Giuseppe Arcimboldo Four elements – Water 1566

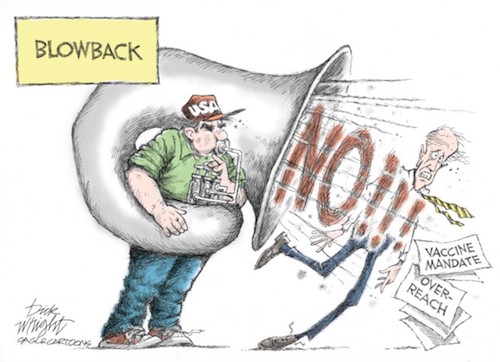

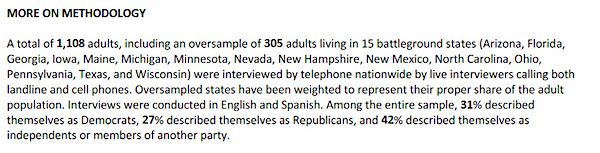

Blue America

NEW: Blue rhetoric toward Red America is getting more vicious than usual.

Political messages used to be crafted to appeal to people. No more. pic.twitter.com/jLWjPpMre5

— Firebrand (@FirebrandPAC) February 4, 2022

“..corrupt bureaucrats in Washington have knowingly poisoned our troops and deceived the American people about the safety and efficacy of the COVID injections.”

• VAERS Data Supports DoD Whistleblowers (UncoverDC)

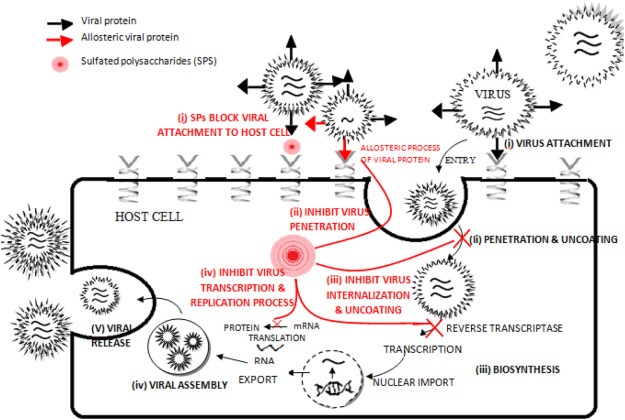

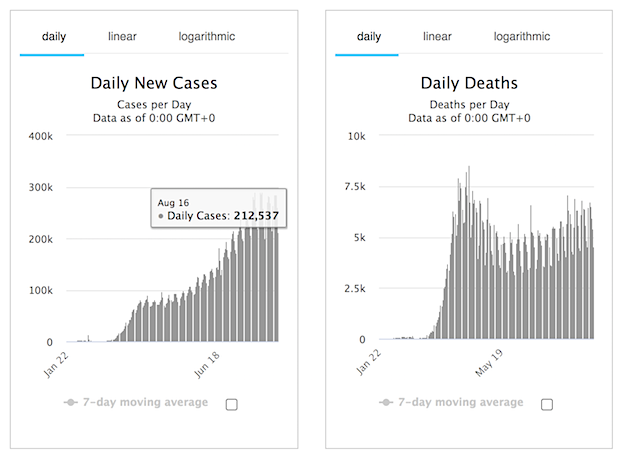

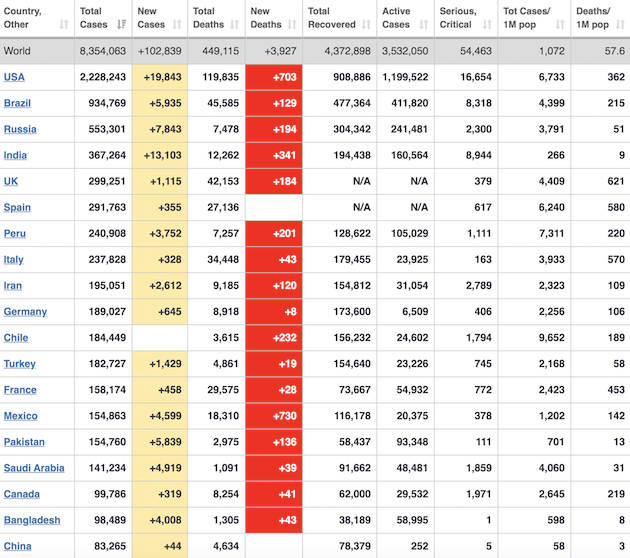

Renz explained to Sen. Johnson that he received significant and damaging data from the DoD whistleblowers under the penalty of perjury. For example, DMED data shows miscarriages increased by nearly 300% over the five-year average. Likewise, data shows an almost 300% increase in cancer over the same five years. Making a point to thank Dr. Ryan Cole for his focused attention to cancer related to COVID jabs and Dr. Pierre Kory for his “stance on the [current] corruption,” Renz continued, presenting the disturbing data to Sen. Johnson, adding:

“We saw—and this one’s amazing—neurological issues, which would affect our [military] pilots, [we saw] over a thousand percent increase—82,000 per year to 863,000 in one year. Our soldiers are being experimented on, injured, and sometimes possibly killed. They know this. And Senator, when these doctors are attacked, they call me. I’m the one dealing with the medical boards. I’m the one watching the witch hunts. I’m the one fighting them off, and I’m going to keep doing that. And let me give you one last thing, Senator—the Sept. 28, 2021, Project Salus weekly report.

