NPC Auto wreck, Washington, DC April 1917

How fitting.

• Betting Sites See Record Wagering On US Presidential Election (R.)

The raucous, passionate and unpredictable 2016 U.S. presidential election is on track to notch another distinction: the most wagered-upon political event ever. With many opinion polls showing a tight race just one day before Tuesday’s election, record numbers of bettors are pouring millions into online platforms from Ireland to Iowa in the hope of capturing a financial windfall from a victory by Democrat Hillary Clinton or Republican Donald Trump. UK-based internet betting exchange Betfair said on Sunday its “Next President” market was set to become the most traded it had ever seen and expected to surpass even Brexit. By Sunday, roughly $130 million had been traded on who will become the next U.S. president, compared with $159 million on the Brexit referendum, Betfair spokeswoman Naomi Totten said.

The amount bet so far on the 2016 contest dwarfs the roughly $50 million laid on the 2012 race. “We think it is because (of) how raw the Brexit (vote) is in people’s minds – they’re not convinced yet that it’s a done deal,” Totten said. Most polls leading into Britain’s June 23 referendum predicted Britons would choose to remain in the EU. Instead, they voted to leave by a 52% to 48% margin. Betfair’s “Next President” market was by far the largest of more than 70 markets on the site related to the U.S. election. As of Friday, some $140 million has been put into play on markets ranging from who will win the popular vote to how many states each party will carry. On Ireland’s Paddy Power, which merged with Betfair earlier this year, the U.S. presidential election “is definitely on course to be the biggest political event,” said spokesman Féilim Mac An Iomaire. The site has had about $4.38 million bet on the race so far.

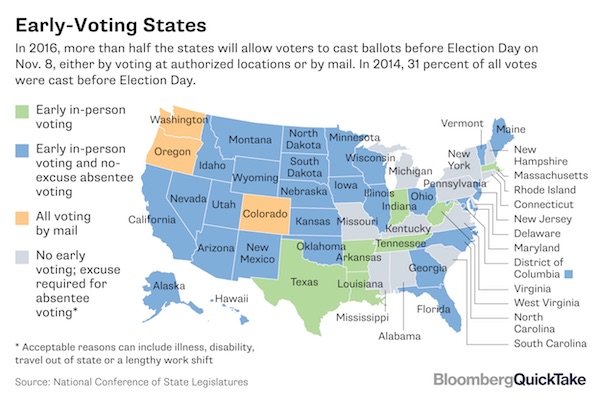

Who needs the west?

• When Might We Know Who Won? Potentially Hours Earlier Than Usual (BBG)

4. When might the public know who won? Potentially hours earlier than usual.

5. Why’s that? There’s a wrinkle this year that might undermine the tradition of major television networks holding off declaring a new president until polls close on the West Coast. Exit polling available to the networks and the Associated Press, combined with early returns in key districts, can point to a likely winner hours before the polls close. Since 1980, when Ronald Reagan’s landslide victory was called while West Coast polls were still open – spurring complaints that some voters didn’t see any reason to go to the polls — networks have resisted calling winners until a given state’s polls have closed.

6. Who’s challenging that arrangement this year? A startup company called VoteCastr plans to collect data from seven battleground states – Colorado, Florida, Nevada, New Hampshire, Ohio, Pennsylvania and Wisconsin – on Election Day, stream it through a mobile app and use it “to generate minute-by-minute projected outcomes.” The news website Slate.com will publish VoteCastr’s findings as they come in. “Publishing our data will help level the playing field, so that voters know as much as campaigns do,” Slate’s editor, Julia Turner, said.

Not easy. Entirely new information would be needed.

• Could Trump Or Clinton Face Impeachment As President? (John Crudele)

[..] .. might it be possible for Congress to initiate impeachment proceedings immediately after their swearing-in as president, whoever wins? I asked professor Eric Schickler, who is the chairman of Travers Department of Political Science at the University of California, Berkeley. “That is an interesting question”, Schickler said. “The conventional understanding of impeachment is that it is due to actions taken while in office. That is how it has traditionally been applied. But impeachment, as anyone who has lived through the Nixon and Bill Clinton eras knows, is ultimately a political decision”, says Schickler. “The Constitution does not define ‘high crimes and misdemeanors’, which is supposed to be the standard for an impeachable offense. “As such, there is discretion for Congress to define its range”, he added.

