DPC Engineer at his post, Michigan Central RR 1904

T’was the day before Brexit…

• US Stocks Have Best Day Since March On Clinton Relief Rally (MW)

U.S. stocks on Monday had their best day since March on a%age basis after the Federal Bureau of Investigation said its review of a new batch of Democratic presidential nominee Hillary Clinton’s emails won’t lead to charges. Gains were broad, with the Dow Jones Industrial Average reclaiming the key 18,000 level and the S&P 500 snapping its nine-day losing streak, the longest since 1980. The slide had been attributed partly to polls showing a closer contest between Clinton and Republican rival Donald Trump. The Dow Jones Industrial Average soared 371.32 points, or 2.1%, to close at 18,259.60. The Dow’s rally marks its best session before a presidential election since Nov. 7, 1932, when the blue chip index rose 3.5%, according to Dow Jones data.

The S&P 500 index rose 46.34 points, or 2.2%, to finish at 2,131.52. The Nasdaq Composite climbed 119.80 points, or 2.4%, to end at 5,166.17. FBI Director James Comey informed lawmakers on Sunday that there were no new findings in the additional emails discovered on the computer of former Rep. Anthony Weiner, whose estranged wife is Clinton aide Huma Abedin. News that the FBI had discovered the new batch of emails just over a week ago jolted the presidential election race, taking a toll on Clinton’s lead in polls. “The rally is all about Clinton having a better chance of winning, though I don’t think the market is celebrating her policies so much as reflecting how markets, like many Americans, are fearful of the unknown that comes with Trump,” said James Meyer, CIO at Tower Bridge Advisors.

As Reuters/IPSOS reports a 90% chance of a Hillary victory.

• Investors Aren’t Ready to Dump Their Trump-Upset Hedges (BBG)

Some of the biggest investors are holding tight to their hedges against market swings should Donald Trump be elected U.S. president, even after the FBI absolved Hillary Clinton a second time of committing a crime. Millennium Global Investments is sticking to its view that the Republican candidate still has a 35% chance of winning the vote Tuesday. Old Mutual Global Investors says it’s keeping its protection as prospects of a surprise victory by the political novice can’t be ruled out. Janus Capital International echoes that view. Together they manage more than $500 billion. Polls still show a tight race hours after the FBI said it adhered to an earlier finding that absolved Clinton of crime in handling e-mails as secretary of state.

While that signaled a boost for her to become the first female president, investors continue to hark to the scenario of the U.K. Brexit referendum in June, saying they’re focused on not getting burned by underestimating a resurgent underdog vote. “I’m not sure if this is a game changer,” said Richard Benson, a London-based money manager at Millennium Global. “I haven’t changed my positions because of this new development. It may halt the Trump momentum that had seen a sharp narrowing of the polls. The issue now is how many quiet Trump supporters are out there.” Benson declined to reveal details of his stakes, saying he has “a number of good/risk reward positions with limited downside established,” to hedge the election outcome.

But today everyone seems to think they already know?!

• Options Price In One of Biggest Stock Moves on Record for US Election (BBG)

Get ready for some volatility. With polls opening nationwide in less than 24 hours, Wall Street is trying to grapple with what different election outcomes would mean for markets across the globe. If options markets are correct, the S&P 500 could move 3.7%, or roughly 80 points, the day after the election. “Implied volatilities surged across asset classes last week as investors grappled with the increasing probability of a Trump presidency,” Mandy Xu of Credit Suisse wrote in a note the day before the election. “S&P 500 Nov 7th vs. 9th options are implying a 3.7% one-day move for the election, which if realized, would be the 3rd-largest move on record in the past 70 years.”

