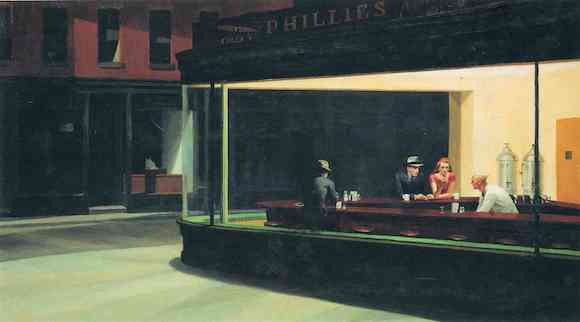

Edward Hopper Nighthawks 1942

Scott Adams: “Trump’s “I’ll only be a dictator for one day” is looking brilliant. Total nut-bait.”

BREAKING: Media warns if Trump wins next election, the world will come to an end. He will assassinate generals, shoot visitors at the White House, kill the First Lady, Suspend the Constitution, kill democracy, destroy the justice department. WATCH pic.twitter.com/L8wQGO2bUH

— Simon Ateba (@simonateba) December 13, 2023

Nap Macgregor

Tucker

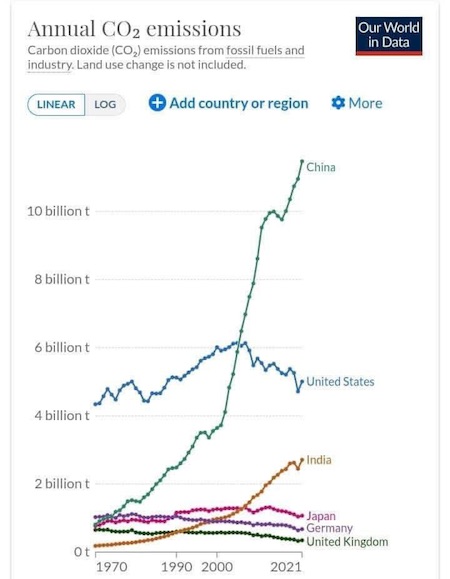

NEW – @TuckerCarlson talks about how Biden's War in Ukraine accelerated the growth of BRICS, uniting half of the world against America.

"I don't think most Americans know that the consequences of what the Biden administration did in February 2022 will be things your… pic.twitter.com/r0Yyll19uE

— KanekoaTheGreat (@KanekoaTheGreat) December 13, 2023

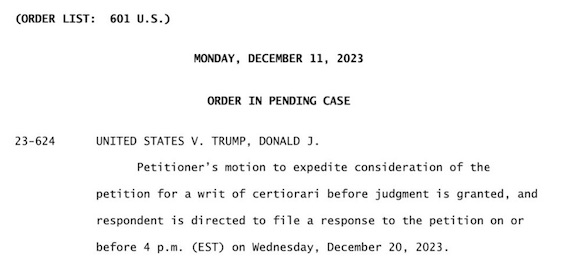

“The justices could decide as soon as next week whether to expedite the review.”

• SCOTUS Accepts Case That Could Demolish Entire Basis For Jan. 6 Prosecutions (ZH)

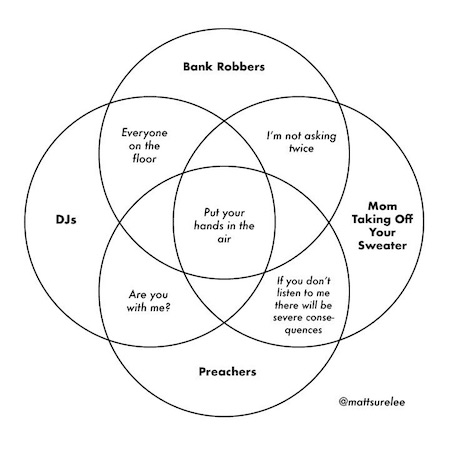

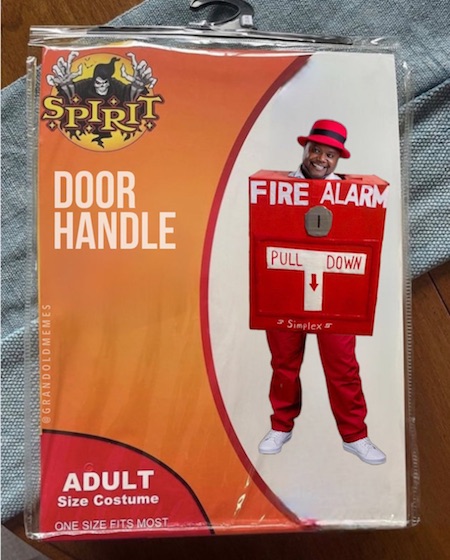

The US Supreme Court on Wednesday agreed to hear an appeal from a Jan. 6 Capitol riot defendant which will highlight a law used to charge hundreds of people in connection with that fateful day. The case will decide whether defendant Joseph Fischer can be charged under a 2002 law which stemmed from the Enron collapse which makes it a crime to obstruct or impede an official proceeding (like pulling a fire alarm to delay a vote?). The law has been invoked against Trump, along with 327 Capitol riot defendants – which an appeals court said the government could continue to invoke. Under the Corporate Fraud Accountability Act of 2002, anyone who “corruptly— (1) alters, destroys, mutilates, or conceals a record, document, or other object, or attempts to do so, with the intent to impair the object’s integrity or availability for use in an official proceeding; or (2) otherwise obstructs, influences, or impedes any official proceeding, or attempts to do so” is subject to prosecution.

A key word in the provision, “otherwise,” has been key – as nearly every judge overseeing riot-related cases in DC federal court have agreed with government prosecutors that rioters who sought to prevent Congress from certifying Joe Biden’s 2020 victory were “otherwise” obstructing that proceeding. One judge, Carl J. Nichols, ruled that “otherwise” could apply to other kinds of document-tampering. The US Court of Appeals for the DC Circuit disagreed in a split decision, which will now go to the Supreme Court for review. “We cannot assume, and think it unlikely, that Congress used expansive language to address such narrow concerns,” wrote Judge Florence Pan, calling Nichols’s ruling a “cramped, document-focused interpretation.” [..] “We must accept, and think it far more likely, that Congress said what it meant and meant what it said.”

