Paul Cézanne The Card Players 1895

The echo chamber smells trouble and starts eating its own tail. The WaPo turns on its co-conspirators.

• The Media’s Mass Hysteria Over ‘Collusion’ Is Out Of Control (WaPo)

Hysteria among the media and Trump opponents over the prospect of “collusion” between the Trump campaign and the Kremlin may have hit its crescendo this week. That’s right: The wailing from the media and their allies about Donald Trump Jr.’s meeting with some “Kremlin-connected Russian lawyer” (whatever that means) may be the last gasp of this faux scandal. Good riddance. Predictably, the New York Times started the ball rolling with front-page coverage, going so far as to argue, “The accounts of the meeting represent the first public indication that at least some in the campaign were willing to accept Russian help.” As if this were some breakthrough moment. The Times followed up with a headline yesterday that the meeting request and subject matter discussed in the prior story were transmitted to Trump Jr. via an email.

Holy cow. The Times is so desperate to move the story that the meeting’s arrangement over email is being made into Page 1 news. You would have thought it had come through a dead drop under a bridge somewhere. And, of course, CNN has been apoplectic in its breathless coverage, running one story after another about this “development” on the air and online. But Politico takes the prize for the most over-the-top, made-up news, claiming that Donald Trump Jr.’s meeting could amount to a crime. As I have written before, there are always people hovering around campaigns trying to peddle information and traffic in supposed silver bullets. There should be nothing to report on when a private citizen who works at a campaign takes a meeting with a friend of a friend offering information about an opponent. And yet, the media wants to make it a smoking gun.

[..] Regarding the delusion that a crime actually occurred in any of this, my favorite allegation is that by having this meeting and listening to what was said, Donald Trump Jr. somehow could have violated the law. According to Politico, Trump Jr.’s “statements put him potentially in legal cross hairs for violating federal criminal statutes prohibiting solicitation or acceptance of anything of value from a foreign national, as well as a conspiracy to defraud the United States.” I’m just barely a lawyer, but I know over-lawyering when I see it. I mean, by that standard, what if someone walked into a campaign and suggested an idea that led to that candidate’s victory? Would it have been a crime to accept “a thing of value” in the form of an idea? Of course not. This whole thing is getting weird.

For many in the media and elsewhere, the collective grievances that they have against Trump personally, the White House as a whole and Trump’s policies somehow justify their zealous promotion of the “collusion scandal.” But not because the story is valid. Rather, the media know that they are not getting to Trump with anything else. Today, much of the “news coverage” of Trump and Co. is about payback. The media thinks they aren’t getting the truth and so they don’t have to deliver it either. It is a bad cycle that is not working for the White House or the media. With this much intensity, it is hard to see how this ends well..

Rumor has it Gary Cohn will take over from Yellen.

• Donald Trump’s Very Own Big, Fat, Ugly Bubble (Stockman)

