Paul Signac Boulevard de Clichy under snow 1886

HEPA

"99.97% of airborne pathogens are captured by the HEPA filtering system… The case is very strong that masks don’t add much if anything in the air cabin." – Southwest Airlines CEO Gary Kelly

It was always about control, not safety. RT to demand no forced masks on planes! pic.twitter.com/XaOwtNESQa

— Robby Starbuck (@robbystarbuck) December 16, 2021

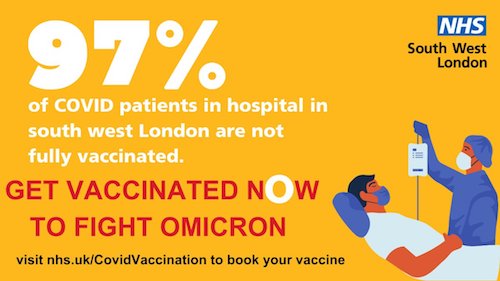

Because the vast majority have “only” had 2 shots, and “only” minority have had 3. Goal posts.

Jessica Rose works with Peter McCullough.

Chemicals that reprogram your immune system are about as scary as it gets.

“..these findings provide very good reasons as to why we are seeing resurgences of latent viral infections and other adverse events..”

• Pfizer Vaccine Reprograms Both Adaptive And Innate Immune Responses (Rose)

A brand new medRxiv pre-print study entitled: “The BNT162b2 mRNA vaccine against SARS-CoV-2 reprograms both adaptive and innate immune responses” has graced our world. This paper is so important and it provides evidence to support what many prominent immunologists and vaccinologists have been saying for a long time, including myself. These COVID-19 mRNA injectable products are causing, yes, causing, immune system dysregulation – and not just in the context of the adaptive system, but in the context of the innate system. Not only that, but these findings provide very good reasons as to why we are seeing resurgences of latent viral infections and other adverse events reported in VAERS (and other adverse event reporting systems) and perhaps more importantly, why we should under no circumstances inject this crap into our children. Children are fine in the context of COVID-19 (for the 80 millionth time – this well documented) and this is due to their extraordinary innate immune response systems.

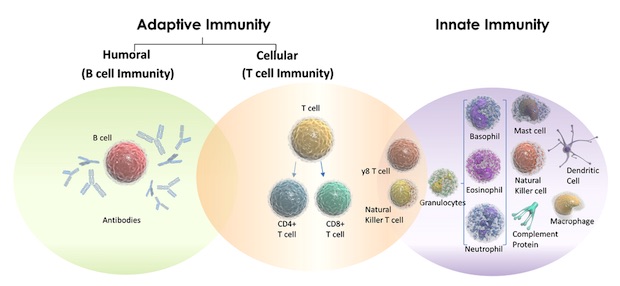

Let’s rip into some background in immunology, shall we? Figure 2 shows many of the different cell types involved in the adaptive and the innate immune system branches. Most of you probably know about T cells and B cells. I would bet that many more of you have not heard of my personal favorite killer, the Natural Killer (NK) cell. They kill infected cells and are of utmost importance to a healthy and functioning immune system. The cell types involved in the innate immune response system emit special molecules in response to invaders. These special molecules primarily comprise defensins, collectins, c-reactive proteins, lipopolysaccharide (endotoxin) binding proteins and complement factors. These responses are non-specific and target invading pathogens and even cancer cells.

Figure 2: The big picture of adaptive versus innate immune cells.

In a nutshell, in this article, what they found was that the BNT162b2 (Pfizer/BioNTech) injectable products are modulating the production of inflammatory cytokines by innate immune cells upon stimulation with both specific (SARS-CoV-2) and non-specific (viral, fungal and bacterial) stimuli whereby the response of innate immune cells to TLR4 and TLR7/8 ligands was weaker after BNT162b2 injection, while fungi-induced cytokine responses were stronger. In conclusion, the mRNA BNT162b2 vaccine induces complex functional reprogramming of innate immune responses, which should be considered in the development and use of this new class of vaccines.

