Paul Gauguin The Seine in Paris 1875

Saudi Reuters

NOW – Saudi Energy energy minister refuses to answer questions from #Reuters at OPEC+ press conference. pic.twitter.com/Kyi5a5bWur

— Disclose.tv (@disclosetv) October 5, 2022

Clausewitz.

• Politics By Other Means (Big Serge)

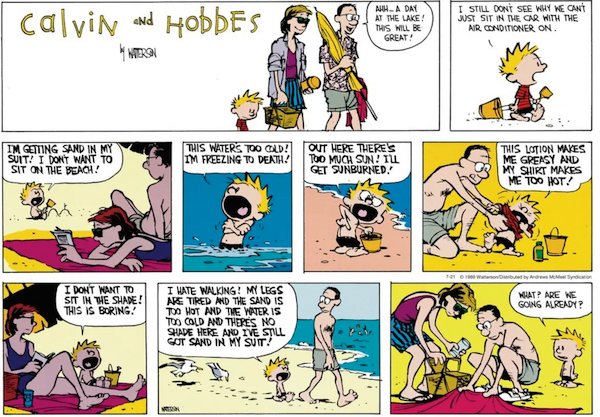

It is often the case that the most consequential men in the world are poorly understood in their time – power enshrouds and distorts the great man. This was certainly the case of Stalin and Mao, and it is equally true of both Vladimir Putin and Xi Jinping. Putin in particular is viewed in the west as a Hitlerian demagogue who rules with extrajudicial terror and militarism. This could hardly be farther from the truth. Almost every aspect of the western caricature of Putin is deeply misguided [..] . To begin with, Putin is not a demagogue – he is not a naturally charismatic man, and though he has over time greatly improved his skills as a retail politician, and he is capable of giving impactful speeches when needed, he is not someone who relishes the podium.

Unlike Donald Trump, Barack Obama, or even – God forbid – Adolf Hitler, Putin is simply not a natural crowd pleaser. In Russia itself, his imagine is that of a fairly boring but level headed career political servant, rather than a charismatic populist. His enduring popularity in Russia is far more linked to his stabilization of the Russian economy and pension system than it is to pictures of him riding a horse shirtless. Furthermore, Putin – contrary to the view that he wields unlimited extralegal authority – is rather a stickler for proceduralism. Russia’s government structure expressly empowers a very strong presidency (this was an absolute necessity in the wake of total state collapse in the early 1990’s), but within these parameters Putin is not viewed as a particularly exciting personality prone to radical or explosive decision making.

Western critics may claim that there is no rule of law in Russia, but at the very least, Putin governs by law, with bureaucratic mechanisms and procedures forming the superstructure within which he acts. This was made vividly apparent in recent days. With Ukraine advancing on multiple fronts, a fresh cycle of doom and triumph was set in motion: pro-Ukrainian figures exult in the apparent collapse of the Russian army, while many in the Russian camp bemoan leadership which they conclude must be criminally incompetent. With all of this underway on the military side, Putin has calmly ushered the annexation process through its legal mechanisms – first holding referendums, then signing treaties on entry in the Russian Federation with the four former Ukrainian oblasts, which were then sent to the State Duma for ratification, followed by the Federation Council, followed again by signature and verification by Putin.

As Ukraine throws its summer accumulations into the fight, Putin appears to be mired in paperwork and procedure. The treaties were even reviewed by the Russian constitutional court, and deadlines were set to end the Ukrainian hryvnia as legal tender and replace it with the ruble. This is a strange spectacle. Putin is plodding his way through the boring legalities of annexation, seemingly deaf to the chorus which is shouting at him that his war is on the verge of total failure. The implacable calm radiating – at least publicly – from the Kremlin seems at odds with events at the front. So, what really is going on here? Is Putin truly so detached from events on the ground that he is unaware that his army is being defeated? Is he planning to use nuclear weapons in a fit of rage? Or could this be, as Clausewitz says, the mere continuation of politics by other means?

Think that’s the final administrative step?!

• Putin Signs Unification Treaties For New Regions (RT)

Russian President Vladimir Putin signed into law four unification treaties with the Donetsk and Lugansk People’s Republics, as well as the Kherson and Zaporozhye Regions, on Wednesday morning. Earlier the documents unanimously endorsed by the Federation Council, the upper house of the Russian parliament. The agreements were ratified on Monday by the State Duma, the lower house of parliament, after they were certified as lawful by the country’s Constitutional Court over the weekend. The agreements were signed by Putin and the heads of the four former Ukrainian regions on Friday, after the residents of the territories overwhelmingly backed the idea of joining Russia during referendums held between September 23 and 27. The votes have been firmly rejected by Kiev and its Western backers, who have vowed to never accept their results nor recognize the four regions’ accession. The DPR and LPR split from Ukraine in 2014 in the aftermath of the Maidan coup and the civil conflict in the country’s east that followed. Shortly after launching a military operation in February this year, Russia seized Kherson Region and a larger part of Zaporozhye Region.