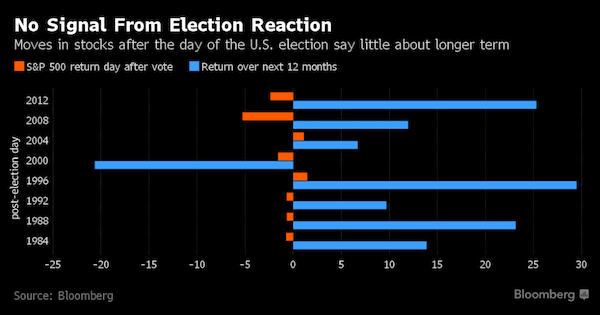

A range of different assets have betrayed sensitivity to the odds of a Republican victory. The Mexican peso, for instance, surged on the recent news that the FBI is sticking to its prior conclusion that Hillary Clinton’s handling of her e-mails as Secretary of State did not involve any criminal action. Other areas to watch are U.S. Treasuries, the U.S. dollar, and emerging-market stocks. Of course, there is reason to believe that these reactions will be short-lived. While the S&P 500 typically swings 1.5% the day after the vote, gains or losses over the first 24 hours predict the market’s direction 12 months later less than half the time, according to Bloomberg data.

“The CIA has been trying ever since 1949 to overthrow Syria’s Ba’athist government – the only remaining non-sectarian government in the Middle East other than the current Egyptian government.”

• Vote As If Your Life Depended On It… Because It Does (Zuesse)

Hillary has repeatedly said: “We should also work with the coalition and the neighbors to impose no-fly zones that will stop Assad from slaughtering civilians and the opposition from the air. Opposition forces on the ground, with material support from the coalition, could then help create safe areas where Syrians could remain in the country, rather than fleeing toward Europe.” This would mean that U.S. fighter-jets and missiles would be shooting down the fighter-jets and missiles of the Syrian government over Syria, and would also be shooting down those of Russia. The Syrian government invited Russia in, as its protector; the U.S. is no protector but an invader against Syria’s legitimate government, the Ba’athist government, led by Bashar al-Assad.

The CIA has been trying ever since 1949 to overthrow Syria’s Ba’athist government – the only remaining non-sectarian government in the Middle East other than the current Egyptian government. The U.S. supports Jihadists who demand Sharia law, and they are trying to overthrow and replace Syria’s institutionally secular government. For the U.S. to impose a no-fly zone anywhere in Syria would mean that the U.S. would be at war against Russia over Syria’s skies. Whichever side loses that conventional air-war would then have to choose whether to surrender, or instead to use nuclear weapons against the other side’s homeland, in order for it to avoid surrendering. That’s nuclear war between Russia and the United States. Would Putin surrender? Would Hillary? Would neither? If neither does, then nuclear war will be the result.

Let me think. Putin?

• What’s Driving The Recent Slump In US Imports? (WS)

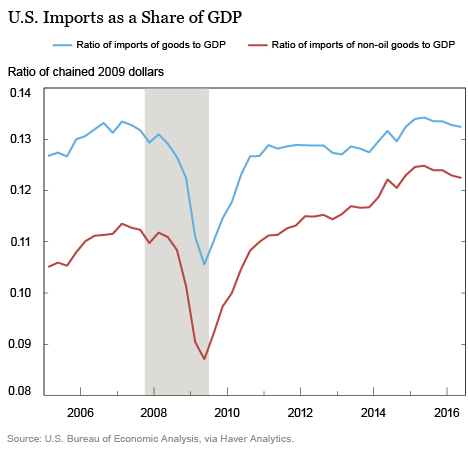

The dollar has strengthened against other currencies since mid-2014 as the Fed was tapering QE Infinity out of existence, and as it began flip-flopping about rate increases. Dollar strength should have done two things in terms of international trade: 1) Weaken exports as US goods would become less competitive for buyers using other currencies; 2) Strengthen imports as imported goods would be cheaper compared to US-made goods. The first has happened. But the second has not happened: Imports have been in a down-trend since mid-2015. This is something that should not happen when the dollar is strong, and it has flummoxed the folks at the New York Fed’s Liberty Street Economics: “The growth in US imports of goods has been stubbornly low since the second quarter of 2015, with an average annual growth rate of 0.7%. Growth has been even weaker for non-oil imports, which have increased at an average annual rate of only 0.1%.”

