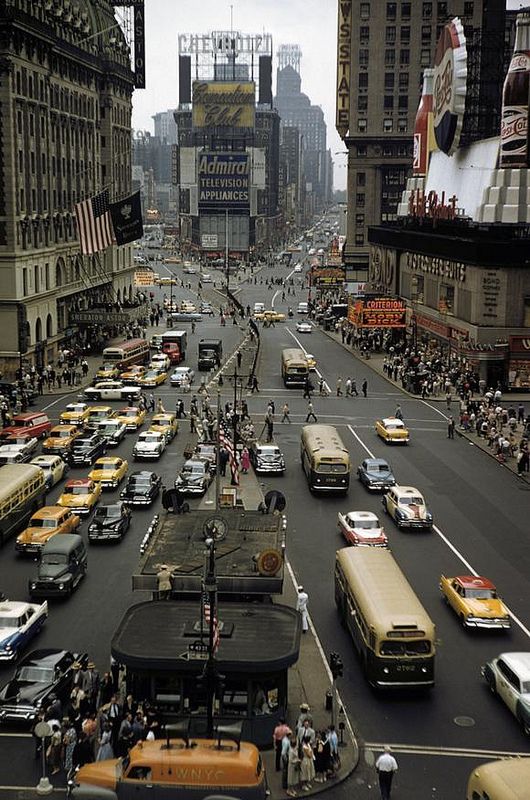

Times Square New York City, 1958

So many diffferent angles. This one from Eli Lake is bearable. “Nunes told me Monday night that this will not end well. “First it’s Flynn, next it will be Kellyanne Conway, then it will be Steve Bannon, then it will be Reince Priebus,” he said. Put another way, Flynn is only the appetizer. Trump is the entree.”

• The Political Assassination of Michael Flynn (BBG)

Representative Devin Nunes, the Republican chairman of the House Permanent Select Committee on Intelligence, told me Monday that he saw the leaks about Flynn’s conversations with Kislyak as part of a pattern. “There does appear to be a well orchestrated effort to attack Flynn and others in the administration,” he said. “From the leaking of phone calls between the president and foreign leaders to what appears to be high-level FISA Court information, to the leaking of American citizens being denied security clearances, it looks like a pattern.” Nunes said he was going to bring this up with the FBI, and ask the agency to investigate the leak and find out whether Flynn himself is a target of a law enforcement investigation. The Washington Post reported last month that Flynn was not the target of an FBI probe.

The background here is important. Three people once affiliated with Trump’s presidential campaign – Carter Page, Paul Manafort and Roger Stone – are being investigated by the FBI and the intelligence community for their contacts with the Russian government. This is part of a wider inquiry into Russia’s role in hacking and distributing emails of leading Democrats before the election. Flynn himself traveled in 2015 to Russia to attend a conference put on by the country’s propaganda network, RT. He has acknowledged he was paid through his speaker’s bureau for his appearance. That doesn’t look good, but it’s also not illegal in and of itself. All of this is to say there are many unanswered questions about Trump’s and his administration’s ties to Russia. But that’s all these allegations are at this point: unanswered questions.

It’s possible that Flynn has more ties to Russia that he had kept from the public and his colleagues. It’s also possible that a group of national security bureaucrats and former Obama officials are selectively leaking highly sensitive law enforcement information to undermine the elected government. Flynn was a fat target for the national security state. He has cultivated a reputation as a reformer and a fierce critic of the intelligence community leaders he once served with when he was the director the Defense Intelligence Agency under President Barack Obama. Flynn was working to reform the intelligence-industrial complex, something that threatened the bureaucratic prerogatives of his rivals. He was also a fat target for Democrats. Remember Flynn’s breakout national moment last summer was when he joined the crowd at the Republican National Convention from the dais calling for Hillary Clinton to be jailed.