“..an exemption from federal income tax for 10 years and the payment of no more than 13.5% to the regional budget..”

• Russia Sets Out How It Will Financially Support New Regions (RT)

Russia’s Ministry of Economic Development announced on Wednesday that it will launch a state financing program to support the Donetsk and Lugansk People’s Republics, as well as Kherson and Zaporozhye Regions. According to the ministry’s statement, the territory has “huge economic and industrial potential.” The statement highlighted plans to pass a federal law on the creation of a common free economic zone for the new regions with preferential treatment for investors, with tax and non-tax incentives guaranteed within its framework. These will be similar to the incentives provided in the free economic zone of Crimea and Sevastopol.

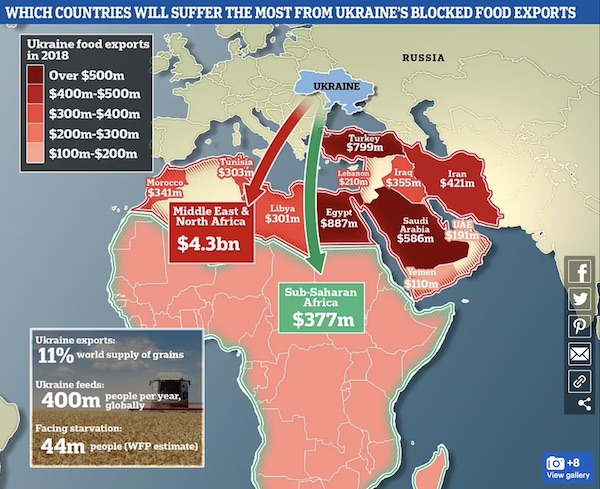

“The accession of new territories in the Russian Federation will ensure an increase in nationwide indicators on such main sectors as the metals industry (by 20%), coal sector (by 6%), grain production (by more than 10%), sunflowers (over 20%),” Deputy Minister Sergey Nazarov said. He pointed out that the “gross regional product of new regions will amount to three trillion rubles ($50 billion) within five years.” According to him, the special provisions could see an exemption from federal income tax for 10 years and the payment of no more than 13.5% to the regional budget. On Wednesday morning, Russian President Vladimir Putin signed into law four unification treaties with the new regions, which overwhelmingly voted to join Russia in referendums in September.

Logic.

• Putin Transfers Europe’s Largest Nuclear Plant Under Russian Control (RT)

President Vladimir Putin has issued an order placing the formerly Ukrainian Zaporozhye power plant under Russian management. A presidential decree on the fate of Europe’s largest nuclear facility was published on Wednesday. The facility will be operated by a subsidiary of Russia’s state-owned nuclear power giant Rosatom. For now, the facility will continue to function under Ukrainian-issued licenses until it obtains Russian-issued equivalents, according to the decree. The move comes as Moscow finalizes the accession of four formerly Ukrainian regions – Zaporozhye, Kherson, as well as Donetsk and Lugansk People’s Republics – to Russia.

The territories overwhelmingly backed a proposal to join Russia in referendums last month. The votes were firmly rejected by Kiev and its Western backers, who denounced them as “sham” votes. In recent weeks, Zaporozhye nuclear power plant has been subjected to repeated missile, artillery and drone attacks, attributed by the Russian military to Ukrainian forces, as well as targeted by saboteurs in apparent attempts to seize the facility from Russian forces. Kiev, along with multiple Western officials, however, has been blaming Moscow for shelling the nuclear facility it controls. The Zaporozhye plant was seized by the Russian military early in the ongoing conflict. Until now, however, it has remained under Ukrainian management.

“..Russia is getting ready for an all-out collision with the Empire of Lies. Alongside top Eurasian powers China and Iran.”

• Pipeline Terror is the 9/11 of the Raging Twenties (Escobar)

There’s no question that future unbiased historians will rank Russian President Vladimir Putin’s address on the Return of the Baby Bears – Donetsk, Lugansk, Kherson, and Zaporizhzhia – on September 30 as a landmark inflection point of the Raging Twenties. The underlying honesty and clarity mirror his speech at the 2007 Munich Security Conference, but this time largely transcending the trappings of the geopolitical New Great Game. This was an address to the collective Global South. In a key passage, Putin remarked how “the world has entered a period of revolutionary transformations, which are fundamental in nature. New development centers are being formed, they represent the majority.”

As he made the direct connection between multipolarity and strengthening of sovereignty, he took it all the way to the emergence of a new anti-colonial movement, a turbocharged version of the Non-Aligned Movement of the 1960s: “We have many like-minded people all over the world, including in Europe and the United States, and we feel and see their support. A liberating, anti-colonial movement against unipolar hegemony is already developing in various countries and societies. Its subjectivity will only grow. It is this force that will determine the future geopolitical reality.” Yet the speech’s closure was all about transcendence – in a spiritual tone. The last full paragraph starts with “Behind these words stands a glorious spiritual choice”.

