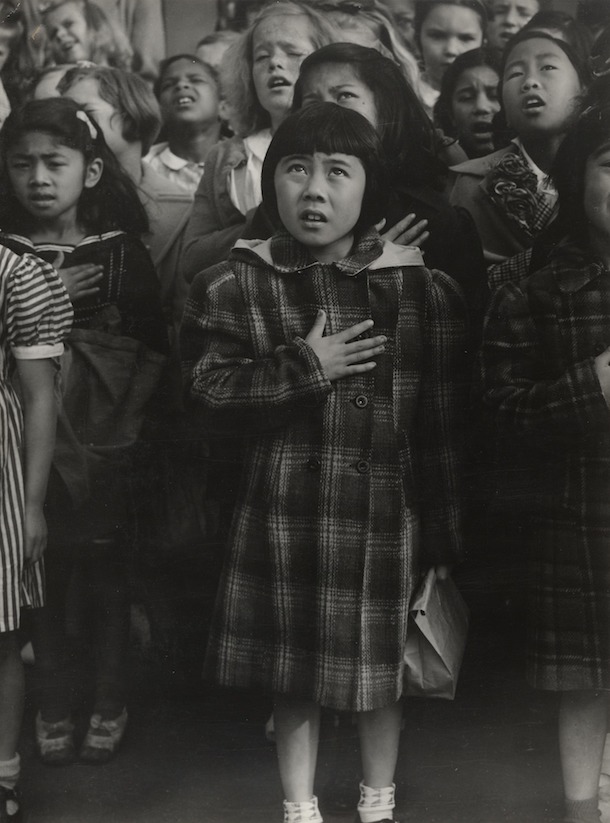

Dorothea Lange One nation indivisible. San Francisco 1942

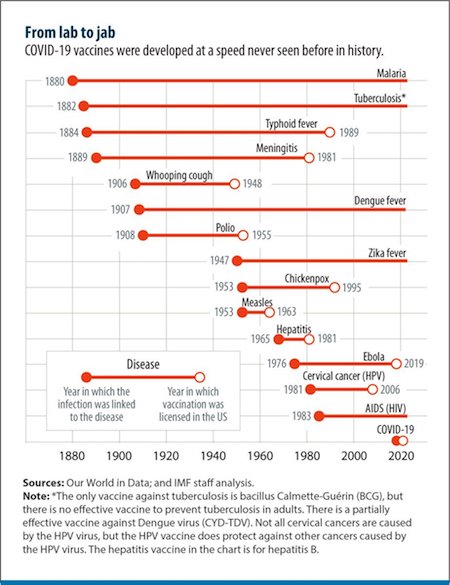

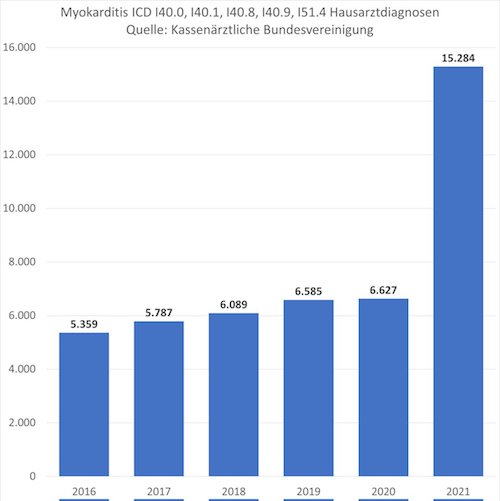

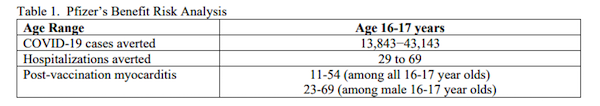

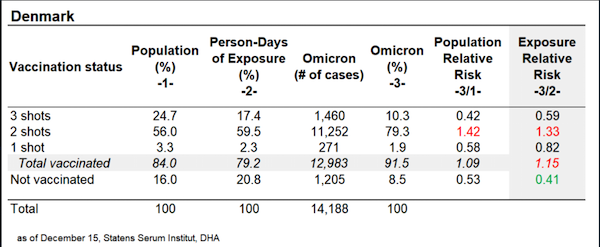

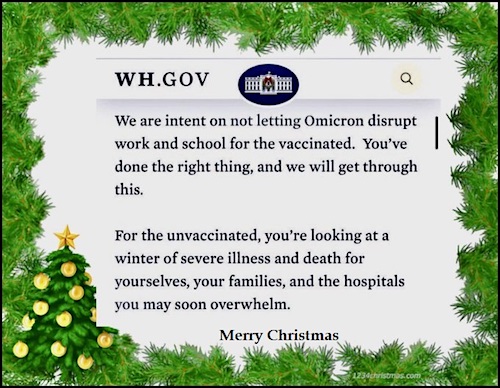

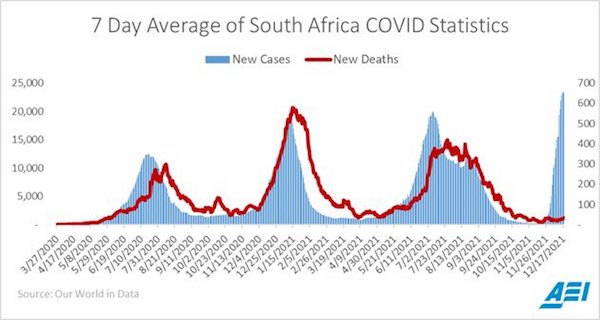

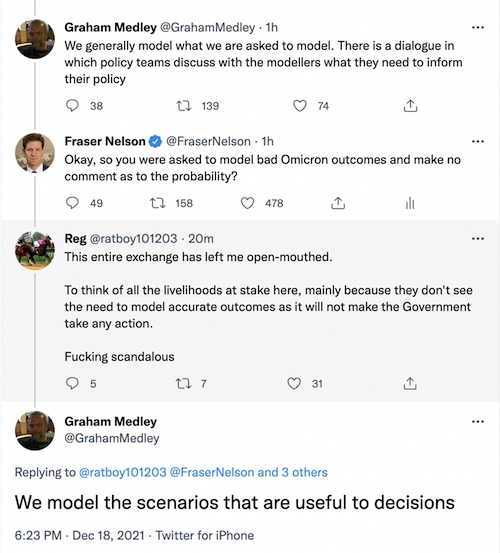

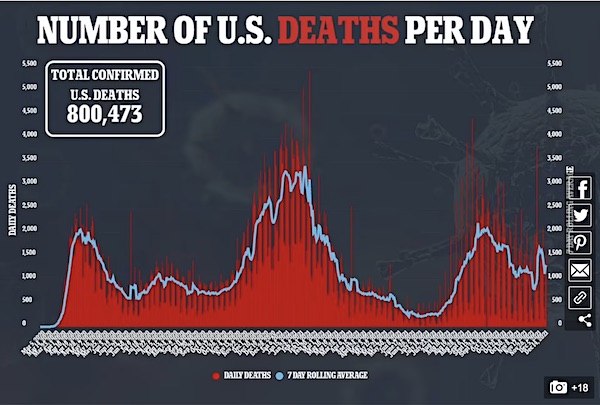

