Edward Steichen Marlene Dietrich 1932

What comes after the bubble. Overblown?

• The World Economy Can’t Handle Even One US Rate Hike (CNBC)

Even one small interest rate increase by the Fed could have a sweeping impact on U.S. and world economies, Komal Sri-Kumar told CNBC on Monday. “I think they are going to hike” on March 15, Sri-Kumar said on “Squawk Box,” echoing a theory shared by many analysts. “But that is going to prompt capital outflows from the euro zone, especially with the political risk. It is going to increase the capital outflow from China, and the U.S. economy will feel the impact.” These moves would strengthen the dollar against other currencies, putting downward pressure on the euro, said Sri-Kumar, president of Sri-Kumar Global Strategies. He acknowledged that some of that pressure “is probably good for the European economy from a trade perspective” because European exports would become cheaper to foreign partners.

“The problem is in terms of capital outflows,” he said, cautioning that divestment in Europe could raise risk in overseas markets. “These economies, despite some positive numbers, … they are not in strong enough shape to take an increase in interest rates on the part of the United States.” The reason for this weakness in global markets stems from a long period of liquidity, or market price stability, according to Sri-Kumar. “We have had too long a period of excessive liquidity,” he said. “The markets have been distorted. The bond yields are very, very low, much lower than they would have been in the absence of quantitative easing and zero interest rate policy.” As a result, small changes in the U.S. economy reverberate worldwide, Sri-Kumar said, adding that had the Fed started hiking rates as the country emerged from the 2008 financial crisis, the United States may have been better off.

That’s going to hurt. Who’s going to be bailed out?

• Wall Street Investors Make $3 Trillion Since Trump Election Victory (Ind.)

Wall Street investors have cashed in big on US President Donald Trump’s election victory. Stocks have added nearly $3 trillion to their paper value since Mr Trump’s election as measured by the Wilshire 5000 Total Market Index. The index, made up of more than 3,000 stocks, including an assortment of big companies, mid-sized businesses and small ones, has gained about 12% since the election. This means the overall increase in market capitalisation of all the US companies in the index jumped $3 trillion between 8 November through 3 March. Mr Trump’s unexpected victory has prompted the steepest rally from election day to inauguration for a first-term president since John F. Kennedy won the White House in 1960.

Last week, the Dow pierced the 21,000 mark for the first time ever after Mr Trump’s measured tone in his first speech to Congress lifted optimism and reassured some investors who had been disconcerted by his aggressive tone and divisive policies. It was just over one month ago that the index surpassed the 20,000 milestone for the first time in its history. The three main stock indexes surged more than 1.3% after the 1 March speech to close at record highs, according to Reuters data. Bank stocks have enjoyed particularly dramatic gains, but other sectors have rallied hard too, spurred by hopes of major tax cuts, regulatory roll-backs and bumper infrastructure spending. Neil Wilson, a market analyst at ETX Capital, last week said that this is the fastest time ever in which the Dow index has risen 1,000 points after a Presidential election.

As measured in ‘assets’.

• China Banking System Overtakes Eurozone To Become Biggest In The World (Ind.)

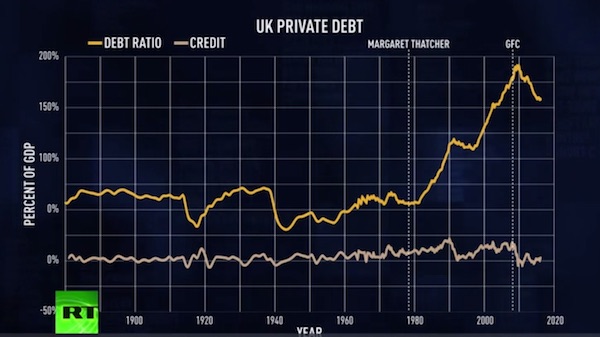

China’s banking system is now the biggest in the world, new analysis has shown. The country’s banks have more assets than those of the eurozone for the first time, the Financial Times found. China’s GDP surpassed that of the EU’s economic bloc in 2011 but its banks have taken more time to catch up, helped by a huge explosion in lending since the 2008 global financial crisis. Beijing launched a vast programme of fiscal stimulus in order to combat the effects of economic slowdown, but this has caused concern among some economists that a dangerous debt bubble has formed.

