Ann Rosener Salvage. Chicago automobile graveyard. 1942

“That way lies 50 blocks of concentrated human humiliation.”

• A Journey Through A Land Of Extreme Poverty: Welcome To America (G.)

Los Angeles, California, 5 December “You got a choice to make, man. You could go straight on to heaven. Or you could turn right, into that.” We are in Los Angeles, in the heart of one of America’s wealthiest cities, and General Dogon, dressed in black, is our tour guide. Alongside him strolls another tall man, grey-haired and sprucely decked out in jeans and suit jacket. Professor Philip Alston is an Australian academic with a formal title: UN special rapporteur on extreme poverty and human rights. General Dogon, himself a veteran of these Skid Row streets, strides along, stepping over a dead rat without comment and skirting round a body wrapped in a worn orange blanket lying on the sidewalk. The two men carry on for block after block after block of tatty tents and improvised tarpaulin shelters. Men and women are gathered outside the structures, squatting or sleeping, some in groups, most alone like extras in a low-budget dystopian movie.

We come to an intersection, which is when General Dogon stops and presents his guest with the choice. He points straight ahead to the end of the street, where the glistening skyscrapers of downtown LA rise up in a promise of divine riches. Heaven. Then he turns to the right, revealing the “black power” tattoo on his neck, and leads our gaze back into Skid Row bang in the center of LA’s downtown. That way lies 50 blocks of concentrated human humiliation. A nightmare in plain view, in the city of dreams. Alston turns right. So begins a two-week journey into the dark side of the American Dream. The spotlight of the UN monitor, an independent arbiter of human rights standards across the globe, has fallen on this occasion on the US, culminating on Friday with the release of his initial report in Washington. His fact-finding mission into the richest nation the world has ever known has led him to investigate the tragedy at its core: the 41 million people who officially live in poverty. Of those, nine million have zero cash income – they do not receive a cent in sustenance.

History is a poet.

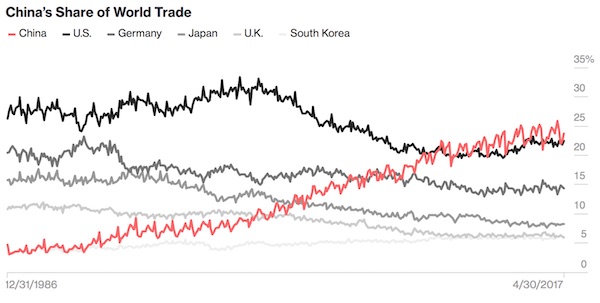

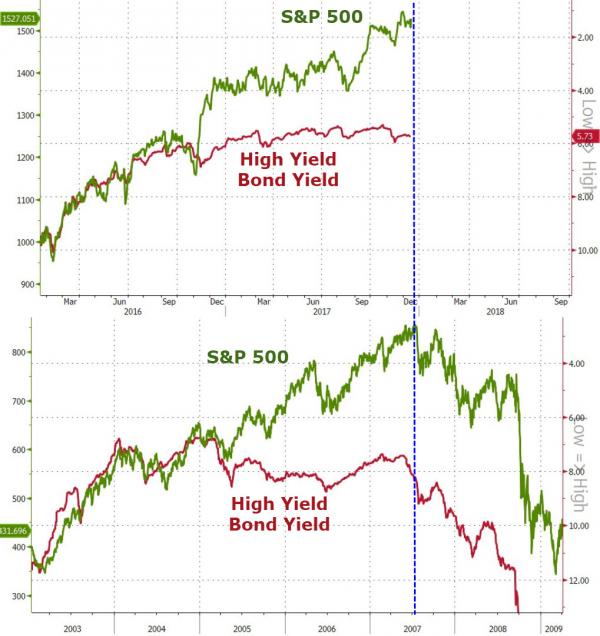

• The Chart That Jeffrey Gundlach Calls “Must Watch” For 2018 (ZH)

Having shown us his favorite trade of the year for 2018, DoubleLine CEO Jeffrey Gundlach tweeted last night his “must watch” chart for 2018. “Since Jan SPX up big & way above MA’s all year…” “…yet JNK unchanged and below 50, 100 & 200 MA’s with a death cross even… As Gundlach concludes: This is “unusual… Must Watch”

So, what happens next?

“80% of Americans continue to live paycheck-to-paycheck” That’s an economy that doesn’t have much of a foundation left. It’s wobbly at best, prone to collapse.

