Paul Klee Still Life 1929

The Trump legal team doesn’t have to prove the voting machines WERE manipulated, only that they COULD BE.

If the courts rule Dominion’s voting machines to be unconstitutional, then how many millions of ballots will be discarded?

Who wins the election if those millions of potentially fraudulent votes are discarded? https://t.co/fZLKY9Z14T— Ron (@CodeMonkeyZ) November 15, 2020

The only reason to use voting machines is to allow cheating.

• 2018 NY Times Video: How Easy It Is to Hack a Dominion Voting Machine (Vaughn)

Much to their current chagrin, in April 2018, The New York Times published a video of a University of Michigan computer scientist, J. Alex Halderman, showing a group of students how easy it is to rig a Dominion Voting Machine. The name of the video is “I Hacked an Election. So Can the Russians.” A caption next to the title read, “It’s time America’s leaders got serious about voting security.” At the time, Democrats were focused on Robert Mueller’s Special Counsel investigation and were anxiously waiting for his team to find evidence that President Trump had colluded with the Russians to win the 2016 election. A colleague of mine, The Western Journal’s Jared Harris, dug up this little gem.

The video shows Homer Simpson using a touch screen to vote for Barack Obama, but it instantly turns into a vote for John McCain. Professor Halderman narrates the brief video and tells students that the Dominion Accuvote TS and TSX machines are obsolete models, but were still being used in American elections.Halderman continues his monologue:”I’m here to tell you that the electronic voting machines Americans got to solve the problem of voting integrity, they turned out to be an awful idea. That’s because people like me can hack them, all too easily.I once turned a voting machine into a video game. Imagine what the Russians and the North Koreans can do.I’ve even gone to Congress to raise the alarm. He is seen testifying at a Congressional hearing. “These machines are vulnerable to sabotage and even to cyberattacks that could change votes.”

Halderman tells viewers how to hack the Dominion voting machines. Step 1: Buy a voting machine on eBay, or if you’re the North Koreans, Hack the manufacturer and steal their software code. Step 2: Write a virus. Step 3: Email your virus to every election official responsible for programming the voting machines with new ballots. Step 4: Wait. Step 5: Hijack the programming and let the election officials copy your invisible malicious code onto the voting machines. Step 6: Watch your code silently steal votes.

How I Hacked an Election

Good overview.

• Voting Fraud Is a Real Concern. Just Look Around the World (NW)

Thirty-seven states have changed their mail-in voting procedures this year in response to the coronavirus. They have followed the lead of Democrats and the media, who claim that concerns about voter fraud and vote buying are figments of the Republican imagination. President Trump’s comments on Thursday and Friday about voter fraud with mail-in ballots have sent the media into a frenzy. One “news” article after another since then has asserted that President Trump’s warning is “baseless” (Associated Press and The Washington Post) or “without evidence” (The New York Times, Politico and NBC News). Liberals and progressives often try to model the U.S. on Western European countries, but you never hear them arguing that we should adopt their voting rules. There is a reason for that.

Banning mail-in voting or requiring people to use photo IDs to obtain a mail-in ballot is quite common in developed countries, especially in Europe. To study this, the Crime Prevention Research Center, of which I am the president, created a database on voting rules around the world. Here is what we found. Besides the United States, there are 36 member states in the OECD. Forty-seven percent ban mail-in voting unless the citizen is living abroad, and 30 percent require a photo ID to obtain a mail-in ballot. Fourteen percent of the countries ban mail-in voting even for those living abroad. In addition, some countries that allow voting by mail for some citizens living in the country don’t allow it for everyone.

For example, Japan and Poland have limited mail-in voting for those who have special certificates verifying that they are disabled. France has made an exception this year to its ban on mail-in ballots to those who are sick or at particular risk during the coronavirus pandemic. Poland will allow mail-in ballots for everyone for this year only. Brazil and Russia satisfy the economic standards of the OECD, but are excluded for various political reasons. Both countries completely ban mail-in voting and require photo IDs for in-person voting. Among the 27 countries in the European Union, 63 percent ban mail-in voting unless living abroad and another 22 percent require a photo ID to obtain a mail-in ballot. Twenty-two percent ban the practice even for those who live abroad.