“The massive size of China’s banking system is less a cause for celebration than a sign of an economy overly dependent on bank-financed investment, beset by inefficient resource allocation, and subject to enormous credit risks,” Eswar Prasad, economist at Cornell University and former China head of the IMF, told the FT. Some analysts have said the stimulus has led to wasteful investments, overcapacity in certain industries and unsustainable debt levels. Chinese local governments have financed large infrastructure projects, mostly through debt. Three of the world’s four largest banks by assets are now Chinese. The total assets of the country’s banking system were $33 trillion at the end of 2016; more than the eurozone’s $31 trillion for the eurozone and more than double the US’ $16 trillion. The value of China’s banking system is more than 3.1 times the size of the country’s annual economic output, compared with 2.8 times for the eurozone and its banks, the FT said.

Excellent Richard Werner, especially the 2nd part, from 16:00 min on. How do banks create money? And how do you solve the problems that rise from that?

“The City of London is not part of the UK. The Queen can’t enter withour permission.”

• The Finance Curse (Renegade)

For many years, we’ve been told that finance is good and more finance is better. But it doesn’t seem everyone in the UK is sharing the benefits. On this program, we ask a very simple question – can a country suffer from a finance curse? Host Ross Ashcroft is joined by City veteran David Buik and the man who coined the term Quantitative Easing, International Banking and Finance Professor Richard Werner.

“A well-managed economy has the means to fund any priority it holds dear.”

• Money and the Government – Ann Pettifor (Vogue)

Let’s start with the obvious question: What is money?As the economist Joseph Schumpeter said, money is nothing more than a promise, a promise to pay. It’s a social construct. Coins, checks, the credit card you hand over at the till—they’re representative of those promises. We’re trained to think of money as a commodity, something there’s a limited supply of, that you can either spend or save, but in fact we’re creating money all the time, by making these promises. When you use a credit card, you’re not handing over your card to the shopkeeper or the waiter to keep, you’re just showing them a piece of plastic that says, “this person can be trusted.” We make myriad uses of these arrangements every day. And there’s far more of those promises in circulation at any given time than there is hard money sitting in vaults, or in people’s wallets, or wherever.

And what does understanding money-as-promise have to do with feminism? Most orthodox economists would have you think of money as finite, like a commodity. Which makes it very easy for politicians to say, when you come asking for paid maternity leave, or government-subsidized childcare, Sorry, ma’am, there’s no money in the budget for that. But you’ll note that they don’t reach for that excuse when they have other priorities—when they want $54 billion for military spending, for instance, or a trillion dollars to bail out the banks, suddenly the money is magically available. A well-managed economy has the means to fund any priority it holds dear.

But surely the government runs a budget, and the government we elect sets priorities for how to spend the money that it has. And some governments prioritize military spending, and others prioritize childcare . . . I’ll give you an example of what I mean. When the Federal Reserve decided to bail out AIG in 2008, a lot of journalists were asking Ben Bernanke: Hey, are you spending taxpayer money on this? And his answer was, no, we’ve just entered this $85 billion into their account. In exchange, AIG had to put up collateral, as you do when you take out a mortgage, but fundamentally, all the Fed was doing was typing some numbers into a computer that said: This belongs to AIG. Where taxpayers come into this is the Fed’s ability to make sure that $85 billion loan is backed by the money people pay to the U.S. government in taxes. Not what the government has on hand now, but what it anticipates taking in next year, five years, 100 years from now.

And there you have two issues: The issue of a well-managed economy, and the issue of how a government is different from an individual or a family where budgets are concerned. Politicians who advocate for austerity measures—cutting spending—like to say that the government ought to run its budget the way women manage our households, but unlike us, the government issues currency and sets interest rates and so on, and the government collects taxes. And if the government is managing the economy well, it ought to be expanding the numbers of people who are employed and therefore paying income tax and tax on purchases—purchases that turn a profit for businesses which then hire more employees, and on and on it goes. That’s called the multiplier effect, and for 100 years or so, it’s been well understood. And it’s why governments should invest not in tax breaks for wealthy people, but in initiatives like building infrastructure.

“..around June sometime the country won’t be able to pay invoices, issue salaries, send out entitlement checks, or do anything, really. It means pure government paralysis.”

