Pablo Picasso Bathers with ball 1 1928

In trying to isolate Russia, the west isolates itself.

• Ukraine War Shows Emerging Post-American World (IC)

In the late 1990s, at a time when U.S. global dominance still looked invincible, Singaporean diplomat and academic Kishore Mahbubani raised questions about whether a rising Asia might thwart American hegemony in the near future. The crux of Mahbubani’s argument — laid out in his provocatively titled 1998 book, “Can Asians Think?” — was that Western elites, then flush with their victory in the Cold War, had become overly comfortable with dictating the bounds of legitimate debate and sound policy to the rest of the world. That imperious relationship, which had existed since the colonial period, was about to come to an end, said Mahbubani. Asians and other non-Westerners had their own ideas about how the world should be run and would soon have the strength to implement them.

A few decades later, the war in Ukraine is revealing how right Mahbubani was. Despite the browbeating of U.S. politicians to take a side in the conflict, a growing number of Asian, African, and Latin American countries have charted a neutral path. China, India, Brazil, Turkey, Indonesia, South Africa, and even Mexico have remained aloof, resisting calls to diplomatically isolate Russia or join the campaign to sanction its economy. Asian companies have remained in Russia even as their Western counterparts have departed en masse. At the United Nations, meanwhile, a bevy of African states, largest among them South Africa, have abstained from resolutions aimed at ostracizing Russian President Vladimir Putin for the invasion. The neutral stance of these countries has evidently come as a shock to many Western elites, long accustomed to instructing other nations on what geopolitical positions they must take.

The way the West corralled support as the only superpower during and after the Cold War, in other words, is no longer effective. India offers the best example of just how much this posture of self-interested neutrality has caught U.S. elites unawares. Richard Haass, the president of the Council on Foreign Relations, an exemplar of the U.S. foreign policy establishment, denounced India for its neutral stance. Haass, apparently unaware of his patronizing tone, said that India’s refusal to side against Russia proved that the country of 1.2 billion people “remains unprepared to step up to major power responsibilities or be a dependable partner.” President Joe Biden similarly criticized India for being “shaky” in its response to Russia, compared with European Union countries and Japan, which have rallied to the Ukrainian cause.

American leaders have long hoped that India would be willing to serve as a partner in helping the U.S. contain China and uphold the U.S.-backed liberal order. As it turns out, India has its own interests to pursue. It is a major customer of Russian arms and energy, enjoying a long relationship with Moscow going back to the Cold War. Morality aside, there are concrete, material reasons that Indians would not want to sacrifice these ties simply to win praise in Washington.

Energy pegged to ruble pegged to gold.

• Russian Central Bank Eases Capital Controls As Ruble Erases Losses (ZH)

Now that the Russian ruble has erased all of its post-incursion losses….the Russian Central Bank decided on Friday that it would loosen restrictions on the transfer of funds abroad, much to the relief of ordinary Russians (particularly the wealthy, as well as the Middle class, who have increasingly been turning to the UAE, Israel and other locales as havens for their capital and assets). CBR said it would allow Russians and non-residents from countries that don’t support sanctions to transfer up to $10,000, or its equivalent in another currency, each month. Shortly after Russia’s “special military operation” began last month, Russia’s central bank tightened restrictions on money flowing abroad, barring non-Russians from transferring more than $5,000 a month out of the country.

Transfer limits will be determined using the CBR’s official exchange rates for the ruble against other currencies, the bank said. Still, Russia will retain a tight grip on its currency market even with the easing of these capital controls. Russian brokerages still aren’t allowed to let foreign clients sell securities, one of a retinue of policies intended to support the ruble. CBR has also restricted the amount of dollars that Russians can withdraw from bank accounts denominated in foreign currencies. Russian banks have been barred from selling foreign currencies to Russians until early September as the Russian banking system continues to face the repercussions of the seizure by the West of hundreds of billions of dollars’ worth of foreign-currency reserves held in accounts abroad.

Bioweapons confirmation. But what are defensive bioweapons? Isn’t that what Pater Daszak was working on?