There are 16 countries in the rest of Europe, and they are even more restrictive. Every single one bans mail-in voting for those living in the country or require a photo ID to obtain a mail-in ballot. Sixty-three percent don’t allow mail-in ballots even for citizens living outside of the country. Are all of these countries, socialist and non-socialist alike, Western and Eastern European, developed and undeveloped, acting “without evidence?” It is not as though people in these countries haven’t heard the same arguments about the importance of the ease of voting—or about how photo ID requirements will, as one professor in the U.K. explained, supposedly “lead to people not being able to vote.”

These countries have learned the hard way what happens when mail-in ballots aren’t secured. They have also discovered how hard it is to detect vote buying when both those buying and selling the votes have an incentive to hide the exchange. France banned mail-in voting in 1975 because of massive fraud in Corsica, where postal ballots were stolen or bought and voters cast multiple votes. Mail-in ballots were used to cast the votes of dead people.

Dominion

https://twitter.com/i/status/1327511568993701888

“Maybe ex-CIA chief John Brennan never should have messed with General Mike Flynn. Just sayin’.”

• Don’t Mess with Miz Powell (Jim Kunstler)

An eerie silence oppressed the election news-space much of last week as Mr. Trump and his people seemed to lay low, Br’er Rabbit style, and a lot of folks wondered what was going on in that-there briar patch. Towards the weekend, Rudolf Giuliani methodically described some of the evidence at hand about janky ballot reporting, but that must have been too plodding for the Big Media gang. Then another Trump lawyer, Sidney Powell, came on Lou Dobbs’s Friday evening news show and some people started paying attention to some things she said, like, “I’m going to release the kraken” — referring to the largest and most feared sea monster in Old Norse mythology. Miz Powell, she means bidness. She went on, “We have staggering statistical evidence; we have staggering personal testimony… we’re beginning to collect evidence on the financial interest of the governors and secretaries of state who bought into the Dominion [vote tabulation] systems… President Trump won this election in a landslide, it is irrefutable… we are gonna go after it, and I am going to expose every one of them.”

Well, that might have put the fear of Gawd in some people. In case anyone in the back-of-the-class wasn’t paying attention, Miz Powell went back on the air Sunday morning with Maria Bartiromo and said, “We’re fixing to overturn the results of this election in multiple states… President Trump won not by hundreds of thousands of votes but by millions of votes that were shifted by this software that was designed expressly for that purpose…. We have so much evidence I feel it’s coming in like a firehose.” Is Ms. Powell bluffing? Why would she try, since the time left in this game is short and her only play is to show her cards? “I never say anything I can’t prove,” she declared.

[..] It’s a pretty rich gameboard out there and the clock is ticking. The possible outcomes are several: The state legislatures in disputed states could choose their own elector slates. In short order, the President’s lawyers will take their case to the US Supreme Court, which might invalidate the disputed states’ elections and send the contest into the House of Representatives a la the 1876 Hayes-Tilden election. The Department of Justice could level felony charges before December 8 at a long list of companies and persons involved in demonstrable ballot fraud. This could amount to decapitation of the Deep State. Would Mr. Barr dare? A lot of people doubt it. I’m sure readers can conjure up other possibilities.

In any case, a final victory for Joe Biden would hopelessly taint any administration he leads and would lead to much harsher resistance coming from the other side this time — while he is trying to govern during an economic calamity worse than the Great Depression of the 1930s. Maybe ex-CIA chief John Brennan never should have messed with General Mike Flynn. Just sayin’.

“.. if the one vote doesn’t give the leading candidate 270 electoral votes, then automatically it goes to the House of Representatives, where a whole new process takes over, and a process that clearly favors President Trump..”

• Trump May Try To Deny Biden 270 Electoral Votes – Dershowitz (ET)

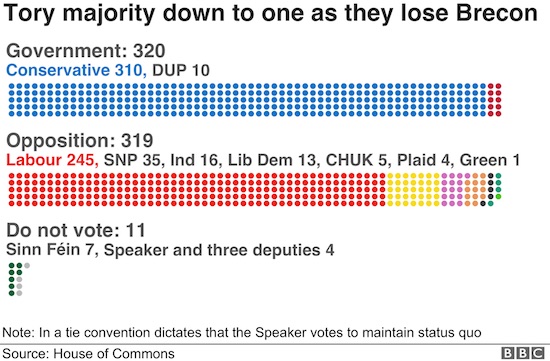

Harvard Law professor emeritus Alan Dershowitz predicted that President Donald Trump will attempt to settle the election in a way not seen since the 19th century. In an interview with Newsmax, the longtime legal expert said Trump no longer is attempting to reach 270 Electoral College votes but will instead focus on denying Democratic nominee Joe Biden’s chances of getting 270 votes. “Let’s look at the big picture: The big picture now has shifted,” Dershowitz told the website. “I do not believe that President Trump is now trying to get to 270 electoral votes. I think he thinks that’s out of the question.” Trump hasn’t signaled in public about his chances of securing 270 votes due to several legal challenges.