But Schickler says it would be a “serious case of political overreach for Congress to impeach after an election for actions taken before a person is in office. That s particularly so where those actions were known at the time of the election itself”, he says. OK, my turn again. So what he s saying is that an impeachment proceeding right after the election would really piss voters off. Then, how about a month after inauguration? Or six months? Or a year from now, when the economy still isn t buzzing (as it s unlikely to be) and people have had enough of our new president – whoever that may be. So let’s figure out what crimes we can come up with for Trump and Hillary Clinton. Clinton’s crimes are obvious. Her opponent has described her as a liar and a crook, and so have I.

She has nearly been indicted twice, and could easily have other offenses that are lurking in the background. She’s become very wealthy because of connections made while in public service. She’s had numerous shady real estate deals and even had a commodities transaction – admittedly long ago – that reeked. And there’s the e-mail controversy. And perhaps lying to Congress and the FBI. And things that may have occurred at the Clinton Foundation. And on and on and on. And if the Republicans keep control of Congress, it’s anyone’s guess if they will go after her. Trump’s “crimes” are a little harder to spot. He’s a pig, that’s for sure. But pinching someone in a bar or saying vulgar things on camera aren’t really impeachable unless, of course, the enemies in his own party decide that they’d prefer vice presidential candidate Mike Pence as a substitute.

Professor Michael J. Gerhardt, the Samuel Ashe Distinguished Professor of Constitutional Law at the University of North Carolina at Chapel Hill, says that a president “may be impeached based on serious misconduct committed prior to the time the individual entered the office he or she currently occupies.” A federal district judge, for instance, got impeached (which is like an indictment) and convicted for lying on a questionnaire he needed to fill out for the job. But there’s a catch, says Gerhardt. The misconduct has to be serious — which is a tricky term to define — and not considered at the time of the election. “It becomes a trickier case if the American people can be said to have ‘ratified’ the prior misconduct” by electing that person.

Planet Ponzi speaks.

• This Election Has Disgraced the Entire Profession of Journalism (Silverstein)

There’s nothing secret about the media’s anti-Trump stance. A formal declaration of war was launched on August 7, when Jim Rutenberg, the New York Times media columnist, wrote a story under the headline, “Trump Is Testing the Norms of Objectivity in Journalism.” Rutenberg wrote that journalists were in a terrible bind trying to stay objective because Trump, among other things, “cozies up to anti-American dictators,” has “put financial conditions on the United States defense of NATO allies,” and that his foreign policy views “break with decades-old …consensus.” Rutenberg made clear that he and other reporters viewed “a Trump presidency as something that’s potentially dangerous,” which required them to report on him with a particularly critical point of view. This, he said, would make journalists “move closer than you’ve ever been to being oppositional,” which would be “uncomfortable and uncharted territory.”

There are so many things wrong with all this that it’s hard to know where to start. Rutenberg’s comment about dictators was clearly a reference to Vladimir Putin, who is an authoritarian leader who Trump, to his shame, admires. However, Russia is not the world’s worst dictatorship — and has been far more effective at fighting ISIS than the Obama administration — and Hillary’s cordial relationship with the Saudi regime, to cite just one example, seems far more dangerous. But rethinking “the alliances that have guided our foreign policy for 60 years” — the alliances that have resulted in non-stop war since 9/11 and the U.S.’s current involvement in seven overseas conflicts — is not an acceptable position for a presidential candidate in Rutenberg’s view.

Furthermore, how is it that the media has derogated to itself the right to decide what candidates deserve special scrutiny and what policies are acceptable? In a democracy, that is supposed to be the voters’ job. And worst of all is Rutenberg’s statement about the role of journalists. “All governments are run by liars and nothing they say should be believed,” I.F. Stone once wrote. “Journalism is printing what someone else does not want printed: everything else is public relations,” said George Orwell. For those two self-evident reasons, being “oppositional” is the only place political journalists should ever be, no matter who is in power or who is campaigning. But for Rutenberg and the New York Times being oppositional is only “uncomfortable” when it comes to covering Hillary Clinton.