Post-post-modernism starts with this speech. It must be read with utmost care so its myriad implications may be grasped. And that’s exactly what tawdry Western spin and a basket of demeaning adjectives will never allow. The speech is a concise road map to how we got to this incandescent historical crossroads – where, to venture beyond Gramsci, the old order refuses to acknowledge its death while the new one is inexorably being born. There’s no turning back. The key consequence of a largely documented fact – “a hybrid war is being waged against Russia because it stands in the way of the neocolonial world order” – is that Russia is getting ready for an all-out collision with the Empire of Lies. Alongside top Eurasian powers China and Iran. Imperial vassals in this case are at best collateral damage.

Moreover, it’s quite telling that Putin’s speech followed India’s External Affairs Minister, Dr. S. Jaishankar, stressing the “pillaging of India by the colonial power” at the UN General Assembly. Putin’s speech and Russia’s resolve to fight the – hybrid and otherwise – war against the collective West set up the Macro Picture. The Micro Picture regards the see-saw in the battlefields in Ukraine, and even the blow-up of the Nord Stream and Nord Stream 2 pipelines: a desperate gambit, a few days before the result of the referendums and their official recognition on September 30.

Dick Black

“Certain territories will be returned, and we will continue consulting with the people, who would wish to live with Russia..”

• Kremlin Responds To Rumors Over Its Ukraine Op (RT)

Moscow has not rebranded its military campaign in Ukraine as a “counter-terrorist operation” after taking four former Ukrainian regions under its sovereignty, contrary to some expectations, Kremlin spokesman Dmitry Peskov has said. “This is solely the prerogative of the commander-in-chief, the country’s president,” he told journalists on Wednesday when asked about a possible change of format. “As of this moment, no such decision has been taken. We are talking about the special military operation, which continues,” he added. Some political observers predicted that the Russian government would reclassify the hostilities with Ukraine after incorporating a number of former Ukrainian regions, where much of the fighting against Kiev’s troops is taking place.

Officials in Moscow accused Kiev on multiple occasions of using “terrorist tactics” against people in frontline regions. There was some expectation that Russia would designate the operation against Ukraine accordingly. Russian President Vladimir Putin signed into law on Tuesday four acts, which designate the Donetsk and Lugansk Republics and Kherson and Zaporozhye Regions as new subjects of the Russian Federation. Ukrainian troops are in control of parts of those territories and have recently retaken a number of settlements, which were previously held by Russian forces. Peskov reacted to Kiev’s advances, stating that the new lands “are with Russia forever [and] will be returned.”

The official also commented on the standing issue of the borders of Kherson and Zaporozhye Regions. Peskov described the two new parts of Russia as lands “where the military-civilian administration was in power at the moment of accession.” “Certain territories will be returned, and we will continue consulting with the people, who would wish to live with Russia,” the spokesman said. Kiev declared Russia’s move to accept new territories as legally void and based on “sham” referendums that changed nothing for Ukraine. The Ukrainian government declared that it will oust Russian troops from all lands it considers to be under its sovereignty with the help of the US and its allies.

What a waste of time.

“The price cap is part of an eighth round of anti-Russia sanctions..”

• EU Agrees To Impose Price Cap On Russian Oil (RT)

The EU has reached a tentative deal to impose a price cap on the sale of Russian oil to third countries, Politico Europe reported on Tuesday citing diplomatic sources. Cyprus, Greece and Malta had concerns about the potential impact on their shipping industries, but were reportedly promised concessions. The price cap is part of an eighth round of anti-Russia sanctions, which Brussels is expected to roll out this week, citing the conflict in Ukraine. EU ambassadors reached an agreement on Tuesday and expect to approve the final text on Wednesday, Politico reported citing seven diplomats – all of whom wished to remain anonymous. Details of the sanctions still need to be confirmed in writing, and there was a “limited” chance the deal could still unravel, one source reportedly said.

The three Mediterranean members were reportedly concerned about the impact of the restrictions on their commercial shipping, but Brussels offered “concessions” in the form of a “monitoring system” that would propose measures to mitigate the impact of the embargo, in case of “significant loss of business” due to practices such as reflagging of commercial vessels. The EU has already banned the import of coal from Russia, with an oil embargo scheduled to go into effect in December. The price cap seeks to block Moscow’s petroleum exports to third countries using EU-registered vessels, as the bloc has already sanctioned all Russian shipping. Meanwhile, Hungary said it had secured assurances the price cap won’t apply to oil delivered through pipelines.

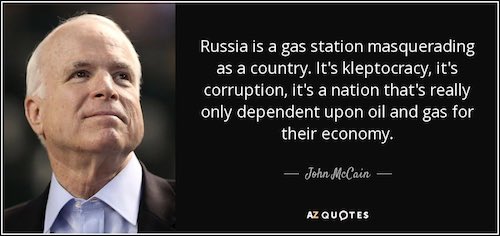

Anti-Russia measures adopted by the US and its allies have led to a spike in oil prices, leaving Russia with more revenue from exports than before the embargo. The price cap proposed by the G7 seeks to neutralize this. According to the proposal, EU vessels will refuse to carry Russian oil if it is priced above the cap, the value of which has yet to be determined. The sanctions have also resulted in the EU facing severe energy shortages. However, the bloc’s leaders have vowed to support Ukraine indefinitely, no matter what. Moscow has made it clear it will not comply with the price cap scheme, with Deputy Prime Minister Alexander Novak warning that Russia will simply refuse to sell fuel to countries that seek to enforce or abide by it.

