in a note to clients on Thursday. He continued (emphasis added): “Whole economy profits never normally fall this deeply without a recession unfolding. And with the US corporate sector up to its eyes in debt, the one asset class to be avoided — even more so than the ridiculously overvalued equity market — is US corporate debt. The economy will surely be swept away by a tidal wave of corporate default.”

Edwards said that many economic researchers discredit profits as a measure of the business cycle, and it is one of the reasons why they are so bad at predicting recessions. Profits are on the decline for two reasons, according to Edwards. On the one hand, they are dropping because of margin pressure from rising labor costs. But this sort of decrease because of higher wages does not always signal a recession, like in 1986. Additionally, much like the mid-1980s decline, an oil-price crash is disproportionately dragging down profits. The second reason is because companies cannot pass on these increasing wage pressures to consumers through prices. In turn, they decrease spending and hiring, and the most vulnerable cannot make debt payments.

Edwards enumerated three reasons why this time around is a recessionary decrease, not a 1986-style aberration. They are:

• “When the oil price slumped in 1986 the economy was steaming ahead at a 4% pace and so withstood the downturn in business investment.”

• “In 1986 Fed Funds were cut from over 8% to less than 6% at a time when the consumer was re-leveraging, i.e. not debt averse as now.”

• “Finally, companies in 1986 were not up to their necks in debt as they currently are, and their solvency now is far more vulnerable to a profits downturn.”So this time will not be a quick, oil-driven recovery. The US is in for a full-blown end to the economic cycle. Edwards did include some advice to investors on how to weather the coming wave, though. “And if I had to pick one asset class to avoid it would be US corporate bonds, for which sky high default rates will shock investors,” he wrote. You’ve been warned.

This will only lead to more stimulus until and unless financial markets start applying serious pressure.

• Asian Shares Drop As Banks Come Under Pressure (Reuters)

Asian shares extended losses to three-week lows on Friday, while the yen soared to a 17-month high against the dollar as investors bet Japan would be hard pressed to drive down its currency in the face of widespread foreign opposition. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.5%, heading for a weekly drop of 1.8%. Japan’s Nikkei pared earlier losses to near-two-month lows to trade 0.6% lower, with financials under pressure. It’s on track for a decline of 3.1% for the week. China’s Shanghai Composite slid 0.9%, poised for a similar drop for the week. The CSI 300 was down 0.8%, set for a 1.2% weekly decline. Hong Kong’s Hang Seng slipped 0.7%, headed for 1.9% loss for the week.

Bank shares led losses in Europe and the U.S. markets on Thursday, amid talk of more layoffs and cutbacks planned by Europe’s major lenders as they struggle with zero rates. The U.S. S&P 500 lost 1.2%, with financial shares falling 1.9%. In Europe, the FTSE closed down 0.8%, hurt by a drop of more than 2% in financials. “When bank shares are making big falls and their CDS spreads are rising like this, obviously you would think something is afoot. If they keep falling in today’s session, that is going to be really worrying,” said Daisuke Uno, chief strategist at Sumitomo Mitsui Bank. U.S. stock futures slipped about 0.1% further in Asian trade after Federal Reserve Chair Janet Yellen, in a conversation with former Fed chairmen, said the U.S. economy is on a solid course and still on track to warrant further interest rate hikes.

All vultures all the way.

• KKR’s Chilling Message about the ‘End of the Credit Cycle’ (WS)

After seven years of “emergency” monetary policies that allowed companies to borrow cheaply even if they didn’t have the cash flow to service their debts, other than by borrowing even more, has created the beginnings of a tsunami of defaults. The number of corporate defaults in the fourth quarter 2015 was the fifth highest on record. Three of the other four quarters were in 2009, during the Financial Crisis. At stake? $8.2 trillion in corporate bonds outstanding, up 77% from ten years ago! On top of nearly $2 trillion in commercial and industrial loans outstanding, up over 100% from ten years ago. Debt everywhere! Of these bonds, about $1.8 trillion are junk-rated, according to JP Morgan data. Standard & Poor’s warned that the average credit rating of US corporate borrowers, at “BB,” and thus in junk territory, hit a record low, even “below the average we recorded in the aftermath of the 2008-2009 credit crisis.”

