Paul Gauguin The Day of the God 1894

Well, not today. Support is low.

• Is The Existing Banking System Coming To An End? (Ren.)

Today Switzerland is set to hold a referendum to decide whether to ban commercial banks from creating money. The aim of campaigners is to limit financial speculation by forcing banks to hold 100 per cent reserves against their deposits. If the referendum result goes the way of the campaign group, the Vollgeld Initiative and the concept known as the sovereign money initiative comes to fruition, Swiss banks will no longer be able to create money for themselves, rather they will only be allowed to lend money that they have accumulated from savers or other banks. The current fractional reserve banking system works like this: Banks lend money that they don’t actually have and then command interest on the non-existent money.

This is akin to x offering to loan y a sum of say, £100,000 that the former hasn’t got. The way around this conundrum is for x to then lodge the sum with another financial institution who happens to be in on the scam. Y then pays x interest on the money that x has never been in the position to lend in the first place. Consistent with the proposed Swiss model, the idea of limiting all money creation to central banks was first touted in the 1930s and supported by renowned US economist Irving Fisher as a way of preventing asset bubbles and curbing reckless spending. If the Vollgeld Initiative succeeds with its campaign on Sunday, the fractional reserve system will be replaced by a bill which will give the Swiss National Bank (SNB) a monopoly on physical and electronic money creation.

Since the establishment of the SNB in 1891, the bank has had exclusive powers to mint coins and issue Swiss bank notes. But over 90% of money in circulation in Switzerland (and arguably the world) currently exists in the form of electronic cash which is created out of nothing by private banks. In modern market economies central banks control the creation of bank notes and coins but not the creation of all money. The latter occurs when a commercial bank offers a line of credit. Iceland, whose bloated banking system collapsed in 2008, has also touted the abolition of private money creation and an end to a practice in which central banks accept deposits, make loans and investments and hold reserves that are a fraction of their deposit liabilities. Fractional banking means that money is effectively produced from thin air.

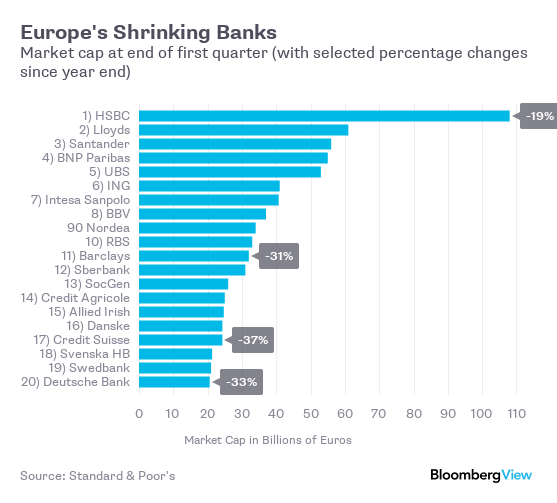

The weakness of the euro. Largely self-induced.

• The Credit Cycle Will Be The EU’s Undoing (Macleod)

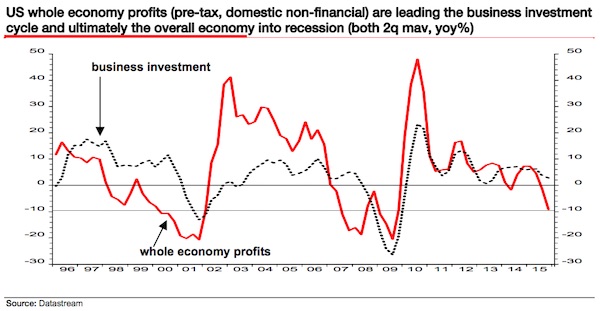

It is a common misconception that the world has a business cycle: that merely puts the blame on the private sector for periodic booms and busts. The truth is every boom and bust has its origins in central bank monetary policy and fractional reserve banking. A central bank first attempts to stimulate the economy with low interest rates, having injected base money into the economy to rescue the banks from the previous crisis. The central bank continues to suppress interest rates, inflating assets and facilitating the financing of government deficits. This is followed by the expansion of bank credit as banks recognise that trading conditions in the non-financial economy have improved. Price inflation unexpectedly but inevitably increases, and interest rates have to rise.