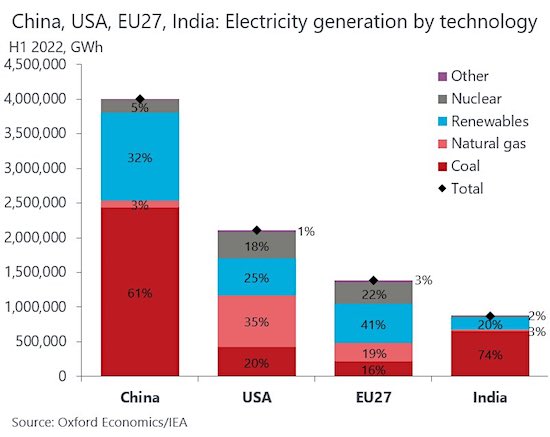

Industry.

• European Gas Demand Set For Record-Breaking Decline In 2022 (OP)

Soaring natural gas prices, demand destruction in the industrial sector, and energy-saving measures are set to reduce gas consumption in Europe’s developed economies by 10% this year, the biggest drop in European demand in history, the International Energy Agency (IEA) said in its quarterly Gas Market Report on Monday.The forecast of a 10% decline in natural gas demand in OECD Europe reflects the expectation of higher gas prices and the EU’s ambition to reduce gas consumption by 15% between August 2022 and March 2023 compared to its five-year average. “Assuming average weather conditions, gas demand in the residential and commercial sectors is expected to remain below 2021 levels,” the IEA said in its report.

Due to sky-high high prices and a very tight gas market, natural gas usage in the power generating sector in Europe is forecast to drop by nearly 3% this year. Industrial gas demand is expected to plunge by as much as 20%, the IEA said. Energy-intensive industries in Europe, including aluminum, copper, and zinc smelters and steel makers, have already warned EU officials that they face an existential threat from surging power and gas prices. After a record slump in gas demand this year, Europe faces another year of gas consumption contraction in 2023, when OECD Europe’s demand is forecast to decline by 4% amid high prices, according to estimates from the IEA.The agency also noted that “Further potential disruption to the supply of Russian gas provides additional downside risk to this outlook.”

Keisuke Sadamori, the IEA’s Director of Energy Markets and Security, commented on the report: “The outlook for gas markets remains clouded, not least because of Russia’s reckless and unpredictable conduct, which has shattered its reputation as a reliable supplier. But all the signs point to markets remaining very tight well into 2023.” The IEA’s Executive Director Fatih Birol said last week that the gas market could be even tighter next year compared to already tight LNG markets in 2022.

The headline says support dropped. Then you learn that the poll is from June, 3 months into the SMO. It is October now. And the authors still say that “measures to support Ukraine in its defense against the war waged by Russia remain popular”.

• EU Public Support For Ukraine Drops – Poll (RT)

A EU-wide survey by the pollster Eupinions has suggested a drop in support for sending weapons to Ukraine and accepting refugees from the country among the EU public. However, measures to aid Kiev in its conflict with Moscow are still supported by the majority of respondents, the study shows. The results of the poll, which was conducted throughout June in 27 member states, were released on Wednesday. They showed that 60% of the EU’s population were on board with sending weapons to Kiev. The backing for lethal aid was the highest in Poland, where 84% spoke in favor of it; and the lowest in Italy, where it was supported by just 42%.“In fact, Italy is the only member state where a majority of citizens oppose the delivery of weapons,” the study pointed out.

Meanwhile, 60% of those surveyed believed that the shipments of arms to Kiev should be organized through EU mechanisms, while 54% preferred them to be carried out by their home countries. A similar poll conducted in March showed that 64% in the bloc were in favor of arms deliveries. Moscow has consistently criticized the US, EU and other countries over their shipments of weapons to Kiev, arguing that they only prolonged the fighting and increased the risk of a direct confrontation between Russia and NATO. Support for welcoming Ukrainian refugees has declined by 5% in the EU since March and stood at 81%, according to the survey. It was the highest in Germany, Italy and Spain (83%, 84% and 90%, respectively), and the lowest in Poland (77%) and France (76%).

Ukraine was granted EU candidate status shortly after the outbreak of the conflict, with 66% of the population in member states now saying they would like to see Kiev joining the union. The respondents were also asked to name the country they thought was the EU’s most trustworthy ally, with 77% saying that it was the US. As for the economic fallout of the sanctions imposed on Moscow by Brussels, Eupinions pointed out that 46% of EU citizens said their personal outlook on the future was negative, compared to 37% at the same period last year. Overall, the authors of the study came to the conclusion that “measures to support Ukraine in its defense against the war waged by Russia remain popular” in the EU.