• Great Expectations -Not- (Jim Kunstler)

Halloween’s coming super-early this year and it will be a shocking surprise to those currently busy looking for Russians behind every potted plant in Washington DC. First, accept the premise that your country has lost its mind. This is what happens when societies (and individuals) can’t face the true quandaries of a particular moment in their history. All of their attention gets channeled into fantasy: spooks, sexual freakery, conspiracies, persecution narratives, savior fairy tales. It’s been quite a cavalcade of unreality for the past six months, with great entertainment value for connoisseurs of the bizarre — until you’re reminded that the fate of the nation is at stake. The questions Americans might more profitably ask ourselves: can we continue living the way we do? And by what means?

These matters of home economics have been sequestered in some forgotten storage unit of the collective mind for at least a year while a clock ticks in the time-bomb that sits on the national welcome mat. That bomb is made of financial plutonium and it’s getting ready to blow. When it does, all the distracting spookery and freakery will vaporize and the shell-shocked citizens will have a clear view of the bleak, toxic, devastated landscape they actually inhabit. March 15 is when the temporary suspension of the national debt ceiling — engineered in a 2015 deal between Barack Obama and then House Speaker John Boehner — finally expires, meaning the government loses its authority to continue borrowing money. The chance that congress can pass a bill raising the debt ceiling to enable further borrowing is about the same as the chance that Xi Jinping will send every American household a dim sum breakfast next Sunday morning by FedEx.

The US treasury will then be left with around $200 billion in walking-around money, at a burn rate of about $90 billion a month — meaning that that around June sometime the country won’t be able to pay invoices, issue salaries, send out entitlement checks, or do anything, really. It means pure government paralysis. It means no infrastructure spending jamboree, no “great” wall, no military shopping spree, none of the Great Expectations sewn into the golden fleece of Trumptopia. Meanwhile, over the next few weeks, Janet Yellen and her crew of economic astrologasters at the Federal Reserve will have to put up or shut up vis-à-vis raising the interest rate on the basic overnight lending rate. The Las Vegas odds of it being raised currently stand at around 95%.

So, they will be running that play around the time that the debt ceiling issue materializes into a live-action event. Of course, the Fed could welsh on its carefully-scripted previous hints and utterances and do nothing. But that option would probably extinguish the last remaining shreds of the Fed’s credibility, since they’ve been jive-talking about raising rates since they began “tapering” the QE bond-buying spree in the spring of 2013, i.e., a long time ago. The Fed’s credibility is synonymous with the dollar’s credibility. Look out below.

“Democracy is staged with the help of media that work as propaganda machines.”

• Manufacturing Consent: The Movie – Journalism Cannot Be A Check On Power (RS)

Nearly 30 years before President Trump’s press gaggle last Friday, Noam Chomsky and Edward Herman authored ‘”Manufacturing Consent“, a book that radically redefined mass media’s relationship with the state. Now, in the age of fake news and alt facts, Democracy Now! co-founder Amy Goodman and animator Pierangelo Pirak have teamed up to give new life to the world renowned linguist and media analyst’s famed work. “Propaganda,” Goodman begins in her narration of the cartoon. “Many use the word when talking about countries like North Korea, Kazakhstan, Iran, Countries viewed as authoritarian through the lens of the western media. ‘Press freedom’. ‘Freedom of thought’. People use those terms when talking about countries like the United States, France, Australia. ‘Democracies’.”

In 1988, “Manufacturing Consent” “blasted apart the notion that media acts as a check on political power,” Goodman explains as a myriad of mouthy orange villains murmur ominously in a machine-like universe. “That media inform the public, serve the public so that we can better engage in the political process,” Goodman continues. “In fact, media manufacture our consent. They tell us what those in power need them to tell us … so we can fall in line. Democracy is staged with the help of media that work as propaganda machines.”

This happened in 8 years of Obama. Calling on Trump now seems a bit strange in that light. First ask yourself: why did Obama fail so badly?

• 66 Of Government’s 100 Largest Contractors Violated Federal Labor Laws (Ibt)

Federal contractors, who employ about 20% of all American workers and receive $500 billion in taxpayer funds annually, have been stealing wages and endangering workers despite Obama administration policies designed to protect workers, Sen. Elizabeth Warren said in releasing a report Monday. The report comes as the Trump administration prepares to slash regulations, and the Senate is scheduled to vote Monday on repealing the Fair Pay and Safe Workplaces executive order issued by former President Barack Obama, which would make it easier for federal contractors to hide labor law violations and make it harder for companies following the rules to do business with the government, Warren said. “All Americans deserve a safe workplace and fair pay for a day’s work,” Warren, D-Mass., said. “But too often, federal contractors break labor laws while continuing to suck down millions in taxpayer dollars.

