Frans Hals Two Laughing Boys with a Mug of Beer 1626 (stolen 3rd time yesterday)

260,000 reads for yesterday’s Are The Tables Starting To Turn? on Zero Hedge alone so far.

Nancy’s 80, and she’s losing again, in her final battle. When saying things like this, she will be seen by many people as a sore loser. Not by those who follow her anyway and anywhere, but by the undecideds. The polls say her party is losing those people. And she’s right, Biden will be hammered, but running away is not a viable option.

Most of all, if you ask me, Biden and Pelosi just look like very old and bitter people. Look at Biden!

• Pelosi Says There Shouldn’t Be Any Debates Between Biden And Trump (Hill)

Speaker Nancy Pelosi (D-Calif.) said Thursday she doesn’t think there should be any presidential debates ahead of the November election, arguing Democratic presidential nominee Joe Biden shouldn’t “legitimize” a discussion with President Trump.“I don’t think that there should be any debates,” Pelosi told reporters. “I do not think that the president of the United States has comported himself in a way that anybody has any association with truth, evidence, data and facts.”“I wouldn’t legitimize a conversation with him nor a debate in terms of the presidency of the United States,” she added.

“I think that he’ll probably act in a way that is beneath the dignity of the presidency,” she said, citing what she called his “disgraceful” actions during the 2016 debates with former Secretary of State Hillary Clinton. “He does that every day,” she added. “But I think he will also belittle what the debates are supposed to be about.” Instead, Pelosi proposed that the candidates take separate stages and answer questions about their policies in a “conversation with the American people” instead of “an exercise in skulduggery.” But she acknowledged that the Biden campaign “thinks in a different way about this.”

Take from RT. I’m pretty sure CNN’s take is slightly different.

• Trump Denounces Riots, Cancel Culture, Failed Political Class In Speech (RT)

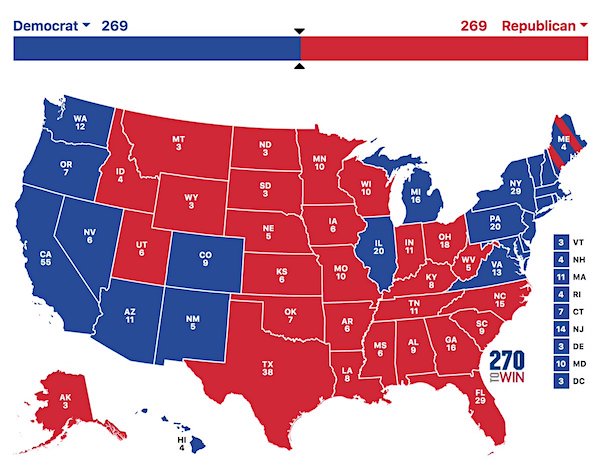

Speaking at the finale of the Republican National Convention, President Donald Trump doubled down on American exceptionalism and once again painted himself as an outsider fighting the Democrats and the entrenched establishment. The speech went on for over an hour, much longer than Joe Biden’s address a week ago at the Democratic convention. But whereas Biden spoke in an empty auditorium in Milwaukee, Trump spoke outside the White House, in the wilting heat of late summer in Washington, DC – and in front of more than a thousand people. In the absence of a formal party platform, Trump defined the Republican position for 2020 as undoing the damage done by the establishment; defending law and order from mobs and anarchy; fighting ‘cancel culture’ and making American great(er) again.

Though the tone of it was uneven – at times a campaign rally, at other times sounding like a State of the Union – and Trump was visibly running out of steam by the end, the underlying message was crystal clear. Time and again, Trump hammered Biden and the Democrats on the difference between their accomplishments during decades in power, and his over just one term. “We have spent the last four years reversing the damage Joe Biden inflicted over the last 47 years.” Trump painted Biden and the Democrats as globalists beholden to China economically, destroying American jobs and industries, opening the borders and starting endless foreign wars – which he was trying to end.

“How can Joe Biden claim to be an ally of the light, when his own party can’t even keep the lights on?” Trump joked, bringing up last week’s power outages in California – but it was also a dig at the theme of Biden’s speech last week, and the efforts by the media to accuse Republicans of being “dark and divisive.” “At no time before have voters faced a clearer choice between two parties, two visions, two philosophies, or two agendas,” Trump said. “This election will decide whether we save the American dream or whether we allow a socialist agenda to demolish our cherished destiny.” Democrats, Trump argued, see America as a wicked nation that must be punished for its sins, with giving them power as the only path to redemption. Yet Republicans – and most Americans, he argued – look to god for salvation, not politicians.