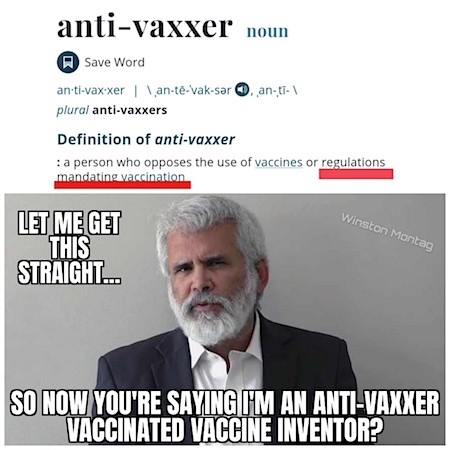

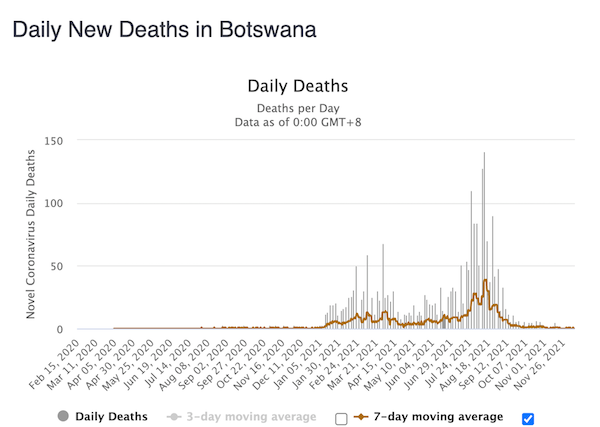

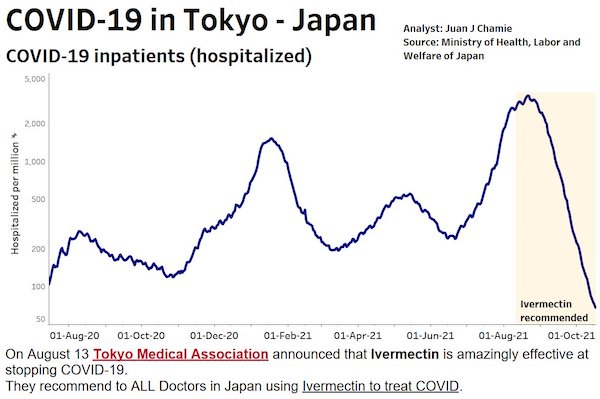

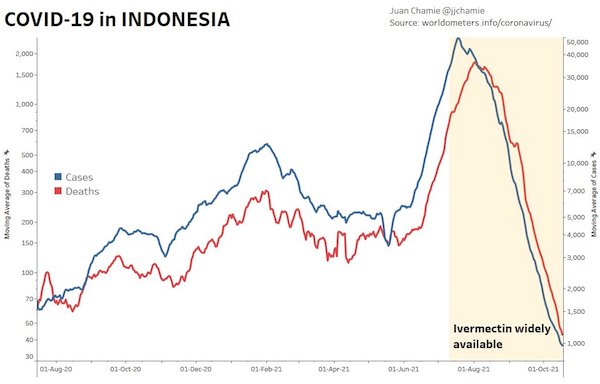

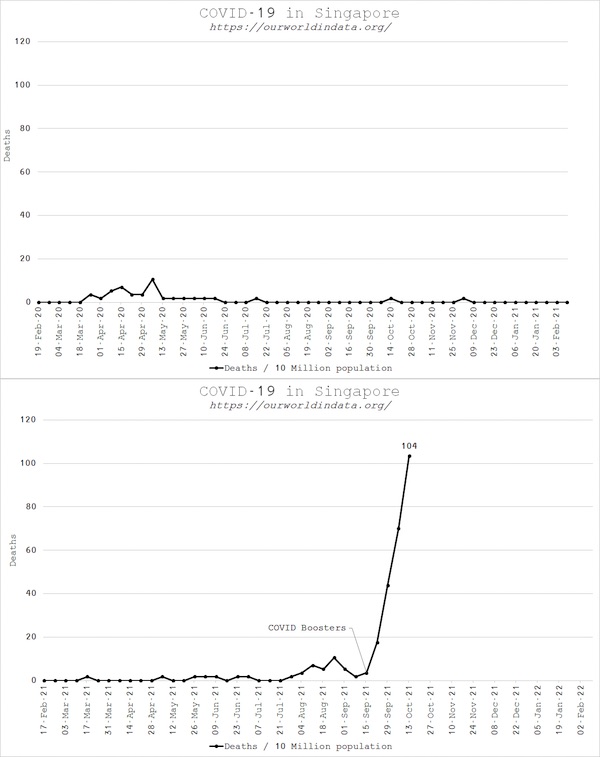

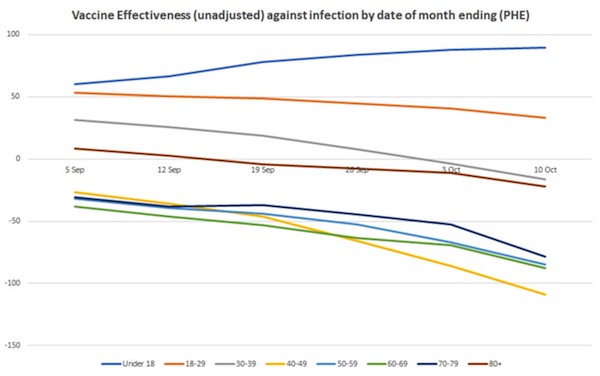

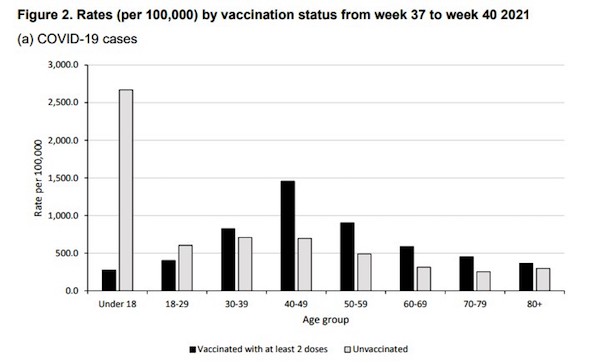

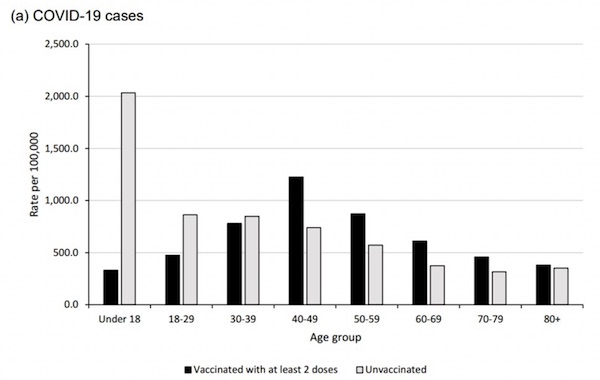

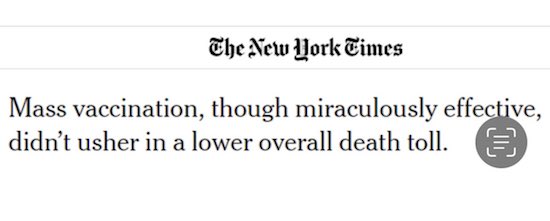

Have the vaccines saved lives?