They rise to the point where earlier malinvestments begin to be liquidated and a loan repayment crisis develops in financial markets. It is fundamentally a credit cycle, not a business one. Central bankers do not, with very few exceptions, understand they are the cause. And the few central bankers who do understand are unable to influence monetary policy by enough to change it. By not understanding that they create the crisis themselves, central bankers believe they can control all financial risks through regulation and intervention, which is why they are always taken by surprise when a credit crisis hits them. For these reasons we know it is only a matter of time before the world faces another credit crisis.

The next one is likely to be unprecedented in its violence, even exceeding that of the last one in 2008/09, because of the scale of additional monetary reflation that has taken place over the last ten years. The further accumulation of debt in the intervening period also means that a smaller increase in price inflation, and therefore a lower height for interest rates will trigger it. My current expectation is that a global debt liquidation and credit crisis is not far away and will occur by the end of Q1 in 2019, perhaps even by the end of this year. The problem is a global one and we know not where it will break. But once it does, the ECB and the euro will possibly face the most violent deflation in modern history, even exceeding the global slump of the 1930s.

We know in advance what the supposed solution will be: monetary hyperinflation to bail out the banks, governments and the indebted. The effects on prices in the Eurozone are unlikely to be as delayed as they have been in the current cycle, partly because of the sheer scale of the issuance of new money and credit required to stabilise the financial system, partly because the euro is subordinate to the dollar as a safe-haven currency, and partly because of its limited history as a medium of exchange.

An exercise in large numbers.

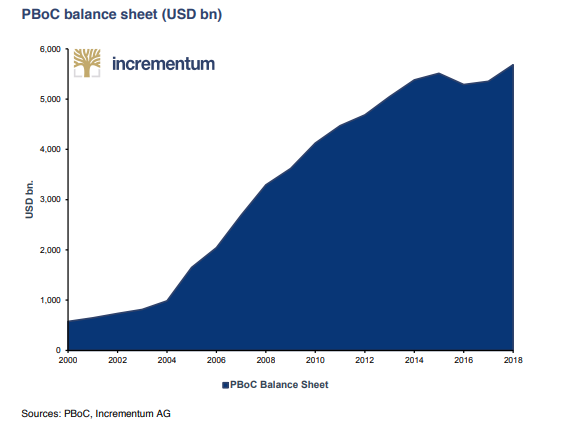

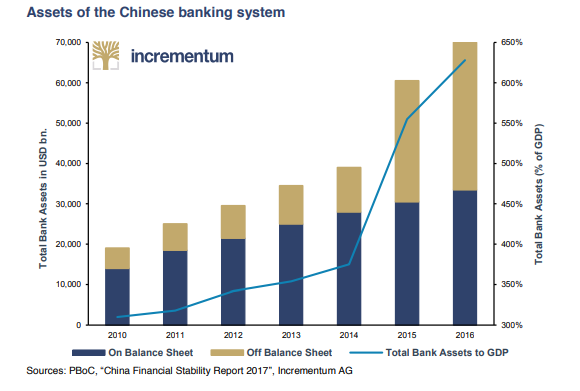

While the rulers of China have been able all along to hedge their plans over longer periods than their Western counterparts have, the new legal situation has extended this planning horizon even further.1 In comparison with those of Western economies, China’s countermeasures against the crisis in 2008 were significantly more drastic. While in the US the balance sheet total of the banking system increased by USD 4,000bn in the years after the global financial crisis, the balance sheet of the Chinese banking system expanded by USD 20,000bn in the same period. For reference: This is four times the Japanese GDP.

The following chart shows the expansion of the bank balance sheet total as compared to economic output. Did the Chinese authorities assume excessive risks in fighting the crisis? Neither the fact that China’s bank balance sheets amount to more than 600% of GDP nor the fact that they have doubled in terms of percentage of GDP in the past several years suggests a healthy development.

