Lewis Wickes Hine Mother and child, Ellis Island, New York 1907

The beauty of low rates.

• Stock Market Rests Happily on Smoldering Powder Keg (WS)

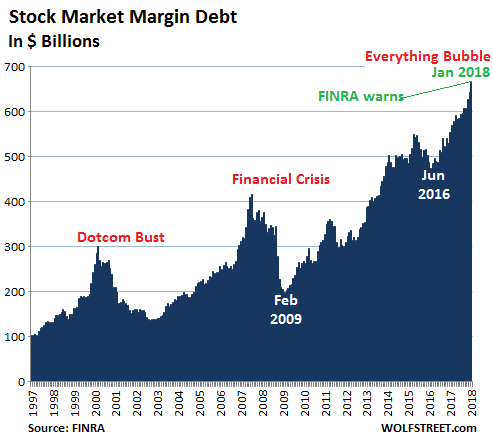

There is nothing like a big shot of leverage to fire up the stock market. And that’s what the market got in 2017, when the S&P 500 surged 26%, and in January 2018, when the index soared another 7.5% through January 26 – until suddenly something happened. One measure of leverage in the stock market is margin debt – the amount individual and institutional investors borrow from their brokers against their portfolios – which surged $22.9 billion in January to a new record of $665.7 billion, according to FINRA (Financial Industry Regulatory Authority), which regulates member brokerage firms and exchange markets, and which has taken over margin-debt reporting from the NYSE.

For the 12-month period through January, margin debt soared $112.2 billion, among the largest 12-month gains in the history of the data series, behind only the 12-month periods ending in: • December 2013 ($123 billion) • July 2007 ($160 billion) • March 2000 ($133.7 billion) • November 1997 ($132 billion). But it’s not just the recent surge; it’s the length of the surge. With only a few noticeable down periods, margin debt has soared for nine years in a row and now exceeds the prior peak of July 2007 ($416 billion) by 60%. By comparison, over the same period, nominal GDP (not adjusted for inflation) has grown 32%, and the Consumer Price Index has grown 20%.

In other words, margin debt has ballooned twice as fast from peak to peak as GDP and three times as fast as the Consumer Price Index. The chart below shows margin debt based on the FINRA data, which includes margin debt from its own member firms and from NYSE Member firms, and is therefore more complete and larger than the NYSE data was. For example, NYSE margin debt in November 2017, the last month available, was $580.9 billion while FINRA’s data for November showed margin debt of $627.4 billion. And in January, FINRA warned about the levels of margin debt – marked in green on the chart. Note the spike that started in June 2016:

Xi’s main problem: he can’t let these companies go belly-up. And there’s lots of them, some big, some smaller.

• China’s Bailouts Won’t End With Anbang (Balding)

When the China Insurance Regulatory Commission announced last week that it was seizing Anbang, the only surprise was that it took so long. Last year, the company was told to sell its overseas assets, its founder was placed behind bars, and banks were ordered to stop offering its products. So what, if anything, does this latest incident tell us about China’s economy and its attempt to crack down on debt? Anbang is often referred to as an insurance company, but this is misleading. Although the company does offer some run-of-the-mill products, such as property and casualty insurance, what really drove its growth were unusually structured life-insurance products. At the end of 2016, shortly before regulators intervened, property and casualty premiums made up a mere 4% of the group’s revenue. Life insurance made up 96%.

The growth in this business stunned even China analysts accustomed to tales of fabulous growth. From 2010 to 2016, Anbang’s annual life-insurance premium revenue increased from 1 million yuan to 114.2 billion yuan, or total growth of 11 million %. Even during a period of rapid economic expansion, annualized growth of 593% is amazing. The problem was that the life-insurance products were actually high-yielding debt instruments; investors could opt out of the insurance portion in as little as two years. With some products yielding more than 5% in the first three years, this essentially made Anbang a highly leveraged investor taking on significant risks to cover its cost of capital. Customers were basically extending loans to Anbang that it used to overpay for assets. Regulators finally stepped in to prevent a collapse that could have led to significant instability – with some 35 million customers demanding their money back.

Econ 101 redux: “..prices will be forced to adjust lower as affordability collapses..”