• Pentagon: No ‘Offensive’ Bioweapons at US-Linked Ukraine Labs (Antiwar)

A Pentagon official told Congress on Friday that there are no “offensive” biological weapons in any of the dozens of US-linked labs in Ukraine. “I can say to you unequivocally there are no offensive biologic weapons in the Ukraine laboratories that the United States has been involved with,” Deborah Rosenbaum, the assistant secretary of defense for nuclear, chemical, and biological defense programs, told the House Armed Services subcommittee. The Pentagon funds labs in Ukraine through its Defense Threat Reduction Agency (DTRA). According to a Pentagon fact sheet released last month, since 2005, the US has “invested” $200 million in “supporting 46 Ukrainian laboratories, health facilities, and diagnostic sites.”

Moscow has accused Ukraine of conducting an emergency clean-up of a secret Pentagon-funded biological weapons program when Russia invaded. The World Health Organization said it advised Ukraine to destroy “high-threat pathogens” around the time of the invasion. For their part, the US maintains that the program in Ukraine and other former Soviet states is meant to reduce the threat of biological weapons left over from the Soviet Union. While downplaying the threat of the labs, Pentagon officials have also warned that they could still contain Soviet-era bioweapons.

Robert Pope, the director of the DTRA’s Cooperative Threat Reduction Program, told the Bulletin of the Atomic Scientists in February that the labs might contain Soviet bioweapons and warned that the fighting in Ukraine could lead to the release of a dangerous pathogen. The Biden administration has tried to portray any concerns about the labs as “Russian propaganda.” When the issue gained more media attention, Biden officials started accusing Moscow of plotting to use chemical or biological weapons, but the US hasn’t presented any evidence to back up its claims.

Good for North Africa and the Middle East.

• Booming Wheat Exports From India To Ease Global Shortage (BBG)

In a world where people are worrying more than ever about food shortages and rising inflation, India’s warehouses are brimming over with grain and the country’s farmers are gearing up for yet another record harvest. The country is the top global producer of wheat after China and has the potential to ship 12 million tons to the world market in the 2022-23 year, the most on record, according to the median of five estimates in a Bloomberg survey of traders, millers and analysts. That compares with shipments of 8.5 million tons in 2021-22, U.S. Department of Agriculture data show. Prices of farm commodities were already on a tear before the Russian invasion of Ukraine as drought shriveled global harvests and demand increased, helping send world food costs to the highest on record.

The war made matters even worse because it has choked shipments from one of the planet’s top producing regions, cutting off more than a quarter of the world’s wheat supplies. “Indian wheat exports help the market in a tight world supply situation,” said Vijay Iyengar, chair and managing director of Singapore-based Agrocorp International. “It helps to keep a lid on global prices as well. If India wasn’t exporting wheat in large quantities, prices would have probably escalated further.” Benchmark wheat prices in Chicago surged to an all-time high of $13.635 a bushel last month after the Russian invasion, compared with an average of only around $5.50 a bushel in the five years through the day preceding the attack.

Tightening supply and rising prices for grain from major exporting countries have made Indian wheat competitive for the first time in years. With ballooning inventories after five straight record crops, India has a huge exportable surplus. That will be crucial for importers in North Africa and the Middle East where soaring food prices sparked violent uprisings more than a decade ago. While India has tended to ship wheat mostly to neighboring countries such as Bangladesh and to some Middle Eastern markets, exporters are now likely to find buyers across Africa and in other areas of the Middle Eastern region.

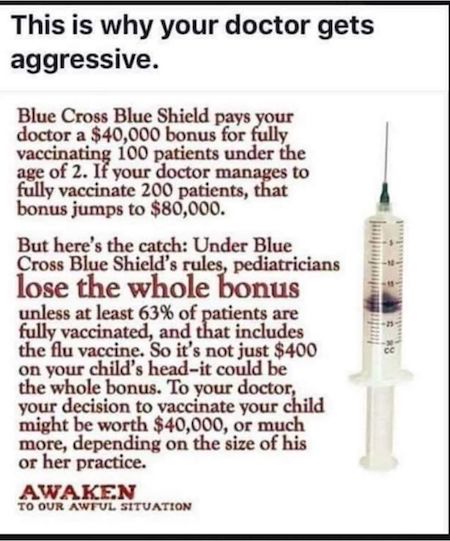

Mass psychosis.