Our friends from Condor Capital expect NPL ratios to rise in China, which could translate into credit losses of USD 2,700 to 3,500bn for China’s banks, and this is under the assumption of no contagion (!). By comparison, the losses of the global banking system since the financial crisis have been almost moderate at USD 1,500bn The most recent crisis does teach us, however, that the Chinese are prepared to take drastic measures if necessary. China fought the financial crisis by flooding the credit markets: 35% credit growth in one year on the basis of a classic Keynesian spending program is no small matter.

Chinese money not only inflates a property bubble domestically but also around the globe (e.g. in Sydney and Vancouver). Further support for the global property markets is in question, given the measures China has recently launched. Due to financial problems, Chinese groups such as Anbang and HNA will have to swap the role of buyer for that of seller. The IMF has forecast a further doubling of total Chinese debt outstanding from USD 27,000bn in 2016 to USD 54,000bn in 2022. By comparison, in 2016 China’s GDP amounted to USD 11,200bn. This spells debt-induced growth at declining rates of marginal utility. From our point of view, this development – which we can also see in the West – is unsustainable.

” Say good-bye to super-cheap cash.”

• How To Plan For Next Round Of Fed Interest Rate Hikes (Freep)

The easy money officially ends Wednesday, as interest rates, much like summer temps, heat up once again. It’s a “slam-dunk” that the Federal Reserve will increase rates by a quarter point after its meeting this week, according to Mark Zandi, chief economist for Moody’s Analytics. And it’s likely we’re in for two more quarter-point hikes in September and December, he said. “If you are thinking about buying a car or home, sooner is better than later, but I wouldn’t rush into anything, as rates, while rising, are still very low,” Zandi said. The U.S. economy — with a national jobless rate at 3.8% in May, the lowest level in 18 years — has put the Great Recession in 2008-09 in the rear view mirror.

Consumers — as well as business leaders — are formulating strategies to cope with higher rates ahead. The Fed began gradually tightening money with the first quarter-point rate hike in December 2015 — then the first rate hike in nearly a decade. Since then, there have been another five rate hikes. The latest rate hike in March took the Fed’s benchmark rate to a target range of 1.5% to 1.75%. If the Fed raises rates as expected Wednesday, the overnight borrowing cost will be in line with the Fed’s inflation target of 2%. For the first time in almost a decade, the cost of borrowing will no longer be essentially free. Say good-bye to super-cheap cash.

Carrot for Kim.

• Trump Open To US Embassy In Pyongyang, North Korea (Axios)

President Trump is willing to consider establishing official relations with North Korea and even eventually putting an embassy in Pyongyang, according to two sources familiar with preparations for the Singapore summit. “It would all depend what he gets in return,” said a source close to the White House. “Denuclearization would have to be happening.” The sources stressed that this is one of many topics that could be discussed at the summit, and that certainly nothing like that has been decided or is necessarily expected to emerge from Trump’s historic mano a mano with North Korean leader Kim Jong-un.

But the U.S. and North Korean working groups — with engagements in New York, the DMZ and Singapore — have discussed establishing official relations between the two countries that would involve putting a U.S. embassy in Pyongyang. One of the sources, who is familiar with the president’s thinking, said Trump had made it a point not to reject any ideas headed into the summit: “It’s definitely been discussed,” the source said. “His view is: ‘We can discuss that: It’s on the table. Let’s see.’ Of course we would consider it. There’s almost nothing he’ll take off the table going in.” The source said North Korean officials have been wildly inconsistent in the pre-meetings, making it difficult to get any read on how the discussions might go.

The source close to the White House added: “POTUS will consider any idea anyone brings him if it delivers on denuclearization that is irreversible and verifiable. He won’t be played by Kim. But it is not his style to — on the front end — rule out possibilities of what could happen or may happen depending on how negotiations go.”

Well, it wasn’t dull.

• Trump Backs Out Of Joint G7 Communique With Attack On Trudeau (Ind.)

Donald Trump has rejected an agreement signed off by the leaders of countries at the G7 summit in Canada despite earlier having appeared to endorse the joint statement vowing to fight back against protectionism and pledging to follow established trade rules. The joint statement between the leaders of US, France, Germany, the UK, Japan, Italy, and Canada comes after US President Donald Trump refused to back down from his decision to impose international tariffs on goods including steel and aluminium imports as a part of his so-called “America First” strategy.

