Lewis Wickes Hine Hot day, East Side, New York 1908

Some numbers in case you were still unsure.

• The Albatross of Debt – Part 2 (David Stockman)

Needless to say, we have reached the mane. What drove the US economy for the past three decades was debt expansion – private and public – at rates far faster than GDP growth. But that entailed a steady ratcheting up of the national leverage ratio until we hit what amounts to the top of the tiger’s back – that is, Peak Debt at 3.5X national income. As we also showed yesterday, the fulcrum event was Nixon’s abandonment of the dollar’s anchor to a fixed weight of gold at Camp David in August 1971. That unleashed the Fed to expand it balance sheet at will, thereby injecting fiat credit into the financial system at relentlessly accelerating rates; and it also paved the way for takeover of the FOMC by Keynesian academics and apparatchiks in lieu of the conservative bankers and money men who had run the Fed prior to 1970.

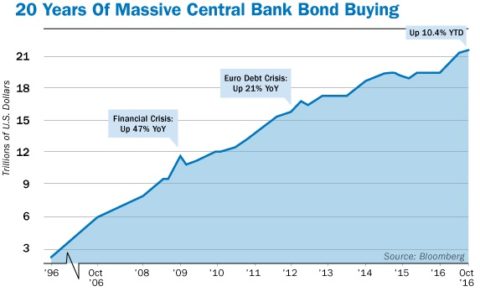

At length, the Fed’s balance sheet grew by 82X over the 48 years since June 1970, erupting from $55 billion to $4.5 trillion at the recent QE3 peak. The effect was drastic and enduring financial repression that drove bond yields far below what would have prevailed on the free market based on the supply of domestic real money savings. Stated differently, as the so-called “reserve currency issuer” the Fed’s massive balance sheet eruption forced money-printing reciprocity among all the central banks of the world owing to the fear of rising exchange rates – a syndrome which afflicts politicians and policy-makers everywhere. So the convoy of modest central bank balance sheets that collectively stood at perhaps $80 billion in June 1970 totals more than $22 trillion today.

That is, herded-on by the rogue central bank unleashed at Camp David, the convoy of global central banks evolved into a gigantic yield-insensitive bond buyer. For all practical purposes, they collectively operated the monetary equivalent of roach motels: The bonds went in but never came out. This massive sequestering of real debt funded by fiat credits, which central banks conjured from thin air, had the obvious first order effect of suppressing yields well below honest market clearing levels. That’s just the law of supply and demand 101.

[..] global GDP has expanded from about $3 trillion to $80 trillion since 1970 or by 26X. By contrast, the balance sheets of central banks has exploded by around 275X. [..] In June 1970 the GDP was $1.1 trillion and it has since expanded by 18X to $19.6 trillion. By contrast, total public and private debt outstanding was $1.58 trillion and has since expanded by 42X to $67 trillion. In effect, the law of compounding eventually rules. That’s because to extend these unsustainably divergent trends for even another decade would lead to an outright absurdity. As we also pointed out in Part 1, ten years from now nominal GDP would total $35 trillion and total public and private debt would reach $150 trillion.

This will not look benign for much longer.

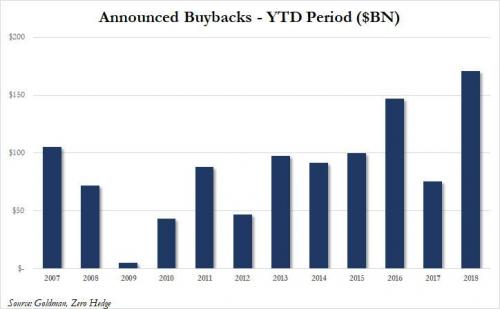

• Day Of Reckoning Nears with Record $650 Billion In Stock Buybacks (ZH)

When it comes to stock buybacks – an increasingly politically charged topic – 2018 has already been a historic year: as we reported last weekend the $171 billion in YTD stock buyback announcements is the most ever for this early in the year. In fact, it is already more than double the prior 10 year average of $77 billion in YTD buyback announcements. And, according to Goldman’s revised forecast of corporate cash use, the buyback tsunami is about to be truly unleashed this year. In a note released on Friday, Goldman’s chief equity strategist David Kostin revises his prior forecast for S&P 500 corporate cash spending, and now expects that in 2018 corporate cash outlays will grow by 15% to $2.5 trillion as a result of corporate tax reform and strong EPS growth, with $1.4 trillion (54% of the total) going toward growth while $1.2 trillion (46%) gets returned to shareholders.