In normal times, the idea that U.S. officials entrusted with our most sensitive secrets would selectively disclose them to undermine the White House would alarm those worried about creeping authoritarianism. Imagine if intercepts of a call between Obama’s incoming national security adviser and Iran’s foreign minister leaked to the press before the nuclear negotiations began? The howls of indignation would be deafening. In the end, it was Trump’s decision to cut Flynn loose. In doing this he caved in to his political and bureaucratic opposition. Nunes told me Monday night that this will not end well. “First it’s Flynn, next it will be Kellyanne Conway, then it will be Steve Bannon, then it will be Reince Priebus,” he said. Put another way, Flynn is only the appetizer. Trump is the entree.

Interesting 8-minute, very clear take from Kucinich: “This is like the electronic version of Mad magazine; Spy vs Spy..”

• Kucinich Pins Flynn Leak on Intel Community, Warns of Another Cold War (Fox)

During an interview on the FOX Business Network’s Mornings with Maria, former Democratic presidential candidate Dennis Kucinich said the intelligence community was responsible for leaking information that Trump’s national security advisor, Mike Flynn, had secretly discussed sanctions with Russian officials before the inauguration and argued their goal was to spoil the relationship between the U.S. and Russia. “What’s at the core of this is an effort by some in the intelligence community to upend any positive relationship between the U.S. and Russia,” Kucinich said.

And in his opinion, there is a big money motive behind it. “And I tell you there’s a marching band and Chowder Society out there. There’s gold in them there hills,” he said. “There are people trying to separate the U.S. and Russia so that this military industrial intel axis can cash in.” Kucinich added the intelligence community could start a war to succeed. “There’s a game going on inside the intelligence community where there are those who want to separate the U.S. from Russia in a way that would reignite the Cold War,” he said.

Many on both the left and the right have these worries.

• America’s Spies Anonymously Took Down Flynn. That Is Deeply Worrying (Week)

The United States is much better off without Michael Flynn serving as national security adviser. But no one should be cheering the way he was brought down. The whole episode is evidence of the precipitous and ongoing collapse of America’s democratic institutions — not a sign of their resiliency. Flynn’s ouster was a soft coup (or political assassination) engineered by anonymous intelligence community bureaucrats. The results might be salutary, but this isn’t the way a liberal democracy is supposed to function. Unelected intelligence analysts work for the president, not the other way around. Far too many Trump critics appear not to care that these intelligence agents leaked highly sensitive information to the press — mostly because Trump critics are pleased with the result.

“Finally,” they say, “someone took a stand to expose collusion between the Russians and a senior aide to the president!” It is indeed important that someone took such a stand. But it matters greatly who that someone is and how they take their stand. Members of the unelected, unaccountable intelligence community are not the right someone, especially when they target a senior aide to the president by leaking anonymously to newspapers the content of classified phone intercepts, where the unverified, unsubstantiated information can inflict politically fatal damage almost instantaneously.

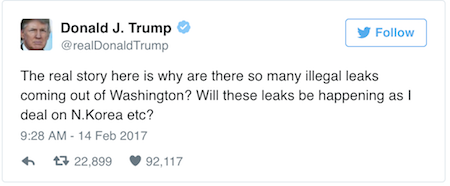

President Trump was roundly mocked among liberals for that tweet. But he is, in many ways, correct. These leaks are an enormous problem. And in a less polarized context, they would be recognized immediately for what they clearly are: an effort to manipulate public opinion for the sake of achieving a desired political outcome. It’s weaponized spin. This doesn’t mean the outcome was wrong. I have no interest in defending Flynn, who appears to be an atrocious manager prone to favoring absurd conspiracy theories over more traditional forms of intelligence. He is just about the last person who should be giving the president advice about foreign policy. And for all I know, Flynn did exactly what the anonymous intelligence community leakers allege — promised the Russian ambassador during the transition that the incoming Trump administration would back off on sanctions proposed by the outgoing Obama administration.

Silly idea. The New Cold War.