BREAKING:

The claim that the covid vaccine have saved 3 million lives is ‘utter nonsense’

Independent analysis suggests ‘the mRNA vaccines have cost more lives than they have saved’

You REALLY couldn’t make up this public health catastrophe – must stop the roll out NOW pic.twitter.com/q3ByctkheQ

— Dr Aseem Malhotra (@DrAseemMalhotra) January 5, 2023

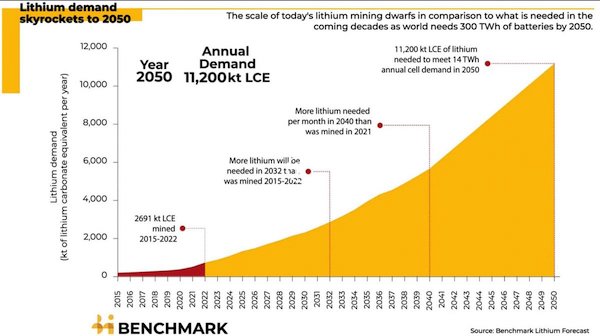

EV

'It’s ridiculous, it’s all virtue signalling BS…Until 2050 the net zero target is going to cost every household a thousand pounds!'

Howard Cox from FairFuelUK says electric cars 'are not practical’ despite hopes to ban petrol and diesel cars by 2030.@HowardCCox pic.twitter.com/S6GBwzFEOY

— GB News (@GBNEWS) January 5, 2023

“..the West wants to destroy Russia, so it provided Ukraine with more weapons than it could ever imagine and Zelensky’s goals grew..”

• Putin Calls for Ceasefire, Ukraine Rejects, Biden Pushes for More War (Celente)

Ukraine rejected Russian President Vladimir Putin’s call for a unilateral, 36-hour ceasefire to mark the celebration of Orthodox Christmas, calling Putin “hypocritical” for even suggesting laying down arms, albeit briefly. Mikhailo Podolyak, Ukrainian President Volodymyr Zelensky’s top adviser, took to Twitter and said Russian troops must withdraw from all occupied territories, and only then will they have a “temporary truce.” “Keep hypocrisy to yourself,” he concluded. Reuters reported that the Kremlin released the statement from Putin calling for the truce after a conversation with Patriarch Kirill of Moscow, the head of the Russian Orthodox Church.

“Proceeding from the fact that a large number of citizens professing Orthodoxy live in the areas of hostilities, we call on the Ukrainian side to declare a ceasefire and allow them to attend services on Christmas Eve, as well as on Christmas Day,” Putin said, according to the report. Needless to say, Washington continued to promote war. President Joe Biden said the ceasefire was an effort by Putin to find breathing room. “He was ready to bomb hospitals and nurseries and churches” on 25 December and on New Year’s Day. I think he’s trying to find some oxygen,” he said. Annalena Baerbock, the German foreign minister, said if Putin was sincere with his peace goals, he would withdraw troops. “A so-called ceasefire brings neither freedom nor security to people living in daily fear under Russian occupation,” Baerbock tweeted, according to Al Jazeera.

Ukraine’s position has been clear since the outbreak of war: all Russian troops must leave the country before any negotiated settlement can occur. But the West wants to destroy Russia, so it provided Ukraine with more weapons than it could ever imagine and Zelensky’s goals grew. Kyiv now wants Crimea and said it will not negotiate until Russian leaders face war-crime trials, which will never happen. Recep Tayyip Erdogan, the Turkish president, spoke with Putin on the phone Thursday and called for the ceasefire. He said “calls for peace and negotiations should be supported by a unilateral ceasefire and a vision for a fair solution.” Putin, again, indicated that he is willing to negotiate for peace, but he will not part with any new territory.

Zelensky, meanwhile, warned that he expects a major Russian offensive after Putin mobilized hundreds of thousands of troops. “We have no doubt that the current masters of Russia will throw everything they have left and everyone they can muster to try to turn the tide of the war and at least postpone their defeat,” Zelensky said. “We have to disrupt this Russian scenario. We are preparing for this. The terrorists must lose.”

NATO wants to keep up the fight.

• White House Rejects Putin’s Christmas Truce As But A “Cynical Ploy” (ZH)

Update(1553ET): The White House has rejected Putin’s call for a Christmas truce in Ukraine. The Russian leader earlier in the day ordered a unilateral 36-hour ceasefire for his forces starting Friday, which will still apparently be in effect despite Ukraine rejecting it. Presumably Russian forces have been told to cease firing along the line of contact starting on Orthodox Christmas Eve day (Friday), unless they are fired upon from the Ukrainian side. The Biden administration cast it as a “cynical ploy” in order for Russian forces to regroup. Biden himself said the ceasefire proposal isn’t “serious” – as The Hill cites of the president’s words: President Biden said Thursday that Russian President Vladimir Putin’s call for a temporary, Christmas ceasefire is an effort to “find some oxygen,” dismissing that the Kremlin is serious about finding an off ramp for its assault against Ukraine.

The president said he was “reluctant to respond to anything Putin says,” but characterized the Kremlin as cynically attacking civilians over the December holidays. “He was ready to bomb hospitals and nurseries and church’s on the 25th and New Years — I mean, I think he’s trying to find some oxygen,” Biden added. At the State Department, spokesman Ned Price called Putin’s Christmas truce declaration a “cynical ploy… to rest, to refit, to regroup, and ultimately to re-attack, to re-attack with potentially even more vengeance, even more brutality, even more lethality, if they had their way.”

The majority of the populations in both countries are adherents of the Orthodox Church, with Russian and Ukrainian Orthodox Christians traditionally celebrating Christmas on Jan. 7th. Germany was earlier in the day among the first Western countries to reject Putin’s announcement as inauthentic. And yet, ironically enough, calls have rang out from the West for months since the start of the conflict for Russian troops to cease fighting. One would think that any pause in fighting, however temporary, would be welcomed by the West – but alas not.