The risks? A company with a credit rating of B- has a 1-in-10 chance of defaulting within 12 months! In total, $4.1 trillion in bonds will mature over the next five years. If companies cannot get new funds at affordable rates, they might not be able to redeem their bonds. Even before then, some will run out of cash to make interest payments. A bunch of these companies are outside the energy sector. They have viable businesses that throw off plenty of cash, but not enough cash to service their mountains of debts! Among them are brick-and-mortar retailers that have been bought out by private equity firms and have since been loaded up with debt. And they include over-indebted companies like iHeart Communications, Sprint, or Univsion.

The “end of the credit cycle” has dawned upon the markets. As credit tightens, companies that can’t service their debts from operating cash flows may be denied new credit with which to service existing debts. The recipe of new creditors’ bailing out existing creditors worked like a charm for the past seven years. But it isn’t working so well anymore. What follows is a debt restructuring — either in bankruptcy court or otherwise. Money is now piling up in funds run by private equity firms, to be deployed at the right moment to profit from this. But not by playing the entire market, or to bail out existing investors. No way. This money will be deployed at the expense of existing investors. One of the biggest players is PE firm KKR, which just raised $3.35 billion to take advantage of opportunities in “distressed assets.” Existing investors, brace yourself!

The west doesn’t stand a chance without protectionism.

• China Steel Exports Will Stay At High Levels For Years (BBG)

Exports of steel from China will remain at high levels as local demand shrinks for years, according to Li Xinchuang, president of the country’s Metallurgical Planning Institute, who said mills in developed markets including the U.K. are struggling because their competitiveness is weak. While export volumes won’t increase from last year’s record, they won’t decline significantly either, Li said. Steel overcapacity is a global problem and China is already playing its part with proposals to close as much as 150 million tons that will put more than half a million people out of work, Li said, speaking in an interview and at a conference. Steel shipments from China surged in 2015 as Asia’s largest economy slowed and domestic demand shrank, with the flood of cargoes boosting global competition, hurting prices and squeezing profits. Britain faces an industry crisis after India’s Tata Steel said last week it was considering selling its unprofitable U.K. division, jeopardizing about 15,000 jobs.

Some steelmakers in the U.K. and U.S. “can’t meet local demand and they can’t compete globally,” Li said on Wednesday, rejecting claims that shipments from China are traded unfairly. “China is competitive for three reasons: good price, good service, good quality.” Tata Steel’s plan to sell its British plants has led to U.K. calls for tougher trade measures against China, which accounts for half of global output. China is prepared to defend itself at the World Trade Organization, according to Li, who’s also deputy secretary general of the China Iron & Steel Association. Fortescue CEO Nev Power sees the country becoming more competitive. “The new steel mills that are being built in China are very efficient, very energy-efficient, very productive,” he said in a Bloomberg TV interview on Thursday. “China is setting itself up to be a very competitive supplier to other emerging economies throughout Asia.”

Sign of the times.

• US Politics Is Closing The Door On Free Trade (FT)

Donald Trump wants to slap punitive tariffs on China. Hillary Clinton opposes the 12-nation Trans-Pacific Partnership she once hailed as a gold standard for a new generation of free trade deals. Republicans are embracing Democrat demands for “fair” trade. The US, the architect of the open global system, is turning inwards. The rest of the world should sit up. This is about more than the raw political emotions stirred by a US presidential race. The WTO’s failed Doha Round saw the end of the multilateral trade liberalisation that gave us the globalised economy. The failure of the TPP would read the rites over the big plurilateral deals that promised an alternative. Free trade has been a powerful source of prosperity. It has lost political legitimacy. And not only in the US: European populists of left and right share the Trumpian disposition to throw up the barricades.

