Paul Caponigro Backlit Sunflower, Winthrop, MA 1965

The buzzword of the day is testing. Under 150,000 people per day are being tested in the US, and consensus appears to be growing that this must be ramped up to 10-20-30 million per day.

Number of #coronavirus deaths in US rises by 1,997 in the past 24hrs to 41,379

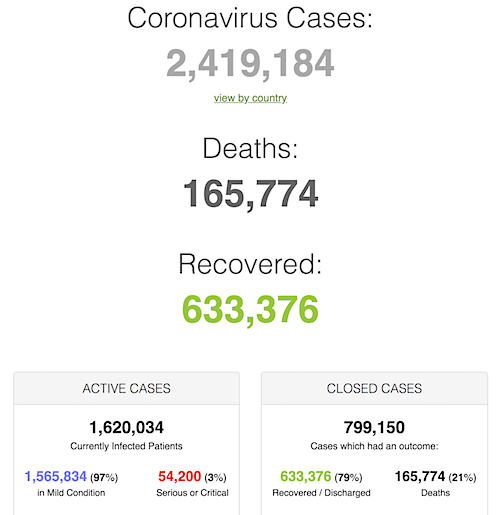

• Cases 2,419,184 (+ 73,798 from yesterday’s 2,345,476)

• Deaths 165,774 (+ 4,578 from yesterday’s 161,196)

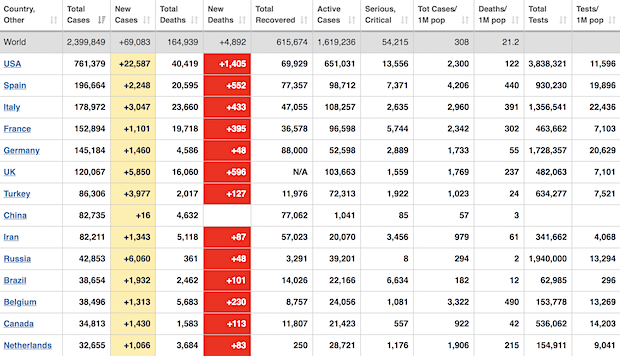

From Worldometer yesterday evening -before their day’s close-

From Worldometer – NOTE: among Active Cases, Serious or Critical fell to 3%

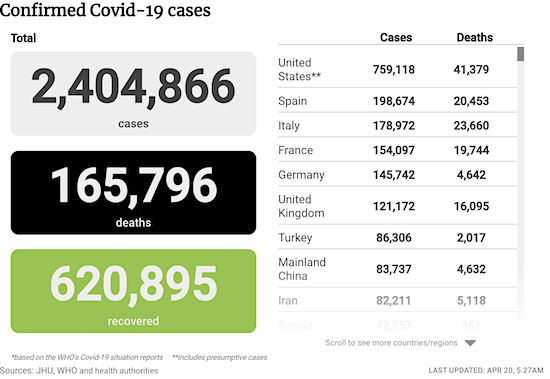

From SCMP:

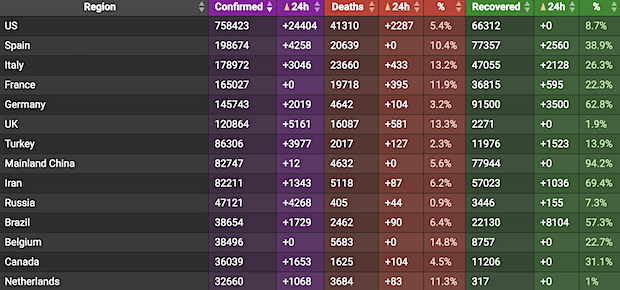

From COVID19Info.live:

Current testing is below 150,000 a day. Still, the US has tested 3.8 million people, and compared to the rest of the world, that’s not terrible.

• 20 Million COVID-19 Tests Per Day Needed To Fully Open US Economy (ABC)

With President Donald Trump saying he wants to lift stay-at-home novel coronavirus orders and open up parts of the country, more than 45 economists, social scientists, lawyers and ethicists say there’s a growing consensus pointing to a major step necessary to put Americans back to work: dramatically upscaling testing. In a report titled “Roadmap to Pandemic Resilience,” set to be released on Monday, a blue-ribbon panel of thought leaders across the political spectrum called COVID-19 “a profound threat to our democracy, comparable to the Great Depression and World War II.” “It’s a moment for a ‘Can Do America’ to really show up and put itself to work,” Danielle Allen, lead author of the report and a professor at Harvard University’s Edmond J.Safra Center on Ethics, told ABC News.

The report says that ending the quarantine safely will require testing, tracing, and supported isolation, a combination known by the acronym TTSI. “What people need to recognize is that a massively scaled-up testing, tracing and supported isolation system is the alternative to national quarantine,” Allen said. “We all had to learn PPE [Personal Protective Equipment] and we all had to learn about flattening the curve … now we have to learn about TTSI.” Test producers will need to deliver 5 million tests per day by early June to safely open parts of the economy by late July, according to the report. To “fully re-mobilize the economy,” the country will need to see testing grow to 20 million a day, the report suggests. “We acknowledge that even this number may not be high enough,” according to the report.