Defense attorneys have argued that such a broad interpretation could put many otherwise law-abiding activists at risk of felony charges, which Judge Gregory Katsas agreed with. While the riot involved “extreme conduct” not protected by the First Amendment, Katsas wrote, under this interpretation of the law a “peaceful protestor in the Senate gallery” could be convicted of a felony for trespassing while exercising free speech rights. Katsas argued that the law can apply beyond documents but only to people who “hinder the flow of truthful evidence to a proceeding.” -WaPo. The decision to hear the case comes just two days after special counsel Jack Smith asked the Court to fast-track a decision on whether former President Trump is entitled to presidential immunity in his 2020 election interference case. The justices could decide as soon as next week whether to expedite the review.

Looks like SCOTUS material to me.

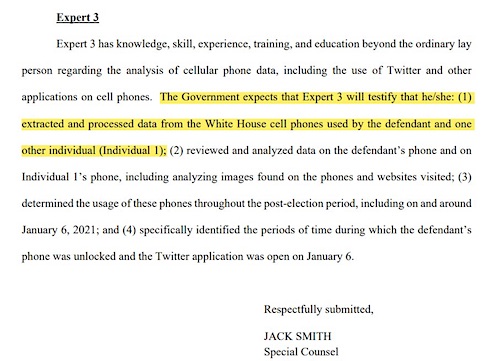

• Judge Halts Trump’s 2020 Election Case Amid Pending Immunity Appeal (Sp.)

US District Judge Tanya Chutkan has granted former President Donald Trump’s request to temporarily pause his 2020 election meddling case pending a decision of the appeals court on his presidential immunity, according to a Wednesday court order. “The court agrees with both parties that Defendant’s appeal automatically stays any further proceedings that would move this case towards trial or impose additional burdens of litigation on Defendant,” the order stated. “The court hereby STAYS the deadlines and proceedings scheduled by its Pretrial Order, as amended.” The order clarified though that the deadlines and proceedings in the 2020 election against Trump case are not permanently frozen but are rather “held in abeyance” until the appeals court makes its decision in the immunity case.

Should the appeals court reject Trump’s appeal, the US district court in the case will decide whether to keep the trial date as it is on March 4, or to move it further into the future, according to the order. Trump’s case stems from charges that were filed against in August and allege he orchestrated an effort to overturn the results of the 2020 presidential election that saw US President Joe Biden come out as the victor. The former president has pleaded not guilty in the case and has repeatedly blasted the legal case as being politically motivated. The appeals court received the case following Chutkan’s decision to reject a motion from the Trump camp that claimed the former president was immune from prosecution. At the time, Chutkan argued Trump cannot be shielded from prosecutorial actions over his deeds while in the Oval Office.

The development comes as special counsel Jack Smith called on the US Supreme Court on Monday to weigh in on whether the former commander-in-chief is in fact “absolutely immune from federal prosecution for crimes committed while in office or is constitutionally protected from federal prosecution when he has been impeached but not convicted before the criminal proceedings begin.” The Supreme Court subsequently agreed to fast-track the matter and called on Trump to issue a response to Smith’s motion by December 20.

“I think we have to go down that route. That doesn’t mean we have high crimes or misdemeanors — we may not ever. But let’s get the facts, and we’ll go from there.”

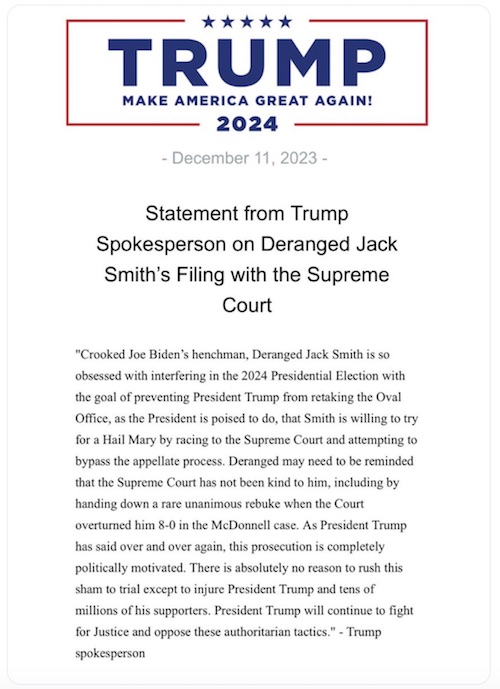

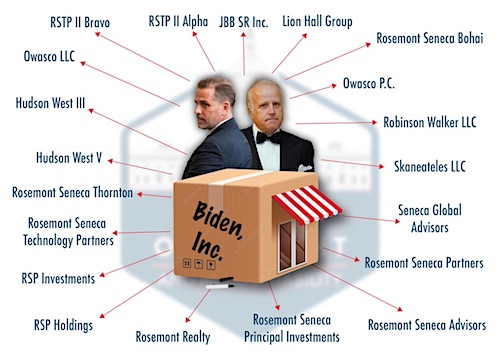

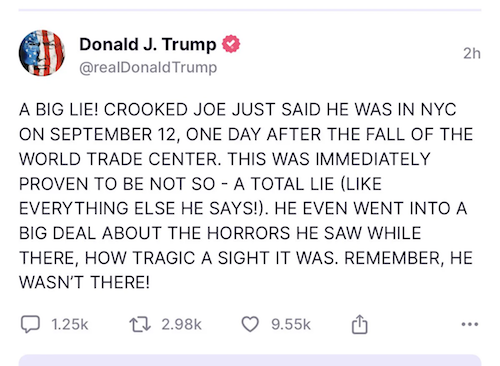

• US House Votes to Authorize Formal Impeachment Inquiry Against Biden (Sp.)

House Republicans voted to formally authorize an impeachment inquiry into US President Joe Biden on Wednesday, a step lawmakers believe is needed to enforce subpoenas issued by the House Oversight and Judiciary Committees, which are heading the impeachment effort. The vote, along partisan lines, saw Democrats overwhelmingly vote against the inquiry and all Republicans in favor of the measure. It cleared the lower congressional chamber 221 to 212. Biden’s son, Hunter Biden, has so far defied a House subpoena to testify behind closed doors. He has offered to testify publicly, arguing that Republicans do not want transparency in the proceedings. After the younger Biden no-showed his deposition earlier Wednesday, Reps. Jim Jordan (R-OH) and James Comer (R-KY) said in a statement that Hunter “defied lawful subpoenas and we will now initiate contempt of Congress proceedings.”