• Russian Foreign Ministry Says Crimea Will Not Be Returned To Ukraine (R.)

Russia will not hand back control of Crimea to Ukraine, Russia’s foreign ministry said on Wednesday, responding to comments from the White House that the United States expected the Black Sea peninsula to be returned. “We don’t give back our own territory. Crimea is territory belonging to the Russian Federation,” Maria Zakharova, spokeswoman for the Russian Foreign Ministry, told a news briefing. On Tuesday, the White House said U.S. President Donald Trump had made it clear that he expects Russia to relinquish control of the territory. Russia annexed Crimea in 2014, prompting the United States and the European Union to impose sanctions on Russia, plunging Western relations with the Kremlin to their worst level since the end of the Cold War.

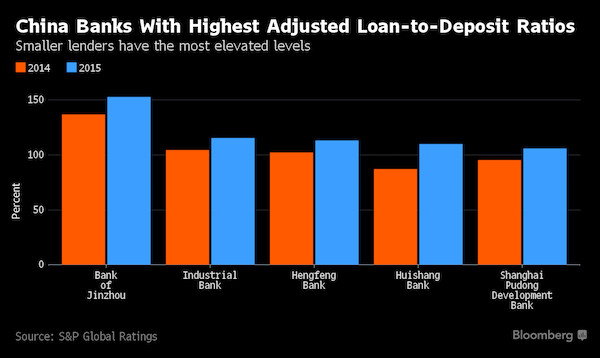

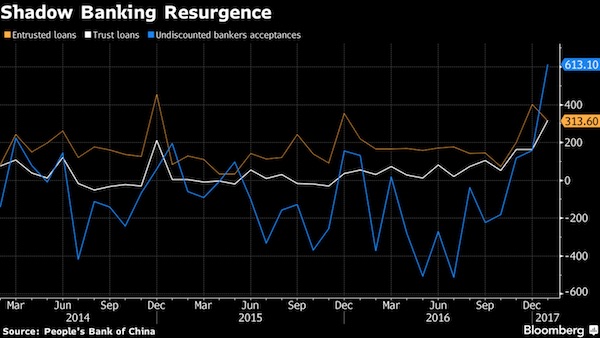

Shadow banking resurgence? It was never gone.

• China Credit Surging to Record Underscores PBOC Shift to Tighten (BBG)

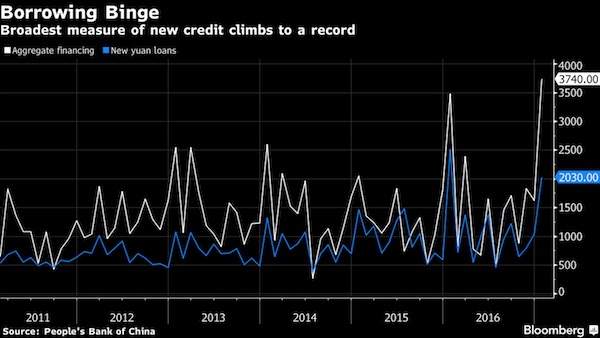

China added more credit last month than the equivalent of Swedish or Polish economic output, revving up growth and supporting prices but also fueling concerns about the sustainability of such a spree. Aggregate financing, the broadest measure of new credit, climbed to a record 3.74 trillion yuan ($545 billion) in January, exceeding the median estimate of 3 trillion yuan in a Bloomberg survey. New yuan loans rose to a one-year high of 2.03 trillion yuan, less than the 2.44 trillion yuan estimate. The credit surge highlights the challenges facing Chinese policy makers as they seek to balance ensuring steady growth with curbing excess leverage in the financial system. The PBOC recently moved to tighten monetary policy by raising the interest rates it charges in open-market operations and on funds lent via its Standing Lending Facility.