[..] Throughout, Trump cast himself as the outsider who left behind his comfortable life to battle the “failed political class” in Washington. He has done so with mixed success, dealing with brutal political intrigue, hostile media, endless lawfare, congressional gridlock, the ‘Russiagate’ probe and even an impeachment. But as he himself quipped, pointing to the White House, “we’re here and they’re not.” Even after four years of that, and an hour in the brutal heat of an August evening, Trump seemed ready, even eager, for more. Democrats may have believed the media and the polls to think this election was in the bag, but it isn’t – not by a long shot.

I’m trying! I am! I’m trying to feel stupid for thinking that it’s great we finally found a way to make people NOT drive a car an hour+ every day that is 20x their weight and uses less than 10% of the energy effectively that moves it forward. I’m trying to feel stupid because, I know, the economy!

• 61 Million Americans Have Stopped Commuting (ZH)

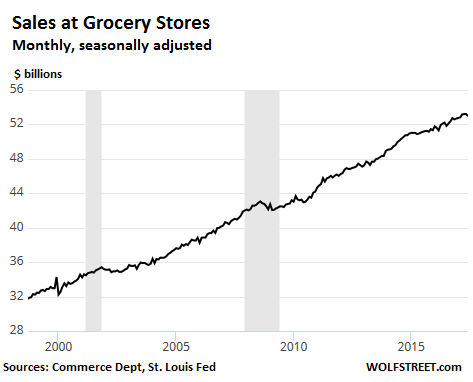

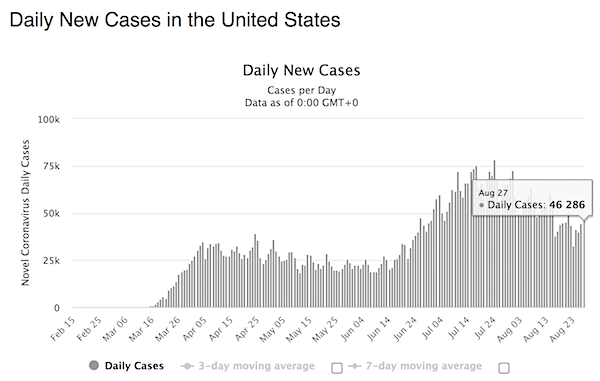

A new survey from ValuePenguin.com, commissioned by LendingTree, found 61 million Americans have stopped commuting to work due to the virus-induced recession. The reduction of motor vehicles on highways will result in deep economic scarring across the entire economy. “The coronavirus has upended nearly every aspect of life in the United States, and Americans’ driving behavior and commutes are no exception. ValuePenguin surveyed drivers to see how their habits have changed. We found a large number of drivers are no longer commuting to the office, whether because they are working from home or have lost employment due to COVID-19.” -ValuePenguin. The survey found three in 10 respondents with motor vehicles are no longer making the daily commute to work in a post-COVID-19 world:

“About three in 10 consumers with a motor vehicle said they no longer have a commute due to COVID-19, either because they’re working from home (19%) or they temporarily or permanently lost their jobs (10%). On the other hand, 26% are back to their daily commute as of August, including essential workers (17%) and those whose employers reopened their offices (9%). (The remainder don’t have commutes either because they worked from home prior to the pandemic, or they were not working prior to the pandemic.)” -ValuePenguin [..] The decline in travel has resulted in respondents making fewer trips to the gas pump. Almost a third said they’re driving every day, compared to 50% of drivers pre-pandemic. The number of respondents who fill up their tanks every week dropped by 26% in August versus before the pandemic.