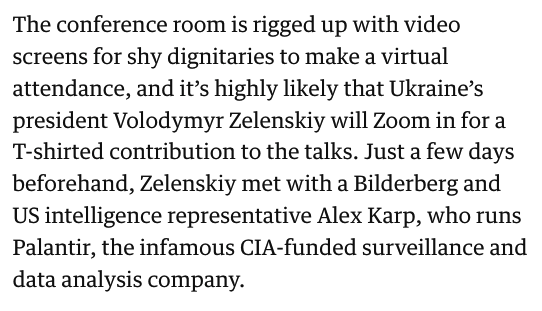

“He did not realize that he was violating the Straussian doctrine by imagining that he was escaping from the US military protectorate.[..] Six days later, Navy Seals blew up the two gas pipelines in the Baltic Sea, setting Germany back eleven years.”

• US Declares War On Russia, Germany, Netherlands And France (Meyssan)

Chancellor Olaf Scholz, who was elected in December 2021, has made two serious mistakes in a few months. On December 7, he went to the White House where he tried to resist the United States’ demand that he stop accepting Russian gas. Back home, he chose to maintain Nord Stream and block Nord Stream 2, while seeking renewable sources. He thought, wrongly, that he was balancing the warmongering of US strategic thinking, the needs of his industry and the doctrine of the Greens, members of his government coalition. The Chancellor had had a close call: during his press conference with the US President, Joe Biden said that his country could destroy Nord Stream 2 and that if Russia invaded the Ukraine, he would do so.

It was absolutely frightening for Scholz to hear his overlord spit in his face that he could destroy a tens of billions of dollars investment if a third party acted without regard to his dictates. We do not know whether President Biden also mentioned the destruction of Nord Stream 1 during the closed-door talks, but it is not impossible. In any case, according to the German journalists who followed him, the chancellor returned to Germany pale. His second mistake was made on September 16, 2022. His country wanted to get out from under the Anglo-Saxon umbrella and ensure its own security as well as that of the entire European Union. « As the most populous nation, with the greatest economic power and located at the center of the continent, our army must become the pillar of conventional defence in Europe, » the chancellor said.

By specifying that he was only talking about “conventional defence”, he intended to spare the susceptibility of his French neighbor, the only nuclear power in the Union. He did not realize that he was violating the Straussian doctrine by imagining that he was escaping from the US military protectorate. In 1992, Paul Wolfowitz signed the Defense Policy Guidance, excerpts of which were published in the New York Times. He indicated that the United States would consider any desire for European emancipation as a cassus belli. Six days later, Navy Seals blew up the two gas pipelines in the Baltic Sea, setting Germany back eleven years.

At the same time, the Baltic Pipe pipeline was inaugurated with great fanfare, a few hours after the sabotage, by the Polish president, the Danish prime minister and the Norwegian energy minister. It does not have at all the same capacities as Nord Stream, but it will be enough to change the times. Once the European Union was dominated by German industry using Russian gas, now it will be dominated by Poland using Norwegian gas. Polish Prime Minister Mateusz Morawiecki triumphantly declared at the inauguration ceremony: “The era of Russian gas domination is coming to an end; an era that was marked by blackmail, threats and extortion.

“..the energy to defend this territory was greater than its strategic importance.”

• Kharkov and Mobilization (Jacques Baud)

The recapture of the Kharkov region at the beginning of September appears to be a success for Ukrainian forces. Our media exulted and relayed Ukrainian propaganda to give us a picture that is not entirely accurate. A closer look at the operations might have prompted Ukraine to be more cautious. From a military point of view, this operation is a tactical victory for the Ukrainians and an operational/strategic victory for the Russian coalition. On the Ukrainian side, Kiev was under pressure to achieve some success on the battlefield. Volodymyr Zelensky was afraid of a fatigue from the West and that its support would stop. This is why the Americans and the British pressed him to carry out offensives in the Kherson sector. These offensives, undertaken in a disorganised manner, with disproportionate casualties and without success, created tensions between Zelensky and his military staff.

For several weeks now, Western experts have been questioning the presence of the Russians in the Kharkov area, as they clearly had no intention to fight in the city. In reality, their presence in this area was only aimed at affixing the Ukrainian troops so that they would not go to the Donbass, which is the real operational objective of the Russians. In August, indications suggested that the Russians had planned to leave the area well before the start of the Ukrainian offensive. They therefore withdrew in good order, together with some civilians who could have been the subject of retaliation. As evidence of this, the huge ammunition depot at Balaklaya was empty when the Ukrainians found it, demonstrating that the Russians had evacuated all sensitive personnel and equipment in good order several days earlier. The Russians had even left areas that Ukraine had not attacked. Only a few Russian National Guard and Donbass militia troops remained as the Ukrainians entered the area.

