Paul Gauguin By the stream, autumn 1885

It’s time for a lot of people to take a lot of very deep breaths and count to ten a million times. The UK is imploding on rhetoric, and in the US people convince themselves they see diametrically opposed things in the exact same material, much of which they‘ve never even read or watched.

There is such a thing as the future of your country and your (grand-)children that must also be considered, guys and gals. You will all have to live together.

• House To Grill Trump Intel Chief About Whistleblower Report (R.)

President Donald Trump’s top intelligence official will be grilled by U.S. lawmakers on Thursday over the administration’s handling of a whistleblower report central to an impeachment inquiry into the president. The acting director of national intelligence, Joseph Maguire, will testify to the House of Representatives Intelligence Committee after refusing to share the complaint with Congress, despite a law requiring that it be sent to lawmakers after an inspector general’s determination that it was urgent and credible. Maguire has been in his position for less than two months.

While the formal impeachment inquiry announced on Tuesday by House Speaker Nancy Pelosi is led by Democrats, some of Trump’s fellow Republicans joined them in calling on the administration to send the report to Congress. Members of the House and Senate intelligence committees were allowed to see the complaint on Wednesday. “Republicans ought not to be rushing to circle the wagons to say there’s no there there when there’s obviously lots that’s very troubling there,” Senator Ben Sasse, a Republican member of the Senate Intelligence Committee, said after reading the document.

We agree then.

• House Backs Release Of Trump Whistleblower Complaint 421-0 (R.)

The U.S. House of Representatives voted 421-0 on Wednesday for a resolution calling on President Donald Trump to release a whistleblower complaint to Congress, despite the administration letting them view the classified document at secure locations in the U.S. Capitol. Two House members voted present and 10 did not vote. The document is central to the impeachment inquiry into the Republican president announced on Tuesday by the Democratic House Speaker, Nancy Pelosi, after reports that Trump had tried to put pressure on Ukraine’s president to help smear a political rival.

The Senate passed a similar resolution by unanimous voice vote on Tuesday. Republicans joined Democrats in backing the release of the document, after many lawmakers argued that Trump’s associates were defying a law calling for whistleblower complaints to be sent to Congress if they are found to be credible.

Doesn’t seem all that far-fetched.

• Biden Campaign Blasts Republican Request For Classified VP Documents (Pol.)

The Biden campaign slammed the Republican National Committee on Tuesday night for urging former Vice President Joe Biden to release the transcripts of his calls with Ukrainian and Chinese leaders, saying it would not be legal or even physically possible for Biden to do that. “Imagine our disbelief that Republicans called for Joe Biden to break the law and release classified transcripts he doesn’t have access to or permission to release, given their track record for holding politicians who commit crimes accountable and their general ethical and moral conduct across the board,” Biden spokesman TJ Ducklo said in a statement provided exclusively to POLITICO.

On Tuesday afternoon, RNC chair Ronna McDaniel called for Biden to release the transcripts of his calls during his years as VP “while his son was conducting shady business deals in those countries.” There’s no indication that Hunter Biden did anything illegal in his business dealings in Ukraine. “With their newfound sense of transparency, will they also ask President Donald Trump to release his tax returns, something he promised to do nearly four years ago?” Ducklo added.

What kind of country will it be, whatever happens?

• Fury And Mistrust As The Brexit Pressure Cooker Blows Its Top (Sky)

Brexit has been a pressure cooker for our government, our parliament, our political parties, our MPs and for all of us too – and finally the tensions really erupted. Back in business after the Supreme Court ruled the government’s decision to suspend parliament was unlawful and therefore void, the whole place was absolutely furious from the moment Geoffrey Cox took to the dispatch box at 11.30am to the close of play nearly 12 hours later. The attorney general, the prime minister’s warm up act, he quickly set the tone. Yes this was a government which had been admonished by the Supreme Court for proroguing parliament unlawfully. But there would be no apologies, contrition or regret.

Instead the government’s top legal brain unleashed an unfettered attack on parliament, working himself into a frenzy as he raged against the “spineless” Labour frontbench and “cowardly” MPs for refusing to grant the prime minister an election. “This parliament is a disgrace,” he boomed to the jeering of opposition MPs. “This parliament is a dead parliament. It should no longer sit, It has no moral right to sit on these green benches.” He charged on: “The time is coming when even these turkeys won’t be able to prevent Christmas!” MPs raged. Labour’s Barry Sheerman shaking in anger as he accused the attorney general of having “no shame all”. “To come here with his barrister’s bluster to obsfucate the truth – a man like him, a party like this and a leader like this to talk about morals and morality. It’s a disgrace.”