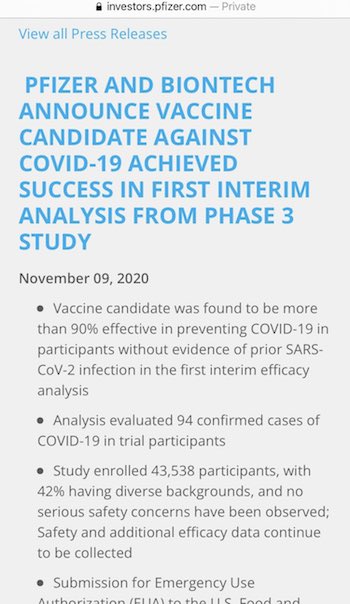

Here’s that study. Which claims: “..has been shown to be up to 95% effective in preventing SARS-CoV-2 infections..”

While even CDC and WHO say it does not prevent infections. Like Pfizer said a year ago|:

• BNT162b2 mRNA Vaccine Reprograms Adaptive And Innate Immune Responses (medRxiv)

The mRNA-based BNT162b2 vaccine from Pfizer/BioNTech was the first registered COVID-19 vaccine and has been shown to be up to 95% effective in preventing SARS-CoV-2 infections. Little is known about the broad effects of the new class of mRNA vaccines, especially whether they have combined effects on innate and adaptive immune responses. Here we confirmed that BNT162b2 vaccination of healthy individuals induced effective humoral and cellular immunity against several SARS-CoV-2 variants.

Interestingly, however, the BNT162b2 vaccine also modulated the production of inflammatory cytokines by innate immune cells upon stimulation with both specific (SARS-CoV-2) and non-specific (viral, fungal and bacterial) stimuli. The response of innate immune cells to TLR4 and TLR7/8 ligands was lower after BNT162b2 vaccination, while fungi-induced cytokine responses were stronger. In conclusion, the mRNA BNT162b2 vaccine induces complex functional reprogramming of innate immune responses, which should be considered in the development and use of this new class of vaccines.

BREAKING: South Africa has decided not to introduce any new restrictions as a result of Omicron.

“If Omicron ‘outcompetes’ the Delta variant, then it could spell the end of the pandemic as we know it, putting coronavirus in the same category of disease as the common cold..”

• Deep Data Dive: Is Omicron The End Of The Pandemic? (Unherd)

Since its discovery in the Gauteng province of South Africa in November, a new Covid variant has set off a spiral of harsh restrictions, travel bans and questions about the efficacy of the existing two-dose vaccines. Dr Angelique Coetzee, the scientist who first raised the alarm in Gauteng, has repeatedly assured the public that early observation of symptoms suggests that Omicron could be milder than the Delta variant. Despite some reassuring signs on the ground, reaction to the new variant has been dramatic, with Boris Johnson warning of a ‘tidal wave’ of cases in the UK and Joe Biden predicting an ‘explosion’ of cases in the US. To unpick some of the data coming out of Gauteng, Freddie Sayers sat down with researcher at the University of Johannesburg, Pieter Streicher, who has been following the developments of the Omicron variant in his home country.

Pieter is clear that, like all waves of the virus, there will predictably be a sharp increase in cases in the coming weeks in South Africa and beyond. But cases are not, he says, the best metric by which to measure the threat of Omicron. When measuring the virulence of any variant, it is more important to study records of hospitalisations and excess deaths. By these measures, Omicron is resulting in hospital admissions well below the previous wave in South Africa, and needing far less interventions like ventilation or supplemental oxygen. Excess deaths look likely to follow this pattern. With Delta, Pieter explains, patients were often coming into hospital with low blood oxygen levels and severe symptoms. Reporting from South African hospitals suggests that a higher percentage of positive tests are ‘incidental’ with the Omicron variant, with patients often asymptomatic or unaware that they were harbouring the virus.