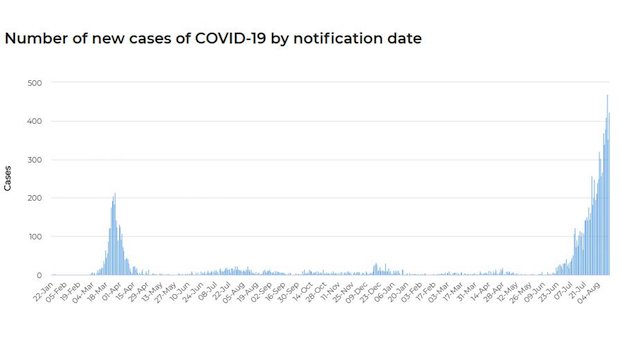

Project Salus is a defense department initiative where they take all this data—that [they now say] doesn’t exist, supposedly—and they give it to the CDC. They’re watching these vaccines. On and around that date, I have numerous instances where Fauci and the entire crew were saying, “it’s a crisis of the unvaccinated. It’s 99% unvaxxed in the hospital.” In the project Salus weekly report, the DOD document says specifically 71% of new cases are in the fully vaccinated and 60% of hospitalizations are in the fully vaxxed. This is corruption at the highest level. We need investigations. The secretary of defense needs to be investigated. The CDC needs to be investigated. Thank you so much, Senator, for having the courage to stand up against these special interests.”

[..] UncoverDC spoke with attorney Renz last Friday. Renz shared that he and others believe DMED data is currently “being manipulated to cover up the fact that corrupt bureaucrats in Washington have knowingly poisoned our troops and deceived the American people about the safety and efficacy of the COVID injections.” Furthermore, Renz called claims that the DMED data from 2016-2020 was incorrect “absurd.” He added that we spend millions per year on DMED and the individuals monitoring it. Renz shared that he and his team believe DMED data is currently “being manipulated to cover up the fact that corrupt bureaucrats in Washington have knowingly poisoned our troops and deceived the American people about the safety and efficacy of the COVID injections.”

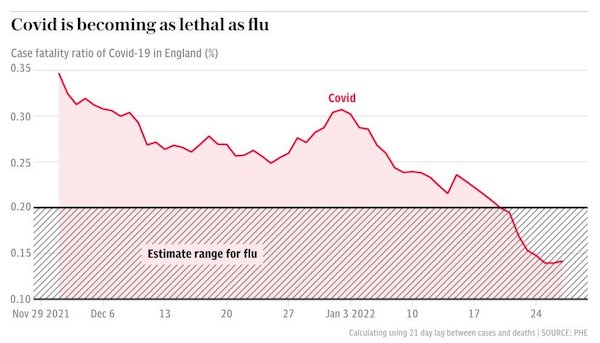

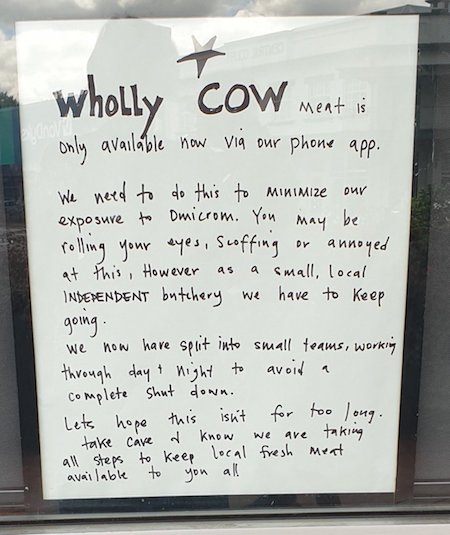

“Omicron may be the death knell of the pandemic…”

• The Rise of Omicron is the Fall of Vaccines (TSN)

