Cave of swimmers, Gilf Kebir plateau, Sahara c6000 BCE

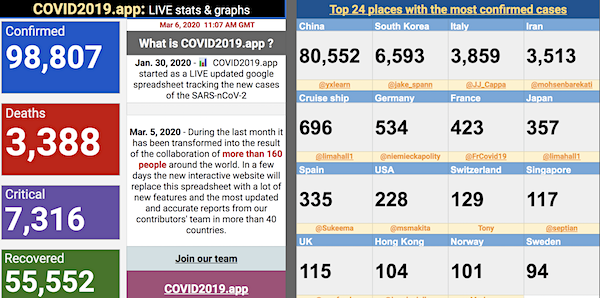

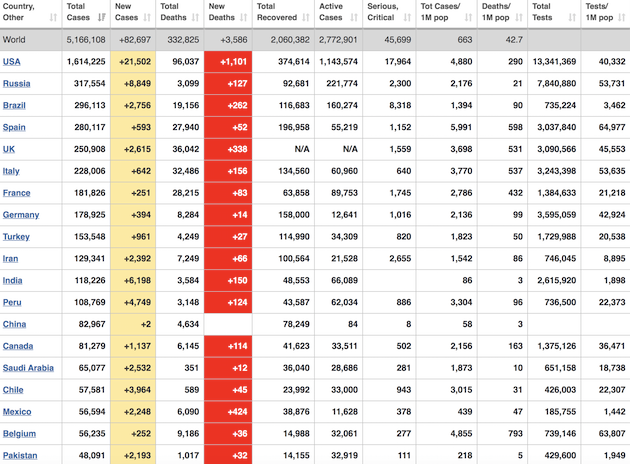

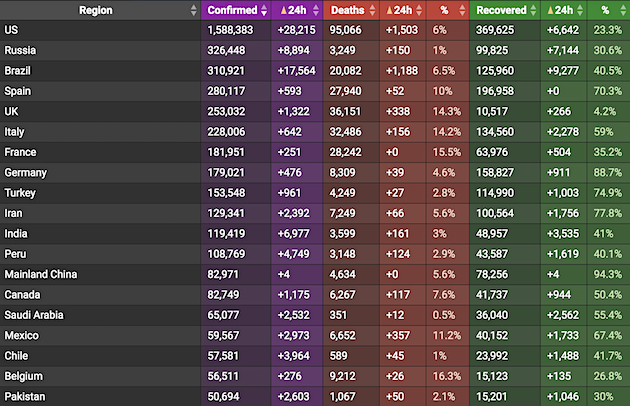

Another record in global new cases over past 24 hrs at 109,627:

• US + 28,215

• Brazil + 17,564

• Russia + 8,894

• India + 7,784

• Peru + 4,749

• Chile + 3,964

• Mexico + 2,973

• Pakistan + 2,603

• Saudi Arabia + 2,532

New deaths

• US + 1,503

• Brazil + 1,188

• Mexico +357

• UK +338

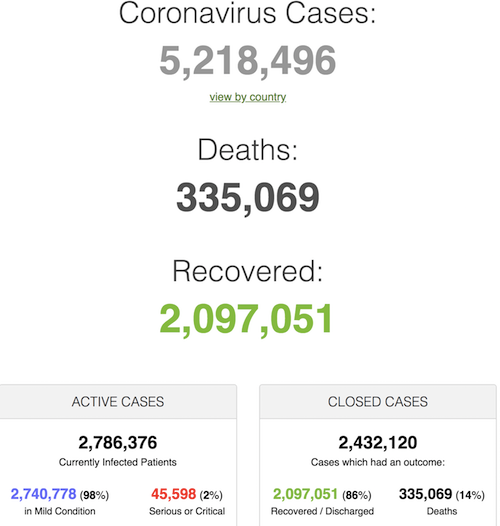

• Cases 5,218,496 (+ 109,627 from yesterday’s 5,108,869)

