Unknown Wharf, Federal artillery, and schooners, City Point, Virginia 1865

Don’t know about you, but I find it refreshing to see actual discussion going on, based on something else than pre-conceived notions.

• Trump Won’t Start A Trade War; He’ll Finish It (MW)

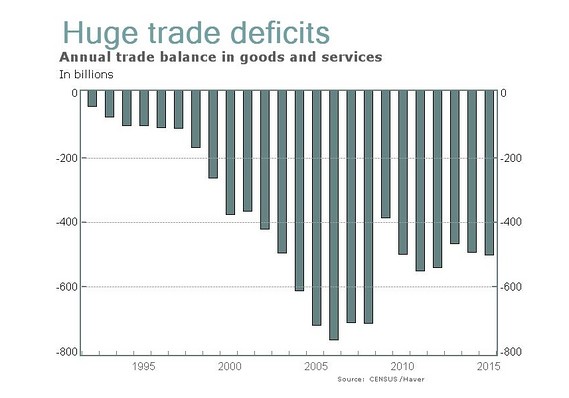

[..] In deriding Trump for everything that comes out of his mouth, mainstream media have been quick to dismiss his repeated claims about his prowess in negotiating. These same media acknowledged early in Obama’s tenure that this former community organizer could not negotiate his way out of a paper bag, starting talks where he wanted to end them and giving up more than he intended. Now, however, anti-Trump voices want to take his threat of 45% tariffs against China as a fait accompli and paint a doomsday scenario of what that will mean for American consumers and the global economy. These critics claim Trump will start a trade war. Newsflash: We are already in a trade war started by the Chinese and others who have traditionally kept their currency devalued to flood our market with their goods while protecting their own.

And we are losing. This was precisely the point made last summer by Dan DiMicco, the former steel executive Trump has charged with managing trade issues during his transition. “Hillary Clinton has claimed Trump’s trade policies will start a ‘Trade War,’ but what she fails to recognize is we are already in one,” he wrote in his blog. “Trump clearly sees it and he will work to put an end to China’s ‘Mercantilist Trade War’! A war it has been waging against us for nearly two decades!” And hard-nosed bargaining will be the way Trump ends this war, DiMicco added. “He will do this by negotiating from a position of strength, not condescending weakness. China respects strength but takes full advantage of weakness. In the end it will be in China’s best interest to stop cheating on trade.”

China needs trade with the U.S. at least as much as we do. The idea, for instance, that China would retaliate against U.S. tariffs on some manufactured goods by blocking agricultural imports from the U.S. ignores the fact that China’s massive population has to eat. China is the focus for unfair trade practices, but let’s not forget there are many others. Germany, for instance, manipulates its currency in a much more subtle fashion. By tying it to lower performing economies to keep the value of the euro low, Germany prospers while driving other euro countries to ruin. Trade pacts with insufficient protections exacerbate this situation, as does a World Trade Organization with unenforceable restrictions. Trump is exposing this charade for what it is. Solutions may not come easy, but you can’t solve the problem if you don’t first figure out what it is.

“When we negotiate free trade agreements, we are lousy at it [..] They are dominated by folks that have a predominant benefit from getting more exports into the world as opposed to having balanced trade, which is good for all Americans.”

• Trump Digs In For Major US Trade Reset With The World (CNBC)

Donald Trump got some of his loudest campaign cheers with a simple pledge to “get tough on trade.” Now the president-elect and his supporters will find out how complex that goal will be. [..] One early indication of where a Trump administration would steer U.S. trade policy came this summer with the appointment of Dan DiMicco, former CEO of Nucor Corporation, as his trade advisor. Nucor, the largest U.S. steel producer, is a scrappy survivor of the massive consolidation of the American steel industry that shed millions of jobs in the 1970s and 1980s as the nation’s backbone supplier of postwar manufacturing fell into decline. That industry was born in the geographic intersection of rich deposits of steel’s two main ingredients: Pennsylvania coal and Michigan iron ore.