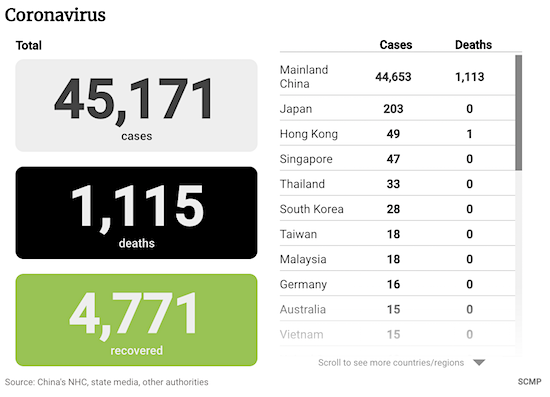

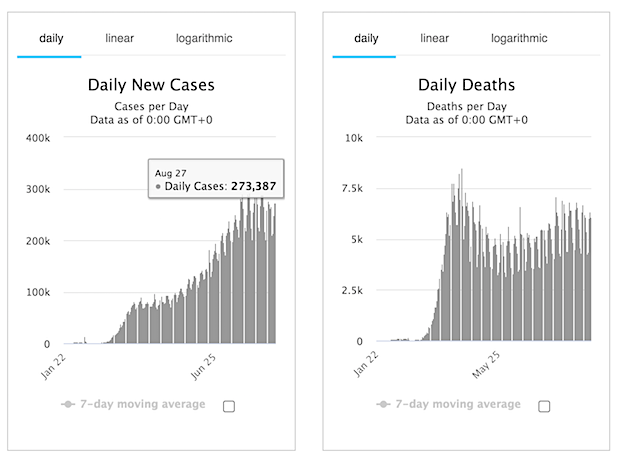

Can we close them down now, finally? I get the point behind having a global health organization, but this is not that point. The WHO should have loudly denounced not being able to access Wuhan a long time ago.

• WHO Skips Wuhan During China Trip; “Sat In Beijing For Three Weeks” (ZH)

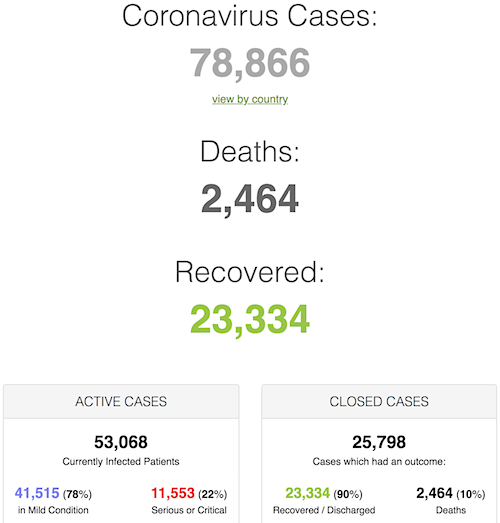

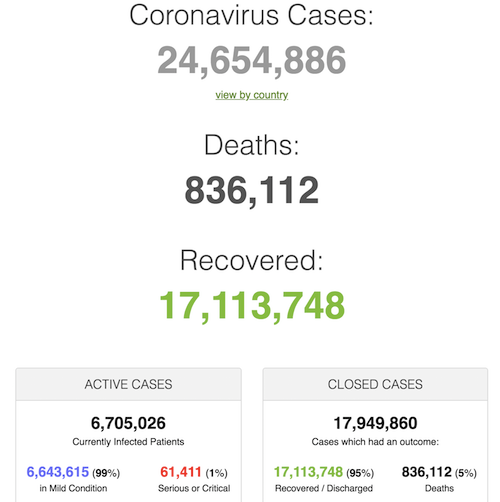

A delegation from the World Health Organization tasked with investigating the origins of COVID-19 failed to go to Wuhan, China – ‘ground zero’ for the pandemic, and instead “sat in Beijing for three weeks” according to a senior US official, who told the Financial Times that Western governments are skeptical over China’s commitment to identifying the origins of the pandemic. “Any chance of finding a smoking gun is now gone,” the official continued. Though we’re not sure what any team of investigators would find after China blocked international epidemiologists for eight months after the outbreak began. Australian MP Dave Sharma told the Times: “The international community is right to have serious concerns about the rigour and independence of the WHO’s early response to this pandemic, and its seeming wish to avoid offending China.

“If this allegation is proven, it is another disturbing incident of the WHO — which is charged with safeguarding global public health — putting the political sensitivities of a member state above the public health interests of the world, in the critical early stages of this pandemic. We are all now bearing the immense costs of such a policy.” The WHO, meanwhile, says that the three-week visit was ‘merely laying the groundwork in advance of a full international mission,’ but gave no indication when this might happen. “After initially bristling at calls from Australia, the US and other countries for a probe into the outbreak, which has claimed more than 800,000 lives, Chinese president Xi Jinping in May endorsed a WHO-led inquiry.

But the WHO resolution “to identify the zoonotic source of the virus and the route of introduction to the human population” — which was backed by more than 130 countries — has been dogged by concerns over transparency and access.” -Financial Times. “A two-person WHO team has recently concluded its three-week assignment in China to lay the groundwork for an investigation into the source of the virus. This was in advance of the full mission, therefore, there are no ‘results of the WHO’s recent mission’ to share.”” said the UN agency in a statement last week.

Like Russia cares. But shouldn’t we seek cooperation in things like this?

• US Imposes Sanctions On Russian Institute That Developed COVID19 Vaccine (GZ)

The Russian government announced this August that it had registered the world’s first Covid-19 vaccine, called Sputnik V. Sputnik V was developed by the Russian Health Ministry’s Gamaleya Research Institute of Epidemiology and Microbiology. This scientific facility created the vaccine in a joint research project with the Russian Defense Ministry’s 48th Central Research Institute. On August 27, the US Commerce Department imposed sanctions on Russia’s 48th Central Research Institute, blacklisting the scientific body. While Russia took a state-led approach to create a coronavirus vaccine, the Trump administration announced a “public-private partnership” in May.

