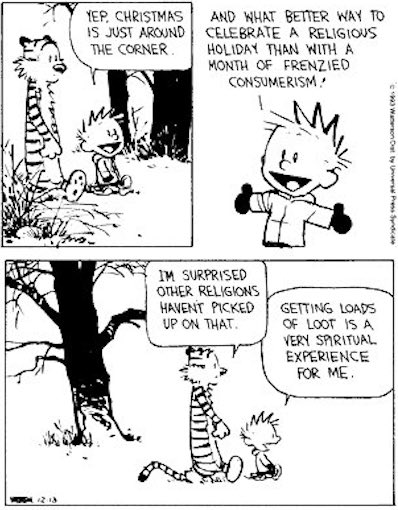

Bill Watterson is God

Got to love this angle.

• He Died For Our Debts, Not Our Sins – Michael Hudson (Ren.)

As many people turn towards their Christian and Jewish faiths this Christmas and Hanukkah in an attempt to make sense of the year that was, at least one economist says we have been reading the bible in an anachronistic way. In fact he has written an entire book on the topic. In ‘…And Forgive them their Debts: Credit and Redemption’ (available this spring on Amazon), Professor Michael Hudson makes the argument that far from being about sex, the bible is actually about economics, and debt in particular. “The Christianity we know today is not the Christianity of Jesus,” says Professor Hudson. Indeed the Judaism that we know today is not the Judaism of Jesus either. The economist told Renegade the Lord’s Prayer, ‘forgive us our sins even as we forgive all who are indebted to us’, refers specifically to debt.

“Most religious leaders say that Christianity is all about sin, not debt,” he says. “But actually, the word for sin and debt is the same in almost every language.” “‘Schuld’, in German, means ‘debt’ as well as ‘offense’ or, ‘sin’. It’s ‘devoir’ in French. It had the same duality in meaning in the Babylonian language of Akkadian.” Professor Michael Hudson has achieved near complete consensus with the assyriologists & biblical scholars that the Bible is preoccupied with debt, not sin. The idea harks back to the concept of ‘wergeld’, which existed in parts of Europe and Babylonia, and set the value of a human life based on their rank, paid as compensation to the family of someone who has been injured or killed. “The payment – the Schuld or obligation – expiates you of the injury caused by the offense,” Dr Hudson said.

People tend to think of the Commandment ‘do not covet your neighbour’s wife’ in purely sexual terms but actually, the economist says it refers specifically to creditors who would force the wives and daughters of debtors into sex slavery as collateral for unpaid debt. “This goes all the way back to Sumer in the third millennium,” he said. Similarly, the Commandment ‘thou shalt not steal’ refers to usury and exploitation by threat for debts owing. The economist says Jesus was crucified for his views on debt. Crucifixion being a punishment reserved especially for political dissidents. “To understand the crucifixion of Jesus is to understand it was his punishment for his economic views,” says Professor Hudson. “He was a threat to the creditors.”

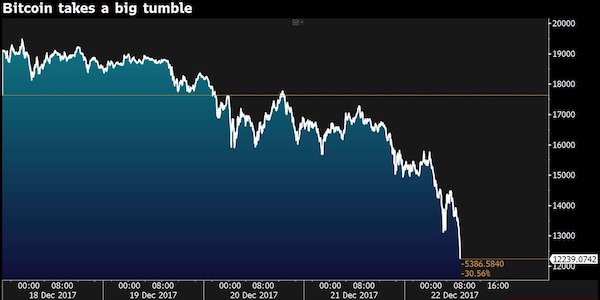

That’s still some serious losses.