It didn’t seem uncomfortable at all when it came to running a story about Trump’s taxes based on three pages of a decades-old tax return that was sent anonymously or when it ran another story with the headline, “The 282 People, Places and Things Donald Trump Has Insulted on Twitter: A Complete List.” All during the campaign we have watched Hillary Clinton rehearse campaign themes and, almost as if by magic, the media amplifying those themes in seeming lockstep. The hacked emails from Clinton campaign chairman John Podesta have demonstrated that this was not mere happenstance, but, at least in part, resulted from direct coordination between the Clintonistas and the press.

“..a chasm that cannot be straddled..”

• Much More Than Trump (Repost), by Robert Gore

While the Kennedy assassination offered the American public a glimpse into the heart of darkness, only a few independent-minded skeptics challenged the Warren Commission whitewash. Vietnam was different; hundreds of thousands returned knowing not just that the so-called best and brightest couldn’t win the war, but that for years they had lied to the American public. In the following decades, it had to have been especially galling for the Vietnam veterans that the hippies, draft-deferred campus protesters, the “fortunate sons” (google Credence Clearwater Revival) whose numbers never came up, and the mockers of the values they held dear ended up among the elite. The Clintons, of course, became the prime example.

Disaffected veterans were the core of a group that would grow to millions, their “faith” in government and the people who ran it obliterated by its repeated failures and lies. Revolutions dawn when an appreciable number of the ruled realize their rulers are intellectual and moral inferiors. The mainstream media is filled with vituperative, patronizing, and insulting explanations of what’s “behind” the Trump phenomenon. It all boils down to revulsion with the self-anointed, incompetent, pretentious, hypocritical, corrupt, prevaricating elite that presumes to rule this country. It is, in a word, inferior to the populace on the other side of the yawning chasm, the ones they have patronized and insulted for decades, and the other side knows it.

Peggy Noonan is one of the few mainstream writers who has tried to understand, rather than insult or condemn, the Trump phenomenon. In a widely cited article, she ascribed it to the split between the “protected,” those who run the government and its allied institutions, and the “unprotected,” the government’s and its allies’ victims (“Trump and the Rise of the Unprotected,” The Wall Street Journal, 2/25/16). It was a nice try, but Ms. Noonan is attempting to straddle a chasm that cannot be straddled. She writes for the Journal, an establishment organ, some of whose writers have been either so clueless or disingenuous that they have denied the existence of an establishment. And ultimately, the protected-unprotected differentiation doesn’t fly.

Most Trump supporters don’t want the government to do something for them; they want the government to quit doing things to them. They viscerally revile the elite—it’s personal—and they want no part of that class or its government. They know how to take care of themselves, and many know the government hurts the most those whom it ostensibly protects.

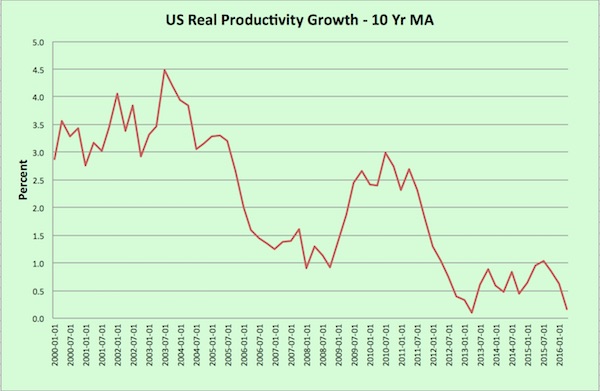

Whet can be done when demand is set to be weak for a long time?

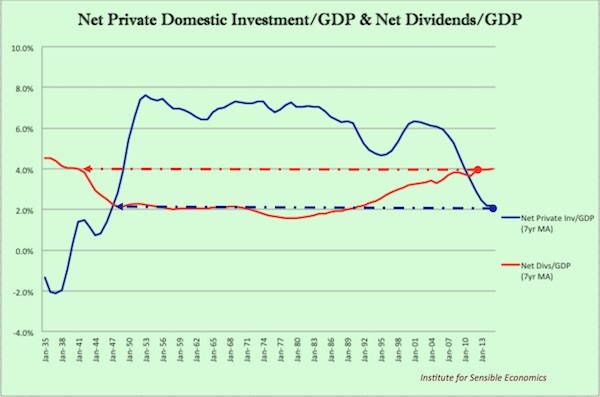

• Private Capital Allocation As Inefficient As In Great Depression (Beversdorf)

1) Economic policy objectives (monetary and fiscal) are meant to incentivize domestic private business investment, which drives incomes and the money multiplier effect, i.e. the engine of the economy.