Pieter appreciates that the initial exponential growth rate for Omicron does look dramatic. But scientists ‘make the mistake to project that [exponential growth rate] well into the future, well beyond even a plausible peak date.’ According to his observations, Omicron’s growth rate appears to already be slowing in Gauteng. If symptoms are less severe and numbers slowing, could this new variant actually be good news? Pieter is cautiously optimistic. If Omicron ‘outcompetes’ the Delta variant, then it could spell the end of the pandemic as we know it, putting coronavirus in the same category of disease as the common cold. Pieter is keeping a close eye on the newer numbers being recorded in Europe, as are we.

“I wrote an op-ed calling out the most recent & blatant non-public health actions committed by our captured health agencies. One path forward is clear: we must redesign the system so Pharma is not in the drivers seat (they can sit in the back..maybe).”

“Why do repurposed drugs require numerous trials prior to an agency recommendation, while high-profit, novel, patented drugs get routinely approved after only a single trial?”

• Studies Proving Generic Drugs Can Fight COVID Are Being Suppressed (Kory)

Since the summer of 2020, U.S. public health agencies have continually shut down the use or even discussion of generic treatments that are minimally profitable. The National Institutes of Health (NIH) funded 20 large research studies of patented pharmaceutical industry drugs before only recently (and slowly) agreeing to study repurposed generic medicines. The Food and Drug Administration and the Centers for Disease Control have recommended next to none. Instead, the Biden administration has thrown its political weight almost solely behind mass vaccinations, and hospitals and pharmacies have dogmatically followed suit. But this approach is proving insufficient to arrest COVID-19.

Just look at the evidence on fluvoxamine, a widely used generic antidepressant. A randomized controlled trial (RCT) published in November 2020 showed that the drug led to far less clinical deterioration in treated patients. Another, larger, double-blind RCT, published in The Lancet in October of this year, found fluvoxamine reduced COVID-19 mortality rates by up to 91 percent and hospitalizations by two-thirds. This is an FDA-approved drug. Dosed correctly and for such short periods, it is safe. And it costs about a dollar a pill. These findings have since been further reinforced by another study published by the Journal of the American Medical Association in November, which showed a strong “class effect” of benefits from anti-depressants very similar to fluvoxamine against COVID-19.

Yet, despite the large double-blind, placebo-controlled trial, neither the NIH nor the Infectious Diseases Society of America (IDSA) has arrived at a recommendation for routine use of these drugs to treat COVID-19. The NIH to date has ignored the study. Its last update on fluvoxamine dates back to April, more than seven months ago. More disturbing is the fact that the IDSA recently reviewed this high-quality trial, yet still held fast to its recommendation of “do not use outside of a clinical trial.” Why do repurposed drugs require numerous trials prior to an agency recommendation, while high-profit, novel, patented drugs get routinely approved after only a single trial?

A recent and most brazen example is Merck’s expensive new anti-viral COVID-19 drug, molnupiravir. The FDA rapidly approved it based on a single study of modest benefits in mildly ill outpatients, and the Biden administration swiftly agreed to pay $700 per course of treatment. That was all despite the fact the medicine costs about $20 per course to manufacture, according to a World Health Organization consultant, and may prove less effective or even harmful in practice. With our national debt registering at $2.77 trillion and inflation rampant, building the capacity in our federal government to study cheap, generic medicines would be a smart economic move. But there appears to be no appetite for fiscal prudence or scientific inquiry beyond the expensive, newly minted solutions churned out by our nation’s pharmaceutical industry.

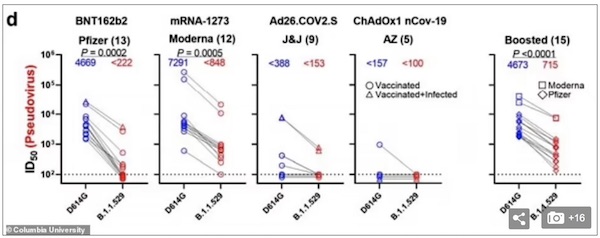

“Omicron is ‘markedly resistant’ to all four COVID vaccines and booster shots may only give ‘slight protection’, Columbia University study finds: Day after Fauci said triple-vaxxed should be protected”