• Deaths 335,069 (+ 4,987 from yesterday’s 330,082)

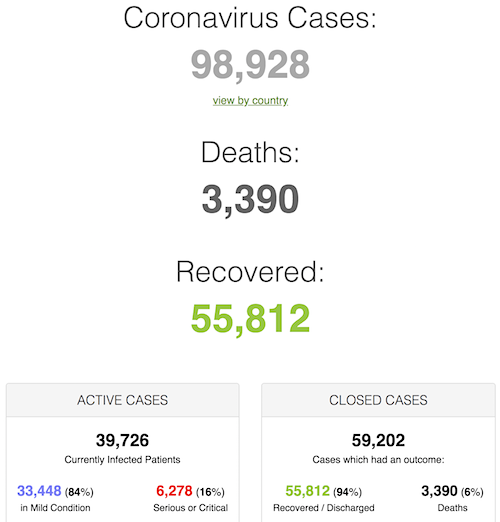

From Worldometer yesterday evening -before their day’s close-

From Worldometer

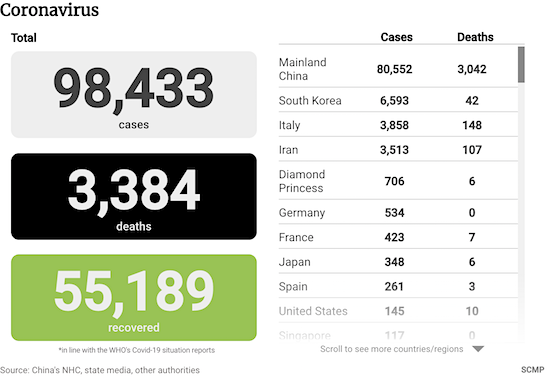

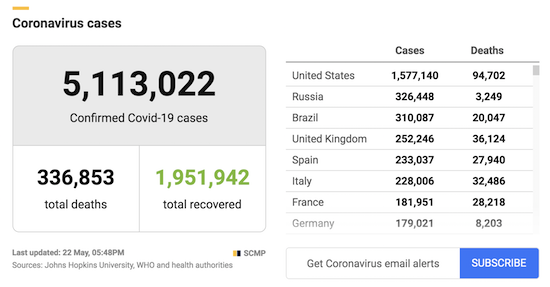

From SCMP:

From COVID19Info.live:

Herd immunity is a failed figment of the imagination, and not one to experiment on the entire population of a country with.

• Just 7.3% Of Stockholm Had COVID19 Antibodies By End Of April (G.)

Just 7.3% of Stockholm’s inhabitants had developed Covid-19 antibodies by the end of April, according to a study, raising concerns that the country’s light-touch approach to the coronavirus may not be building up broad immunity. The research by Sweden’s public health agency comes as neighbouring Finland warned that it would be risky to welcome tourists from Sweden after figures suggested the country’s death rate per capita was the highest in Europe over the seven days to 19 May. Sweden’s state epidemiologist, Anders Tegnell, said the Stockholm antibodies figure was “a bit lower than we’d thought”, but added that it reflected the situation some weeks ago and he believed that by now “a little more than 20%” of the capital’s population had probably contracted the virus.

However, the public health agency had previously said it expected about 25% to have been infected by 1 May and Tom Britton, a maths professor who helped develop its forecasting model, said the figure from the study was surprising. “It means either the calculations made by the agency and myself are quite wrong, which is possible, but if that’s the case it’s surprising they are so wrong,” he told the newspaper Dagens Nyheter. “Or more people have been infected than developed antibodies.” Björn Olsen, a professor of infectious medicine at Uppsala University, said herd immunity was a “dangerous and unrealistic” approach. “I think herd immunity is a long way off, if we ever reach it,” he said after the release of the antibody findings.

They’re only just starting.

• Brazil Suffers Record Daily Coronavirus Death Toll, Soon To Be World No. 2 (R.)