With the stage set, Mr Johnson was straight into character as he arrived in the parliament, unrepentant and indignant as he tried to goad his opponents into tabling a motion of no-confidence in the government. The people versus the parliament election, Mr Johnson cast himself as the prime minister trying to deliver on the biggest popular vote in history while ‘the establishment’ – be it the parliament or the courts – block his path. The language provocative and incendiary as he sought to portray his political rivals as anti-democratic and treacherous. Parliament was “refusing to deliver on the priorities of the people” while Jeremy Corbyn and his cronies “do not trust the people. They are determined to throw out the referendum result, whatever the cost.””We will not betray the people who sent us here,” he bellowed as MPs erupted in fury.

Complaints that his inflammatory words were being cited in death threats were dismissed as “humbug”. When he told MPs that the “best way” to honour Jo Cox, who was murdered in the 2016 referendum, was to “get Brexit done”, the chamber moved past boiling point and into complete meltdown. Some MPs walked out of the chamber in protest. Others left in tears.

“The balance sheet . . . of the Fed is going to go from around $4 trillion to $40 trillion. It is going to go to $100 trillion before this is over.”

• Financial System Disappearing into Black Hole – Egon von Greyerz (USAW)

Europe is starting QE again with $20 billion a month, but that’s nothing compared to what is coming. . . . The panic that started with central banks in the summer in late July and August was, to me, the first step towards total chaos in the world that we will be seeing in the months and years to come. They (central bankers) see it clearly. They know the banking system is absolutely on the verge of collapse. They know Deutsche Bank (DB) and CommerzBank, too, are down 95%. If you show this chart to a child and ask where is that likely to go, it is likely to go to zero. DB, with their $50 trillion in derivatives, there is no chance they will survive. Of course, Germany and the ECB is panicking because that will affect the whole banking system worldwide.

This is why they have started to print money now because there is a massive liquidity problem, and that’s Germany, which is the best country in the EU from the point of economics. Then you take Italy, Spain, France and Greece and they are in a real mess. This is why the whole system is on the verge of disappearing into a black hole. . . . With the U.S., there is massive liquidity pressure there too.” The massive amount of money printing to keep the fiat system afloat is just starting. EvG contends, “This is just a practice round. This is just more money at this point. The balance sheet . . . of the Fed is going to go from around $4 trillion to $40 trillion. It is going to go to $100 trillion before this is over.

All of these bubble assets that are based on just credit and credit expansion are going to implode measured in real terms, measured in gold. I expect the stock market and the property market to lose at least 95% or more in real terms. . . . The next up cycle for gold (and silver) has started. The next phase of this market has started, and it is going to go on for a long, long time. It is going to go to levels that will be hard to believe today.

People suffer and die.

• How Employees & Employers Get Bled by Health Insurance (WS)

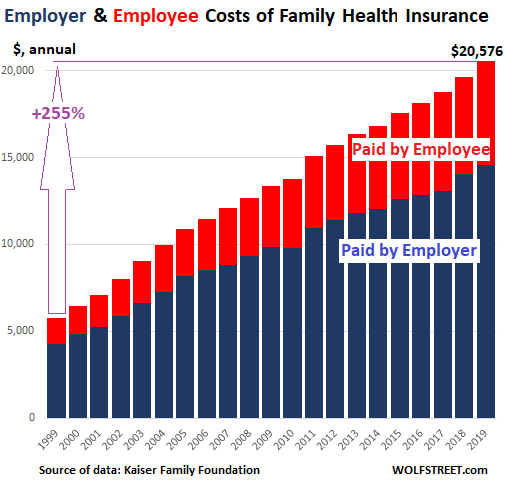

The annual cost of the average health insurance family plan through employers — employer and employee contributions combined – rose another 4.9% in 2019, to $20,576. This is up 255% from 20 years ago, having soared five times faster than the Consumer Price Index (+52%). Employees paid about 29% of the premium for family coverage ($6,015 annually, red portion) and employers paid about 71% ($14,561 annually, blue portion). Over the past 20 years, the employee contribution has increased by 290%. These are among the findings of the annual survey of over 2,000 companies, both small (3-199 employees) and large (200+ employees), including non-federal public employers, by the nonprofit Kaiser Family Foundation.

