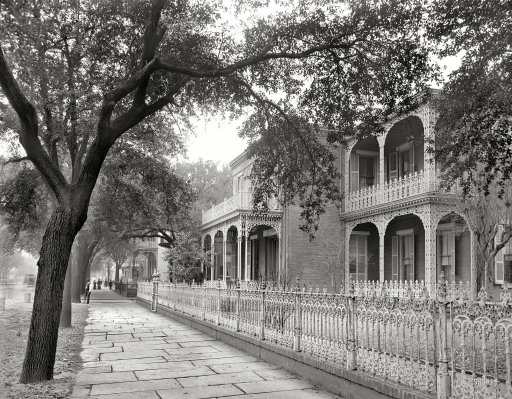

DPC Government Street, Mobile, Alabama 1906

Certainly of this decade. A whole century is a bit much. A harbinger of things to come sounds about right.

• Human Migration Will Be A Defining Issue Of This Century (Alexander Betts)

This is the first time in its history that the European Union has faced a mass influx of refugees from outside the region. Each year, as UNHCR announced record numbers of displaced people, the general assumption – until recently – was that this is a problem for other parts of the world. However, rising displacement that had mainly affected the Middle East and Africa has finally reached Europe’s shores in significant numbers. Many are beginning to ask whether the current crisis represents a temporary peak in displacement or presages a new, long-term trend. On what basis can we know? Will the dystopian images we see at the Hungarian-Serbian border of desperate families being beaten back by armed guards or the shocking image of Alan Kurdi become “the new normal”? The simple answer is: it depends.

It depends significantly on us, and the policies we, and our leaders, choose to adopt – nationally, regionally, and globally. Asylum numbers do fluctuate over time depending on the state of the world, and Europe has witnessed significant spikes in numbers before. In 1992, the EU received 672,000 asylum seekers, and numbers remained high during the Bosnia conflict. In 2001, numbers again peaked at 424,000 following the Kosovo crisis and with many arriving from Somalia and Afghanistan. This year, numbers are likely to exceed those figures but not dramatically, especially when one considers that in 1992 there were 15 EU member states and today there are 28. In general terms, the number of refugees in the world is broadly a function of the number of wars and human-rights-abusing dictatorships at any given time.

Today, there are a series of internal and regional armed conflicts around the world. Most of these are in two regions, the Middle East and Africa. There are humanitarian emergencies in Syria, Iraq, Afghanistan, South Sudan, Central African Republic, Somalia, Nigeria and, closer to home, in Ukraine. The UN high commissioner for refugees, António Guterres, has described a “world at war”. If we were able to address the root causes of those conflicts, the number of refugees in the world would decline significantly. However, there are also grounds to believe that refugees and displacement are likely to become a defining issue of the 21st century. Two global trends in particular suggest this: fragility and mobility. In both cases, the international community is struggling to come up with viable collective responses.

Without photographs, the reaction is completely different.

• 5-Year Old Child Drowns Off Greece, Others Paddle Across From Turkey (Reuters)

A girl believed to be five years died on Saturday and 13 other migrants were feared lost overboard after their boat sank in choppy seas off the Greek island of Lesbos, the Greek coastguard said. A second, exhausted group of around 40 people reached the island in a small boat following a traumatic journey from Turkey, having paddled through the night with their hands across 10 kilometers (six miles) of ocean after their engine failed. “When we were on the sea … I didn’t have any hope … I said: I am dead right now, nobody can help me,” Mohammed Reza, 18, said after being pulled ashore from the boat by foreign volunteers. Hundreds of thousands of mainly Syrian refugees have braved the short but precarious crossing from Turkey to Greece’s eastern islands this year, mainly in flimsy and overcrowded inflatable boats.

Reza, who fled from Afghanistan and left the rest of his family in Iran, told Reuters TV: “The water and fuel mixed up together … and we were on the sea for about seven or eight hours without any water or any food.” He said neither the Greek and Turkish coastguard had assisted the group of men, women and children. “At that moment, we, all of us, thought that we are useless, we are not human.” Greek coastguard spokesman Nikos Lagkadianos said 11 people were rescued from the boat that sank and a twelfth swam ashore in the early hours. The girl who died was found unconscious and was later declared dead in hospital, Lagkadianos said, adding that the coastguard and Greek navy were searching for survivors. Fifteen babies and children were among 34 refugees who died when their boat capsized off the small island of Farmakonisi last Sunday. Twenty-two others drowned and 200 were rescued two days later trying to reach Kos.

To be continued.

• 30 Refugees Missing In New Boat Sinking Off Greece On Sunday (AFP)

Nearly 30 migrants were feared missing off the Greek island of Lesbos, the coastguard said Sunday, in the latest boat sinking in an ongoing Aegean Sea tragedy that has cost hundreds of lives. The coastguard said it had rescued 20 people spotted in the water by a helicopter from EU border agency Frontex, but the survivors said another 26 people had been in the boat. The state news agency ANA said there were children among those missing. On Saturday, a five-year-old Syrian girl died in another attempted crossing from Turkey to Greece, and there were no news on another dozen people who were in the boat with her. The accident again occurred east of the island of Lesbos, one of the Greek islands that has seen a heavy influx of refugees from war-torn Syria this year.

Many have perished trying to cross the Aegean Sea in search of a better future in Europe. Earlier this month, harrowing pictures of three-year-old Syrian refugee Aylan Kurdi, whose body was found washed up on a Turkish beach after the boat carrying his family to the Greek island of Kos sank, caused an outpouring of emotion around the world, pressuring European leaders to step up their response to the refugee crisis. The body of another four-year-old Syrian girl washed up on a beach in western Turkey on Friday. Migrants have in recent days turned to Turkey’s land borders with Greece and Bulgaria to avoid the sea voyage that has cost over 2,600 people their lives in the Mediterranean this year. Greece has seen over 300,000 refugees and migrants enter the country this year, most of them passing through to other European countries.