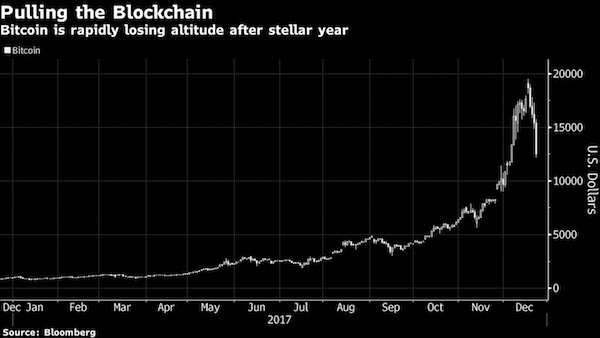

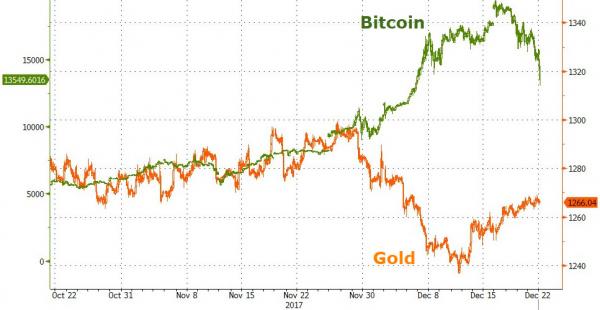

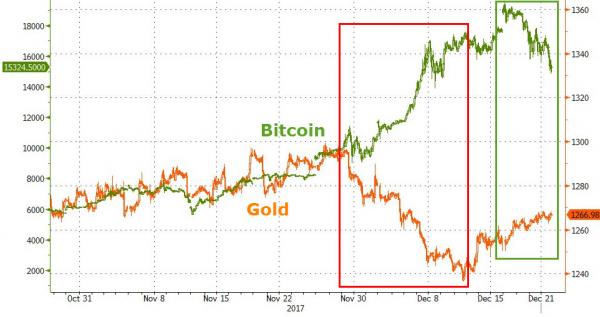

• Bitcoin Tumbles Below $13,000, Down Almost 40% From Record Peak (BBG)

Bitcoin sank as much as 21% on Friday, extending its loss from its intraday high this month toward 40%. The digital currency dropped to as low as $12,191.80 before trading at $12,601.75 as of 3:29 p.m. in Hong Kong. Bitcoin, which is down 38% from its peak of $19,511, is still up more than 1,100% this year. Investors are having a “reality check,” said Stephen Innes, head of trading for Asia Pacific at Oanda. “At the heart of the matter was a frenzied demand for coins with limited supply has now led to unsophisticated investors holding the bag at the top.” Bitcoin’s drop comes amid concern that an offshoot is becoming a stronger rival to the more well-known cryptocurrency. Bitcoin cash, which emerged earlier this year amid a split between factions over proposed software upgrades, was added to Coinbase offerings this week.

Read more …

Zero Hedge overnight. It’s hard to keep up.

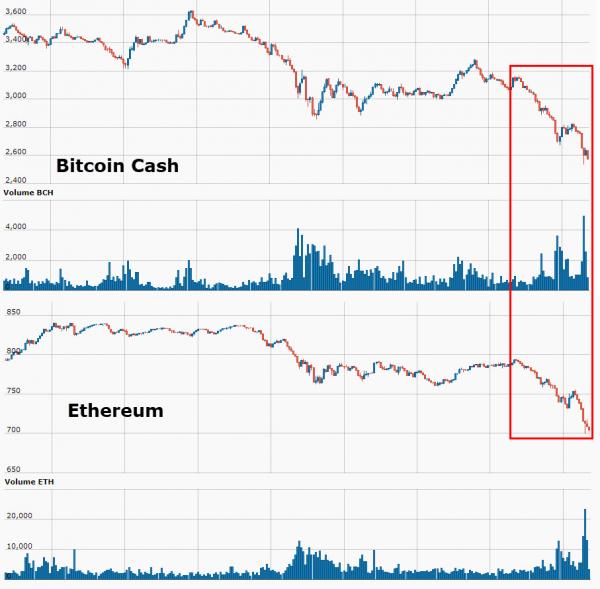

• Crypto Carnage Continues, Bitcoin Falls Back To $13,000 Handle (ZH)

The carnage across cyrptocurrencies has escalated with Bitcoin back to a $13K handle, Ethereum back below $700, and Bitcoin Cash below $2,600… Bitcoin is now almost $6,000 off its record high…

ETH and BCH in trouble too…

The question is – which happens first – Bitcoin $10,000 or Gold $1,300?

[..] renowned analyst Peter Schiff issued a foreboding warning to investors buying Bitcoin at current prices. Even with a shaky week, Bitcoin is hovering around the $15,000 mark, after a two-month bull run that saw the price rise by more than 200%. Schiff says those trying to ride the bubble are too late: “People who got it years ago, even people who got it at the beginning of the year have the opportunity to cash out and make a lot of money. But people who are buying it at these prices or higher prices are going to lose practically everything.” The old adage, “buy on the rumor and sell on the news,” seems to be the perfect way to sum up Schiff’s sentiments: “These currencies are going to trade to zero or pretty close to it when the bubble pops. Right now, the only reason why people are buying Bitcoin is because the price is going up. When it turns around, they are not going to sell it for the same reason.”