Optimists hope the protectionist turn in the US is cyclical. Things will get back to normal once the cacophony of the presidential contest subsides. Freed from the primary challenge of Bernie Sanders, Mrs Clinton, the most likely successor to President Barack Obama, will find a way to change her mind again. The TPP could yet be smuggled through Congress during the lame-duck interlude after November’s elections. Such is the line from Mr Obama’s White House and from a diminishing band of Republicans true to their free trade heritage. All the evidence points the other way. Globalisation has gone out of fashion. Shrewd Washington observers have concluded that, as one puts it, “ there is not a chance in hell” of the next president or the next Congress – of whatever colour – backing the TPP.

As for the mooted, and now being negotiated, Transatlantic Trade and Investment Partnership (TTIP) designed to integrate the US and European economies, dream on. Mr Trump has struck a powerful chord among his core constituency in blaming foreigners for America’s economic ills. The backlash against free trade, though, runs deeper than cheap populism. The middle classes have seen scant evidence of the gains once promised for past deals. Republicans, fearful that they have already lost the presidency, do not want to risk handing Congress to fair-trade Democrats. Some problems are specific to the TPP. The prospective wins for the US are heavily tilted towards technology businesses on the west coast.

Manufacturing America thinks it secures little in the way of better access to Asian markets and complains that the deal leaves US companies vulnerable to currency manipulation by overseas competitors. Many more Americans than would ever gift their votes to Mr Trump question whether they get anything out of trade deals. Free trade has always created losers, but now they seem to outnumber the winners. There is nothing populist about noticing that globalisation has seen the top 1% grab an ever-larger share of national wealth.

Time for shareholders.

• VW Managers ‘Refuse To Forego Bonuses’ (AFP)

Top executives at Volkswagen are refusing to forego their bonuses this year, despite prescribing belt-tightening for the carmaker’s workforce in the wake of the massive emissions-cheating scandal, the weekly magazine Der Spiegel reported on Thursday. Without naming its sources, the magazine said that shortly before a supervisory board decision that executive board members had made it clear they were willing to “accept a cut in their bonuses, but not forego them entirely”, even though they have repeatedly told the workforce that the crisis threatens the group’s very existence. VW’s former chief executive Martin Winterkorn received a bonus of more than €3 million a year ago. A company spokesman told AFP that the board pay would be published in VW’s annual report on April 28.

“The management board is determined to set an example when it comes to the adjustment in the bonuses,” he said, dismissing the Spiegel article as “pure speculation.” Winterkorn’s successor Matthias Mueller was parachuted in last year to steer the carmaker out of its deepest-ever crisis which erupted when VW was exposed as having installed emissions-cheating software into 11 million diesel engines worldwide. At the time, Mueller told the workforce that there would have to be “belt-tightening at all levels” from management down to the workers. But according to Der Spiegel, the former finance chief Hans-Dieter Poetsch, who was appointed to the head of the supervisory board in October, pocketed nearly €10 million as “compensation” for the lower pay he would receive as a result.

The scandal is expected to cost VW still incalculable billions of euros in fines and possible legal costs. Unions are concerned that the belt-tightening needed to cope with the fallout from the engine-rigging scandal could lead to job cuts. “We have the impression that the diesel engine scandal could be used as a backdoor for job cuts that weren’t up for discussion until a couple of months ago,” the works council wrote in a letter to the management of VW’s own brand and published on the website of the powerful IG Metall labour union.

“.. 90% of the world’s banks will have disappeared in the next 20 years..”

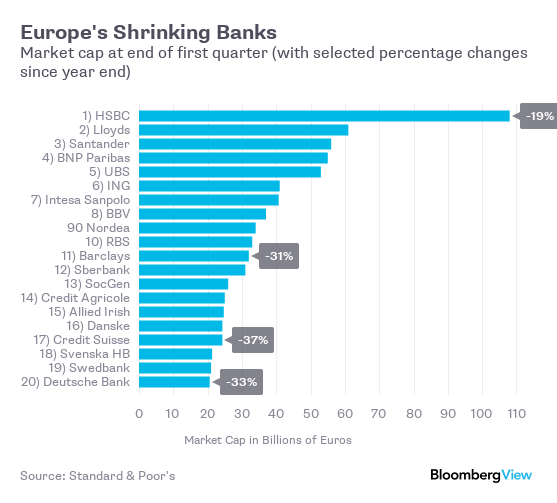

• It’s Time To Start Worrying About The Health Of European Banks (BBG)