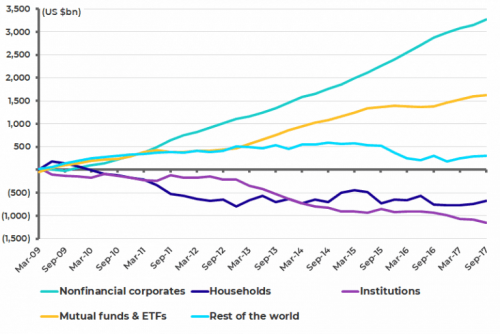

While Goldman expects capex to grow by a modest 11% to $690BN, remaining the single largest use of cash, it will be so only by a fraction as buybacks will be breathing down CapEx’ neck, and are set to increase by a whopping 23% from $527BN in 2017 to an all time high of $650BN, an amount which would make total 2018 buybacks the highest annual S&P500 stock repurchase on record. A quick reminder: corporations – via share buybacks – have been the main buyers of shares in the U.S. since 2009. Non-financial corporates have repurchased a net US$3.3 trillion worth of US equities since 2009, according to the Federal Reserve’s flow of funds data based on calculations from CLSA’s Chris Wood. By contrast, households and institutions (insurers and pension funds) have sold a net US$672 billion and US$1.2 trillion respectively over the same period, while mutual funds and ETFs have bought a net US$1.6 trillion.

[..] Chris Cole last October perfectly encapsulated the importance of stock buybacks to perpetuate the record low vol regime observed until recently: “The later stages of the 2009–2017 bull market are a valuation illusion built on share buyback alchemy…The technique optically reduces the price-to-earnings multiple because the denominator doesn’t adjust for the reduced share count… Share buybacks are a major contributor to the low volatility regime because a large price insensitive buyer is always ready to purchase the market on weakness…Share buybacks result in a lower volatility, lower liquidity, which in turn incentivizes more share buybacks, further incentivizing passive and systematic strategies that are short volatility in all their forms. Like a snake eating its own tail, the market cannot rely on share buybacks indefinitely to nourish the illusion of growth. Rising corporate debt levels and higher interest rates are a catalyst for slowing down the $500-$800 billion in annual share buybacks artificially supporting markets and suppressing volatility.” A graphic representation of Cole’s lament:

One-eyed leading blind?!

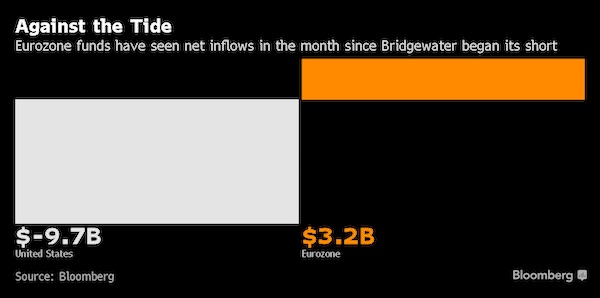

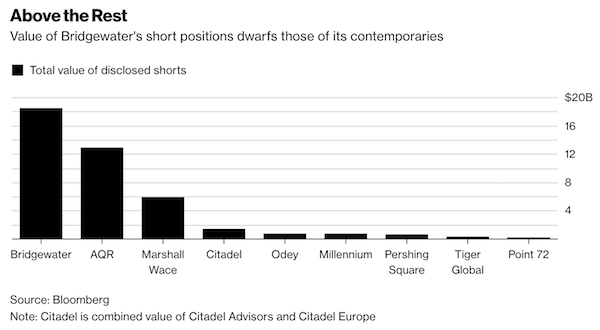

• It’s Dalio Versus Everyone Else as Money Flows to Europe Stocks (BBG)