Some experts, including Nobel laureate economist Paul Romer, who did not assist in the report but has a similar approach, estimate the country may need more than 30 million tests per day. [..] One of the largest biotech firms manufacturing the COVID-19 test, Roche Diagnostics, said it is producing about 400,000 test kits per week. Abbott Laboratories, which has created a 5-minute test, says it plans to boost its production from 50,000 tests per week to 1 million and is also working to distribute about 4 million antibody tests — which shows if someone has recovered from the virus, even people who were never symptomatic — by the end of April and about 20 million per month by the end of June.

According to the bipartisan team who worked on the report, implementing its plan would cost between $100 billion and $300 billion over two years. But Allen suggested comparing the price tag to the astronomical cost the shutdown is accumulating. ”Collective quarantine is costing us $350 billion a month … and we’ve seen the massive unemployment numbers,” Allen told ABC News.

[..] The report details 4 specific phases to reopening the economy and ending the lockdown: Phase 1: (May-June) 40% of the population — including all essential workers (health care workers, firemen, police, sanitation, etc) — will be tested and their contacts traced. Phase 2: (June-July) 70% of the population goes back to work — including workers directly supporting the health sector, such as delivery, service, construction workers, building engineers, maintenance and food workers. The government makes massive infrastructure investments. Phase 3: (July-Aug) 80% of the population is back to work, including those who must work at locations and in offices. Phase 4: (Aug-March) All workers return to work and schools reopen. Continue to take precautions until a vaccine is widely available, but the lockdown is over.

Who to test if not everyone?

• Without More Tests, America Can’t Reopen. And We’re Testing The Wrong People (Atl.)

How many tests do we need in order to safely relax social-distancing measures, reopen nonessential businesses and schools, and allow large gatherings? According to the Morgan Stanley analyst Matthew Harrison and the Harvard professor Ashish Jha, we should be conducting a minimum of 500,000 tests a day. One of the authors of this article, Paul Romer, has called for the capacity to run 20 million to 30 million tests a day. Even this has been criticized as insufficient for the task of identifying enough of the asymptomatic spreaders to keep the pandemic in check.

Current guidelines from the Centers for Disease Control and Prevention give priority first to hospitalized patients and symptomatic health-care workers, then to high-risk patients, specifically those over 65 and those suffering from other serious health conditions, with COVID-19 symptoms. Under this system, asymptomatic individuals are not tested, even if they had contact with people who tested positive. This is an enormous mistake. If we want to control the spread of COVID-19, the United States must adopt a new testing policy that prioritizes people who, although asymptomatic, may have the virus and infect many others.

We should target four groups. First, all health-care workers and other first responders who directly interact with many people. Second, workers who maintain our supply chains and crucial infrastructure, including grocery-store workers, police officers, public-transit workers, and sanitation personnel. The next group would be potential “super-spreaders”—asymptomatic individuals who could come into contact with many people. This third group would include people in large families and those who must interact with many vulnerable people, such as employees of long-term-care facilities. The fourth group would include all those who are planning to return to the workplace. These are precisely the individuals without symptoms whom the CDC recommends against testing.

[..] To shift the focus of testing away from the sickest patients and toward the people most likely to spread the coronavirus, we will have to conduct millions of tests a day. Millions of health-care workers in the United States are in positions that may expose them to infection: physicians, nurses, respiratory therapists, midwives, pharmacists, phlebotomists, hospital cleaners, and others. By one estimate, 3 million people work in grocery stores. To screen everyone in these two groups once a week will require about 1 million tests a day. We currently lack the infrastructure for that. And that is before we add the approximately 800,000 police officers, 290,000 bus drivers, and 60,000 sanitation workers—and patients without any symptoms in the health-care system.

People are starting to understand stuff. It took a pandemic for that.

I never never dreamed that my Russian Roulette argument would be expressed by those against whom I have used it over the past 2 decades. pic.twitter.com/Xih2Vse1Ft

— Nassim Nicholas Taleb (@nntaleb) April 19, 2020

“Some say that as many as 20 to 30 million people per day will need to be tested..”

• Trump To Use Defense Production Act To Increase Swab Production (CNBC)

President Donald Trump announced on Sunday that he plans to use the Defense Production Act to increase the nation’s swab production by at least 20 million per month for coronavirus tests. Trump said the administration is close to finalizing a partnership with one manufacturer to produce an additional 10 million swabs per month for coronavirus test kits, which are used to collect specimens from a patient’s throat or nose. Trump said he is preparing to use the Defense Production Act on another manufacturer to increase its swab production by over 20 million per month. Trump did not disclose the names of the manufacturer.

The president previously enacted the Defense Production Act on companies like General Motors and General Electric to manufacturer additional ventilators, although many had already ramped up production. “We’ve had a little difficulty with one so we’re calling in, as in the past you know, we’re calling in the Defense Production Act and we’ll be getting swabs very easily,” Trump said. “Swabs are easy. Ventilators are hard.” Trump’s announcement comes after some governors cited a lack of swabs and reagents as hampering their ability to conduct more coronavirus tests. Michigan Gov. Gretchen Whitmer told NBC’s “Meet the Press” on Sunday that her state could triple the number of tests conducted if the key components were made available.