Brazil suffered a record of 1,188 daily coronavirus deaths on Thursday and is fast approaching Russia to become the world’s No. 2 COVID-19 hot spot behind the United States. Brazil also passed 20,000 deaths on Thursday and has 310,087 confirmed cases, up over 18,500 in a single day, according to Health Ministry data. The true numbers are likely higher but Brazil has not carried out widespread testing, the ministry said. President Jair Bolsonaro is under growing pressure for his handling of the outbreak, which looks set to destroy the Brazilian economy and threatens his re-election hopes.

He strongly opposes social distancing measures and has repeatedly pushed for greater usage of chloroquine as a remedy for the virus, despite health experts’ warnings about risks. Bolsonaro’s relationship with governors and mayors has also grown increasingly bitter. The president is angry over local shutdowns to slow the spread of the virus and argues that keeping the economy running is more important. Bolsonaro said he will approve on Thursday or Friday a 60 billion-real ($10.72 billion) federal aid program for states and cities hit by coronavirus but asked governors for support freezing public sector pay increases.

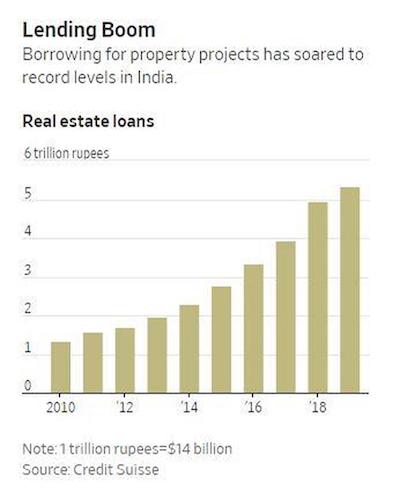

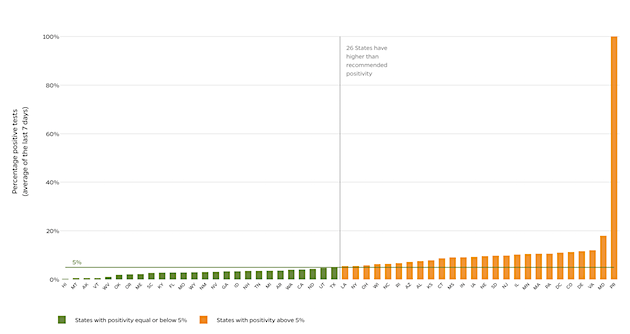

An unfortunate format for the graph. Click the link to the original for a somewhat better version.

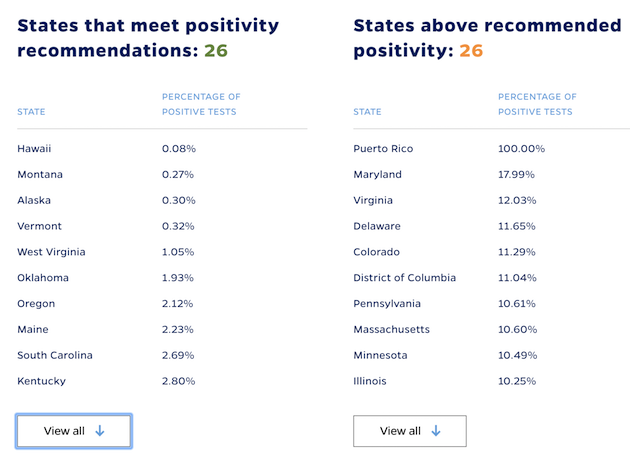

• Which US States Meet WHO Recommended Testing Criteria? (Johns Hopkins)

On May 12, 2020 the World Health Organization (WHO) advised governments that before reopening, rates of positivity in testing (ie, out of all tests conducted, how many came back positive for COVID-19) of should remain at 5% or lower for at least 14 days. If a positivity rate is too high, that may indicate that the state is only testing the sickest patients who seek medical attention, and is not casting a wide enough net to know how much of the virus is spreading within its communities. A low rate of positivity in testing data can be seen as a sign that a state has sufficient testing capacity for the size of their outbreak and is testing enough of its population to make informed decisions about reopening.