Billionaire Ray Dalio has $18.45 billion in bets against Europe’s biggest stocks. Most of the rest of the investing world is headed in the other direction. U.S. stocks lost $9.7 billion in investment so far this month while Eurozone shares have gained $3.2 billion, according to data compiled by Bloomberg. Peers of Dalio’s firm, Bridgewater Associates, are mostly wagering that Eurozone equities will rise. “I’m surprised. That’s a big bet. Dalio and his team are very confident,” said Rick Herman at BB&T Institutional Investment. “That’s definitely out of consensus. European stocks are cheaper, and they also have stronger earnings growth.”

Dalio has always marched to the beat of his own drummer, so his big short position, especially when other hedge funds are betting in the opposite direction, could be seen in that context. Even among those who are short, Bridgewater stands out, according to a Bloomberg survey of hedge funds. The combined value of their shorts stands at $23 billion. Dalio’s position has decreased from $22 billion on Feb. 15 but is still a whopping 43% larger than the outstanding bets by Cliff Asness’s AQR Capital Management.

” A weak dollar while the US economy grows as it is, means an opportunity for the Federal Reserve. Will Powell use this opportunity?”

• A Strong Euro Is A Headache For The ECB (Mises)

In recent weeks, the euro has been at its highest level, relative to the US dollar, that we’ve seen in the last three years. This is a movement that surprises when the European Central Bank is carrying out the most aggressive monetary expansion in the world after the Bank of Japan. A strong euro is not a problem for any European citizen. European households keep a large part of their financial wealth in deposits. Additionally, a strong euro curbs inflation in imported products, mainly energy and food, generating a significant wealth effect. If we look at the commodity index between January 6, 2017 and January 12, 2018, we can see that it has fallen by more than 12% in euros, while it is slightly up in US dollars. For the average European citizen, a stable or strong euro is a blessing, and one of the essential factors for the recovery of household disposable income.

A strong euro has not been a problem either for exports. Spain, for example, has increased by 53% the weight of exports in GDP in the last five years and Eurozone exports in 2017 marked a record, growing more than the average of global trade and with a record trade surplus, which is one of the decisive factors explaining the euro strength. But a strong euro is bad news for central planners, indebted states and obsolete or low value-added sectors that need the hidden subsidy of devaluation. A strong euro destroys the ECB expectations of inflation, the increase in estimated profits of the low productivity sectors and puts in danger the debt reduction of inefficient states, which have been unable to reduce their deficits quickly enough. The ECB´s monetary policy, which becomes an assault on the savers and efficient sectors to subsidize the inefficient and indebted, does not work in a globalized world with open economies.

And, ironically, that is good for European families, who see their wealth in deposits strengthen and stable disposable income because inflation is low. Although the ECB maintains ultra-low rates and monthly repurchases of 30,000 million euros, they are unable to devalue as they would like. The European central planner must scratch its head thinking why. The US economy accelerates its growth, inflation expectations rise, the trade deficit is at decade-lows, the Federal Reserve is raising interest rates … And the US dollar does not strengthen. The main explanation lies in the trade surplus of China and the Eurozone. Central banks should know it is difficult to have rising trade profits and weakening currencies. A weak dollar while the US economy grows as it is, means an opportunity for the Federal Reserve. It can raise rates and strengthen options ahead of a global slowdown without worrying about its currency. Will Powell use this opportunity?

Eevryone’s favorite bubble.

• 1% Interest Rate Rise Would Cost Average UK Homeowner £930 a Year (G.)

A 1% rise in interest rates would add around £10bn to the UK’s mortgage bill, according to analysis from estate agent Savills. The increase would equate to adding £930 a year to the cost of servicing the average mortgage. Borrowers on variable rate deals influenced by movements in the Bank of England base rate would be the first to feel the pain, putting the annual mortgage bill up by £4.3bn immediately, Savills said. The 59% of borrowers on fixed-rate deals would feel the impact later, when their existing mortgage deals come to an end. Of the total increase, Savills calculates that buy-to-let landlords would pay an additional £2.4bn, with other home owners paying £7.8bn more.