The program, called “Operation Warp Speed,” saw the US government dole out billions of tax dollars to Big Pharma companies. The Trump administration awarded massive contracts to private corporations like Novavax, Pfizer, and Moderna, while Trump reportedly offered “large sums of money” for exclusive rights to a vaccine being developed by a German firm so it could be sold for profit. But the US public-private partnership was unable to develop a vaccine before foreign countries with government-led research efforts did. Besides Russia, a state-owned Chinese company says its vaccine will be ready by the end of 2020, while Cuba is doing clinical trials for a vaccine of its own.

It would really help to know what this mask mandate entails. Does it include people outside? In their own homes? These are important details.

• Germany Imposes Fine For All Non-Mask Wearers In New National Crackdown (ZH)

It should surprise nobody that this happens first within the EU. While much of the world takes to mask-wearing more out of a social and health consciousness “most people are on board” type attitude, the government of Germany has announced fines as punishment for people not wearing them. Chancellor Angela Merkel announced during a virtual meeting Thursday with state governors that almost the entire country will be under a 50 euros minimum ($59) fine for breaching the national mask mandate. After the meeting it was announced that all federal states except the east’s Saxony-Anhalt agreed on setting a minimum fine. In her comments Merkel also urged Germans to stay home “wherever it is possible” and avoid traveling to “hot spots” like the United States. Berlin also agreed to impose a strict limiting on gatherings.

Not only have many major public events been canceled outright, but police are enforcing a ban on private parties of more than 25 persons. Large public events will not return until 2021. The new stringent measures including the mask fines go into effect by the end of the day Thursday. This also as most German schools are now back in session, though there’s been a handful of closures due to new coronavirus cases. It’s part of a broader initiative proposed by German health officials to crackdown on people flouting social distancing measures amid the pandemic, even though in recent weeks authorities say coronavirus clusters are due mainly to incoming vacationers. Germany’s confirmed COVID-19 numbers have been on the whole relatively low compared to other Western nations, at about 240,000 out of a population of 83 million.

You sure it shouldn’t read they ARE the problem?