European banks have lost their mojo. A toxic combination of negative interest rates, comatose economies and a regulatory backdrop that might euphemistically be described as challenging is wreaking havoc with bank business models. Their collective market value has dropped by a quarter so far this year. The smoke signals emanating from the European Central Bank in recent weeks suggest regulators aren’t blind to this. Daniele Nouy, who chairs the ECB’s bank supervisory board, said earlier this week that the central bank “is aware that the low-interest-rate environment is putting pressure on the profitability of European banks.” Regulators may respond by going easier when drafting new rules.

Bank-failure rules to prescribe how banks design their balance sheets to absorb potential losses may be eased, according to a European Commission discussion paper prepared last month. Meanwhile, a global panel of regulators will hold a meeting in London this month to let banks give additional feedback on proposed rules about how much capital they must set aside to back their trading activities. This comes none too soon. The drop in industry capitalization, which reflects investor unease about future profitability, is rearranging the pecking order in European finance. Deutsche Bank, for example, was the most active manager of European bond sales in 2014 with a market share approaching 6.5%; last year it slipped to third, and so far this year it ranks fourth. At the end of 2015 the German lender was Europe’s 14th biggest bank; now it’s 20th:

Deutsche Bank Chief Executive Officer John Cryan said last month that, burdened by restructuring and legal costs, he doesn’t expect his firm to be profitable this year. It’s far from the only one struggling; on Tuesday, Barclays warned that its first-quarter investment banking income will be worse than it was last year. In Italy, officials are scrambling to create a state-backed fund to prop up an industry burdened by more than €200 billion of the €1.2 trillion of bad loans hampering the euro zone’s recovery. No wonder ECB President Mario Draghi spent much of his press conference a month ago answering questions about the damage negative interest rates are doing to banks. They have to pay for the privilege of holding cash on deposit at the central bank, but can’t pass those costs onto their own depositors.

The current structure of the banking system is “unfeasible,” and 90% of the world’s banks will have disappeared in the next 20 years, Banco Bilbao Vizcaya Argentaria SA Chairman Francisco Gonzalez said in an interview published by El Pais newspaper last week. Banks that can’t cover their cost of capital aren’t viable, making industry consolidation inevitable, he said.

Subprime revisited. The weight will shift from borrowers to lenders.

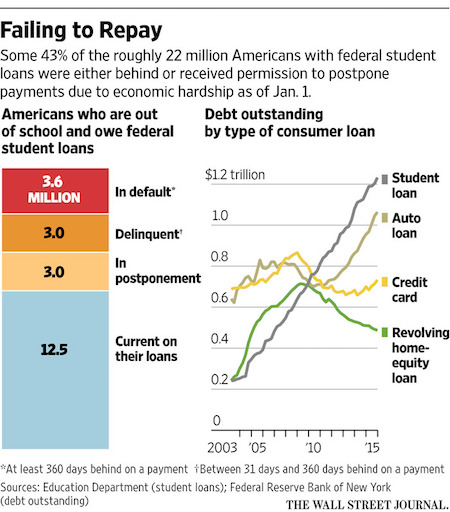

• More Than 40% of Student Borrowers Aren’t Making Payments (WSJ)

More than 40% of Americans who borrowed from the government’s main student-loan program aren’t making payments or are behind on more than $200 billion owed, raising worries that millions of them may never repay. The new figures represent the fallout of a decadelong borrowing boom as record numbers of students enrolled in trade schools, universities and graduate schools. While most have since left school and joined the workforce, 43% of the roughly 22 million Americans with federal student loans weren’t making payments as of Jan. 1, according to a quarterly snapshot of the Education Department’s $1.2 trillion student-loan portfolio. About 1 in 6 borrowers, or 3.6 million, were in default on $56 billion in student debt, meaning they had gone at least a year without making a payment.