Fed flying blind.

• Gold Only Safe Asset Left – David Stockman (USAW)

Record high stock and bond prices are flashing danger signs to former Reagan White House Budget Director David Stockman. Stockman contends, “I don’t think we are going to have a liquidity crisis. I think it’s going to be a value reset. I think there is going to be a jarring downward price adjustment both in the stock market and in the bond market. This phantom or phony wealth that has been created since the last crisis is going to basically evaporate.” So, what asset is safe? Stockman says gold and goes onto explain, “I think the time to buy (gold and silver) is ideal. Gold is the ultimate and only real money. Gold is the only safe asset when push comes to shove. They tell you to buy the government bond, that’s a safe asset. It’s not a safe asset at its current price. I am not saying the federal government is going to default in the next two or three years.

I am saying the yield on a 10-year bond of 2.4% is way below of where it’s going to end up. So, the only safe asset left is gold. This crazy Bitcoin mania has drained off what would otherwise be a demand for gold. . . . When Bitcoin collapses, spectacularly, which it will because it’s sheer mania in the markets right now. When it collapses, I think a lot of that demand will come back into gold, as well as people fleeing the standard stock and bond markets for the first time in 9 or 10 years.” What about the so-called Trump tax cuts? Stockman predicts, “I think it’s going to be a fiscal calamity of Biblical proportions. I want to be clear. I am always for tax cuts and shrinking the size of government, but you have to earn it. You have to cut spending and entitlements and this massive defense budget. Obviously, they didn’t do that.

If you look at honest accounting . . this bill will add $2.5 trillion to the public debt which, and this is a key point, is already going to rise by $10 trillion over the next decade based on the current law and taxes that is still in.” “More importantly,” Stockman says, “The central banks realize they cannot keep printing money at these crazy rates, and by that I mean the bond buying. Now, they are going to begin to normalize and shrink their balance sheet . . By the fall (of 2018), they (the Federal Reserve) will be shrinking their balance sheet by $600 billion a year. What that means in plain simple English is that they (the Fed) are dumping $600 billion a year of existing bonds into the market just as Uncle Sam will be attempting to borrow $1.25 trillion more. Now, if you don’t think that is a financial collision waiting to happen, then I am not sure what would be.

The tax bill is not one-dimensional.

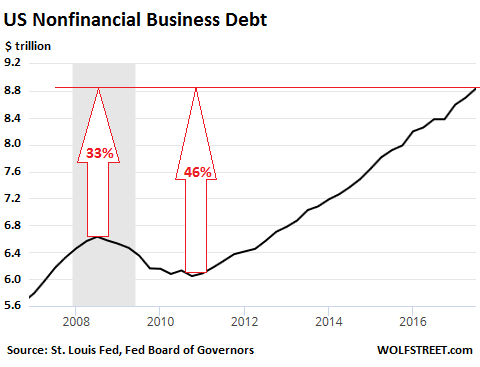

• What Will the Tax Law Do to Over-Indebted Corporate America? (WS)

The new tax law is larded with goodies for Corporate America, but there is one shift – a much needed shift – in this debt-obsessed world that will punish over-indebted companies, discourage companies from taking on too much leverage, and perhaps, just maybe, make these companies less risky: The new law sharply limits the deductibility of corporate interest expense. Starting in 2018, a company can only deduct interest expense of up to 30% of its Ebitda (earnings before interest, taxes, depreciation, and amortization). Any amount in interest expense beyond it will no longer be deductible. This will tighten further in 2022, when the deductibility of corporate debt will be capped at 30% of earnings before interest and taxes but after depreciation and amortization expenses.

This is a much smaller number than Ebitda. And interest expense deduction is capped at 30% of that much smaller amount. This will raise the tax bill further. Most impacted will be highly indebted companies, which often have a junk credit rating. And due to this junk credit rating, they also pay higher interest rates. This made the interest expense deduction very valuable. But now it is getting partially gutted. Businesses have long been incentivized to borrow, not only by the extraordinarily low interest rates even for junk-rated companies, but also by the full deductibility of interest expense. And thus encouraged by the tax code, corporate debt has surged. Mergers & acquisitions, share buybacks, leveraged buyouts, and dividends have often been funded at least partially with debt. And over the years, companies have piled on an enormous amount of debt.