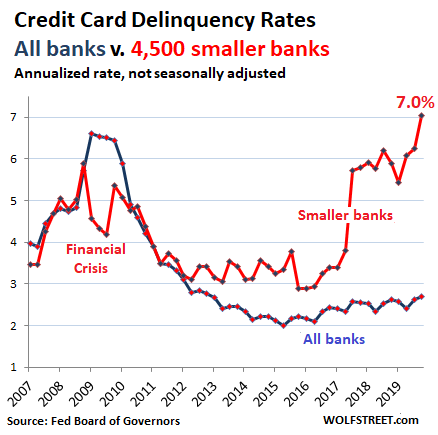

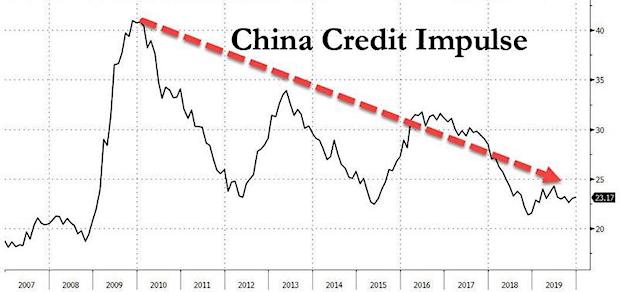

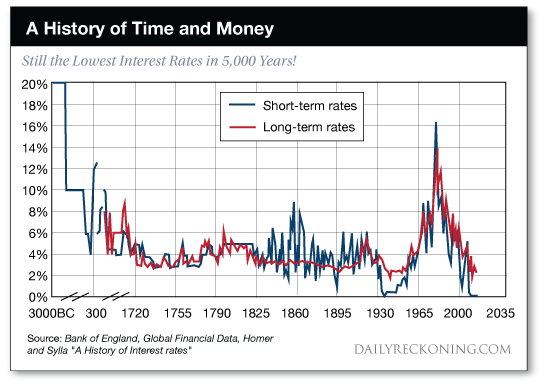

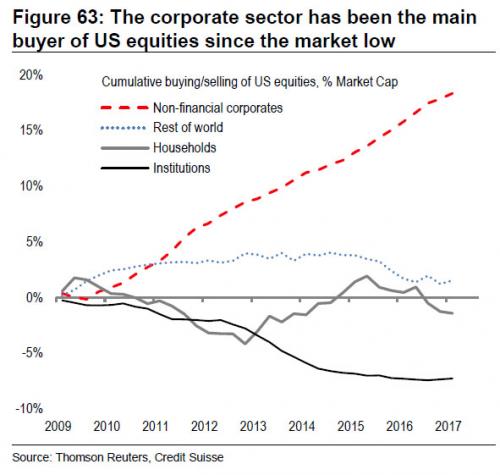

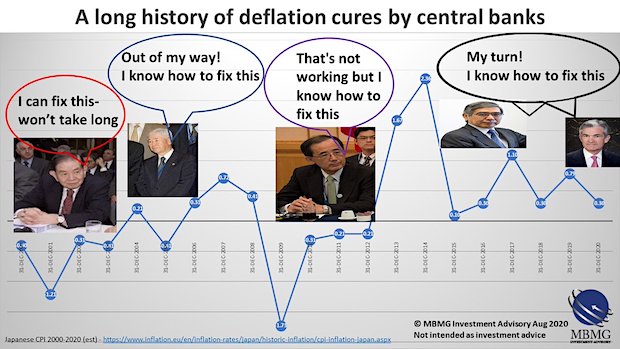

• The Fed Policies Have Become Part Of The Problem (ZH)

In one of the most overt criticism of the Fed we have read to date, [Rabobank’s Philip] Marey writes that “while the Fed’s step to make the inflation target “more” symmetric may benefit the wages of the average American somewhere beyond 2022, it does not really address the deeper problem with the role the Fed is playing in the US economy. It could be argued that the Fed’s policies have become part of the problem, instead of the solution.” And, as the Rabobank strategist suggests, “at least this should be a topic for debate in the FOMC, instead of talking a whole year about whether to use an average or not.”

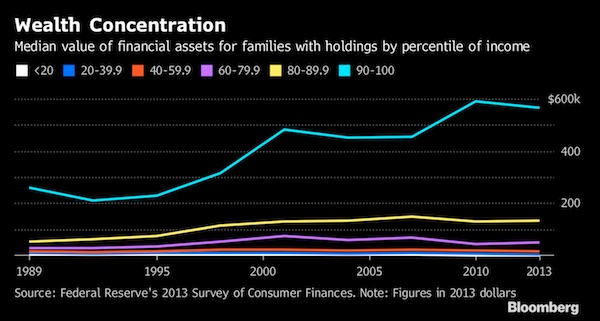

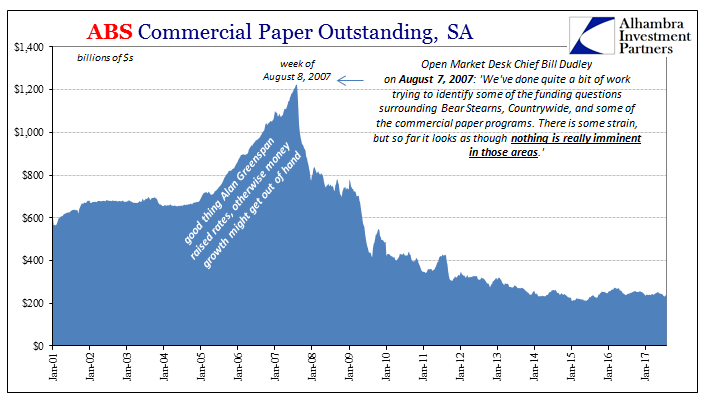

To this all we would add is that the Fed should take a long, hard look at its prefered metric of core PCE: as we have repeatedly explained in recent years, the Fed continues to purposefully undercount inflation, and on top of that, it now has openly said it will disregard the politically palatable core PCE/CPI number just so it can continue blowing an asset bubble of epic proportions. It was Marey’s conclusion however that was the piece de resistance:

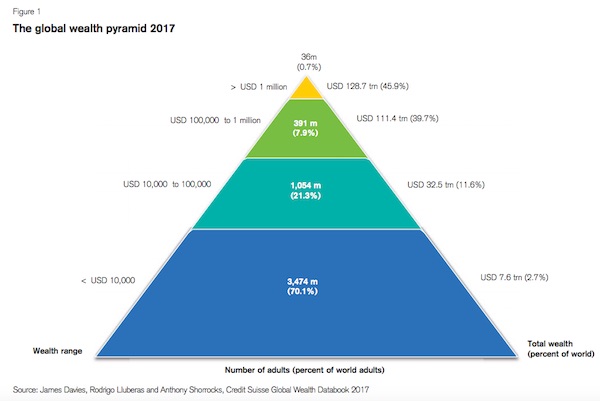

“The much deeper problem for the US economy is the asymmetric impact of Fed policies on households and businesses. The Fed’s monetary and regulatory policies have contributed to a form of capitalism where the rewards are going to the 1% and the risks are borne by the 99%. The current crisis response has made it painfully clear again that the Fed’s policies benefit high income individuals and large corporations, while small businesses and low income individuals bear the burden. While the Fed likes to see itself as part of the solution to America’s economic problems, it should ask itself whether it is also part of these problems.”

