Russell Lee Shasta Dam under construction. Shasta County, California 1942

Only 10? You sure?

• Zombie Corporations: 10% Of Global Companies Depend On Cheap Money (Mish)

10% of corporations survive only because central banks have kept real interest rates negative. The BIS defines Zombie firms as those with a ratio of earnings before interest and taxes to interest expenses below one, with the firm aged 10 years or more. In simple terms, Zombies are those firms that could not survive without a flow of cheap financing. The chart shows the median share of zombie firms across AU, BE, CA, CH, DE, DK, ES, FR, GB, IT, JP, NL, SE and US. According to the BIS Quarterly Report one out of ten corporations in emerging and advanced countries is a “Zombie”. Let’s dive into the report for more details.

The inability to come to grips with the financial cycle has been a key reason for the unsatisfactory performance of the global economy and limited room for policy manoeuvre. Since 2007, productivity growth has slowed in both advanced economies and EMEs. One potential factor behind this decline is a persistent misallocation of capital and labour, as reflected by the growing share of unprofitable firms. Indeed, the share of zombie firms – whose interest expenses exceed earnings before interest and taxes – has increased significantly despite unusually low levels of interest rates. Over the past 10 years, there has been a close positive correlation between the growth of corporate credit and investment.

A build-up of corporate debt has financed investment in many economies, particularly in EMEs, including high investment rates in China. Turning financial cycles in these economies could therefore weigh on investment. As with consumption, the level of debt can affect investment. Rising interest rates would push up debt service burdens in countries with high corporate debt. Moreover, in EMEs with large shares of such debt in foreign currency, domestic currency depreciation could hurt investment. As mentioned before, an appreciation of funding currencies, mainly the US dollar, increases debt burdens where currency mismatches are present and tightens financial conditions (the exchange rate risktaking channel).

Empirical evidence suggests that a depreciation of EME currencies against the US dollar dampens investment significantly, offsetting to a large extent the positive impact of higher net exports. For the above reasons, I believe the end of the global recovery is at hand. And when the next bust happens, the last thing central banks will be doing is raising interest rates.

How to define the Fed.

• America’s Inequality Machine Is Sending the Dow Soaring (BBG)

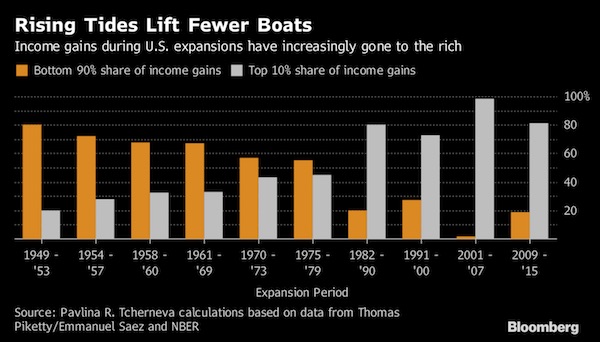

The Great Recession is a speck in the rear-view mirror for America’s financial markets. They’ve advanced far beyond pre-crisis levels. In fact, Goldman Sachs says you can go back a century before 2008, and still not find a “bull market in everything” like today’s. If the real economy had roared back the same way, Donald Trump might not be president. Instead, it’s been a grind. While unemployment is near a two-decade low, wages have grown slowly by past standards. They’re nowhere near keeping pace with the asset-price surge. Elected on a promise of better jobs and pay, Trump is about to pull the most powerful lever any government has for firing up the economy: fiscal policy. By slashing taxes on corporate profits, its authors say, the Republican plan will unleash the animal spirits of American business – and everyone will benefit.

A rising tide does lift all boats – but nowadays, in the U.S., not equally. Under both parties, recoveries have become increasingly lopsided. The current one has helped millions of people find work; it’s also benefited asset-owners far more than people who trade their labor for a paycheck. Income distribution, already the most unequal in the developed world, is getting worse. And that’s starting to influence everything from America’s spending habits to its elections. “The story of our time is polarization – by party, by class and by income,” said Mark Spindel, founder and chief investment officer at Potomac River Capital in Washington, and co-author of a 2017 book about the Federal Reserve. “I don’t see anything in the tax bill to make that any better.’’

The Fed’s post-2008 toolkit included massive purchases of financial assets, which supported a liftoff on the markets but took time to trickle through to the real economy. Trump’s tax critics say his plan will have a similar effect, because companies will spend the windfall on share buybacks or dividends, instead of job-creating investments. Plenty of executives say that’s exactly what they’ll do. Bank of America’s most recent buyback program totals $18 billion. Chairman Brian Moynihan championed the tax proposal this month. “It’s good for corporate America, and it’s good for us,” he said.

Same thing: inequality machine.

