Max Ernst Santa Conversazione 1921

The echo chamber is highly profitable. Gossip sells. It’s not personal. It’s only business. And in many boardrooms the question these days is: Why are we not more like the New York TImes?

• Trump Bump for President’s Media Archenemies Eludes Local Papers (BBG)

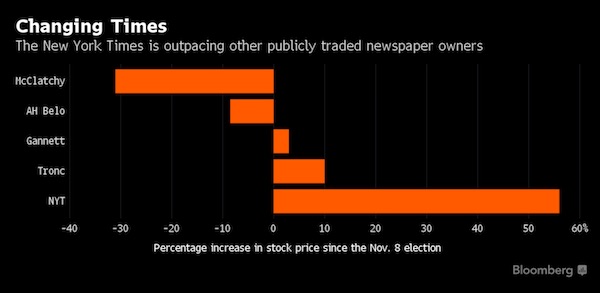

President Donald Trump loves to hurl his Twitter-ready insult at the New York Times: #failingnytimes. But in the stock market, the New York Times Co. has been looking like a roaring success lately, particularly by the standards of the beleaguered newspaper industry. Since Trump won the presidency in November, the publisher’s share price has soared 57%. Online subscriptions are up, bigly – about 19% in the first quarter alone. Scrutinizing the president turns out to be good business, at least for top national papers like the Times and the Washington Post. A different story is playing out for local publications, which are still suffering through the industry’s long decline and need to retain subscribers who are sympathetic to Trump.

Consider McClatchy Co., which owns about 30 papers, including the Miami Herald. Its shares have plummeted 31% since Election Day. Subscriptions have barely budged. The diverging fortunes in the industry have underscored what many in the traditional news business know only too well: Famous titles can lumber on as they grope for a digital future, but most local papers are fighting for survival. “For us in Texas, the bump has definitely been more muted because we’re not the primary source of news out of the White House,” said Mike Wilson, editor of the Dallas Morning News. “We serve a community with many deeply conservative pockets. That may be a different demographic from the New York Times and Washington Post audience.”

[..] The Washington Post, owned by Amazon.com founder Jeff Bezos, has more than 900,000 digital subscribers, including hundreds of thousands who signed up in the first quarter, according to a person familiar with the matter who asked not to be identified discussing private information. The newspaper declined to comment on its subscriber figures. The Post and the Times have been competing for scoops on the biggest story of the year: the Trump administration’s alleged ties to Russia. On several occasions, they’ve published blockbuster stories within hours of each other. Trump often attacks their coverage on Twitter, which seems to drive even more readers to subscribe.

We adhere to the school of economics that suits the powerful best.

• How Economics Became A Religion (Rapley)

Although Britain has an established church, few of us today pay it much mind. We follow an even more powerful religion, around which we have oriented our lives: economics. Think about it. Economics offers a comprehensive doctrine with a moral code promising adherents salvation in this world; an ideology so compelling that the faithful remake whole societies to conform to its demands. It has its gnostics, mystics and magicians who conjure money out of thin air, using spells such as “derivative” or “structured investment vehicle”. And, like the old religions it has displaced, it has its prophets, reformists, moralists and above all, its high priests who uphold orthodoxy in the face of heresy. Over time, successive economists slid into the role we had removed from the churchmen: giving us guidance on how to reach a promised land of material abundance and endless contentment.

For a long time, they seemed to deliver on that promise, succeeding in a way few other religions had ever done, our incomes rising thousands of times over and delivering a cornucopia bursting with new inventions, cures and delights. This was our heaven, and richly did we reward the economic priesthood, with status, wealth and power to shape our societies according to their vision. At the end of the 20th century, amid an economic boom that saw the western economies become richer than humanity had ever known, economics seemed to have conquered the globe. With nearly every country on the planet adhering to the same free-market playbook, and with university students flocking to do degrees in the subject, economics seemed to be attaining the goal that had eluded every other religious doctrine in history: converting the entire planet to its creed.

Yet if history teaches anything, it’s that whenever economists feel certain that they have found the holy grail of endless peace and prosperity, the end of the present regime is nigh. On the eve of the 1929 Wall Street crash, the American economist Irving Fisher advised people to go out and buy shares; in the 1960s, Keynesian economists said there would never be another recession because they had perfected the tools of demand management. The 2008 crash was no different. Five years earlier, on 4 January 2003, the Nobel laureate Robert Lucas had delivered a triumphal presidential address to the American Economics Association. Reminding his colleagues that macroeconomics had been born in the depression precisely to try to prevent another such disaster ever recurring, he declared that he and his colleagues had reached their own end of history:

“Macroeconomics in this original sense has succeeded,” he instructed the conclave. “Its central problem of depression prevention has been solved.”