Instead of making it easier for companies to cheat their employees or threaten workers’ health and safety, President Trump and Republicans in Congress should join Democrats in standing up for the hardworking Americans who do important jobs for our country.” The report indicates 66 of the largest 100 federal contractors have violated federal wage and hour laws, and a third of the largest penalties levied since 2015 were imposed by the Occupational Safety and Health Administration. Some violations have been fatal, including four in a single year at Goodyear. [..] The employer with the most wage and hour violations nationwide was AT&T with nearly 30,000, the report said. Another major violator was private prisons operator Corrections Corporation of America, now known as CoreCivic, with more than 21,000 violations. When it came to federal contracts specifically, Manpower Group racked up the most violations with 19,838, followed by USProtect Corp. with 7,263 and Management & Training Corp. with 5,519.

The UK as a caring society does not exist anymore. The sick, the old, the young, all the most vulnerable groups are targeted.

• UK Housing Benefit Cuts ‘Put Young People At Risk Of Homelessness’ (G.)

The government’s move to exclude young people from receiving housing benefit could bar most of them from the private rental market, a landlords’ association has warned, as charities said the decision could leave thousands at risk of homelessness. Amid widespread anger among charities at the decision to strip housing benefit entitlement from single people aged 18 to 21, the National Landlords Association (NLA) said one effect would be to put off most of its members from housing young tenants on benefits. “The message that will go out from these changes is that 18- to 21-year-olds don’t have automatic entitlement to housing benefit,” said Richard Lambert, the NLA’s chief executive. “Yes, there are all these exceptions in the actual policy, but the nuances won’t cut through. I wouldn’t go as far to say young people will be totally excluded, but they’re going to find it very, very difficult.”

The change, first mooted under David Cameron in 2012 and outlined in the 2015 Conservative party manifesto, was pushed through without fanfare in a ministerial directive to parliament late on Friday. It means that from 1 April, new single claimants aged 18 to 21 will not be entitled to the housing element of universal credit unless they fall into certain categories. The exceptions include people with children, or those where to continue living with their parents would bring a “serious risk to the renter’s physical or mental health” or would otherwise cause “significant harm”. While such categories are broad, homelessness charities warned that to prove such potential harm would be so difficult that many young people would instead opt to sleep rough or sleep on friends’ sofas instead.

“As we’ve seen before, the bureaucracy of the welfare state is not good at capturing people in delicate situations,” said Kate Webb, head of policy for Shelter. “This is particularly so if we’re talking about 18- or 19-year-olds who have suffered really unpleasant, very personal things at home, and don’t want to disclose that to someone.” Webb said that even those who wished to claim the exception would struggle to find a landlord willing to take them on. “If you’re a landlord now, every 18- to 21-year-old is a risk,” she said. “You have no reason to believe that someone will be eligible for an exemption. The idea this is going to work in practice is fanciful. “It’s a real worry – there is no way this isn’t going to lead to an increase in rough sleeping.”

Good and detailed overview. It’s going to be a legal fight every step of the way.

• Trump’s New Travel Ban Is Much Narrower – And Possibly Courtproofed (Vox)

The first version of President Donald Trump’s refugee and visa ban — the one he signed on January 27, in place for only a week before federal courts put it on hold — was an ambitious disaster. It attempted, literally overnight, to prevent people who had already bought plane tickets from entering America. It posed a substantial problem for people currently living in the US who might want to travel abroad. And it turned preference for “persecuted religious minorities” into a cornerstone of US refugee policy. The latest version of the executive order, signed by Trump Monday, does none of those things. It all but admits that the administration overreached the first time, provoking a legal and political backlash that could have been avoided.

What it offers, instead, is a much more narrowly tailored and thoughtfully considered version of the ban — one that’s much more likely to stand up in court. The administration has done basically all it can to judgeproof the new executive order. It was a foregone conclusion that immigration advocates and Democratic prosecutors would sue to stop the 2.0 executive order just as they stopped the first one, but it’s a lot less clear that they’ll succeed this time around. The first version of President Donald Trump’s refugee and visa ban — the one he signed on January 27, in place for only a week before federal courts put it on hold — was an ambitious disaster. It attempted, literally overnight, to prevent people who had already bought plane tickets from entering America. It posed a substantial problem for people currently living in the US who might want to travel abroad.