• US January New Home Sales Crash As Rates Spike (ZH)

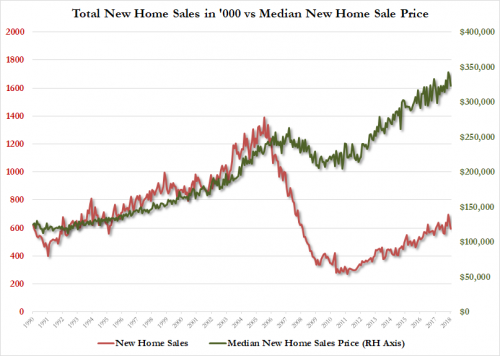

Following the significant disappointment of January’s existing home sales, hopes were high for a rebound in new home sales (+3.5% expected after December’s 9.3% plunge) but those hopes were crushed as January new home sales crashed 7.8% MoM. This is the lowest level since August, even as the supply of homes at current sales rate climbed to 6.1 months from 5.5 months.

This is the biggest two-month drop in new home sales SAAR since August 2013. The Median price dropped from $336,700 to $323,000 – the lowest since October…

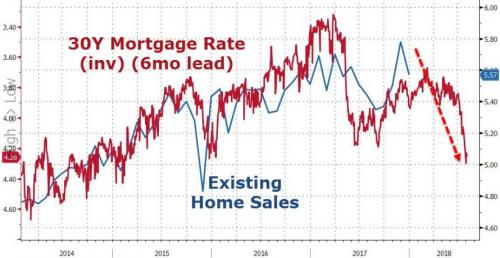

16% of new homes sold in January cost more than $500,000, down from 22% last month. As sales in the Northeast collapsed: • Northeast -33.3%, from 36K to 24K • Midwest +15.4%, from 65K to 75K • South -14.2%, from 351K to 301K • West +1.0%, from 191K to 193K So we are sure NAR will blame ‘inclement’ weather – as opposed to soaring rates and plunging affordability. Just as we warned previously, the following chart shows, that surge in rates will have a direct impact on home sales (or prices will be forced to adjust lower) as affordability collapses… This won’t end well.

When trapped by crazy, go crazier.

• US Gross National Debt Spikes $1 Trillion in Less Than 6 Months (WS)

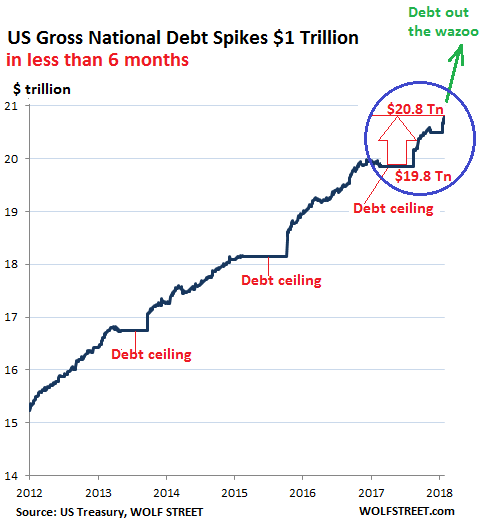

As of the latest reporting by the Treasury Department, the US gross national debt rose by $41.5 billion on Thursday, February 22, to a grand total of $20.8 trillion. Here’s the thing: On September 7, 2017, five-and-a-half months ago, just before Congress suspended the debt ceiling, the gross national debt stood at $19.8 trillion. At that time, I was holding my breath waiting for the gross national debt to take a huge leap in a single day – as it always does after the debt ceiling gets lifted or suspended – and jump to the next ignominious level. It sure did the next day, when it jumped $318 billion. And it continued. Over a period of 8 weeks, the gross national debt jumped by $640 billion.

Four weeks after that, it had ballooned by $723 billion, at which point Fed Chair Yellen – whose cheap-money policies had enabled Congress to do this for years – said that she was “very worried about the sustainability of the US debt trajectory.” Then Congress served up another debt ceiling – a regular charade lawmakers undertake to extort deals from each other, beat the White House into submission, and keep the rest of the world their on their toes. It goes like this: First they pass the spending bills, directing the Administration to spend specific amounts of money on a gazillion specific things spread around specific districts. Then they block the means to pay the credit card bill. That debt ceiling was suspended on February 8, at which point the gross national debt began to surge again, adding $960.4 billion, a 5% jump in the gross national debt in just 5.5 months:

Dark money will end up killing everything.