Update (1109ET): Within a mere hour after President Putin declared there would be a 36-hour ceasefire for all Russian forces along the line of contact in observation of Orthodox Christmas, Zelensky’s office has issued a firm rejection, calling it “hypocrisy” and demanding that all Russian troops must leave occupied territory immediately. Zelensky advisor Mykhailo Podolyak announced on Twitter, that Russian forces… must leave the occupied territories – only then will it have a “temporary truce”. Keep hypocrisy to yourself. He had earlier responded to Russian Orthodox Church leader Patriarch Kirill by calling the proposed Christmas ceasefire “a trap”. Ukrainian officials are also calling this a ploy for Russian forces to regroup and to take the momentum out of the Ukrainian army counteroffensive, which has been making some gains of late.

Update (1015ET): Shortly after Erdogan spoke with Putin this morning, the Russian leader has ordered a temporary cease-fire in Ukraine Friday and Saturday to mark Orthodox Christmas. The statement from the Kremlin cites earlier appeal from Patriarch Kirill for ceasefire over the holiday. Russian Orthodox Church leader Patriarch Kirill had previously said in a statement posted to the church’s official website: “I, Kirill, Patriarch of Moscow and of all Rus, appeal to all parties involved in the internecine conflict with a call to cease fire and establish a Christmas truce from 12:00 on January 6 to 00:00 on January 7 so that Orthodox people can attend services on Christmas Eve and on the day of the Nativity of Christ.” [..] Russian and Ukrainian Orthodox Christians celebrate Christmas on Jan. 7th, and is a major holiday just as in the West during December (the Orthodox Church’s Julian calendar December 25 falls on January 7 on the West’s Gregorian calendar).

Bloomberg has meanwhile hinted at a negative response from Ukrainian leaders, given their initial reaction to Patriarch Kirill’s Christmas truce call: Russian President Vladimir Putin ordered his forces to cease fighting in Ukraine for 36 hours starting Friday at noon, Moscow time, in what appeared to be a rare sign of conciliation in an invasion that’s heading for its second year. The Kremlin said Putin gave the order Thursday for Russian Orthodox Christmas. It follows an appeal by the patriarch of that church, which has close ties to the Kremlin. Ukrainian officials denounced that as a trap. Kyiv has demanded Russia remove its troops from Ukraine as a condition for any ceasefire.

Almost funny.

• Ukraine Warns Germany Of ‘Russians Outside Berlin’ (RT)

Should Germany fail to provide Ukraine with tanks, it will soon have to use them to defend its own capital from advancing Russian troops, Alexey Danilov, the head of Ukraine’s National Security and Defense Council, warned on Wednesday. Speaking to Ukrainian TV, Danilov took a swipe at Germany’s leadership, particularly at Chancellor Olaf Scholz, criticizing him for refusing to send Kiev modern Leopard 2 battle tanks. If Scholz “wants the Germans to deploy German tanks to fight off the Russians outside of Berlin and Stuttgart, he could continue this game, conducting sociological surveys on whether they need to give us tanks or not,” he said. The official also highlighted the significance of the Ukraine conflict for Europe, adding that it poses “huge challenges” to the region.

“Those countries that understand that help us at 150% capacity. Those countries that are slowly wising up about the need to tackle this issue, they also started to act,” Danilov stated. While Berlin has been providing Kiev with large amounts of weaponry, it has been reluctant to supply it with modern Leopard 2 battle tanks. German Chancellor Olaf Scholz had earlier explained that because no other country had made equivalent weaponry available to Ukraine, Berlin should not be the first one to do so. A December YouGov poll also showed that 45% of Germans do not want to send Leopard 2 tanks to Kiev, with another 33% saying they were in favor of such a step. Ukrainian officials have repeatedly voiced discontent over Germany’s stance on the matter, with Foreign Minister Dmitry Kuleba saying last month that Kiev does not understand why Germany is sending artillery but not heavy armor.

On Monday, Michael Mueller, who sits on the Bundestag’s Foreign Policy Committee, told the German media that Berlin would continue to refrain from any “ill-considered unilateral moves,” especially in the context of arms shipments. Such deliveries are possible only “in coordination with our NATO partners,” he said, adding that the US-led military bloc wants to avoid becoming a direct party to the Ukraine conflict. Moscow has long warned Kiev backers against sending weapons to Ukraine, arguing that it would only prolong the hostilities. President Vladimir Putin also accused the West of turning Ukraine into “a colony,” and using its people as “cannon fodder, a battering ram against Russia.”

M1 Abrams main battle tank is scrap metal: “..tanks’ heavy fuel consumption and propensity to break down make them unsuitable for the Ukrainian military.”

• US Won’t Fulfill Ukrainian Request – WaPo (RT)

The US will not send M1 Abrams main battle tanks to Ukraine, the Washington Post reported on Wednesday, citing officials. Despite repeated requests from the Ukrainian government, no NATO power has donated Western-designed battle tanks thus far. Speaking on the condition of anonymity, the official said that the Abrams tanks’ heavy fuel consumption and propensity to break down make them unsuitable for the Ukrainian military. One of the heaviest main battle tanks in service worldwide, the M1 Abrams weighs in at 60 tons, with the latest M1A2 variant increasing this heft to more than 73 tons. An M1 Abrams tank costs more than $450 per mile in fuel and repairs, according to a 1991 Government Accountability Office (GAO) report adjusted for inflation.

The Abrams’ poor reliability was noted by the GAO. After a decade in service with the US military, the report stated that the average M1 Abrams needs its track replaced after as little as 710 miles, with engines typically suffering catastrophic “blowouts” after 350 hours of operation. However, the US Army insists that the latest M1A2 variant, which rolled off production lines in 2020, “is the most reliable Abrams tank ever produced.” Ukraine has repeatedly requested delivery of the American-made behemoths, portraying them as crucial to its war effort. Mikhail Podoliak, an advisor to Ukrainian President Vladimir Zelensky, put them on his “Christmas wishlist” in a social media post last month, while Zelensky has himself repeatedly asked the US and its allies for tanks since March.

Zelensky and his officials have singled out Germany in particular, asking Berlin for Marder infantry fighting vehicles and Leopard main battle tanks on multiple occasions. Germany has thus far rebuffed these requests, with lawmaker and Bundestag Foreign Policy Committee member Michael Mueller telling reporters this week that sending the tanks could trigger “an escalation that none of us want to imagine.” France on Wednesday became the first NATO member to announce the transfer of Western-made “light tanks” to Ukraine, although the vehicles in question – six-wheeled AMX-10 units – are outdated, and technically closer to armored fighting vehicles than tanks such as the Abrams or Leopard.

The French AMX-10s are similar in weight to the US-made Bradley Fighting Vehicle, with both coming in at less than 30 tons. US President Joe Biden said on Wednesday that the transfer of an unspecified number of Bradleys is currently being discussed in the White House. Russia has repeatedly warned the West against arming Kiev, saying that doing so will only serve to prolong the conflict, and risks making Western nations de-facto participants.