Three million more owing roughly $66 billion were at least a month behind. Meantime, another three million owing almost $110 billion were in “forbearance” or “deferment,” meaning they had received permission to temporarily halt payments due to a financial emergency, such as unemployment. The figures exclude borrowers still in school and those with government-guaranteed private loans. The situation improved slightly from a year earlier, when the nonpayment rate was 46%, but that progress largely reflected a surge in those entering a program for distressed borrowers to lower their payments. Enrollment in those plans, which slash monthly bills by tying them to a small%age of a borrower’s income, jumped 48% over the year to 4.6 million borrowers as of Jan. 1.

Advocacy groups, some members of Congress and the federal Consumer Financial Protection Bureau fault loan servicers—companies the government hires to collect debt—for not doing enough to reach troubled borrowers to offer such payment options. “The servicers aren’t quite promoting them in the way they should be—I think some of it’s information failure,” said Rachel Goodman, a staff attorney at the American Civil Liberties Union.

Foot. Mouth.

• UK’s Cameron Admits He Profited From Father’s Offshore Fund (AFP)

British Prime Minister David Cameron admitted Thursday he had held a £30,000 stake in an offshore fund set up by his father, after days of pressure following publication of the so-called Panama Papers. Cameron sold the stake in the Bahamas-based trust in 2010, four months before he became prime minister, he said in an interview with television channel ITV. Downing Street have issued four statements on the affair this week following Sunday’s publication of the leaked Panama Papers, which showed how Panama-based law firm Mossack Fonseca had helped firms and wealthy individuals set up offshore companies. “We owned 5,000 units in Blairmore Investment Trust, which we sold in January 2010. That was worth something like £30,000,” Cameron said.

“I sold them all in 2010, because if I was going to become prime minister I didn’t want anyone to say you have other agendas, vested interests.” He insisted he had paid income tax on the dividends from the sale of the units, which he bought in 1997. Downing Street first dismissed the story as a private matter on Monday before saying Cameron had no offshore funds, then saying he and his wife and children did not benefit from any offshore funds. It later added that Cameron would not benefit from such funds in the future. The row is the latest headache for Cameron, who faces a tight race to ensure Britain stays in the European Union in a referendum due to be held on June 23.

The prime minister has been under intense pressure from the main opposition Labour party and media this week to come clean over his financial arrangements past and present. Labour’s deputy leader Tom Watson told Sky News that, while it was too early to say whether Cameron should quit, “he may have to resign over this but we need to know a lot more about what his financial arrangements have been”.

A wave of lost jobs.

• European Bankers Step Down as Panama Papers Pile on Pressure

European regulators pressed the region’s banks for details of their offshore business dealings, as two senior bankers resigned over allegations arising from the Panama document leak. Britain’s financial watchdog sent out letters asking banks and other financial companies to disclose any ties to Panama law firm Mossack Fonseca, said a person with knowledge of the situation. Swiss regulator Finma said it would also investigate “suspicious” connections unearthed by the Panama Papers. “The leaked database from Panama is just the latest proof of how money flows like water through multiple jurisdictions, sometimes for legitimate purposes, sometimes not,” Finma director Mark Branson told reporters in Bern on Thursday.

Media reports this week based on millions of documents leaked from Mossack Fonseca revealed how its lawyers, including a Geneva team, worked with Credit Suisse, UBS and other banks to create offshore shell companies for world leaders, athletes and other rich clients. On Thursday, ABN Amro announced the resignation of supervisory board member Bert Meerstadt after his name appeared in the leaked records. He said in a statement that he had already planned to leave but was now resigning immediately “to prevent any detrimental effects to the bank.” Meerstadt was a shareholder of a British Virgin Island-based entity in March 2001, Dutch newspaper Het Financieele Dagblad reported Thursday. ABN Amro CEO Gerrit Zalm said he had never heard of Mossack Fonseca before the leak and that he doesn’t know the facts of the case but considers it a private matter. In Austria, the chief executive officer of Vorarlberger Landes- und Hypothekenbank, resigned after the province-owned bank was mentioned in reports about offshore companies.