Will the last days of our economics coincide with the last days of our economic model? Will Keynes die in a collapse?

• The Breaking Point & Death Of Keynes (Roberts)

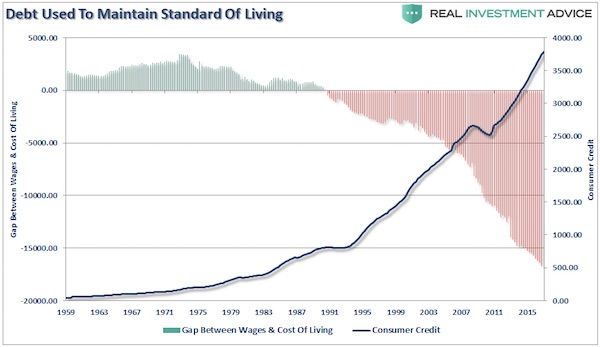

Keynes contended that “a general glut would occur when aggregate demand for goods was insufficient, leading to an economic downturn resulting in losses of potential output due to unnecessarily high unemployment, which results from the defensive (or reactive) decisions of the producers.” In other words, when there is a lack of demand from consumers due to high unemployment then the contraction in demand would, therefore, force producers to take defensive, or react, actions to reduce output. In such a situation, Keynesian economics states that government policies could be used to increase aggregate demand, thus increasing economic activity and reducing unemployment and deflation. Investment by government injects income, which results in more spending in the general economy, which in turn stimulates more production and investment involving still more income and spending and so forth.

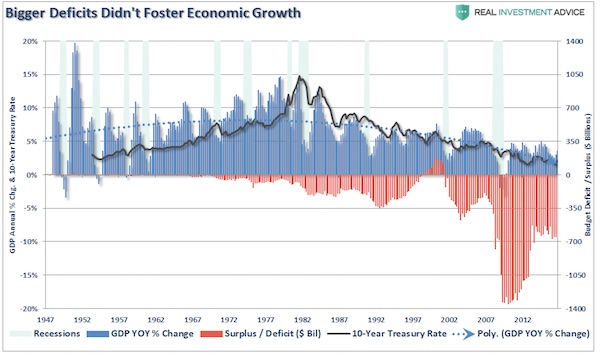

The initial stimulation starts a cascade of events, whose total increase in economic activity is a multiple of the original investment. Unfortunately, as shown below, monetary interventions and the Keynesian economic theory of deficit spending has failed to produce a rising trend of economic growth.

Take a look at the chart above. Beginning in the 1950’s, and continuing through the late 1970’s, interest rates were in a generally rising trend along with economic growth. Consequently, despite recessions, budget deficits were non-existent allowing for the productive use of capital. When the economy went through its natural and inevitable slowdowns, or recessions, the Federal Reserve could lower interest rates which in turn would incentivize producers to borrow at cheaper rates, refinance activities, etc. which spurred production and ultimately hiring and consumption.

However, beginning in 1980 the trend changed with what I have called the “Breaking Point.” It’s hard to identify the exact culprit which ranged from the Reagan Administration’s launch into massive deficit spending, deregulation, exportation of manufacturing, a shift to a serviced based economy, or a myriad of other possibilities or even a combination of all of them. Whatever the specific reason; the policies that have been followed since the “breaking point” have continued to work at odds with the “American Dream,” and economic models.

Central banks focus on their member banks.

• Central Banks’ Focus on Financial Stability Has Unintended Consequences (BBG)

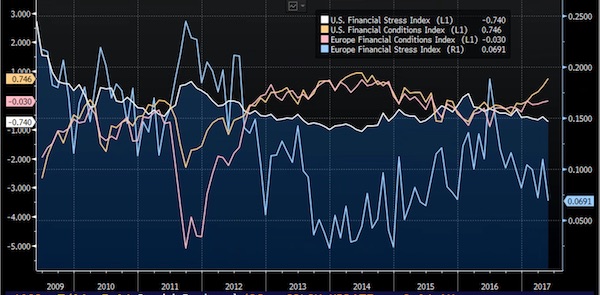

Central bankers are spending a lot of time talking about financial stability. So much so that many economists, strategists and investors are saying financial stability has become a de facto third mandate for policy makers along with price stability and full employment. This development, however, has the potential to bring about some unintended consequences such as central banks adopting a much shallower tightening path than they currently envision. It’s important to understand two things. First, in highly levered economies, like those we currently see in developed nations around the world, interest rates and financial stability are closely linked. That was evident in the recent “synchronized” global sell-off in the rates markets triggered by central banks signaling concern about relatively high asset prices brought on by artificially low borrowing costs, and their potential to foster financial instability.