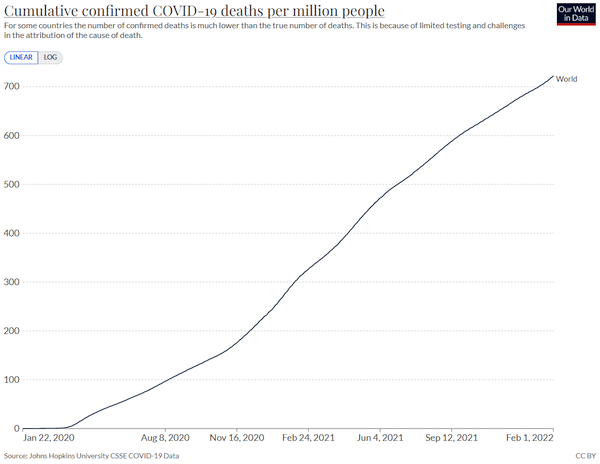

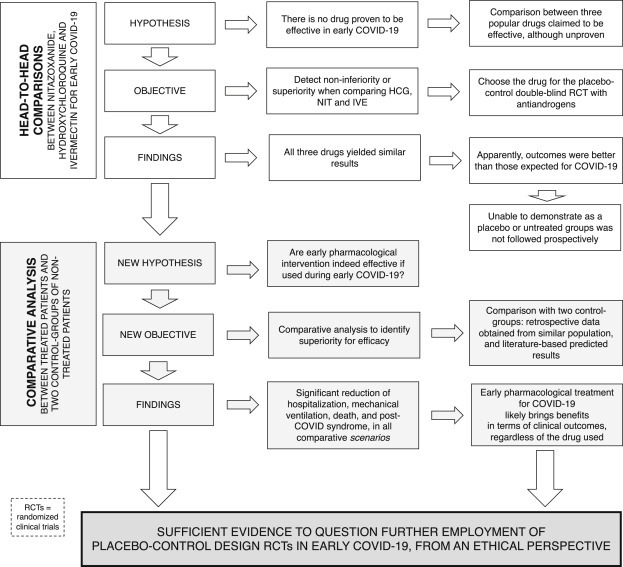

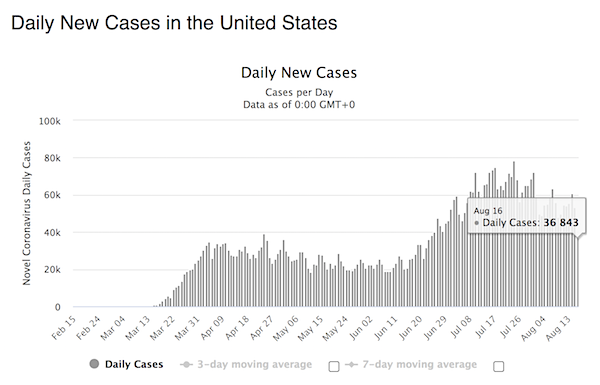

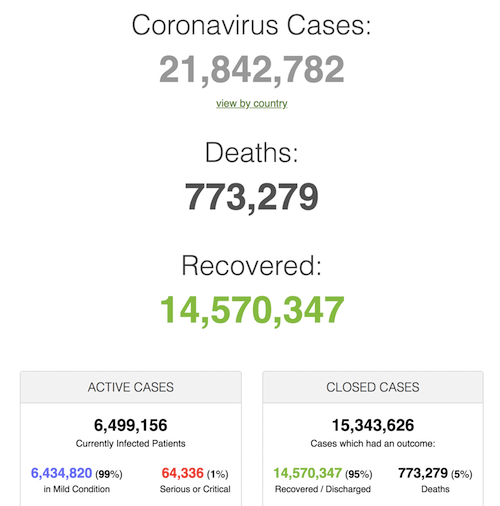

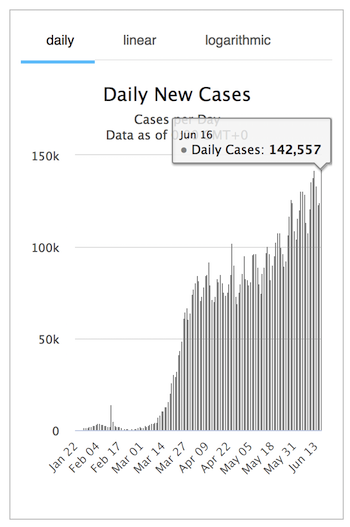

Unless one sells vaccines for a living, the overall numbers for the covid-19 variant Omicron will seem wildly encouraging. Take a California study of 53,000 Omicron and 17,000 Delta cases from November 30, 2021, to January 1, 2022. In every way, Omicron patients did far better—a quarter the hospitalizations of Delta, miniscule admissions to ICU, no ventilation whatever, and a death rate of less than one-tenth of one percent. The study, by researchers at UC-Berkeley and Kaiser Permanente, suggests, as do others, that Omicron may be the death knell of the pandemic. But, buried deep within its piles of data, it also calls into question the utility of the vaccines themselves.

Beyond showing that the vaccines faltered as Omicron overtook Delta in December, the study lays bare what until now was a heretical assertion. The share of unvaccinated people hospitalized for Omicron infection was a mere 24 percent—43 of 182 hospitalized patients—compared to 69 percent for Delta. Put the other way around, the vaccinated have morphed into about three-quarters of hospital admissions for the now-dominant Omicron. These figures belie the rock-solid mainstream narrative that hospitals are filled with the unvaccinated. Clearly, the “pandemic of the unvaccinated”—always open to question—is no more.