Which U.S. states are testing enough to meet the WHO’s goal? The graph below compares states’ rate of positivity to the recommended positivity rate of 5% or below. States that meet the WHO’s recommended criteria appear in green, while the states that are not testing enough to meet the positivity benchmark are in orange.

Time to assess what jobs will never return. There will be millions.

• US Layoffs Spread Despite Businesses Reopening (R.)

Millions more Americans filed for unemployment benefits last week, more than two months after a shutdown of the country to deal with the coronavirus crisis, pointing to a second wave of layoffs in industries not initially impacted by closures caused by the pandemic. The Labor Department’s weekly jobless claims report on Thursday, the most timely data on the economy’s health, also showed the number of people on unemployment rolls surging to a record high in early May, suggesting that businesses were probably not rushing to rehire workers as they reopen.

This also raises questions about the efficacy of the government’s Paycheck Protection Program. A broad lockdown of the country in mid-March to contain the spread of COVID-19 initially led to layoffs in mostly low-wage consumer-facing businesses such as restaurants and retailers. But economists say weak demand was causing layoffs in other industries like utilities, information, finance and insurance, and education. “This raises the possibility that new private and public sector cutbacks may be creating a major barrier to stopping the labor market bleeding,” said Joel Naroff, chief economist at Naroff Economics in Holland, Pennsylvania.

Initial claims for state unemployment benefits totaled a seasonally adjusted 2.438 million in the week ended May 16, down from 2.687 million in the prior week, the government said. Last week’s claims reading [..] marked the seventh straight weekly decline. First-time claims have been gradually decreasing since hitting a record 6.867 million in the week ended March 28. Still they remained more than triple their peak during the 2007/09 Great Recession. The elevated claims have also been blamed on backlogs after the unprecedented amount of applications overwhelmed state unemployment offices.

[..] Attention is shifting from new claimants for jobless benefits to the number of people still on aid. These so-called continuing claims numbers are reported with a one-week lag, but are considered a better gauge of the labor market. They offer a glimpse into how soon the economy ramps up and companies’ ability to get people off unemployment or keep workers on payrolls as they access their share of a historic fiscal package worth nearly $3 trillion, which offered loans that could be partially forgiven if they were used for employee salaries. Continuing claims surged 2.525 million to a record 25.073 million in the week ending May 9.

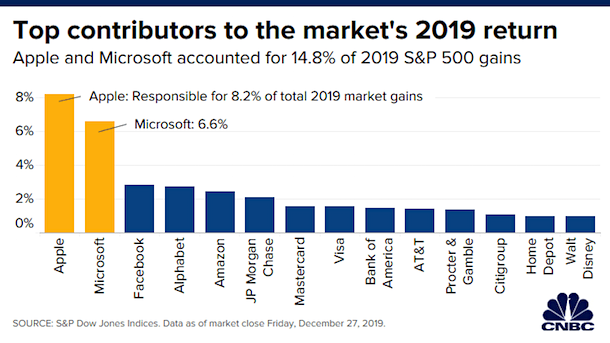

Intuitively, we can sense that stocks have disconnected from earnings estimates; but check out below, which shows that correlation betweeen S&P 500 & forward earnings estimates has been +.90 over past 20 years, but a mirror image -.90 since 3/23/20 pic.twitter.com/7xet0QqXLX

— Liz Ann Sonders (@LizAnnSonders) May 21, 2020

Nice size economy to try something like it. But they dare not call it UBI.

• New Zealand Discussing ‘Helicopter Money’ Handouts To Stimulate Economy (R.)