And it turned preference for “persecuted religious minorities” into a cornerstone of US refugee policy. The latest version of the executive order, signed by Trump Monday, does none of those things. It all but admits that the administration overreached the first time, provoking a legal and political backlash that could have been avoided. What it offers, instead, is a much more narrowly tailored and thoughtfully considered version of the ban — one that’s much more likely to stand up in court. The administration has done basically all it can to judgeproof the new executive order. It was a foregone conclusion that immigration advocates and Democratic prosecutors would sue to stop the 2.0 executive order just as they stopped the first one, but it’s a lot less clear that they’ll succeed this time around.

If Trump officials could only make everyone forget that the first version of the executive order existed at all, they’d be golden. Unfortunately for them, they can’t. Between the chaos of the first executive order and the internal tussles over the drafting of the second, “travel ban 2.0” is already associated in the public mind with its more aggressive predecessor. And federal judges may be similarly disinclined either to forgive or forget.

Obama had 8 years to do something about this. What happened?

“America has locked up so many people it needs to rethink how it measures the economy…”

“Black Americans are twice as likely as whites to be out of work and looking for a job — the same ratio as in 1954..”

• America Has Locked Up So Many Black People It Warps Our Sense Of Reality (WaPo)

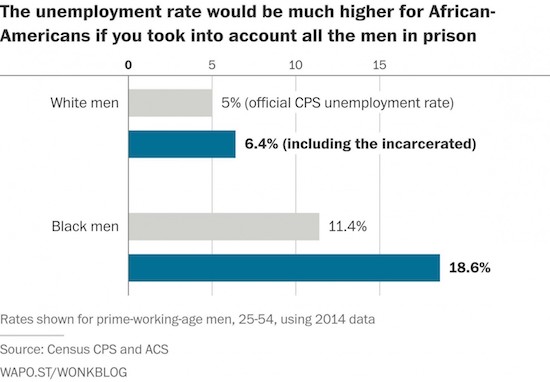

For as long as the government has kept track, the economic statistics have shown a troubling racial gap. Black people are twice as likely as white people to be out of work and looking for a job. This fact was as true in 1954 as it is today. The most recent report puts the white unemployment rate at around 4.5%. The black unemployment rate? About 8.8%. But the economic picture for black Americans is far worse than those statistics indicate. The unemployment rate only measures people who are both living at home and actively looking for a job. The hitch: A lot of black men aren’t living at home and can’t look for jobs — because they’re behind bars. Though there are nearly 1.6 million Americans in state or federal prison, their absence is not accounted for in the figures that politicians and policymakers use to make decisions. As a result, we operate under a distorted picture of the nation’s economic health.

There’s no simple way to estimate the impact of mass incarceration on the jobs market. But here’s a simple thought experiment. Imagine how the white and black unemployment rates would change if all the people in prison were added to the unemployment rolls. According to a Wonkblog analysis of government statistics, about 1.6% of prime-age white men (25 to 54 years old) are institutionalized. If all those 590,000 people were recognized as unemployed, the unemployment rate for prime-age white men would increase from about 5% to 6.4%. For prime-age black men, though, the unemployment rate would jump from 11% to 19%. That’s because a far higher fraction of black men — 7.7%, or 580,000 people — are institutionalized. Now, the racial gap starts to look like a racial chasm. (When you take into account local jails, which are not included in these statistics, the situation could be even worse.)

“Imprisonment makes the disadvantaged literally invisible,” writes Harvard sociologist Bruce Western in his book, “Punishment and Inequality in America.” Western was among the first scholars to argue that America has locked up so many people it needs to rethink how it measures the economy. Over the past 40 years, the prison population has quintupled. As a consequence of disparities in arrests and sentencing, this eruption has disproportionately affected black communities. Black men are imprisoned at six times the rate of white men. In 2003, the Bureau of Justice Statistics estimated that black men have a 1 in 3 chance of going to federal or state prison in their lifetimes. For some high-risk groups, the economic consequences have been staggering. According to Census data from 2014, there are more young black high school dropouts in prison than have jobs.

A Greek recovery is not possible. All this is theater. Tsipras said Greece was back to growth, about half an hour before this report came out.