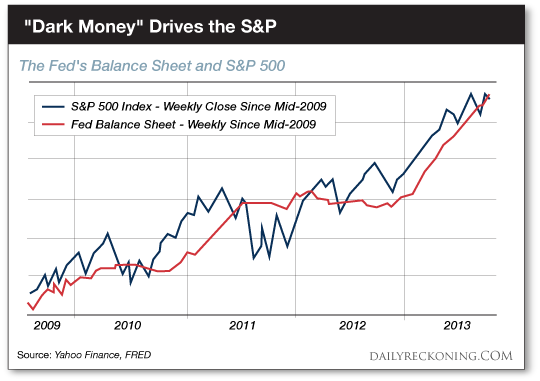

• “Dark Money” Runs the World (Nomi Prins)

Dark money is the #1 secret life force of today’s rigged financial markets. It drives whole markets up and down. It’s the reason for today’s financial bubbles. On Wall Street, knowledge of and access to dark money means trillions of dollars per year flowing in and around global stock, bond and derivatives markets. I learned this firsthand from my career on Wall Street. My first full year working on Wall Street was in 1987. I wasn’t talking about “dark money” or central bank collusion back then. I was just starting out. Eventually, I would uncover how the dark money system works… how it has corrupted our financial system… and encouraged greed to the point of crisis like in 2008. When I moved abroad to create and run the analytics department at Bear Stearns London as senior managing director, I got my first look at how dark money flows and its effects cross borders.

The “dark money” comes from central banks. In essence, central banks “print” money or electronically fabricate money by buying bonds or stocks. They use other tools like adjusting interest rate policy and currency agreements with other central banks to pump liquidity into the financial system. That dark money goes to the biggest private banks and financial institutions first. From there, it spreads out in seemingly infinite directions affecting different financial assets in different ways. Yet these dark money flows stretch around the world according to a pattern of power, influence and, of course, wealth for select groups. To be a part of the dark money elite means to have control over many. How elite is a matter of degree. These is not built upon conspiracy theories. To the contrary, alliances make perfect sense and operate publicly.

Even better, their exclusive dealings and the consequences that follow are foreseeable — but only if you understand how the system works and follow the dark money flows. It’s easy to see how this dark money affects the stock market at a high level, because we can monitor its constant movement. Here’s the smoking gun:

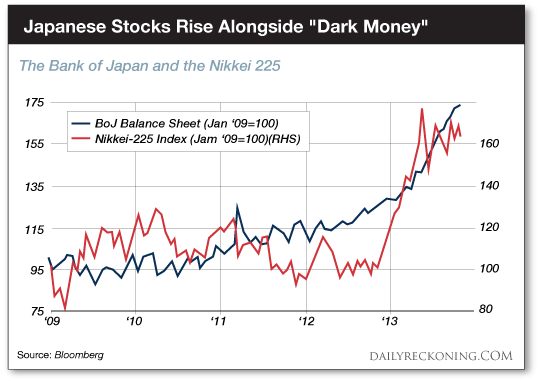

The red line shows you how much “dark money” the Federal Reserve has printed since 2008. The gray line shows you the S&P 500. They move together — more dark money drives the market higher. Much higher. There are dark money charts from around the world, just like the one I showed you for the Federal Reserve and U.S. stock market. Look at this “dark money” chart from Japan, for example:

Time for a change.

• ‘There’s No Life Here’: A Journey Into Britain’s Precarious Future (O.)

Ebbw Vale is the largest town in the county of Blaenau Gwent. This autumn the county was found to be the cheapest place to buy a home in England and Wales (averaging £777 per sq m in 2016, compared with £19,439 for the most expensive, London’s Kensington and Chelsea). It offers the second-lowest mean salary in Britain, and its GCSE results are the worst in Wales. Five food banks operate within an area of about 42 square miles. People here are struggling economically and physically. It’s a grim irony that an area encompassing the former constituency of Aneurin Bevan, architect of the National Health Service, should today be facing a quietly unfolding health crisis. Some 12% of working-age residents receive government support for disability or incapacity – twice the national average.

Life expectancy for both men and women is among the lowest in England and Wales. Out of a population of 60,000, one in every six adults is being prescribed an antidepressant, according to NHS data from 2013. “GPs haven’t got time to listen, to talk to people, to find out what’s going on. They’ve got that five- or 10-minute slot, somebody’s in tears, they’re saying they’re depressed,” Tara Johnstone tells me at the Phoenix Project, the publicly funded drop-in centre where she works in nearby Brynmawr. It’s run by a local charity, Torfaen and Blaenau Gwent Mind, and people come to chat about their problems: anxiety, depression, illness, bereavement. Most stories revolve around the same theme. “It’s lack of work,” explains Trish Richards, another Phoenix staff member. “I’ve had people come to me on zero-hours contracts. They don’t know where they are from one week to the next. Can’t plan. Can’t even plan to go to the dentist in case they get called in to work.”