[..] Earlier on Sunday, Vice President Mike Pence said the administration has “laid a strong foundation for testing for phase one.” He said that there are enough tests for any governor who meets the 14-day criteria of declining case numbers outlined by the White House to move into phase one and begin reopening their state’s economy. Experts have warned, however, against opening the country before widespread testing is available. Some say that as many as 20 to 30 million people per day will need to be tested before the nation can return to a semblance of economic normality. There are currently more than 150,000 tests being conducted per day, Pence said, but that number could “double” once laboratories across the country are activated.

I want one!

• Israel Launches New ‘Contactless’ Roadside COVID19 Testing Booths (DM)

Israel has launched a network of new ‘contactless’ roadside covid-19 testing booths which have zero contact between nurse and patient. The country has offered to share the design, which is relatively cheap and easy to produce, with other countries as part of the fight against the coronavirus pandemic. The booths, produced by healthcare companies together with civilian and military partners, provide an entirely sealed, sterile environment for the medic, and can be quickly disinfected between patients. Tests are carried out using two rubber gloves which are attached to the outer wall with airtight seals. Results are processed in a matter of hours and reported directly via the patient’s electronic health record.

‘After proving itself as a safe and easy way to test patients with minimum risk, the booth we created is sparking national and international interest,’ said Ran Sa’ar, CEO of Maccabi Healthcare Services, one of the firms behind the booth. ‘We would be happy to share the design plans with any health organization worldwide in order to support our shared mission of fighting the covid-19 virus.’ The booth was designed to ensure zero exposure between the patient and the tester. It enables a sterile sampling process from the moment the patient begins the test to the transfer of the sample to the laboratory. The development of the contactless testing centre, which is highly effective yet relatively simple and cheap to manufacture, took less than a week.

The innovative technology has been watched closely by governments around the world struggling to provide safe, effective and fast coronavirus tests on a mass scale to their citizens. Israel has been one of the world leaders in its response to covid-19, enacting lockdown measures early on and introducing technological solutions to help fight the spread of the disease. These have included the use of anti-terror phone tracking technology to trace people who have come into contact with covid patients and tell them to self-isolate before they experience symptoms. In addition, hotels have been repurposed to cater for coronavirus patients, helping alleviate the strain on hospitals. There have been just 140 deaths from covid-19 in the Jewish state, with 12,591 infections and 2,624 recoveries.

Because children don’t get tested at all: “..estimated that 176,190 children in the US had been infected with the virus, based on data showing 74 children admitted to paediatric intensive care units ..”

• US Coronavirus Study Warns Sick Children Could Overwhelm Health System (SCMP)

Paediatric services in the US could be overwhelmed by thousands of sick infants and young children – an overlooked group which has a higher risk of serious illness from Covid-19, the disease caused by the new coronavirus, according to a new study. While children are at a lower risk of fatality from Covid-19 compared to the elderly, the very young were most at risk of becoming seriously ill and the sheer weight of population numbers in the US meant the need to be prepared for an influx of cases was urgent, the study said. The research was led by Elizabeth Pathak, a population health scientist and president of the US think tank Women’s Institute for Independent Social Inquiry, and warned against a sense of complacency about the impact of the disease on children.

The most conservative estimates considered in the study showed that one in 200 children in the US would be infected with the virus, with 991 severe enough to require hospitalisation. In the most extreme scenario, three out of five US children would be infected, with 118,887 becoming seriously ill. “Severity and case fatality are much lower for children than for elderly persons, and this truth has created a sense of complacency that Covid-19 is not a major concern for children’s health,” according to the study which was published last week in the Journal of Public Health Management and Practice. “Because there are 74 million children 0 to 17 years old in the United States, the projected number of severe cases could overextend available paediatric hospital care resources under several moderate cumulative paediatric infection proportion scenarios for 2020, despite lower severity of Covid-19 in children than in adults.”

[..] Pathak and her colleagues estimated that 176,190 children in the US had been infected with the virus, based on data showing 74 children admitted to paediatric intensive care units in 19 states in the US, as of April 6. For every admission of a child to an intensive care unit – estimated at 11 per cent of children hospitalised for the virus – the researchers calculated a further 2,381 children were infected with the Covid-19 virus who remained in their local communities. The report cited studies from China which found infants at the highest risk of becoming severely or critically ill with the virus, at 10.6 per cent, followed by 7.3 per cent of severe or critical infection for those aged between one and five, falling to 4.2 per cent among children between six and 15 years old.

Because “testicles are walled off from the immune system”..