• COVID Is Exploding, And Everything Is Fine (CS)

New wastewater data collected by the University of Calgary’s Cumming School of Medicine shows that COVID-19 is on the rise again — but it’s not clear it’s making much of an impact. According to Cumming School of Medicine microbiologist Dr. Dan Gregson, “The wastewater testing has shown, especially in Calgary, that the number of cases is going up and the positivity rate in the people we are testing has gone up as well.” He further says that he believes hospitalization numbers could rise throughout April due to a brand new variant called the BA.2 variant — I guess they’ve dropped the Greek alphabet branding. Based on the wastewater data released on March 28, 2022, SARS CoV-2 RNA has risen to levels above the spike seen on September 19, 2021 — around the same time Premier Jason Kenney locked Alberta down, implemented a vaccine passport, and issued an apology for letting Albertans be free for the summer.

However, despite COVID being more prevalent in wastewater, hospitalizations remain significantly lower. At the time of writing, Alberta is only reporting 964 hospitalizations, with 47 currently in the ICU. However, on September 17, 2021, there were nearly 20,000 active cases, and the province needed to use surge beds as ICUs would have been at 155 per cent capacity. Regardless, Gregson says Albertans should be concerned, get more vaccines, avoid contact with others, and return to masking indoors only a month after Kenney dropped the mask mandate. “Get your vaccines up to date. If you are at risk of severe disease, try and limit your contacts, use a mask in most indoor settings and limit your contacts with people who may be infectious.” Despite this recommendation, he concedes that contracting the new variant for most who’ve had COVID or received the vaccine will be like a “mild to moderate infection similar to a bad flu.”

Full anonymity. It’s like WikiLeaks.

• $1 Million Reward For A CDC or FDA Whistleblower (Kirsch)

I wrote an article earlier on how the safety signals in VAERS were flashing red back in January 2021. Yet nobody at the CDC or FDA said anything even though they were watching VAERS like a hawk (as the FDA’s Steven A. Anderson admitted on video). It’s simply impossible not to see the safety signals if they aren’t corrupt or incompetent. Since everyone in authority says these organizations are competent, then there is only one alternative left: they are corrupt. I am willing to pay up to $1M for information that I can give to the DOJ and state attorney generals to bring criminal charges against these people. You don’t have to reveal your identity. All you need to do is supply information that we can authenticate that shows the corruption for how all the safety signals were ignored.

You can keep your job at the CDC or FDA. Nobody has to know. You can contact me at [email protected] and put WHISTLEBLOWER in caps in the subject line of your message and put in the body what evidence you have, why the evidence is credible, and we can go from there. Armed with this information, we’ll also see whether any members of Congress call for an investigation. This will allow us to identify corrupt members of Congress. Note to members of DHS: By seeking this information, I am not a “domestic terrorist” since my goal is to expose corruption to restore faith in government institutions. Here is a complete list of members of Congress who agree that the CDC must be either incompetent or corrupt:

< this space intentionally left blank>

15 very fit individuals in 1 tournament.

• Tennis World Shocked After Scores Of Players Drop Out Of Miami Open (FWM)

The tennis world reacted with shock after favorites Paula Badosa and Jannik Sinner had to retire during the quarterfinals of the Miami Open. Badosa, soon to be the number three in the world, became unwell during her match against Jessica Pegula and left the court in tears. Badosa, who was comforted by her American opponent, decided to stop after consultation with her physiotherapist. Pegula reached the semifinals of the Miami tennis tournament for the first time in her career after Badosa’s resignation, reported Yahoo Sports. In the men’s tournament, the Italian phenomenon Jannik Sinner was forced to withdraw.

He gave up after 22 minutes in the game against Francisco Cerundolo, the number 103 in the world ranking. “When I served at 3-1 and 30-0, I saw him bend over. It was very strange,” Cerundolo said during an interview. “I hope he’s okay, he’s a great player.” The 23-year-old Argentinian surprisingly reached the semifinals with his first participation in the master tournament in Miami. It was the second game in a row that ended prematurely for the tennis fans. Fans reacted with shock to the bizarre tennis day. “What is going on?” someone asked.”