So oil imports cannot be blamed. This is in sharp contrast to the pattern in the five quarters preceding the second quarter of 2015, when real [inflation adjusted] non-oil imports were growing at an annualized rate of 8% per quarter. The timing of the weakness in import growth is particularly puzzling in light of the strong US dollar, which appreciated 12% in 2015, lowering the price of imported goods relative to domestically produced goods. The “recent slump” in imports of non-oil goods becomes clear in this chart that shows imports as a ratio of GDP, adjusted for inflation. The ratio of non-oil imports = red line; the ratio of total goods imports (including oil) = blue line:

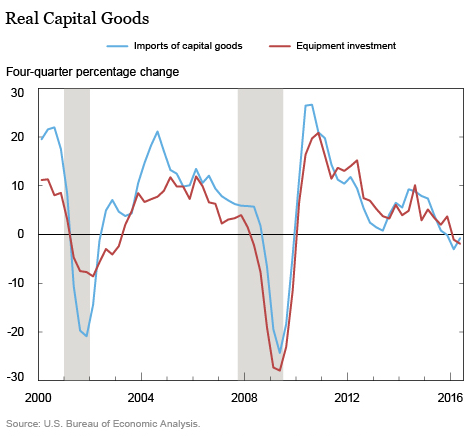

[..] Imports of capital goods are “very highly correlated” with investment by businesses in equipment. Alas: “Equipment investment has been unusually weak, with its four-quarter%age change falling into negative territory, which is unusual outside a recession period. These data suggest that the slowdown in import growth likely stems from whatever is behind the weakness in equipment, rather than from trade-specific factors such as trade policies or higher trade costs.” This chart shows the deterioration of imports of capital goods and equipment, adjusted for inflation. Note how the declines in the prior two cycles were followed by recessions:

The poisoned chalice inherited by the new president.

• Portrait of the American Debt Slave, as of Q3 (WS)

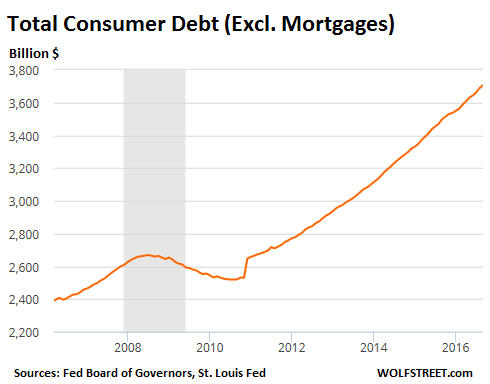

Consumer debt rose by $19.3 billion in September to $3.71 trillion, another record in a five-year series of records, the Federal Reserve’s Board of Governors reported on Monday. Consumer debt is up 6% from a year ago, at a time when wages are barely creeping up and when consumer spending rose only 2.4% over the same period. This follows the elegant principle of borrowing ever more to produce smaller and smaller gains in spending and economic growth. Which is a highly sustainable economic model with enormous future potential, according to the Fed. Consumer debt – the Fed uses “consumer credit,” which is the same thing but sounds a lot less onerous – includes student loans, auto loans, and revolving credit, such as credit cards and lines of credit. But it does not include mortgages. And that borrowing binge looks like this:

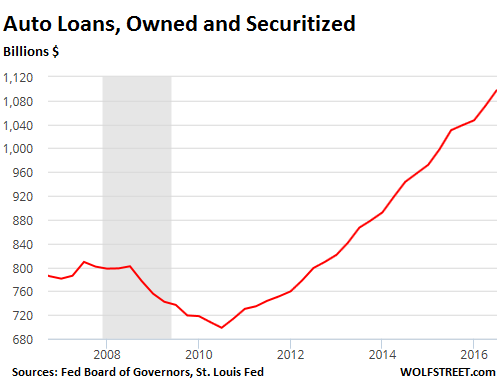

Diving into the components, so to speak: outstanding balances of new and used vehicle loans and leases jumped by $22.6 billion from Q2 to $1.098 trillion, another record in an uninterrupted four-year series of records. They’ve soared 38% from Q3 2012, the time when auto loans regained the glory levels from before the Financial Crisis:

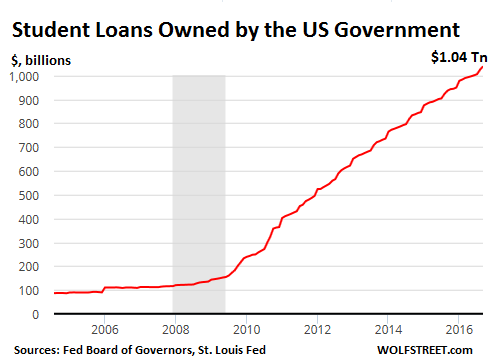

Then to the next-generation debt slaves, many of whom might not even know yet what that term means since they haven’t started to make payments on it. Total student loans, owned by the US government and by private-sector lenders, were $1.396 trillion at the end of September. The portion owned by private-sector lenders fell during the third quarter by $4.8 billion to $357.6 billion, as they’re pulling back from this business. But student loans owned by the government jumped by $14.2 billion in September alone, and by $37.5 billion in Q3, to a new record of $1.039 trillion. So here’s what’s coming at these hapless debtors:

All you need to know about world trade.

• China’s Exports -7.3%, Imports -1.4%, on ‘Tepid Global Demand’ (BBG)

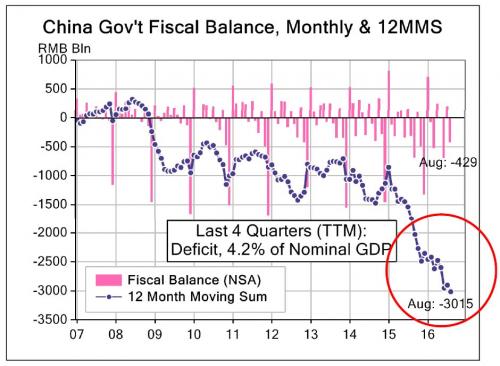

China’s exports fell for a seventh month, leaving policy makers reliant on domestic growth engines to hit their economic expansion goals. Overseas shipments dropped 7.3% from a year earlier in October in dollar terms. Imports slipped 1.4%. Trade surplus widened to $49.1 billion. A depreciation of about 9% in the yuan since August 2015 has cushioned the blow from tepid global demand, but failed to give shipments a sustained boost. Rising input costs and surging wages have flattened exporter profit margins to the point where many can no longer discount and may raise prices, according to interviews at the Canton Fair last month. With global demand tepid, policy makers are relying on infrastructure investment and a property led pick up in local demand to reach their expansion goal of at least 6.5% this year.

“External demand remains sluggish across the board,” said Julia Wang, an economist at HSBC in Hong Kong. “On the import side, commodities demand is still holding up well, suggesting that domestic infrastructure investment likely remains strong.” “Trade’s contribution to China’s economy is now diminishing as the economy increasingly depends on domestic demand,” said Zhu Qibing, chief macro economy analyst at BOCI International (China) in Beijing. “With both global and domestic growth unlikely to accelerate much further, the medium-term outlook for Chinese trade remains challenging,” said Julian Evans-Pritchard, an economist at Capital Economics in Singapore. “The ongoing cyclical rebound in China’s economy should support imports for another quarter or two but is unlikely to last.” Exports to U.S. slipped 5.6% in October and fell 8.7% to EU. Imports from U.S. fell 6.9%.

Is Beijing just going through the motions of stopping this?