“China is learning what other central banks realized decades ago: trying to control monetary aggregates in a modern financial system is next to impossible,” said James Laurenceson, deputy director of the Australia-China Relations Institute in Sydney. “I expect the PBOC will focus more on interest rates and prudential regulation and supervision going forward.” China’s major state-backed banks tend to splurge at the start of the year as they seek to maximize their profits on lending. The main categories of shadow finance all increased significantly. Bankers acceptances – a bank-backed guarantee for future payment – soared to 613.1 billion yuan from 158.9 billion yuan the prior month. “The PBOC is restraining loans but allowing private credit to flow through shadow banks,” said Andrew Collier, an independent analyst and former president of Bank of China International USA. “This is not a policy designed to conquer China’s debt burden.”

Yeah, well, it does nothing of the kind.

• China Should Prudently Manage Deleveraging Process – PBOC (R.)

China should prudently manage the country’s debt deleveraging process and seek to avoid a liquidity crisis and asset bubbles, according to a central bank working paper published on Wednesday. While overall debt ratios in the world’s second-largest economy were still not high relative to many other countries, the pace of increase has been rapid in recent years, the paper said. China’s debt to GDP ratio rose to 277% at the end of 2016 from 254% the previous year, with an increasing share of new credit being used to pay debt servicing costs, UBS analysts said in a recent note.

China’s top leaders have pledged to focus on addressing rising financial risks and asset bubbles this year. The People’s Bank of China has moved to a moderate tightening bias, raising some key primary money rates this year, which analysts said was part of a bid to control risks from rising leverage. The working paper said China should avoid the negative consequences of both increases in leverage and rapid deleveraging. China should let market forces play a decisive role in the deleveraging process, including allowing defaults, the paper published on the People’s Bank of China website said.

h/t Mish. “The people want less Europe. We see this again and again when people have referendums and they reject aspects of EU membership. But something more fundamental is going on out there.”

• Nigel Farage – You’re In For a Bigger Shock in 2017 (TNTV)

I feel like I am attending a meeting of a religious sect here this morning. It’s as if the global revolution of 2016, Brexit, Trump, the Italian rejection of the referendum, has completely bypassed you. You can’t face up to the fact that this bandwagon is going to roll across Europe in these elections in 2017. A lot of citizens now recognize this form of centralized government simply doesn’t work. … At the heart of it is a fundamental point: Mr. Verhofstadt this morning said, the people want more Europe. They don’t. The people want less Europe. We see this again and again when people have referendums and they reject aspects of EU membership. But something more fundamental is going on out there. ….

No doubt, many of you here will probably despise your own voters for what I am about to say because just last week, Chatham House, the reputable group, published a massive survey from 10 Europen states, and only 20% of people want immigration from Muslim countries to continue. Just 20%. … Which means your voters have a harder line position on this than Donald Trump, or myself, or frankly any party sitting in this Parliament. I simply cannot believe you are blind to the fact that even Mrs. Merkel has now made a u-turn and wants to send people back. Even Mr. Schulz thinks it is a good idea. And the fact is, the Europen Union has no future at all in its current form. And I suspect you are in for as big a shock in 2017 as you were in 2016.

Throw this into the German election campaign and see what happens.

• Germany’s Burden: The Euro Is The Most Crisis-Ridden Currency (MW)

Target-2 occupies a central place. According to latest Bundesbank figures, the German central bank’s claims under the system rose to €796 billion at the end of January, from €754 billion at the end of December, well above the previous record €751 billion in August 2012. The Bundesbank’s ECB claims make up more than half of Germany’s net foreign assets of €1.5 trillion, which have themselves increased enormously since the euro was launched in 1999. If the eurozone broke up, or euro members redenominated their liabilities in a new, lower valued currency, Germany would relinquish a large part of these assets — a loss of German savings that would rival the country’s forced write-downs after the first and second world wars.