The communique had been confirmed by Canadian Prime Minster Justin Trudeau, who conceded that Mr Trump’s tough talk on trade showed there was a lot of work to be done between the countries, but nevertheless portrayed the joint statement as a positive step towards international cooperation. However, Mr Trump later tweeted that he had would not now endorse the communique due to “false statements” from the Canadian prime minister. He wrote: “Based on Justin’s false statements at his news conference, and the fact that Canada is charging massive tariffs to our US farmers, workers and companies, I have instructed our US reps not to endorse the communique as we look at tariffs on automobiles flooding the US market!”

He added: “PM Justin Trudeau of Canada acted so meek and mild during our G7 meetings only to give a news conference after I left saying that, ‘US tariffs were kind of insulting’ and he ‘will not be pushed around.’ Very dishonest & weak. Our tariffs are in response to his of 270% on dairy!”

These people see themselves as no.1, because that’s what they are where they come from. Being contradicted is then hard to take.

• One ‘Rant,’ Rough Talks Sour G7 Mood In Confrontations With Trump (R.)

Trump gave “a long, frank rant”, the official said, repeating a position he carried through the 2016 U.S. election campaign into the White House that the United States had suffered at the hands of its trading partners, with French President Emmanuel Macron pushing back on the assertion and Japanese Prime Minister Shinzo Abe chiming in. It was a “a long litany of recriminations, somewhat bitter reports that the United States was treated unfairly,” said the French official, who spoke on condition of anonymity. “It was a difficult time, rough, very frank.” The U.S. president did not appear to be listening during some of the trade presentations, another G7 official familiar with the meeting said.

Trump himself told reporters on Saturday that the summit was not contentious and called his relationship with G7 allies a “10”. Despite smiles and jokes for the cameras, the tension among the leaders was clear. At one point, German Chancellor Angela Merkel was seen having a brief, intense one-sided conversation with a stony-faced Trump on Friday. On Saturday, Canadian Prime Minister Justin Trudeau sniped about “stragglers” after Trump was late to a breakfast session on gender equality. Trump left the summit early for Singapore, where he will meet North Korean leader Kim Jong Un next week.

One scene at the very beginning of the gathering of presidents and prime ministers of the biggest industrialized nations set the mood for facing the brash Trump. He arrived at La Malbaie, the scenic luxury resort on the banks of the St. Lawrence River in Quebec, as the four European leaders and the two EU heads were huddled together in a room to coordinate their strategy. The noise of Trump’s helicopter landing was so loud they had to stop talking for a while, in a scene one official compared to the opening from the U.S. television series M.A.S.H. “The EU understands that the only way with Trump is strength,” said one European official. “If you give in now, he will come back tomorrow for more.”

All policies must benefit China.

• China’s Xi Calls Out ‘Selfish, Short-Sighted’ Trade Policies (R.)

Chinese President Xi Jinping, whose country is locked in a high-stakes trade dispute with the United States, on Sunday said China rejects “selfish, shortsighted” trade policies, and called for building an open global economy. Xi did not mention the United States during a speech at a summit meeting of the Shanghai Cooperation Organisation (SCO), a regional security bloc led by China and Russia. “We reject selfish, shortsighted, closed, narrow policies, (we) uphold World Trade Organisation rules, support a multi-lateral trade system, and building an open world economy,” Xi said in a speech in the port city of Qingdao.

The United States and China have threatened tit-for-tat tariffs on goods worth up to $150 billion each, as President Donald Trump has pushed Beijing to open its economy further and address the United States’ large trade deficit with China. Xi spoke hours after Trump said he was backing out of the Group of Seven communique, thwarting what appeared to be a fragile consensus on a trade dispute between Washington and its top allies. “We must … discard Cold War thinking, group confrontation; we object to acts of getting one’s own absolute security at the cost of other countries’ security,” Xi said.

Skripal and Crimea. It’s all they got.

• G7 Leaders Urge Russia To Stop Undermining Democracies (R.)