• Omicron ‘Markedly Resistant’ To All 4 Covid Vaccines (DM)

Columbia University researchers claimed that COVID-19 Omicron is noticeably resistant to vaccines and that boosters sometimes provide only just enough protection, but US COVID tsar Dr. Anthony Fauci insisted booster shots provided adequate coverage. In a study published Wednesday by Dr. David Ho and 20 other researchers, the scientists said that Omicron’s ‘extensive’ mutations can ‘greatly compromise’ all major COVID-19 vaccines – Pfizer, Moderna, Johnson & Johnson and AstraZeneca – even neutralizing them. The report, the first of its kind and conducted along side the University of Hong Kong, also said that while booster shots provided an additional layer of protection, the variant ‘may still pose a risk’ for those who get the third shot.’

The study does not prove booster shots are ineffective, and it comes a day after Fauci said the additional shots work against the Omicron variant and urged Americans to get their third jab. ‘Our booster vaccine regimens work against omicron. At this point, there is no need for a variant-specific booster,’ Fauci said. ‘If you’re unvaccinated, you need to get vaccinated to diminish you’re vulnerability, and if you are vaccinated, get boostered.’ The Columbia University study looked at the effectiveness of each major vaccine against the Omicron variant, finding several cases where they failed to provide the needed protection against infection. While the booster shots proved to be overall consistent, some recorded instanced put it right at the threshold of being fully effective.

‘These findings are in line with emerging clinical data on the Omicron variant demonstrating higher rates of reinfection and vaccine breakthroughs,’ the scientists wrote. ‘Even a third booster shot may not adequately protect against Omicron infection.’ Ho and the Columbia research team said the study delivers a grave warning about the future of COVID and its variants. ‘It is not too far-fetched to think that this [COVID-19] is now only a mutation or two away from being pan-resistant to current antibodies,’ the researchers wrote. ‘We must devise strategies that anticipate the evolutional direction of the virus and develop agents that target better conserved viral elements.’ The new study, however, is out of step with other reports that found three jabs provided sufficient coverage.

Drug pushers. And that’s all they are.

• EU Agency Backs Pfizer Covid Pill For Emergency Use (Br.)

The EU’s drug regulator on Thursday allowed member states to use Pfizer’s new Covid pill ahead of its formal approval, as an emergency measure to curb an Omicron-fuelled wave. Pills like those by US pharma giant Pfizer and rival Merck have been hailed as groundbreaking because they do not need to be injected or taken intravenously, making them more accessible. Pfizer said this week that its Paxlovid pill reduced hospitalisations and deaths in vulnerable people by almost 90 percent. “The medicine, which is not yet authorised in the EU, can be used to treat adults with Covid-19 who do not require supplemental oxygen and who are at increased risk of progressing to severe disease,” the EMA said in a statement.

“EMA issued this advice to support national authorities who may decide on possible early use of the medicine… for example in emergency use settings, in the light of rising rates of infection and deaths due to Covid-19 across the EU.” Pfizer CEO Albert Bourla said the decision “signifies the strength of our data for Paxlovid in the treatment of high-risk adults diagnosed with Covid-19.” “If authorised, Paxlovid has the potential to help save lives and reduce hospitalisations,” he said in a statement. The Pfizer pill is a combination of a new molecule, PF-07321332, and HIV antiviral ritonavir, that are taken as separate tablets. The Amsterdam-based EMA said it should be taken as soon as possible after a diagnosis and within five days of the start of symptoms, with the treatment lasting five days.

Possible side effects were taste changes, diarrhoea and vomiting. Pregnant women should not use the drug. The EMA said it also launching a “rolling review” of the Pfizer pill that could lead to its full approval in months. Merck’s pill received EMA emergency approval in November. It is already authorised in Britain and is in the process of being approved in the United States. Denmark on Thursday became the first EU country to approve its use.

“..Just 20% to 24% of BioNTech vaccine recipients had detectable neutralising antibodies against Omicron..”