“..It remains to be seen if the next cycle will not be the last for mankind..”

• 2022: The World As We Knew It Ended. Decades Of Conflict Lie Ahead (Timofeev)

In 2022, the remnants of the ‘end of history’ era finally became a thing of the past. However, there has not been a return to the Cold War either. Russian policy is mainly concerned about security interests. It is not derived from ideology, although it does include components of the identity of ‘the Russian world’, as well as historical motives for opposing Nazism. Russia does not offer a global ideological alternative comparable to liberalism – nor has China yet taken such initiatives. The end of the ‘end of history’ is notable for several other details. Firstly, a major power has risked giving up the benefits of the ‘global world’ overnight. Historians will argue about whether Moscow anticipated such harsh sanctions and the departure of hundreds of foreign companies so quickly. However, it is clear that Russia is vigorously adapting to the new realities and is in no hurry to return to US-centric globalization.

Secondly, Western countries have embarked on a very tough ‘purge’ of Russian assets abroad. Overnight, their jurisdictions ceased to be ‘safe havens’ where the ‘rule of law’ is followed. Now it is politics that calls the shots and Russia is the only harbor to which its citizens can return to relative peace. Stereotypes about the ‘stability and security’ of the West are breaking down. Of course, they are unlikely to begin a similar purge of other assets there. But looking at the Russians, outside investors are wondering whether they should hedge their risks. Thirdly, it turned out that in the West, they might face not only asset stripping, but outright discrimination on the grounds of nationality. Thousands of Russians ‘fleeing’ the ‘bloody regime’ have suddenly faced rejection and contempt. Others trying to prove that they are even bigger ‘Russophobes’ than their host partners are running ahead of the anti-Russian propaganda train. However, this does not guarantee that the stubborn dogmatists will embrace them.

The conflict between Russia and the West is likely to drag on for decades, regardless of how the conflict in Ukraine ends. In Europe, Russia will play the role of North Korea, while possessing much greater capabilities. Whether Ukraine has the strength, the will, and resources to become a European South Korea is a big question. Conflict between Russia and the West will lead to a strengthening of China’s role as an alternative financial center and source of modernization. A stronger China will only accelerate its rivalry with the US and its allies. The ‘end of history’ has ended with a return to its usual course. One of these is the collapse of the world order as a result of large-scale conflicts between centers of power. It remains to be seen if the next cycle will not be the last for mankind, given the risks of an open military clash between the great powers with a subsequent escalation into full-scale nuclear conflict.

Ukraine makes up stories and the west duly repeats them.

• Russian “New Mobilization Process” For Major Offensive Imminent? (ZH)

Ukraine says it’s bracing for a major new Russian offensive, which will involve a large influx of new ground forces at a time Russian forces are under pressure and reportedly lacking enough manpower to maintain front lines, but did not give a timeline for the expected push. In fresh statements widely circulated Wednesday, Ukrainian President Volodymyr Zelensky said Russia is planning a major “new offensive” which will involve a planned “new mobilization processes.” He suggested the new mobilization is imminent given recent Russian battlefield losses in the east, which includes the devastating strike on a barracks in the city of Makiivka, resulting an a huge Russian troop death toll.

“We have no doubt that the current masters of Russia will throw everything they have left and everyone they can muster to try to turn the tide of the war and at least postpone their defeat,” Zelensky said. “We have to disrupt this Russian scenario. We are preparing for this. The terrorists must lose.” Kiev had begun issuing these warnings of a major escalation by Moscow shortly after last month Putin referred to the Ukraine special operation as a “war” for the first time. As the The Hill also details: Some Ukrainian officials also warned last month about a potential new Russian offensive in January or February, including Gen. Valeriy Zaluzhnyi, a top commander in the Ukrainian army who told The Economist that Russia is preparing some 200,000 troops and could have another go at Kyiv.

Previously, Ukraine’s defense minister Oleksii Reznikov also issued a New Year message, and in it appealed to the Russian people, warning that Putin his about to declare martial law and close borders to men, in preparation for a new wave of mobilization. Reznikov called for Russians to resist these efforts and stand for peace in the video address… Within Russia, public opinion appears increasingly divided on how military and Kremlin leadership is executing the war, particularly in the wake of the Makiivka barracks attack, which left up to hundreds of Russian conscripts killed. Hawks within Russia in the meantime have continued pushing for a more muscular escalation in order to achieve the military objectives laid out since the start of the invasion. Others are calling for both sides to implement a Christmas truce this weekend in observation of Orthodox Christmas (Jan.7 according to the Julian calendar).

“Just last month, Latvia, Lithuania, and Estonia protested French President Emmanuel Macron’s proposal to offer Russia security guarantees..”

• Arrest Of Russian Outlet’s Journalist Is Blow To Press Freedom – Moscow (RT)

The arrest of Sputnik Lithuania’s editor-in-chief is a violation of international norms of freedom of speech and the rights of journalists, Russian Foreign Ministry spokeswoman Maria Zakharova said on Thursday. She called on international organizations to react appropriately to Latvia’s “overreach” in arresting Marat Kasem. “Riga has once again demonstrated that for it such values of a democratic society as media pluralism and the rights of journalists are nothing more than empty phrases,” Zakharova said in a statement. Earlier, the spokeswoman shared a video on her Telegram channel of Kasem speaking about the problems he was facing, noting that he had complained for years about pressure and mistreatment at the hands of governments in the Baltic states.

All the international organizations concerned with freedom of speech, who spent years ignoring Kasem’s safety concerns, should “finally justify their existence” and intervene, Zakharova argued. “It is not just a duty, but an obligation of the international community to do everything so these overreaching regimes would return to following the law,” she said. Kasem is a Latvian citizen, but has lived and worked in Moscow for the past several years. He returned to Latvia on family business just before New Year’s Eve. On Thursday, the authorities in Riga ordered his arrest and charged him with espionage and violating EU sanctions against Russia. If convicted, he faces up to 20 years behind bars. His lawyer has not yet been given the case files, and her request to release Kasem on bail has been denied. He is currently being held in Riga’s Central jail.

Moscow has complained about the ongoing persecution of several journalists in Baltic states back in 2021, prior to the conflict in Ukraine escalating. Kasem had been detained in Vilnius and deported from Lithuania as a “threat to national security” in 2019. His colleague Valentin Rozentsov, editor-in-chief of Sputnik Latvia, was detained and interrogated in Riga in 2018. The former Soviet republics have adopted a hardline stance on the conflict in Ukraine. Just last month, Latvia, Lithuania, and Estonia protested French President Emmanuel Macron’s proposal to offer Russia security guarantees, and demanded no exemptions on the ban on Russian fertilizer exports, despite EU concerns about potential famine in Africa.