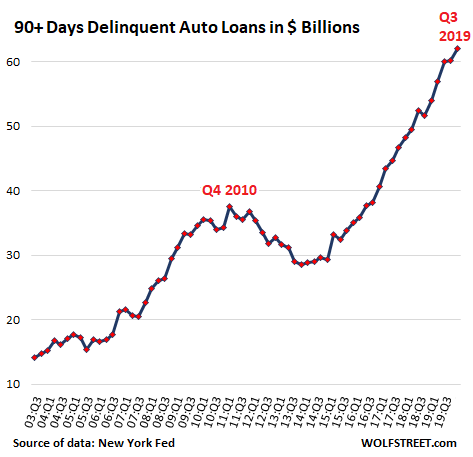

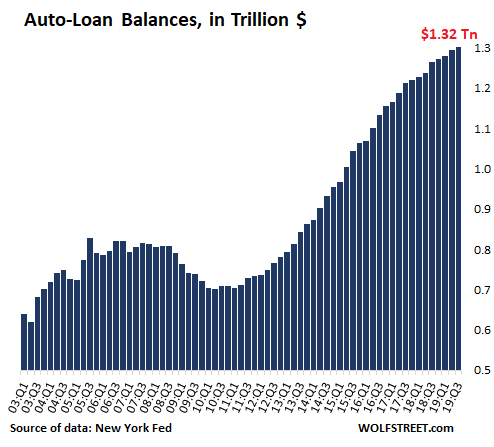

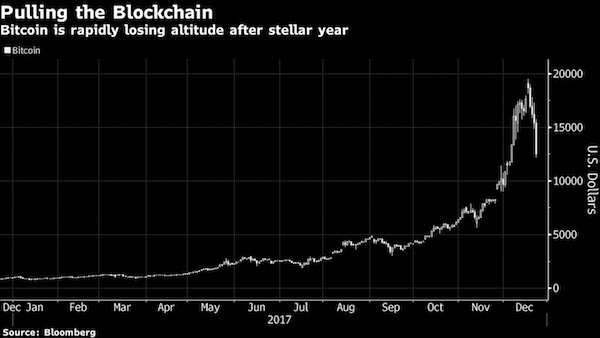

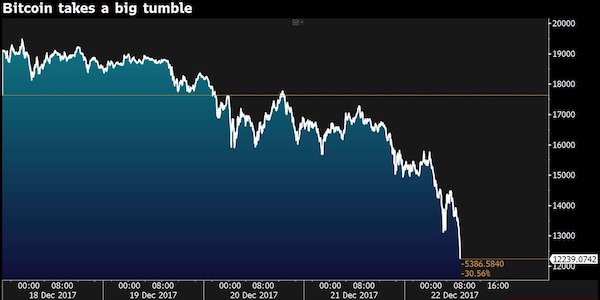

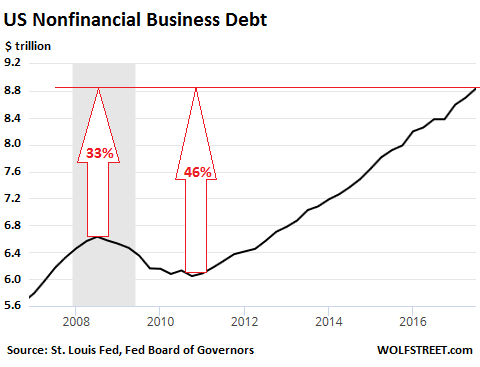

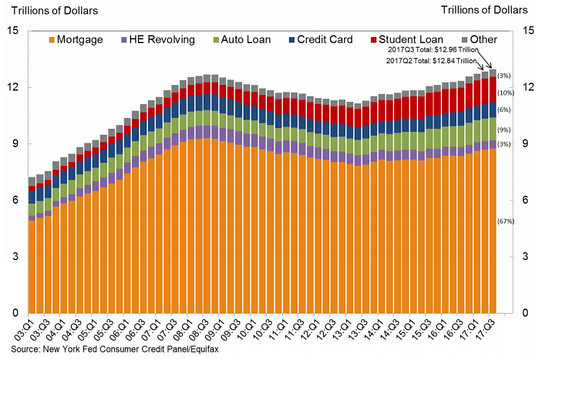

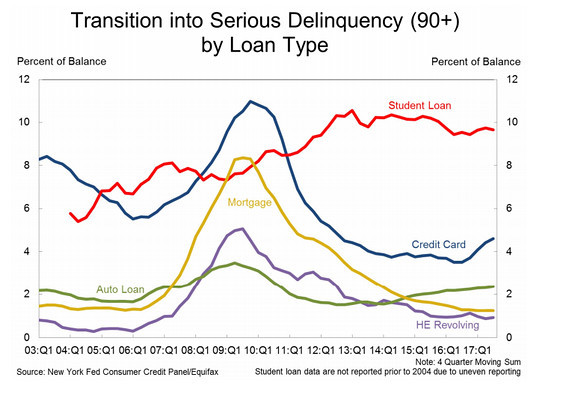

