Up Stories Evia 2021

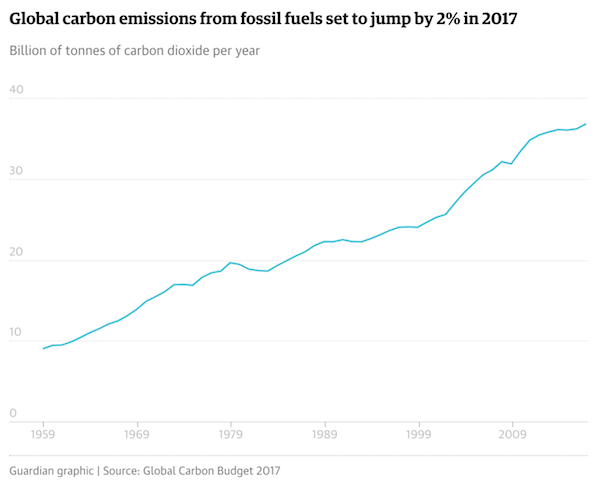

The IPCC came out with another report today, which is a lead-in to another climate conference, this time in Glasgow in Oct-Nov 2021. All the headlines and reactions are exactly the same as they always are: There is no time to lose!, We have to act now!, but also: There is still hope! Since it’s all the same, I thought I’d repost an article from December 2015, ahead of the Paris conference named COP21. All I had to do was change the number and call this one not CON21 but CON26.

No, we’re not going to act in time, and no, there is no hope to halt the degradation of our planet. It’s all long baked into the cake, and if it wasn’t we’d still not stop it. We can do things as individuals but not as a group, let alone as a species. We cannot change our approach to the problems because we cannot change who we are.

I don’t know what makes me lose faith in mankind faster, the way we destroy our habitat through wanton random killing of everything alive, plants, animals and people, through pollution and climate change and blood-thirsty sheer stupidity, or if it is the way these things are being ‘protested’.

I’m certainly not a climate denier or anything like that, though I do think there are questions people gloss over very easily. And one of those questions has to be that of priorities. Is there anyone who has thought over whether the COP21 stage in Paris is the right one to target in protest, whatever shape it takes? Is there anyone who doesn’t think the ‘leaders’ are laughing out loud in -plush, fine wine and gourmet filled- private about the protests?

Protesters and other well-intended folk, from what I can see, are falling into the trap set for them: they are the frame to the picture in a political photo-op. They allow the ‘leaders’ to emanate the image that yes, there are protests and disagreements as everyone would expect, but that’s just a sign that people’s interests are properly presented, so all’s well.

COP21 is not a major event, that’s only what politicians and media make of it. In reality, it’s a mere showcase in which the protesters have been co-opted. They’re not in the director’s chair, they’re not even actors, they’re just extras.

I fully agree, and more than fully sympathize, with the notion of saving this planet before it’s too late. But I wouldn’t want to rely on a bunch of sociopaths to make it happen. There are children drowning every single day in the sea between Turkey and Greece, and the very same world leaders who are gathered in Paris are letting that happen. They have for a long time, without lifting a finger. And they’ve done worse -if that is possible-.

The only thing standing between the refugees and even greater and more lethal carnage are a wide, even confusingly so, array of volunteers, and the people of the Greek coastguard, who by now must be so traumatized from picking up little wide-eyed lifeless bodies from the water and the beaches, they’ll live the rest of their lives through sleepless nightmares.

Neither Obama nor Merkel nor Hollande will have those same nightmares. And let’s be honest, will you? You weren’t even there. And still, you guys are targeting a conference in Paris on climate change that features the exact same leaders that let babies drown with impunity. Drowned babies, climate change and warfare, these things all come from the same source. And you’re appealing to that very same source to stop climate change.

What on earth makes you think the leaders you appeal to would care about the climate when they can’t be bothered for a minute with people, and the conditions they live in, if they’re lucky enough to live at all? Why are you not instead protesting the preventable drownings of innocent children? Or is it that you think the climate is more important than human life? That perhaps one is a bigger issue than the other?

Moreover, the very same leaders that you for some reason expect to save the planet -which they won’t- don’t just let babies drown, they also, in the lands the refugees are fleeing, kill children and their parents on a daily basis with bombs and drones. Dozens, hundreds, if not thousands, every single day. That’s how much they care for a ‘healthy’ planet (how about we discuss what that actually is?).

And in the hallways of the CON21 conference they’ve been actively discussing plans to do more of the same, more killing, more war. Save the world, bombs away! That’s their view of the planet. And they’re supposed to save ‘the climate’?

There are a number of reasons why the CON21 conference will not move us one inch towards saving this planet. One of the biggest is outlined in just a few quoted words from a senior member of India’s delegation -nothing new, but a useful reminder.