Leaders of the Group of Seven countries urged Russia on Saturday to stop undermining democracies and said they were ready to step up sanctions against Moscow if necessary. The leaders of the United States, Canada, Japan, France, Germany, Italy and Britain made the strongly worded statement just hours after U.S. President Donald Trump, who is part of the G7, said he wanted Moscow re-invited to the group. “We urge Russia to cease its destabilizing behavior, to undermine democratic systems and its support of the Syrian regime,” the leaders said in a statement at the end of their two-day meeting in La Malbaie, Quebec.

The G7 leaders condemned an attack in Salisbury in Britain on a former Russian spy using a Russian-made military grade nerve agent, saying it was highly likely Moscow was responsible because there was no other plausible explanation. Russia denies having anything to do with the attack. The G7 leaders made a commitment on Friday, without naming Russia, to share information between themselves and work with internet service providers and social media companies to thwart foreign meddling in elections. The Kremlin has denied allegations by the United States and some European countries that Russia interfered in their elections. Earlier on Saturday, Trump told a news conference the issue of Russia’s return to the group was discussed. Russia was a member of the then G8 until it was expelled for annexing Crimea in 2014.

“I think it would be an asset to have Russia back in. I think it would be good for the world. I think it would be good for Russia. I think it would be good for the United States. I think it would be good for all of the countries of the current G7,” Trump said. Italy’s new Prime Minister Giuseppe Conti expressed similar sentiment. But the final communique struck a different note, saying western sanctions against Russia would continue as long as Moscow failed to meet its obligations in Ukraine under the Minsk accord it signed, and could even be stepped up. “We reiterate our condemnation of the illegal annexation of Crimea and reaffirm our enduring support for Ukrainian sovereignty, independence and territorial integrity within its internationally recognized borders,” the G7 statement said.

World order.

• Iran’s Rouhani Criticizes US For Imposing Its Policies On Others (R.)

Iranian President Hassan Rouhani on Sunday said that U.S. efforts to impose its policies on others are a threat to all, after Washington last month said it was withdrawing from the Iran nuclear deal and would reimpose economic sanctions. Rouhani, speaking at a summit of the Chinese and Russian-led security bloc the Shanghai Cooperation Organisation (SCO) in the port city of Qingdao, said he appreciated efforts by Beijing and Moscow to maintain the nuclear deal.

“One believed in scientific ingenuity as the answer to our problems, the other was convinced that it only deepened the crisis.”

• The Relationship Between Population And Consumption Is Not Straightforward (G.)

Charles C Mann is a science journalist, author and historian. His books 1491 and 1493, looking at the Americas before and after Columbus, were widely acclaimed. His new book, The Wizard and the Prophet, examines the highly influential and starkly contrasting environmental visions of Norman Borlaug (the Wizard) and William Vogt (the Prophet). Borlaug (1914-2009) was instrumental in the green revolution that vastly expanded the amount of food humanity has been able to cultivate. Vogt (1902-1968) was a pioneering ecologist who argued that humans had exceeded the Earth’s “carrying capacity” and were heading for cataclysm unless consumption was drastically reduced. One believed in scientific ingenuity as the answer to our problems, the other was convinced that it only deepened the crisis.

What made you frame this story of humanity’s future in terms of these two individuals?

It really started the night my daughter was born 19 years ago. I was standing in the parking lot at three in the morning and it suddenly popped into my head that when Amelia, my daughter, became my age there would be almost 10 billion people in the world. And I believe that centuries from now, when historians look back at the time when you and I have been alive, the big thing that they’ll say happened is that hundreds of millions of people in Asia and Latin America and Africa lifted themselves from destitution to something like the middle class. So not only will there be 10 billion people but all those people will want the same things you and I want – nice homes, nice car, nice clothes, the odd chunk of Toblerone, right?

And so I stood there in the parking lot and thought to myself: how are we meant to do this? I’m a science journalist, so when I was talking to researchers, I’d say: “How are we going to feed everybody, how are we going to get water for everybody, house everybody? What are we going to do about climate change?” After a while I realised that the answers I was getting fell into two broad categories, each of which had a name that kept being associated with it: one was Borlaug, the other Vogt.

Caitlin Johnstone is a gem. I was thinking next Memorial Day make every American listen to With God On Our Side.