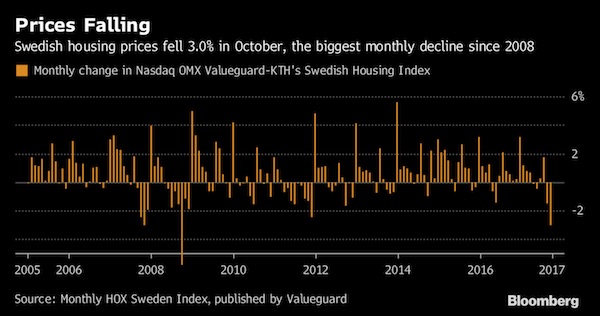

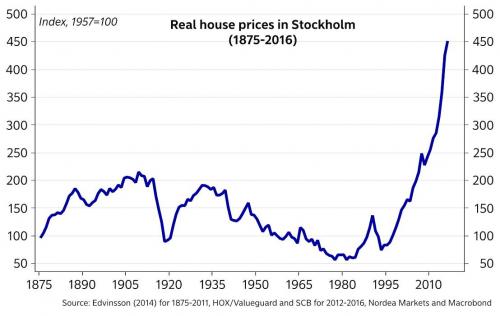

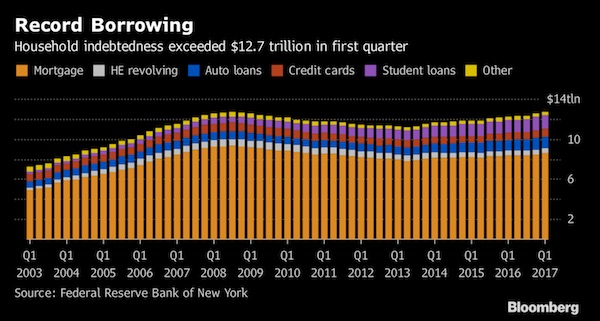

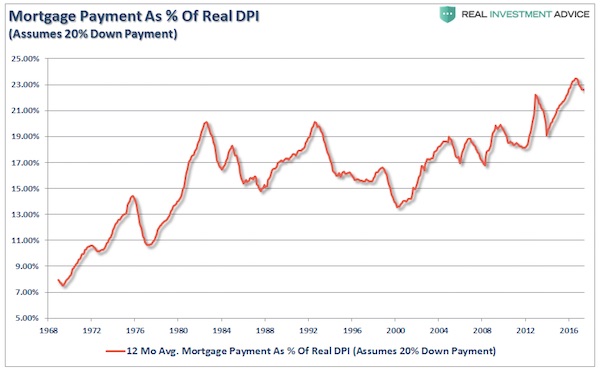

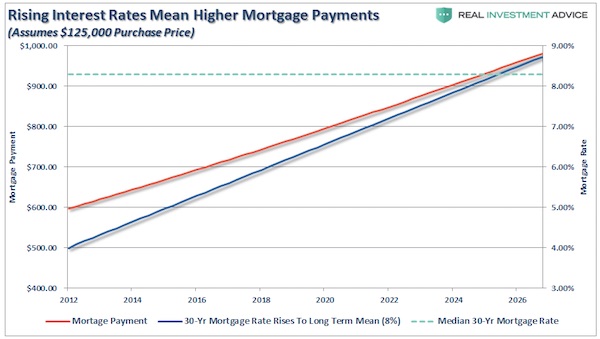

The amounts of leverage everywhere in the system makes a price decline of 10-20% an absolute catastrophy.