• Testicles May Make Men More Vulnerable To Coronavirus (NYP)

The coronavirus could linger in the testicles, making men prone to longer, more severe cases of the illness, according to a new study. Researchers tracked the recovery of 68 patients in Mumbai, India, to study the gender disparity of the virus, which has taken a worse toll on men, according to a preliminary report posted on MedRxix, which hosts unpublished medical research papers that have not been peer reviewed. Dr. Aditi Shastri, an oncologist at Montefiore Medical Center in the Bronx, and her mother, Dr. Jayanthi Shastri — a microbiologist at the Kasturba Hospital for Infectious Diseases in Mumbai — said the virus attaches itself to a protein that occurs in high levels in the testicles.

This protein, known as angiotensin converting enzyme 2, or ACE2, is present in the lungs, the gastrointestinal tract and the heart in addition to large quantities in the testicles. But since testicles are walled off from the immune system, the virus could harbor there for longer periods than the rest of the body, according to the study. The mother-daughter researchers said these findings may explain why women bounce back from the virus more quickly than men. They determined that the average amount of time for female patients to be cleared of the virus was four days, while men saw recoveries that on average were two days longer, the report said. “These observations demonstrate that male subjects have delayed viral clearance,” the authors wrote, adding that the testicles may be serving as “reservoirs” for the virus.

The only reason to give out such painfully poor advice is they are afraid there are not enough masks. Well, say that then!

• WHO Stands By Recommendation To Not Wear Masks (CNN)

World Health Organization officials Monday said they still recommend people not wear face masks unless they are sick with Covid-19 or caring for someone who is sick. “There is no specific evidence to suggest that the wearing of masks by the mass population has any potential benefit. In fact, there’s some evidence to suggest the opposite in the misuse of wearing a mask properly or fitting it properly,” Dr. Mike Ryan, executive director of the WHO health emergencies program, said at a media briefing in Geneva, Switzerland, on Monday. “There also is the issue that we have a massive global shortage,” Ryan said about masks and other medical supplies. “Right now the people most at risk from this virus are frontline health workers who are exposed to the virus every second of every day. The thought of them not having masks is horrific.”

Dr. Maria Van Kerkhove, an infectious disease epidemiologist with the WHO, also said at Monday’s briefing that it is important “we prioritize the use of masks for those who need it most,” which would be frontline health care workers. “In the community, we do not recommend the use of wearing masks unless you yourself are sick and as a measure to prevent onward spread from you if you are ill,” Van Kerkhove said. “The masks that we recommend are for people who are at home and who are sick and for those individuals who are caring for those people who are home that are sick,” she said. WHO officials warned at a media briefing last week that globally there is a “significant shortage” of medical supplies, including personal protective gear or PPE, for doctors. “We need to be clear,” Van Kerkhove said last week. “The world is facing a significant shortage of PPE for our frontline workers — including masks and gloves and gowns and face shields — and protecting our health care workers must be the top priority for use of this PPE.”

Thought I’d include this because all I see is negative stories. It’s exactly like 4 years ago. But of course Trump et al don’t get every single thing wrong.

• Cuomo Praises Trump’s COVID19 Response: ‘Phenomenal Accomplishment’ (TH)

New York Democratic Governor Andrew Cuomo was asked on Sunday whether or not he has faith in President Trump when it comes to handling the Wuhan coronavirus. Gov. Cuomo made it clear that he not only trusts the president but that what Trump and his administration have done was nothing short of a “phenomenal accomplishment.” “What the federal government did working with states was a phenomenal accomplishment,” the governor marveled. “We bent the curve. We flattened the curve. Government did it. People did it, but government facilitates people’s actions, right?”

Gov. Cuomo has consistently praised the president for helping New Yorkers while the state quickly emerged as an international hotspot of the Wuhan coronavirus. Only on the issue of ventilators, when Gov. Cuomo anticipated New York would need some 40,000 ventilators, were the president and the governor at odds. Trump expected the actual number of ventilators New York needed to be much lower, and Trump was right. Instead of 40,000 ventilators, New York needed about 5,000. The state now has so many ventilators they have begun sending them to other states.

“We had to double the hospital capacity in New York State,” Gov. Cumo recalled on Sunday. “That’s what all the experts said. The president brought in the Army Corps of Engineers. They built 2,500 at Javits … It was a phenomenal accomplishment. Close to a thousand people have gone through Javits. Luckily, we didn’t need the 2,500 beds. But all the projections said we did need it and more … so these were just extraordinary efforts and acts of mobilization, and the federal government stepped up and was a great partner, and I’m the first one to say it. We needed help and they were there.”

The only viable option until -much- later.

• Australians Told Restrictions Must Stay Even As New Virus Infections Slow (R.)

More than 150 Australian economists on Monday warned the government against easing social distancing rules aimed at halting the spread of the new coronavirus even as the rate of infections slowed to a multi-week low. Australia has so far avoided the high numbers of coronavirus casualties reported around the world after closing its borders and imposing restrictions on public movement. While the measures have slowed the growth in new infections to fewer than 40 new cases a day, the restrictions are expected to push unemployment to a 16-year high of about 10%. With growing calls to ease the restrictions, leading Australian economists issued an open letter to call on the government to prioritise containing the spread of coronavirus.