I stay away from celebrity stories, but what struck me earlier about this was that there was a full toxicology report, which included at least 10 substances, many of which were hard to trace and/or just old, within 24 hours. In Colombia! Ever seen such a report that fast in the US?

• Foo Fighters Drummer Taylor Hawkins Dead At 50 (Kirsch)

Here is a summary of the evidence I’ve pieced together from both public and private sources (who knew him personally). You can draw your own conclusions. The evidence is consistent with the primary cause being vaccine-induced myocarditis. It fits the facts like a glove. No other hypothesis I’m aware of can explain the evidence. His drug use, which as far as I have been able to determine was limited to smoking weed, played only a minor role. [..] I find it interesting to note that the cardiologists I talked to ranged from “Normal size 350g. It’s vax myocarditis strikes again” to “it is impossible to rule out the vaccine as the proximate cause of death” [..]

He was found dead in his hotel room on March 25, 2022 after complaining about chest pains. Press reported he died of cardiac arrest. That is really important. The vaccine causes death by cardiac arrest. Marijuana and heroin and the other drugs aren’t consistent with the symptoms observed before he died. He appeared to be perfectly normal other than chest pains. Taylor Hawkins was all about the music and his fans. Those were his passions. He was not in it for the money or any other reason. He was just a great guy. [inside source] He was married for 17 years and had three kids: Shane, Annabelle, and Everleigh. He had everything to live for.

Toxicology reports from the Columbian authorities claim there were 10 substances found in his body including opioids, benzodiazepines, marijuana and antidepressants but there was no mention of the amount of each substance. People have mentioned that drug reports from Columbian sources can be unreliable. An autopsy also found Hawkins’ heart weighed at least 600 grams, as reported by Colombian publication, Semana. This is about double the size of a normal heart for a man of his age. We know that the COVID vaccine can cause a heart to double in size and then kill you. This can happen in as little as 5 days after injection. One of the most public examples of this is the death of the son of Ernest Ramirez. His son died just 5 days after his first dose of Pfizer and his heart was double in size at the time of his death.

I checked with one of the world’s top cardiologists (Peter McCullough) who confirmed that yes, your heart can double in size in just 5 days. McCullough looked at the medical records for Ernest’s son and concluded his death was due to the COVID vaccine. FEMA offered Ernest Ramirez a lot of money to change his story and say that the death was caused by COVID. Ramirez refused. Hawkins had a history of drug use, and a 2001 heroin overdose left him in a coma, according to the Los Angeles Times. However, he “made clear he learned his lesson in 2001, and had lived a solid family life with perhaps occasional drug use here and there.” So it seems unlikely that he just decided on a spontaneous heroin/benzo/cocaine bender right before a show, called for help, then died of an overdose. He still smoked weed. This was well known. This probably elevated his risk, but he’d been smoking weed for decades.

[..] My best guess is: He likely got vaccinated around May 2021 with his first two doses after pressure from Grohl and the band manager. His medical exam done after his first vaccination(s) showed he had an enlarged heart for the first time. This was our first clue of vaccine injury. But clearly the doctor wasn’t that concerned since he didn’t tell Hawkins he was at any risk at all. The booster on Feb 26, 2022 took 30 days to damage his heart for the final time. As I noted early, it took only one dose and 5 days to kill Ernest Ramierez’s son who was completely normal until he died. For Hawkins, it just took longer. Unfortunately, I don’t think there will ever be an autopsy by a competent pathologist who knows how to spot vaccine injury (or embalming by a vaccine aware embalmer), so we’ll never know for sure, but all of the evidence is consistent with the vaccine hypothesis. It fits all the facts like a glove.

CEOs are strong, independent people. But no independent thought is allowed with Covid.

• Hospital CEOs Are Joining The Great Resignation (BHR)

The number of departing hospital CEOs is on the rise as C-level executives are grappling with challenges tied to the COVID-19 pandemic. Twelve hospital CEOs exited their roles in January, double the number who stepped down from their positions in the same month a year earlier, according to a report from Challenger, Gray & Christmas, an executive outplacement and coaching firm. While some hospital and health system CEOs are retiring, others are stepping down from their posts into C-level roles at other organizations. At least eight hospital and health system CEOs have stepped down from their positions since mid-February.