Both the ECB and the Bundesbank are playing down the renewed Target-2 increase, saying it reflects technical reasons linked to cross-border payments stemming from the ECB’s asset purchase program. On the one hand, these facts would argue for Germany keeping the system going. On the other, they would suggest that the Germans should try to renegotiate the Target-2 arrangements. At the present rate of increase, the Target-2 balances could be close to €1 trillion by the German elections in seven months. Target was developed during the 1990s as a technical transfer mechanism for facilitating payments within the eurozone. The innocuous name — Trans-European automated real-time gross settlement express transfer — signals its original arcane purpose.

According to Helmut Schlesinger, former Bundesbank president, the system was expected to advance credit simply for overnight settlement. Two decades later, as Schlesinger explains, it has become an overdraft system under which Germany, through its central bank, extends interest-free credit without any repayment date and without economic conditions to the central banks of heavily indebted nations.

Paradox: BECAUSE the economy shrinks, more cuts ‘reforms’ will be demanded. The IMF wants more pension cuts. But that’s what half the population lives on.

• Greece Defies Creditors Over More Cuts As Economy Shrinks Unexpectedly (G.)

The standoff between Greece and its creditors has escalated, with the embattled Athens government vowing it will not give in to demands for further cuts as data showed the country’s economy unexpectedly contracting. As thousands of protesting farmers rallied in Athens over spiralling costs and unpopular reforms, the Hellenic statistical authority revealed that Greek GDP shrank by 0.4% in the last three months of 2016. After growth of 0.9% in the previous three-month period the fall was steep and unforeseen. On Monday the European commission announced that the eurozone’s weakest member was on course to achieving a surplus on its budget of 2.3% after exceeding its 2016 fiscal targets “significantly”.

The setback came as prime minister Alexis Tsipras’ lefist-led coalition said it would not consent to additional austerity beyond the cuts the country had already agreed to administer under its third, EU-led bailout programme. Speaking on state TV, the digital policy minister Nikos Pappas, Tsipras’ closest confidant, insisted that ongoing differences between the EU and IMF over how to put the debt-stricken state back on the road to recovery were squarely to blame for the failure to conclude a compliance review at the heart of the standoff. The IMF has argued vigorously that extra measures worth 2% of GDP will have to be enforced with immediate effect if Greece is to achieve a high post-programme primary surplus of more than 1.5%. “The negotiations should have ended. Greece has done everything that it was asked to do,” he said and added there would be “no more measures”.

The future of the €86bn financial aid programme is contingent on Athens implementing agreed economic reforms. The IMF has repeatedly said it will not sign up to the programme unless the crisis-plagued country is given more generous debt relief in the form of a substantial write-down. With Greece facing a €7bn debt repayment to the ECB in July, fears of a Greek default have once again hit markets with shares falling and interest rates on Greek debt rising. But Tsipras is also under pressure from back-benchers in his fragile two-party administration. After seven years of adopting grueling austerity in return for emergency bailout aid many are openly questioning the wisdom of applying yet more measures that have already put Greece in a permanent debt deflationary cycle.

Yellen was “oblivious as the housing market in her region imploded on multiple fronts.”

• ‘Fed Up’ Exposes The Elite Rot Inside The Federal Reserve (MW)

She came armed with an M.B.A., not a Ph.D., which made her suspect in the eyes of staff economists as she gradually worked her way up to Class I Clearance, with access to all policy-related material and briefings. In her columns, DiMartino Booth had warned about lax mortgage-lending standards, a housing bubble and escalating systemic risk. Once ensconced at the Fed, she was left to wonder why so many “highly educated and well-paid economists” were “oblivious as the worst financial crisis since the Great Depression was about to break over their heads.” (One of the main reasons is the Fed’s reliance on econometric models that don’t include anything related to the financial system, such as debt or credit.) It wasn’t just the staff economists who were blind to what was going on in the real world.