“This is a huge change,” said Juan Chamie, a covid data expert who verified my conclusion from the data. “It is clearly contradicting the ‘99-percent unvaccinated in hospital’ narrative.” Dr. Mobeen Syed, a YouTube medical educator who favors vaccination of high-risk groups, agreed. The public health message on the hospitalized unvaccinated, he said, was “not up-to-date and transparent enough,” relying on data early in the pandemic when fewer were vaccinated and the variant was different. “They want to scare,” he told me. “They should have the courage to look at the data and say, ‘Hey guys, the risk (with Omicron) is reducing. Become happy, become more comfortable.’”

“..only now that millions of vaccines have been distributed and the public’s trust in the President and in his Covid response is at all time lows – she has completely and totally changed her tune.”

• COVID “Conspiracy Theories” Become “Fact-Checked” Mainstream Narrative (QTR)

I started out 2022 by predicting that capitalism and common sense would catalyze a massive pivot in how the mainstream media reports on Covid. I believed that the media would eventually start the process of pivoting from hysteria and that politicians, understanding full well that they can’t get re-elected during mid-terms this year on a platform of locking people in their homes, would follow. All I can say one month into the year is holy shit, does it look like I was right. So far in 2022, innumerable U.S. states, in addition to countries like Sweden, Norway and Denmark, are lifting Covid restrictions. Connecticut and Delaware are planning on lifting school mask mandates by the end of March. Oregon officials have also announced that general mask mandates would be lifted March 31. Even New Jersey and California announced they would ease mandates in coming weeks.

And the media narrative has very quickly changed, too. Dr Leana Wen, columnist with The Washington Post and CNN medical analyst who has, in the past, gushed non-stop about following the government’s Covid guidance, has now completely changed her playbook for her appearances on CNN. On Monday of this week, she told CNN: “There was, and is, a time and place for pandemic restrictions. But when they were put in, it was always with the understanding that they would be removed as soon as we can. And, in this case, circumstances have changed. Case counts are declining. Also, the science has changed. The responsibility should shift from a government mandate imposed from the state or the local district of the school … it should shift to an individual responsibility by the family, who can still decide that their child can wear a mask if needed.”

[..] In fact, where the fuck was this woman 6 months ago? On New Years, she was urging people to mask up while heading outdoors to watch the ball drop: “Make sure that you’re vaccinated and boosted. Make sure that you’re wearing a mask even though it’s outdoors. There are lots of people packed around you, wearing a three-ply surgical mask.” In Spring of last year, she was expressing “fears” about the U.S. not being able to reach herd immunity. In Summer of last year, she was spreading the narrative that “we can’t trust the unvaccinated”. Heading into the Fall, she was writing op-eds called “Why Covid-19 Vaccines Should Be Required For All Americans”. And now – and only now that millions of vaccines have been distributed and the public’s trust in the President and in his Covid response is at all time lows – she has completely and totally changed her tune.

“..you might need a booster only every four or five years.”

• Fauci Says ‘Full-Blown’ Covid-19 Pandemic Is Almost Over In US (Fox)

Dr. Anthony Fauci, the chief medical adviser for President Biden, said in an interview published Tuesday that the U.S. is almost past the “full-blown” pandemic phase of the coronavirus and said he hopes that all virus-related restrictions could wind down in a few months. Fauci discussed his idea of the virus’s trajectory with the Financial Times. He told the paper that the government response to the disease will eventually be handled on a local level and not federal. He did not mention a specific month or season but told the paper that these restrictions — including mask mandates — could end “soon.” The number of people in the hospital with COVID-19 across the U.S. has tumbled more than 28% over the past three weeks to about 105,000 on average, according to the Centers for Disease Control and Prevention.

Dr. Chris Beyrer, an epidemiologist at the Johns Hopkins Bloomberg School of Public Health, told the Associated Press, “What we want to see is that the omicron surge continues to decrease, that we don’t see another variant of concern emerge, that we start to come out of the other side of this.” Fauci told the paper that there is no way to eradicate the virus, but it is his hope that “we are looking at a time when we have enough people vaccinated and enough people with protection from previous infection that the Covid restrictions will soon be a thing of the past.” He also said it may not been needed for all Americans to get boosted in the future. “It will depend on who you are,” he said. “But if you are a normal, healthy 30-year-old person with no underlying conditions, you might need a booster only every four or five years.”

Well, actually, there is no plan, at least in the article. But he does sound scared.

“You have a number of people who are … part of the protest group who have openly stated … they feel such a passion for this particular cause that they are willing to die for it..”