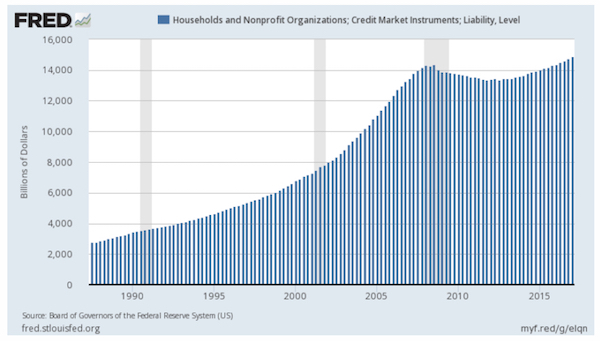

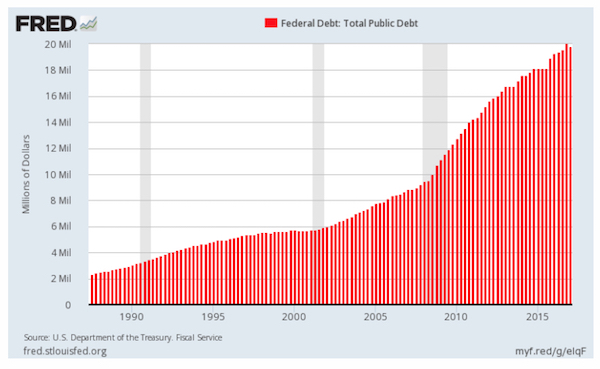

The overwhelming source of what ails America economically is found in the Eccles Building. During the past three decades the Federal Reserve has fostered destructive financial mutations on Wall Street and Main Street. Bubble Finance policies have fueled an egregious financial engineering by the C-suites of corporate America. This bubble has skyrocketed to the tune of $15 trillion of stock buybacks, debt-fueled mergers deals and buyouts of the last decade. The Fed fostered a borrowing binge in the household sector after the 1980s. It eventually resulted in Peak Debt and $15 trillion in debilitating debts on the homes, cars, incomes and futures of what used to be middle class America. It also led politicians down the path of free lunch fiscal policy.

By monetizing $4.2 trillion of Treasury and GSE debt during the last three decades, the Fed numbed the US economy from effects of crowding out and rising interest rates that would have come from soaring government deficits. This left the public sector impaled on Peak Debt. Ever since Alan Greenspan launched Bubble Finance in the fall of 1987, public debt outstanding has increased by nearly 9 times. Measured against national output, the Federal debt ratio has risen from 47% to 106% of GDP. These actions have stripped-mined balance sheets and cash flow from main street businesses. The Fed has stifled economic growth while delivering multi-trillion windfalls into the hands of a few thousand speculators on Wall Street.

These rippling waves of financial mutation are why the US economy is visibly failing and why vast numbers of citizens in Flyover America voted for Donald Trump for president. Ironically, even as he stumbled to his victory on November 8, Trump barely recognized that the force behind all the economic failure that he railed against was the nation’s rogue central bank. Only when it occurred to him that Janet Yellen was doing everything possible to insure Clinton’s victory did he let loose an attack on the Fed. In his famous warning, he leveled that America was threatened by a big, fat, ugly bubble. [..] When Wall Street launched a phony Trump Reflation trade during the wee hours of election night, the Donald forgot all about the great bubble. In fact, he quickly embraced it as a sign that investors were enthusiastically embracing Trump-O-Nomics.

No new arrival in the Oval Office was ever more mistaken.

Create the bubble with ZIRP, milk it for all you can, then walk out and leave millions with grossly overvalued assets as the economy sinks.

• Canada’s Housing Boom Expected to Spark Rate Rise (WSJ)

The Bank of Canada is widely expected on Wednesday to raise its benchmark policy rate for the first time in seven years, signaling the Canadian economy is on the path to recovery after years of tepid growth following the global slump in commodities. Canada’s central bank, led by Gov. Stephen Poloz, is joining peers at the Federal Reserve, the Bank of England and the European Central Bank as they dial back on the extraordinary run of ultralow interest rates aimed at jump-starting the global economy in the aftermath of the recession of 2008-09. In Canada, which was hit with an income shock after the downturn in prices of oil and other commodities, low rates have resulted in an extended period of loose money that has fueled a housing boom in pockets of the country.

Some analysts say soaring real-estate prices, which have stretched affordability and forced official measures to curb investing, could be a factor driving Wednesday’s expected increase. Canadian housing starts rose 9.1% to a seasonally adjusted annual rate of 212,695 units in June, Canada Mortgage and Housing Corp. said on Tuesday. Amid recent growth in gross domestic product and robust job creation, Mr. Poloz has signaled he will remove stimulus this week, monetary-policy analysts said. That is even though inflation—at an annualized 1.3% rate in May—remains well below the central bank’s 2% target, and wage growth remains stubbornly low.

See, I don’t know who Rosso means when he talks about people having forgotten Minsky. Are those the people whose investments he advises on?