• Dark Money: The Secret Force Behind Today’s Rigged Markets (Nomi Prins)

Markets were up again big today and volatility was down. But we haven’t seen the last of rising volatility, nor of the central banks’ attempts to thwart it. This week, new Fed Chair Jerome Powell will be giving his first congressional testimony, and you can be sure that markets are waiting on his words with bated breath. Before his testimony, the Fed will be releasing its Monetary Policy Report, which will also give an indication to the direction of Fed policy. Because these will be his first official comments as Fed chair, Powell will want to both make a personal mark and make sure markets don’t panic over his remarks. I believe he will temper his comments to neutralize any negative market impact the report could have. Wall Street wants to hear that Powell’s not going to aggressively hike rates.

The risk is that, as an article from CNBC reports, “Powell may not clarify anything,” in which case, “traders could be stuck with the same dilemma that shook stocks and sent bond yields spiking [last] Wednesday after the release of the minutes from the Fed’s January meeting.” I think Powell will sound as dovish as he can to avoid that outcome. So even if he confirms rate hikes will be executed at the already forecast pace of three rates this year, he won’t indicate there could be more, which should keep markets calmer and bullish. In other words, I don’t believe that Powell will implement dramatically different monetary policy from his predecessors Janet Yellen or Ben Bernanke. The Fed will do whatever the markets need. Banks have grown accustomed to what I call “dark money” and don’t want Powell to rock the boat.

What is dark money? Dark money basically means money coming from central banks. In essence, central banks “print” money or electronically fabricate money by buying bonds or stocks. They use other tools like adjusting interest rate policy and currency agreements with other central banks to pump liquidity into the financial system. That dark money goes to the biggest private banks and financial institutions first. From there, it spreads out in seemingly infinite directions, affecting different financial assets in different ways. These dark money flows stretch around the world according to a pattern of power, influence and of course, wealth for select groups. Dark money is the No. 1 secret life force of today’s rigged financial markets. It drives whole markets up and down. It’s the reason for today’s financial bubbles.

CNN wakes up.

• Problem With Rising Rates: Corporate America Has Binged On Debt (CNN)

Corporate America, egged on by ridiculously-low borrowing costs, has built up more debt than any time since the end of the Great Recession. The credit binge has allowed companies to grow faster, invest in the future and reward shareholders with huge dividends and share buybacks. Yet elevated levels of debt will also make businesses vulnerable when the next recession strikes or if borrowing costs spike because of rising interest rates. Either outcome will make it harder for Corporate America to pay back the $4 trillion of debt coming due by 2022. This risk has been underlined by the recent surge in Treasury yields and rising concerns that inflation could force the Federal Reserve to consider aggressive rate hikes.

“Removing the easy money punch bowl could trigger the next default cycle,” S&P Global Ratings wrote in a recent report titled “Debt high, defaults low – something’s gotta give.” For nearly a decade, companies have taken advantage of extremely cheap money set by the Fed and foreign central banks trying to pump up sluggish growth. Excluding the highly leveraged financial sector, corporate debt relative to GDP matched an all-time high during the third quarter of 2017, according to an analysis of the most recent numbers by Informa Financial Intelligence. “It’s certainly a reason to be cautious, particularly when we are long into this growth cycle and the Fed is raising rates,” said David Ader, chief macro strategist at Informa Financial Intelligence. “Everything is fine and well – until it isn’t,” he said.

US, China, Europe et al. Leverage is all that’s left.

• European Companies’ Alarming Leverage (BBG)