Lots of things changed and somehow became normal.

• The Coup We Never Knew (Hanson)

Did someone or something seize control of the United States? What happened to the U.S. border? Where did it go? Who erased it? Why and how did 5 million people enter our country illegally? Did Congress secretly repeal our immigration laws? Did Joe Biden issue an executive order allowing foreign nationals to walk across the border and reside in the United States as they pleased? Since when did money not have to be paid back? Who insisted that the more dollars the federal government printed, the more prosperity would follow? When did America embrace zero interest? Why do we believe $30 trillion in debt is no big deal? When did clean-burning, cheap, and abundant natural gas become the equivalent to dirty coal?

How did prized natural gas that had granted America’s wishes of energy self-sufficiency, reduced pollution, and inexpensive electricity become almost overnight a pariah fuel whose extraction was a war against nature? Which lawmakers, which laws, which votes of the people declared natural gas development and pipelines near criminal? Was it not against federal law to swarm the homes of Supreme Court justices, to picket and to intimidate their households in efforts to affect their rulings? How then with impunity did bullies surround the homes of Justices Brett Kavanaugh, Samuel Alito, Amy Coney Barrett, Neil Gorsuch, John Roberts, and Clarence Thomas—furious over a court decision on abortion? How could these mobs so easily throng our justices’ homes, with placards declaring “Off with their d—s”?

Since when did Americans create a government Ministry of Truth? And on whose orders did the FBI contract private news organizations to censor stories it did not like and writers whom it feared? How did we wake up one morning to new customs of impeaching a president over a phone call? Of the speaker of the House tearing up the State of the Union address on national television? Of barring congressional members from serving on their assigned congressional committees? When did we assume the FBI had the right to subvert the campaign of a candidate it disliked? Was it legal suddenly for one presidential candidate to hire a foreign ex-spy to subvert the campaign of her rival?

Was some state or federal law passed that allowed biological males to compete in female sports? Did Congress enact such a law? Did the Supreme Court guarantee that biological male students could shower in gym locker rooms with biological women? Were women ever asked to redefine the very sports they had championed? When did the government pass a law depriving Americans of their freedom during a pandemic? In America can health officials simply cancel rental contracts or declare loan payments in suspension? How could it become illegal for mom-and-pop stores to sell flowers or shoes during a quarantine but not so for Walmart or Target?

The emptiness expands.

• The Ginni Thomas Investigation Ends Without a Mention in J6 Report (Turley)

The Jan. 6 committee issued its long-awaited report at 2022’s end, with the expected breathless punditry. Spoiler alert: It turns out the culprit of this “whodunit” was … wait for it … Donald Trump. What’s more interesting is the dog that did not bark. In Sir Arthur Conan Doyle’s story “Silver Blaze,” the local inspector asks Sherlock Holmes, “Is there any other point to which you would wish to draw my attention?” Holmes responds, “To the curious incident of the dog in the night-time.” When the inspector objects, “The dog did nothing in the night-time,” Holmes replies, “That was the curious incident.” In the 895-page report, the “curious incident” is the lack of any reference to Ginni Thomas, Justice Clarence Thomas’ wife.

For months, members, the media and an army of pundits hammered away at the “smoking gun” texts Thomas sent to Trump chief of staff Mark Meadows and others calling the election stolen and demanding challenges to certifying the electoral votes. Rep. Ilhan Omar (D-Minn.) was the first member of Congress to call for Justice Thomas to be impeached over his wife’s 29 messages. Rep. Bill Pascrell (D-NJ) called for Thomas to resign immediately as a “corrupt jurist.” Former Sen. Barbara Boxer and others joined these calls. (Boxer was particularly ironic since she used the same underlying federal law to challenge the certification of George W. Bush’s election.) Sen. Sheldon Whitehouse (D-RI) demanded an investigation. On the committee itself, Rep. Adam Schiff (D-Calif.) fueled the frenzy and demanded subpoenas for both Thomases.

The media also went into hyperbolic overload. Liberal sites demanded Thomas be impeached, citing “watchdogs” who turned out to be the same crowd that has long denounced the justice. MSNBC’s Mehdi Hasan tweeted, “I have a question for Speaker Nancy Pelosi and House Democrats: Why haven’t you impeached Clarence Thomas yet?” CNN and MSNBC commentator Tristan Snell tweeted that the couple had to be subpoenaed: “At best, they are material fact witnesses. At worst, they are co-conspirators to be charged with seditious conspiracy.” Professor Laurence Tribe (who declared Trump should be charged with attempted murder) also demanded the justice and his wife be subpoenaed. MSNBC’s Zeeshan Aleem declared in June that the scandal “keeps getting worse” but “the silver lining is that it will likely intensify calls for overhauling the high court, and help strip more people of the illusion that the Supreme Court is an apolitical branch of government and a neutral arbiter of the law.”

Activists like Sarah Lipton-Lubet, Take Back the Court Action Fund executive director, declared that “there’s much more to the story of Ginni Thomas’ participation in the January 6 attack that the House Select Committee and the American public deserve to know.” Yet it turns out what we knew was largely all we needed to know. There was not “much more to the story.” The entire Ginni Thomas scandal merited nary a mention in the massive report. Indeed, it doesn’t appear the committee had anything more than what we knew when the controversy began. The texts were never denied, and they weren’t surprising since Ginni Thomas was publicly supporting Trump and his claims. She was willing, moreover, to answer the committee’s questions voluntarily.

Something’s not going right.

• Trump Announces Plan To Destroy The Drug Cartels With The US Military (PM)

Former President Donald Trump announced on Thursday that he would order the US military to declare cartels as enemy combatants if he were to be reelected president. Trump said that he would deploy the Navy and Special Forces to defend the security of the Western hemisphere. Trump made the announcement as President Joe Biden prepares to make his first trip to the southern border, after having previously said that there were “more important” things to deal with. “The drug cartels are waging war on America—and it’s now time for America to wage war on the cartels,” President Trump said in his announcement. “The drug cartels and their allies in the Biden administration have the blood of countless millions on their hands. Millions and millions of families and people are being destroyed. When I am back in the White House, the drug kingpins and vicious traffickers will never sleep soundly again.”