2) Economic policy objectives have failed because CEO’s, the private capital allocators, simply cannot accommodate business investment when the demand function is as weak as we currently find it, no matter how available and how cheap the capital.

3) The demand function is weak because we misunderstood and ignored the side effects of trade policies and their reliance on new world economies that naturally have a lower money multiplier effect than old world economies.

4) A materially damaged demand function leads to a misallocation of resources; for the past 15 years capital has been and continues at an accelerating rate to be allocated to cash distribution (the most economically inefficient use of capital) rather than investment, further deteriorating the demand function (economic death spiral).

5) The only question that matters now then is; How do we get private sector capital allocators to allocate capital more efficiently? I’ll give you a hint, it requires indications of sustainable demand improvement and neither monetary nor fiscal policy have the capacity to generate sustainable demand improvement when the demand function is damaged to the point that CEO’s refuse to invest productively. This then requires a new economic policy framework, one that CAN generate sustainable demand improvement, which will allow capital allocators to invest productively.

We can understand the problem without villainizing any particular stakeholders by focusing on where we are today and delivering a viable solution. Mistakes were made and judging whether they were honest or malicious in nature is irrelevant to finding the solution. Our focus here is a solution.

Bloated home prices strangle consumption, which is typically 50-70% of GDP.

• Housing ‘Wealth Creation’ Leads To National Wealth Destruction (Janda)

Robertson cites two brunches a week, two coffees a day and a $60 dinner a week as areas where many Gen Ys could save some cash. Aside from the many responses I’ve heard from Gen Ys who don’t spend anything like this much on such items, when you add up the savings it really isn’t that much. On Robertson’s figures one could save just under $6,000 a year. Let’s be extra tight arse and cut out the booze, say $50 a week for $2,600 a year, save another $1,000 by holidaying up the coast in a caravan park instead of heading overseas and $400 more through buying cheaper clothes. So let’s assume it’s reasonable to cut $10,000 in expenses and let’s also assume, even though it’s unlikely given their other spending habits, that our hypothetical Gen Y already saves $5,000 a year from their post-tax, post-HECS/HELP repayment income.

With a median home price of $800,000 in Sydney, it would take a single person more than a decade to save a deposit, so more than five years for a couple who were both saving $15,000 a year. But first time buyers shouldn’t be buying the median, or middle-priced, home I hear boomers respond. Agreed. So let’s take the median apartment price instead. Given the number of studios and tiny one-bedders out there, the median unit price probably gets you a pretty small apartment within 10km of the CBD or a two-bedder somewhere further out. Surely the boomers can’t begrudge that as being excessively luxurious? That’s still $138,000 for a 20% deposit, not including stamp duty, legal and moving costs.

For a single person that’s still nine years of saving, or the best part of five for a couple, and that’s assuming home prices don’t keep rising faster than their incomes and the earnings on their savings, which has been the experience of the past four years. Even a deposit on a Melbourne apartment is six-and-a-half years of saving for a single and more than three years for a couple, again not including other unavoidable purchase costs. That’s the individual challenge that Gen Ys face, even those on pretty decent incomes which are becoming rarer in an increasingly part-time and casualised labour market. But what all of the analysis thus far has ignored is the macroeconomic cost. Imagine for a second that hundreds of thousands of Gen Ys gave up all their brunches and coffees – cafes across Australia would be going broke.

Who do they employ? Often Gen Ys. Likewise the restaurants, bars and retailers that would also be hit if Gen Y really did close their wallets completely. This illustrates the problem with an over-inflated housing market, it absolutely sucks the life out of every other part of the economy.

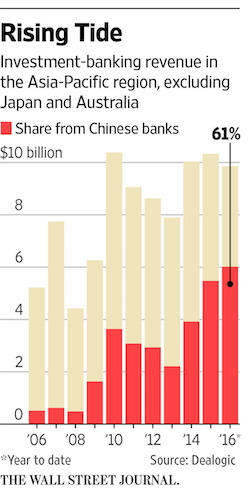

“Chinese banks had a 10% share of investment-banking revenue in Asia [..] a decade ago… This year, that share has increased to 61%..”