“We cannot have a functioning economy unless we first comprehensively address the public health crisis,” the group of 157 economists from Australian universities wrote. Australia’s government and central bank have said they will inject A$320 billion ($203 billion) into the country’s economy to try and cushion the economic blow. Prime Minister Scott Morrison last week said there would no easing of Australia’s restrictions for at least four weeks, and several state premiers on Monday urged the public to keep to the social distancing rules. “We’ve all made massive sacrifices, given a lot. We can’t give back all the gains made because of sense of frustration gets the better of us,” Victoria state Premier Daniel Andrews told reporters in Melbourne.

Any significant easing of the current limitations would not occur until Australia had increased testing capacity, strengthened contact tracing and readied local responses for further outbreaks, Andrews said. Central to the government’s strategy is a controversial new mobile phone app that will track users’ movements to allow contact tracing in the event of an outbreak of coronavirus. The government said it will need at least 40% of the country’s population to be signed up to make it effective.

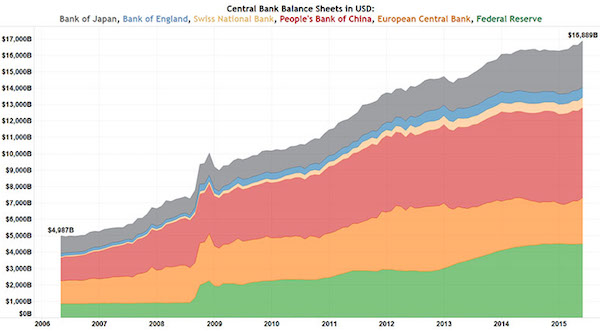

MMT goes mainstream?!

• No Need To Worry About Paying Off Government Debt – Think Tank (TND)

Australians shouldn’t worry about rising public debt as the federal government can roll it over indefinitely, a think tank has said. Instead, governments should be encouraged to borrow even more money to protect jobs and boost economic activity. Using public debt to fund investments in critical infrastructure, as well as education and training, would boost the nation’s productive capacity and help it service the debt through stronger economic growth, argues progressive think tank Per Capita. It says the “virtuous circle of public investment leads to higher wages and profits and thus to a broader tax base,” which allows government to either pay down the debt or keep investing in economic productivity.

Per Capita makes the case for sustained government spending in a new report that describes growing fears over how to pay for the government’s coronavirus support measures as “largely misplaced”. Report authors Emma Dawson and Matthew Lloyd-Cape argue this is because the federal budget is not like a household’s, as governments borrow against the productive capacity of the economy, which unlike the working lives of home owners has an infinite lifespan. This means governments never need to pay off their debts completely. All that matters is whether they can meet their repayments.

“Australia will never ‘retire’. It will continue to generate income through productive economic activity,” the authors wrote in the report’s introduction. “Therefore, unlike a household, the federal government can roll its debt over indefinitely, provided the nation’s economic activity continues and Australia’s productive capacity operates to its full potential.” [..] Per Capita points out that Australia’s public debt-to-GDP ratio (roughly 20 per cent) is much lower than other advanced economies’. And although future generations will inherit an economy with higher levels of public debt, Per Capita argues they need not suffer as a result, so long “as we prioritise the maintenance of economic activity to support the jobs and incomes our children need to build a good life”.

Getty

“However, the number of fatalities is still rising in Germany, as is the number of infected health care workers.”

• Germany Says Its Outbreak Is ‘Under Control’ (BBC)

Germany’s health minister says the month-long lockdown has brought his country’s coronavirus outbreak under control. Jens Spahn said that since 12 April the number of recovered patients had been consistently higher than the number of new infections. The infection rate has dropped to 0.7 – that is, each infected person passed the virus to fewer than one other. In Germany 3,868 have died of Covid-19 – fewer than in Italy, Spain or France. However, the number of fatalities is still rising in Germany, as is the number of infected health care workers. So far almost 134,000 people have been infected in Germany. The degree of lockdown varies across Germany’s regions – it is tightest in the states of Bavaria and Saarland.

On Wednesday Chancellor Angela Merkel announced tentative steps to start easing the restrictions. Some smaller shops will reopen next week and schools will start reopening in early May, with the focus on students due to sit exams soon. But Mrs Merkel warned there was “little margin for error” and that “caution should be the watchword”. Sports and leisure facilities, as well as cafes and restaurants, will remain closed indefinitely. Germany’s network of diagnostic labs has been praised internationally for having responded rapidly to the pandemic. By early April Germany was doing more than 100,000 swab tests daily, enabling more coronavirus carriers to be traced than in other EU countries. Mr Spahn said that by August, German companies would produce up to 50 million face masks a week for healthcare workers.