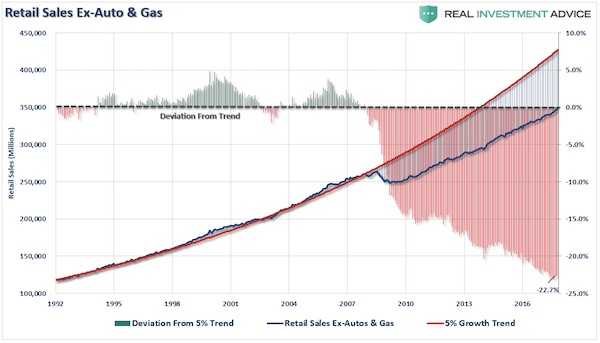

• Ignorance Is No Excuse (Roberts)

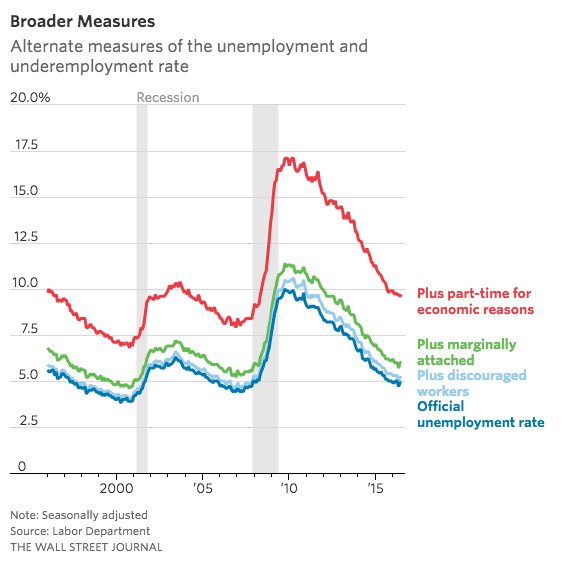

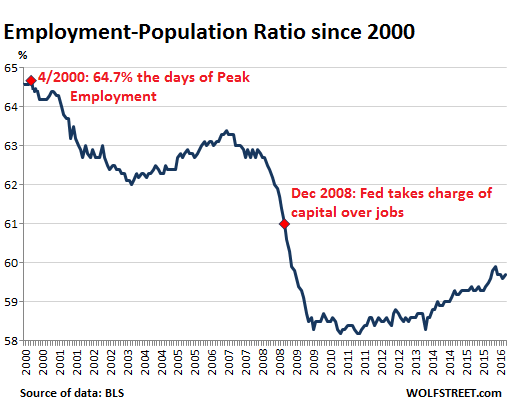

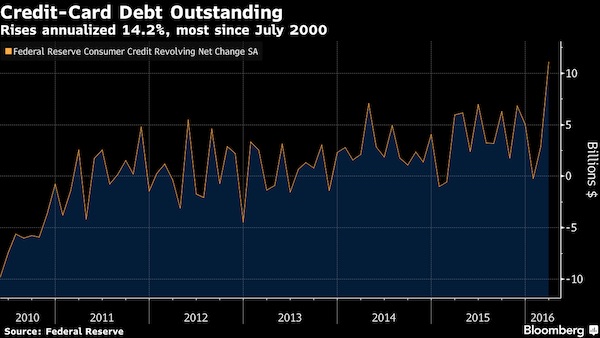

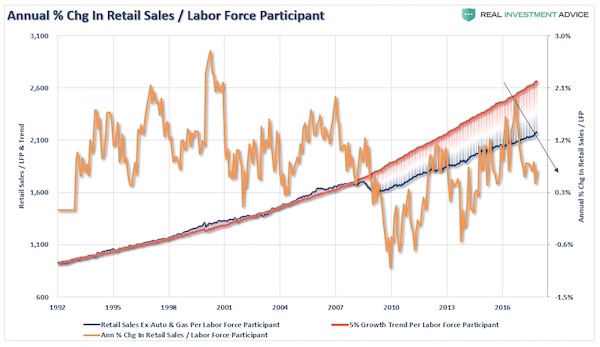

On Thursday, the retail sales report for November clicked up 0.8%. Good news, right? Not so fast. First, sales of gasoline, which directly impacts consumers ability to spend money on other stuff, rose sharply due to higher oil prices and comprised 1/3rd of the increase. Secondly, building products also rose sharply from the ongoing impact of rebuilding from recent hurricanes and fires. Again, this isn’t healthy longer-term either as replacing lost possessions drags forward future consumptive capacity. But what the headlines miss is the growth in the population. The chart below shows retails sales divided by those actually counted as part of the labor force. (You’ve got to have a job to buy stuff, right?)