Neither former Fed chairman Alan Greenspan, who can boast of two bubbles on his watch, nor his successor Ben Bernanke saw the train wreck coming. Greenspan said a national housing bubble was “unlikely” while Bernanke expected any fallout from the subprime mortgage crisis to be “contained.” Janet Yellen, the current Fed chairwoman, is subject to withering criticism in the book. From 2004-2010, Yellen was president of the San Francisco Fed, whose district encompasses nine Western states and was ground zero for the housing bubble and subsequent bust. DiMartino Booth portrays Yellen as an uber-dove and devout Keynesian, someone who was “oblivious as the housing market in her region imploded on multiple fronts.”

Why bubbles are blown.

• Why “Everyone Wins” When Housing Is More Expensive (AS)

The perceived creditworthiness of a nation is largely dependent on market sentiment of that nation insofar as that the volume and indeed the acceleration of capital flow from that nation towards traditionally hedge instruments is indicative of their realisation of mania and is often known as the Minsky moment. Human nature inherently creates inefficiencies in markets as the incentives for those involved continue to grow, and it is that immutable fact that creates opportunities for those that see the market as being overwhelmingly influenced by self interest. The housing market is a fantastic example of this incentivised self interest. There are layers of self interest that largely go ignored as driving factors for housing price growth and poor risk modelling.

On the lowest level, buyers see property as a safe investment, and most of the time they seek to either make a return on their investment either through rental that exceeds the cost of the mortgage repayments (positive gearing) or to make money by a perceived increase in market value of the property that they can realise once they resell the property, or in many cases a combination of both. There are also people who seek to reduce their tax payment by charging less for rent than they pay in mortgage repayments, however these losses are eventually passed on to tax payers as the government thinks this is a suitable method for reducing rental costs for low income earners and that it reduces overall rental costs. The next level up from this is a combination of brokers, people employed to undertake property valuations and real estate agents, all of whom receive commission as a percentage of the sale price of the property.

There exists such a thing as home equity loans wherein banks and borrowers agree upon a valuation of the property which allows mortgagees or property owners to take on debt based on the perceived value of the property, which extends further credit than the initial loan. This feature of home equity lends itself to false market valuations by appraisers, real estate agents and brokers, in particular because it means that they are incentivised to originate additional loans that then pay commissions based on the appreciation of the previous property investment. Even if the current broker, appraiser or real estate agent is not used by the borrower for financing further property purchases, the industry wide practice almost certainly means that these people will continue to receive additional income as a direct result of the availability of credit in the form of home equity for property purchases.

Maintenance is far less sexy than building.

• Who Will Be Blamed if the Oroville Dam Fails? (McMaken)

While everyone likes to see a shiny new dam or railroad or bridge, the problem with infrastructure projects is that they require maintenance. Unfortunately, while it’s fun to build new dams and promise cheap water to many voters and powerful special interests, maintaining those projects is less exciting. As The Mercury News has reported, 12 years ago, both California and federal officials refused to consider a demand that California heighten precautions and maintenance standards at the Oroville Dam. In response to the demands, the Federal Energy Regulatory Commission (FERC) said the dam’s emergency features were perfectly fine and that the emergency spillway “was designed to handle 350,000 cubic feet per second and the concerns were overblown.”

But, in a development reminiscent of the Army Corp of Engineers’ failure in New Orleans, state officials began ordering evacuations when flows over the spillway reached a mere “6,000 to 12,000 cubic feet per second” or “5% of the rate that FERC said was safe.” Basically, thanks to poorly maintained spillways — and perhaps other oversights — the dam itself is being eroded away, and may soon face total failure. If it does fail, the dam will have failed less than 50 years after its initial — and very, very expensive — construction. The “experts” assure us that this sort of thing has never happened before, of course, and it’s the fault of global warming or it’s just a fluke. But, it’s not as if the dam has never been under strain before. As Reisner recounted in 1987:

“In February of 1980, in the midst of a long spell of wet Pacific fronts, Oroville Reservoir, despite its capacity of something like a trillion gallons, was full, and the dam was spilling — 70,000 cubic feet per second, the Hudson River in full flood, roaring down the spillway at forty miles per hour, sending a plume of mist a thousand feet in the air.” At the time, the dam was only 12 years old. Today, the now-49-year old dam isn’t looking nearly as robust.