Employers and employees both are groaning under the relentlessly ballooning weight of health insurance costs. And the numbers are large: 153 million Americans are covered by employer sponsored health insurance. At companies with few lower-wage workers, the employee contribution for family coverage was on average $5,968 annually. But at companies with many lower-wage workers, the employee portion for family coverage was $7,047 annually. “The single biggest issue in health care for most Americans is that their health costs are growing much faster than their wages are,” KFF CEO Drew Altman said. “Costs are prohibitive when workers making $25,000 a year have to shell out $7,000 a year just for their share of family premiums.”

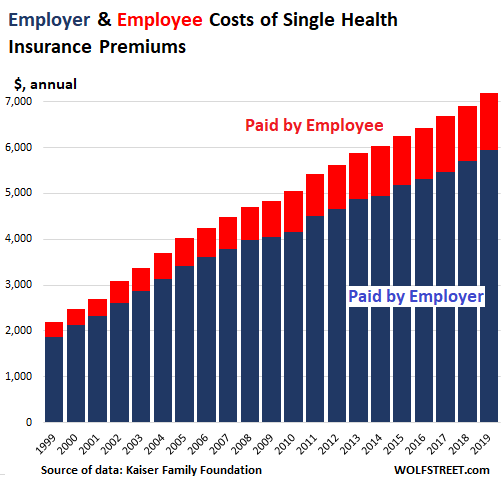

Many lower-wage workers cannot afford the contributions and forego the health insurance even if their companies offer it. As a result, at companies with many lower-wage workers, only 33% of the workers are covered by the employer’s health insurance, compared to 63% at the other companies. For single coverage of the employee only, the annual cost of the average health insurance premium — employer and employee contributions combined — rose 4.2% in 2019, to $7,188, with the employee paying 17% or $1,242 (up from 14% in 1999) and the employer paying 83% or $5,946 (down from 86% in 1999).

“Before the Eurozone debt crisis of 2011-12, even the European Central Bank was forbidden to buy sovereign debt.”

• The Disaster of Negative Interest Rates (Brown)

EU member governments have lost the sovereign power to issue their own money or borrow money issued by their own central banks. The EU experiment was a failed monetarist attempt to maintain a fixed money supply, as if the euro were a commodity in limited supply like gold. The central banks of member countries do not have the power to bail out their governments or their failing local banks as the Fed did for U.S. banks with massive quantitative easing after the 2008 financial crisis. Before the Eurozone debt crisis of 2011-12, even the European Central Bank was forbidden to buy sovereign debt. The rules changed after Greece and other southern European countries got into serious trouble, sending bond yields (nominal interest rates) through the roof.

But default or debt restructuring was not considered an option; and in 2016, new EU rules required a “bail in” before a government could bail out its failing banks. When a bank ran into trouble, existing stakeholders–including shareholders, junior creditors and sometimes even senior creditors and depositors with deposits in excess of the guaranteed amount of €100,000–were required to take a loss before public funds could be used. Also included in Italy were subordinated bonds that were owned not just by well-off families and other banks but by small savers who in many cases were fraudulently mis-sold the bonds as being risk-free (basically as good as deposits). The Italian government got a taste of the potential backlash when it forced losses onto the bondholders of four small banks. One victim made headlines when he hung himself and left a note blaming his bank, which had taken his entire €100,000 savings.

Making sense.

• New Weapons for the ECB (Varoufakis)

Fortunately, an effective weapon can immediately be built to all four of these standards: ECB conversion bonds. A sketch of their announcement follows: “Henceforth, whenever a eurozone government bond matures, the ECB will issue a conversion bond with a face value equivalent to the Maastricht-compliant portion of the member-state’s total public debt. The bond’s purpose is to service, at low interest rates that only the ECB can fetch, member states’ Maastricht-compliant public debt (up to 60% of GDP) – conditional on member states’ commitment to redeem the bond and afford it seniority over all other debts (presumably serviced at higher interest rates).”

To give a numerical example, if a member state’s debt-to-GDP ratio is 90%, the ECB conversion bond services €667 of each €1,000 of maturing state debt. The less the member state has exceeded its Maastricht debt limit, the larger the percentage of its public debt that will be serviced at the ultra-low ECB bond yields. Immediately, we see how this interest rate differential encourages discipline and eliminates the fear of moral hazard that the present quantitative easing program has elevated to dangerous levels. Note also that, besides minimizing moral-hazard risks, the new ECB bonds meet the other three standards. Their issuance requires no discretionary powers by the ECB as it follows directly from the existing Maastricht limits.