• China’s Investors Get Creative About Capital Controls (BBG)

China’s policy makers are playing catch-up as investors get more creative in evading capital controls. The authorities are taking a series of steps to plug loopholes, such as a potential plan to curb transactions that use the bitcoin digital currency to take funds out of the country, as well as a statement from UnionPay Co. limiting mainlanders from using its cards to buy insurance in Hong Kong. These add to more traditional measures, including an order seen as asking mainland banks to reduce foreign-exchange sales. These measures, all reported in the past two weeks, follow a period during which Chinese officials and state media stepped up efforts to talk up the yuan even as the currency fell to six-year lows at home and overseas.

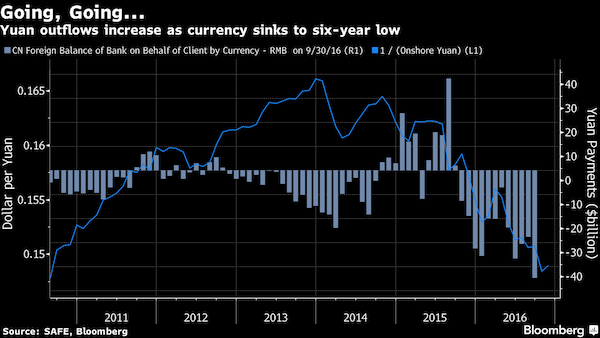

While the exchange rate received some relief last week as the dollar dropped on concern over the U.S. presidential election, the onshore yuan is still down about 4.2% for the year in Asia’s worst performance. The nation’s foreign-exchange reserves plunged $45.7 billion in October, the most since January, according to data released Monday. “The People’s Bank of China is doing this now because data show capital outflow pressures remain significant and there are no signs of a reversal,” said Ken Cheung, a currency strategist at Mizuho Bank Ltd. in Hong Kong. “It looks like the government will block outflow channels as and when they find them. This will slow the yuan’s internationalization and discourage foreign investment due to concern money will get locked up once invested.”

The yuan’s accelerated declines – it fell 1.53% last month in the biggest drop since a surprise devaluation in August last year – have worsened outflow pressures. This has prompted investors to find innovative ways to move their wealth overseas by bypassing a range of curbs set in place after the devaluation. A record $44.7 billion left the nation in September in yuan payments rather than in foreign exchange, official data show. Also, regulators have recently noticed that some investors bought bitcoins on local exchanges and sold them offshore, evading rules on foreign exchange and cross-border fund flows, according to people familiar with the matter.

Mainland investors have flocked to Hong Kong to buy insurance policies, which offer a way to skirt money controls. A Bloomberg News report in March this year cited an example from Hong Kong insurance agent Raymond Ng, who said he swiped the credit cards of a mainland Chinese client 800 times for the purchase of HK$28 million ($3.6 million) of insurance policies. Chinese firms have also accelerated overseas acquisitions, with spending on international acquisitions and investments reaching $222.8 billion so far this year, more than double last year’s amount.

The fall gets dramatic. And still exports fall.

• Yuan Heads Toward Six-Year Low as Capital Outflows Fuel Weakness (BBG)

The yuan weakened toward its lowest level in six years as the greenback strengthened and the government struggled to plug loopholes in capital controls. The exchange rate fell 0.03% to 6.7788 per dollar at 12:04 p.m. local time, extending a 0.3% slump on Monday that was the biggest in a month. The latest data show China’s foreign-exchange reserves dropped last month by the most since January while exports plunged 7.3%, adding pressure for further currency weakness. The yuan slid for a sixth day against a basket of peers. Officials have stepped up measures to curb outflows as investors seek to hedge against a weakening currency and traders ascribed a higher likelihood that Hillary Clinton will become the next U.S. president, boosting the dollar.

In recent weeks China limited the use of UnionPay’s cards to buy insurance products in Hong Kong, while Bloomberg News reported authorities are planning to curb transactions that use bitcoins to shift funds out of the country. “The larger-than-expected drop in reserves underscores capital outflows in October, and as we know central banks also intervene in the forward markets, the reserves data are hardly likely to give a full picture of fund exits,” said Fiona Lim, a senior currency strategist at Malayan Banking in Singapore. “And there is wide expectation for the yuan to weaken against the dollar beyond the U.S. presidential election result. So all in all, risks to the yuan really are to the downside.”