According to estimates by the Congressional Joint Committee on Taxation, cited by The Wall Street Journal, the first phase of curtailing interest-expense deductibility – the phase that kicks in next year – would raise $171 billion in tax revenues over 10 years. The second phase that commences in 2022 would raise $307 billion over 10 years. This would be the billions of dollars that highly indebted companies would pay more in taxes because they’re losing the deductible of some of their debts. It will be a significant hit to their after-tax income. It won’t kill them, but it will lower the incentive to borrow.

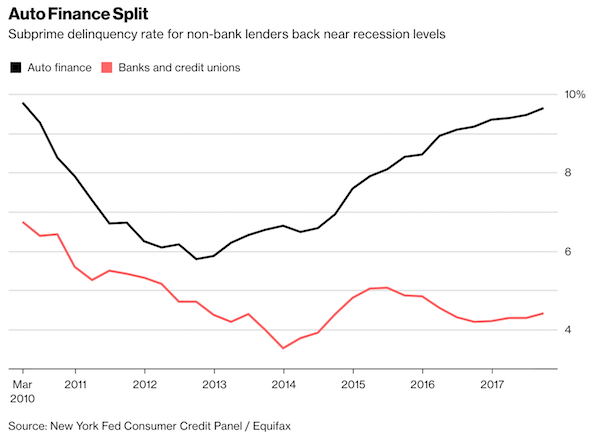

It’ll get messier than subprime housing.

• Subprime Auto Defaults Are Soaring, and Private Equity Has No Way Out (BBG)

Private-equity firms that plunged headlong into subprime auto lending are discovering just how hard it might be to get out. A Perella Weinberg Partners fund has been sitting on an IPO of Flagship Credit Acceptance for two years as bad loan write-offs push it into the red. Blackstone has struggled to make Exeter Finance profitable, despite sinking almost a half-billion dollars into the lender since 2011 and shaking up the C-suite multiple times. And Wall Street bankers in private say others would love to cash out too, but there’s currently no market for such exits. In the years after the financial crisis, buyout firms poured billions into auto finance, angling for the big profits that come with offering high-interest loans to buyers with the weakest credit.

At rates of 11% or more, there was plenty to be made as sales boomed. But now, with new car demand waning, they’ve found the intense competition – and the lax underwriting standards it fostered – are taking a toll on profits. Delinquencies on subprime loans made by non-bank lenders are soaring toward crisis levels. Fresh investment has dried up and some of the big banks, long seen as potential suitors, have pulled back from the auto lending business. To top it off, state regulators are circling the industry, asking whether it preyed on borrowers and put them in cars they couldn’t afford. “The PE guys sailed into this thing with stars in their eyes. Some of the businesses have done fine and some haven’t,” said Chris Gillock at Colonnade Advisors, a boutique investment bank. But right now, “it’s about as out-of-favor a sector as I can think of.”

Two more years to go? I don’t know about that. But then, I didn’t predict the ’29 crash either.

• The Ghost of Gann: Another Crash is Coming (Ren.)

While the metrics noted above can accurately indicate the peak of an equities bubbles several months in advance, they cannot tell us anything years ahead of time. For this, we must turn to the research of the original wizard of Wall Street, W.D. Gann. He was a finance trader who developed technical analysis tools and forecasting methods based on geometry, astronomy, astrology and ancient mathematics. He was a successful and wealthy speculator, spending decades investigating patterns in equities markets. He concluded that equities exhibited a cyclical trend over decades and thus prices could be predicted long in advance. In 1908, Gann constructed his financial timetable, which tabulated the booms and busts, peaks and troughs of the US equities market.

Just like the Geoist land market cycle, there is a repeating 18-year average between every major cycle. Gann managed to predict the crash of 1929 years in advance. He realised that the timetable would have to be recalibrated on the 25th December 1989. The updated timetable is amazingly accurate from that date onward, predicting the Dot-Com bubble peak in 2000 and its collapse. The GFC peak was off by one year; 2007 instead of one year earlier in 2006. The trough was in 2009, followed by a minor panic in 2015, when the S&P500 dipped but has since boomed. According to the timetable, 2020 will be the peak of the equities bubble, followed by a major crash similar to that of the Dot-Com bubble.