New Zealand is considering distributing free cash directly to individuals as a way of policy stimulus to help boost the economy reeling from a COVID-19 pandemic driven contraction, Finance Minister Grant Robertson said on Friday. At a regular news conference Robertson was asked to share details about the government’s plans for launching ‘helicopter money’ – whether it would be the central bank printing money and distributing it or the government increasing its borrowing and then handing it out. Robertson said the concept was being discussed but “it’s not something that has got to that level of discussion at all.” “I am pretty keen on making sure that fiscal policy remains the role of the government,” he added.

The idea of helicopter money, or dumping cash unexpectedly onto a struggling economy, is slowly gaining currency among economists and policymakers as the pandemic looks to inflict the worst blow to global growth since the Great Depression in the 1930s. None of the wealthy countries have embarked on it, though, citing risks such as central bank independence and the risk of flaring long-term inflation. In a helicopter money drop, a central bank would directly increase the money supply and, via the government, distribute the new cash to the population with the aim of boosting demand and inflation.

An entire state run by gullible grandmas.

• Washington State Loses 100s Of Millions Of Dollars In Unemployment Fraud (ST)

Washington state officials have acknowledged the loss of “hundreds of millions of dollars” to an international fraud scheme that hammered the state’s unemployment insurance system and could mean even longer delays for thousands of jobless workers still waiting for legitimate benefits. Suzi LeVine, commissioner of the state Employment Security Department (ESD), disclosed the staggering losses during a news conference Thursday afternoon. LeVine declined to specify how much money was stolen during the scam, which is believed to be orchestrated from Nigeria. But she conceded that the amount was “orders of magnitude above” the $1.6 million that the ESD reported losing to fraudsters in April.

LeVine said state and law enforcement officials were working to recover as much of the money as possible, though she declined to say how much had been returned so far. She also said the ESD had taken “a number of steps” to prevent new fraudulent claims from being filed or paid but would not specify the steps, to avoid alerting criminals. “We do have definitive proof that the countermeasures we have put in place are working,” LeVine said. “We have successfully prevented hundreds of millions of additional dollars from going out to these criminals and prevented thousands of fraudulent claims from being filed.”

Thursday’s disclosure, which came after state officials had largely refused to discuss the scale of the fraud, helped explain the unusual surge in the number of new jobless claims filed last week in Washington. For the week ending May 16, the ESD received 138,733 initial claims for unemployment insurance, a 26.8% increase over the prior week and one of the biggest weekly surges since the coronavirus crisis began. That sharp increase came as the number of initial jobless claims nationwide fell 9.2%, to 2.4 million, according to data released earlier in the day by the Labor Department.

Since they won’t stop it, and it can’t last either, it’s up to you.

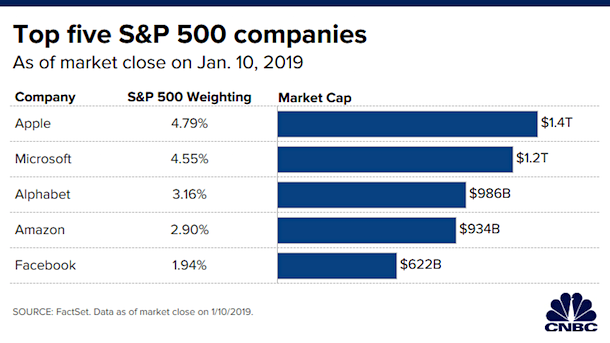

• America’s 600+ Billionaires So Far Made $434 Billion During The Pandemic (F.)

America’s billionaires saw their wealth increase by $434 billion during the course of the global pandemic, according to a new report, a staggering figure that coincided with upheaval to the global economy and more than 38 million Americans filing for unemployment. Per the report by Americans for Tax Fairness and the Institute for Policy Studies’ Program for Inequality, between March 18 and May 19, the total net worth of the 600-plus U.S. billionaires jumped by $434 billion or 15%, based on the group’s analysis of Forbes data. The top five U.S. billionaires (Jeff Bezos, Bill Gates, Mark Zuckerberg, Warren Buffett and Larry Ellison) saw their wealth grow by a total of $75.5 billion.