At this point, the Ukrainians were busy launching multiple attacks in the Kherson region, which had resulted in repeated setbacks and huge losses for their army since August. When US intelligence detected the Russians’ departure from the Kharkov region, they saw an opportunity for the Ukrainians to achieve an operational success and passed on the information. Ukraine thus abruptly decided to attack the Kharkov area that was already virtually empty of Russian troops. Apparently, the Russians anticipated the organisation of referenda in Lugansk, Donetsk, Zaporozhe and Kherson oblasts. They realised that the territory of Kharkov was not directly relevant to their objectives, and that they were in the same situation as with Snake Island in June: the energy to defend this territory was greater than its strategic importance.

There’s only one John Bolton. Problem is, there’s 1000s of wannabees.

• Putin Must Go: Now Is The Time For Regime Change In Russia (John Bolton)

There is no long-term prospect for peace and security in Europe without regime change in Russia. Russians are already discussing it, quietly, for obvious reasons. For the United States and others pretending that the issue is not before will do far more harm than good. Notwithstanding recent Kyiv’s military advances, the West still lacks a shared definition of “victory” in Ukraine. Last week, Putin “annexed” four Ukrainian oblasts, joining Crimea, “annexed” in 2014. The war grinds on, producing high Russian casualties and economic pain. Opposition to Putin is rising, and young men are fleeing the country. Of course, Kyiv’s civilian and military casualties are also high, and its physical destruction is enormous.

Hoping to intimidate NATO, Moscow is again rhetorically brandishing nuclear weapons, and has sabotaged the Nord Stream pipelines. Europe worries about the coming winter, and everyone worries about the durability of Europe’s resolve. No one predicts a near-term cease-fire or substantive war-ending negotiations, or how to conduct “normal” relations with Putin’s regime thereafter. To avoid the war simply grinding along indefinitely, we must alter today’s calculus. Carefully assisting Russian dissidents to pursue regime change might just be the answer. Russia is, obviously, a nuclear power, but that is no more an argument against seeking regime change than against assisting Ukrainian self-defense.

White House virtue signaling already empowers the Kremlin, accusing us of “satanism,” to claim America is trying to overthrow Russia’s government even though Biden is doing no such thing. Just to remind, the Kremlin has been doing this to us for many decades. Since we are already accused of subverting the Kremlin, why not return the favor? Obstacles and uncertainties blocking Russian regime change are substantial, but not insuperable. Defining the “change” is critical, because it must involve far more than simply replacing Putin. Among his inner circle, several potential successors would be worse. The problem is not one man, but the collective leadership constructed over the last two decades. No civilian governmental structure exists to effect change, not even a Politburo like the one that retired Nikita Khrushchev after the Cuban missile crisis. The whole regime must go.

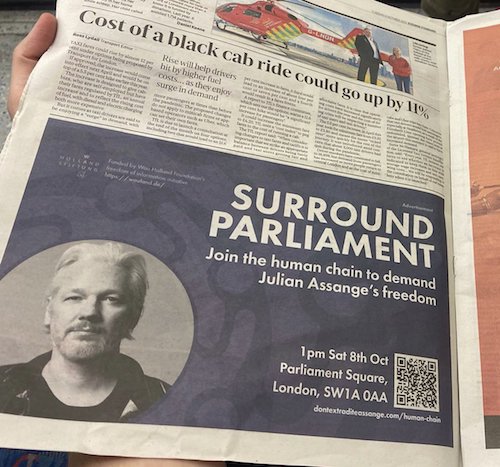

wow Stella Assange really just told John Bolton to his face he should be tried at the Hague. pic.twitter.com/k3DbkuRGUr

— dilan (@dilanpcook) October 5, 2022

EU is not the same thing as Europe.

• After Russia, Now Turkey Questions Europe’s Territory (Euractiv)

A memorandum of understanding for exploring hydrocarbons at sea signed between the government of Tripoli and Turkey openly questions EU territory causing more headaches in Brussels amid an ongoing war in Ukraine. “Ankara’s latest agreement shows that Turkey follows a pattern”, an EU source told EURACTIV ahead of an EU summit this week which Turkish President Recep Tayyip Erdogan is expected to attend. The preliminary deal on energy exploration was signed between the Libyan Government of National Unity and Turkey and is considered a follow-up of a wider memorandum of understanding between the two countries in 2019. The deal questions Greece’s territorial waters south of the island of Crete and has triggered strong reactions.

The EU, Washington and Athens have all condemned the deal, saying it destabilises the region, infringes upon the sovereign rights of third states, does not comply with the Law of the Sea and cannot produce any legal consequences for third states. Since the Arab Spring, Libya has been facing a fragile political landscape considering that there are two rival governments: the Tripoli-based Government of National Unity which signed the deal with Ankara and the Sirte-based Government of National Stability. The latter also slammed the agreement, saying any deal made by an outgoing government is not binding for the Libyan state. Moreover, Ankara is increasingly escalating its rhetoric daily, openly questioning the sovereignty of the Greek islands.