• China Might Finally Give Wall Street What It Wants – 20 Years Late (WSJ)

Beijing is considering allowing Wall Street firms to run their own investment-banking businesses on the mainland, according to people briefed on the discussions, a long-awaited step that would give them more access to China’s hard-to-crack domestic market. The move is being discussed as part of a new U.S.-China trade and investment framework. Firms such as Goldman Sachs and J.P. Morgan Chase potentially could operate investment-banking business in China on their own. Currently, the firms must pair with domestic brokerages in joint ventures. The people briefed on the discussions caution negotiations aren’t finalized. Details need to be hashed out with Chinese regulators, and any agreement would need to be ratified by the U.S. Senate.

The possibility of getting closer to the Chinese market is a breakthrough for Wall Street firms. Global banks have limited access to the $7.48 trillion stock markets of Shanghai and Shenzhen and China’s domestic bond market, compared with the ease they can operate in global markets such as London and Tokyo. Any change, however, would come at a late stage. China’s banks have large balance sheets and have become formidable rivals. The banks also have long relationships with corporate Chinese clients, some of whom may not recognize Western brand names.

Chinese banks had a 10% share of investment-banking revenue in Asia, excluding Japan and Australia, a decade ago, according to data provider Dealogic. This year, that share has increased to 61%, boosted by Chinese companies that prefer to do business with domestic firms. Although U.S. banks have spent heavily to bulk up operations in the region, their share has declined since 2000, from 43% to just 14% so far this year, according to Dealogic.

Popping bubbles before they become tumors.

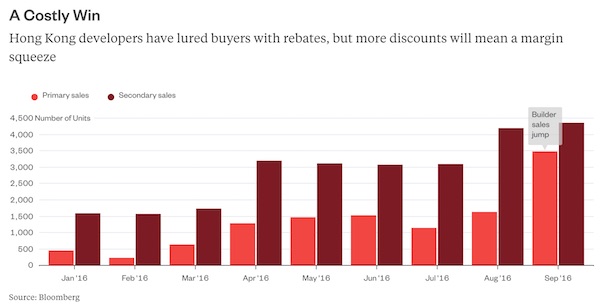

• Hong Kong Derails Property Streetcar (BBG)

When pro-market authorities tamper with prices to cool asset bubbles, economists speak of “throwing sand in the wheels of finance.” Having emptied its bucket of sand without stanching the desire to own property, Hong Kong decided to derail the out-of-control streetcar in a pit of exorbitant taxation. Considering the more painful alternative, it’s a wise move. Now that foreigners, including all-important mainland Chinese buyers, must pay a 30% stamp duty to buy overpriced shoeboxes, transactions could drop by 70%, Bloomberg News reported. Weaker demand might jolt earnings of the city’s developers. That’s what the biggest drop in 16 months in Cheung Kong Property’s shares suggested Monday. A more violent reaction, which might have occurred as Hong Kong’s U.S.-linked interest rates rose, may have been avoided.

As Gadfly pointed out, Hong Kong property has been a magnet for the kind of speculative frenzy that Singapore managed to tame. A gush of money out of the People’s Republic and into something – anything – in Hong Kong is the main reason a skilled worker in the territory was being asked to hand over seven years’ more wages than his Singapore counterpart to own the roof over his head. Even as Hong Kong’s pro-democracy activists are ticked off by Beijing for trying to chart an independent political course, the city can exert more control over its economic destiny by making the world’s least affordable housing a little less so. Not only will the 30% tax dissuade mainland buyers, it also could also put an end to speculative land purchases by Chinese developers.

Well, let’s all get us some deflation then.

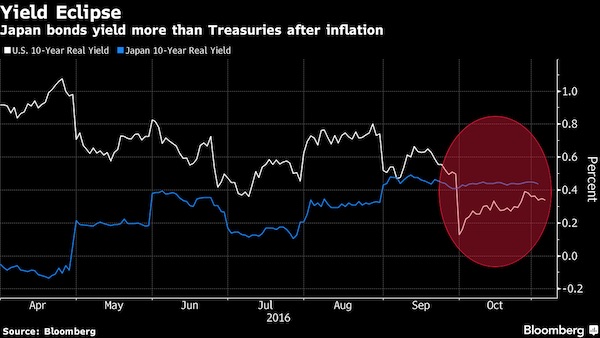

• Negative Bond Yields in Japan Don’t Look So Bad With Deflation (BBG)

If you thought Japan’s negative yields don’t offer any value, take a look at the nation’s fall back into deflation. The 10-year Japanese government bond yield of minus 0.065% turns into a real yield of about 44 basis points, near a three-year high, after accounting for consumer prices. The figure beats the U.S. 10-year real yield of about 30 basis points. The Bank of Japan last week acknowledged its negative short-term interest rates and its plan to control the yield curve will need more time to push up living costs. It forecast 2% inflation won’t be achieved until the year ending March 2019. Bondholders are the beneficiaries, with Japan’s debt market little changed over the past month, even as Treasuries dropped 0.4%, based on the Bloomberg World Bond Indexes.