“What he’s trying to do is to deny Joe Biden 270 votes, by challenging in Pennsylvania, Georgia, in Nevada, in Michigan, in Arizona,” Dershowitz said, adding that not allowing Biden to reach 270 out of 538 votes would eventually force House state delegations to vote, where Republicans have an advantage over Democrats. Currently, the GOP has a 26-23-1 state delegation majority in the House of Representatives. “If he can keep the Biden count below 270, then the matter goes to the House of Representatives, where, of course, there is a Republican majority among the delegations of states, and you vote by state if it goes to the House,” Dershowitz said. “He’s trying to follow the playbook of three elections of the 19th century.”

Dershowitz noted that a number of things would have to align perfectly for Trump to win under that circumstance. “You need a perfect storm for it to work,” he said. “You need to get enough states, enough state attorneys general, or state departments, or whoever, secretaries of state or governors that are Republican that legitimately refuse to certify the results because they’re under challenge on the day the Electoral College meets by statute.” “If on that day, Biden doesn’t have 270 votes—you don’t get to vote two or three times on that; as far as the Constitution’s concerned, it’s one vote—and if the one vote doesn’t give the leading candidate 270 electoral votes, then automatically it goes to the House of Representatives, where a whole new process takes over, and a process that clearly favors President Trump,” added the former law professor.

Hmmm.

• Biden Campaign Director Arrested For Electoral Fraud (PN)

The Democrat Director of Texas state political strategy for the Joe Biden Presidential campaign has been arrested for electoral fraud. Democratic Party operative Dallas Jones was formally accused of helping to run an illegal ballot harvesting operation in the state of Texas on behalf of the Joe Biden campaign during this contested Presidential election. According to the National File, two investigators, including a former FBI agent and former police officer, testified under oath that they have Democratic Party internal documentation, as well as video evidence and witnesses, for their investigation. The following is an affidavit from private investigator and retired Houston police officer Mark A. Aguirre, which was submitted under oath.

“My name is Mark A. Aguirre. I am above the age of eighteen years and am fully competent to make this affidavit. The facts stated in this affidavit are within my personal knowledge and are true and correct. “I am a retired captain with the Houston Police Department. I am now a private investigator. “I am currently involved in an investigation related to a wide-ranging and fraudulent ballot harvesting scheme in Harris County intended to rig the elections in the Houston/Harris County area. This scheme involves voter fraud on a massive scale. “Based on interviews, review of documents, and other information, I have identified the individuals in charge of the ballot harvesting scheme. These individuals include political consultant Dallas Jones, who was recently hired by the Joe Biden for President campaign to oversee their Harris County initiative, District 13 Texas State Senator Borris Miles, who is the handler of Mr. Jones, political consultant Gerald Womack, and Precinct 1 Harris County Commissioner Rodney Ellis.

One of the companies these individuals are using as a front for this operation is AB Canvassing, although there are others that have been identified that we are investigating.” “I have in my possession video-taped interviews of witnesses attesting to the aforementioned people having groups of people completing thousands of absentee and mail-in ballots, including completing ballots for deceased individuals; illegally going into nursing homes, with the complicity of the nursing home staff, and filling out and forging the signatures of nursing home residents; signing up homeless individuals to vote using the ballot harvester’s address, then completing the ballot and forging the homeless individual’s signature.

Where is Durham?

• Durham’s Lame Duck Period (Turley)

Before going dark in October, U.S. Attorney John Durham’s investigation made headlines with the criminal plea of former FBI lawyer Kevin Clinesmith, who lied to the Foreign Intelligence Surveillance Act (FISA) court in order to continue surveillance of a Trump campaign adviser. There have been rumors for months that Durham found material not disclosed by special counsel Mueller or the Justice Department’s inspector general in their prior investigations. He also is known to have been working with a grand jury as part of his investigation. There is ample reason why a Biden administration would want to see Durham’s investigation closed.