Those two states sent Trump to the White House on Election Day. Today, the fiery forges that once melted raw iron to build U.S. skyscrapers, consumer appliances and family station wagons have largely gone cold. Under CEO DiMicco, Nucor, now North America’s largest recycler, survived the decline of Big Steel by building a business melting down scrap steel produced by others — some 17 million tons last year. Last month, Trump promised to restore the Midwest as the “manufacturing hub of the world again” and “fight for steel businesses that have been taken away.” “We’re going to bring back steel,” he told a cheering crowd. “Your steel has been stolen from you.”

In DiMicco, the president-elect has chosen an outspoken advisor – and potential appointee – who shares his belief that restoring industries like steel manufacturing means getting “tough” with global competitors. “When we negotiate free trade agreements, we are lousy at it,” DiMicco told CNBC a year ago. “They are dominated by folks that have a predominant benefit from getting more exports into the world as opposed to having balanced trade, which is good for all Americans.” With DiMicco as one of the architects, the Trump campaign has sketched out initial plans for reforming U.S. trade relations with the rest of the world. In a heavily footnoted position paper in June, Trump laid out a seven-step plan to “change our failed trade policy – quickly” and “bring back our jobs.”

The sooner credit card rates go back to ‘normal’, the better.

• Panic In Housing Market As Trump Effect Pushes Mortgage Rates To 4% (CNBC)

More selling in U.S. bond markets Monday pushed mortgage rates to a psychological breaking point. The average contract rate on the popular 30-year fixed mortgage hit 4%, according to Mortgage News Daily, a level most didn’t expect to see until the middle of next year. Rates have now moved nearly a half a%age point higher since Donald Trump was elected president. “The situation on the ground is panicked. Damage control,” said Matthew Graham, chief operating officer of Mortgage News Daily. “People were trying to lock loans quickly last week and are now facing a tough choice to lock today or hope for a bounce. Many hoped for a bounce last week heading into the long weekend and we obviously didn’t get it.”

Mortgage rates follow loosely the yield on the 10-year Treasury bond. That yield on Monday hit the highest level since December, as investors flooded the stock market and pulled out of the bond markets. The runup on stocks is backed by a belief that the Trump administration will be a boon to the economy overall and the banking sector specifically. Higher mortgage rates, however, will throw a wrench into an already shaky housing recovery. Home prices have been rising dramatically in the past few months, largely due to a lack of homes for sale. During housing’s recovery from the worst crash in history, historically low mortgage rates allowed prices to gain quickly and, more recently, to rise far faster than both income and employment growth.

“The chances are elevated that Trump starts his presidency off with a recession.”

• The Bond Vigilantes Are Back, And Trump Better Be Careful (CNBC)

[..] the Federal Reserve has kept its short-term rate target anchored for the past eight years, raising just once – a quarter-point increase in December 2015 – and perhaps once more next month. The Fed had been an aggressive buyer in the Treasury market, ballooning its balance sheet to $4.5 trillion in three rounds of quantitative easing. In the meantime, investors continue to fret over a bond bull market that has been ongoing for more than three decades. Each predicted end of the fixed income rally has been wrong. But Trump’s plans for aggressive fiscal policy, the likes of which hasn’t been since before the Great Recession, have renewed fears.

“When you have inflation and growth, or the prospect for more growth, that slams smack into a bond bubble, it’s a very dangerous cocktail,” said Michael Pento, head of Pento Portfolio Strategies. Pento worries that the combination of market factors could stop the president-elect before he gets started. “There’s a lot of bad stuff that’s already occurred,” he said. “If you put them on a ledger, on the good side there’s hoped-for growth policies in 2017. On the bad side, you already have a spiking dollar, spiking interest rates. The chances are elevated that Trump starts his presidency off with a recession.”