The shift is only just starting. Incompetence will rule 2018 in Britain.

• Brexit: Britons Now Back Remain Over Leave By 10 Points (Ind.)

The British public has swung behind staying in the EU by its largest margin since the referendum, with those backing Remain outstripping Leavers by ten points, a new poll has revealed. The exclusive survey for The Independent by BMG Research showed 51% now back remaining in the union, while 41% want Brexit. Once “don’t knows” were encouraged to choose one way or the other, or excluded, the Remain lead rises to 11 points. Either way, it is the biggest gap since the June 2016 vote. It comes as leading political figures write in The Independent tomorrow about whether the country needs a further referendum to decide on Brexit, once terms of departure are known.

Michael Heseltine, Peter Mandelson, Gina Miller and Vince Cable call for a rethink, while Leave campaign mastermind Matthew Elliott and Conservatives James Cleverly and Suella Fernandes demand Brexit is seen through. Last week again underlined the difficulties of withdrawal, after the EU set out terms for a Brexit transition period that will likely be unacceptable to leading Conservative Eurosceptics. Theresa May also suffered a damaging defeat in the Commons while trying to pass her key piece of Brexit legislation, before being forced to make a major concession to avoid further embarrassment next week. Amid the furore, the latest poll indicates British voters have slowly but steadily been turning their backs on Brexit.

When a weighted sample of some 1,400 people were asked: “Should the United Kingdom remain a member of the European Union, or leave the European Union?” – 51% backed Remain, and 41% backed Leave. 7% said “don’t know” and 1% refused to answer. After “don’t knows” were either pushed for an answer or otherwise excluded, 55.5% backed Remain and 44.5 backed Leave. Polling since this time last year appears to demonstrate a clear trend; Leave enjoyed a lead last December which gradually shrank, before turning into a lead for Remain in the month of the general election, that has since grown.

Pretty soon the only thing left will be dividing lines.

• Call Off Brexit Bullies Or Face Defeat, Conservative Peers Tell May (G.)

Theresa May was warned on Sunday by Tory peers that she will face a string of parliamentary defeats over Europe in the House of Lords if she tries to “bully” members of the second chamber into backing an extreme form of Brexit. After 11 Conservative MPs joined opposition parties to inflict a humiliating loss on the government last week, Tory grandees are warning that the spirit of rebellion will spread to the Lords unless May shows she respects parliament and decisively rejects those with “extreme views” in her own party. Writing in the Observer, two Tory peers, the former pensions minister Ros Altmann and Patience Wheatcroft, a former editor of the Sunday Telegraph, say they are appalled at the insults heaped by hardline Brexiters on MPs who voted with their consciences, and at the “strong-arm” tactics of the Tory whips.

They say it is vital to democracy that parliamentarians be given the right to assess the Brexit deal on behalf of the British people without being threatened or bullied, and suggest that the aggression of Tory party managers has helped create a “toxic atmosphere”, not only in parliament but across the UK. Altmann and Wheatcroft write: “The resulting appalling insults from Brexiters, calls for expulsion from the party, and even death threats, are worrying symptoms of the toxic atmosphere which has been created in our country.” They add: “There are many moderate Conservatives in both Houses of Parliament who are deeply concerned that some in our party are so desperate to leave the EU, with or without a deal, that they believe any cost is justified to bring Brexit. They maintain ‘freedom is priceless’ but this extreme view does not reflect public opinion.”

The two peers say Conservative members of the House of Lords, in which there was a large pro-Remain majority, will not take kindly to being told by the Tory whips and the executive what to think about Brexit and how to vote. “Mindful of the monumental importance for future generations of getting Brexit right, the Lords is unlikely to be receptive to bullying over a restricted timetable or vigorous whipping to toe the party line,” they say. “The people voted to ‘take back control’ but that has to mean control by parliament, not a small group with extreme views or an executive that will brook no challenge. It is parliament that must have the final say on whether the deal that is negotiated for breaking away from the EU … is in the UK’s best interests.”

The shape of things to come.

• Metlife Says It Failed To Pay Some Pensions, Flags Hit To Reserves (R.)

Metlife failed to pay pensions to potentially tens of thousands of people and will have to strengthen its reserves because of the costs of finding and repaying them, the New York insurer said. Metlife said in a filing on Friday that it believed the group missing out on the payments represented less than 5 percent of about 600,000 people who receive benefits from the company via its retirement business. Those affected generally have average benefits of less than $150 a month, it said. When taken, however, the increase to reserves could be material to Metlife’s financial results. The insurer said it would provide further disclosure on its fourth-quarter earnings call and in its annual report for 2017. MetLife did not say how many years of missing income was owed. The people who missed out on the payments have changed jobs, relocated or are otherwise unreachable based on currently available information, the company said, adding that it was widening its search efforts and making better use of technology.