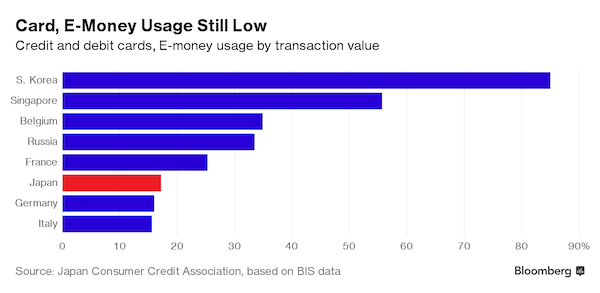

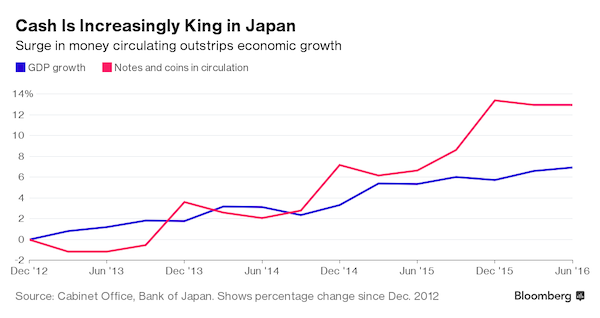

“More than 101 trillion yen ($966 billion) of cash was circulating at the end of October. It was used for more than 80% of transactions by value in 2014.”

• Cash Is Still King in Japan, and That is a Problem for the BOJ (BBG)

As anyone who has visited Japan knows, cash is still king. Even though many places now take credit cards, Apple Pay and other forms of cashless technology, the actual amount of notes and coins circulating in the country has doubled in 20 years. And that’s while the economy and population has shrunk. More than 101 trillion yen ($966 billion) of cash was circulating at the end of October. It was used for more than 80% of transactions by value in 2014. One problem with this preference for notes and coins is that it limits the central bank’s policy options. The tendency of Japanese to prefer cash means that any attempt to further lower negative interest rates or to impose them on private bank accounts might push people to take their money from the banking system and add it to their stash under the mattress.

The decision in Europe to stop printing the €500 note prompted concerns that governments were trying to make it harder to hold cash, and thus make it easier to impose deeper negative interest rates. In Sweden, where the vast majority of payments don’t use cash and many bank branches won’t even accept cash deposits and withdrawals, the central bank argued last year that negative rates function better in a cashless society. Rates are minus 0.5% in Sweden, but that isn’t an option in Japan, which “is a cash-based economy,” according to former BOJ board member Sayuri Shirai. The BOJ could maybe cut the negative interest rate to minus 0.2% or minus 0.3% at most, she said earlier this month. It’s currently minus 0.1%.

Keep your eye on this going forward.

• In “Seismic Shift”, Saudis Halt Egypt Oil Supplies As Cairo Turns To Iran (ZH)

While the proxy war in the middle-east rages, a curious, and largely under the radar pivot has been taking place in one of the countries directly impacted by Hillary Clinton’s foreign policy: Egypt. In mid-October, we reported that, for the first time ever, Russia and Egypt would conduct joint military drills. This followed news that Russia will sell attack helicopters to the North African nation and invest billions in Egyptian infrastructure. These items, along with the fact that Egypt is eager to be re-granted Russian tourism rights for its citizens after recent bad blood between the countries, lead one to the logical conclusion that Egypt has every incentive to cooperate with Russia going forward.