Amazon founder and CEO Jeff Bezos has seen his net worth grow 30.6% in the past two months, boosting it to $147.6 billion; the fortunes of Bezos and Zuckerberg combined grew by nearly $60 billion, or 14% of the $434 billion total. Tech stocks have continued to rise, with both Facebook and Amazon hitting new all-time highs on Wednesday. While the technology sector has remained strong, many Americans in other markets haven’t been nearly as fortunate, as evidenced by an additional 2.4 million workers filing for temporary unemployment benefits last week, and with 47% of adults reporting that they or another person in their household has lost income since mid-March. Low-income earners have been hit hardest over the last two months, as almost 40% of people working in February and earning less than $40,000 annually have lost their jobs over the last month.

They know the US has already lost the arms race, but A) you can’t explain that to the people, and B) the industry must be kept well-fed.

• US Prepared To Spend Russia, China Into Oblivion To Win Nuclear Arms Race (R.)

U.S. President Donald Trump’s arms control negotiator on Thursday said the United States is prepared to spend Russia and China “into oblivion” in order to win a new nuclear arms race. “The president has made clear that we have a tried and true practice here. We know how to win these races and we know how to spend the adversary into oblivion. If we have to, we will, but we sure would like to avoid it,” Special Presidential Envoy Marshall Billingslea said in an online presentation to a Washington think tank.

Just in case he still doubted he does NOT intend to win.

• Biden Asks Amy Klobuchar To Undergo Vetting As Possible Running Mate (CBS)

Senator Amy Klobuchar, Democrat of Minnesota, has been asked by Joe Biden to undergo a formal vetting to be considered as his vice presidential running mate, one of several potential contenders now being scrutinized by his aides ahead of a final decision, according to people familiar with the moves. In an interview with Stephen Colbert on Thursday night, Biden said “no one’s been vetted yet by the team” but confirmed the initial preliminary outreach to gauge interest is “coming to an end now.” Biden said the “invasive” vetting process will soon begin. When pressed on Klobuchar’s chances of making his running mate “short list,” Biden responded positively: “Amy’s first rate, don’t get me wrong.”

The request for information from potential running mates like Klobuchar “is underway,” a senior Biden campaign aide tells CBS News. If a potential contender consents, she should be poised to undergo a rigorous multi-week review of her public and private life and work by a hand-picked group of Biden confidantes, who will review tax returns, public speeches, voting records, past personal relationships and potentially scandalous details from her past. While several are expected to consent to a vetting, at least one potential contender has bowed out. Senator Jeanne Shaheen, Democrat of New Hampshire, who is running for reelection this year, declined Biden’s invitation to be considered, according to a person familiar with her decision. But Senator Maggie Hassan, the other New Hampshire senator, has agreed to be vetted, according to local news reports.

https://twitter.com/megslay27/status/1263591562476285954

• Warren Pivots On ‘Medicare For All’ In Bid To Become Biden’s VP (Pol.)

In the thick of primary season, Elizabeth Warren and Joe Biden brawled over “Medicare for All”: He called her approach “angry,” “elitist,” “condescending”; she shot back, anyone who defends the health care status quo with industry talking points is “running in the wrong presidential primary.” Six months later, with Biden the presumptive Democratic nominee and Warren in the running for VP, she is striking a more harmonious chord. “I think right now people want to see improvements in our health care system, and that means strengthening the Affordable Care Act,” she told students at the University of Chicago’s Institute of Politics this week, while adding that she still wants to get to single payer eventually.

The shift is the latest public signal Warren has sent Biden’s way in recent weeks that she wants the job of vice president — and wants Biden to see her as a loyal governing partner despite their past clashes, which go back decades. Warren’s policy-centered, team-player pitch is counting on Biden caring more about Jan. 20 than Nov. 3, when he makes his vice presidential pick. In other words, that the current crisis has elevated governing concerns above political ones — and that the times call for someone with her policy chops and, yes, plans.