The president’s son did appear in Washington, DC, but not behind closed doors as Republicans demanded. Instead, he held a news conference in front of the Capitol, where he again offered to testify in public and called the investigation “illegitimate.” “I’m here today to make sure that the House committee’s illegitimate investigations of my family did not proceed on distortions, manipulated evidence, and lies,” Hunter Biden said, reading from a prepared statement. The inquiry vote was made more difficult for House Speaker Mike Johnson (R-LA) because of the recent expulsion of former Rep. George Santos (R-NY), which sharply narrowed the Republican hold on the US House. The White House has defied Republican subpoenas and requests for more information, including transcribed interviews with White House staff and Biden family members and their associates. The White House argues the impeachment probe is illegitimate because it was not ratified with a formal vote in the House; Wednesday’s vote invalidates that argument.

Previously, several moderate Republicans expressed hesitancy in voting for a formal impeachment inquiry, especially those in swing states where an on-the-record vote for an impeachment may hurt them politically. However, several moderate Republicans came out in favor of the inquiry as it became more apparent that the White House planned to do what it could to block the investigation. “If [Joe Biden is] not providing the information because he says there’s no formal impeachment inquiry, that means we need a formal impeachment inquiry to get the information,” Rep. Don Bacon (R-NE) said. “I think we have to go down that route. That doesn’t mean we have high crimes or misdemeanors — we may not ever. But let’s get the facts, and we’ll go from there.”

Hunter’s team appear spooked. They would rather have him in contempt of Congress than testifying at a closed-door hearing. The reason is that in a public hearing, classified material is off limits.

• Hunter Biden Defies Congressional Summons (RT)

US President Joe Biden’s son Hunter has refused to comply with a subpoena ordering him to testify before a Republican-led committee investigating his father’s involvement in his business dealings. House Republicans are expected to formalize impeachment proceedings against President Biden later on Wednesday. The House Oversight Committee issued a subpoena to Hunter Biden last month, ordering the president’s son to testify at a closed-door hearing on Wednesday. Along with the House Judiciary Committee, the Oversight Committee is leading an impeachment probe against President Biden and has released evidence suggesting that Hunter took tens of millions of dollars from foreign clients in exchange for access to his father while the latter was vice president of the US.

Hunter

NOW – Hunter Biden: "My father was not financially involved…"pic.twitter.com/IIf2kautvD

— Disclose.tv (@disclosetv) December 13, 2023

Speaking at a press conference outside the US Capitol, Hunter Biden denounced the impeachment inquiry as “illegitimate” and said that he would only testify at a public hearing. Classified information usually cannot be discussed in such a public session. “Let me state as clearly as I can: My father was not involved in my business. There is no evidence to support the allegations my father was involved in my business, because it did not happen,” he told reporters. However, Joe Biden has been photographed with several of his son’s clients, and Hunter’s former business partner – Devon Archer – told the Oversight Committee in July that Hunter’s position on the board of Burisma, a Ukrainian energy firm, was given to him solely to guarantee that the company would have influence over US policy.

Archer also alleged that Joe Biden dined multiple times with Hunter’s clients, and that Hunter received money transfers immediately after at least two of these meetings. According to files retrieved from Hunter’ Biden’s laptop and published by the GOP, his family received around $24 million in payments through shell companies from business figures and politicians in China, Kazakhstan, Romania, Russia, and Ukraine. Some 150 of these transactions were flagged as “suspicious” by the US Treasury Department, according to the committees. Hunter Biden’s decision to skip the closed-door deposition was expected. In a letter to Oversight Committee Chair James Comer last month, Hunter’s lawyer stated that he would only testify in public, for fear that the GOP would use his private sworn testimony to “distort the facts and misinform the public.”

Earlier this month, Comer and Judiciary Committee Jim Jordan warned Hunter’s lawyer that they would “initiate contempt of Congress proceedings” if the president’s son failed to comply with the subpoena. “We expect to depose the president’s son, and then we will be more than happy to have a public hearing,” Comer told reporters on Wednesday. In a post on X (formerly Twitter) on Wednesday morning, House Speaker Mike Johnson said that he would hold a vote later that day to formalize the ongoing impeachment inquiry. With Republicans holding a slim majority in the House of Representatives, the measure is expected to pass.

“That’s a decision to leave families waiting on the wrong side of the digital divide when we have the technology to get them high-speed service today.”

• Biden ‘Gave Federal Agencies Green Light’ to Target Elon Musk (Sp.)

The Federal Communications Commission (FCC) announced on Tuesday that it denied the Elon Musk-owned Starlink’s appeal and will not award the company a $866 million subsidy from the Universal Service Fund meant to expand broadband access to rural areas. Writing in fiery dissent, FCC Commissioner Brendan Carr accused the agency of targeting Elon Musk and his businesses at the behest of the Biden administration. Carr began his dissent by pointing out that US President Joe Biden told reporters in early November that Musk “is worth being looked at” after his purchase of Twitter, since renamed X. It notes that when Biden was pressed by a reporter on what ways the government would look into at Musk, the president responded “there’s a lot of ways.” “President Biden gave federal agencies a green light to go after him [Musk],” Carr wrote.

Carr then notes that the Department of Justice, the Federal Aviation Administration, the Federal Trade Commission, the National Labor Relation Board, the US Attorney for the Southern District of New York and the US Fish and Wildlife Service have all opened investigations into Musk or his businesses since Biden made those comments. The subsidy was planned to fund Starlink and help bring broadband internet to 640,000 rural homes in 38 states. In his dissent, Carr stated the FCC applied a novel new standard specifically for Starlink, ostensibly over concerns about how its low-Earth-orbit satellites (LEOs) made it impossible to pass and then applied that standard only to Starlink. He contends the decision by the FCC “cannot be explained by any objective application of laws, facts, or policy.” According to Carr, the FCC required that Starlink show it is currently providing the required 100 megabits per second (Mbps) download and 20 Mbps upload speed to the 640,000 homes, rather than the previous standard of providing that service to at least 40% of those homes by December 31, 2025.

The commissioner noted that none of the other companies awarded contracts by the FCC in 2020 are required to meet that standard and that if they were, none of them would pass it. He further argued that looking at what Starlink is currently providing in those areas “would be like watching the pace lap of a NASCAR race and then predicting that the cars will never exceed 50 MPH.” Had the FCC looked at more relevant data sets, Carr argued, it would have seen that Starlink is certainly capable of meeting the speed benchmark by 2025, noting Starlink now has a median download speed greater than 100 Mbps in 14 European countries. That, along with the number of new satellites in orbit and Starlink’s “detailed descriptions of its plan” would provide a “much richer and probative set of data” that would “confirm that Starlink is on track to meet its FCC obligations.”