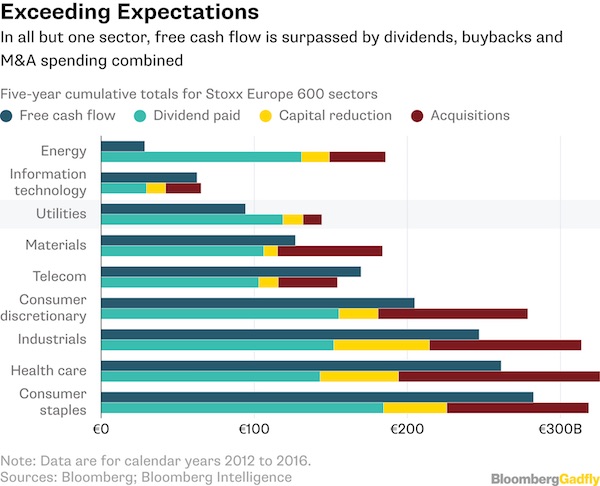

Much has been written recently about whether companies are going to look overstretched as monetary policy is tightened and bond yields rise. Some excellent research on European non-financial corporates by our Bloomberg Intelligence colleagues Laurent Douillet and Tim Craighead shines more light on the subject. It’s a slightly worrying picture. First off, they looked at cumulative free cash flows over the five years between 2012 and 2016, and then compared them with shareholder payouts and M&A spending. In every sector, except telecoms, free cash flow was exceeded by combined dividends, buybacks and deal-making, as this chart shows:

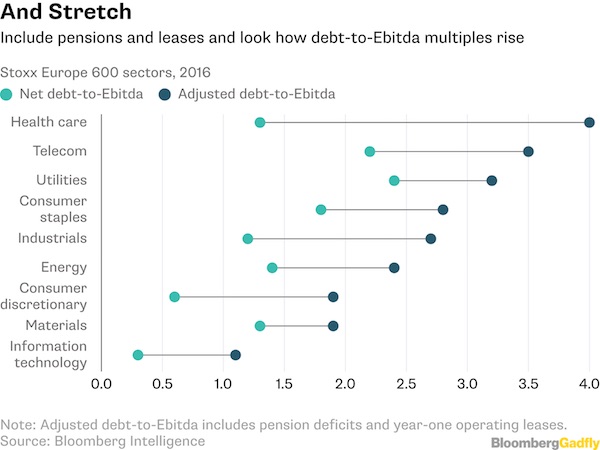

Consumer companies, drugs makers and industrials have splurged the most on dividends and takeovers. When you take a first glance at leverage, this doesn’t appear to be the end of the world. When you look at the most recent period, net debt to Ebitda looks pretty undemanding, except for the utilities – which are something of a problem child in Europe generally. Even if you look at free cash flow as a proportion of total debt, utilities are probably the only real outlier. Yet if you take a stricter view of what makes up debt, and include pension deficits and operating lease obligations, things start to look less benign. Operating leases are something that Gadfly’s Chris Bryant has looked at before, as companies will have to include them as part of their assets and associated debts when the new IFRS 16 accounting rules come in next year. If you use an adjusted measure of debt by including pensions and leases, as our BI colleagues have done, you get this:

Blah blah.

• Central Banks Need To Stay Vigilant For Further Volatility – Lagarde (BBG)

Central banks need to stay vigilant as uncertainty remains over the impact of the normalization of monetary policies in advanced economies, IMF Managing Director Christine Lagarde said. “We have known for some time that this is coming, but it remains uncertain as to how exactly it will affect companies, jobs, and incomes,” Lagarde told a conference in Jakarta on Tuesday. “Clearly, policy makers need to stay vigilant about the likely effects on financial stability, including the prospect of volatile capital flows.” Stock markets from the U.S. to Asia were in turmoil in recent weeks on concerns that the U.S. could raise interests rates at a faster pace than previously thought. Investors are awaiting Jerome Powell’s first public comments in the role of Fed chairman on Tuesday.

The global economy is on a broad-based upswing, involving about two-thirds of the world, and it offers an opportunity to reform financial markets, upgrade labor laws, and lower barriers to entry in overly protected industries, Lagarde said. The IMF forecasts global economic growth of 3.9 percent this year and in 2019. “As I have been saying recently, the time to repair the roof is when the sun is shining,” Lagarde said. “Repairing the roof also means using fiscal reforms to generate higher public revenues, where needed, and improve spending. By boosting public finances, countries can increase infrastructure investment and development spending, especially on social safety nets for the most vulnerable.‘”

Burn baby burn.

• US Will Overtake Russia As Top Oil Producer By 2019 (R.)

The United States will overtake Russia as the world’s biggest oil producer by 2019 at the latest, the International Energy Agency (IEA) said on Tuesday, as the country’s shale oil boom continues to upend global markets. IEA Executive Director Fatih Birol said at an event in Tokyo the United States would overtake Russia as the biggest crude oil producer “definitely next year”, if not this year. “U.S. shale growth is very strong, the pace is very strong … The United States will become the No.1 oil producer sometime very soon,” he told Reuters separately. U.S. crude oil output rose above 10 million barrels per day (bpd) late last year for the first time since the 1970s, overtaking top oil exporter Saudi Arabia.