• The Return Of The “Minsky Moment” (Rosso)

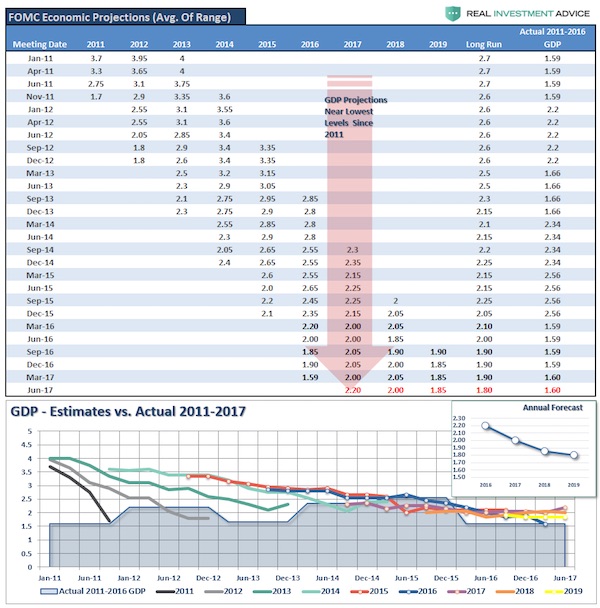

As he was a proponent of a pliable system of reform which could be altered based on the innovative risk humans create, Minsky would have been disappointed to know that the interconnected global shadow banking web continues to expand, Federal Reserve policies have created a great misallocation of financial resources, price discovery of risk assets is basically non-existent and the segment of the population or Main Street that was a concern for him, suffers great wealth inequality and wage disparity. Several catalysts exist today that may remind investors of Minsky. Readers should remain vigilant and keep the following concerns in mind as they invest and manage their personal wealth. The Federal Reserve has appeared to gravitate from data dependent to data ignorant.

Economic data remains sub-par. Inflation has fallen below the Fed’s target of two percent, yet they appear in their statements, determined to continue hiking short-term rates. In theory, a rate-tightening cycle is designed to take the edge off, tap the brake on accelerating economic growth. So, with GDP running below the long-term average of three percent and the personal consumption expenditures or PCE Index, the Fed’s preferred measure of inflation slipping to 1.4% year-over-year in May, the lowest in six months, a question begs asking. Yellen, what are you putting a brake on? Based on the analysis below, the Fed has no reason to continue rate hikes this year. However, they seem hell-bent to ignore the data. Why?

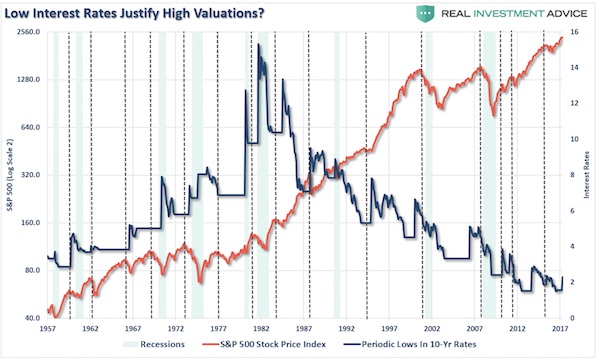

The Fed may be on an unofficial mission to curb stock market speculation. Several Fed officials including Vice-Chairman Stanley Fischer and San Francisco Fed President John Williams have voiced their concerns over lofty stock market valuations. Regardless, of the Fed’s agenda to forge ahead with rate hikes, it’s crucial to remember that low interest rates have been the primary accelerant for stock market appreciation, not earnings growth; rising rates along the yield curve eventually puts a damper on the economy and sets up a prime catalyst for market correction. If the Fed moves too quickly or inflation heats up to warrant swifter action, then a Minsky Moment may be closer than pundits believe.

Undoubtedly well meant, but it turned the Fed into a political instrument. Not a good thing.