“Even with the BOJ being vigilant about controlling bond levels, Japanese yields are on a gradual declining path given the lack of conviction that prices will rise,” said Souichi Takeyama at SMBC Nikko Securities Inc. in Tokyo, a unit of Japan’s second-biggest lender. “There is a lack of concern about inflation.” The government will test demand when it sells 10-year debt Tuesday and 30-year bonds on Thursday. Japanese consumer prices are falling at a year-on-year pace of 0.5%, matching the biggest declines since 2013, giving bondholders reason to stick with the securities at a time when the central bank is trying to hold nominal 10-year yields at about zero. In the U.S., investors get 1.80%. Japan’s 40-year bond is more attractive at 0.575%, or a real yield exceeding 1%.

Wonder how much he blames himself for.

• Architect Of Euro In Stark Warning (BBC)

A founding father of monetary union has given a damning assessment of the euro bloc, saying that not incorporating an exit strategy was a mistake. Prof Otmar Issing told the BBC’s Wake up to Money that faultlines across the eurozone remain, citing economic weakness in Greece, Portugal and Italy. The ECB’s first chief economist also warned about the impact of negative interest rates. And he said political pressures threatened central banks’ independence. Prof Issing told the BBC that structural problems in the eurozone and dwindling public support in some countries were still major problems. The euro currency was “stable and performing much better than expected”, he said. “But I wish I could say the same about the euro area.”

Countries that tipped the bloc into recession during the global financial meltdown were still in serious economic trouble. Greece was in “permanent crisis”, and economic reforms in Portugal and Italy were either on hold or being reversed, the professor said. Prof Issing, a former adviser to Germany’s Chancellor Angela Merkel, has in recent years become suspicious of the euro project he helped to create, warning that it would collapse without reform. He told the BBC that it was a “mistake in the construction of the whole arrangement that once a member, you remain a member for eternity”. It meant that countries not complying with the eurozone’s economic and budgetary rules “can blackmail the others”. Allowing a temporary exit would, for example, have helped Greece to reform its economy so that it could then return later in better financial health.

However, some countries should never have joined the euro in the first place, he said, without naming names. They “were not yet ready to thrive under a single monetary policy and one central bank”. Prof Issing is also increasingly concerned about central banks’ use of zero or negative interest rates in a bid to stimulate growth. The policy has been used by, among others, the ECB, Japan, Switzerland and Sweden It is hindering the recovery of banks, he said, adding: “If it persists for longer, then I think we will see dramatic consequences for insurance companies and pension schemes.” Furthermore, “the longer zero interest rates continue, the more difficult it will be to exit from this situation”.

A lasting impression accompanied by Victoria Nuland and new ambassador to Greece Geoffrey Pyatt. Athens has better be very careful with the Ukraine star couple in place.

• Obama Aiming To Make Lasting Impression With Athens Speech (Kath.)

US President Barack Obama is planning to deliver what American officials have described to Kathimerini as a “legacy speech” when he visits Athens on November 15. Although the details of the president’s trip have not been finalized, officials in Washington indicated that Obama intends to make a statement that resonates when he comes to Greece. One official likened it to the historic speech delivered by John F. Kennedy when he visited Berlin in 1962. Obama is expected to make extensive references to democracy and how it has endured in Greece despite its recent problems. The US president is also due to highlight the need for Athens to receive debt relief and for the Greek government to persist with structural reforms.

Obama is expected to tread carefully on the issue of debt so that his comments do not appear as an attack on German Chancellor Angela Merkel, who he considers an important partner and who he will be visiting after his trip to Athens. Sources said that the American president’s speech will also contain a message for Turkey. Obama wants to draw attention to the refugee crisis during his visit to Greece but due to security concerns a visit to the island of Lesvos has been ruled out. There is, however, a possibility that he will visit a refugee camp in Attica.