“This would bring an end to the historically low mortgage costs that have boosted housing affordability and limit the buying power of those needing a mortgage, and underscores our forecasts for more subdued house price growth over the next five years,” said Lucian Cook, head of residential research at Savills. Savills forecasts that average UK house price growth will stand at 14% in total over the next five years. Borrowers are bracing themselves for further possible interest hikes following the increase last year from 0.25% to 0.5%. Earlier this month, the Bank of England governor, Mark Carney, readied borrowers for further and faster interest rate hikes, although he also stressed that rises would be limited and gradual.

“For the many, not the few” already sounds old and stale. Be careful with that.

• Corbyn Policy Shift Draws Brexit Battle Lines (Ind.)

Jeremy Corbyn will today create a clear Brexit dividing line between Labour and the Tories in a keynote speech which will see him finally commit to keep the UK in a European customs union. The Labour leader will argue the move would enable his party to secure “full tariff-free access” to the single market but without committing to all of its rules, allowing him to negotiate exemptions on freedom of movement and workers’ rights. The move ends months of speculation about Mr Corbyn’s stance on the issue, which goes to the heart of the debate about Britain’s future. It also simultaneously heaps pressure on Theresa May as pro-EU Tory rebels are poised to join Labour and force her to keep the UK in the customs union.

The Prime Minister is scrambling to agree Britain’s approach to the future relationship with the EU by Friday, as Brexiteers also threaten her leadership from the right, if she fails to seek a deal that allows the UK to agree trade deals – something staying in the customs union would preclude. In a much-anticipated speech in Coventry, Mr Corbyn will say: “Britain will need a bespoke relationship of its own. Labour would negotiate a new and strong relationship with the single market that includes full tariff-free access and a floor under existing rights, standards and protections. “That new relationship would need to ensure we can deliver our ambitious economic programme, take the essential steps to upgrade and transform our economy, and build an economy for the 21st century that works for the many, not the few.”

Dressing up one’s propaganda as a war against propaganda.

• Erdogan Slams ‘Worldwide War Of Propaganda’ Against Turkey (K.)

Turkish President Recep Tayyip Erdogan has lashed at what he claims is a “worldwide war of propaganda” against his country. “The launching of a worldwide war of propaganda based on lies, slander and distortion, by those who cannot deal with Turkey on the ground will not work,” Erdogan was quoted by Anadolu agency as saying during a meeting of his ruling Justice and Development Party (AKP) in southern Turkey on Saturday. “Those who see us as yesterday’s Turkey and treat us in this manner have begun to gradually realize the truth,” Erdogan said, according to the report.

We’re back to Putin kills babies.

• Eastern Ghouta Crisis: The West’s Hypocrisy Knows No Bounds (SCF)

As usual, the West has demonstrated its ability to fire off a quick response when it comes to slamming Russia for something it has not done. This time it’s about Eastern Ghouta, a Damascus suburb under terrorist control. The accusation? Russia and its ally Syria are guilty of killing innocent civilians, thanks to their “devastating” attacks and “siege-and-starve tactics.” It’s the same old story – no actions against terrorists are permissible because of the risk of collateral damage. The Western media have jumped on the anti-Russia bandwagon as readily as if they were orchestra members carefully following the tempo of their conductor’s baton. US Ambassador to the UN Nikki Haley wasted no time chiming in. One has to do some digging into the problem to see what’s really happening in Eastern Ghouta.

It was reported on Feb. 21 that talks to end the hostilities had broken down because the terrorists had refused to lay down their arms. The anti-government groups, including the notorious Al-Nusra (Hayat Tahrir al-Sham), have prevented civilians from leaving this dangerous zone. They are obstructing the humanitarian operations of international aid agencies, such as the Red Cross and World Food Program. The UN has repeatedly expressed its concern over the situation in the region, urging that humanitarian access to the area be safeguarded.