The increase in CEO departures isn’t unique to healthcare. More than 100 CEOs of U.S.-based companies left their posts in January, up from 89 in the same month a year earlier, according to the Challenger, Gray & Christmas report. The uptick in executive exits shouldn’t be surprising given the challenges presented by the COVID-19 pandemic, experts told NBC News. CEOs and other executives aren’t immune to the pressures that are prompting people to leave their jobs. “It’s many factors — the burnout, the pandemic, the school closures, the need to take stock of life,” Julia Pollack, chief economist at ZipRecruiter, told NBC News in January. “It’s a whole wide range of shocks.”

“He got, I think $4.8, yes, million from Chinese energy companies to sit on the board and consult. Yeah, that was his passion in life..”

• Hunter Biden Scandal ‘Wasn’t Part Of ‘Left-wing Media’ Narrative’ – Maher (Fox)

“Real Time” host Bill Maher blasted the “left-wing media” for failing to report on the Hunter Biden scandal during the 2020 presidential election. During his panel discussion on Friday night, Maher offered a history lesson about how in the “John Adams day” the country had “different newspapers for different parties” and what “brought it home to me” was how The Washington Post as well as The New York Times authenticated the laptop the New York Post first reported on nearly two years ago. “I remember reading about this a couple of years ago, the New York Post came across… Hunter Biden’s computer, which he apparently left at a computer repair store. I didn’t even know they existed. And if anyone should not leave his computer with other people, it would be Hunter Biden just for the personal stuff,” Maher said.

“But it also had stuff about how, you know, c’mon, he’s a ne’er-do-well. I’m sorry, Hunter Biden, but you are… You made a living being ne’er-do-well who was taking money just because you were the vice president’s son and you had influence.” “He got, I think $4.8, yes, million from Chinese energy companies to sit on the board and consult. Yeah, that was his passion in life,” Maher quipped. His exploration, hooker exploration, was his passion.” Maher continued, “So the New York Post got a hold of what was in the computer. And, you know, because the New York Post is a Republican paper, and The New York Times and The Washington Post are the Democratic paper[s]… And the Republican paper, Twitter… canceled their account! They can’t even report on this story. And now two years later, The New York Times and The Washington Post have come around and say, ‘Okay, there was something there.'”

The HBO star conceded that the laptop story should have been taken with a “giant thing of salt” since the New York Post retrieved it from Trump allies Rudy Giuliani and Steve Bannon, but “not two years.” “It looks like the left-wing media just buried the story because it wasn’t part of their narrative and that’s why people don’t trust the media,” Maher said. Former Democratic presidential candidate Andrew Yang agreed, pointing to polling that showed trust in media “falls very sharply along party lines” where 69% of Democrats say they still trust the media while just 15% of Republicans and 36% of independents say the same. “This is part of the erosion of institutional trust, where one side feels like the media is on their side,” Yang said. “And it does seem like this Hunter Biden laptop story did get buried because of the timing. I mean, it was coming out during the height of the election in 2020. And they did not want that out in the mainstream.”

Building backlash.

• Judge Strikes Down Corporate Board Diversity Law In California (JTN)

A judge has ruled that California’s mandate for corporate boards to diversify with members from certain racial, ethnic or LGBT groups violates the constitution. The ruling Friday was a major win for the conservative legal group Judicial Watch, which challenge the law on the grounds that are violated the equal protection clause. “This historic California court decision declared unconstitutional one of the most blatant and significant attacks in the modern era on constitutional prohibitions against discrimination,” Judicial Watch President Tom Fitton said.

“In its ruling today, the court upheld the core American value of equal protection under the law. Judicial Watch’s taxpayer clients are heroes for standing up for civil rights against the Left’s pernicious efforts to undo anti-discrimination protections.” The brief ruling granted summary judgment blocking the legislation that had been signed into law last year. The Legislature had wanted to require corporate boards of publicly traded companies to have a member from an “underrepresented community,” including LGBT, Black, Latino, Asian, Native American or Pacific Islander.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.