As you can see, retail sales per labor force participant was on a 5% annualized growth trend beginning in 1992. However, after the financial crisis, the gap below that long-term trend has yet to be filled as there is a 22.7% deficit from the long-term trend. (If we included the entirety of the population, given the number of people outside of the labor force that are still consuming, the trajectory would be worse.) But wait, retail sales were really strong in November? Again, not so fast. The chart below shows the annual % change of retail sales per labor force participant. The trend has been weakening since the beginning of 2017 and shows little sign of increasing currently.

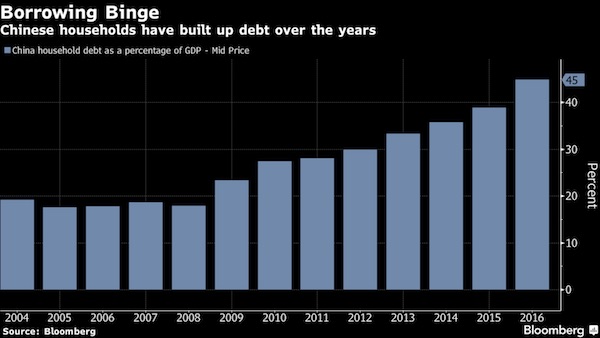

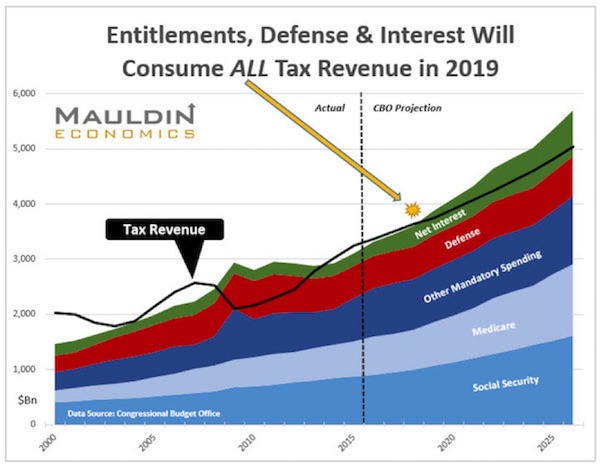

While tax cuts may provide a temporary boost to after-tax incomes, that income will simply be absorbed by higher energy, gasoline, health care and borrowing costs. This is why, 80% of Americans continue to live paycheck-to-paycheck and have little saved in the bank. It is also why, as wages have continued to stagnate, that the cost of living now exceeds what incomes and debt increases can sustain. Yes, corporations will do well under the “tax reform” plan, and while the average American may well see an increase in take-home pay, it will unlikely change their financial situation much. As a result, economic growth will likely remain weak as the deficit expands to $1 Trillion over the next couple of years and Federal debt marches toward $32 trillion.

Anyone surprised?

• Uber Stole Trade Secrets, Bribed Foreign Officials And Spied On Rivals (G._

Uber allegedly engaged in a range of “unethical and unlawful intelligence collections”, including the theft of competitive trade secrets, bribery of foreign officials and spying on competitors and politicians, according to an explosive legal document published on Friday. It’s the latest chapter in the discovery process for the company’s messy legal squabble with Waymo, Google’s driverless car spin-off, which has accused Uber of stealing trade secrets. The details were outlined in a 37-page demand letter filed by the ex-Uber security manager Richard Jacobs, who left the company earlier this year. The document paints a picture of a team of employees dedicated to spying on rivals and “impeding” legal investigations into the company.

Jacobs alleges that when he raised concerns over the techniques being used, he was given a poor performance review and demoted as “pure retaliation” for refusing to buy into the culture of “achieving business goals through illegal conduct even though equally aggressive legal means were available”. He had sent the letter to Uber’s in-house counsel with his allegations about possible criminal activity carried out by the special group in May this year, threatening to sue the company. Uber did not provide the letter to Waymo as part of legal discovery before the trial started. An Uber spokeswoman said in a statement: “While we haven’t substantiated all the claims in this letter – and, importantly, any related to Waymo – our new leadership has made clear that going forward we will compete honestly and fairly, on the strength of our ideas and technology.”