• Mayor Reveals Plan To Deal With Truckers Blocking US-Canada Bridge (RT)

Trying to forcibly remove truckers blockading the busiest US-Canadian border crossing at the Ambassador Bridge could lead to violence and even death, the mayor of Windsor, Ontario cautioned on Wednesday, while his police chief called for a diplomatic approach. “You have a number of people who are … part of the protest group who have openly stated … they feel such a passion for this particular cause that they are willing to die for it,” Mayor Drew Dilkens told reporters on Wednesday. “If you have people who hold that sentiment, the situation can escalate and get very dangerous for police and those members of the public in very short order. It’s fair to say we don’t want to see anyone get hurt.” Dilkens added that he’s been getting calls from Windsor residents and businesses demanding the forcible removal of the truckers, but said “such action may inflame the situation and cause more folks to come and join the protest.”

The Ambassador Bridge runs between Windsor and Detroit, Michigan. It has been closed to commercial traffic since Monday, when several dozen truckers set up a blockade on the Canadian side, in solidarity with the Freedom Convoy in Ottawa. Another group of truckers and farmers has been blockading a border crossing in the western province of Alberta for over a week as well. Detroit-Windsor bridge traffic accounts for about $355 million worth of goods traded between the US and Canada, more than a quarter of all commerce between the two countries. The Canadian authorities have tried to route trucks to the Blue Water Bridge in nearby Sarnia. On Wednesday, truckers and farmers parked their vehicles near that bridge as well, causing a 4.5-hour delay to enter the US, the Canada Border Services Agency said.

Canadian Prime Minister Justin Trudeau has refused to meet with the protesters in Ottawa, calling them a “fringe minority with unacceptable views,” and accusing them of violence, racism, bigotry, and even Nazi sympathies. Other Canadian officials have denounced the trucker protests as an “insurrection” and a “threat to our democracy.” Trudeau’s public safety minister, Marco Mendicino, called the bridge protests illegal, telling the truckers, “you are hurting Canadians and you are not above the law.” “This is an illegal economic blockade against the people of Ontario and against all Canadians,” Transport Minister Omar Alghabra said, adding that they are putting supply chains of food and manufacturer parts at risk.

Tyranny at its finest

Organiser of Freedom Convoy is expecting 1800-3000 Riot Police to enter Ottawa and begin kettling protestors. Cell phone services will be shut down throughout the city to stop videos of the operation from leaking to the public.

Democracy? pic.twitter.com/s45v2KEWpT

— ZNeveri (@ZNeveri) February 9, 2022

Ardern and Trudeau. What a couple.

• Dozens Arrested As New Zealand Police & Anti-mandate Protesters Clash (RT)

New Zealand police cracked down on protesters outside Parliament in Wellington on Thursday, arresting more than 50 people after forcibly dispersing the demonstration against Covid-19 restrictions. Shortly before the scuffles erupted, police threatened the crowd of around 150 protesters with arrest if they refused to leave the area voluntarily. Those who ignored the order were subsequently detained by law enforcement. Protesters could be seen chanting “this is not democracy” and “shame on you” as police officers moved in to clear the grounds. Footage showed police officers tearing down tents that had been erected by protesters and scuffling with the protesters unwilling to scatter on their own.

“Police continue to appeal to protestors to leave Parliament Grounds peacefully, as the area is closed to the public,” New Zealand Police said in a statement on Thursday. “We continue to acknowledge people’s rights to protest, however those who behave unlawfully will face arrest,” the statement continued. By 11:30am, New Zealand Police claimed to have arrested more than 50 protesters on charges such as trespassing and obstruction for remaining on Parliament grounds after they decreed the area closed to the public. “Wellingtonians have the right to conduct their lives and go about their business without the interference of ongoing unlawful activity,” the police declared, warning that “additional resources” would be “deployed from around the country” to crack down on protests if they continued.

“I will not stand by and allow these big tech firms to perniciously cancel or stifle speech they disagree with.”

• Texas Probes GoFundMe Shutdown Of Freedom Convoy Fundraiser (RT)

The Texas state government has opened an investigation into crowdfunding platform GoFundMe after the site shut down a campaign on behalf of Canadian truckers in the Freedom Convoy, a large anti-vaccination mandate protest staged primarily in Ottawa. The state’s attorney general, Ken Paxton, announced the move on Wednesday, saying he would act to “protect Texas consumers” and “get to the bottom of this deceitful action” following the platform’s decision to cancel the Freedom Convoy fund drive. “GoFundMe’s response to an anti-mandate, pro-liberty movement should ring alarm bells to anyone using the donation platform and, more broadly, any American wanting to protect their constitutional rights,” he said, arguing that Texans deserve to “know where their hard-earned money is going, rather than allowing GoFundMe to divert money to another cause” without their consent.

The site halted donations after “multiple discussions with local law enforcement” and “reports of violence and other unlawful activity” at the trucker-led protest against Covid-19 vaccine mandates. Demonstrators have camped out in the Canadian capital, Ottawa, for over a week – what GoFundMe has described as an “occupation.” By the time the campaign shut down, it had raised more than $8 million. While the platform initially said it would issue refunds to donors only if they explicitly requested it – noting that it would otherwise send the money to charities approved by itself and the Freedom Convoy organizers – it has since reversed course. Earlier this week, GoFundMe issued an update, stating that, “due to donor feedback,” refunds would instead be processed automatically.