However, if the bond vigilantes do swoop in, they could find themselves with a formidable opponent, namely the Fed and other central banks, which could adopt a whatever-it-takes approach to keeping yields in check and thwarting an economic downturn. The Fed has been at the global forefront for ambitious and unconventional monetary policies, but the Bank of Japan’s recent move to target its 10-year note yield at zero took the game to a new level. Should troubles erupt in the bond market, more action would be likely by the Fed. “Consider a scenario where a large fiscal stimulus (or the expectation of such stimulus) pushes up bond yields so sharply that risk assets and the economy suffer,” Joachim Fels, global economic adviser at bond giant Pimco, said in a note Tuesday.

“To prevent a bond tantrum, the central bank may want to limit the rise in yields by intervening in the bond market directly. The cleanest way to do this is to announce a cap on yields and stand ready to buy unlimited amounts to preserve the cap if needed.” That would be over the long term, though. In a shorter time frame, Kroll’s Whalen said he thinks a recent prediction by Jeff Gundlach at DoubleLine that the U.S. 10-year yield could hit 6% in five years is “conservative.”

Even Warren gets back to making some sense. What she doesn’t get is that this is exactly what Trump wants her to do. If she would want to irk him, she’d stay silent and let the selection process create its own swamp. By speaking out, she helps The Donald select his crew. Because the transition team is not in disarray, as I see 1000 voices claim; it’s simply a different process. They put a name out there with the express goal of seeing what the reactions are. And in typical Trump style, the first ones are extreme (Bannon), so he has room to climb down.

• Elizabeth Warren Criticizes Trump Transition Team’s Wall Street Ties (WSJ)

Sen. Elizabeth Warren warned President-elect Donald Trump against choosing “Wall Street insiders” for top financial posts, likely previewing the confirmation battles to come in the Senate. In a letter to the president-elect dated Tuesday, the Massachusetts Democrat specifically noted three members of the Trump transition team with ties to Wall Street and “demonstrated records of failure during the 2008 financial crisis” whom she would find unacceptable for top positions: David Malpass,Paul Atkins and Steve Mnuchin. Mr. Malpass, a former Bear Stearns chief economist, is working on shaping Mr. Trump’s Treasury Department, which Mr. Mnuchin is a leading candidate to lead. Mr. Atkins, a former SEC commissioner during the George W. Bush administration, is working to fill the ranks of financial regulatory agencies in the Trump administration.

“In case you were wondering, I was not jumping up and down cheering the Trump victory, amazing as it was. I figured the good news was that Hillary lost and the bad news was that Trump won. Now, we just have to roll with it.”

The USA is squandering its vitality trying to maintain a half-assed global empire of supposed interests, economic, ideological, and existential. Lately, this hapless project has only resulted in wars with no end in places we don’t belong. It includes reckless experiments such as the promotion of regime change (Iraq, Libya, Ukraine, Egypt, Syria), and senseless, provocative exercises such as the use of NATO forces to run war games near Russia’s border. The monetary cost of all this is off the hook, of course, redounding to the financial mess. Reigning in these imperial impulses could be on the Trump agenda, but his own gold-plated imperial pretensions suggest that he might actually make the situation worse by conflating a reduction of our empire with a loss of the very “greatness” he wants to reclaim.

[..] The great project awaiting this country is how we might redistribute our people into re-scaled walkable communities with re-localized economies, including re-scaled agriculture. It’s going to happen whether we like it or not. It’s only a matter of how disorderly the process may be. Obviously all the suburban crapola out there also represents a tremendous load of presumed wealth. The vested “value” in suburban houses alone is the underlayment of structured finance. There is almost no conscious political awareness in any party — including the Greens – as to how we might attempt to work this out. But, for example, and for a start, Mr. Trump might consider the effect that national chain “Big Box” shopping has had on Main Street America. It literally destroyed local commercial economies all over the land, and with it numberless vocational niches and social roles in communities.

[..] The chatter this week has been all about the upcoming “infrastructure” orgy that Trump will undertake. That depends first of all on how badly the financial sector cracks up. I hope we do not squander more of our dwindling capital on the accessories of car dependence, because that addiction is on the way out. One thing Mr. Trump might get behind is restoring the passenger railroads of America so that we can at least get around the continental nation when the Happy Motoring fiesta grinds to a halt. It would put an awful lot of people to work on something with real long-term benefit – it ties into the restoration of Main Street towns and their economies – and it is a do-able project that might give us the needed encouragement to get on with the many other necessary projects awaiting our attention.