Particularly, the far-right government partner of Recep Tayyip Erdogan, Devlet Bahçeli, recently said the sovereignty of the Dodecanese and North Aegean islands are Turkish and not Greek. “We will pull out the eyes of anyone who tries to cover our rights and justice,” Bahçeli said. An EU source told EURACTIV that Brussels is closely following the escalation in the Mediterranean and in no way wants to face another front of instability after Russia’s invasion in Europe’s east. “All Turkey’s moves, both in rhetoric and in practice, show that Erdogan is following a pattern through the repetition of certain moves”, the EU source said. The source emphasised that in 2019 the Turks signed the Turkish-Libyan memorandum with something in mind because they are coming in 2022 to strengthen it in the same sense. “The objective is to question the current status quo”, the source added.

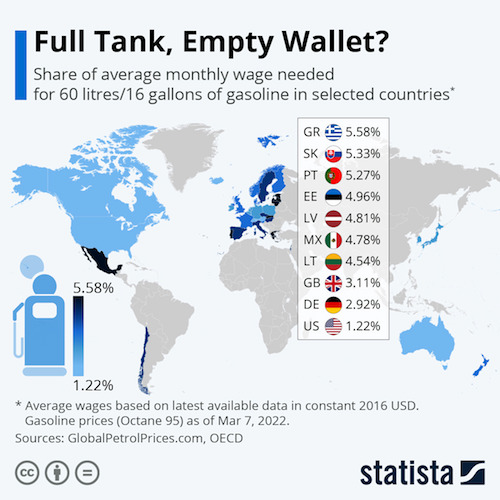

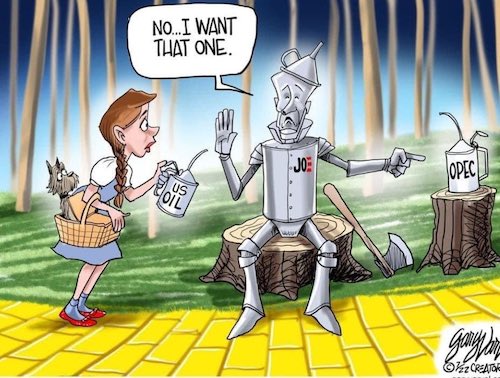

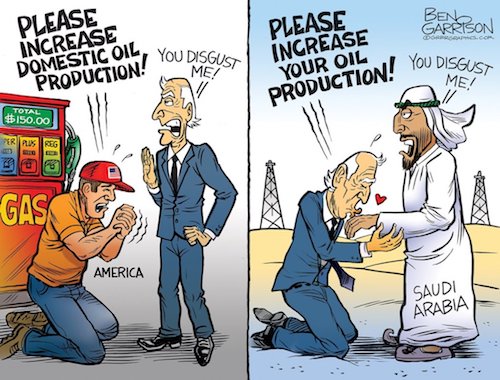

White House: “It’s clear that OPEC+ is aligning with Russia with today’s announcement.”

• Biden Blasts “Short-Sighted” OPEC+ Cut (ZH)

OPEC+ could be on the verge of one of the largest production cuts in two years, a move White House officials would undoubtedly have a ‘panic attack’ as they attempt to dissuade the 23 crude-producing countries and its allies, such as Russia, from making the cuts. OPEC+ is considering cutting 2 million barrels a day, and on the smaller side, a reduction of 1-1.5 million barrels a day, delegates said. Such a move would be a blow to Washington as the Biden administration has scrambled to unleash record amounts of crude from the strategic petroleum reserve to tame soaring crude prices this summer. “Higher oil prices, if driven by sizeable production cuts, would likely irritate the Biden administration ahead of US midterm elections,” Citi strategists wrote in a note.

Citi strategists appear correct: CNN obtained some of the draft talking points circulated by the White House to the Treasury Department this week and called the prospect of a production cut a “total disaster” and “hostile act.” “There could be further political reactions from the US, including additional releases of strategic stocks,” the strategists added. They said the Biden administration could also push forward with an anti-trust bill targeting OPEC. But that’s not all. According to Bloomberg, White House officials are discussing possible export bans on gasoline, diesel, and other refined petroleum with the Energy Department. People familiar with discussions said administration officials are discussing export bans of refined products with top oil industry leaders as the risk of an OPEC+ reduction could catapult fuel pump prices higher ahead of the midterm elections in November.

[..]Despite Biden’s SPR drain, hitting levels not seen since 1984, the export ban could be the most controversial move yet by the desperate administration to tame pump prices ahead of the midterm elections next month. Biden’s political emptying of the SPR has left it with a record low of just 22 days of supply… Top oil execs and industry experts have blasted the proposed export ban, saying it could backfire and result in even higher gasoline, diesel, and jet fuel prices, while throwing energy markets into turmoil in Europe ahead of winter. In a letter to the Energy Department, Exxon’s CEO Darren Woods wrote last week that “continuing current Gulf Coast exports is essential to efficiently rebalance markets—particularly with diverted Russian supplies.” “Reducing global supply by limiting US exports to build region-specific inventory will only aggravate the global supply shortfall,” Woods said.