Two other states have also vowed to launch similar probes. Missouri AG Eric Schmitt told Fox News on Wednesday that his office would investigate “GoFundMe’s actions to silence the Freedom Convoy,” adding, “I will not stand by and allow these big tech firms to perniciously cancel or stifle speech they disagree with.” Florida Governor Ron DeSantis previously said that his state would look into the canceled fund drive, accusing GoFundMe of “deceptive practices.”

“..they must let some of the pressure out of the balloon and ease some of the restrictions affecting the average family.”

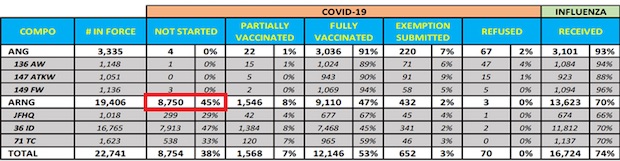

• What Will Gov. Abbott Do With Vax Mandate In The Texas National Guard? (Blaze)

These were supposed to be part-time citizen soldiers, but so many of them have served multiple tours of duty in the Middle East. More recently, nearly all of them are at the Texas-Mexico border attempting to do the job the federal government won’t do. Now that same federal government is threatening to terminate thousands of Texas guardsmen if they fail to get a shot that quite literally is outdated, and numerous data points and testimony from military doctors raise concerns about adverse reactions. Will Texas Gov. Greg Abbott stand up for his Guard? What about other GOP governors? The Biden administration officials know that with mounting opposition to COVID mandates, they must let some of the pressure out of the balloon and ease some of the restrictions affecting the average family.

But they also understand that the military is a minority of the minority and that they can get away with illogical and illegal mandates on it for far longer. At present, it appears that no number of facts on the ground will change the minds in the Pentagon in terminating their July 1 deadline on all Army soldiers, including state guardsmen, to receive the experimental shots. While the damage has already been done in most circles of the active-duty military, there are thousands of Texas guardsmen who have not gotten the shots and are now starring down the barrel of losing their careers and all retirement benefits. Here are the most recent vaccination numbers released by the Texas Military Department obtained by the Blaze:

As you can see, just 47% of the Texas Army National Guard are fully vaccinated, and 45% — accounting for 8,750 troops – have not begun the shots. At the border, 48% of the soldiers, nearly 3,000 of them, are unvaccinated, according to my source. And from speaking to two sources on the ground in the Texas Guard, it appears that most of them will refuse to get the shots. Will Gregg Abbott allow them to be terminated? Will Republicans in the U.S. Senate vote for the upcoming budget bill that continues to fund the DOD mandate?

The obvious question everyone should be asking is why are the GOP governors not uniting at a meeting and declaring the DOD mandate null and void? Remember, while governors have no control over the active-duty military, they do control the chain of command for disciplinary actions in their respective guards, absent a “Title 10” order from the president. At a minimum, each governor should direct the adjunct general of the Guard to announce that the state plans to fight the mandates and will dismiss any officer who encourages, much less coerces, soldiers to get the shots. That is fully within the legal authority of a governor.

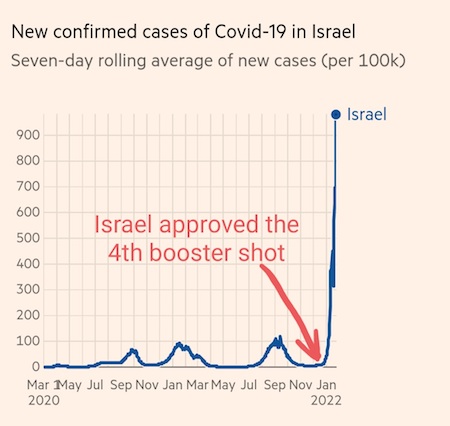

“CVS is not counting on booster shots boosting its business.”

• CVS Forecasts 80% Drop In Covid Vaccine Sales For 2022 (R.)

CVS on Wednesday said it expected a 70% to 80% drop in the number of COVID-19 vaccines its drugstores will administer this year and said 2022 profit would be driven by its health insurance and pharmacy benefit management businesses. Shares of the company fell more than 4% in early trading after the company left its 2022 earnings forecast unchanged despite beating profit expectations in the fourth quarter. CVS made the comments during a conference call to discuss fourth-quarter results, which exceeded Wall Street estimates for profit and sales. The company, which operates one of the largest US drugstore chains, manages pharmacy benefits for employers and health plans and owns the Aetna health insurer, also forecast a 40% to 50% fall in COVID-19 testing at its stores.