Earlier this year, disclosures contradicted Biden’s denials that he knew of or was involved in the investigation of figures like Trump national security adviser Michael Flynn; the disclosures indicated Biden may have sought to “unmask” Flynn in surveillance reports. There also are accounts from the Oval Office that Biden was briefed on the Flynn investigation, including the fact that the FBI thought his discussions with Russian diplomats were “legit.” Earlier, FBI investigators sought to end the Flynn investigation for lack of evidence of any crime; according to one report, Biden raised the possibility of prosecuting Flynn under the Logan Act, a federal law widely viewed as unconstitutional.

The Durham investigation may not result in new indictments but could result in the release of new evidence. Indeed, the greatest risk of intervention by the Biden administration would be the withholding of any report or the use of classification rules to bar parts of its release. That report could shed light on how the Russia investigation began and was sustained, despite early intelligence refuting the collusion allegations. This includes recently released information that President Obama was briefed on intelligence suggesting that Hillary Clinton was working to falsely paint Trump as colluding with Russians. Such findings could be highly embarrassing not only to Obama administration officials but a number of congressional Democrats — including Rep. Schiff, who assured the public that, after contrary findings by the special counsel and the inspector general, his House committee had clear evidence of collusion. Schiff never produced that evidence.

A “dangerous attack on our democracy” indeed.

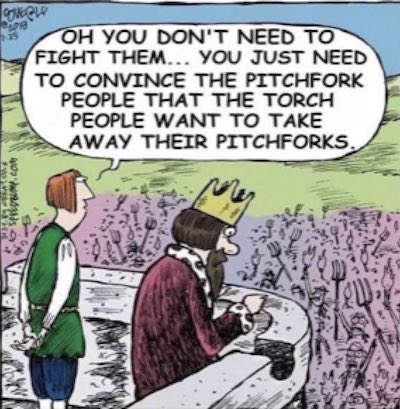

• The Lawless Campaign To Harass Lawyers Representing The Trump Campaign (Turley)

As in the past, there is a disturbing symbiosis of the media and activists feeding off each other. When Biden was viewed as the likely winner, theories of voting irregularities instantly became “conspiracy theories.” Groups like the Lincoln Project targeted law firms and launched a campaign to force lawyers to abandon Trump as a client. This effort resulted in Twitter blocking the Lincoln Project for targeting individual Trump lawyers in a tweet (accompanied by a skull-and-crossbones emoji) that was deemed threatening and abusive. That only seemed to thrill the Lincoln Project. It reportedly joined Democrats in targeting law firms like Porter, Wright, Morris & Arthur and threatening its lawyers with professional ruin. It claimed that any firm working for Trump on election litigation was part of a “dangerous attack on our democracy.”

Trying to strip people of their counsel, of course, is the real attack on our democracy — and it worked: The firm buckled and withdrew, saying the pressure caused internal struggles and at least one lawyer’s resignation. Other campaigns have targeted individual lawyers and what used to be called “fellow travelers” during the McCarthy period. After the election, Rep. Alexandria Ocasio-Cortez (D-N.Y.) called for liberals to assemble enemies lists of those “complicit” in the Trump administration. (Ironically, the first entry by a Bernie Sanders surrogate were the Republicans who founded the Lincoln Project). Former Obama spokesman Hari Sevugan proudly tweeted: “WH staff are starting to look for jobs. Employers considering them should know there are consequences for hiring anyone who helped Trump attack American values.”

However, the effort to intimidate lawyers representing Trump or his campaign is not about vengeance. It is about insurance. Even though the success of these challenges is small and shrinking, opponents do not want to risk any judicial scrutiny of the vote. Social media campaigns targeted the clients of firms like Jones Day, while the Lincoln Project pledged $500,000 to make the lives of these lawyers a living hell. It is the kind of tactic used by Antifa and other activists to “deplatform” speakers or harass individuals at their homes. Trump is highly unpopular with many Americans — and virtually all of the media — so it is popular to harass anyone who supports or represents him. It is mob justice targeting the justice system itself.