• There Are No War Heroes. There Are Only War Victims. (CJ)

The US special operations soldier who was killed in Somalia (one of the “seven countries in five years” famously named in General Wesley Clark’s revelation of the US war machine’s plans for world domination) and the four others who were injured are not heroes. The US servicemen and women who have fought and died in America’s nonstop acts of military expansionism and wars of aggression are not heroes. They are victims. They are victims of a sociopathic power establishment which does not care about them, and never has. If what I just wrote bothered you, it is because you have been conditioned to oppose such ideas by generations of war propaganda.

If you believe that US soldiers are heroes, it means that you believe that they are fighting and dying for a noble cause; for your freedom, for democracy, for the good and the just. It turns the deaths of the fallen into a tragic but noble sacrifice in your eyes, which keeps you from realizing that they have actually been dying for the profit margins of war plutocrats, land and resource assets, and the neoconservative agenda to secure control of the planet. There is nothing heroic about being thrown into the gears of the war machine and having one’s body and mind ripped apart for the advancement of plutocratic interests. But if your rulers can trick you into thinking that dead US soldiers died for something worth dying for, you won’t turn around and lay the blame on the war profiteers and ambitious sociopaths who are truly responsible for their deaths.

So they lie to you. Constantly. People often counter this notion by pointing at World War 2, about which a case for the possibility of heroism in war can indeed be made. But the fact that this argument needs to reach back 73 years to the very brink of living memory in order to find a justifiable US war tells you everything you need to know about the weakness of that argument. Since 1945, when human civilization looked completely different and America itself was still an apartheid state, we have seen the US military spread around the globe, collapse nations, and butcher millions upon millions of people, all at the expense of the lives of US military personnel, and all without just cause. The people whose lives have been used like Kleenex and discarded by the US war machine did not die for a good cause.

They did not die fighting for freedom or democracy. They are not heroes. They are victims. We need to talk about this. The way we can be shamed into silence for saying such things is truly toxic, because it prevents us from addressing the very real problem that the United States starts unjust wars constantly and spends soldiers’ lives like pennies. It probably is nice for the families of war victims to tell themselves comforting stories about how their loved one died fighting to make the world a better place, and normally I’d be happy to let them harbor that personal fantasy without saying anything to disrupt it, but people are dying here.

Annie Leonard is the boss at Greenpeace USA. And she has it upside down. You don’t ask multinationals if they would pretty please use less plastic. You ban them from using it.

• Our Plastic Pollution Crisis Is Too Big For Recycling To Fix (Leonard)

Every minute, every single day, the equivalent of a truckload of plastic enters our oceans. In the name of profit and convenience, corporations are literally choking our planet with a substance that does not just “go away” when we toss it into a bin. Since the 1950s, some 8.3bn tons of plastic have been produced worldwide, and to date, only 9% of that has been recycled. Our oceans bear the brunt of our plastics epidemic – up to 12.7m tons of plastic end up in them every year. Just over a decade ago, I launched the Story of Stuff to help shine a light on the ways we produce, use and dispose of the stuff in our lives. The Story of Stuff is inextricably linked to the story of plastics – the packaging that goes along with those endless purchases.

We buy a soda, sip it for a few minutes, and toss its permanent packaging “away”. We eat potato chips, finish them, then throw their permanent packaging “away”. We buy produce, take it out of the unnecessary plastic wrap, then throw its permanent packaging “away”. The cycle is endless, and it happens countless times every single day. But here’s the catch – there is no “away”. As far as we try to toss a piece of plastic – whether it’s into a recycling bin or not – it does not disappear. Chances are, it ends up polluting our communities, oceans or waterways in some form. For years, we’ve been conned into thinking the problem of plastic packaging can be solved through better individual action. We’re told that if we simply recycle we’re doing our part.

We’re told that if we bring reusable bags to the grocery store, we’re saving the world. We think that if we drink from a reusable bottle, we’re making enough of a difference. But the truth is that we cannot recycle our way out of this mess. [..] We need corporations – those like Coca-Cola, Unilever, Starbucks and Nestlé that continue to churn out throwaway plastic bottles, cups, and straws – to step up and show real accountability for the mess they’ve created. Drink companies produce over 500bn single-use plastic bottles annually; there is no way that we can recycle our way out of a problem of that scale.