The decision to deny Starlink, Carr argued, will hurt the rural communities it planned to serve. “By reversing course, the FCC has chosen to vaporize that commitment and replace it with . . . nothing,” Carr wrote. “That’s a decision to leave families waiting on the wrong side of the digital divide when we have the technology to get them high-speed service today.” Carr also argued that if the government ever decides to provide those areas with high-speed internet access, it will cost taxpayers significantly more. “[I]t will cost us orders of magnitude more money to do so […] extending high-speed fiber lines to these same areas will likely cost somewhere in the neighborhood of $3 billion based on past bidding patterns and analysis – more once you start accounting for inflation.”

“The Jerusalem Post reported recently that cars containing the blood stains or ashes of Israelis who died on 7 October would be crushed and – in what the paper said was a first – buried in a cemetery.”

• Israel Now Admits to ‘Immense Amount of Friendly Fire’ on October 7th (21CW)

For those who are paying attention to the actual evidence (or lack thereof) of “Hamas mass atrocities” on October 7th will have already known that an Israeli police investigation has already shown how Israeli Apache helicopters opened fire on the attendees of the Nova Music Festival that day. If widely disseminated, it would be a game changer, and would trigger a reversal on blind, unfettered US and UK support for Israel’s unprecedented massacre of Palestinian civilians in Gaza. So it’s hardly surprising that the mainstream media have completely blacked-out these explosive revelations. Initial Nova music festival revelations were mentioned in a Haaretz reported on November 18th, where an Israeli police source confirmed how an Israeli combat helicopter that arrived on the scene from the Ramat David base, and proceeded to fire on music festival attendees, estimating that some 364 people were ‘mowed-down’ there. And there’s more details coming out by the day…

Asa Winstanley from Electronic Intifada reports… Israel’s army on Tuesday admitted that an “immense and complex quantity” of what it calls “friendly fire” incidents took place on 7 October. The key declaration was buried in the penultimate paragraph of an article by Yoav Zitun, the military correspondent of Israeli outlet Ynet. It is the first known official army admission that a significant number of the hundreds of Israelis who died on 7 October were killed by Israel itself, and not by Hamas or other Palestinian resistance factions. An Israeli police source last month appeared to admit that some of the Israelis at the Supernova rave taking place near Gaza that day were hit by Israeli helicopters. A second police source later partially walked back the admission. Citing new data released by the Israeli military, Zeitun wrote that: “Casualties fell as a result of friendly fire on October 7, but the IDF [Israeli military] believes that … it would not be morally sound to investigate” them. He reported that this was “due to the immense and complex quantity of them that took place in the kibbutzim and southern Israeli communities.” The Ynet article also reported that “at least” one fifth of the Israeli army deaths in Gaza since the ground invasion began were also due to “friendly fire” incidents.

Drone footage released by the Israeli military last month shows the extent of the destruction of the cars fleeing the Supernova rave on 7 October, likely inflicted by Israeli drones and helicopters (RT/Israeli military)

Israel has in recent weeks faced increased internal pressure to investigate the failings of 7 October. On Monday in Tel Aviv, family members of those Israelis who died on 7 October established a new group calling for an official Israeli government investigation into the events of that day. One of the speakers accused the government of a “cover-up.” Israel does indeed appear to be covering up a lot of the evidence. The Jerusalem Post reported recently that cars containing the blood stains or ashes of Israelis who died on 7 October would be crushed and – in what the paper said was a first – buried in a cemetery. The paper provided a religious pretext for all this. Nonetheless, this is a worrying development which amounts to a state-sanctioned coverup of what could potentially be some of the most important forensic evidence from 7 October.

Since that day, there has been a steadily growing mountain of evidence that many – if not most – Israelis killed that day were killed by Israel itself. This evidence has been reported in English almost entirely by independent media, including The Electronic Intifada, The Grayzone, The Cradle and Mondoweiss. In one of the most recent revelations, an Israeli air force colonel admitted to a Hebrew podcast that they blew up Israeli homes in the settlements but insisted they never did so “without permission.” Colonel Nof Erez also said that 7 October was a “mass Hannibal” event – a reference to a controversial Israeli military doctrine. Named after an ancient Carthaginian general who poisoned himself rather than be captured alive, the Hannibal Directive allows Israeli forces to take any means necessary to stop Israelis being captured alive – even at the cost of killing the captives.

Long read. In part 1 John Helmer provides the “history”, in part 2, Christopher Busby makes the case that Israel is using this today.

• Neutron Bomb: New Evidence That Israel Is Using A New Uranium Weapon (Helmer)

The neutron bomb was invented in 1958 by Samuel Cohen of the Livermore Laboratory of California and then RAND. In 1984 he proposed that Israel construct a neutron radiation wall around the country. “What I am suggesting is the construction of a border barrier whose most effective component is an extremely intense field of nuclear radiation (produced by the operation of underground nuclear reactors), sharply confined to the barrier zone, which practically guarantees the death of anyone attempting to breach the barrier. Establishing such a ‘nuclear wall’ at the borders of a threatened country can make virtually impossible any successful penetration by ground forces – as well as a preemptive ground attack by the threatened country.” Cohen, who described himself as an “unbelieving Jew”, believed that by creating this radiation barrier around Israel, no Arab state army would attack.

He also believed that by deterring that form of escalation, Cohen’s neutron wall would be protecting the US because, in the end, Cohen believed the US would abandon Israel to its fate if the US were threatened directly. “If the Soviets intrude again in an Arab-Israeli war, “ Cohen wrote, “this time with vastly improved nuclear capabilities to back up their actions, the survival of the United States would be at stake. Clearly this is a situation where it would be irrational—indeed, intolerable—for us to remain committed to Israel. Clearly, the most responsible thing the United States can do, to ensure its own security, is to make drastic changes in its military assistance to Israel (and to other Mideast countries as well) to prevent such a situation from ever arising. Otherwise, based on the wretched history of this turbulent arena, there is every reason to expect that one of these days a nuclear showdown will arise.” What Cohen was proposing was a neutron bomb to be deployed by Israel except that, because there was no detonation, no explosion, he claimed there was no neutron bomb.