The presence of armed jihadists in Eastern Ghouta, which is at the root of the problem, is never mentioned in Western press reports. The attacks on Russia’s embassy in Damascus, carried out by the same “guys” who are causing the suffering of civilians in Ghouta, receive little or no media attention. Russian aircraft did not conduct air strikes on this suburb. The Western accusations are groundlessand offer no details. The Russian military has been involved in humanitarian efforts to help the refugees fleeing this dangerous area. It was Moscow alone who called for the urgent UN Security Council meeting to discuss the situation.

The Syrian authorities have never made a secret of their intention to rid the area of jihadists. A ground offensive might be coming soon, but would that be a bad thing? Isn’t it the duty of any government to provide security to its citizens by fighting the terrorists who are holding civilians hostage? Terrorists from Eastern Ghouta regularly shell Damascus, killing civilians. The sooner the suburb is liberated, the better for everyone. If the anti-Assad fighters were real patriots, they would have left the populated areas a long time ago. Instead, they use civilians as human shields. Aren’t they the ones to blame for this dire situation? But no, the Western media call them “rebels,” not “gangs of ruthless murderers.” The terrorists in Ghouta won’t surrender because they are pinning their hopes on the West to help them out.

It’s a duty.

• It Is Always, Always, ALWAYS Okay To Question Official Narratives (CJ)

On the fifth of April, 2017, CNN staged a fake, scripted interview featuring a seven year-old Syrian girl sounding out pro-regime change talking points syllable-by-syllable using concepts that she could not possibly understand. CNN host Alisyn Camerota was asking the child questions throughout the performance, which means that Camerota necessarily had the other half of the script. CNN has never offered an explanation for this event, and nobody has ever been able to provide me with a plausible defense of it. This is not some tinfoil hat fantasy I made up in my imagination. This happened. CNN knowingly staged a fake, scripted interview and deceitfully passed it off to its audience as a real one, exploiting a small child for interventionist propaganda in an inexcusably fraudulent way.

And yet CNN has the gall to get huffy and indignant when it’s suggested that they tried to use scripted questions in a town hall about the Florida school shooting. I rarely pay much attention to the false flag theories which emerge after every hotly publicized mass shooting in America. They’re very convoluted and consist mostly of pointing out inconsistencies and plot holes in the official story being advanced, without offering any clear substantial narrative about what did happen and why. It’s not that I doubt for one second that the US power establishment would butcher American citizens if it significantly benefitted them, I just see no clearly laid-out evidence that that’s what happened in these cases. That said, the fact that the same mass media machine which brazenly staged a war psyop using a seven year-old girl is loudly condemning people who question the official narrative about the Florida school shooting is obscene.

[..] The mass media created conspiracy theories. By lying to the public day after day after day in the most grotesque and brazen ways imaginable, they created an environment where people will necessarily question the ways in which reality differs from what they’ve been told. How could they not? And yet these depraved manipulators still dedicate massive amounts of resources toward putting immense public pressure on anyone who still has unanswered questions, because Seth Rich’s family wants you to shut up and some guy shot a hole in a pizza shop floor.

Math for sociopaths.

• The Exponent Problem Of Running Other People’s Lives (Gore)

Most people find managing their own affairs sufficiently challenging. Earning a living, establishing a family, rearing children, saving for college and retirement, and dealing with illness and aging fill the days and leave little time, attention, or energy to manage someone else’s affairs. A hypothesis: the effort required to run other people’s lives is an exponential function. If X is the sum total of everything required to run your life; running two lives is X squared; three lives is X cubed, and so on. Call it the exponent problem. For partial verification, try running someone else’s life for a day or two. See how it works out for you and the other person. Why do governments fail? Government is someone imposing rules on someone else, and backing them up with repression, fraud, and violence when necessary.

The governed always outnumber those governing, which means the latter face the exponent problem. In the US, there are around 22 million employed by the government, and let’s add in another million who actively influence it. The US population is around 323 million, so there are 23 million rulers to 300 million ruled, or about 13 ruled per ruler. How fitting, like the 13 original colonies! Whatever amount X of time, energy, money, attention, and other resources the rulers expend on their own lives, they must expend that X to the thirteenth power to “govern” the ruled. If X could actually be quantified and it was only 2, it would still take 8192 times the effort to rule the US as it does for the rulers to govern their own lives. Those are just illustrative numbers, but you get the picture. No wonder rulers use repression, fraud, and violence.