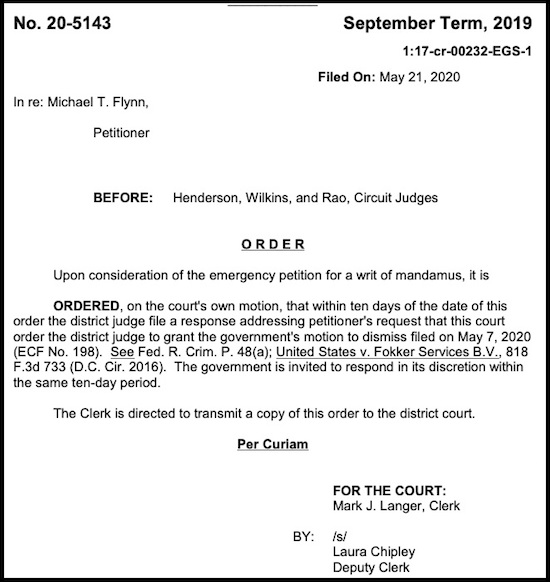

The power of Sidney Powell.

• Appeals Court Orders Judge In Flynn Case To Explain Actions (JTN)

A federal appeals court Thursday has agreed to hear a request from Michael Flynn’s legal team to remove the district judge overseeing his case, and has also ordered the judge to explain his controversial and unorthodox conduct in handling it. Judge Emmett Sullivan has been given a June 1 deadline to respond. The government has also been invited to “respond in its discretion” during that window. Flynn’s legal team had filed a request on Tuesday asking the appeals court to remove Judge Emmett Sullivan from the case, claiming the judge was biased against the defendant. Following the Justice Department’s request earlier this month to dismiss the case against Flynn, Sullivan had appointed retired federal Judge John Gleeson to file an amicus curiae brief arguing in favor of not dropping the case against the general.

Flynn’s lawyers sharply criticized Sullivan’s handling of the case. “The district judge’s latest actions – failing to grant the Government’s Motion to Dismiss, appointing a biased and highly-political amicus who has expressed hostility and disdain towards the Justice Department’s decision to dismiss the prosecution, and the promise to set a briefing schedule for widespread amicus participation in further proceedings – bespeaks a judge who is not only biased against Petitioner, but also revels in the notoriety he has created by failing to take the simple step of granting a motion he has no authority to deny,” the Tuesday petition read.

The Court specifically invited the DOJ to respond to the Writ as well. Barr joining Powell’s side in arguing to dismiss the case will make it much more powerful than on its own, if he takes that opportunity (which I suspect he will) pic.twitter.com/RExQzYzZkg

— Undercover Huber (@JohnWHuber) May 21, 2020

Good long overview.

• The Railroading of Michael Flynn (Lake)

As it happens, the FBI case manager for the Flynn investigation, Joe Pientka, had indeed drafted a memo closing the Flynn investigation—but he hadn’t filed it formally. Because of Pientka’s “incompetence” (the word was Peter Strzok’s, in a delighted text exchange on January 4, 2017, with his paramour Page), the probe was not shut down and a new predicate wasn’t required. In his motion to dismiss the prosecution of Flynn, U.S. Attorney Timothy Shea said this “sidestepped a modest but critical protection that constrains the investigative reach of law enforcement: the predication threshold for investigating American citizens.”

Until the end of April 2020, Pientka’s memo was kept from Flynn’s counsel and the public. It has been released only now because career U.S. attorney Jeffrey Jensen completed his review of Flynn’s case and declassified documents relevant to it. The Pientka memo provides far more detail on the status of the Flynn investigation than was previously known—and what it shows isn’t pretty. We learn from the memo that after the FBI ran down a lead provided by a confidential human source about Flynn’s contact with a person with links to the Russian state, the bureau could not confirm that any such relationship ever existed. That source was likely Stefan Halper, a fellow at Cambridge University and an intelligence community insider. Halper was being paid by the U.S. government to inform on Flynn as well as another Trump campaign aide, George Papadopoulos.