Michael Grahammer cited “biased” local media reports about offshore accounts linked to Gennady Timchenko, a Russian billionaire targeted by U.S. sanctions since 2014. “I’m still 100 percent convinced that the bank has at no time violated laws or sanctions,” Grahammer said. “At the end of the day, the media bias against Hypo Vorarlberg and myself that showed in the last few days was the main reason for me to take this step.” In its letters, the U.K. Financial Conduct Authority gave firms an April 15 deadline to disclose any connections to Mossack Fonseca. In Sweden, the government will consider tightening laws against money laundering and tax evasion. Financial Markets Minister Per Bolund said. He said authorities are investigating allegations that Nordea Bank, the biggest bank in Scandinavia, helped clients evade tax through shell companies in low-tax countries.

More signs of the times.

• Pirate Party Backed By Almost Half Of Iceland’s Voters (Ind.)

The Pirate Party would receive nearly half of voters’ support if Iceland held a general election now, new statistics have revealed. The anti-establishment party received 43% of the vote according to research by Icelandic media organisations Frettabladid, Stod 2 and Visir. The Progressive Party, currently in a coalition with the Independence Party, would only receive 7.9% support, Iceland Monitor reports. The rising popularity of the Pirate Party, which campaigns in favour of transparency and direct democracy, among people in Iceland is in response to the leak of the Panama Papers. The documents from Panamanian law firm Mossack Fonseca reportedly revealed that Sigmundur David Gunnlaugsson, who stood aside as Prime Minister for an unspecified amount of time earlier this week, owned an offshore company in the British Virgin Islands with his wife.

Mr Gunnlaugsson did not declare Wintris, which held millions in the bonds of failed Icelandic banks, when he entered parliament, according to the International Consortium of Journalists. He has denied any wrongdoing and says he sold his shares in the company to his wife. But MPs in the opposition have said it is a conflict of interest with his duties. The government has named Fisheries Minister Sigurdur Ingi Johannsson as Prime Minister and he is due to meet Iceland’s president Olafur Ragnar Grimsson on Thursday. However the opposition in planning on pursuing a vote of no confidence in the government in parliament. Earlier, Pirate Party member Helgi Hrafn Gunnarsson said: We will still push forward for a proposal to dissolve parliament and hold earlier elections. Elections have now been brought forward to autumn.

The EU will cause the deaths of many more people.

• Turkey Will Ditch Migrant Deal If EU Breaks Promises: Erdogan (AFP)

Turkish President Recep Tayyip Erdogan on Thursday warned the European Union that Ankara would not implement a key deal on reducing the flow of migrants if Brussels failed to fulfil its side of the bargain. Erdogan’s typically combative comments indicated that Ankara would not sit still if the EU fell short on a number of promises in the deal, including visa-free travel to Europe for Turks by this summer. Meanwhile, the Vatican confirmed that the pope would next week make a brief, unprecedented trip to the Greek island of Lesbos where thousands of migrants are facing potential deportation to Turkey under the deal. “There are precise conditions. If the European Union does not take the necessary steps, then Turkey will not implement the agreement,” Erdogan said in a speech at his presidential palace in Ankara.

The March 18 accord sets out measures for reducing Europe’s worst migration crisis since World War II, including stepped-up checks by Turkey and the shipping back to Turkish territory of migrants who land on the Greek islands. In return, Turkey is slated to receive benefits including visa-free travel for its citizens to Europe, promised “at the latest” by June 2016. Turkey is also to receive a total of €6 billion in financial aid up to the end of 2018 for the 2.7 million Syrian refugees it is hosting. Marc Pierini, visiting scholar at Carnegie Europe, described the visa-free regime as one of the “biggest benefits for Turkey” in the migrant deal. He told AFP that Turkey still has to fulfil 72 conditions on its side to gain visa-free travel to Europe’s passport-free Schengen zone and that the move would also have to be approved by EU interior ministers.