“During peacetime, the reactors (employed underground, for protection and safety) are operated on a continual basis, as are our power reactors. The neutrons produced by the fission reactions escape into a solution containing an element that, upon absorbing the neutrons, becomes highly radioactive and emits gamma rays (very high energy X-rays) at extremely high intensity. The radioactive solution is then passed into a series of pipes running along the barrier length in conjunction with conventional obstacle components—mines, Dragon’s Teeth, tank traps, barbed wire, etc. To the rear of the pipes and obstacle belts is a system of conventional defensive fortifications. (The obstacles, the firepower from the fortifications, and tactical air power all serve to impede the rate of advance of the attacker, increasing the attacker’s exposure to the gamma radiation. Vice versa, by quickly incapacitating the attacker, the radiation serves to make it difficult, or even impossible, for the attacker to remove the obstacles and assault the fortifications.) The width of the entire defensive system need be no more than a few miles.”

Since it was Cohen’s idea that the Palestinians and the Arabs were neither defending their lands or themselves, but were the “aggressors” against Israel, Cohen argued it was perfectly moral for the Israelis to use their neutron weapon “defensively”. “Regarding the morality (or immorality) of such defensive use of nuclear radiation, one should keep in mind that the gamma rays themselves can, of course, have no intentions; nor is there necessarily any intent by those who produce them to kill anyone. The intent to kill has to lie with the aggressor—to kill himself. This contrasts sharply with the employment of conventional weapons, where there is every intent to kill the enemy. The basic purpose of the radiation is to deter the would-be aggressor from attacking; that is, to prevent war.”

“But the president has no interest in destroying Ukraine as a state.”

• Chechen Leader Kadyrov Eyes End Of Ukraine Conflict In Coming Months (RT)

The Ukraine conflict will likely be over by the spring or the summer of 2024, since Kiev is running out of all necessary resources, Chechen leader Ramzan Kadyrov predicted during a televised phone-in session on Wednesday. Soldiers recruited from Chechnya have played a significant role in what Moscow calls the special military operation; the head of the southern Russian republic is paying close attention to its progress. He said he expects the shortage of manpower, weapons and money to fully erode Kiev’s military capabilities by June or July at the latest. Speaking in Chechen, he mused that Russia could have crushed Ukraine in three months, if it were willing to fight the way Israel is waging war in Gaza at the moment.

“President [Vladimir Putin] ordered us to keep the infrastructure and cities as intact as possible, or we would have taken Kiev. We were seven kilometers away,” Kadyrov was quoted by the Russian media as saying. “But the president has no interest in destroying Ukraine as a state.” Russian troops approached the Ukrainian capital during the early phase of the hostilities. The Defense Ministry announced, however, that it was withdrawing troops after a breakthrough was announced during the Türkiye-mediated peace talks in Istanbul in March 2022, where delegations signed the draft version of a truce. Ukrainian President Vladimir Zelensky later aborted the negotiations, claiming that they were no longer possible due to the alleged discovery of evidence of war crimes in the town of Bucha, which Russian troops had abandoned. Moscow responded by denying the allegations and has called Kiev’s claims a pretext for the continuation of hostilities.

Ukrainian and international media have reported that then-British Prime Minister Boris Johnson torpedoed the nascent peace deal, telling the Ukrainian government that Western nations would not endorse it. This was recently confirmed by Ukrainian MP David Arakhamia, who headed his country’s delegation. Johnson told Kiev to “just make war,” the lawmaker said in an interview. Kiev and its foreign backers had counted on scoring battlefield successes during a counteroffensive this year, for which the Ukrainian army was provided Western-made heavy weapons, including main battle tanks. The six-month-long push failed to produce any major territorial gains and came at a steep price for Ukraine. The Russian military has estimated the losses of its opponent at over 125,000 troops. Kiev’s ability to secure continued Western assistance is currently in doubt, as opposition to the spending grows both in the US and in Europe.

“..everyone is tired of the Kievan beggarman.”

• Ukraine Was Never Going To Win – US Senator (RT)

Ukraine always faced the prospect of losing the conflict with Russia in the event that Washington cut off its aid, US Republican Senator Tommy Tuberville has said. The comments came after the US Senate last week blocked a bill by President Joe Biden that intended to provide Kiev with a further $60 billion in funding. Republicans opposed to the spending package have demanded tougher immigration control on the US-Mexico border in exchange for approving the bill. Speaking to CNN on Tuesday, Tuberville was asked whether cutting off funding to Kiev could result in its defeat. The senator replied that he personally “never thought they can win to begin with,” especially with the way the US “eased into” the conflict.

Tuberville also dismissed concerns by supporters of continued aid to Kiev, who have claimed that Russia will advance elsewhere in Europe once it defeats Ukrainian forces. The Republican argued that Moscow “can’t beat Ukraine on the eastern side,” and questioned how it was expected to push further across Europe. “I’ve never believed that scenario. I think it’s a good selling point to send more money,” Tuberville suggested. The US has so far provided Ukraine with an estimated $111 billion in military and economic assistance since the outbreak of its conflict with Russia in February 2022. While Washington has increasingly warned that funds are beginning to run out, Ukrainian President Vladimir Zelensky has nevertheless continued to insist on receiving more money. The Ukrainian leader traveled to Washington on Tuesday to hold a series of meetings with top US officials, in an attempt to save Biden’s $60 billion aid package.

However, Zelensky appears to have failed to convince key Republicans to change their mind about opposing the bill. Instead, some senators left the meeting while describing it as “the same old stuff” and “very scripted.” Biden has continued to urge Congress to approve the funding package and has also pledged an additional $200 million in emergency military aid for Kiev through the Presidential Drawdown Authority, which allows him to send weapons from US stocks without congressional approval. Meanwhile, Moscow has brushed off Zelensky’s latest visit to Washington as inconsequential for the outcome of the conflict. Russia’s ambassador to the US, Anatoly Antonov, claimed that “everyone is tired of the Kievan beggarman.” Kremlin spokesperson Dmitry Peskov has also stressed that no amount of money would change the situation on the front lines.

“I said you need to thank Mike Johnson for being willing to pass a package if border security is in it, because half his conference probably doesn’t agree with that..”

• US Lawmakers Demand Answers On Ukraine (RT)

Ukraine’s President Vladimir Zelensky has failed to provide any new arguments in defense of his cause during his talks in Washington with American lawmakers, several senators and representatives, including House Speaker Mike Johnson, have told the media in the wake of the meeting on Tuesday. Zelensky arrived in the capital to hold a series of meetings with top US officials to save a $61-billion aid package for Kiev that remains in limbo. Last week, GOP senators blocked the Biden administration’s major $111-billion supplemental funding request, which included aid for Ukraine, Israel and Taiwan, citing the Democrats’ reluctance to address the tense situation on the US-Mexico border. Some Republicans have also repeatedly pointed to the lack of accountability in terms of the funds Washington had spent on helping Ukraine.