• Hong Kong Researchers Urge Third Covid-19 Shot After New Omicron Study(R.)

Researchers in Hong Kong have urged people to get a third dose of COVID-19 vaccine as soon as possible, after a study showed insufficient antibodies were generated by the Sinovac (SVA.O) and BioNTech (22UAy.DE) products to fend off Omicron. Tuesday’s release of the results of a study by scientists in the microbiology department of the University of Hong Kong was the first published preliminary data on the impact of Sinovac’s vaccine against the Omicron variant of coronavirus. None of the serum of the 25 Coronavac vaccine recipients contained detectable antibodies that neutralised the new variant, according to the preprint study that has been accepted for publication in the journal Clinical Infectious Diseases, the researchers said.

Just 20% to 24% of BioNTech vaccine recipients had detectable neutralising antibodies against Omicron, the study found. “The public is advised to get a third dose of the vaccine as soon as possible while waiting for the next generation of a more matched vaccine,” the researchers said in a news release. The study, funded by the Hong Kong government, was carried out by microbiologists Yuen Kwok-yung, Kelvin To and Chen Honglin. Sinovac did not immediately respond to questions on the study, but a spokesperson said its own laboratory testing showed a third dose of its vaccine was effective in producing Omicron antibodies.

How far away are we from saying the refugees are the lucky ones?

• Refugees Lack Covid Shots Because Drugmakers Fear Lawsuits (R.)

Tens of millions of migrants may be denied COVID-19 vaccines from a global programme because some major manufacturers are worried about legal risks from harmful side effects, according to officials and internal documents from Gavi, the charity operating the programme, reviewed by Reuters. Nearly two years into a pandemic that has already killed more than 5 million people, only about 7% of people in low-income countries have received a dose. Vaccine deliveries worldwide have been delayed by production problems, hoarding by rich countries, export restrictions and red tape. Many programmes have also been hampered by hesitancy among the public read more . The legal concerns are an additional hurdle for public health officials tackling the coronavirus – even as officials say unvaccinated people offer an ideal environment for it to mutate into new variants that threaten hard-won immunity around the world.

Many COVID-19 vaccine manufacturers have required that countries indemnify them for any adverse events suffered by individuals as a result of the vaccines, the United Nations says. Where governments are not in control, that is not possible. The concerns affect people, such as those displaced by the Myanmar, Afghanistan and Ethiopian crises, who are beyond the reach of national governments’ vaccination schemes. For refugees, migrants and asylum-seekers, as well as people afflicted by natural disasters or other events that put them out of reach of government help, the global programme known as COVAX created a Humanitarian Buffer – a last-resort reserve of shots to be administered by humanitarian groups. Gavi, the vaccine alliance, is a public-private partnership set up in 2000 to promote vaccination around the world.

The president of Bayer’s Pharmaceuticals Division.

• mRNA Shots Are ‘Gene Therapy’ Marketed As ‘Vaccines’ To Gain Public Trust (LSN)

The president of Bayer’s Pharmaceuticals Division told international “experts” during a globalist health conference that the mRNA COVID-19 shots are indeed “cell and gene therapy” marketed as “vaccines” to be palatable to the public. Stefan Oelrich, president of Bayer’s Pharmaceuticals Division, made these comments at this year’s World Health Summit, which took place in Berlin from October 24-26 and hosted 6,000 people from 120 countries. Oelrich told his fellow international “experts” from academia, politics, and the private sector that the novel mRNA COVID “vaccines” are actually “cell and gene therapy” that would have otherwise been rejected by the public if not for a “pandemic” and favorable marketing.

“We are really taking that leap [to drive innovation] – us as a company, Bayer – in cell and gene therapies … ultimately the mRNA vaccines are an example for that cell and gene therapy. I always like to say: if we had surveyed two years ago in the public – ‘would you be willing to take a gene or cell therapy and inject it into your body?’ – we probably would have had a 95% refusal rate,” stated Oelrich. “Our successes over these 18 months [the duration of the COVID ‘pandemic’] should embolden us to fully focus much more closely on access, innovation and collaboration to unleash health for all, especially as we enter, on top of everything else that is happening, a new era of science – a lot of people talk about the Bio Revolution in this context,” continued the businessman.