The U.S. Energy Information Administration said early this month that U.S. output would exceed 11 million bpd by late 2018. That would take it past top producer Russia, which pumps just below that mark. Birol said he did not see U.S. oil production peaking before 2020, and that he did not expect a decline in the next four to five years. The soaring U.S. production is upending global oil markets, coming at a time when other major producers — including Russia and members of the Middle East-dominated OPEC — have been withholding output to prop up prices. U.S. oil is also increasingly being exported, including to the world’s biggest and fastest growing markets in Asia, eating away at OPEC and Russian market share.

Briatin’s much further down the rabbit hole than it wants to see.

• The Matrix? Alice In Wonderland? Praise For Corbyn From UK Business (Ind.)

A Labour Party led by Jeremy Corbyn as the party of business? JC as the last, best hope for the business community? It’s the sort of thing that would make even one of those nutty internet conspiracy theorists who believe that contactless payments are a satanic plot scoff. Now? Now we’re in Terri May’s Brexit wonderland and the Cheshire Cat is pissing himself. Madness is part of everyday life and nothing seems strange anymore, not even the CBI’s director general Carlyn Fairbairn saying this: “The Labour leader’s commitment to a customs union will put jobs and living standards first by remaining in a close economic relationship with the EU. It will help grow trade without accepting freedom of movement or payments to the EU.”

Or Stephen Martin, the director general of the Institute of Directors, saying this: “Labour has widened the debate today on the UK’s relationship with the EU post-Brexit, and many businesses, particularly manufacturers, will be pleased to hear the Opposition’s proposal to keep a customs union on the table.” You remember the scene from the Wachowskis’ Matrix where Morpheus references Lewis Carroll’s most famous work? “You take the blue pill, you stay in your bed and believe whatever you want to believe. You take the red pill, you stay in wonderland and I show you how deep the rabbit hole goes.” With the Tory party having taken leave of its senses in favour of plunging us into a nightmare beyond anything either Carroll or the the brothers could have conceived, the red pill suddenly doesn’t seem quite as scary as it once did, not now the Tories’ mad ideologues are making merry. The Corbyn rabbit hole might actually be the better option.

Prediction: no-one’s even going to try to control this, because it would mean having to admit that pensions are Ponzis.

• Generational Battle Lines Harden Over Pensions (G.)

A report by the Intergenerational Foundation, a charity that funds research into issues that divide the generations, has found that far from losing out to younger people, baby boomers have proved themselves adept at ensuring they are the winners across many areas of public policy. Governments, say the authors, have been “tempted by short-term pressures to set rates that clearly disadvantage the young and favour the older generations” – compare university fees charged at an interest rate of 6.1% with the 2% the elderly are charged on loans to pay for residential care costs. Another example can be found in the rates of interest offered on state-sponsored savings bonds. The pensioner bond, which was launched by George Osborne and proved so popular it was credited with helping the Tories secure a majority in the 2015 general election, paid a 4% rate of interest.

National Savings bonds for everyone else pay a maximum 2.2%. Worst of all is the huge bill in store for younger people in 30 or 40 years’ time by virtue of the current calculations of future liabilities. Pension liabilities are top of the list, with public sector pensions in particular carrying a heavy cost. The foundation’s concern is that the government overestimates the state’s capacity to pay for future liabilities by exaggerating how fast the UK’s income will grow over time. If GDP growth is forecast at an absurdly high rate then the income will supposedly be in place to pay generous pension payments in 30 years. If that growth fails to materialise, those who are in their 20s and 30s today will need to find large sums of cash to fill the hole when they are in their 50s and 60s.

The debate centres on the discount rate, which is the calculation of a fund’s long-term growth, which is used to reflect how much money should be set aside today to pay for tomorrow. Downgrade the discount rate by 0.5% and the government will need to set aside additional pension contributions worth 3% of salaries, it says. “From this you can see very starkly why representatives of older workers have been lobbying strongly for higher discount rates. If they succeed in keeping discount rates 1% above what they should be, they have essentially transferred 6% of the total pension bill for each of these years from the old to the young, so the young will have to pay this bill,” the authors say.