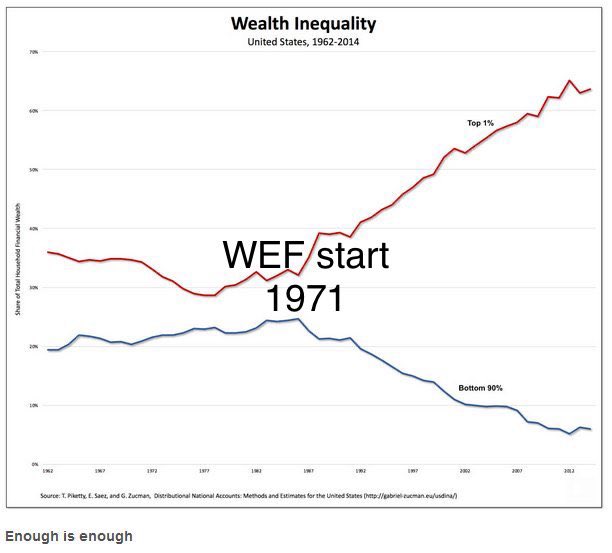

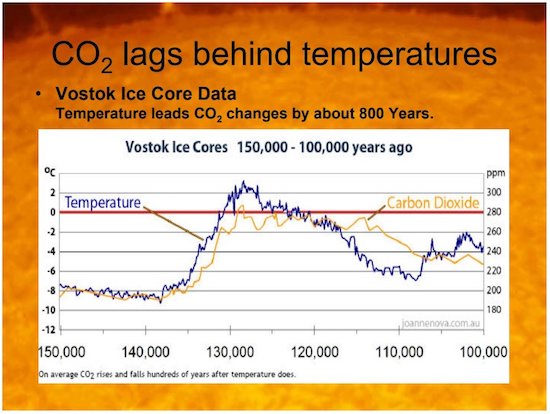

“The increasing cost of hurricane damage can be explained entirely by more people and more property in harm’s way.”

• Media Lying About Climate And Hurricanes (Shellenberger)

Over the last several weeks, many mainstream news media outlets have claimed that hurricanes are becoming more expensive, more frequent, and more intense because of climate change. The Financial Times reported that “hurricane frequency is on the rise.” The New York Times claimed, “strong storms are becoming more common in the Atlantic Ocean.” The Washington Post said, “climate change is rapidly fueling super hurricanes.” ABC News declared, “Here’s how climate change intensifies hurricanes.” Both the FT and N.Y. Times showed graphs purporting to show rising hurricane frequency using data from the U.S. government’s National Oceanic and Atmospheric Administration (NOAA). All of those claims are false.

The increasing cost of hurricane damage can be explained entirely by more people and more property in harm’s way. Consider how much more developed Miami Beach is today compared to a century ago. Once you adjust for rising wealth, there is no trend of increasing damage. Claims that hurricanes are becoming more frequent are similarly wrong. “After adjusting for a likely under-count of hurricanes in the pre-satellite era,” writes NOAA, “there is essentially no long-term trend in hurricane counts. The evidence for an upward trend is even weaker if we look at U.S. landfalling hurricanes, which even show a slight negative trend beginning from 1900 or from the late 1800s.” What’s more, NOAA expects a 25% decline in hurricane frequency in the future.

What about intensity? Same story. Explains NOAA, “after adjusting for changes in observing capabilities (limited ship observations) in the pre-satellite era, there is no significant long-term trend (since the 1880s) in the proportion of hurricanes that become major hurricanes.“ Bottom line? “We conclude that the historical Atlantic hurricane data at this stage do not provide compelling evidence for a substantial greenhouse warming-induced century-scale increase in: frequency of tropical storms, hurricanes, or major hurricanes, or in the proportion of hurricanes that become major.”

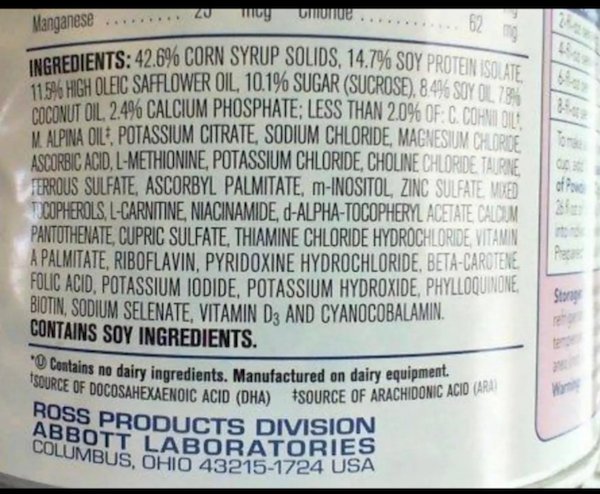

Ingraham chemistry

Laura Ingraham – Introducing… Generation C pic.twitter.com/HJPcmbZoxb

— Wittgenstein (@backtolife_2023) October 5, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.