• Martin Luther King’s Economic Dream Changed The Federal Reserve Forever (BI)

Most Americans have watched or heard Martin Luther King’s famous “I Have a Dream” speech, delivered before the Lincoln Memorial in Washington in 1963. Few know his rousing call for racial equality was the culmination of an event called the March for Jobs and Freedom. This is crucial because it reveals the central, and largely unrecognized, role of the American civil rights movement of the 1960s on the US approach to economic policy. That included a more prominent role for government in economic stimulus policies and, importantly, a broader, jobs-focused mandate for the Federal Reserve. That role is the focus of a new report by a group of Fed policy activists known as Fed Up, a coalition of community and pro-poor groups that have been pushing the Fed to adopt a more consciously pro-full employment stance.

“From the 1930’s and through the rise of the civil rights movement, racial justice activists including Coretta Scott King, called for a coordinated federal effort to attain full employment,” says the report, published in conjunction with the liberal Center for Economic and Policy Research, referring to Martin Luther King’s wife, who continued his fight after his assassination in 1968. “They envisioned an economy where every person who seeks employment can secure a job. King joined Congressional leaders Augustus Hawkins and Hubert Humphrey in eventually passing the landmark 1978 Full Employment and Balanced Growth Act (Humphrey-Hawkins) which legally required the Fed to pursue maximum employment.” Before the act, the mandate had been limited to low, stable inflation. To this day, Fed Chair Yellen’s semi-annual address to Congress on monetary policy, which is taking place on Wednesday, is known as the Humphrey-Hawkins testimony.

Fed Up and CEPR argue that the employment mandate, while not fully realized, has already generated millions of additional jobs over time, particularly in poor communities, which are most affected by steep levels of persistent unemployment. “There can be no question that the Fed would never have allowed the late 1990s boom and the consequential sharp reduction in the unemployment rate if it did not have a full employment mandate,” the study argues after reviewing data from that period and the rationale used by then-chairman Alan Greenspan for keeping interest rates low despite falling unemployment. The debate remains highly relevant today given that some Fed officials, despite their duty to maintain maximum employment, have recently expressed curious worries about the unemployment rate falling too quickly.

Expectation is Russia will expel 30 US diplomats.

• Russia Will Retaliate If US Does Not Release Property – Lavrov (R.)

Russia will retaliate in a reciprocal manner if the United States does not heed its demands for a return of diplomatic assets, Foreign Minister Sergei Lavrov said on Tuesday. “We hope that the United States, as a country which promotes the rule of law, will respect its international obligations,” Lavrov told reporters after a meeting in Brussels with EU foreign policy chief Federica Mogherini. “If this does not happen, if we see that this step is not seen as essential in Washington, then of course we will take retaliatory measures. This is the law of diplomacy, the law of international affairs, that reciprocity is the basis of all relations.” He declined to answer when asked if that meant that Russia would expel U.S. diplomats and seize diplomatic property.

Qatar flying in cows from Australia and fruit from Peru says a lot about what’s wrong with the world.

• Qatar’s First Shipment of Air-Lifted Cows Lands in Doha (BBG)

The first batch of an anticipated 4,000 dairy cows was flown into Qatar Tuesday, five weeks after the start of a Saudi Arabia-led boycott of the Gulf country. A shipment of 165 cows, sourced from Germany and flying via Budapest, are ready to produce milk immediately and the product should reach local markets this week, according to a spokesman for Power International Holding, which is importing the animals. Other shipments will include cows from Australia and the U.S., and should arrive every three days, the company spokesman said Tuesday. In total, the bovine airlift is expected to bring in the 4,000 cows within about a month. Led by Saudi Arabia, Qatar has been accused of supporting Islamic militants, charges the sheikdom has repeatedly denied.

The boycott that started on June 5 has disrupted trade, split families and threatened to alter long-standing geopolitical alliances. The showdown has forced the world’s richest country per capita to open new trade routes to bring in food, building materials and equipment for its natural gas industry. As part of its response, Qatar has imported Turkish dairy goods along with Peruvian and Moroccan fruit. Until last month, most of the fresh milk and dairy products for Qatar’s population of 2.7 million was imported from Saudi Arabia. When all the cows purchased by Power International Chairman Moutaz Al Khayyat are flown in, his brand of milk will supply about 30 percent of the country’s needs

What’s Schäuble up to now?

• Greece’s Market Return May Be Imminent (R.)