Second, central banks have, perhaps paradoxically, contributed to financial instability by employing so-called forward guidance that provided investors with a sense of how long they would be keeping rates at record-low levels. So, with economies gradually recovering and employment generally robust, it’s understandable that investors would behave in a manner that suggests they expect favorable financial conditions to seemingly last in perpetuity. Consider the dollar. Its weakness against both developed and emerging-market currencies this year occurred even though expectations for stronger economic growth and fiscal stimulus rose. The decline in the value of the dollar value means the cost to borrow in the currency has dropped despite the Federal Reserve’s three interest-rate increases since mid-December.

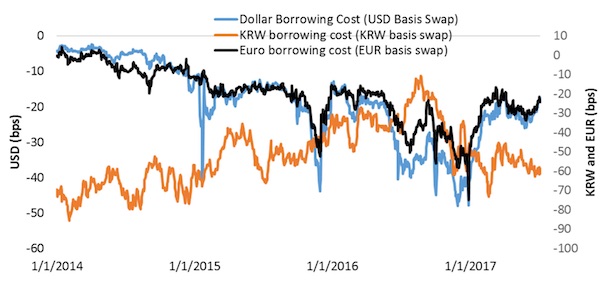

It also means hedging costs in currencies ranging from the euro to the South Korean won are rising at a less-than-ideal time. That can be seen in cross-currency basis swap rates, which are essentially the cost to exchange a fixed-rate obligation for a floating-rate obligation. In the case of the won, the swap rate has turned more negative, suggesting a possible “shortage” of the currency to borrow in the interbank market as geopolitical tensions in the region reach levels not seen in years. And, the almost 8% appreciation in the euro in both nominal and real effective exchange rate terms has driven the cost to borrow in the shared currency higher as European Central Bank officials surprise markets by starting to talk about pulling back from unprecedented monetary easing measures.

Looks like the world would have been much better off without central banks.

• Janet Yellen’s Complacency Is Criminal (Bill Black)

[..] her inaction as Fed chairman has encouraged criminal behaviour. First, Yellen’s “lifetime” pronouncement in 2017 ignored Yellen’s pronouncements in 1996 – and how disastrously they fared in the most recent financial crisis. In 1996, Yellen gave a talk at a conference at the Levy Institute at Bard College, which Minsky attended. The Minneapolis Fed published her speech as an article entitled “The New Science of Credit Risk Management.” The speech was an ode to financial securitization and credit derivatives. The Minneapolis Fed, particularly in this era, was ultra-right wing in its economic and social views. Yellen’s piece is memorable for several themes. With the exception of two passages, it reads as gushing propaganda for the largest banks. It is relentlessly optimistic. Securitization and credit derivatives will reduce individual and systematic risk.

Yellen assures the reader that finance is highly competitive and that the banks will pass on the savings from reducing risk to even unsophisticated borrowers in the form of lower interest rates. The regulators should reduce capital requirements, particularly for credit instruments with high credit ratings. Banks now have a vastly more sophisticated understanding of their credit risks and manage them prudently. There is no discussion of perverse incentives even though bank CEOs were making them ever more perverse at an increasing rate. There is no discussion of the fate of the first collateralized debt obligations (CDOs). Michael Milken, a confessed felon, devised and sold the first CDO – backed by junk bonds. That disaster blew up five years before she gave her speech. At the time Yellen published her article the second generation of CDOs was becoming common.

That generation of CDOs was backed by a hodgepodge of risky loans. They blew up about four years after she gave her speech. The third wave of CDOs was backed by toxic mortgages, particularly endemically fraudulent “liar’s” loans. They blew up in 2008. Securitization contributed to the disaster. The Fed championed vastly lower capital requirements for banks – particularly he largest banks. Fortunately, the Federal Deposit Insurance Corporation (FDIC) fought a ferocious rearguard opposition that blocked this effort. The Fed succeeded, however, in allowing the largest banks to calculate their own capital requirements through proprietary risk models that (shock) massively understated actual risk. Bank CEOs used the lower capital requirements, the biased risk models, and the opaque CDOs to massively increase risk and predate on black and Latino home borrowers.