Failed education systems.

• The Real Reason Behind The US Student Debt Problem (F.)

The New York Fed publishes the always-interesting Quarterly Report on Household Debt and Credit. The Q4 2017 version came out recently. In total, Americans carried $13.15 trillion in debt as of year-end 2017. Most of it is mortgage debt—about 71% of the total, if you include home equity loans. Much to our surprise, the next-largest category isn’t auto loans or credit cards. It’s student loans, which are now 10% of total debt. Their share has been growing steadily. This might be okay if the debt enhanced the student’s financial security, but for millions of Americans, that’s not what has happened. Borrowers don’t achieve the desired results but remain stuck with the debt anyway. While delinquency rates for other forms of debt fell after the recession, student loans didn’t. As of year-end 2017, about 11% of nearly $1.4 trillion in student debt was at least 90 days delinquent.

It’s actually worse than that. Roughly half of student debt is held by borrowers who aren’t required to make payments yet. That’s because they are still in school, unemployed, or otherwise excused. Much of that debt would likely be delinquent too. Also important: The delinquent loans tend to be small (less than $10,000) and held by borrowers who never earned degrees. These borrowers probably thought they were doing the right thing. They wanted decent jobs and saw that having a college degree was necessary to get one. So why is college the key to gainful employment? It hasn’t always been so. It’s because employers require a degree as a job qualification… and that’s partly the fault of IQ tests.

[..] College degrees are convenient, legal substitutes for the kind of testing employers haven’t been able to use since the 1970s. So apart from whatever you learn in college, merely having the credential became necessary to career success. As a result, everyone in the equation made certain choices. • Employers: demand a college degree even for jobs that don’t require college-level skills. • Workers: get a college degree even if you must take on debt. Colleges: Raise prices since so many students are begging for degrees.

This made college more expensive, forcing students to borrow more and more money.Politicians jumped in to promote and guarantee those loans. And here we are.

Thw two parties will have to come together to solve this. Just blaming the other won’t do it.

• 20 US States Sue Federal Government, Seeking End To Obamacare (R.)

A coalition of 20 U.S. states sued the federal government on Monday over Obamacare, claiming the law was no longer constitutional after the repeal last year of its requirement that people have health insurance or pay a fine. Led by Texas Attorney General Ken Paxton and Wisconsin Attorney General Brad Schimel, the lawsuit said that without the individual mandate, which was eliminated as part of the Republican tax law signed by President Donald Trump in December, Obamacare was unlawful. “The U.S. Supreme Court already admitted that an individual mandate without a tax penalty is unconstitutional,” Paxton said in a statement.

“With no remaining legitimate basis for the law, it is time that Americans are finally free from the stranglehold of Obamacare, once and for all,” he said. The U.S. Justice Department did not immediately respond to a request for comment on whether the Trump administration would defend the law in court. The individual mandate in Obamacare was meant to ensure a viable health insurance market by forcing younger and healthier Americans to buy coverage. Republicans have opposed the 2010 law formally known as the Affordable Care Act, the signature domestic policy achievement of Trump’s Democratic predecessor Barack Obama, since its inception.

The Supreme Court is wise enough to keep its distance from executive and legislative branches.

• US Supreme Court Rebuffs Trump, Won’t Hear Immigration Appeal (BBG)

The U.S. Supreme Court rejected a Trump administration appeal aimed at ending deportation protections for young undocumented immigrants, steering clear for now of the debate over the fate of hundreds of thousands of people. The justices, without published dissent, turned away the administration’s appeal of a ruling that has kept the Obama-era program in place. The rejection buys time for the so-called dreamers even as Congress has been unable to agree on legislation to give them permanent protection. The Senate earlier this month blocked three proposals that would have shielded the dreamers. The administration was asking the Supreme Court to take the unusual step of bypassing an appeals court and granting fast-track review of a federal trial judge’s decision.

The court’s rebuff leaves open the possibility that the justices could consider the case later, after a San Francisco-based federal appeals court hears it. “It is assumed that the Court of Appeals will proceed expeditiously to decide this case,” the Supreme Court said in its two-sentence order. The Deferred Action for Childhood Arrivals program “is clearly unlawful,” White House spokesman Raj Shah said in a statement. “We look forward to having this case expeditiously heard by the appeals court and, if necessary, the Supreme Court, where we fully expect to prevail,” he said. DACA, begun under President Barack Obama, protects undocumented immigrants who were brought to the U.S. as children. Applicants are shielded from deportation and allowed to apply for work permits.