A statement from Trump lays out an action plan that he says will “destroy the drug cartels,” which includes steps such as:

• “Restore all Trump border policies and fully secure the border”

• “Deploy all necessary military assets, including the US Navy, to impose a full naval embargo on the cartels, to ensure they cannot use our region’s waters to traffic illicit drugs to the US”

• “Order the Department of Defense to make appropriate use of special forces, cyber warfare, and other covert and overt actions to inflict maximum damage on cartel leadership, infrastructure, and operations”

• “Designate the major drug cartels as foreign terrorist organizations”

• “Cut off the cartels’ access to the global financial system”

• “Get full cooperation of neighboring governments to dismantle the cartels, or else fully expose the bribes and corruption that protect these criminal networks”

• “Ask Congress to ensure drug smugglers and traffickers can receive the Death Penalty”“Joe Biden has spent the last two years dismantling the southern border,” the statement says. “Biden’s Open Borders policies are killing innocent Americans, ravaging American communities, enriching the cartels, and destabilizing large parts of Mexico and Latin America.” Trump’s statement points out that since Biden took office, 200,000 Americans have died from drug overdoses, with hundreds of thousands of pounds of fentanyl, heroin, meth, cocaine, and other illicit narcotics “pouring across our wide-open border and into American communities.” Enough fentanyl was seized at the border last year to kill every single American. “BOTTOM LINE,” Trump’s statement ends, “Biden has destroyed the border—President Trump will destroy the cartels.”

Joe Biden claims 20,000 lbs of fentanyl is "enough to kill as many as 1,000 people in this country."

20,000 lbs of fentanyl would kill 4.5 billion people. pic.twitter.com/HAYvTfR1XX

— RNC Research (@RNCResearch) January 5, 2023

From Abortion

• Sotomayor Felt “Sense of Despair” Because Babies Would be Protected (LN)

Supreme Court Justice Sonia Sotomayor expressed a “sense of despair” and sadness Wednesday about recent decisions by the conservative-majority court, including the Dobbs v. Jackson abortion case. Sotomayor and two other justices dissented in the historic June ruling, which overturned Roe v. Wade and began allowing laws to protect unborn babies from abortion again. Research estimates at least 10,000 unborn babies were saved from abortions just in the first two months. Speaking at the Association of American Law Schools’ annual meeting in San Diego, Sotomayor said she feels “deeply sad” about the new direction of the court, according to Reuters. “I did have a sense of despair about the direction my court was going,” the Obama appointee said.

Although she did not mention the Dobbs case specifically, Sotomayor talked about feeling “shell-shocked” and “deeply sad” about recent rulings, adding: “It’s not an option to fall into despair. I have to get up and keep fighting,” Reuters reports. Sotomayor would have upheld Roe and continued to force states to legalize killing unborn babies for any reason up to viability, but she was overruled. Some of her arguments against Dobbs were based on false and misleading claims by the pro-abortion movement and have been debunked by researchers and doctors. The Dobbs decision may have been the most monumental ruling by the Supreme Court in decades. For nearly 50 years under Roe, American abortion laws were among the most extreme and permissive in the world.

Just a few other countries, including China and North Korea, allow elective abortions up to birth, as Roe did. As a result, more than 63 million unborn babies were legally aborted in the U.S. Now, because of Dobbs, state and local lawmakers may pass legislation to protect unborn babies again. Already 14 states are enforcing laws that limit or ban abortions and eight more are fighting in court to do the same. In November, voters also elected more pro-life lawmakers to their state legislatures in several states, paving the way for even more protections. Despite her pro-abortion leanings, Sotomayor recently did defend her conservative colleague Justice Clarence Thomas from unfounded leftist attacks, saying she knows he “cares about people.” Thomas joined the majority in Dobbs.

Whatever.

• These Doctors Pushed Masking, Lockdowns on Twitter. But They Don’t Exist (SFS)

Last month, Dr. Robert Honeyman lost their sister to Covid. They wrote about it on Twitter and received dozens of condolences, over 4,000 retweets and 43,000 likes. Exactly one month later, on Dec. 12, Honeyman wrote that another tragedy had befallen their family. “Sad to announce that my husband has entered a coma after being in hospital with Covid. The doctor is unsure if he will come out,” they tweeted. “This year has been the toughest of my life losing my sister to this virus. This is the first time in my life I don’t see light at the end of the tunnel.” Again, the condolences and well-wishes rolled in. But there was a problem: Honeyman wasn’t real.

The transgender “Doctor of Sociology and Feminist studies” with a “keen interest in poetry” who used they/them pronouns was, in fact, a stock photo described on DepositPhotos, a royalty-free image site, as “Smiling happy, handsome latino man outside—headshot portrait.” Their supposedly comatose husband, Dr. Patrick C. Honeyman, was also fake. His Twitter photo had been stolen from an insurance professional in Wayne, Indiana. The two fake doctors, whose accounts urged extreme caution about Covid-19, were part of a network of at least four fake accounts that touted their ties to the LGBTQ+ community, vocally advocated for mask-wearing and social distancing, and dished out criticism to those they felt were not taking the pandemic seriously.

The Honeymans could not be reached for comment, as they do not exist. At publication time, Robert Honeyman’s account was no longer active. The fake doctors were uncovered by Joshua Gutterman Tranen, a self-described “gay writer” pursuing a master’s of fine arts at Bennington College. He saw Robert Honeyman’s tweet about their husband being in a coma, noticed people he followed also followed them, and thought that they might be part of the LGBTQ+ academic community. But after 10 minutes of googling, Gutterman Tranen concluded that Robert Honeyman’s photo was a stock image and their biography stretched boundaries of believability: an academic who left no traces on academic websites and had lost two family members to Covid in late 2022, despite masking and distancing.

The character looked like “liberal Mad Libs,” Gutterman Tranen said. “I’m a self-identified leftist, and I understand that people have a lot of different identities, but it felt concocted in the lab about how many identities and horrible experiences can we put on one person,” he said.

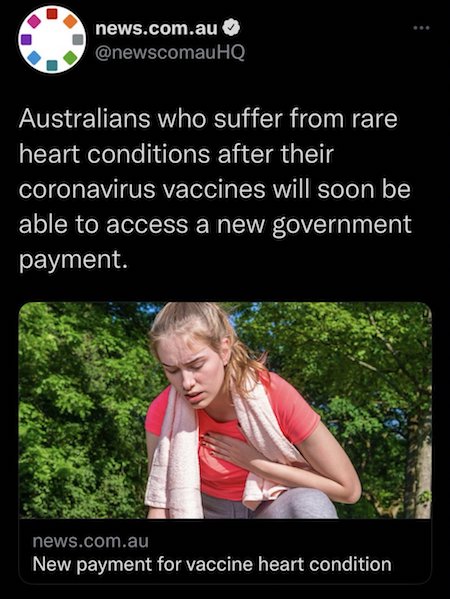

“..Della Pietra has contacted hundreds of clinics all over Europe, all of which still don’t allow people “the human right of free blood choice.”