Greece could return to financial markets in the next few weeks, investors and bankers close to the discussions told Reuters, raising private cash that would mark an important step towards ending its dependence on official funding next year. Athens’ largest creditor, the European Stability Mechanism, said on Monday that Greece should develop a strategy to end a three-year exile from markets before its current bailout program expires in mid-2018. Greek finance minister Euclid Tsakalotos met with investors in London last month and one of those funds, BlueBay Asset Management, said the volume of calls they are receiving from bankers about a potential deal suggest it’s very close. “Over the last few months we would get one call on this every couple of weeks (from bankers), but over the last 10 days it seems to be every day I’m getting a call asking about this particular topic,” BlueBay’s Mark Dowding told Reuters.

“One senses we are getting to a point where this feels more imminent. We could well expect to see a deal in the next couple of weeks before investors depart for their summer holidays.” Dowding said BlueBay holds Greek bonds and would buy a new bond issue if the price was attractive. Tsakalotos also met investors including the world’s biggest bond fund PIMCO and US-based asset manager Standish, sources close to those meetings told Reuters. [..] A senior Greek government official told Reuters last week that no decision had yet been made on the timing of a deal. A banker advising Greece on its market return told Reuters on condition of anonymity: “They (Greece) are monitoring the market and they are trying to do something right now, so I wouldn’t rule out a deal within the next week or two.”

FIghts in the Lesbos Moria camp yesterday.

• NGOs Fearful Of Handing Island Refugee Camps To Greek State (K.)

Seven top NGOs aiding refugees in Greece have issued a joint statement expressing their concerns over the handover of responsibilities at migrant camps on the Greek islands to the government as of August 1. The NGOs say the Greek government has released few details about how it plans to continue providing existing assistance to residents at the camps. A deterioration of living conditions and diminished access to essential services are the main concerns cited if the Greek government does not communicate a plan to the NGOs before the handover. Since the start of the year, more than 9,500 refugees and migrants have arrived on the Greek islands, where nearly 14,000 are currently stranded. “Without a transitional plan, vulnerable men, women and children will be put at greater risk,” the statement said.

The EU: where people go to drown.

• EU Migrant Rescue Mission ‘Led To Increase In Deaths’ (Ind.)

A major naval mission spearheaded by the EU has failed to tackle people smuggling in the Mediterranean and may even be leading to higher death tolls, a new report has found. Operation Sophia, launched in 2015, has had little effect in deterring migration and its mandate should not be renewed, according to findings by the House of Lords EU External Affairs Sub-Committee. But the report concludes that the operation’s search and rescue work which has saved the lives of many people should continue. The initiative, involving 25 EU member states including the UK, was set up in the wake of disasters in which hundreds of migrants drowned attempting to reach Europe.

Yet detection of irregular migrants on the central Mediterranean route was at its highest level in 2016, when 181,436 people arrived in Europe by this route — an increase of 18 per cent on 2015, when the figure was 153,842. A naval mission is the “wrong tool” to tackle irregular migration, which begins onshore, the assessment found. It claimed an unintended consequence of Operation Sophia’s destruction of vessels had been that the smugglers have managed to adapt, sending migrants to sea in unseaworthy vessels. This led to a tragic increase in deaths, with 2,150 in 2017 to date, the report added. But it also noted that Operation Sophia vessels have rescued more than 33,000 people since the start of the mission.

The report comes just days after Amnesty International said “reckless” EU operations were destroying smugglers’ safest boats in the Mediterranean and causing more refugee deaths. It claimed the EU had “turned its back” on the search and rescue strategy. A report by the human rights group argued that the search-and-rescue measures implemented in 2015 dramatically decreased the numbers of deaths at sea, but that EU governments had now shifted their focus to disrupting smugglers and preventing boats departing from Libya. It said the EU strategy was “exposing refugees and migrants to even greater risks at sea”, destroying so many of the wooden boats used by smugglers that huge numbers of people had now started making the crossing on less safe rubber dinghies.

Home › Forums › Debt Rattle July 12 2017