To the economists we’ve spoken to, the peak could range between 2019M09 to 2020M03. Given how large the S&P500 bubble has become, it is worth treading very carefully during this period for those exposed to US equities. Gann is famous for saying: “Every movement in the market is the result of a natural law and of a Cause which exists long before the effect takes place and can be determined years in advance. The future is but a repetition of the past, as the Bible plainly states…”

How hard will they come down on Catalunya this time? Neither Rajoy nor Brussels can afford to lose face.

• Catalan Separatists Win Election In Rebuke To Spain and EU (R.)

Catalonia’s separatists look set to regain power in the wealthy Spanish region after local elections on Thursday, deepening the nation’s political crisis in a sharp rebuke to Prime Minister Mariano Rajoy and European Union leaders who backed him. With nearly all votes counted, separatist parties won a slim majority in Catalan parliament, a result that promises to prolong political tensions which have damaged Spain’s economy and prompted a business exodus from the region. Rajoy, who called the elections after sacking the previous secessionist government, had hoped Catalonia’s “silent majority” would deal separatism a decisive blow in what was a de facto independence referendum, but his hard line backfired.

The unexpected result sets the stage for the return to power of deposed Catalan president Carles Puigdemont who campaigned from self-exile in Brussels. State prosecutors accuse him of sedition, and he faces arrest if he were to return home. “Either Rajoy changes his recipe or we change the country,” Puigdemont, said in a televised speech. He was flanked by four former cabinet members that fled with him. At jubilant pro-independence rallies around Barcelona, supporters chanted “President Puigdemont” and unfurled giant red-and-yellow Catalan flags as the results came in. Puigdemont’s spokesman told Reuters in a text message: “We are the comeback kids.” The result unnerved global markets, contributing to a softer euro and subdued sentiment in stock markets.

Opinion polls had predicted secessionists to fall short of a majority. More than 3,100 firms have moved their legal headquarters outside Catalonia, concerned that the indebted region, which accounts for a fifth of the national economy, could split from Spain and tumble out of the EU and the euro zone by default. Spain has trimmed its growth forecasts for next year, and official data shows foreign direct investment in Catalonia fell 75% in the third quarter from a year earlier, dragging down national investment. The EU’s major powers, Germany and France, have backed Rajoy’s stance despite some criticism of his methods at times.

China exports Ponzi and overcapacity.

• China’s Creditor Imperialism (PS)

Just as European imperial powers employed gunboat diplomacy, China is using sovereign debt to bend other states to its will. As Sri Lanka’s handover of the strategic Hambantota port shows, states caught in debt bondage to the new imperial giant risk losing both natural assets and their very sovereignty. This month, Sri Lanka, unable to pay the onerous debt to China it has accumulated, formally handed over its strategically located Hambantota port to the Asian giant. It was a major acquisition for China’s Belt and Road Initiative (BRI) – which President Xi Jinping calls the “project of the century” – and proof of just how effective China’s debt-trap diplomacy can be.

Unlike International Monetary Fund and World Bank lending, Chinese loans are collateralized by strategically important natural assets with high long-term value (even if they lack short-term commercial viability). Hambantota, for example, straddles Indian Ocean trade routes linking Europe, Africa, and the Middle East to Asia. In exchange for financing and building the infrastructure that poorer countries need, China demands favorable access to their natural assets, from mineral resources to ports. Moreover, as Sri Lanka’s experience starkly illustrates, Chinese financing can shackle its “partner” countries. Rather than offering grants or concessionary loans, China provides huge project-related loans at market-based rates, without transparency, much less environmental- or social-impact assessments.

As US Secretary of State Rex Tillerson put it recently, with the BRI, China is aiming to define “its own rules and norms.” To strengthen its position further, China has encouraged its companies to bid for outright purchase of strategic ports, where possible. The Mediterranean port of Piraeus, which a Chinese firm acquired for $436 million from cash-strapped Greece last year, will serve as the BRI’s “dragon head” in Europe. By wielding its financial clout in this manner, China seeks to kill two birds with one stone. First, it wants to address overcapacity at home by boosting exports. And, second, it hopes to advance its strategic interests, including expanding its diplomatic influence, securing natural resources, promoting the international use of its currency, and gaining a relative advantage over other powers.