This means when the Russian fleet reaches the Mediterranean – whether the intent is to park in those waters and bombard Aleppo, as some believe, or merely to project Russian might to the world, as others suggest – it will be flanked by friendlies on three sides. Turkey to the north, Syria to the east, and Egypt to the south. It appears, however, that the quiet Egyptian pivot has not gone unnoticed by the US and its mid-east allies, and on Monday, Saudi Arabia informed Egypt that critical shipments of oil products expected under a $23 billion aid deal have been halted indefinitely, which according to Reuters suggests a deepening rift between the Arab world’s richest country and its most populous.

The official narrative is that while Saudi Arabia has been a major donor to Egypt since President Abdel Fattah al-Sisi seized power in a violent countercoup in mid-2013, Riyadh has become frustrated with Sisi’s lack of economic reforms and his reluctance to be drawn into the conflict in Yemen. During a visit by Saudi King Salman in April, Saudi Arabia agreed to provide Egypt with 700,000 tonnes of refined oil products per month for five years but the cargoes stopped arriving in early October as festering political tensions burst into the open. What is curious is that the deal fell apart just weeks after Cairo suddenly became friendly with Moscow.

While Egyptian officials said since that the contract with Saudi Arabia’s state oil firm Aramco remains valid and had appeared to expect that oil would start flowing again soon, on Monday, however, Egyptian Oil Minister Tarek El Molla confirmed it had stopped shipments indefinitely. Aramco has not commented on the halt and did not respond to calls on Monday. “They did not give us a reason,” an oil ministry official told Reuters. “They only informed the authority about halting shipments of petroleum products until further notice.”

Today 20,000 accounts are plundered. What is tomorrow it’s ten times as many, or 100 times? Who’s going to pay you back? How safe is your money in banks?

• Tesco Bank Freezes Transactions After Cash Stolen From 20,000 Accounts (G.)

Tesco Bank was scrambling to restore services for customers on Monday after it admitted 40,000 customers had been affected by an online heist over the weekend when money was stolen from half the number of accounts targeted. Tesco immediately froze online transactions and pledged to refund the 20,000 customers whose current accounts had been plundered in one of the largest cyber-thefts ever to hit a UK bank. Benny Higgins, chief executive of the supermarket chain’s banking arm, said the decision to suspend some banking activities was an attempt to protect customers from “online criminal activity”. The National Crime Agency (NCA) is one of a number of organisations scrutinising what has taken place at a bank with more than 7 million customers.

“We apologise for the worry and inconvenience that this has caused for customers, and can only stress that we are taking every step to protect our customers’ accounts,” said Higgins. Refunds to customers – some of whom claimed they had lost thousands of pounds – were under way on Monday but Higgins was facing demands from MPs for an explanation of what had gone wrong in the face of repeated warnings about cybersecurity from regulators in recent years. It is thought to be the first time such a large group of UK bank customers have lost money as a result of a single cyber-crime incident and could prove costly for its parent supermarket group in reputational as well as financial terms.

There were also concerns of collateral brand damage for other digital and online banks attempting to compete with established high street players, as Tesco raced to keep pace with the deluge of complaints on social media about difficulty reaching its call centres in Glasgow and Newcastle. Higgins provided little explanation for what had gone wrong over the weekend, when the bank started to text customers to warn them it had detected suspicious activity. However, he told the BBC it was “a systematic, sophisticated attack”.

Inevitable for a society built on bubbles.

• Australia Returns To The Gilded Age Of Rent-Seekers And Robber Barons (RR.)

With the world currently in the process of tearing itself apart piece by piece as the failed Western neoliberal project succumbs to the internal contradictions and terminal imbalances of unfettered globalisation, finance capitalism, and residual and covert imperialism, you’d be forgiven for missing the devastating and cynical betrayal of young Australians that recently happened right under our noses. It escaped the attention of our myopic and clueless presstitute media for nearly four months. But before I discuss that betrayal, which at first glance seems to be just garden variety political neglect and bastardry, let’s first remind ourselves of the report released earlier this year by the University of Melbourne into the state of income and wealth equality, retirement outcomes and home ownership in Australia.