India Opposes Deal To Phase Out Fossil Fuels By 2100

India would reject a deal to combat climate change that includes a pledge for the world to wean itself off fossil fuels this century, a senior official said, underlying the difficulties countries face in agreeing how to slow global warming.

India, the world’s third largest carbon emitter, is dependent on coal for most of its energy needs, and despite a pledge to expand solar and wind power has said its economy is too small and its people too poor to end use of the fossil fuel anytime soon. “It’s problematic for us to make that commitment at this point in time. It’s certainly a stumbling block (to a deal),” Ajay Mathur, a senior member of India’s negotiating team for Paris, told Reuters in an interview this week.

“The entire prosperity of the world has been built on cheap energy. And suddenly we are being forced into higher cost energy. That’s grossly unfair,” he said.

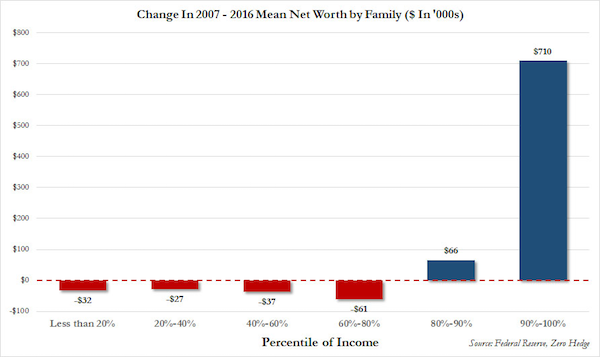

This means the ‘poorer’ countries, -by no means just India; China has 155 more coal plants in the pipeline despite their pollution levels moving ‘beyond index’-, the poorer counties won’t volunteer to lower their emissions unless richer nations lower theirs even a lot more. US per capita emissions are over 10 times higher than India’s, those of the EU six times. Ergo: Step 1: lower US emissions by 90%. It also means that richer nations won’t do this, because it would kill their economies.

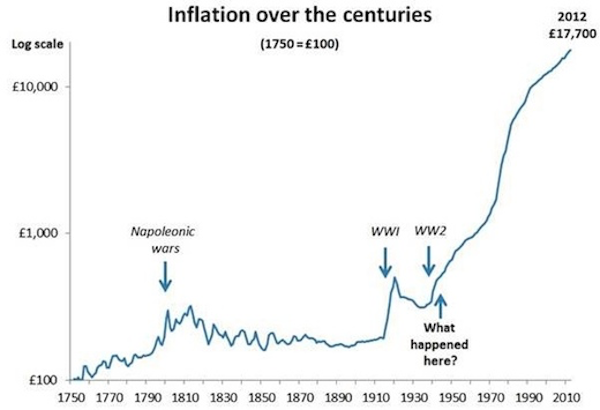

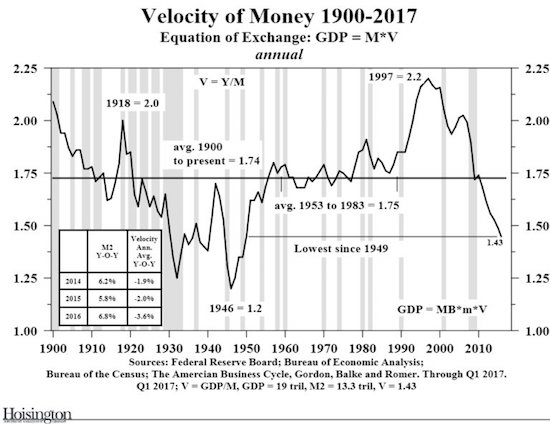

Which, in case you haven’t noticed, are already doing very poorly, much worse than the media -let alone politicians- will tell you. In fact, the chances that the richer countries will ‘recover’ from the effects of their debt binge are about on par with those of renewable energy sources becoming cheaper than fossil fuels -barring subsidies. If only because producing them depends entirely on those same fossil fuels. All the rest of what you hear is just con.

The people of India obviously know it, and you might as well. It’s going to cost many trillions of dollars to replace even a halfway substantial part of our fossil energy use with renewables, and we already don’t have that kind of money today. We will have much less tomorrow.