Are we really to believe Europe will stand up against its most powerful banks?

• EU Banks Told to Get Crisis-Ready by Removing Wind-Down Hurdles (BBG)

Big euro-area lenders face a choice; clean up the complicated corporate structures that make them difficult to wind down in a crisis, or watch Elke Koenig do it for them. Koenig, head of the Brussels-based Single Resolution Board, said in an interview that streamlining banks’ architecture and ensuring they can fund their own demise without taxpayers’ help will be priorities in the year ahead. “You have banks where you end with something that looks more like a spider web than a clean structure,” Koenig said. The message that those banks will receive is: “Please tidy up,” she said. The SRB is part of the EU’s efforts to end the problem of too-big-to-fail banks. In 2018, it will adopt resolution plans for nearly all of the 140-odd lenders within its remit, then start to identify “substantive impediments” to orderly wind-down.

Under EU law, when the SRB finds such obstacles, it sends a report to the bank, which must respond within four months on how it plans to fix the problem. If the SRB isn’t satisfied, it can instruct the supervisor to impose a range of measures on the bank, including issuing loss-absorbing liabilities, altering its legal or operational structures and selling assets. This task assumed greater importance earlier this year when the the European Commission withdrew a bill that could have forced major banks such as Deutsche Bank and BNP Paribas to split their trading and retail operations. Finance Watch, a public-interest watchdog, has said that without that bill, it’s “squarely” on authorities like the SRB to make sure systemically important banks can be wound down in an orderly manner.

Koenig accepts that the SRB is responsible for making sure banks have resolvable structures. “That’s clearly on us,” she said. “And it’s something that needs to be addressed swiftly.” “The ideal structure for me is one where you can with confidence isolate certain functions to keep them up and running in case something unforeseen happens,” Koenig said. “I would not try to differentiate between investment banking functions and retail banking functions, but think about it this way: If you need to separate businesses, are you producing a viable set of companies? Can you really separate them in a timely manner?”

But we were going to implant robots into ourselves… When will we learn that it’s the limits that set us free?

• Humans At Maximum Limits For Height, Lifespan And Physical Performance (SD)

Humans may have reached their maximum limits for height, lifespan and physical performance. A recent review suggests humans have biological limitations, and that anthropogenic impacts on the environment – including climate change – could have a deleterious effect on these limits. Published in Frontiers in Physiology, this review is the first of its kind spanning 120 years worth of historical information, while considering the effects of both genetic and environmental parameters. Despite stories that with each generation we will live longer and longer, this review suggests there may be a maximum threshold to our biological limits that we cannot exceed. A transdisciplinary research team from across France studied trends emerging from historical records, concluding that there appears to be a plateau in the maximum biological limits for humans’ height, age and physical abilities.

“These traits no longer increase, despite further continuous nutritional, medical, and scientific progress. This suggests that modern societies have allowed our species to reach its limits. We are the first generation to become aware of this” explains Professor Jean-François Toussaint from Paris Descartes University, France. Rather than continually improving, we will see a shift in the proportion of the population reaching the previously recorded maximum limits. Examples of the effects of these plateaus will be evidenced with increasingly less sport records being broken and more people reaching but not exceeding the present highest life expectancy. However, when researchers considered how environmental and genetic limitations combined may affect the ability for us to reach these upper limits, our effect on the environment was found to play a key role.

“This will be one of the biggest challenges of this century as the added pressure from anthropogenic activities will be responsible for damaging effects on human health and the environment.” Prof. Toussaint predicts. “The current declines in human capacities we can see today are a sign that environmental changes, including climate, are already contributing to the increasing constraints we now have to consider.” “Observing decreasing tendencies may provide an early signal that something has changed but not for the better. Human height has decreased in the last decade in some African countries; this suggests some societies are no longer able to provide sufficient nutrition for each of their children and maintain the health of their younger inhabitants,” Prof. Toussaint explains.

To avoid us being the cause of our own decline, the researchers hope their findings will encourage policymakers to focus on strategies for increasing quality of life and maximize the proportion of the population that can reach these maximum biological limits. “Now that we know the limits of the human species, this can act as a clear goal for nations to ensure that human capacities reach their highest possible values for most of the population. With escalating environmental constraints, this may cost increasingly more energy and investment in order to balance the rising ecosystem pressures. However, if successful, we then should observe an incremental rise in mean values of height, lifespan and most human biomarkers.” Prof. Toussaint warns however, “The utmost challenge is now to maintain these indices at high levels.”