MSM destroying its credibility more every day.

• While Truth Puts On Its Shoes (W.Standard)

Covering the Trump presidency has not always been the media’s finest hour, but even grading on that curve, the month of December has brought astonishing screwups. Professor and venerable political observer Walter Russell Mead tweeted on December 8, “I remember Watergate pretty well, and I don’t remember anything like this level of journalistic carelessness back then. The constant stream of ‘bombshells’ that turn into duds is doing much more to damage the media than anything Trump could manage.” [..] Since October of last year, when Franklin Foer at Slate filed an erroneous report on a computer server in Trump Tower communicating with a Russian bank, there have been an unprecedented number of media faceplants, most of them directly related to the Russia-collusion theory. The errors always run in the same direction—they report or imply that the Trump campaign was in league with Moscow.

For a politicized and overwhelmingly liberal press corps, the wish that this story be true is obviously the father to the errors. Just as obviously, there are precedents for such high-profile embarrassments in the past. Editors at top news organizations once treated anonymous sourcing as a necessary evil, a tool to be used sparingly. Now anonymous sources dominate Trump coverage. It’s not just a problem for readers, who should rightly be skeptical of information someone isn’t willing to vouch for by name. It’s a problem for reporters, too, because anonymous sources are less likely to be cautious and diligent in providing information. According to CNN, the sources behind the busted report on Trump Jr.’s contact with WikiLeaks didn’t intend to deceive and had been reliable in the past. Maybe so, but given the network’s repeated errors it’s difficult to just take CNN’s word for it.

But it’s one thing to use anonymous sources; it’s quite another to be entirely trusting of them. CNN decided to report the contents of an email to Donald Trump Jr. based only on the say-so of two anonymous sources and without seeing the emails. [..] For their part, the media don’t seem to be coming to grips with the damage they’re doing to their own credibility. CNN, which calls itself “the most trusted name in news,” didn’t retract their WikiLeaks report but rewrote it in such a way as to render the story meaningless. They also came to the defense of Raju and Herb, saying the reporters acted in accordance with the network’s editorial policies. And of course they didn’t out their sources—the ultimate punishment news organizations can mete out to anonymous tipsters who steer them wrong.

It understandably infuriates the media that President Trump remains unwilling to own up to his own glaring errors and untruths, while news organizations run correction after correction. And it also understandably upsets the media to watch the president actively attack and seek to undermine their work, which remains vital to ensuring accountability in American governance. What they haven’t grasped is how perversely helpful to him they are being: On a very basic level, President Trump’s repeated salvos against “fake news” have resonance because, well, there does indeed appear to be a lot of fake news.

“The desperation to get rid of Trump by the Democratic Party and its handmaidens in the media has an odor of reckless dishonesty..”

• Taking Liberty (Jim Kunstler)

I’m not a Trump admirer, didn’t vote for the guy (nor Hillary, either), am not invested emotionally in his political survival, but I do have a pretty firm idea of what he represents: primitive maleness in all its lumbering vulgarity. I can see why he has a certain symbolic appeal in a society that increasingly shouts “men need not apply here.” He also represents the widespread disappointment with the poor job that the remaining men in charge of things have done in recent decades caretaking this polity. They’ve managed to dodge the repair of every broken institution and duck engagement with any of the really scary problems facing citizens of this republic, from the gross disparities of wealth, to pervasive racketeering in health care and education, to our rotting infrastructure, to the quandaries of race, immigration, climate change — you name it and they have done squat.

Men mostly in charge of the FBI are currently busy demonstrating that they can completely botch the wished-for Trump-ending investigation of Russian “meddling and collusion” — whatever that is as a legal matter — under special prosecutor Robert Mueller. The agency begins to look like the brotherhood depicted on The Sopranos TV show some years back. The congressional committees (mostly men) with oversight on the FBI (and its umbrella agency, the Department of Justice) can’t even get a few deputy Attorneys General to answer a subpoena. If ever there was a display of feckless impotence, this is it. The desperation to get rid of Trump by the Democratic Party and its handmaidens in the media has an odor of reckless dishonesty from a faction that succumbs more and more each day to the dangerous idea that the ends justify the means.

Despite the momentary jubilation over the defeat of Roy Moore in the Alabama special election for senator, the party is close to committing suicide via the collective fantasy that all romantic gambits by men are always and everywhere a prelude to rape. But then, the Republican Party ought to be on suicide watch, too, as it debates a stupendously mendacious tax reform bill that will only shove the country closer to financial meltdown.