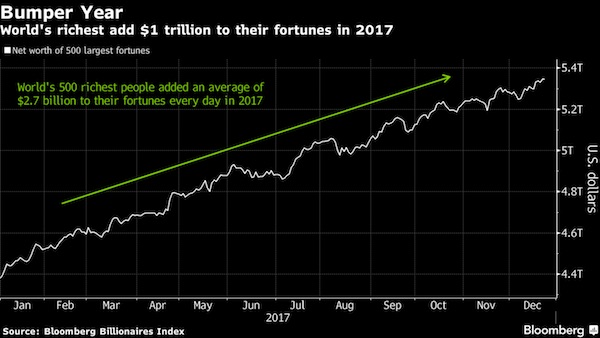

Besides, despite all the talk of Big Oil turning into Big Energy, Shell et al are not energy companies, they’re oil -and gas- companies, and they’ll defend their (near) monopolies tooth and claw. Especially now that their market caps are sinking like so many stones. They have no money left to invest in anything, let alone an industry that’s not theirs. They lost some $250 billion in ‘value’ this week alone. They’re getting killed.

In the same vein, China can’t close more than a token few of its most polluting plants. China’s getting killed economically. And for all nations and corporations there’s one principle that trumps all: competitive advantage. If going ‘green’ means losing that, or even some of it, forget it. We won’t volunteer to go green if it makes us less rich.

And who do you think represents big oil -and the bankers that finance them- more than anyone else? Right, your same leaders again, who make you pay for the by now very extensive and expensive security details that keep them from having to face you. Just like they’re planning to make you pay dearly for the illusion of a world running on renewables.

Because that’s where the profit is: in the illusion.

Whatever makes most money is what will drive people’s, corporations’, and nations’ actions going forward. Saving energy and/or substituting energy sources is not what makes most money, and it will therefore not happen. Not on any meaningful scale, that is.

There will be attempts to force people to pay through the nose to soothe their consciences -which will be very profitable for those on the receiving end-, but people’s ability to pay for this is shrinking fast, so that won’t go anywhere.

The only thing that could help save this planet is for all westerners to reduce their energy use by 90%+, but, though it is theoretically and technically feasible, it won’t happen because the majority of us won’t give up even a part of our wealth, and the powers that be in today’s economies refuse to see their profits (re: power) and those of their backers go up in -ever hotter- air.

The current economic model depends on our profligate use of energy. A new economic model, then, you say? Good luck with that. The current one has left all political power with those who profit most from it. And besides, that’s a whole other problem, and a whole other issue to protest.

If you’re serious about wanting to save the planet, and I have no doubt you are, then I think you need to refocus. COP21 is not your thing, it’s not your stage. It’s your leaders’ stage, and your leaders are not your friends. They don’t even represent you either. The decisions that you want made will not be made there.

There will be lofty declarations loaded with targets for 2030, 2050 and 2100, and none of it will have any real value. Because none of the ‘leaders’ will be around to be held accountable when any of those dates will come to pass.

An imploding global economy may be your best shot at lowering emissions. But then again, it will lead to people burning anything they can get their hands on just to keep warm. Not a pretty prospect either. To be successful, we would need to abandon our current political and economic organizational structures, national governments and ‘up’, which select for the sociopaths that gather behind their heavy security details to decide on your future while gloating with glee in their power positions.

Better still, we should make it impossible for any single one of them to ever be elected to any important position ever again. For now, though, our political systems don’t select for those who care most for the world, or its children. We select for those who promise us the most wealth. And we’re willing to turn a blind eye to very many things to acquire that wealth and hold on to it.

The entire conference is just an exercise in “feel good”, on all sides. Is there anyone out there who really thinks the likes of Bill Gates and Richard Branson will do anything at all to stop this world from burning to the ground? You have any idea what their ecological footprints are?

Sometimes I think it’s the very ignorance of the protesting side that dooms this planet. There’s a huge profit-seeking sociopathic part of the equation, which has caused the problems in the first place, and there’s no serious counterweight in sight.

Having these oversized walking talking ego’s sign petitions and declarations they know they will never have to live up to is completely useless. Branson will still fly his planes, Gates will keep running his ultra-cooled server parks, and Obama and Merkel will make sure their economies churn out growth ahead of anything else. Every single country still demands growth. Whatever gains you make in terms of lower emissions will be nullified by that growth.

And in the hallways, ‘smart’ entrepreneurs stand ready to pocket a ‘smart’ profit from the alleged switch to clean energy. At the cost of you, the taxpayer. And you believe them, because you want to, and because it makes you feel good. And you don’t have the knowledge available to dispute their claims (hint: try thermodynamics).

You’re seeking the cooperation of people who let babies drown and who incessantly bomb the countries these babies and their families were seeking to escape.

I’m sorry, I know a lot of you have a lot of emotion invested in this, and it’s a good emotion, and you’re thinking this conference is really important and all, and our ‘last chance’ to save the planet. But you’ve been had, it’s as simple as that. And co-opted. And conned.

And it’s not the first time, either. All these conferences go the same way. To halt the demise of the planet, you can’t rely on the same people who cause it. Never works.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.