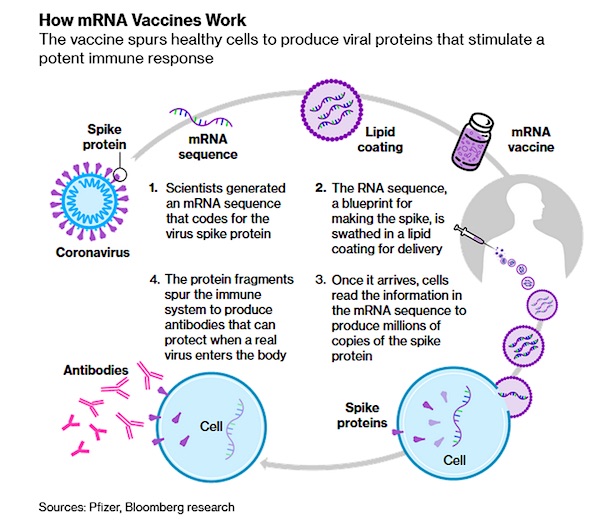

The Moderna vaccine appears to be far superior when it come to storage:

ZH: “Pfizer’s vaccine must be stored ultra-cold until a few days before it is used, but can be kept at refrigerator temperatures for as much as five days. Moderna, meanwhile, pointed to new data showing its vaccine is stable at refrigerator temperatures for 30 days, much longer than a previously estimated seven days.”

• Moderna COVID19 Vaccine Candidate Is 94.5% Effective – Trials (RT)

A new Covid-19 vaccine candidate is almost 95 percent effective, its American manufacturer has said, potentially giving it the edge in the race to defeat the virus. US-based biotechnology company Moderna announced on Monday that the two-dose mRNA-1273 vaccine it is developing has an efficacy of 94.5 percent, based on the results of a Phase-3 study, involving over 30,000 people. In the clinical trials, 90 cases of Covid-19 were observed in the group given the placebo, compared to five cases among those given the vaccine. It comes as a rival vaccine by US-based Pfizer and German firm BioNTech was found to have an efficacy of 90 percent, while the developers of Russia’s Sputnik V vaccine reported a 92 percent efficacy.

“The overall effectiveness has been remarkable…it’s a great day,” Moderna’s chief medical officer, Tal Zaks, told BBC News. The company now intends to apply for an emergency use authorization with US regulator the Food and Drug Administration in the coming weeks. Europe’s health regulator, the European Medicines Agency, said on Monday that it had started a real-time “rolling review” of Moderna’s vaccine candidate, following similar checks on Pfizer and AstraZeneca’s vaccines. Moderna expects to have 20 million doses of its vaccine ready to ship to the US by the end of the year and said it remains “on track” to manufacture between 500 million and a billion doses globally in 2021. It also announced on Monday that its vaccine has a better shelf life and stability than that of Pfizer’s, which must be stored at -70 degrees Celsius, or -94 Fahrenheit.

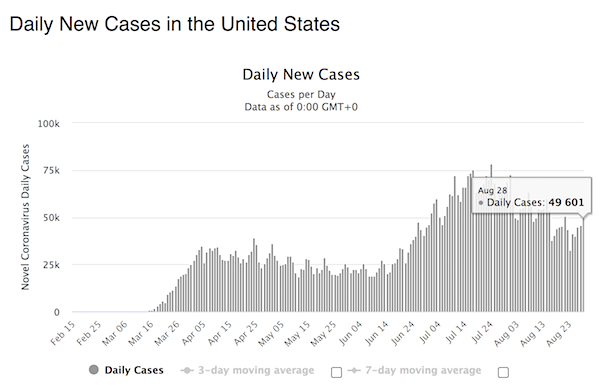

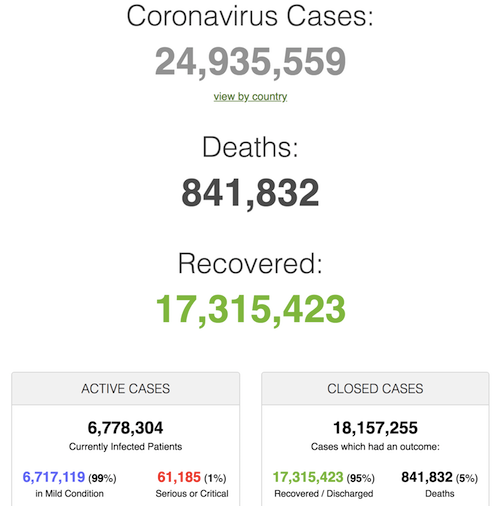

“In the real world, the difference between 1,500 deaths in a day and 1,000 is staggering, real and personal. To the endemic mindset, they are functionally identical.”