The HILDA (Household, Income and Labour Dynamics in Australia Survey) report, which rightly garnered a huge amount of attention in the media and commentariat, laid bare exactly how far down the path of class warfare that Australia has travelled. Almost by stealth over several decades, short-sighted, self-interested and often corrupt decisions have been made in all offices of power in this nation to restructure our entire economy and society toward the extreme and nearly exclusive benefit of landowners, rentiers, and those that seek to extract unearned windfall gains from the fruits of our considerable prosperity. We have created a system wherein the tax burden for land speculators is less than that for workers, innovators and savers. Far less. Indeed, the tax burden on land is often negative.

We actually reward landowners and speculators while punishing workers, innovators and savers. This is a balance that has striking similarities with the Gilded Age of the late 19th century, wherein landowners, monopolists and creditors (the modern equivalent of the medieval ‘Robber Barons’) bled economies dry to such an extreme extent, that capitalism itself was reinvented, giving birth to the Progressive Era, which attempted to save the world from the grip of rentiers. Few today would recall that the origin of the term Progressive, as used in political context, was this tumultuous moment in the history of industrialisation. The leftwing or so-called progressive parties in today’s world have all but abandoned any pretence to protecting society and the economy from contemporary Robber Barons and rent-seekers.

Blame countries, blame the EU, for sure. But with €370 million having gone to (i)NGO’s, you MUST wonder what they have been doing with all that cash. Which is why the Automatic Earth supports O Allos Anthropos, which while it has no access to these funds, is far more effective. Give us just a fraction of that and we’ll be able to solve many of the issues that are still not being tackled.

I’m working on a Christmas fund raiser for Athens, but of course you can donate today as well. Any amount donated via our Paypal widget (top left corner) that end in $0.99 or $0.37 will as always go to Athens’ poor and homeless and refugees.

• Winter is Coming for Refugees in Greece (HRW)

“Winter is coming” has become an anxious refrain among asylum seekers living in tented refugee camps across Greece, that offer no shelter from damp and cold. Ali, a 25-year-old father of three very young children from Afghanistan, including a 6-year-old who has a disability, was living with his family in a tent pinned to the ground of Elliniko camp in Athens, when I met him in late October. “Now that winter is coming, the conditions are not good… When it rains water gets inside our tent. And every morning, the inside of our tent is wet because of the damp,” he explained. We heard similar testimonies across Greece. Ali’s predicament reflects Europe’s utter failure to respond collectively and compassionately to people seeking protection.

More than 60,000 women, men, and children are stranded in Greece as a result of Western Balkan border closures and a poorly executed EU relocation plan. Thousands are restricted to abysmal and volatile conditions on the islands, while tens of thousands face deplorable conditions without access to services in the camps on the mainland. As part of a winterization plan, the UN refugee agency (UNHCR) and Greek authorities are replacing tents with prefabricated housing units in some of the over 40 camps across Greece. At other sites, winter items are being distributed and in fifteen of them infrastructure improvements are planned, such as installing heating. However, many of the largest and worst camps where thousands of people live, will essentially remain unsuited for winter.

The government says it plans to close most of these facilities by January, but if the asylum seekers are not relocated to other appropriate sites, they will soon find themselves exposed to worsening weather conditions without proper shelter. On the islands, efforts are underway to transfer a small number of people, who are presently living in severely overcrowded and filthy conditions, to the mainland. But Greece is under pressure from the European Commission to contain most asylum seekers on the islands to prevent onward movement to other EU countries.

With winter approaching, there is an urgent need to transfer people to hardier facilities and in the short-term, fully adapt remaining camps for falling temperatures. In the long-term, the Greek authorities should end encampment. With almost €128 million provided by the European Commission to the Greek government and €370 million given to humanitarian aid agencies and international organizations, including the UNHCR, there’s no excuse for the failure to provide humane and dignified reception conditions to asylum seekers.

Home › Forums › Debt Rattle November 8 2016