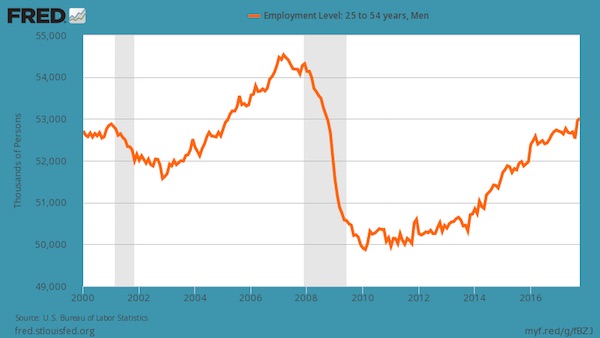

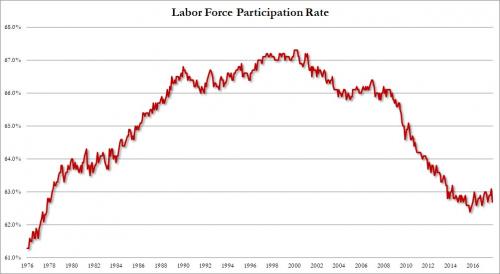

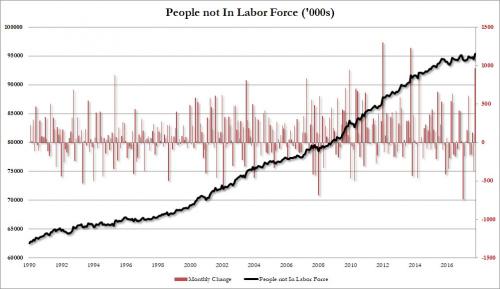

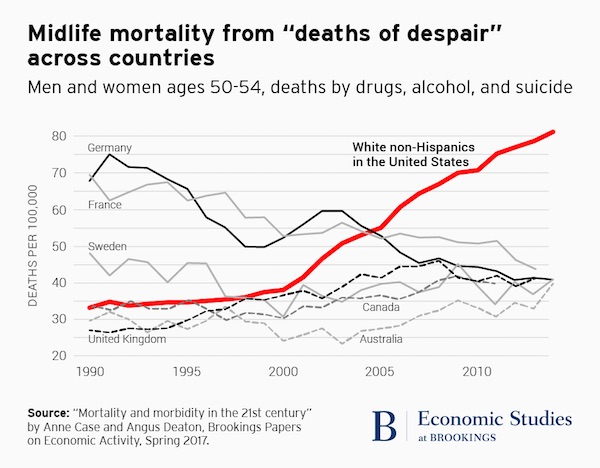

Europe has kept far more jobs than the US so far. But Europe is Germany AND Greece, and those are not the same thing.

• McKinsey Predicts Near Doubling Of Unemployment In Europe (R.)

Unemployment in Europe could nearly double in the coming months, with up to 59 million jobs at risk from permanent cutbacks as well as reductions in pay and hours because of the coronavirus pandemic, estimates from consultancy McKinsey said. The consulting firm estimated unemployment levels in the 27-member state bloc peaking at 7.6% in 2020 and a return to pre-crisis levels in Q4 2021. But in a worst-case scenario, unemployment could peak in 2021 at 11.2%, with a recovery to 2019 levels by 2024. Euro zone unemployment fell to a 12-year low in February, the month before coronavirus containment measures began to be introduced widely across Europe. The jobless rate was 7.3% in the 19 countries sharing the euro zone, the lowest level since March 2008.

McKinsey said that the levels of impact would vary between demographic groups and industry sectors. “Losing those jobs would not only be a tragedy on an individual level, but would also be very painful from an economic perspective,” McKinsey said in its report. The study highlighted a close link between level of education and the short-term risk for jobs, “potentially exacerbating existing social inequalities.” Half of all jobs at risk are in customer service and sales, food service and builder occupations. In Europe’s wholesale and retail sector, 14.6 millions jobs could be threatened, 8.4 million jobs in accommodation and food and 1.7 million in arts and entertainment.