NIH PubMed, Oct 22 2021.

If the vaccines actually worked, there’d be no need for persuasion.

• Persuasive Messaging To Increase Covid-19 Vaccine Uptake Intentions (NIH)

Widespread vaccination remains the best option for controlling the spread of COVID-19 and ending the pandemic. Despite the considerable disruption the virus has caused to people’s lives, many people are still hesitant to receive a vaccine. Without high rates of uptake, however, the pandemic is likely to be prolonged. Here we use two survey experiments to study how persuasive messaging affects COVID-19 vaccine uptake intentions. In the first experiment, we test a large number of treatment messages. One subgroup of messages draws on the idea that mass vaccination is a collective action problem and highlighting the prosocial benefit of vaccination or the reputational costs that one might incur if one chooses not to vaccinate.

Another subgroup of messages built on contemporary concerns about the pandemic, like issues of restricting personal freedom or economic security. We find that persuasive messaging that invokes prosocial vaccination and social image concerns is effective at increasing intended uptake and also the willingness to persuade others and judgments of non-vaccinators. We replicate this result on a nationally representative sample of Americans and observe that prosocial messaging is robust across subgroups, including those who are most hesitant about vaccines generally. The experiments demonstrate how persuasive messaging can induce individuals to be more likely to vaccinate and also create spillover effects to persuade others to do so as well.

There is so much more going on than just this. It’s full capture.

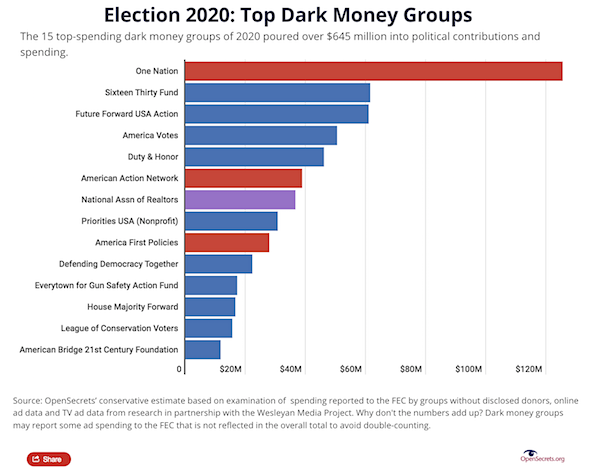

• Pfizer and Moderna Made Large Dark-money Donations During 2020 Election (Fang)

The representatives of the biopharmaceutical companies behind the Covid-19 vaccines made undisclosed donations to Democratic and Republican campaign organizations last year. The revelations are detailed in the latest tax filings of the Biotechnology Innovation Organization, which lobbies on behalf of Moderna, Pfizer, Johnson & Johnson, and other leading biotech companies involved in the business of treating the Covid-19 virus. BIO has long served as an influential voice for the biotech industry on Capitol Hill and has more recently become the public face of the vaccine industry amid the Covid-19 crisis. But the decision to step up direct contributions to dark-money groups active in the 2020 election reflects a new strategy for BIO, which in previous years only gave to congressional leaders through relatively low-dollar and transparent PAC donations.

The tax disclosure shows that BIO gave $500,000 to Majority Forward, a nonprofit that works to elect Senate Democrats. BIO gave $250,000 to American Bridge 21st Century, a Democratic fact-checking and research website that sponsored campaign advertisements in support of Joe Biden’s presidential campaign and Democrats during the Georgia special election. Neither group discloses donor information. Center Forward, which was instrumental in backing conservative Democrats opposed to broad drug price negotiation policies proposed this year as part of the Build Back Better Act, received $35,000 from BIO. The spending was part of a wave of pharma money entering politics through both lobbying and campaign cash that paid dividends.