According to senior GOP senator Lindsey Graham, Tuesday’s meeting has failed to bring about any changes in the lawmakers’ stance. “Nothing has changed,” he told journalists. The South Carolina senator, who emerged as a staunch supporter of Kiev amid its conflict with Moscow, explained that, although he would like to aid Ukraine, border security comes first. “I admire him, but he didn’t change my mind at all about what we need to do,” Graham said, referring to Zelensky and adding that the Democrats were supposedly trying to “use” the Ukrainian leader “in a way that I think wasn’t helpful.” “I want to secure the border,” the senator said, adding that the number of people supposedly linked to various terrorist groups that were crossing America’s southern border was “just chilling.” Another Republican Senator, Missouri’s Eric Schmitt, also said that the meeting was effectively reduced to “the same old stuff.” “There’s nothing new,” he told journalists, adding that the questions for the Ukrainian president “were very scripted.”

Louisiana Republican Mike Johnson, the Speaker of the House of Representatives, who also met Zelensky on Tuesday, pointed to the fact that the White House and Kiev were asking for billions of dollars with no oversight and no clear strategy that would allow Ukraine to prevail in the ongoing conflict. “Their responses have been insufficient,” Johnson said, referring to the Biden administration and adding that he had been requesting details on Washington’s strategy for Ukraine “over and over since literally 24 hours after I was handed the gavel as Speaker of the House.” Lindsey Graham also told journalists that he’d told Zelensky to be thankful to the House Speaker for even being willing to place military aid for Ukraine on the agenda. “I said you need to thank Mike Johnson for being willing to pass a package if border security is in it, because half his conference probably doesn’t agree with that,” the senator said.

The US has already provided Kiev with $111 billion in military and economic assistance since military confrontation between Moscow and Kiev began in February 2022. Washington has recently warned that funds for the government of Vladimir Zelensky have almost run out. Last week, US National Security Council spokesman John Kirby said that Kiev can’t expect additional funding until the gridlock in Congress is resolved. Zelensky’s chief of staff, Andrey Yermak, then warned that delays in US assistance could lead to Ukraine’s defeat by Russia. The Kremlin said on Tuesday that any further assistance Washington decides to provide to Kiev is doomed to fail from the start. No amount of money can change the situation on the front lines, Kremlin spokesman Dmitry Peskov told journalists.

“immovable, verging on the messianic..”

• Zelensky Gives US TV Viewers Fake Frontline Facts (RT)

Ukrainian President Vladimir Zelensky has contradicted frontline developments by claiming that Russian troops have failed to capture a single village from Kiev’s forces this year. The Ukrainian leader talked up his country’s supposed military achievements in an interview with Fox News anchor Bret Baier on Tuesday. Zelensky is visiting Washington this week to urge continued military assistance for Kiev in 2024. Political clashes on Capitol Hill have caused a White House request for more than $110 billion in foreign security spending, including over $60 billion for Ukraine, to be blocked. Speaking in English, Zelensky claimed that Ukrainian forces had “destroyed mostly [the] Russian fleet that was situated in our waters and near… occupied Crimea.” Kiev has launched several successful attacks on Russia’s Black Sea Fleet using Western-provided cruise missiles, although Moscow’s forces have repelled numerous other assaults.

Zelensky further claimed that Ukraine had killed 20,000 members of the now-disbanded Wagner private military company, and that “Russia did not occupied [sic] any Ukrainian village during this year.” The Ukrainian leader made the assertions despite evidence to the contrary on the battlefield, with Wagner fighters playing an important role in the fighting for the Donbass city of Artyomovsk (known as Bakhmut in Ukraine). The Zelensky government had declared the city an invincible “fortress” and reportedly ignored repeated US calls to pull troops out. After losing control of the city in May, Zelensky downplayed the significance of the settlement, declaring that it no longer existed and remained “only in our hearts.” In early 2023, Kiev also lost control of Soledar in Donbass. Fox News host Baier did not dispute Zelensky’s claims that Russia had enjoyed no success in the conflict.

According to Western media, Kiev’s bid to retain Artyomovsk significantly impacted its summer counteroffensive, having needlessly drained Ukrainian manpower and resources. The push to break through Russian defensive lines, which started in June and according to Russia estimates cost Ukraine over 125,000 casualties, failed to yield significant territorial gains for Kiev. Zelensky and his aides publicly clashed with Ukraine’s top general, Valery Zaluzhny, after he described the frontline situation as a “stalemate” in early November. The president’s office finally acknowledged that no progress was being made by the end of the month. A profile of Zelensky published by Time magazine in late October said his close associates believe him to be delusional. His belief in a Ukrainian victory over Russia is “immovable, verging on the messianic,” according to the outlet.

“..if right now you asked me to take part in a demonstration, for example, I would tell you that I have a sick mother and money problems, and I’d rather take care of my family.”

• ‘No One Will Stop Us From Destroying Israel and The US’ (RT)

One cannot say that the city of Sidon, located in southern Lebanon, is a more dangerous place than Beirut. Even further south, in Tyre, everything is relatively calm, except that one may hear distant sounds of explosions. Frankly, I thought I would see a more depressing picture. However, after driving through several Lebanese towns, I can say that life there continues peacefully. “Ninety percent of Lebanese people see no reason to fight against Israel and are not ready for war,” said Lebanese journalist Wafiq al-Hiwari, whom I met through friends in Sidon. This elderly Lebanese man has been covering the political situation in his country for many years and does not like to talk about global politics. Wafiq is a fierce opponent of dividing Lebanon into sections based on religious beliefs. He complains that today, there is no unity in Lebanon – the country is broken into pieces and divided between the Shiites, Sunnis, Druze, and Christians.

— This conflict has already caused us many problems. About 60,000 Lebanese people living on the border with Israel had to leave their homes. About 70% of them came to live with relatives and friends. And this happened in extremely difficult times from an economic point of view. — And what do you personally think about the situation in Gaza? — Of course, I condemn Israel. And it hurts me to see innocent people die. But if right now you asked me to take part in a demonstration, for example, I would tell you that I have a sick mother and money problems, and I’d rather take care of my family. — And most people think like that? — In general, yes. The crisis has paralyzed Lebanese society. There’s no strength left for either political or social activism. Moreover, religious division also polarizes society.