We have a hard time remembering and learning.

• ‘We’re Flowing Toward The Path Of 1928-29’ – Yusko (CNBC)

Although the economy has been steady this year, at least one analyst has dire predictions, comparing the current period to the buildup to the Great Depression and warning that this fall is when things will come to a head. Mark Yusko, CEO of Morgan Creek Capital, has been predicting bad news for the economy since January and he is sticking by that, saying Monday on CNBC’s “Power Lunch” that he believes too much stimulus and quantitative easing has resulted in a “huge” bubble in U.S. stocks. “I have this belief that we’re flowing toward the path of 1928-29 when Hoover was president,” Yusko said. “Now Trump is president. Both were presidents with no experience who come in with a Congress that is all Republican, lots of big promises, lots of things that don’t happen and the fall is when people realize, ‘Wait, it hasn’t played out the way we thought.'”

He points to evidence of declining growth as well as that fall is a weak time traditionally for the U.S. economy as people return from vacation. “[By the fall], we’ll have a lot more evidence of declining growth. Growth has been slipping,” he said. However, it was not all gloom and doom as Yusko said the emerging markets were still strong places to invest. “Growth is where you want to invest,” he said. “All the growth is in the emerging markets, the developing world. It’s really tough if you look around the developed world.” he said profits in the United States are the same as they were in 2012. Yusko said at the beginning of the year “every single analyst” said emerging markets were going to underperform the U.S. “That hasn’t been the case,” he said. Indeed, in 2017 the iShares MSCI Emerging Markets ETF (EEM) has been up more than 18% while the S&P 500 index has risen more than 8%.

“..the number of homes sold in May for less than the asking price rose to 77%.”

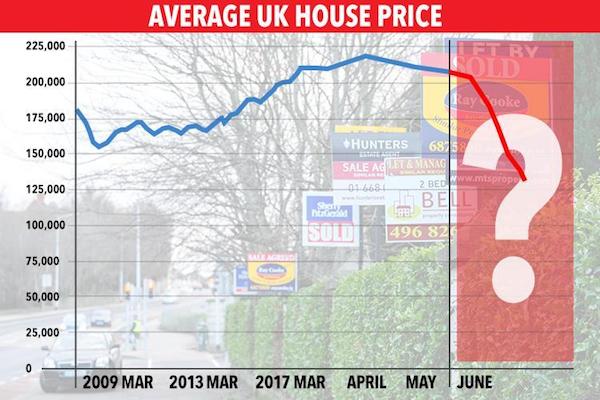

• Fresh Fears Of UK Housing Market Collapse (Sun)

New signs of the housing market slipping are expected this week when one of the best lead indicators of house price movement is released. The UK Residential Market Survey from the Royal Institution of Chartered Surveyors is expected to show a decrease in the number of members reporting house price rises. It comes after last weekend, it was reported is on the edge of a property price crash which could be as bad as the collapse in the 1990s according to experts who are also warning property value could plunge by 40%. Ahead of this week’s survey, Howard Archer, chief economic adviser to consultancy EY Item Club, told the Mail on Sunday: ‘It may well be that heightened uncertainty after the General Election weighed down on an already fragile housing market in June.’

The expectation of a crash has raised alarms about whether we could see a return of “negative equity” which is when a house falls so much in value it is worth less than the mortgage. Around one million people were hit with negative equity in the 1990s, the Mail on Sunday has reported. Paul Cheshire, professor of Economic Geography at the London School of Economics, said: “We are due a significant correction in house prices. “I think we are beginning to see signs that correction may be starting.” Prices plunged by 37% in 1989 when the price boom fell apart. In its most recent figures, The National Association of Estate Agents reported the number of homes sold in May for less than the asking price rose to 77%. Prof Chesire added that falls in real incomes is also likely to spark for a fall in house prices.

The EU has a power problem. Germany dictates all important decisions, and in its favor.

• The European Union Has a Currency Problem (NI)

Donald Trump, for all his rhetorical clumsiness and intellectual limitations, still sometimes makes a valid point. He does when he says that Germany is “very bad on trade.” However much Berlin claims innocence and good intentions, the fact remains that the euro heavily stacks the deck in favor of German exporters and against others, in Europe and further afield. It is surely no coincidence that the country’s trade has gone from about balance when the euro was created to a huge surplus amounting at last measure to over 8% of the economy—while at the same time every other major EU economy has fallen into deficit. Nor could an honest observer deny that the bias distorts economic structures in Europe and beyond, perhaps most especially in Germany, a point Berlin also seems to have missed.