• Subprime Mortgages Fall Massively Delinquent (WS)

The Federal Housing Administration (FHA) prides itself in insuring subprime mortgages with, as it says, “low down payments,” “low closing costs,” and “easy credit qualifying” – all true. Of its active portfolio of 8 million mortgages that it insures, 17% were delinquent in July, the highest rate in FHA history. In many metros, the delinquency rates of FHA mortgages are above 20%; and in two metros, the delinquency rates exceed 27%. The delinquency rates include mortgages that were delinquent and then entered a forbearance agreement with the lender, where the lender agreed to not pursue its rights due to nonpayment of the mortgage.

During the term of forbearance – six months, under the CARES Act, extendable by another six months – the borrower isn’t making payments, but the missed interest and principal payments are added to the mortgage balance and will need to be paid somehow. A FICO credit score below 620 is considered “subprime.” The FHA insures mortgages of borrowers with credit scores well below that. • If the borrower has a credit score of at least 580, the FHA will accept down payments of only 3.5%. • If the FICO score is below 580, no problem, but then down payment is 10%. Many of the people whose mortgages the FHA insures have lost their jobs or had had their hours or work reduced. In terms of the lenders, the good thing is that they don’t carry the risk. The FHA and thereby the taxpayer carry the risk.

In terms of the taxpayer, the good thing is that home prices have risen in many markets in recent years, and are rising there right now, and that many fallen-behind homeowners can sell their home and pay off the defaulted mortgage with the proceeds from the sale, and maybe have a little cash left over. And if the home goes into foreclosure because the proceeds wouldn’t have been enough to pay off the mortgage, the losses would be relatively small. The widespread home price declines that occurred during the subprime crisis of Housing Bust have not happened yet. And that’s why at the moment no one is panicking about these sky-high delinquency rates. But when millions of homeowners cannot make the mortgage payments and have to put these millions of homes on the market – forced sellers – they trigger a sudden surge of supply of homes for sale, and the entire supply-and-demand equation, and thereby the pricing environment, are going to change.

No more Abenomics would be a plus.

• Shinzo Abe, Japan’s Longest-Serving PM, Resigns Due To Health Issues (RT)

Prime Minister Shinzo Abe, who led Japan for eight consecutive years, has said he is stepping down hours after he informed his ruling coalition that he was suffering from health issues. Explaining his decision earlier in the day, Shinzo Abe said he feared the illness would affect his decision-making. “I will not be able to make proper judgments due to illness,” the outgoing premier clarified, as quoted by Kyodo news agency. Abe has been suffering from ulcerative colitis, an inflammatory chronic disease, for many years. The prime minister himself revealed that his condition started to worsen around the middle of the last month, possibly prompting him to consider stepping down.

Moving on, Abe apologized “from the bottom of my heart” to his fellow countrymen, adding that he didn’t want his resignation to cause trouble for Japan’s domestic politics. With his eyes getting misty, the prime minister said it is now up to the Japanese to judge his legacy. He noted that his administration had created four million jobs while keeping the economy going. Meanwhile, local media reported that he will continue to serve as prime minister until a new leader is chosen, thus avoiding the need to appoint an acting premier. Abe’s ruling Liberal Democratic Party (LDP) is reportedly set to arrange a leadership election next Thursday.

Seems to have been okay so far?!

• Laura Ravages Louisiana Coast With Wind Speeds Not Seen In A Century (Hill)

Hurricane Laura made landfall as a powerful Category 4 hurricane early Thursday morning packing 150 mile-per-hour winds and bringing a storm surge with the potential to inundate coastal areas of western Louisiana to the Texas border with up to 20 feet of water. Laura made landfall around 1 a.m. near Cameron, La. The 400-person community is more than 30 miles east of the Texas border. Around 7 a.m. CDT, the storm was centered near Leesville, La., roughly 100 miles north of the Gulf Coast. The storm ties with a hurricane from more than 160 years ago as the strongest storm to hit the region. A hurricane called “Last Island” made landfall in Louisiana as a Category 4 storm with 150 mph winds in 1856, according to CNN.

Laura weakened to a Category 2 hurricane after making landfall but still packs sustained winds of more than 100 mph and will continue to produce heavy rain and flash flooding that are not expected to recede for several days. Government officials had warned people to find safety and get out of harm’s way as the storm approached. More 500,000 people in the storm’s path in coastal Texas and Louisiana were under evacuation orders, although as many as 150 people in Cameron Parish, where the hurricane came ashore, ignored the orders and were unreachable as of Thursday morning, according to The Associated Press. “This is a time for all of us to be praying for the best, while we’re prepared for the worst. God bless you and your families,” Louisiana Gov. John Bel Edwards (D) tweeted just before the storm made landfall.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, your support is now an integral part of the process.

Thank you for your ongoing support.

Support the Automatic Earth in virustime.