Imagine having to lick up to Trump.

• GOP Rushes To Embrace Trump (Hill)

Republican lawmakers spent the past year keeping Donald Trump at arm’s length. Now they’re tripping over themselves to embrace him. Returning to Washington for the first time since Trump’s presidential victory, GOP leaders handed out “Make America Great Again” hats at their weekly conference meeting on Tuesday. Speaker Paul Ryan (R-Wis.) named a top Trump ally, Rep. Chris Collins (R-N.Y.), as the congressional liaison to the presidential transition team. At one point Tuesday, Ryan referred to the president-elect by his first name, “Donald.” In past months, Ryan wouldn’t even dare mention his name, often calling him only “the nominee.” This all would have been unimaginable even a month ago. Some Republicans acknowledged there had been a sea change since Trump surprised Democrats and some in his own party by defeating Hillary Clinton.

Republicans on Capitol Hill “are so excited. People are coming up to me, telling me they’ve been with Trump since day one,” Collins explained to reporters. “And I kind of look and say, ‘Well, OK, if you say so.’ “Donald Trump has accomplished for us something no one thought possible. … Everything is red, and we’ve got four solid years to get this right.” After winning the GOP nomination to be Speaker for the next two years, Ryan gave yet another shout-out to Trump – the second of the day. “This leadership team is unified. This entire House Republican Conference is unified,” said Ryan, flanked by his leadership team. “And we are so eager to get to work with our new president-elect to fix America’s pressing problems.” Never mind when Trump called Ryan a “very weak and ineffective leader” last month, after the Speaker announced he’d no longer try to defend or campaign with him.

“They’re going to lock down the system.”

• Rickards: Financial Crisis Coming Soon, Will Be Different (BBG)

Jim Rickards, West Shore Group’s chief global strategist and author of “The Road to Ruin,” discusses the possibility of another financial crisis with Bloomberg’s Vonnie Quinn and David Gura on “Bloomberg Markets.”

It’s troubling that the Chinese have started borrowing to buy everything, holding up a mirror to us westerners. It’s more troubling that it turns banks into outlets for the shadow banking system.

• Another Financial Warning Sign Is Flashing in China (BBG)

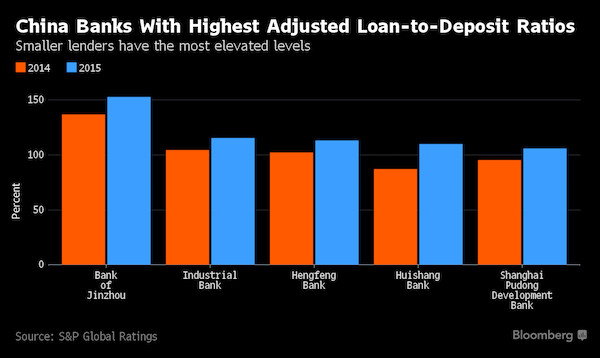

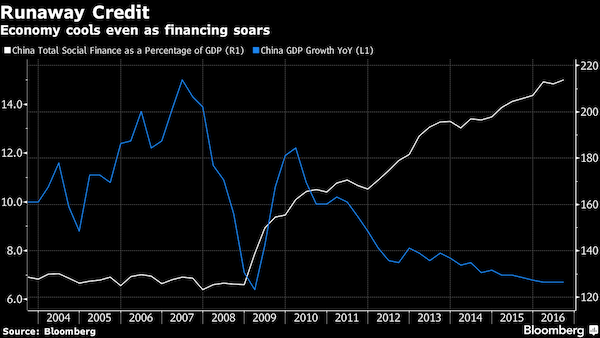

Add another credit indicator to the financial warning signs flashing in China. The adjusted loan-to-deposit ratio, which includes a range of off-balance sheet items and is an indicator of the banking system’s ability to weather stress, climbed to 80% as of June 30, according to S&P Global Ratings. For some smaller lenders, the ratio has already topped 100%, S&P estimates. S&P’s adjusted measure is rising much faster than the official loan-to-deposit ratio as banks pile into off-balance sheet lending, sidestepping government efforts to rein in credit. At the current pace, overall credit could surpass deposits on an adjusted basis within a few years – a level that would give China little leeway to stave off financial turmoil, S&P says.