Flynn’s suspected contact, whose name is redacted in the memo, is likely Svetlana Lokhova. She is a Russian-born academic who, the Guardian and other news outlets reported in 2017, had traveled in the same car with Flynn as they left a Cambridge University seminar in 2016. These stories made it seem as if Lokhova was luring Flynn into a honey trap, during which sex is offered for blackmail leverage later on. “The CIA and FBI were discussing this episode, along with many others, as they assessed Flynn’s suitability to serve as national security adviser,” the Guardian reported.

The Lokhova story was a smear. Two months after it was published, the Guardian was forced to append an embarrassing correction. The correction read in part, “Her lawyers have also subsequently informed us that she does not have privileged access to any Russian intelligence archive. We also wish to make clear, for the avoidance of doubt, that there is no suggestion that Lokhova has ever worked with or for any of the Russian intelligence agencies.” Last year, Lokhova sued Halper and several news organizations for the smear against her.

https://twitter.com/SidneyPowell1/status/1263557289950228481

Flynn was opposed to it. He had to go.

• Russiagate Began With Obama’s Iran Deal Domestic Spying Campaign (Tablet)

Obama and his foreign policy team were hardly the only people in Washington who had their knives out for Michael Flynn. Nearly everyone did, especially the FBI. As former director of the Defense Intelligence Agency, the Pentagon’s spy service, and a career intelligence officer, Flynn knew how and where to find the documentary evidence of the FBI’s illegal spying operation buried in the agency’s classified files—and the FBI had reason to be terrified of the new president’s anger. The United States Intelligence Community (USIC) as a whole was against the former spy chief, who was promising to conduct a Beltway-wide audit that would force each of the agencies to justify their missions.

Flynn told friends and colleagues he was going to make the entire senior intelligence service hand in their resignations and then detail why their work was vital to national security. Flynn knew the USIC well enough to know that thousands of higher-level bureaucrats wouldn’t make the cut. Flynn had enemies at the very top of the intelligence bureaucracy. In 2014, he’d been fired as DIA head. Under oath in February of that year, he told the truth to a Senate committee—ISIS was not, as the president had said, a “JV team.” They were a serious threat to American citizens and interests and were getting stronger. Former Director of National Intelligence James Clapper and Undersecretary of Defense for Intelligence Michael Vickers then summoned Flynn to the Pentagon and told him he was done.

“Flynn’s warnings that extremists were regrouping and on the rise were inconvenient to an administration that didn’t want to hear any bad news,” says former DIA analyst Oubai Shahbandar. “Flynn’s prophetic warnings would play out exactly as he’d warned shortly after he was fired.” Flynn’s firing appeared to be an end to one of the most remarkable careers in recent American intelligence history. He made his name during the Bush administration’s wars in Iraq and Afghanistan, where soldiers in the field desperately needed intelligence, often collected by other combat units. But there was a clog in the pipeline—the Beltway’s intelligence bureaucracy, which had a stranglehold over the distribution of intelligence.

Flynn described the problem in a 2010 article titled “Fixing Intel: A Blueprint for Making Intelligence Relevant in Afghanistan,” co-written with current Deputy National Security Adviser Matt Pottinger. “Moving up through levels of hierarchy,” they wrote, “is normally a journey into greater degrees of cluelessness.” Their solution was to cut Washington out of the process: Americans in uniform in Iraq and Afghanistan needed that information to accomplish their mission.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

.@PressSec calls out Susan Rice for her lies surrounding the Flynn Unmasking and for Emailing herself on Inauguration day emphasizing that they did things "By the Book" pic.twitter.com/kRflPgiNyG

— Benny (@bennyjohnson) May 20, 2020

The Golden Rule of Central Banking pic.twitter.com/xdNG9OZWlS

— Hugh Hendry Eclectica (@hendry_hugh) May 22, 2020

Support the Automatic Earth in virustime.