If you ask Christians – for example, members of the Free Patriotic Movement – they will tell you that this situation does not concern them. They’ll say that Hezbollah has started another conflict and poses a threat to the security of Lebanon. If you ask the Druze, they’ll tell you to wait and see how things end. That has been their philosophy throughout history. If you ask the Sunnis, they will say that they are against Israel, but they hate Hezbollah even more and believe that it has conspired with Israel and is plotting against them. And the Shiites will declare that they are the only ones who are ready to fight against Israel and will continue to fight the occupiers until Jerusalem is completely liberated. In other words, there is no unity in Lebanon either on the Palestinian issue or on any other issue, for that matter.

How much longer can the Scholz government last?

• Germany May Declare Emergency Over Ukraine – Scholz (RT)

Germany may have to declare an emergency at home in order to provide additional assistance to Kiev next year if the situation in Ukraine gets any worse, Chancellor Olaf Scholz warned in a government statement to the parliament on Wednesday. The opposition has branded his plan “financial trickery” and vowed to never let it happen. Scholz’s coalition government has just reached a deal on its 2024 budget following weeks of tense negotiations. The cabinet agreed to keep existing debt restrictions while cutting the operational costs of various departments and slashing certain climate-related subsidies. Further military and financial aid to Kiev was still named as one of Berlin’s top priorities, alongside Germany’s green-economy transformation and the strengthening of social cohesion.

“I will advocate sustainable, reliable support for Ukraine, because it is about the security of Europe,” Scholz told the Lower House of parliament, the Bundestag. According to the chancellor, Berlin plans to spend €8 billion ($8.63 billion) on arms for Kiev next year, along with an unspecified amount of money allocated for financial aid to the Ukrainian budget, and another €6 billion ($6.47 billion) to support Ukrainian refugees living in Germany. He also admitted that international support for Kiev was waning and might force Berlin to spend even more of its funds to aid Ukraine. Russia is supposedly counting on Kiev’s Western backers abandoning Ukraine, he added, and “the danger that calculation could work cannot be dismissed.”

“It is… clear that, if the situation worsens… because other supporters withdraw their aid, then we have to react to it,” Scholz explained, adding that doing so might require the government to trigger a special emergency clause and circumvent legislation on the national debt. “We have already decided to propose a debt-brake exception resolution in the Bundestag” in case of such a development, the chancellor said. Enacted in 2009, a fiscal rule known as the ‘debt brake’ in Germany limits the national budget deficit to 0.35% of the GDP and restricts the issuance of new government bonds. A special clause still allows the government to bypass these restrictions in case of an “unforeseen emergency.”

Scholz’s cabinet already faced what was called a “no-debt crisis” in November when the German constitutional court ruled its 2024 budget to be illegal due to violating this debt-brake rule and banned the government from repurposing unused Covid-19 funds. The chancellor’s plan was blasted by the opposition as “financial trickery” as lawmakers accused him of essentially abusing the legal loopholes to push for more aid for Kiev. “What you have presented as an orderly procedure has been a tangible government crisis,” Friedrich Merz, the leader of the biggest opposition party, the Christian Democratic Union (CDU), said in response to Scholz. “We won’t let this trick go through,” he added. The CDU chief also said that the situation in Ukraine was becoming increasingly “more dramatic.” “You know that, under the current circumstances, this country has no chance at all of winning this war,” he told Scholz.

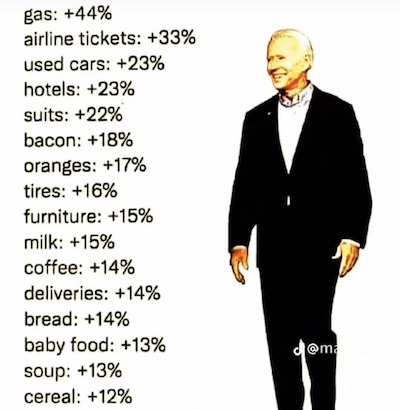

“..we are going to have 40-50 million Americans that are going to land really hard and probably 10 million of them are just going to splatter on the concrete.”

• Economist: Biden Admin Pushing US Towards ‘Economic Suicide’ (Sp.)

On Wednesday, Ukrainian President Volodymyr Zelensky left the United States without securing a significant military aid package for his country, having to instead be satisfied with $200 million worth of old equipment from the Defense Department’s stocks. Speaking to Sputnik’s Fault Lines, economist Mark Frost explained how the economic situation in the United States is making further aid to Ukraine untenable politically. “I’m an economist. I’m not known for analyzing political sentiment but just anecdotally […] people who used to be hawks are now doing a second take, saying ‘wait a minute, what are we getting for this?’” Frost explained. “It seems to me this administration is alienating the very demographics that got them elected in the first place […] folks are saying “okay, we’re citizens, why don’t we matter?’”

Frost also told hosts Jamarl Thomas and Melik Abdul that if US President Joe Biden gets the $60 billion or more that he requested from Congress for Ukraine, “it would be the largest transfer of wealth to a country since World War II.” The United States has squandered the opportunity it had to focus on internal issues after the Cold War, Frost added. “I’m waiting for my peace dividends,” Frost explained. “Folks old enough to remember what it was like when the wall came down on the Soviet Union, we all were happy, at least most of us were. […] ‘Finally, this stupid Cold War that wastes so many resources [is over], we can reduce our military expenditures now, we can keep a credible nuclear threat, keep a reasonable Army, Air Force and Navy and now we can concentrate on our internal problems, we don’t have the boogie man of the USSR anymore to worry about.’ And it never, ever happened.”

The money spent on Ukraine and its coming collapse will be a “driving issue” in the 2024 Presidential election, Frost added. He then noted that in addition to hard economic indicators that are pointing downwards, the behaviors of the people on the street are even more troubling. “I run the local Humane Society here and pet abandonments are at an all-time high. People show up and say ‘I can’t afford my cats and dogs, can you take them?’ and that tells me, combined with all the macroeconomic leading indicators that we’re heading into a severe recession, to the point where you might even use the depression word, and if that happens[…] no one is going to care about Iran.”

Frost, who said that he has voted for more Democrats in his life than Republicans, explained that what the Biden administration has done since taking office makes no sense from a macroeconomic perspective. “This administration gets an ‘F’ in macroeconomics. I’m trying to think of anything they’ve done that has made economic sense with respect to doing what’s best for the country. I cannot think of another administration that has been worse,” Frost said. Thomas asked Frost about US Secretary of the Treasury Janet Yellen’s comments that the US economy was coming in for a “soft landing” after two years of historic inflation.