“The next two to three years is a crucial window for China to rein in the ratio, or we will be in serious trouble,” said S&P’s Beijing-based director Liao Qiang. “Reaching 100% doesn’t mean a crisis will ensue immediately, but it shows China’s entire deposit base is used up and any loss of confidence from savers will severely destabilize the banking system.” Even after S&P’s adjustments, the ratio in China remains lower than in many other countries. Yet the country’s rapid loan growth, diminishing return on credit and rising bad debts combine to make deposits a particularly important buffer against future financial distress, according to Liao. Deposit-taking has formed a cornerstone of China’s banking system as it expanded in tandem with the economy, providing lenders with a stable, low-cost funding base to fuel credit growth.

Chinese households and companies hold $22 trillion of bank deposits, more than anywhere else in the world. That cushion has made lenders less dependent on short-term wholesale funding than banks elsewhere. For two decades, China imposed a cap that limited loans to a maximum 75% of deposits as part of measures to contain risks. That ceiling was abolished in October 2015, in part because it was seen as a blunt tool that encouraged illicit deposit-hoarding and moving loans off balance sheets. The official loan-to-deposit ratio among Chinese lenders stood at 67% at the end of September, up only slightly from 66% when the cap was lifted. But that measure has become less relevant as Chinese banks – especially small and mid-sized ones – have stepped up shadow lending and sales of savings-like offerings called wealth management products, which don’t get carried on their balance sheets.

This could yet get out of control in sinister ways. Fishing industries collapse, farmers can’t buy seeds.

• India’s Great Rupee Fail (BBG)

One week after India’s sudden declaration that 500- and 1,000-rupee notes were no longer legal tender, the economy is in chaos. And that’s perhaps because the policy was designed as much to shock and awe observers with the government’s command of the Indian economy as to control India’s “black money” problem. What seemed at first to be a masterstroke by Prime Minister Narendra Modi now looks like a grave miscalculation. Modi is beginning to sound like he may agree. His recent speeches on the subject have been frankly bizarre. In one, he seemed to laugh at those inconvenienced by the ban; in another, he broke down while speaking of the “sacrifices” he’d made for India, and warned that he might be assassinated by “forces” desperate to protect their “loot.”

What’s changed in a week? Well, for one, it’s become clear that the government was simply too cavalier in its planning. Now that 86% of India’s currency is no longer valid, the central bank has struggled to print replacement denominations – and the new notes are the wrong size for existing ATMs. Modi’s asked people to be patient for 50 days, but the process could take as long as four months. You have to wonder if Modi truly sought expert advice, or relied once again on a small and trusted set of politicians to determine policy. India’s simply too big and complex for shock and awe. Large parts of the rural economy use cash for 80% of transactions and have been hard-hit. In seafood-mad West Bengal, for example, the fishing industry is in a state of near-collapse; in the wheat-growing states of the northwest, farmers halfway through the sowing season have run out of cash to buy seeds.

Few villagers have access to an ATM. Most have to trek to a bank branch to change their cash, which means losing out on crucial days of labor. Many Indians, particularly women, still don’t have an active bank account. Finance Minister Arun Jaitley wondered aloud how many poor people would even have 1,000-rupee notes – probably a rhetorical question, but surely it shouldn’t have been. Someone should’ve sought the answer before shutting down India’s financial system. Among India’s middle class, Modi’s “surgical strike on black money” still appears to be popular. It’s the old “vegan fallacy” – if something tastes terrible, it must be good for you. Enough Indians are suffering that they believe it must be in a greater cause. It’s a moral project, not an economic one. Stand in line, we’re told, and you honor our brave soldiers at the border.