The euro was supposed to help all who joined it. When it was introduced at the very end of the last century, the EU provided the world with white papers and policy briefings itemizing the common currency’s universal benefits. Politically, Europe, as a single entity with a single currency, could, they argued, at last stand as a peer to other powerful economies, such as the United States, Japan and China. The euro would also share the benefits of seigniorage more equally throughout the union. Because business holds currency, issuing nations get the benefit of acquiring real goods and services in return for the paper that the sellers hold. But since business prefers to hold the currencies of larger, stronger economies, it is these countries that tend to get the greatest benefit. The euro, its creators argued, would give seigniorage advantages to the union as a whole and not just its strongest members.

All, the EU argued further, would benefit from the increase in trade that would develop as people worried less over currency fluctuations. With little risk of a currency loss, interest rates would fall, giving especially smaller, weaker members the advantage of cheaper credit and encouraging more investment and economic development than would otherwise occur. Greater trade would also deepen economic integration, allow residents of the union to choose from a greater diversity of goods and services, and offer the more unified European economy greater resilience in the face of economic cycles, whether they had their origins internally or from abroad. It was a pretty picture, but it did not quite work as planned. Instead of giving all greater general advantages, the common currency, it is now clear, locked in distorting and inequitable currency mispricings.

Those rules only last until they get in the way of some greater good anyway.

• Schaeuble Says Italy Bank-Liquidation Aid Shows Rule Discord (BBG)

German Finance Minister Wolfgang Schaeuble joined his counterparts from the Netherlands and Austria in calling for a review of European Union bank-failure rules after Italy won approval to pour as much as €17 billion ($19.4 billion) of taxpayers’ cash into liquidating two regional lenders. Schaeuble said Italy’s disposal of Banca Popolare di Vicenza and Veneto Banca revealed differences between the EU’s bank-resolution rules and national insolvency laws that are “difficult to explain.” That’s why finance ministers convening in Brussels on Monday have to discuss the Italian cases and consider “how this can be changed with a view to the future,” he told reporters in Brussels before the meeting.

Dutch Finance Minister Jeroen Dijsselbloem said the focus should be on EU state-aid rules for banks that date from 2013, before the resolution framework was put in place. Italy relied on these rules for its state-funded liquidation of the two Veneto banks and its plan to inject €5.4 billion into Banca Monte dei Paschi di Siena SpA. The EU laid down new bank-failure rules in the 2014 Bank Recovery and Resolution Directive after member states provided almost €2 trillion to prop up lenders during the financial crisis. The BRRD foresees small banks going insolvent like non-financial companies. Big ones that could cause mayhem would be restructured and recapitalized under a separate procedure called resolution, in which losses are borne by owners and creditors, including senior bondholders if necessary.

Elke Koenig, head of the euro area’s Single Resolution Board, said last week that the framework for failing lenders needs to be reviewed to “see how to align the rules better.” The EU commissioner in charge of financial-services policy, Valdis Dombrovskis, said that this could only happen once banks have built up sufficient buffers of loss-absorbing debt. The EU’s handling of the Italian banks was held up by U.S. Federal Reserve Bank of Minneapolis President Neel Kashkari as evidence that requiring banks to have “bail-in debt” doesn’t prevent bailouts. The idea that rules on loss-absorbing liabilities that can be converted to equity or written down to cover the costs of a bank collapse “rarely works this way in real life,” he wrote in an op-ed in the Wall Street Journal.

“..the average Chinese would have had to spend more than 160 times his annual income to purchase an average housing unit at the end of 2016.”

• Is This the End of China’s Second Housing Bubble? (ET)

When the economy started to cool in the beginning of 2016, China opened up the debt spigots again to stimulate the economy. After the failed initiative with the stock market in 2015, Chinese central planners chose residential real estate again. And it worked. As mortgages made up 40.5% of new bank loans in 2016, house prices were rising at more than 10% year over year for most of 2016 and the beginning of 2017. Overall, they got so expensive that the average Chinese would have had to spend more than 160 times his annual income to purchase an average housing unit at the end of 2016. Because housing uses a lot of human resources and raw material inputs, the economy also stabilized and has been doing rather well in 2017, according to both the official numbers and unofficial reports from organizations like the China Beige Book (CBB), which collects independent, on-the-ground data about the Chinese economy.