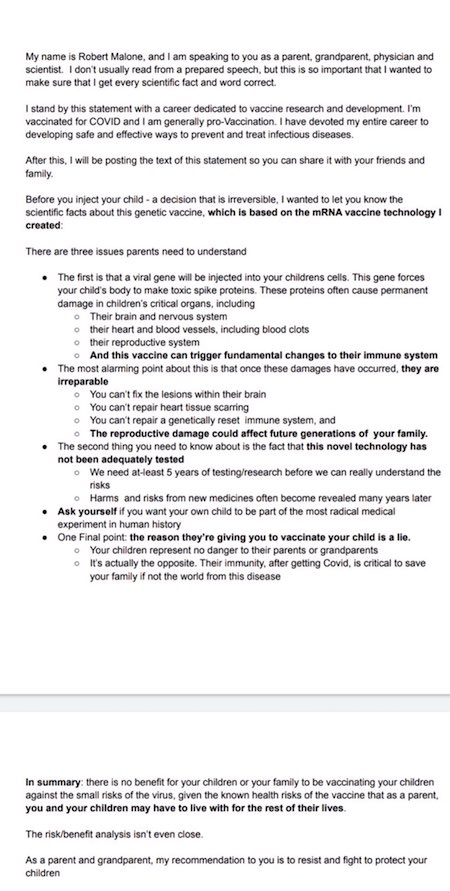

• Swiss Organization To Provide Safe Blood Transfusions From Unvaxxed (NN)

An organization in Switzerland called Safe Blood Donation has been set up to provide people all over the world with safe blood transfusions exclusively from people who remain unvaccinated against the Wuhan coronavirus (COVID-19). The organization was founded in late 2022 by Swiss naturopath George Della Pietra. According to the group’s website, the group’s goal is to provide people all over the world with a way to receive life-saving blood transfusions while refusing to take the vaccines developed against COVID-19. “Be it an emergency, a scheduled operation or because you need regular transfusions for other medical reasons. This is where Safe Blood Donation comes into play as an intermediary,” reads a statement on the organization’s website.

The group will essentially act as a middleman to connect people all over the world with medical partners who are willing to accept blood donations and provide blood transfusions to people with health needs, but are hesitant to go to hospitals where they will almost certainly receive blood from vaccinated individuals. Della Pietra created his organization due to the release of the mRNA COVID-19 vaccines causing disputes all over the world over blood treatments and transfusions. Specifically, people who are skeptical of the benefits that come with taking the experimental vaccines and doesn’t want their body tainted by the unsafe products. [..] Della Pietra has contacted hundreds of clinics all over Europe, all of which still don’t allow people “the human right of free blood choice.”

Furthermore, dozens of clinics he contacted have all refused to become a partner of the new organization. Some of these clinics are sympathetic, but claimed they do not want to be mentioned for fear of reprisals from the mainstream medical community. The founder further noted that his main goal is not to run Safe Blood Donation as a blood bank, noting that “this is not possible at the moment” due to legal concerns, but to act as a quick referral service “to match blood donors and recipients” who are then sent to a medical partner’s clinic where the safe, unvaccinated blood transfusion will be handled. In return for providing people with this service, members are also urged to “make themselves available as blood donors” for other people looking for unvaccinated blood transfusions.

“..in all cases there has been “airtight privacy” about whether they were vaccinated and what their diagnosis was..”

• What Caused Damar Hamlin’s Cardiac Arrest? Experts Weigh In (CHD)

Damar Hamlin’s sudden collapse on live TV during Monday night’s NFL game triggered an avalanche of media coverage, with experts weighing in on what might have caused the 24-year-old player’s cardiac arrest after what appeared to be a routine tackle. Some news outlets quickly concluded Hamlin’s heart attack most likely was caused by commotio cordis, a rare phenomenon that occurs when a small and extremely fast-moving projectile — such as a baseball, hockey puck or lacrosse ball — strikes the chest in a precise location, disrupting the heart’s rhythm. The condition affects about 10-20 people per year, usually teenage boys. Most mainstream media reports rejected the theory that Hamlin’s cardiac arrest might be linked to COVID-19 vaccines, using terms such as “far-right,” “vile,” “anti-vaxxer” and “conspiracy theorists.”

“I wonder why every major media outlet immediately claimed the vax did not hurt that NFL player” pic.twitter.com/n9d7PT5DhO

— Rogan O’Handley (@DC_Draino) January 5, 2023

However, Dr. Peter McCullough told “Good Morning CHD” host Aimee Villella McBride why he believes the vaccines can’t be ruled out. McCullough, an internist, cardiologist, epidemiologist and leading expert on COVID-19 treatment, explained the possible role of the vaccines in cardiac arrest and other heart injuries among athletes. He explained that any physician watching replays of Hamlin’s collapse immediately starts thinking through a differential diagnosis of what could have caused it. He said: “Let me tell you that I did see head and neck contact with a tackle, which is not uncommon at all in football. Remember that the shoulder pads have a breastbone protector, [a] pretty substantial breastbone [protector], so they take helmets in the chest all the time.”

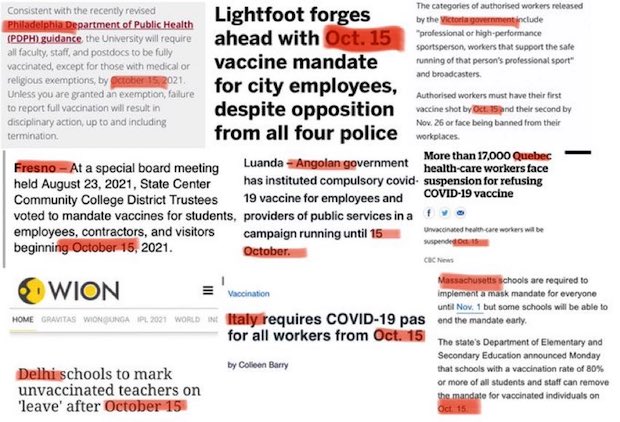

McCullough acknowledged that when a baseball hits an unprotected breastbone, it can precipitate a cardiac arrest, but said he was not aware of that happening in pro football, leading him to rule out commotio cordis. “And as I watched things unfold it was relatively clear that [Hamlin] was in a primary cardiac arrest,” he said. McCullough believes there is a public health obligation to disclose what happened. He said: “This is a player who is employed by a team, and the team and the league mandated the vaccine very publicly. “So we have a situation where we have a public figure, the public employer mandates the vaccine in a very public manner, there is a disclosure that 95% of the players have taken the vaccine, and the FDA says the vaccine causes myocarditis and the published peer-reviewed literature says that it can be fatal.”

“This is not a time for privacy,” McCullough said. “The public needs to know that diagnosis because he was under one of these mandates and this happened on the national and world stage.” McCullough said numerous athletes have collapsed on the field and been resuscitated, but that in all cases there has been “airtight privacy” about whether they were vaccinated and what their diagnosis was. “I think the Hamlin case is going to break through all this,” he said.

Cut a tree

Watching things go wrong, is okay, but this is superb! pic.twitter.com/V6mablUiF1

— Rob Poulussen (@rgpoulussen) January 5, 2023

Chinese exercise

https://twitter.com/i/status/1610702098198413313

1842 farmer

Farmer born in 1842 talks about life and change. (Filmed in 1929) pic.twitter.com/oDROSaEony

— Historic Vids (@historyinmemes) January 5, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.