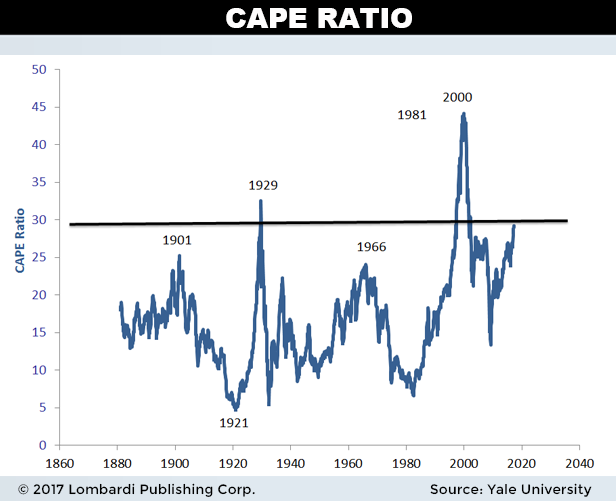

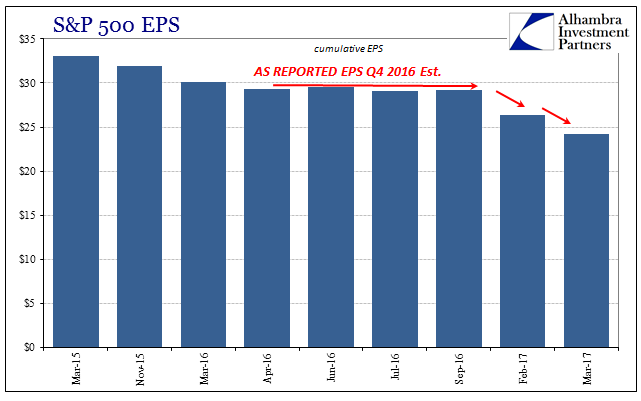

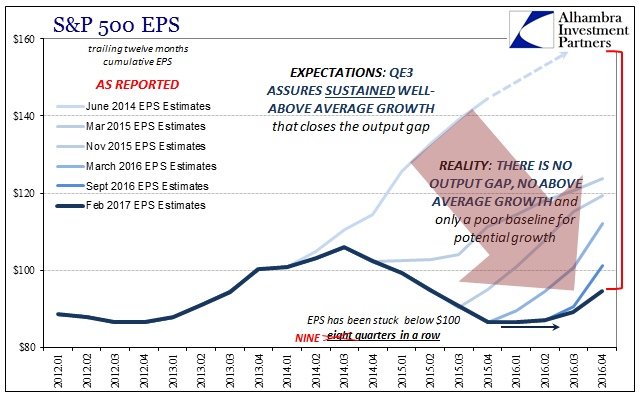

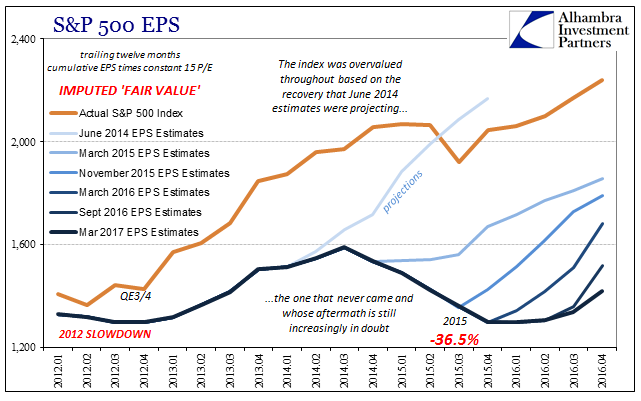

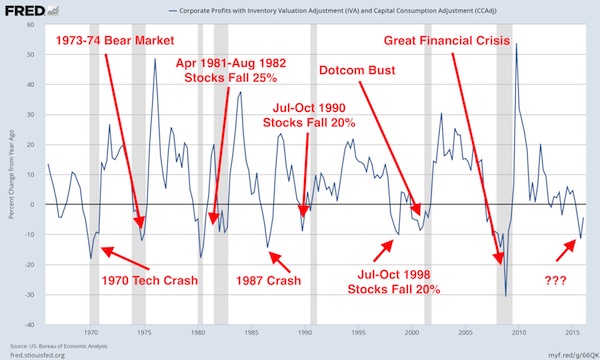

This is all so backward looking it’s depressing.

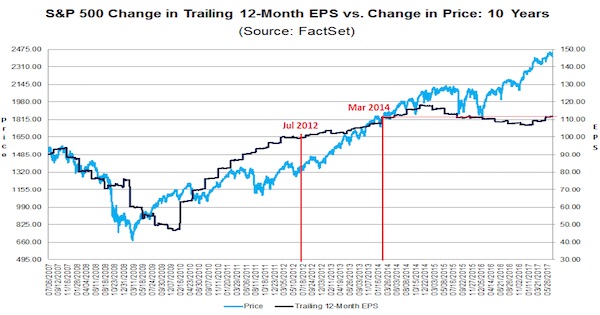

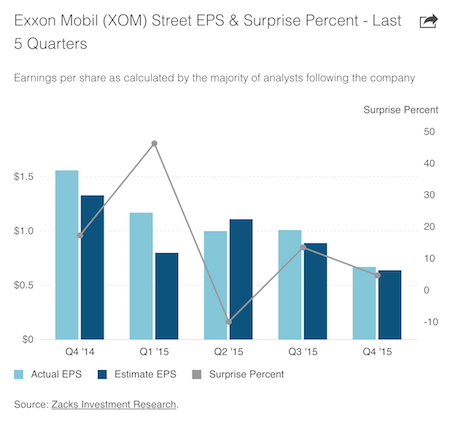

• Earnings Set For Biggest Dive Since Late 2009 – And It Gets Worse (MW)

The S&P 500 index is set to suffer the worst quarter for earnings since the 2008 financial crisis, and it’s likely to get a lot worse because the results due this week will barely show the impact of the COVID-19 pandemic. About 9% of S&P 500 companies reported earnings through Friday and after the first official week of 2020 first-quarter results earnings are on track to decline 14.5% from a year ago, according to John Butters, senior earnings analyst at FactSet. That would be the biggest decline since the 15.7% plunge in the third quarter of 2009. Butters’s projections are based on blended estimates compiled by FactSet, which include actual results and consensus analyst estimates of companies that haven’t reported yet.