Same story. I’ve said a thousand times that China is buying the world with Monopoly money. It is.

• China Uses Cheap Debt To ‘Bend Other Countries To Its Will’ (CNBC)

China’s continents-spanning Belt and Road network threatens to “shackle” partner countries and deprive them of valuable natural assets, according to one critic. Beijing is financing and executing massive infrastructure projects across the 68 nations participating in the ambitious scheme, which snakes along Europe, the Middle East and Asia. These recipient countries, many of them emerging economies in dire need of investment, obtain funding in various forms such as sovereign loans from Chinese President Xi Jinping’s administration and credit from Chinese state-owned banks. But concerns of developing countries taking on unrealistic financial obligations have sparked allegations of what’s being called ‘dept-trap diplomacy.’

Earlier this year, Indian Prime Minister Narendra Modi’s administration released a statement warning of unsustainable debt burdens being created by Belt and Road. “Just as European imperial powers employed gunboat diplomacy, China is using sovereign debt to bend other states to its will,” according to Brahma Chellaney, professor of strategic studies at the New Delhi-based Center for Policy Research, who described Beijing’s policies as “creditor imperialism.” In a stinging editorial published on Project Syndicate, Chellaney — a former adviser to India’s National Security Council — pointed to Sri Lanka as an example. The South Asian state, unable to pay back onerous bills to China, recently handed over its Hambantota port to state owned China Merchants Port Holdings in a $1.1 billion deal that was widely viewed as an erosion of sovereignty.

“As Hambantota shows, China is now establishing its own Hong Kong-style neocolonial arrangements,” Chellaney said. “Like the opium the British exported to China, the easy loans China offers are addictive. And, because China chooses its projects according to their long-term strategic value, they may yield short-term returns that are insufficient for countries to repay their debts,” he explained. As a result, the world’s second-largest economy holds political leverage over governments and can “force borrowers to swap debt for equity, thereby expanding China’s global footprint by trapping a growing number of countries in debt servitude.”

The government in charge of the bubble.

• Fannie And Freddie Are Here To Stay – There Is No Alternative (ZH)

Since the US government nationalized the two GSEs in 2008 in a $187 billion bailout of the mortgage giants, there have been consistent calls for them to be wound down and for the private sector to fill the void. As we discussed, this view is, or was, shared by new Fed Chairman, Jay Powell. Mr. Powell has called on Congress to overhaul the housing finance system, saying he’d like to see the country’s two large mortgage-finance firms, Fannie Mae and Freddie Mac, move out from under government conservatorship. More private capital in those firms would reduce the risk of a taxpayer-funded bailout in the event of a downturn, he said in a speech in July. Although the Fed isn’t responsible for housing finance, it supervises some of the country’s largest lenders who frequently sell their loan to the two agencies. “No single housing finance institution should be too big to fail,” he said.

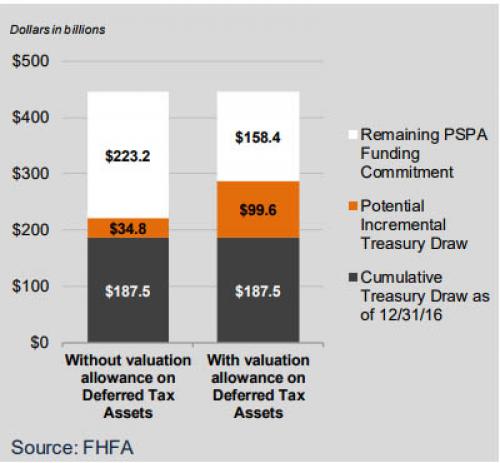

In August this year, Fannie and Freddie’s regulator, the Federal Housing Finance Agency (FHFA), published the results of its latest annual stress tests on the two GSE’s. The FHFA outlined a “severely adverse” scenario in which US real GDP decline 6.5%, the unemployment rate rises to 10.0%, equity prices decline almost 50%, home prices decline 25% and commercial real estate prices by 35%. Under these conditions, it estimates Fannie and Freddie would need a bailout of up to $100 billion in the form of a draw on the Treasury (depending on how they treat assets to offset tax). Sadly, after almost a decade of federal ownership, the hope that Fannie and Freddie could be wound down has evaporated. Senators on both sides of the political divide have concluded that they are too big and too risky to replace. Proposed legislation in 2018 will see them retained at the centre of the US mortgage industry, rather than replacing them as a previous senate proposal tried and failed four years ago.