“We shall see if that is a realistic prospect,” he said. Turkey’s long-stalled accession process to join the EU is also supposed to be re-energised under the deal. But Pierini said there were many conditions still to be fulfilled here. “The worst reading of the EU-Turkey deal would be to imagine that Turkey is about to get a ‘discount’ on EU membership conditions just because of the refugees,” he said. Erdogan argued Turkey deserved something in return for its commitment to Syrian refugees, on whom it has spent some $10 billion since the Syrian conflict began in 2011. “Some three million people are being fed on our budget,” the president said. “There have been promises but nothing has come for the moment,” he added.

Europe’s true character is being revealed.

• Amnesty: ‘Serious Flaws’ Mar Greek Side Of EU-Turkey Migrants’ Deal (Reuters)

Migrants held on the Greek islands Lesbos and Chios live in “appalling” conditions with little access to legal aid or information about their fate under a European Union agreement that will send some back to Turkey, Amnesty International said on Thursday. Under a deal between the EU and Ankara in place since March 20, undocumented migrants who cross to Greek islands will be kept in holding centers until their asylum claims are processed. Those who do not qualify will be returned to Turkey. The first group of 202 migrants to be returned, most of them from Pakistan and Afghanistan, were sent back to Turkey on Monday.

“People detained on Lesbos and Chios have virtually no access to legal aid, limited access to services and support, and hardly any information about their current status or possible fate,” said Amnesty Deputy Director for Europe Gauri van Gulik. “The fear and desperation are palpable,” she said. In a report published Thursday, Amnesty said among those held in the centers are a small baby with complications after an attack in Syria, heavily pregnant women, people unable to walk, and a young girl with a developmental disability. Many refugees spoke about the lack of access to doctors or medical staff. Legal aid is scarce and inaccessible to the vast majority, and asylum procedures are expected to be rushed, it said. Refugees told Amnesty that they did not get enough information about what the asylum process will entail. Many have received no or incomplete documentation of their registration.

“It is likely that thousands of asylum seekers will be returned to Turkey despite it being manifestly unsafe for them,” Amnesty wrote. Monitors visited the islands this week. One Syrian woman told Amnesty she and her family signed several documents despite not having an interpreter present, and were not provided with copies. “I don’t need food, I need to know what is happening,” the woman was quoted as saying. “Serious and immediate steps must be taken to address the glaring gaps we’ve documented in Lesbos and Chios,” Amnesty’s van Gulik said. “They show that in addition to Turkey not being safe for refugees at the moment, there are also serious flaws on the Greek side of the EU-Turkey deal. Until both are fully resolved, no further returns should take place.”

Chaos is the MO.

• Questions Mount Over EU’s Role In Processing Greece Asylum Requests (IT)

Four days after the deportation by the EU border agency Frontex of the first group of migrants from Greece to Turkey following the signing of the EU-Ankara deal, questions are mounting as to the EU’s role in processing asylum applications from the thousands of people who have arrived on Greece’s islands since March 20th, when the agreement came into force. While no more deportations have taken place since Monday, almost 5,500 people are now in detention on four Greek islands, 3,100 of them in the Moria hotspot on Lesbos alone, including women, children and other vulnerable groups. According to Boris Cheshirkov of the UN’s refugee agency, the UNHCR, “close to everyone” in Moria has submitted an asylum application.

Under the new regime created by the EU-Turkey agreement, asylum applications from island detainees must be processed within two weeks, in a fast-tracked time frame that includes the appeal process. Previously, the Greek asylum service took an average of three months to adjudicate on each application. A key aspect sees the European Asylum Support Office (Easo), another EU agency, advise overburdened Greek asylum officials on the “admissibility” of each asylum seeker at the initial stage of processing. Easo spokesman Jean Pierre Schembri told the BBC: “This is a relatively short process involving our experts … accessing every applicant on his or her own merits. We then issue an opinion and the Greek authorities then issue the final decision.”