It said it expects “modest full-year volume growth” in over-the-counter test kits. CVS said it administered COVID-19 vaccine booster doses during the fourth quarter that it had previously expected to provide in 2022, helping drive a near 13% increase in sales at its retail stores. That was also a factor in not raising the 2022 forecast, it said. While some countries such as Israel have begun giving out fourth vaccine doses, CVS is not counting on booster shots boosting its business.

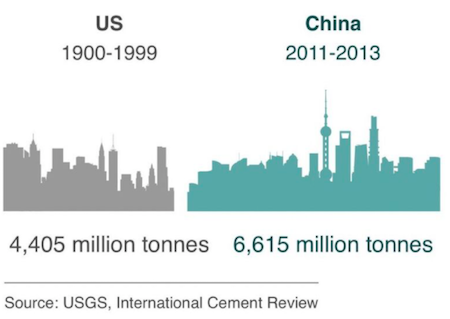

Three times higher than international average

• Germany Electricity Prices Soar To World Record Highs (NTZ)

Germany’s power supply, once mostly made up of a mixture of coal and nuclear power, used to be among the most stable and affordable in the world. Power outages were rare and grid interventions were infrequent. But then in the 1990s environmental activists and politicians got involved, believing they could manage and design a grid and power supply that would be technically and environmentally superior than what the leading power generation and electrical engineers and experts themselves had in place. Sun and wind were the way to go, the environmentalist Greens and SPD socialist’s declared. After all, the wind and sun don’t send electric bills and are “free for the taking”. This they somehow managed to convince the public. And so the greening of the grid began.

In 2000, the coalition government of the Socialist’s and Greens, led by Chancellor Gerhard Schroder, introduced the EEG renewable green energies feed-in act. What followed was a green energies construction frenzy with hundreds of megawatts of volatile wind and solar capacity being added to the grid every year while nuclear power was shut down. Today now comes the EED’s price shock. Wind and solar are not free after all. In fact they are outrageously expensive, and they are even more volatiles in terms of supply than the country’s Corona policies! Today German weekly news magazine FOCUS here reports how Germany’s electricity prices have now reached “record” levels: “Germany is the world champion in electricity prices – no country pays more for electricity.

According to new data from the German Association of Energy and Water Industries, German households paid an average of 36.19 cents for a kilowatt hour in January 2022.” That’s over 40 US cents per kilowatt-hour! “Never before have German consumers had to pay so much,” writes FOCUS. “Germans have to pay almost three times as much for electricity from the outlet compared to the international average. This is mainly due to unusually high taxes and eco-taxes in this country.” What’s worse, the country now teeters on power grid collapse, meaning blackouts are a real threat. Moreover, high-tech computer-controlled production machines and plants rely on a steady supply frequency to operate. As grid frequency becomes increasingly unstable due to the volatile wind and solar power input, the equipment risks costly unplanned production shutdowns.

“kind of weird, people will get really mad if you use that word and tweet about it on a phone that’s made by slaves.”

• Joe Rogan Mocks His Controversy In Surprise Stand-up Appearance (RT)

Headlining a small comedy show in Austin, Texas, Joe Rogan took to the stage to speak about the recent controversy surrounding him and his podcast on Spotify, and comment on the recently circulated video compilation of him using the n-word on his show. “I used to say it if [I was talking about] a Richard Pryor bit or something, I would say it in context,” Rogan said. “Somebody made a compilation of every time I said that word over 14 years and they put it on YouTube, and it turned out that was racist as f**k. Even to me! I’m me and I’m watching it saying, ‘Stop saying it!’ I put my cursor over the video and I’m like, ‘Four more minutes?!’” Rogan added that he hadn’t used the word in years, before saying he found it “kind of weird, people will get really mad if you use that word and tweet about it on a phone that’s made by slaves.”

The number one podcast host then addressed the other major controversy surrounding his show – the alleged Covid and vaccine misinformation. “I talk shit for a living — that’s why this is so baffling to me,” he said. “If you’re taking vaccine advice from me, is that really my fault? What dumb shit were you about to do when my stupid idea sounded better? ‘You know that dude who made people eat animal dicks on TV? How does he feel about medicine?’ If you want my advice, don’t take my advice.” After the show, Rogan held a brief Q&A with the audience, where one fan asked if he would accept the recent $100-million offer to move his show onto Rumble, but the host said he’ll stay where he is for now: “No, Spotify has hung in with me, inexplicably, let’s see what happens.”

In a recent episode with comic Akaash Singh, Rogan has decried the controversy surrounding him as “a political hit job” saying that the video of him saying the n-word had always been out there and was being used now for political reasons. “They’re taking all this stuff I’ve ever said that’s wrong and smushing it all together. It’s good because it makes me address some stuff that I really wish wasn’t out there.” Rogan also responded to criticism leveled against him by former US president Donald Trump and Florida governor Ron DeSantis, who said Rogan shouldn’t have apologized to the mob. “You should apologize if you regret something,” said Rogan, adding that “I do think you have to be careful not to apologize for nonsense.”