They would provide eurozone banks the missing safe asset they need to wean themselves off bonds issued by often-weak national governments (while creating a safe asset for foreigners to buy with their euros). Finally, ECB conversion bonds would allow interest rates in surplus countries like Germany to rebound, because the ECB would no longer need to buy German bunds as a condition for purchasing Italian bonds. [..] Technically speaking, ECB conversion bonds are the obvious replacement for the failing quantitative easing program. Only the misplaced fear of debt mutualization stands in their way.

It seems like only yesterday that they offered $120,000. Wait, that WAS yesterday.

• Boeing Settles First Lion Air Lawsuits For At Least $1.2 Million Apiece (R.)

Boeing Co has settled the first claims stemming from the crash of a Lion Air 737 MAX in Indonesia, a U.S. plaintiffs’ lawyer said, and three other sources said that families of those killed will receive at least $1.2 million apiece. Floyd Wisner of Wisner Law Firm said he has settled 11 of his 17 claims against Boeing on behalf of families who lost their relatives when a brand-new MAX crashed into the Java Sea on Oct. 29 soon after take-off, killing all 189 aboard. Boeing spokesman Gordon Johndroe declined comment. Boeing did not admit liability in its 11 settlements, Wisner said.

The claims, each representing one victim, are the first to be settled out of some 55 lawsuits against Boeing in U.S. federal court in Chicago and could set the bar for mediation talks by other Lion Air plaintiffs’ lawyers that are scheduled through next month, three people familiar with the matter said. Wisner said he could not disclose the amount of the settlements because of a confidentiality agreement with Boeing. The three people familiar with the matter said families of Lion Air victims, who were nearly all from Indonesia, are set to receive at least $1.2 million each. That amount would be for a single victim without any dependents.

“If passed, it would, among other actions, require the US to sanction Chinese officials deemed responsible for “undermining basic freedoms in Hong Kong…“

• Beijing Vows To Retaliate After US Hong Kong Human Rights Bill Approved (SCMP)

China said it would “hit back forcefully” at the United States after the US Congress officially pushed ahead with a bill to support democratic freedoms in Hong Kong by putting pressure on Chinese authorities. The Hong Kong Human Rights and Democracy Act of 2019 moved through the Senate Foreign Relations Committee and the House of Representatives Foreign Affairs Committee on Wednesday, setting the stage for votes in both chambers in the coming weeks. The bill could pave the way for diplomatic action and economic sanctions against the Hong Kong government.

If passed, it would, among other actions, require the US to sanction Chinese officials deemed responsible for “undermining basic freedoms in Hong Kong” and require the US president to review Hong Kong’s special economic status. China’s foreign ministry spokesman Geng Shuang said in a statement on Thursday that the bill was an attempt to “wantonly interfere in China’s domestic affairs” and had shown the “malicious intention of some in the US Congress to contain China’s development”.

This must be the strangest thing I’ve read in a long time. The claim is that the Novichock used in the first (Skripal) incident was found after the second incident. But we know that bottle was sealed, and couldn’t have been used on Skripal. How is this a story then to be published today?

• Salisbury Attack Novichok Bottle Was Not Recovered For 4 Months (Ind.)

Investigators took almost four months to recover the bottle which contained the deadly novichok nerve agent for almost four months after it was used in an assassination attempt in Salisbury. After it was placed on the front door of former double agent Sergei Skripal on 4 March 2018, a counterfeit Nina Ricci perfume bottle which was used to smuggle the nerve agent into the UK, was not recovered until 27 June. Police believe two Russian men, Alexander Petrov and Ruslan Boshirov, then used a secret pump to spread the nerve agent on Mr Skripal’s front door in March 2018. The former Russian military intrelligence officer and his daughter Yulia were both left seriously ill and a further six people were exposed to novichok in Salisbury, which saw large swathes of it’s town centre shut down as police investigated.

Nick Bailey, a police officer, also fell seriously ill after being exposed to the substance while investigating the case. The source of the novichok was found almost four months later, after the death of Dawn Sturgess. Ms Sturgess was given the perfume bottle as a gift by her partner Charlie Rowley, who had found it in a charity shop bin on 27 June 2018. She died from exposure to the nerve agent three days later. Mr Rowley fell seriously ill but later recovered.

He’s getting an award.

Home › Forums › Debt Rattle September 26 2019