The endemic mindset is the world of abstractions we see under the influence of learned helplessness. There are only so many days in which death or hospitalization counts may still function as information for the human mind. There are only so many descriptions, images or videos of hospitals in the early stages of being overwhelmed which will be able to change anyone’s perspective. There is a point of diminishing informational returns from another story about a lost small business, or a struggling low income family. In the real world, the difference between 1,500 deaths in a day and 1,000 is staggering, real and personal. To the endemic mindset, they are functionally identical. In the real world, the difference between a 60% drop in revenue and a 30% drop in revenue is breathtaking.

To the endemic mindset, they are functionally identical. In the real world, the difference between being out of work for 9 months and being out of work for 4 months may be nearly existential. But if we are not the one affected, to the endemic mindset, they are functionally identical. In short, the endemic mindset is one in which our default expectation is that our world has become permanently worse in a way that we are helpless to do anything about.I don’t think I miss the mark by saying that ALL of us are suffering from this just a little bit.At some point in the last several months, did it start to feel like checking in every few days with elderly neighbors wasn’t really helping? Did it feel like extraordinary support of waitstaff, servers and owners of local businesses demanded much of you and still couldn’t keep them from going under?

Did your capacity to give to local food security charities give way to a recognition that the need never went away? Are you a financial advisor or professional being asked for good advice or wisdom about how to navigate “these challenging times”, and feeling like you ran out of both months ago? Are you a parent forced into remote learning supervision, feeling like you’ve botched it and waiting out the clock to give you a reprieve?Does the choice between standing outside in the cold, six feet apart, mask obscuring any sign of warmth or human emotion, or staying at home for Thanksgiving with the same people you’ve seen day in and day out for 8 months make you want to scream?

In your heart of hearts, do all of those things make it a little bit easier to believe that there’s just maybe nothing we can do that’s really going to take this shock away? That maybe we live our lives and weather all of this as best we can? If you are feeling that a bit – I feel that pull from time to time, too, if it helps – it doesn’t make you bad. It makes you human.

Listen to the scientists.

• 65 Virus Cases, With 1 Cluster, In WHO Geneva Staff (AP)

The World Health Organization has recorded 65 cases of the coronavirus among staff based at its headquarters, including at least one cluster of infections, an internal email obtained by The Associated Press shows, despite the agency’s past assertions that there has been no transmission at the Geneva site.The revelation comes amid a surge of cases in Europe, host country Switzerland, and the city of Geneva, in particular, and the email said about half of the infections were in people who had been working from home. But 32 were in staff who had been working on premises at the headquarters building, indicating that the health agency’s strict hygiene, screening and other prevention measures were not sufficient to spare it from the pandemic.

Farah Dakhlallah, a WHO spokeswoman, confirmed the accuracy of the information about the case count in an email to the AP and that officials were still investigating.“We have not yet established whether transmission occurred on campus, but are looking into the matter,” Dakhlallah said. Raul Thomas, who heads business operations at WHO, emailed staff on Friday noting that five people — four on the same team and one who had contact with them— had tested positive for COVID-19. While the email did not use the term “cluster,” one is generally defined as two or more cases in the same area, and the five cases indicate basic infection control and social distancing procedures were likely being broken.

A previous email he sent on Oct. 16 indicated that no clusters had been found at the site. “As per standard protocols, these colleagues are receiving the necessary medical attention and are recovering at home,” the email Friday said. “These last five cases bring the total reported number of affected members of the Geneva based workforce to 65 since the beginning of the pandemic.”