After the election, many prominent Democrats, including Rep. Stephanie Murphy of Florida and Rep. Richard Neal of Massachusetts, sided with BIO against proposals to share vaccine intellectual property with low-income countries. More recently, the Build Back Better Act passed by the House contained a watered-down version of the original Democratic proposal for Medicare drug price negotiations. One Nation, the dark-money nonprofit with ties to Sen. Mitch McConnell, R-Ky., received $250,000 from BIO during the election. The group transferred much of its cash to super PACs backing Senate Republicans involved in closely contested races.

The campaign money, undisclosed during the 2020 election, was only made public in the 990 tax form over a year after voters went to the polls. And the true source of the money is still obscured. BIO is funded through annual contributions by biotech companies that use the organization as a veil of anonymity to cloak their political engagement. The group raised over $77 million last year. Johnson & Johnson voluntarily disclosed that it provided at least $500,000 last year to BIO and says that about one-third of its support to the organization goes to lobbying or direct political advocacy. Moderna also voluntarily discloses its support of BIO. John Young, a Pfizer executive, sits on BIO’s board of directors.

I’m not sure that shouting “fascist” 20 times a minute at the top of your lungs is the way to go, but he does it…

• The Year of the New Normal Fascist (CJ Hopkins)

I don’t need to review the entire year in detail. You remember the highlights … the roll-out of the “safe and effective” miracle “vaccines” that don’t keep you from catching or spreading the virus, and which have killed and injured thousands of people, but which you now have to get every three or four months to be allowed to work or go to a restaurant; the roll-out of the global social-segregation/digital compliance-certificate system that makes absolutely no medical sense, but which the “vaccines” were designed to force us into; The Criminalization of Dissent; The Manufacturing of “Reality”; The Propaganda War; The Covidian Cult; the launch of The Great New Normal Purge; the whole Pathologized Totalitarianism package.

I’d like to end on an optimistic note, because, Jesus, this fascism business is depressing. So I’ll just mention that, as you have probably noticed, more and more people are now “waking up,” or relocating their intestinal fortitude, and finally speaking out against “vaccine” mandates, and “vaccination passes,” and social segregation, and all the rest of the fascist New Normal program. I intend to encourage this “awakening” vociferously. I hope that those — and you know who you are — who have been reporting the facts and opposing the New Normal, and have been ridiculed, demonized, gaslighted, censored, slandered, threatened, and otherwise abused, on a daily basis for 21 months, as our more “prominent” colleagues — and you know who you are — sat by in silence, or took part in the Hate Fest, will join me in applauding and welcoming these “prominent” colleagues to the fight … finally.

Oh, and, if you’re one of those “prominent” colleagues and you start beating your chest and sounding off like you’ve just rediscovered investigative journalism and are now leading the charge against the New Normal for your YouTube viewers or your Substack readers, please understand if we get a little cranky. Speaking for myself, yes, it’s been a bit stressful, doing your job and taking the shit for you out here in the trenches for the past 21 months. Not to mention how it has virtually killed my comedy … and I’m supposed to be a political satirist.

But there I go, getting all “angry” again … whatever. As the doctor said, “buy the ticket, take the ride.” And it’s the season of joy, and love, and forgiveness, and publicly crucifying dissidents, and paranoia, and mass hysteria, and persecuting “Unvaccinated” relatives, and, OK, I might have had one too many. Happy holidays to one and all, except, of course, to the New Normal fascists, especially the ones that are torturing the children. God, forgive me, but I hope they fucking choke.

DOA.

• Biden’s Build Back Better Bill Suddenly In Serious Danger (Hill)

President Biden’s $2 trillion climate and social spending bill, which appeared to have strong momentum when it passed the House a month ago, now appears to be in real danger of collapsing in the Senate. Democratic senators now concede there is no chance of passing the Build Back Better Act before the end of the year, as they had hoped. A Senate Republican aide on Thursday said that Senate Majority Leader Charles Schumer (D-N.Y.) and Republicans are close to a deal to confirm a bloc of nominees and hold some others over until January, which would clear the Senate calendar for the rest of 2021 and allow senators to go home for Christmas.