“China Beige Book’s new Q2 results show an economy that improved again, compared to both last quarter and a year ago, with retail and services each bouncing back from underwhelming Q1 performances,” states the most recent CBB report. However, because Beijing’s central planners must walk a tightrope between stimulating the economy and exacerbating a financial bubble, they tightened housing regulations as well as lending in the beginning of 2017. Research by TS Lombard now suggests the housing bubble may have burst for the second time after 2014. “We expect the latest round of policy tightening in the property sector to drive down housing sales significantly over the next six months,” states the research firm, in its latest “China Watch” report. One of the major reasons for the concern is increased regulation. Out of the 55 cities measured in the national property price index, 25 have increased regulation on housing purchases.

The most tragic species.

“..Earth’s capacity to support life, including human life, has been shaped by life itself..”

• The World Is Facing A ‘Biological Annihilation’ Of Species (Ind.)

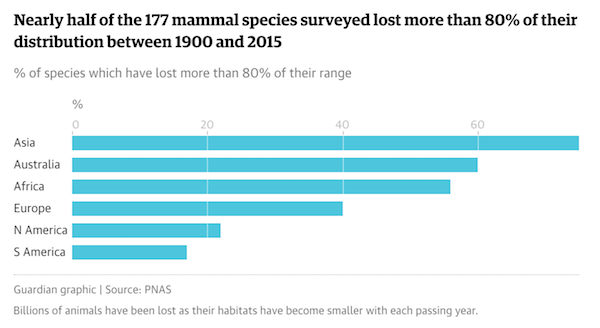

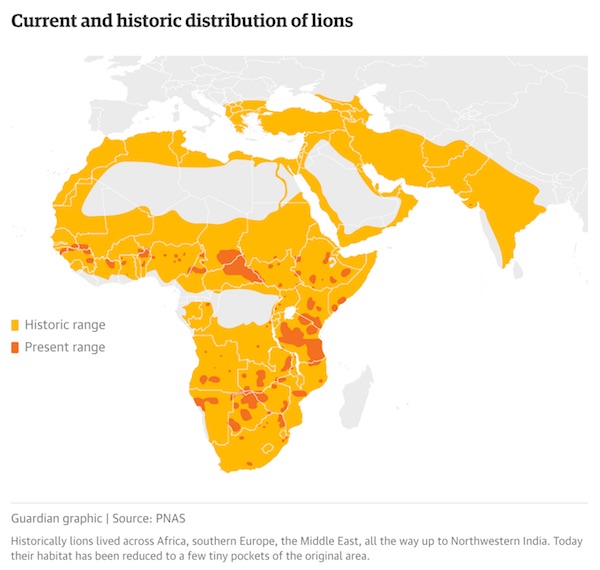

The world is experiencing a “biological annihilation” of its animal species because of humans’ effect on the Earth, a new study has found. Researchers mapped 27,600 species of birds, amphibians, mammals and reptiles – nearly half of known terrestrial vertebrate species – and concluded the planet’s sixth mass extinction even was much worse than previously thought. They found the number of individual animals that once lived alongside humans had now fallen by as much as 50%, according to a paper in the journal Proceedings of the National Academy of Sciences. The study’s authors, Rodolfo Dirzo and Paul Ehrlich from the Stanford Woods Institute for the Environment, and Gerardo Ceballos, of the National Autonomous University of Mexico, said this amounted to “a massive erosion of the greatest biological diversity in the history of the Earth”.

The authors argued that the world cannot wait to address damage to biodiversity and that the window of time for effective action was very short, “probably two or three decades at most”. Mr Dirzo said the study’s results showed “a biological annihilation occurring globally, even if the species these populations belong to are still present somewhere on Earth”. The research also found more that 30% of vertebrate species were declining in size or territorial range. Looking at 177 well-studied mammal species, the authors found that all had lost at least 30% of the geographical area they used to inhabit between 1990 and 2015. And more than 40% of these species had lost more than 80% of their range. The authors concluded that population extinction were more frequent than previously believed and a “prelude” to extinction.

“So Earth’s sixth mass extinction episode has proceeded further than most assume,” the study said. About 41% of all amphibians are threatened with extinction and 26% of all mammals, according to the International Union for Conservation of Nature (IUCN), which keeps a list of threatened and extinct species. [..] “When considering the frightening assault on the foundations of human civilisation, one must never forget that Earth’s capacity to support life, including human life, has been shaped by life itself,” the paper stated.

Home › Forums › Debt Rattle July 11 2017