Excellent Dmitry: “..there are at least 5.8 billion people alive in the world who don’t own a car. How can something be considered a necessity if 82% of us don’t seem to need it?”

• The Technosphere: You Are Not In Control (Dmitry Orlov)

A good example of how the technosphere controls our tastes is the personal automobile. Many people regard it as a symbol of freedom and see their car as an extension of their personalities. The freedom to be car-free is not generally regarded as important, while the freedoms bestowed by car ownership are rather questionable. It is the freedom to make car payments, pay for repairs, insurance, parking, towing and gasoline. It is the freedom to pay tolls, traffic tickets, title fees and excise taxes. It is the freedom to spend countless hours stuck in traffic jams and to suffer injuries in car accidents. It is the freedom to bring up neurologically damaged children by subjecting them to unsafe carbon monoxide levels (you are encouraged to have a CO detector in your house, but not in your car—because it would be going off all the time). It is the freedom to suffer indignities when pulled over by police, especially if you’ve been drinking. In terms of a harm/benefit analysis, private car ownership makes no sense at all.

It is often argued that a car is a necessity, although the facts tell a different story. Worldwide, there are 1.2 billion vehicles on the road. The population of the planet is over 7 billion. Therefore, there are at least 5.8 billion people alive in the world who don’t own a car. How can something be considered a necessity if 82% of us don’t seem to need it? In fact, owning a car becomes necessary only in a certain specific set of circumstances. Here are some of the key ingredients: a landscape that is impassable except by motor vehicle, single-use zoning that segregates land by residential, commercial, agricultural and industrial uses, a lifestyle that requires a daily commute, and a deficit of public transportation. In turn, widespread private car ownership is what enables these key ingredients: without it, situations in which private car ownership becomes a necessity simply would not arise.

Now, moving people about the landscape is not a productive activity: it is a waste of time and energy. If you can live, send your children to school, shop and work all without leaving the confines of a small neighborhood, you are bound to be more efficient than someone who has to drive between these four locations on a daily basis. But the technosphere is rational to a fault and is all about achieving efficiencies. And so, an obvious question to ask is, What is it about the car-dependent living arrangement, and the landscape it enables, that the technosphere finds to be efficient? The surprising answer is that the technosphere strives to optimize the burning of gasoline; everything else is just a byproduct of this optimization.

Not the strongest effort, but at the same time, children should always receive our protection.

• Greece’s Frozen Children: What Will Happen To Young Refugees? (NS)

The snow-covered tents were an ugly spectacle around the island of Lesbos as this harsh winter gripped Greece. It was in this same area that an accident involving a gas heater had killed a mother and child in late November, when their tent – and others near it – went up in flames. It was pure luck that there weren’t more victims. The incident served as a stark reminder that there are numerous children living in these miserable conditions and that sometimes they die as a result. I had visited the camp just days earlier, hoping to talk to some of the approximately 80 unaccompanied minors who live there. Facilities for refugees around Greece can look anything from decent to shabby, but none resembles a prison as much as the Moria camp on Lesbos. It looks the last place you would host vulnerable children, some of whom are as young as 13.

Yet more than 5,000 children have arrived in Greece without their parents and, like everyone else, they have to be sorted through “hot spots” such as Moria. About 2,500 are still in Greece, and some of them have to live in places like this. While adults and children accompanied by their parents can leave the camp, unaccompanied children, who are placed formally under the guardianship of the district attorney, cannot. The facility, guarded by police in full riot gear and surrounded by concrete walls topped with barbed wire, is both home and prison. It takes nine months on average for an unaccompanied child to be reunited with family in another country – if indeed the child has one. The alternative is that they remain in Greece until they turn 18, when they can try to claim asylum. If a child’s application is rejected, he is then deported back to the country he left years earlier as a child.