2018 is set to become a very divisive year for the EU.

• France, Germany To Unveil Eurozone Reforms In March (AFP)

Germany and France will offer their joint vision for reforming the eurozone by March, German Chancellor Angela Merkel said on Friday, in an effort to bridge divisions over the future of the single currency. Meeting without departure-bound Britain, the bloc’s 27 leaders were tasked by EU President Donald Tusk to speak freely about their often clashing visions for the single currency’s future at a summit widely expected to be dominated by Brexit. Overhauling the eurozone and making it more resilient to economic shocks has been a top priority of French President Emmanuel Macron, as well as for European Commission head Jean-Claude Juncker.

But these ambitions have been stymied by political uncertainty in Germany, where Macron ally Merkel is still trying to form a government after the pro-business FDP party abandoned talks amid doubts about eurozone reform. “We will find a common position because it is necessary for Europe,” Merkel said at a news briefing, speaking alongside Macron after a summit focused mostly on Brexit. Merkel’s overture to France will rankle her conservative CDU party which toes an austerity-minded line on economic matters, but appeals to Social Democrats, with whom she must now build a coalition. Reform of the eurozone is often blocked by political divisions, with rich countries – such as Germany and the Netherlands – reticent to adopt policies that share risks with their heavily-indebted eurozone partners, such as France, Spain, Italy or Greece.

EU needs to open up about Luxembourg, Netherlands et al as tax havens.

• EU To Force Firms To Reveal True Owners In Wake Of Panama Papers (G.)

Companies across the EU will be forced to disclose their true owners under new legislation prompted by the release of the Panama Papers. Anti-corruption campaigners applauded the agreement as a major step in the fight against tax evasion and money laundering, but expressed disappointment that trusts will mostly escape scrutiny. The revised terms of the EU’s fourth anti-money laundering directive include: • A requirement for companies to disclose their beneficial, or true, owners in a publicly available register. • Data on the beneficial owners of trusts to be available to tax and law enforcement authorities, as well as sectors with an obligation to follow anti-money laundering rules, such as lawyers. • A requirement for member states to verify beneficial ownership information submitted to their registers. • Extending anti-money laundering and counter-terrorism regulations to apply to virtual currencies, provision of tax services and those dealing in works of art.

EU member states will have 18 months to transpose the new directive into domestic legislation. As a current member of the EU, the UK will implement the legislation. “This is a big breakthrough and confirms that full transparency of corporate ownership is now the global standard against which other countries will be judged,” said Laure Brillaud, the anti-money laundering policy officer at Transparency International EU. “The EU deserves credit for taking this bold leap to end the secrecy that facilitates corruption, tax evasion and other crimes.” Global Witness applauded the move “in the face of opposition from countries like the UK, Luxembourg, Ireland, Malta and Cyprus,” but criticised the failure to introduce the same requirements for trusts.

All the time in the world. Who cares about the misery?

• EU Gives Itself June Deadline On Refugees (K.)

EU leaders appealed for unity in a last-ditch effort to break their deadlock on sharing out refugees by June, telling reluctant eastern states they could otherwise be outvoted on a dispute that has shaken the bloc’s foundations. Coming out from a fraught discussion among 28 EU leaders that went into the small hours on Friday morning in Brussels, rivals in the two-year-old dispute all stuck to their guns, hemmed in by expectations they have raised with their own voters. The Mediterranean frontline states Italy and Greece, and the rich destination countries including Germany, Sweden, Belgium, France, Luxembourg and the Netherlands are demanding that all countries host some refugees as a way to demonstrate solidarity.

Their four ex-communist peers Poland, Slovakia, Hungary and the Czech Republic refuse to accept people from the mostly-Muslim Middle East and North Africa, saying that would threaten their security after a raft of Islamic attacks in Europe. “There are areas where there is no solidarity and this is something I find unacceptable,” German Chancellor Angela Merkel told reporters. At one point during the two days of talks in Brussels, cameras caught Merkel, the bloc’s paramount national leader, as she appeared to become agitated when talking with the leaders’ chairman, Donald Tusk, making her displeasure with him clear. That came after Tusk, a former prime minister of Poland, came out strongly against “ineffective” and “highly divisive” obligatory refugee quotas, ruffling the feathers of those states that back them as well as the executive European Commission.