But human rights organisations fear the outcome of this truncated, two-step process, where Greek officials will essentially sign off on Easo recommendations, is predetermined to result in most applicants being returned to Turkey, a “safe third country” according to the agreement. Referring to Syrians, Schembri said Turkey “for one may be safe, but for the other it might not be”. Groups such as Amnesty International say that far too many questions remain about how Easo will make its recommendations. “You can’t have confusion or doubt around these procedures before you kick it off,” said Gauri van Gulik, Amnesty’s deputy director for Europe.

“The biggest question for us is what information and which criteria will be used to decide whether someone is or isn’t at risk in Turkey . . . In some cases, it is quite random how some people are targeted, so it’s not about the individual’s experience or how long they’ve lived in Turkey, alone. It’s also about Afghans not getting any status legally in Turkey if they go back. “The bottom line is that here is no permanent protection for anyone [in Turkey]. There’s only temporary protection status for Syrians and then there’s the practice of certain groups being tolerated for a certain while, which is very different to having protection, access to work and access to social services.”

After saying yesterday nothing would happen for 2 weeks…

• Greece Ferries Second Boat Of Migrants To Turkey Under EU Pact (Reuters)

A ferry carrying 45 migrants left the Greek island of Lesbos for Turkey on Friday, the second such journey carried out under a controversial EU deal to stem mass irregular migration to Europe. A second boat carrying a larger group was scheduled to leave the island later in the morning, state TV reported. Those who left early on Friday were from Pakistan, it said. The first group of 202 migrants to be returned, most of them from Pakistan and Afghanistan, were sent back to Turkey on Monday. At the port of Mytilene, at least two activists jumped into the water close to the small ferry, dangling from the heavy chain of the anchor and flashing the ‘v’ sign for victory. They were hoisted out of the water by the Greek coastguard.

The first group of 202 migrants to be returned, most of them from Pakistan and Afghanistan, were sent back to Turkey on Monday. Under the EU-Turkey deal, Ankara will take back all migrants and refugees, including Syrians, who enter Greece through irregular routes in return for the EU taking in thousands of Syrian refugees directly from Turkey and rewarding it with more money, early visa-free travel and progress in its EU membership negotiations.

No decency, no mercy, no nothing.

• Refugees In Greece Warn Of Suicides (G.)

Syrians and Afghans threatened with deportation from the Greek islands of Lesbos and Chios have said they would rather take their own lives than be expelled from the EU under its migration deal with Turkey. On Monday, 202 migrants were forcibly returned from Lesbos and Chios to the Turkish coast under the landmark deal aimed at halting “irregular” migration to Europe. But Souaob Nouri from Kabul, who is held in the high-security camp in Chios, said: “If they deport us, we will kill ourselves. We will not go back.” A man next to him warned of “terrible scenes” if Greek authorities insisted on pursuing policies that have already caused alarm among human rights groups.

“We are not terrorists,” said the man, who gave his name as Akimi. “We are refugees. The conditions here are very bad. There is no water. They hit pregnant women. Why do they treat us like this? All we want is asylum.” Similar threats of self harm were echoed on Lesbos this week. In a letter passed to the Guardian by aid volunteers on the island, inmates held in the Moria detention centre wrote that they would rather “accept death” than be deported to Turkey. “We will accept death but not return back,” the letter said, adding: “We will all commit suicide if they deport us.” The expulsions have been fraught with controversy.

Thirteen of the 66 deportees who were sent back across the Aegean Sea from Chios under armed guard are believed to have “expressed intent” to apply for asylum – enough, say UN officials, to have kept them in Greece until their requests were examined. “Between 20 March when the deal came into effect and 1 April when it was voted into legislation [by Greek MPs] we have seen limits in the ability of authorities to process claims,” said Katerina Kitidi with the UN refugee agency on Chios, an east Aegean island south of Lesbos. “There has been a definite lack of clarity.” The uncertainty has quickly fuelled tensions on the island. More than 800 inmates broke out of the vastly overcrowded detention facility last week in violent scenes that ultimately saw men, women and children march into Chios town.

Home › Forums › Debt Rattle April 8 2016