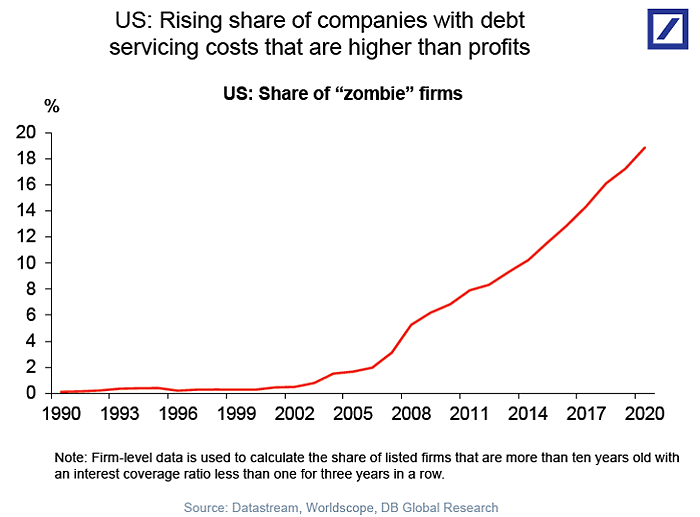

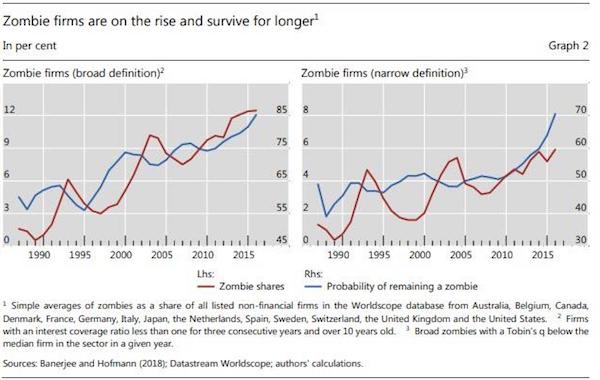

Zombies.

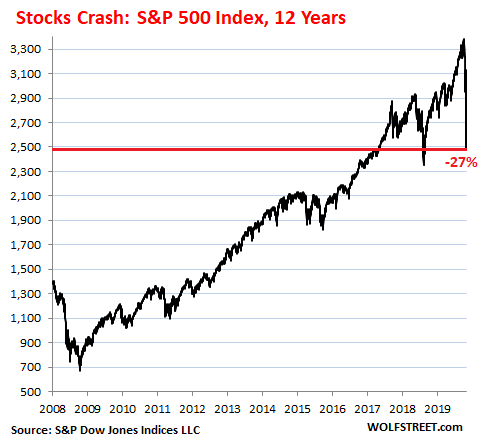

• The Economy is Imploding from Over-Capacity and Corrupt Cartels (CHS)

Here’s the fantasy: if we stop the shutdowns, the economy will naturally bounce back to its oh-so wunnerful perfection of Q3 2019. This is a double-dose of magical thinking and denial. The U.S. economy was unraveling in 2019 from 11 long years of Fed-induced over-capacity in almost everything (except integrity, competition, transparency and social cohesion) and the bone-crushing burden of corrupt, greedy cartels that have the nation by the throat. The reality nobody dares mention is that thanks to 20 years of the Federal Reserve’s easy money, there’s rampant over-capacity everywhere you look: there’s too many cafes, bistros, restaurants, fast-food outlets, hotels, resorts, AirBnBs, unprofitable Tech Unicorns, airline flights, Tech startups, office towers, retail space, malls, absurdly overpriced apartments for rent, storage facilities, delivery services, office sublets, colleges, attorneys, unemployed workers with multiple credentials–the list of too much, too many is endless.

Thanks to the Fed, the most profitable venture was borrowing to increase capacity, then borrow some more to extract the phantom value created by the greater capacity. Nobody cared if the office tower remained mostly empty; the money was made in building it and extracting its “value” via debt, not operating a legitimate enterprise. This Fed-created house of cards was never sustainable, or healthy, as all the incentives to add capacity were perverse. The illusion that every mall, office tower, retail space, college, apartment building, etc. would be filled was only plausible as long as consumers and zombie corporations were borrowing and spending more than they earned. That was never sustainable, but rather than look at the systemic set-up of an insanely predatory, fragile debt bubble resting precariously on over-capacity, the status quo is blaming Covid and lockdowns. The problem isn’t the pin, it’s the bubble that was begging to be popped by something, anything.

A double edged sword.

• Zombification in Europe in Times of Pandemic (Vox.eu)

The COVID-19 crisis has prompted extraordinary financial support to firms by governments and central banks. This support has taken the form of public credit guarantee schemes, debt moratoria, direct support to firms via financial aid programmes, central bank lending and purchase programmes, and a loosening of micro- and macro-prudential supervisory rules. While this support is crucial to keep a cash-strapped economy afloat, it has invigorated a debate on whether such policies are promoting ‘zombie’ lending and ‘zombie’ firms. Zombie lending is generally defined as lending to non-viable (i.e. zombie) firms. The literature proposes different methods to measure zombies, which remains challenging, however.