They’re overwhelmed by the exponent problem. On its best days governance is a comic proposition, on its worst, a tragic and terrible one. A farce, but in its own way tragic and terrible, is preceding the ultimately tragic and terrible outcome of the US government’s efforts to govern every aspect of its constituents’ lives and exercise power over what it considers its global domain.

Let theme at jellyfish.

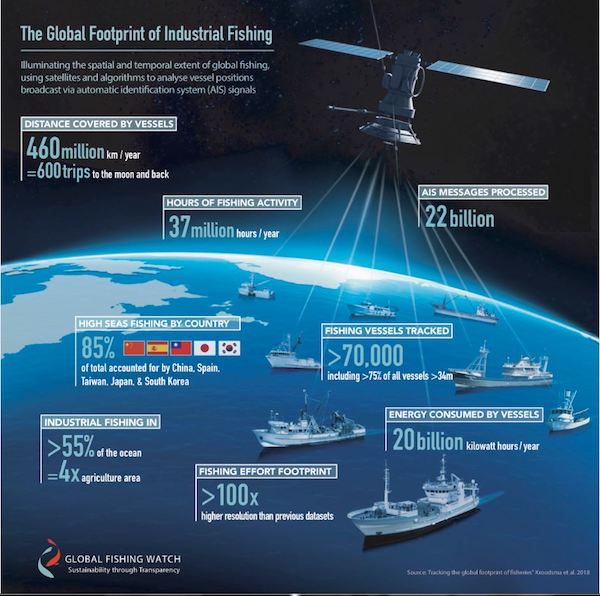

• More Than Half of World’s Ocean Surface Hit By ‘Industrial Fishing’ (CNBC)

Commercial fishing covers more than 55% of the ocean’s surface, a new study has revealed in a potentially worrying sign about the depletion of marine resources. Fish from the wild do not currently contribute a significant portion of human caloric consumption, but “the footprint of industrial fishing in the ocean is over four times larger than the land area occupied by agriculture,” researchers said in a paper published by the journal Science on Thursday. And the bulk of activity is dominated by just five countries: China, Spain, Taiwan, Japan and South Korea. Publishing a comprehensive map of global fisheries for the first time using satellite technology and big data, researchers discovered that fishing patterns were strongly influenced by cultural and political events rather than weather.

“The Christmas holiday and fishing moratorium in China have a bigger effect on the global temporal footprint of fishing than any seasonal weather changes.” Every year, the world’s second-largest economy imposes a nation-wide fishing ban that usually lasts for three months. Beijing will institute the rule in the Yellow River from April 1 to June 30 this year, Xinhua reported this week. Other water bodies, such as the Yangtze River and Pearl River, could also see annual bans.

Causing the biggest leap in demand for health care in history. A system that‘s already shaking on its foundations.

• Millennials To Be Most Overweight Generation in History (Ind.)

Middle-aged millennials are set to be the most overweight generation since records began, with experts warning they are unwittingly and significantly increasing their risk of cancer. Analysis by Cancer Research UK (CRUK) shows that on current trends 70% of millennials, those born between the early 1980s to mid-1990s, will be overweight or obese by the age 35 to 45. However, despite being linked to 800,000 cancer cases a year, the vast majority of people are unaware of the additional risk obesity brings. Health campaigners said the figures were “horrifying” and a consequence of the Government only paying “lip service” to tackle the obesity crisis, while slashing health budgets.

The seven out of 10 figure for millennials compared to around 50% of the “baby boomer” generation, born between 1945 and 1955, who were overweight or obese in their thirties and forties. “This means millennials are the most overweight generation since current records began”, said CRUK after it extrapolated current obesity trends to look at the state of the nation’s weight in 2028. The UK is already the most overweight nation in Western Europe, with obesity rates rising even faster than in the US. However, just 15% of people in the UK are aware that being obese increases your risks of developing bowel, kidney and breast cancers, and at least 10 other types.

Home › Forums › Debt Rattle February 26 2018