It is not yet known who will accompany the American leader on his visit but the impression is that First Lady Michelle Obama will not accompany him on the trip. There has been no final decision on whether Treasury Secretary Jack Lew will also travel to Athens. It is considered likely that Assistant Secretary of State for European and Eurasian Affairs Victoria Nuland and Special Envoy for International Energy Affairs Amos Hochstein will be part of the team that will fly to Greece from Washington.

Prediction: “we” are going to let this run awfully out of control.

• Erdogan Blasts West As Turkey’s Kurdish Party Boycotts Parliament (R.)

Turkish President Tayyip Erdogan accused Europe on Sunday of abetting terrorism by supporting Kurdish militants and said he did not care if it called him a dictator. Turkey drew international condemnation for the arrest on Friday of leaders and lawmakers from the pro-Kurdish Peoples’ Democratic Party (HDP), the second-largest opposition grouping in parliament, as part of a terrorism investigation. The government accuses the HDP, which made history last year by becoming the first Kurdish party to win 10% of the vote and enter parliament, of financing and supporting an armed Kurdish insurgency, which it denies. The HDP announced a partial boycott of parliament on Sunday, saying it was “halting its legislative efforts” and that its deputies would stop participating in sessions of the legislature or meetings of parliamentary commissions.

“I don’t care if they call me dictator or whatever else, it goes in one ear, out the other. What matters is what my people call me,” Erdogan said in a speech at an Istanbul university, where he was receiving an honorary doctorate. Erdogan and the government are furious at what they see as Western criticism of their fight against the Kurdistan Workers Party (PKK) militant group, which has waged a three-decade insurgency for Kurdish autonomy and whose allied groups in Syria enjoy U.S. support in the fight against Islamic State. Erdogan said the PKK, listed as a terrorist group by the EU and US, had killed almost 800 members of the security forces and more than 300 civilians since a ceasefire in the largely Kurdish southeast collapsed last year. [..] “Europe, as a whole, is abetting terrorism. Even though they declared the PKK a terrorist organisation, this is clear,” Erdogan said. “We see how the PKK can act so freely and comfortably in Europe.”

HDP co-leaders Selahattin Demirtas and Figen Yuksekdag were jailed pending trial on Friday after refusing to give testimony in a probe linked to “terrorist propaganda”. Ten other HDP lawmakers were also detained, though some were later released. The US expressed deep concern, while Germany and Denmark summoned Turkish diplomats over the Kurdish arrests. European Parliament President Martin Schulz said the actions “call into question the basis for the sustainable relationship between the EU and Turkey”. “After discussions with our parliamentary group and our central executive board, we have decided to halt our legislative efforts in light of everything that has happened,” HDP spokesman Ayhan Bilgen said in a statement read out in front of the party’s offices in Diyarbakir and broadcast online. HDP officials would consult with the party’s supporters, many of whom are in the largely Kurdish southeast, and could then consider a full withdrawal from parliament, he said.

“Climate change is intergenerational theft.”

• Great Barrier Reef: What Have We Left For Our Children? (Naomi Klein)

There is no question that the strongest emotions I have about the climate crisis have to do with Toma and his peers. I have flashes of sheer panic about the extreme weather we have already locked in for them. But even more intense than this fear is the sadness about what they won’t ever know. These kids are growing up in a mass extinction, robbed of the cacophonous company of being surrounded by so many fast-disappearing life forms. According to a new WWF report, since I was born in 1970 the number of wild animals on the planet has dropped by more than half – and by 2020 it is expected to drop by two-thirds. What a lonely world we are creating for these kids. And what more powerful place to illustrate that absence than the Great Barrier Reef, on the knife-edge of survival?

So this film shows the reef through Toma’s eyes. He’s too young to understand concepts like coral bleaching and dying – it’s tough enough for him to understand that coral was ever alive in the first place. It also shows the Great Barrier Reef through the eyes of his mother: moved by the beauty that remains, heartbroken and infuriated by what has been lost. Because what has happened to this wondrous part of the world is not just a tragedy, it’s a crime. And the crime is still very much in progress, with our respective governments busily clearing the way for new coalmines and new oil pipelines.

Home › Forums › Debt Rattle November 7 2016