But will that support last? The government’s plan is likely to be ineffective in the long term. Economists agree it will have no effect on the generation of black money through corruption. Meanwhile, estimates of the amount of black money that will eventually be recovered vary widely. The optimists (wrongly) think enough cash will be destroyed by hoarders that the central bank will be able to pay a hefty dividend to the government. Others point out that a very small fraction of black money tends to be held as cash and that there are a dozen ways still available to launder that fraction.

And anyone who ever thought otherwise was a fool to do so.

• Lack Of New Building Not To Blame For Soaring House Prices (Ind.)

Soaring house prices and plummeting home ownership rates in the UK have not been driven by a lack of new housing construction, a Labour party-commissioned review has found, contradicting conventional wisdom on the nature of the housing crisis. The Redfern Review, published today, states, instead, that the biggest drivers of the large increase in house prices over the past two decades have been rising incomes, falling interest rates and, more recently, a lack of mortgage finance availability for first-time buyers and the weakness of this group’s income growth. It also warns that even substantially increasing the supply of new homes will not directly improve the home ownership rate in the near term.

“New household formation and supply have been broadly in balance over the last 20 years and therefore the significant increases in house prices over that period have not been driven primarily by supply constraints,” it concludes. It finds that tougher rules on how much first time buyers can borrow for a mortgage has been the biggest downward force on the home ownership rate since 2008, followed by rapid increase in house prices. It said that the third biggest driver was a 10 per cent fall in the incomes of young people aged 28-30 relative to those aged over 40 since the financial crisis.

It’s high time to put the issue to rest, and show native Americans that treaties will be respected.

• Fate Of Controversial US Oil Pipeline Heads Back To Court (AFP)

The operators of a North Dakota oil pipeline struck back at the US government Tuesday, asking a court to stop regulators from further delaying the contentious project opposed by Native Americans. The move by Energy Transfer Partners and Sunoco Logistics Partners came after the US Army Corps of Engineers on Monday effectively put the brakes on the four-state long Dakota Access Pipeline by calling for more analysis and discussion. The companies responded by asking a federal district court in Washington, the US capital, to declare that they had the right to complete their project without the need for more approvals from regulators.

“The Dakota Access Pipeline has waited long enough,” Kelcy Warren, chief executive of Energy Transfer Partners, said in a statement. “It is time for the Courts to end this political interference and remove whatever legal cloud that may exist.” The decision by the Corps, whose permission is required for the pipeline to be built under the Missouri River and the man-made Lake Oahe in North Dakota, was a victory for the Standing Rock Sioux Tribe. The waterways are the tribe’s drinking water source, and it has objected to building the 1,172-mile pipeline underneath the river and lake, for fear that it might leak. “The Army continues to welcome any input that the Tribe believes is relevant to the proposed pipeline crossing,” the Corps said.

The tribe, which now believes it has the momentum in its battle against the companies, wants the pipeline’s route altered away from lands near its reservation. It also claims those lands contain sacred historic artifacts. “They are wrong and the lawsuit will not succeed,” the tribe’s chairman Dave Archambault said Tuesday in a statement responding to the companies’ action. He claimed that the pipeline’s operators are in a rush to complete the project before the end of the year, or risk losing shipping contracts that would jeopardize its viability. “They made bad decisions and are now facing the consequences. The tide is turning against this project. We thank all of our water protectors who have raised their voices against it. You are being heard,” Archambault said.

He may ask Trump to end US investigation. That would be a bold move.

• Assange Optimistic Sweden Will End Probe Into Rape Claim (SMH)

Julian Assange is optimistic that Swedish prosecutors will drop their investigation into rape allegations after he spent a day and a half being questioned in London, his lawyer says. And his team will write to the new Trump administration asking that the US end its investigation of Assange over Wikileaks’ publication of leaked classified material. Swedish assistant prosecutor Ingrid Isgren was present at the interview, which was conducted by an Ecuadorian prosecutor. After Assange gave a day-long statement on Monday, Tuesday was a question-and-answer session lasting about four hours. The results of the interview will be reported from Ecuador to the Swedish prosecutors in a written statement. The prosecutors will then decide whether to continue or end their investigation.