“Great Britain has lost an empire but not yet found a role.”

• Britain’s Second Elizabethan Age Has Been 70 Years Of Dismal Decline (Nuttall)

There’s no doubt that Queen Elizabeth II is a wonderful monarch, perhaps one of the greatest Britain has ever seen. To put her long reign in perspective, she ascended to the throne only seven years after the end of the Second World War, and Winston Churchill was her first prime minister. Her commitment to duty and to her people are beyond reproach, and, as a result, her jubilee will be met with a swathe of celebratory television documentaries and news articles. But let’s not fool ourselves. Although she has been a magnificent monarch, her time on the throne has been one of steep British decline, and a far cry from the glorious first Elizabethan age in the 16th century.

This reign of Elizabeth I, from 1558 to 1603, is regarded as a ‘golden age’ for Britain, one of economic prosperity, technological advancement, and global exploration. She inherited an unstable kingdom, one divided by religion, increasing poverty, and beset with powerful foreign enemies. Under the guidance of its shrewd ‘Virgin Queen’, however, England emerged as a world power able to tackle its outward and internal foes. Her achievements included the restoration of England to Protestantism, the execution of Mary, Queen of Scots, and the Royal Navy’s defeat of the Spanish Armada in 1588, which laid the foundations for Britain to go on to ‘rule the waves’. Indeed, when it comes to the navy, it could be argued that the second Elizabethan period represents the undoing of the first.

When her namesake became Queen in February 1952, Britain was one of the most powerful nations on the planet; alongside the United States and the Soviet Union, it was considered one of the ‘Big Three’. Britain’s strength was augmented later that same year, when it became a nuclear power. At the time, Britain was spending 11.2 percent of GDP on its armed forces, yet this figure today has shrunk to a mere 2.3 percent. In 1952, Britain had a standing army of 871,000. This now stands at 82,000 and is due to be reduced to 72,500 by 2025. This is not really an army, but a corps. It is the same with the Royal Navy. In the 1950s, Britain had a navy worthy of policing the oceans. There were 280 active ships in 1950 and 12 aircraft carriers.

By 2020, however, the Royal Navy only had seventy active vessels, with only two aircraft carriers. Indeed, if coastal patrol vessels are excluded, the number of ships in the Royal Navy has declined by around 74 percent since the Falklands War of 1982. By any measure, this can only be construed as military decline. I am not making an argument in favour of colonialism, but the fact that Britain was prepared to abandon – or “scuttle” as Churchill put it – her empire in such a hurry only serves to highlight the country’s rapidly diminishing status. Indeed, as Dean Acheson, the former US secretary of state, said in 1962, “Great Britain has lost an empire but not yet found a role.”

“Bayer AG purchased Monsanto and dumped the company name back in 2018. As if … that would be helpful. ”

• Glyphosate’s Dirty Secrets — Are We About to Learn More? (CHD)

Truth will out. Eventually, given enough time, the good, the bad and the ugly will be revealed. Such is the case with Monsanto‘s dubious herbicide glyphosate. The long-winding story on how Monsanto and its governmental enablers at the Environmental Protection Agency first registered the weedkiller Roundup under at best dubious circumstances is sickening. In March 2015 U.S District Judge for the Northern District of California allowed public release of internal Monsanto documents showing how Monsanto influenced EPA to reclassify glyphosate from a Class C carcinogen to a Class E category which paved the way for glyphosate Roundup production. It was nothing short of a cover-up that put greed ahead of public safety.

And now ironically we learn the cover-up may have included Monsanto’s own investors. Bayer AG purchased Monsanto and dumped the company name back in 2018. As if … that would be helpful. Bayer has lost a string of jury trials where glyphosate was believed to be responsible for cases of non-Hodgkin lymphoma. Now Bayer investors are saying the German agri-giant played fast and loose with the facts, misleading them on 1) the safety of glyphosate and Roundup; 2) Bayer’s efforts at due diligence; and 3) the legal risks in the acquisition of Monsanto. Their lawsuit in the U.S. District Court for the Northern District of California makes for some interesting reading:

“Defendants specifically downplayed the liability risks related to Monsanto’s Roundup product, emphasizing that Bayer conducted a ‘thorough analysis’ during the due diligence process and ‘undertook appropriate due diligence of litigation and regulatory issues throughout the process’ which led Bayer to finalize the Acquisition. “These and similar statements made by Defendants during the Class Period were false and misleading. In truth, Defendants knew or recklessly disregarded that the Acquisition would not result in the benefits for Bayer that Defendants had represented, due to Monsanto’s significant exposure to liability risk related to Roundup.”

Nate Hagens Energy Blind | Part 01 of 05 | The Great Simplification

Arnold

I had such a blast filming with @salmahayek for @BMWUSA! Now…GET TO THE CHARGER!! @BMW #BMWElectric #ad pic.twitter.com/o2YmKELhIL

— Arnold (@Schwarzenegger) February 9, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.