“The manner in which the principle of solidarity was being questioned does not only undermine the discussion on the refugee issue, but the future of Europe,” Greek Prime Minister Alexis Tsipras told reporters after what he called “intense” talks. Tusk said the ineffectiveness of relocation schemes was demonstrated by the fact that only 35,000 asylum seekers had been transferred from Greece and Italy under a 2015 plan meant to move 160,000 people. “Mandatory quotas remain a contentious issue,” Tusk told a joint news conference with the Commission’s head Jean-Claude Juncker, the disagreement between the two playing out visibly despite their usually friendly rapport. “Relocation is not a solution to the issue of illegal migration.”

Oh well, that only took a year and a half. Were they hoping his suicide attempts would be successful?

• First Vulnerable Child Refugee Arrives In UK From Greece (G.)

The first vulnerable child refugee stranded in Greece who qualifies for sanctuary under the Dubs amendment has arrived in the UK, more than a year after the government pledged to bring over hundreds of children. The Home Office had accepted that the boy was vulnerable and eligible for transfer 16 months ago. The Dubs amendment, part of the 2016 Immigration Act, was passed after a campaign to transfer 3,000 unaccompanied child refugees stuck in camps to Britain. There are more than 3,300 unaccompanied children in Greece, 11,186 in France and 13,867 in Italy. The Home Office agreed to resettle 480 under the Dubs scheme. Conditions for lone children in Greece have been condemned by Human Rights Watch, which found filthy cells infested with bugs and vermin, sometimes without mattresses or access to showers.

Hammersmith and Fulham council in west London has stepped in to offer the boy a home and one of its social workers travelled to Greece to assess the child, who has lost contact with his family in Syria. The boy, who is said to be deeply traumatised, was detained until last month in a police cell with no access to medical professionals, and forced to sleep on an inch-thick mattress on the ground. Police said the boy had repeatedly self-harmed, tried to kill himself and was at “imminent risk” of doing this. According to Antonia Moustaka, a lawyer for the humanitarian agency Praksis, he spent more than 380 days in psychiatric clinics, 124 days in shelters for unaccompanied minors and six weeks in police detention.

[..] George Gabriel, the project lead at the charity Safe Passage, said: “There are more than 3,300 unaccompanied children in Greece and only 1,130 spaces in shelters. The winter is bitterly cold and conditions are getting worse. “Over a year and a half ago, the Dubs amendment brought hope that hundreds of these kids would be brought to safety. It has been appalling to watch these minors wait, month after month, on bureaucratic delays.”

Only took 2,000 years. What were all other mayors of Rome during that time thinking?

• Ovid’s Exile To The Remotest Margins Of The Roman Empire Revoked (G.)

More than 2,000 years after Augustus banished him to deepest Romania, the poet Ovid has been rehabilitated. Rome city council on Thursday unanimously approved a motion tabled by the populist M5S party to “repair the serious wrong” suffered by Ovid, thought of as one of the three canonical poets of Latin literature along with Virgil and Horace. Best known for his 15-book epic narrative poem Metamorphoses and the elegy Ars Amatoria, or the Art of Love, Publius Ovidius Naso was exiled in 8 AD to Tomis, the ancient but remote Black Sea settlement now known as the Romanian port city of Constanta. He remained there until his death a decade later. Although ordered directly by the emperor, scholars have long speculated over the motive for Ovid’s exile; the poet himself attributed it to “carmen et error”, a poem and a mistake.

Experts believe the cause was probably a combination of three factors: that Ovid’s erotic poetry was considered offensive, his attitude to Augustus was too disrespectful, and that he may have been involved in an unspecified plot or scandal. La Republicca reported that M5S, which holds a majority of the seats on the council, demanded that “necessary measures” be adopted to revoke the order in what the capital’s deputy mayor, Luca Bergamo, described as an important symbol. “It is about the fundamental right of artists to express themselves freely in societies in which, around the world, the freedom of artistic expression is increasingly constrained,” Bergamo told councillors.

Ovid was indisputably “one of the greatest poets in the history of humanity,” the deputy mayor said, and moreover the real reasons for his mysterious banishment by the emperor “were never placed on the historical record”. Sulmona, the Abruzzo town where the poet was born (then Sulmo), formally acquitted him of any wrongdoing. Dante, the great Renaissance poet, was similarly pardoned in 2008 by Florence – from where he was exiled on pain of death in 1302.