The first group of DACA recipients had been set to lose their protected status in March before U.S. District Judge William H. Alsup’s Jan. 9 order. The Trump administration appeal argued that the judge’s order “requires the government to sanction indefinitely an ongoing violation of federal law being committed by nearly 700,000 aliens.” The administration resumed accepting DACA renewal applications after the order. Congress is at an impasse over legislation to protect the dreamers, as President Donald Trump and many Republicans insist that it must be combined with strict new limits on legal immigration. Even though the judge’s order means the prior March deadline isn’t in force, House Speaker Paul Ryan of Wisconsin said this month, “we want to operate on deadlines. We clearly need to address this issue in March.”

Alsup said the Department of Homeland Security based its decision to end the program on the “flawed legal premise” that Obama lacked the authority to set it up in the first place. In issuing his temporary order, which extends the protection while the lawsuit goes forward, Alsup said the “public interest” would be served by keeping the program in place. The judge pointed to Trump tweets that suggested he actually supported DACA. A September tweet read: “Does anybody really want to throw out good, educated and accomplished young people who have jobs, some serving in the military? Really! . . . .” Alsup wrote: “We seem to be in the unusual position wherein the ultimate authority over the agency, the chief executive, publicly favors the very program the agency has ended.”

” Can I be alone in wondering how these agencies can mount massive prosecutions of nobodies like George Papadopoulos and Rick Gates while ignoring the much better documented intrigues?..”

• And Now the Schiff Memo (Jim Kunstler)

The excruciating quandary President Trump presents to the nation is dragging the sad remnant of the thinking class ever-deeper into a netherworld of desperation, paranoia, and mendacity that may exceed even their own official fantasies about the enemy in the White House. Everything about the lumbering, blundering occupant of 1600 Pennsylvania Avenue drives his Dem/Prog opponents — or #Resistance, if you will — plumb batshit: his previous incarnations as a shady NYC real estate schmeikler, as a TV clown, as a business deadbeat, as a self-described pussy-grabber… his vulgar casinos, his mystifying hair-do, his baggy suits and dangling neckties, his arrant, childish, needless lying about trivialities, his intemperate tweets, his unappetizing associates, his loutish behavior in foreign lands, his fractured, tortured syntax, his obvious insincerity, his sneery facial contortions… and lots lots more — and of course that doesn’t even touch the actual policy positions he struggles to articulate.

In sum, Trump represents such a monumentally grotesque embarrassment to the permanent Washington establishment that they will pay any price, bear any burden, meet any hardship, support any friend, oppose any foe, in order to assure the removal of this odious caitiff. And in the process abandon all reason and decency. To complicate matters, there really are policy differences that, despite Mr. Trump’s oafish profferings, must somehow be faced for the sake of the country’s future — two of the clearest, just for example, being whether we will have coherent, enforceable immigration laws and whether we will continue to allow the sale of tactical military rifles to the general public. These are matters, by the way, which people of sound mind and honorable intentions could actually resolve through open legislative debate.

[..] in creating this horror movie, the #Resistance is dangerously perverting institutions that may not recover from being written into the script. For instance, the Department of Justice, its subsidiary, the FBI, and sundry intel outfits whose highest officers have been enlisted as cast members. Can I be alone in wondering how these agencies can mount massive prosecutions of nobodies like George Papadopoulos and Rick Gates while ignoring the much better documented intrigues of officials such as Bruce Ohr, Andrew McCabe, Peter Strzok, Lisa Page, Sally Yates, James Comey, Loretta Lynch, John Brennan, Debbie Wasserman-Schultz, Hillary Clinton, and possibly even the sainted Barack Obama?

All the west has left is fabricated narratives.