In a brief statement, the Swedish Prosecution Authority said the investigation and the interview at the embassy were “subject to confidentiality”. Assange’s lawyer Jennifer Robinson said on Tuesday evening she was unable to give details of the day’s questioning, including whether her client was asked for a DNA sample – as the Swedish prosecutors had said they intended. [..] Wikileaks played a crucial role during the presidential election, releasing emails hacked from Democratic Party servers which linked Hillary Clinton to big business and pulled the curtain from the political machinations behind her campaign. Asked if Donald Trump would return the favour by ending the investigation into Assange, Ms Robinson said “we would always be open to a conversation about closing it down”. “We’ll have to discuss that with our US counsel but we’ve written to the Obama administration and no doubt we will write to future US administrations until this is resolved.”

Color revolution passes from Ukraine to America.

• The Technosphere Hiccups (Dmitry Orlov)

[..] it would appear that the technosphere has suffered a setback. But it will not give up so easily, and the next step for it is to deploy political technologies to, if at all possible, invalidate and nullify the results of its electoral defeat. Indeed, this has already started: Bill and Hillary Clinton have recently shown up for a meeting with another ectoplasmic emanation of the technosphere, the predatory billionaire George Soros, clad in accents of Roman imperial purple. The rationale they gave for displaying the colors of the emperor’s toga is that it is a mixture of red and blue, and thus represents compromise. However, compromise, in their case, would be to exit from public life, for both of them are too old to ever run for any office again.

No, this display of imperial colors is just that: a signal that the empire is getting ready to strike back: we should look forward to another attempt at a Color Revolution—the Purple Revolution—this time in the United States, financed by the very same George Soros. This mixed-up signaling is typical: after the Russian election, in which Putin was again elected president, the same Color Revolution syndicate organized and financed protests there, featuring little white ribbons—which, as it happens, were worn by Nazi collaborators during World War II. This nuance was not lost on the Russians, and the protests came to naught. The technosphere is powerful, but is not all-powerful or infallible, and the world is developing effective antibodies against it generally, and against its political technologies, and the technology of the Color Revolution Syndicate in particular.

Here’s an example: the US spent some $5 billion on destabilizing the Ukraine politically and turning it into an enemy of Russia. For a while people in Kiev could earn more in a day by protesting than in a month by working a job. End result: in a recent opinion survey, 84% (34,900) Ukrainians said that the person they want to be the president of the Ukraine is… Vladimir Putin, with the current president, hand-picked by the US State Department, lost somewhere in the margin of error. [..] there now exists an anti-technology for dealing with the technology of Color Revolution, and all it takes to put it into action is a few groups of patriots. To remind: patriots are not nationalists; nationalists are people who hate other nations; patriots are people who love their land, and their people, more than any other, and are willing to lay down their lives in defense of it.

One of the world’s richest nations. Shame on you, Justin.

• One Quarter Of Children in Toronto, Montreal Live In Poverty (CP)

A new report says Toronto has the highest percentage of children living in poverty of any large city in Canada – 27% – and that the closest runner-up is Montreal. In Montreal, 25% of children were living in poverty in 2014. At 24%, Winnipeg was third on a list of Canadian cities with a population higher than 500,000. The report, titled Divided City: Life in Canada’s Child Poverty Capital, says 133,000 children in Toronto were living in low-income families in 2014, the year the data were collected.

A coalition of groups including the Children’s Aid Society of Toronto issued the report as that city weighs up to $600 million in cuts to such programs and services as community housing, transit and student nutrition. It says racialized families, new immigrant families, single-parent families and families with disabilities are up to three times more likely to live in poverty. Only half of children in families with an annual income of less than $30,000 were found to participate in out-of-school art or sports programs, compared with 93% of students in families with an income of $100,000 or more.

Home › Forums › Debt Rattle November 16 2016