Mortgages guaranteed by Fannie and Freddie amount to about $4 trillion and account for about 40% of the total US market.

The incompetence is painful.

• UK’s Secret Brexit Studies Reveal That Airbus Makes Planes (BBG)

For months, journalists tried to get their hands on government papers setting out how leaving the European Union will affect different parts of the British economy. They contained, according to Brexit Secretary David Davis, “excruciating detail.” But despite boasting about their contents, ministers were reluctant to let anyone else see the documents. In November, after being forced to give way by a vote in Parliament, the government allowed lawmakers to read them under controlled conditions. Their phones were confiscated, and they were only permitted to make notes with pen and paper, lest too much information leak into the public domain. “These documents in aggregate represent the most comprehensive picture of our economy on this issue to date,” Davis wrote this month, explaining why he was being cautious about publication.

On Thursday, the documents were released online. There was detail, as promised. “The parts of an aircraft can be simplistically split into three areas,” began the first, on aerospace. It was explained what the industry makes: “structures which include the nose, fuselage, wings, engine nacelles (which encase the engines) and tail; propulsion system which includes engines and propellers, or fan blades; and systems which include the electronics used in the flight system.” It went on to reveal that there are two companies in the world that make large passenger aircraft. Now that the documents are public, these firms can be named as Boeing and Airbus. The paper covering the insurance and pensions sector, which employs one in every 100 British workers, is 2,732 words long. “Insurance business operates by firms writing insurance policies for clients, intermediated by brokers,” it reveals.

You sure that you want to victimize the victims?

• Eco-Terrorists Threaten To Inject Acid In Greek Supermarket Products (WaPo)

Greek supermarkets were forced to withdraw several food and beverage products from their shelves this week, after a group threatened to contaminate them with acid as part of an environmentally influenced protest of Christmas consumerism. Authorities urged residents in Athens and the city of Thessaloniki not to buy or consume certain types of Coca-Cola, a Greek milk brand and packages of meat. Thessaloniki and Athens combined have about 1 million residents who were affected by the precautionary measures. The “Blackgreen Arsonists” — whose name suggests an eco-anarchist outlook — threatened to inject the products with hydrochloric acid, a powerful, colorless corrosive used in research and industry.

They said it was because the thousands of people doing their Christmas shopping meant “the sacrifice of millions of living creatures, slaughtered and drained to the last drop to satisfy consumers’ needs.” To protest this need every year for people to fill their empty lives with “consumer garbage with beautiful and glittering wrappings,” the sabotaged products would be placed on supermarket shelves in the run-up to Christmas. Authorities said they have no information on the identities of the group members. Similar threats have emerged in the past and nothing has happened, though in this case the group included photos of its members injecting something into the products as part of their online threat.

Real values.

• New Zealand Gives Mount Taranaki Same Legal Rights As A Person (G.)

Mount Taranaki in New Zealand is to be granted the same legal rights as a person, becoming the third geographic feature in the country to be granted a “legal personality”. Eight local Maori tribes and the government will share guardianship of the sacred mountain on the east coast of the North Island, in a long-awaited acknowledgement of the indigenous people’s relationship to the mountain, who view it as an ancestor and whanau, or family member. The new status of the mountain means if someone abuses or harms it, it is the same legally as harming the tribe. In the record of understanding signed this week, Mount Taranaki will become “a legal personality, in its own right”, said the minister for treaty negotiations, Andrew Little, gaining similar rights to the Whanganui river, which was granted legal personhood earlier this year.

Little said the agreement offered the best possible protection for the landmark, which is becoming an increasingly popular tourist attraction after Lonely Planet named the Taranaki region the second best place to visit in the world last year. “As a New Plymouth local I grew up under the gaze of the maunga [mountain] so I’m particularly pleased with the respect accorded to local tangata whenua [local people] and the legal protection and personality given to the mountain,” Little said. “Today’s agreements are a major milestone in acknowledging the grievances and hurt from the past as the Taranaki iwi experienced some of the worst examples of Crown behaviour in the 19th century.” As part of the agreement the New Zealand government will apologise to local Maori for historical breaches of the Treaty of Waitangi against the mountain, although local tribes will receive no financial or commercial redress.