But more importantly, there is also a chance the entire Build Back Better bill will have to be reworked to accommodate Sen. Joe Manchin’s (D-W.Va.) opposition to including a one-year extension of the expanded child tax credit in the bill. Manchin says he does not oppose the tax credit, which he has backed in past legislation. But he argues that because the credit is likely to be renewed over the next decade, its true cost is not reflected in the current bill’s official Congressional Budget Office score. The West Virginia senator wants the bill to reflect the 10-year cost of the tax credit, which would require other tax hikes or spending cuts to prevent the official cost of the bill from rising heavily.

With the Senate evenly divided, Democrats acknowledge they can’t move forward without Manchin and the bill will have to wait until 2022. And frustrations are rising. “The situation points out that a 50-50 Senate is really problematic, I’ve used the word sucks. It definitely enables one or two people to hold things up, so yes, I’m frustrated,” Sen. Mazie Hirono (D-Hawaii) told reporters, expressing frustration shared by many Democratic senators over the impasse.

“Their whole original case in Westminster Magistrates Court was that Assange isn’t really a journalist and was just engaged in common-or-garden thievery.”

• Assange Lost Because The Judges Couldn’t Imagine The US Was Lying (Rees)

The irony is a deep and bitter one. The defeat for Julian Assange’s lawyers in the Court of Appeal proved beyond doubt that their argument is correct. How so? It has always been a central contention of Julian Assange’s defence that the US government is bringing a political prosecution which should be thrown out because the Extradition Act specifically excepts political cases. The US prosecution mob’s lawyer, Jimmy Lewis, and his faithful assistant (Clair) Dobbin, make this point over and over again. Their whole original case in Westminster Magistrates Court was that Assange isn’t really a journalist and was just engaged in common-or-garden thievery. And yet, for all that, here they were in the appeal court relying on those most political of all political things: a diplomatic assurance from a government.

For in the end the whole appeal rested on diplomatic assurances from the US government that they would not subject Julian Assange to life-threatening conditions in a super-max US prison, the very reason why the original Magistrates Court had ruled against extradition earlier this year. To have upheld that refusal to extradite the appeal court judges would have had to said they did not trust the US government’s assurances. It’s not, of course, that the judges couldn’t reach such a view based on the evidence before them. Indeed, all the evidence pointed in that direction. The CIA were revealed, during the appeal, as plotting to either kidnap or kill Assange; the key US witness was revealed as a liar; the ongoing case in Spain has revealed that the CIA spied on Julian Assange, his family and lawyers; the US authorities are impeding that investigation.

These are hardly trust-building actions of a state with Assange’s best interests at heart. And then there’s the fact that the very document which offers the assurances also says that they can be withdrawn at any time. So, all in all, there are many reasons which might have led the judges to conclude that US bagman Jimmy Lewis was offering the court assurances that could not be trusted. The judges took a different view. They took the assurances very seriously. In the gravest and most sonorous tones the appeal court judge stressed how important it was to take US government diplomatic assurances in good faith. They were not something that was lightly given, he intoned, and had to be accepted. As the written judgement says: “There is no reason why this court should not accept the assurances as meaning what they say. There is no basis for assuming that the USA has not given the assurances in good faith.”

michael breton @michaelpbreton

How is a ‘virus’ with a .00189% worldwide death rate over 2 FUCKING YEARS! even news????

“Morality is doing what is right regardless of what you are told. Obedience is doing what is told regardless of what is right.”

—H. L. Mencken

Keep fighting

A True Story of what is happening. Keep Fighting, The Truth Will Prevail. Please share, save, download, I could and this could be deleted. #NoVaccineMandates #NoVaccinePassports #NoGreenPassObbligatorio #ItEndsWithUs #WeWillNotComply pic.twitter.com/1HwlsWl8N2

— Shaun (@skbytes) December 16, 2021

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.