• East Ghouta: The Last Great Battle Of The Syrian War? (Duran)

Just as was the case with the crisis in Aleppo in 2016, the crisis in east Ghouta today is the subject of much handwringing in the Western media. There are also – just as there were in 2016 – pleas to President Putin to “show mercy”. In 2016 these pleas came mainly from British Foreign Minister Boris Johnson. This time they are coming from German Chancellor Merkel and French President Macron. Meanwhile – as in 2016 – there is grandstanding against Russia at the UN Security Council by the US’s UN ambassador. In 2016 it was Samantha Power; this time it is Nikki Haley. Just as in 2016 we are now seeing overheated and hysterical demands for ‘military action’ to ‘bring the killing to a stop’, with all concerns about what that might lead to brushed aside.

To complete the truly extraordinary parallels, there has even been a US bombing raid on Syrian forces far away in eastern Syria in Deir Ezzor province, just as there was during the fighting in Aleppo in 2016. Moreover the Russian response to the US threats and to the US bombing raid appears to be the same as it was in 2016: the deployment of further powerful additional military forces to Syria and to Khmeimim air base. In 2016 it was S-300VM Antey 2500 anti aircraft missiles; today it is additional S-400 anti aircraft missiles and (reportedly) SU-57 fighters. As to what is really behind the furious campaign to stop the attack on east Ghouta, it is the same as was the case with the furious campaign to stop the attack on eastern Aleppo in 2016: to prevent a Jihadi enclave which threatens one of Syria’s two great cities – Aleppo in 2016, Damascus today – from being destroyed.

As to what would actually happen if – or rather when – that Jihadi enclave is finally destroyed, I can do no better than quote Marcus Papadopoulos “Once East Ghouta is liberated from Al-Qaeda, the world will see the same response from its inhabitants as the world saw once East Aleppo was liberated: jubilation. And, like with East Aleppo, East Ghouta will serve as another testimony about the facade that is the White Helmets.” Why all these frantic attempts to save an Al-Qaeda controlled Jihadi enclave from being destroyed near Damascus? The short answer is that just as the destruction in 2016 of the Jihadi enclave in eastern Aleppo showed to the Western ‘democracy promotion’ lobby that their regime change war in Syria could not be won, so the destruction of the Jihadi enclave in east Ghouta near Damascus today would show to the Western ‘democracy promotion’ lobby that their regime change war in Syria is irretrievably lost.

The UN is just as guilty as Oxfam etc.

• Women ‘Sexually Exploited In Return For Aid’ By Charities In Syria (BBC)

Women in Syria have been sexually exploited by men delivering aid on behalf of the UN and international charities, the BBC has learned. Aid workers said the men would trade food and lifts for sexual favours. Despite warnings about the abuse three years ago, a new report shows it is continuing in the south of the country. UN agencies and charities said they had zero tolerance of exploitation and were not aware of any cases of abuse by partner organisations in the region. Aid workers told the BBC that the exploitation is so widespread that some Syrian women are refusing to go to distribution centres because people would assume they had offered their bodies for the aid they brought home. One worker claimed that some humanitarian agencies were turning a blind eye to the exploitation because using third parties and local officials was the only way of getting aid into dangerous parts of Syria that international staff could not access.

The United Nations Population Fund (UNFPA) conducted an assessment of gender based violence in the region last year and concluded that humanitarian assistance was being exchanged for sex in various governorates in Syria. The report, entitled “Voices from Syria 2018”, said: “Examples were given of women or girls marrying officials for a short period of time for ‘sexual services’ in order to receive meals; distributors asking for telephone numbers of women and girls; giving them lifts to their houses ‘to take something in return’ or obtaining distributions ‘in exchange for a visit to her home’ or ‘in exchange for services, such as spending a night with them’.” It added: “Women and girls ‘without male protectors’, such as widows and divorcees as well as female IDPs (Internally Displaced Persons), were regarded as particularly vulnerable to sexual exploitation.” Yet this exploitation was first reported three years ago.

Danielle Spencer, a humanitarian adviser working for a charity, heard about the allegations from a group of Syrian women in a refugee camp in Jordan in March 2015. [..] “I remember one woman crying in the room and she was very upset about what she had experienced. Women and girls need to be protected when they are trying to receive food and soap and basic items to live. The last thing you need is a man who you’re supposed to trust and supposed to be receiving aid from, then asking you to have sex with him and withholding aid from you.” She continued: “It was so endemic that they couldn’t actually go without being stigmatised. It was assumed that if you go to these distributions, that you will have performed some kind of sexual act in return for aid.”

Home › Forums › Debt Rattle February 27 2018