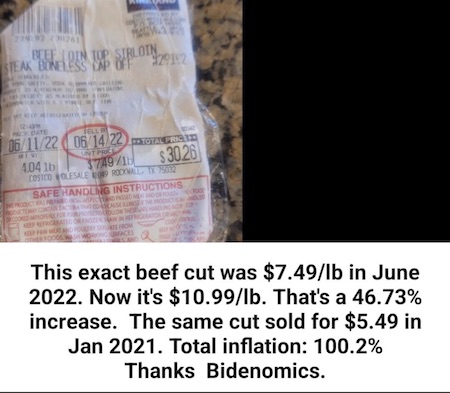

“I have no doubt that Janet Yellen’s people are going to land soft. I have zero doubt I’m going to land soft,” Frost explained. “The problem is, we are going to have 40-50 million Americans that are going to land really hard and probably 10 million of them are just going to splatter on the concrete.” “What are they trying to do, what is the endgame here?” Frost asked. “I cannot understand it because everything we are doing, to me, is economic suicide.” He added that he does not believe the official rate of inflation, which has fallen to 3%. “Remember when the government is measuring this, they use economic tricks, and they weigh certain variables,” Frost explained. “If they determine something is ‘volatile’ then they weigh that lower in the averaging process than they do something that they say is stable, but if you look at regular people’s expenditures on bacon, eggs, stuff like that, the prices are still going up.”

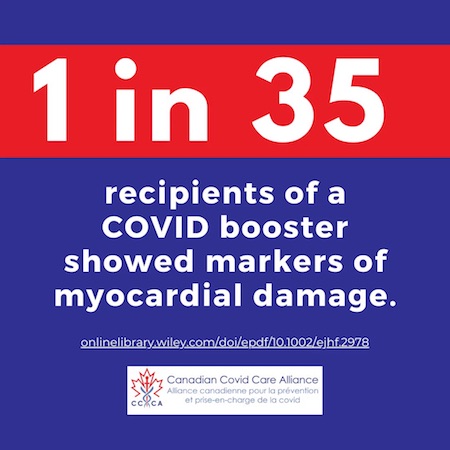

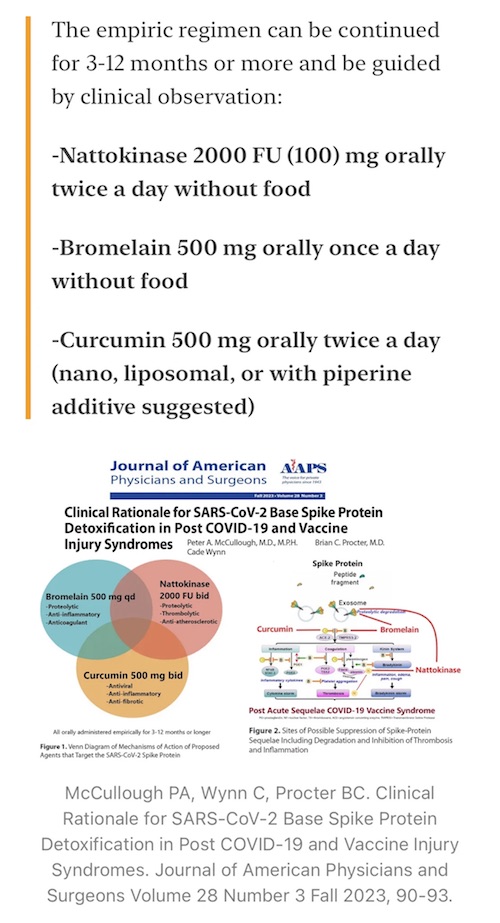

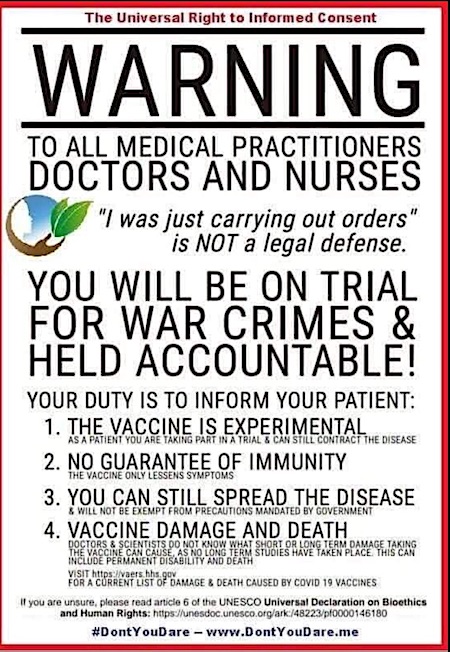

Efficacy

Compilation of people that believed in Covid vaccines until the evidence of their harm & ineffectiveness became clear.@Johnincarlisle @DrAseemMalhotra @ABridgen pic.twitter.com/htScjzNZTh

— MilkBarTV (@TheMilkBarTV) December 12, 2023

Roar

Lion cub practices its roar

pic.twitter.com/Zj5zDxW6nW— Science girl (@gunsnrosesgirl3) December 13, 2023

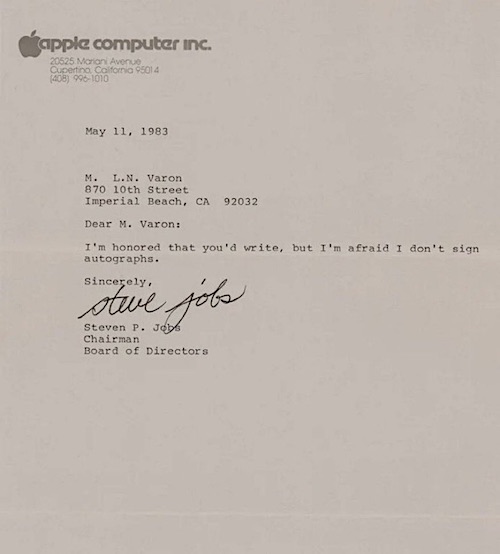

In 1983 Steve Jobs replied to a letter saying he didn’t sign autographs. It sold at auction in 2021 for $500k.

Humpback

Giant humpback whale loses its way and ends up in harbour.pic.twitter.com/m8aKrvndBN

— Figen (@TheFigen_) December 13, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.