The ‘zombification’ of the economy refers to a situation where public support programmes and bank lending actions keep unviable firms alive. This term gained widespread prominence following the Japanese crisis of the 1990s, when a collapse in real estate prices followed by a prolonged period of low growth resulted in many weak banks and firms, with weak banks preserving their lending relationships with weak firms, rolling over credits to unviable firms. Why would banks lend to alleged zombie firms? The literature has put forward two main explanations. On the dark side, banks may want to engage in the ‘evergreening’ (i.e. rolling over) of existing loans to avoid loan loss recognition. Recognising loan losses implies a deterioration of capital buffers.

It therefore follows that especially low-capitalised banks have an incentive to lend to zombies. On the bright side, banks may lend to zombies to preserve valuable relationships. To the extent that relationship lenders have an informational advantage over their customers, this may allow them provide credit to illiquid but viable firms in crisis times. Provision of such liquidity to firms in distress has the positive externality that it can avoid disruptions of supply chains.

“If the economic situation were in the announced expansion, inventories would be falling rapidly when sold.”

• Is There Really A China Economic Miracle? (Lacalle)

The year 2020 will be an extremely tough year for the European economy. Added to an unprecedented drop is a strong impact in the fourth quarter due to the new lockdowns. Morgan Stanley estimates that the eurozone’s GDP will fall by 2.2% in the fourth quarter, a 7% drop in the full year 2020. In addition, the investment bank lowers the outlook for 2021 with a rebound of only 5% in the average of the euro area, delaying the recovery of 2019 GDP to 2023. The “jobless recovery” is even more worrying. The apparently spectacular rebound data for the third quarter resulted in zero job creation. Unemployment in the eurozone in September stood at 8.3% and in Spain at 16.5%, not counting the millions of furloughed jobs in Europe.

In this environment, the United States’ recovery seems much stronger. GDP recovered in the third quarter to just 3.5% below 2019 levels. Unemployment has fallen to 6.9% in October but remains well above the record employment levels of 2019. However, the data from China is apparently spectacular. The manufacturing and services index already show an enviable expansion. GDP for the first three quarters is already growing at 0.7% after an expansion of 4.9% in the third quarter. Urban unemployment in China is 5.4% after shooting to a paltry 6%. What is behind the Chinese miracle compared to the poor eurozone?

A planned GDP. The GDP of China is dictated by production, not demand. It is not an observed GDP, but rather planned by the government together with the provinces. For this reason, many analysts scrutinize the data and deduct various factors, including the increase and valuation of inventories. It is not by chance that inventories of iron ore, automobiles and finished goods have risen to the highest level in seven months as the economy recovers. If the economic situation were in the announced expansion, inventories would be falling rapidly when sold.

Much is produced that is then not sold and remains in warehouses. Thus, it is not surprising that industrial prices fell 2.1% in September, export prices 0.9%, and the country’s debt soared 13.5% amid an apparently miraculous recovery. Industrial business profits have fallen 2.4% between January and September and, furthermore, factory door prices fell faster than expected in September and were at risk of deflation. These are signs of a slowly recovering economy, like all others, but not of a growth miracle.

People flee cities everywhere.

• Rents In British Cities Fall By Up To 15% Amid Covid ‘Exodus’ (G.)

Private rents in Britain’s cities have fallen by as much as 15% over the past year as tenants quit urban areas for a new life in the suburbs or the countryside, data shows. What has been described by some an “exodus” from the cities sparked by the Covid-19 pandemic is now pushing up rental costs in rural areas. In October, average rents in the countryside were 5.5% higher than a year earlier, while typical city rents were down by almost exactly the same amount (5.3%), according to figures for Great Britain from the estate agents Hamptons International. This gear change in demand has created a glut of properties in some areas and shortages in others. There were 29% more homes available to rent in cities than at the same time last year, while the number available in the countryside was down sharply – by 48%.

The reassessing of priorities brought on by the pandemic, with millions working from home and many wanting more space, combined with plummeting numbers of international students, is wreaking particular havoc on central London. Hamptons said rents in inner London were down by 14.9% year on year as landlords slashed costs to attract tenants – lopping almost £400 off the average monthly rent, which fell from £2,564 in October 2019 to £2,182 last month. The figures come after a series of surveys suggesting that many city dwellers have either moved out or are planning to do so after re-evaluating their lifestyle. Many are likely to have concluded that they will be able to continue working from home for at least part of the week once the crisis has subsided.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Cars collecting food in Dallas

Thousands of cars lined up to collect food in Dallas, Texas, over the weekend, stretching as far as the eye can see. pic.twitter.com/xLFGOcBkPK

— CBS News (@CBSNews) November 16, 2020

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.