The bad news is that actual results have been a lot worse than expected so far, as earnings for the 46 companies that have already reported dropped 32.7%, according to FactSet. Companies have thus far missed earnings-per-share expectations in aggregate by 7.0%, according to Credit Suisse chief U.S. equity strategist Jonathan Golub. That compares with a beat of 5.2% on average over the past three years. The worst is yet to come. The energy and consumer-discretionary sectors are expected to suffer the biggest profit declines, but only one of 27 energy companies and six of 62 consumer discretionary companies have already posted numbers. Energy earnings are projected to decline 64.2% and consumer discretionary earnings are expected to fall 34.7%.

Until the next 45, that is.

• Next 45 Days Are The ‘Most Critical Period In US Financial History’ (MW)

After recovering a chunk of the losses racked up during the worst of the coronavirus-induced selloff last month, the stock market finds itself at a crucial inflection point, writes Alan B. Lancz. “The next 45 days may just become the most critical period in U.S. financial history,” he wrote in a newsletter published Wednesday. “While on average we may face a bear market every 10 years, this one is like no other,” he said. The contrarian money manager, who is a disciple of famed investor Sir John Templeton, said that the timing and execution of the reawakening of the U.S. economy from its dormancy could be one of the biggest factors in determining how the market recovers from COVID-19, which has forced swaths of businesses to shut down to help stem the spread of the deadly contagion [..]

And even if the economic revival is executed flawlessly, the founder of the eponymous Toledo, Ohio-based investment advisory firm said the result will be a so-called U-shaped recovery, where a rebound in business and consumer activity from pre-crisis levels will be long and slow. “Even if we execute properly, the recovery will take time and a best-case scenario is a ‘U’ shaped recovery,” he wrote. “The much talked about ‘V’ shaped recovery is no longer in the equation because of the unprecedented combination of negatives with this crisis,” he said, referring to hope for a recovery that is sharp and fast. The money manager’s comments come as President Donald Trump has underscored his eagerness to restart the economy after a string of bleak reports demonstrate the damage the illness is doing to the health of small and large businesses.

Indeed, a reading on Wednesday of business activity in the New York state area, the New York Empire State Index, dropped to a record low of negative-78.2 in April from negative-21.5 in the previous month. A report on U.S. industrial production fell 5.4% in March, the steepest decline since early 1946, and retail sales in March registered a record 8.7% slump; meanwhile, a reading of confidence among U.S. home builders in April fell to its lowest reading since 2012 and the largest monthly change in the index’s 30-year history.

$15 a barrel.

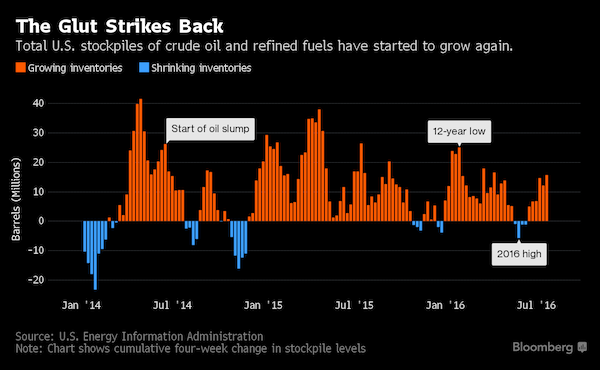

• US Oil Falls More Than 10% To Lows Not Seen Since 1999 (R.)

Crude oil futures fell on Monday, with U.S. futures touching levels not seen since 1999, extending weakness on the back of sliding demand and concerns that U.S. storage facilities will soon fill to the brim amid the coronavirus pandemic. The oil market has been under pressure due to a spate of reports on weak fuel consumption and grim forecasts from the Organization of the Petroleum Exporting Countries (OPEC) and the International Energy Agency. The volume of oil held in U.S. storage, especially at Cushing, Oklahoma, the delivery point for the U.S. West Texas Intermediate (WTI) contract, is rising as refiners throttle back activity due to slumping demand. The front-month May WTI contract was down $2.62, or 14%, to $15.65 a barrel by 0142GMT.

At one point, the contract had fallen as much as 21% to hit a low of $14.47 a barrel, the lowest since March 1999. That contract is expiring on Tuesday, and the June contract CLc2, which is becoming more actively traded, fell $1.28, or 5.1%, to $23.75 a barrel. Brent was also weaker, down 21 cents, or 0.8%, to $27.87 a barrel. The plunge in crude oil prices reflects a glut at the main U.S. storage facilities at Cushing and a big drop in demand, said Michael McCarthy, chief market strategist at CMC Markets in Sydney. “It hasn’t reach capacity but the fear is that it will,” he said, adding that once the maximum capacity is reached, producers will have to cut output. Production cuts from OPEC and its allies such as Russia will also kick from May. The group has agreed to reduce output by 9.7 million bpd [..]

We would like to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the process.

Thanks everyone for your wonderful donations to date.

Take a look at one critical care physician’s shift in a NYC hospital during COVID-19 pic.twitter.com/sJGtWLKXmN

— NowThis (@nowthisnews) April 20, 2020

You’d almost forget it perhaps, but it’s spring!

It’s very bad luck to draw the line

On the night before the world ends

We can draw the line some other time

X – Some other time

Support the Automatic Earth. It’s good for your mental health.