• Greek Economy Performed Even Worse Than Expected At The End Of 2016 (BI)

Greece’s economy performed much worse than forecast in the final quarter of 2016, according to the latest data from the country’s statistical service Elstat. GDP shrank 1.2% in Q4 of 2016 — marking the worst quarterly performance for the stricken southern European economy since the heart of its debt crisis in the summer of 2015. A previous first estimate of GDP in the quarter suggested that the economy shrunk just 0.4%, but the final figure is significantly worse. The data comes just days after the country’s central bank governor Yannis Stournaras said that international lenders should lower the country’s fiscal targets from 2021 onwards to help boost its growth potential.

“The easing of the primary surplus targets, together with the implementation of the agreed structural reforms, would put the necessary conditions in place for a gradual lowering of tax rates, with positive multiplier effects on economic growth,” Stournaras said at an event over the weekend. Greece is in the middle of a major tug of war between its creditors over how its current bailout packages are handled. A second review of its bailout has dragged on for months, mainly due to differences between the EU and the International Monetary Fund over Greece’s fiscal targets in 2017, when its current bailout programme expires. The IMF favours a softer approach to fiscal conditions, saying in a report in February that additional austerity measures and spending cuts would not improve Greece’s financial prospects in the longer term.

Never trust Pyatt.

• US Ambassador Pyatt Concerned About “Accident” Between Greece And Turkey (KTG)

US Ambassador to Greece Geoffrey Pyatt expressed concern about the possibility of an “accident” between Greece and Turkey due to the increased activity in the Aegean Sea in recent weeks. At the same time, Pyatt praised the Greek government’s responsible attitude at a time of heightened tension and for the financial contributions of the indebted state to the NATO. Pyatt made these remarks speaking to a journalist at the side of the Delphi Economic Forum over the weekend. Regarding on the Cyprus issue, meanwhile, he said the new U.S. administration will continue its efforts for a solution. Turning to economic affairs and the role of the IMF, the ambassador said that he had not observed any change in the attitude of the new U.S. leadership, expressing U.S. support for growth in Greece.

Pyatt also referred to the importance of transatlantic relations, with emphasis on NATO and bilateral ties. “I want to see Greece play an even greater role as a pillar of regional stability,” he added. “Economic stability and prosperity are important elements of any effort to broaden Greece’s role in this region and in Europe. And, therefore, my number one priority is to sustain the U.S. effort to spur growth and support economic recovery in Greece,” the ambassador said, “As Greece demonstrates its commitment to reform and builds additional trust with its creditors, I am convinced that new investments, both by foreign investors and domestic ones, will buoy the economy and create new jobs,” he added. Pyatt said that the U.S. government was eager to see U.S. companies expand existing investments and invest in new ventures in Greece.

“Children wish they were dead and that they would go to heaven to be warm and eat and play..”

• War-Scarred Syrian Children May Be ‘Lost To Trauma’ (AFP)

Syrian children terrified by shelling and airstrikes are showing signs of severe emotional distress and could grow up to be a generation “lost to trauma,” Save the Children warned Monday. Interviews with more than 450 children and adults showed a high level of psychological stress among children, with many suffering from frequent bedwetting or developing speech impediments. At least three million children are estimated to be living in Syria’s war zones, facing ongoing bombing and shelling as the conflict heads into its seventh year. Two-thirds of those interviewed by the aid organization have lost a loved one or had their house bombed or shelled, or suffered war-related injuries themselves.

“After six years of war, we are at a tipping point,” said the report entitled “Invisible Wounds” on the war’s impact on children’s mental health. “The risk of a broken generation, lost to trauma and extreme stress, has never been greater,” it said. A staggering 84% listed bombing and shelling as the number one cause of stress in children’s daily lives. About 48% of adults reported that children had lost the ability to speak or developed speech impediments since the start of the war. Some 81% of children have become more aggressive while 71% suffer from frequent bedwetting, according to the research. Half of those interviewed said domestic abuse was on the rise and one in four children said they don’t have a place to go or someone to talk to when they are scared, sad or upset.

Sonia Khush, Save the Children’s Syria director, cited instances of attempted suicide and self-harm. In the besieged town of Madaya, six teenagers – the youngest a 12-year-old girl – have attempted suicide in recent months, said Khush. The report quoted a teacher in Madaya who said children there were “psychologically crushed and tired.” “They draw images of children being butchered in the war, or tanks, or the siege and the lack of food.” “Children wish they were dead and that they would go to heaven to be warm and eat and play,” said Hala, another teacher in Madaya.