Much as Europe is criminally negligent, this is a global issue, not a European one.

• Europe Needs To Take Big Numbers Of Refugees. Until Then Chaos Reigns (Guardian)

Europe’s heads of government gather this week for a meeting billed as a last-ditch effort to resolve the refugee crisis sweeping the continent. But the pace of arrivals has accelerated so fast that the deal some are touting as a solution to the challenge is actually more of a stopgap measure to tackle an emergency. Politicians in Brussels have been arguing fiercely about where 120,000 refugees should be allowed to settle, even though tens of thousands more have already travelled into the continent. Borders are being sealed with bewildering speed, as columns of desperate people move from country to country in their attempt to find a haven. And winter is only likely to bring a pause, rather than an end, to the crisis.

The sea crossing from Turkey to Greece may soon be partly “sealed” by harsh weather, but migration groups have warned that many people will die in a desperate attempt to cross before the seas get too stormy. And when spring comes again, the exodus will almost certainly pick up. Claude Moraes, MEP and chair of the European parliament’s justice, civil liberties and home affairs committee, said: “My concern is that we have had this paralysis for so long that the numbers are now out of date. So even if we get [a deal] on Wednesday we are going to have to lift them again. The EU has worked hard on this. But these were figures for the start of the crisis, not now.” Countries from the Balkans to Denmark are sealing land borders, setting up a chain of obstacles that may eventually all but block passage for refugees to prosperous western European nations.

But the journeys from Turkey to Europe’s eastern edge will be almost impossible to stop. Franck Düvell, senior researcher at Oxford University’s migration observatory, said: “Along the sea border with Greece there are too many routes and beaches. [Turkish authorities] can launch operations like they are doing around Bodrum now, but people will find other routes and other beaches.” The long, irregular coastline will always be a challenge, and Turkish police and border guards have told Düvell they are stretched too thin by other emergencies to monitor it all now. “They are at the limits of what they can do, and at the moment their priority lies in the east, borders with Syria and Kurdish areas.” While sea crossings are possible, they will continue to be made.

The trip is relatively short, and although the odds of survival may seem terrifying to people watching from safety, many fleeing war or the endless suffocating limbo of refugee camps long ago decided that they are not unreasonable. “You can’t block the border with Turkey in any meaningful way,” said Leonard Doyle, spokesman for the International Organisation for Migration. “There is the rise of expectation that you can do it, the push factor of people with Isis at their back, and the result is they put themselves at far greater risk than they would have before.” Only an unlikely peace, a moderation of the violence in Syria or far better conditions in regional refugee camps are likely to reduce the number of boats landing on Greek shores. Tighter border controls further north will only trap new arrivals in Greece, where they will still be a European responsibility.

“If you scream about foreigners usurping the nation here, people might mistake you for a fascist. Back in America, you can be a frontrunner in a major political party.”

• Greece Is Making America Look Bad (Pittsburgh Post-Gazatte)

More than 200,000 refugees fleeing mayhem in the Middle East already have worked their way this year from Turkey to Greece, site of the worst economic crisis to hit a developed country since World War II. About 100,000 illegal immigrants come each year from Mexico to the United States, which has 30 times as many people as Greece and a vastly more prosperous economy. So which country is witnessing the meteoric rise of an anti-immigrant political figure? Hint: It’s not Greece. It’s America, of course, where Donald Trump has shot to the top of the Republican presidential fold on an astoundingly nativist platform: Put up a wall between the United States and Mexico, deport anyone who is in America illegally and deny birthright citizenship to their offspring.

And that’s not because waves of Mexicans have been sneaking across our borders to steal jobs and commit crimes, as Mr. Trump would have you believe. Illegal immigration declined with the recession of 2007-2009 and remains a relative trickle. As for Mr. Trump’s fear-mongering, undocumented workers are less likely to engage in criminal activity than native-born citizens. It’s been especially depressing to watch Mr. Trump’s ascent from here in Greece, which has an actual — rather than imagined — flood of newcomers on its hands. On the islands closest to Turkey, especially Kos and Lesbos, 33,000 migrants have arrived in the last month alone. Despite their own economic crisis, however, Greeks have aided the refugees in every way they can.

Greece dispatched 60 extra coast guard officials to register refugees on the island of Lesbos, where an estimated 20,000 people were sleeping in streets and parks awaiting travel permits. The government also provided special ferries to transport refugees to Athens, where most of them will continue toward other destinations in Europe. In the wake of the debt deal signed earlier this summer, however, the government’s capacities are obviously limited. So ordinary citizens have stepped into the breach. Spurred by photos of a drowned Syrian child who was trying to reach Greece, vacationers in speedboats have rescued people cast adrift on the sea. Waves of volunteers have been providing food and clothing for refugees when they get to shore.

To be sure, there have also been reports of young thugs beating refugees. And the far-right Golden Dawn party has tried to capitalize on the crisis, spreading a rumor earlier this summer that Muslim immigrants had defecated in churches on Lesbos. “We will do everything we can to protect the Greek homeland against immigrants,” the party declared in response to the defecation story, which was later exposed as a lie. As Greece braces for elections Sunday, however, Golden Dawn’s popularity has remained in single digits. Its leader has denied the Holocaust, which took the lives of an estimated 60,000 Greek Jews. Its symbol is a slightly modified swastika. And whereas Donald Trump wants to build a wall on America’s southern border, Golden Dawn advocates putting land mines around Greece to kill illegal immigrants.

But Golden Dawn also helps to stigmatize anti-immigrant sentiment in Greece, in ways that might surprise Americans. If you scream about foreigners usurping the nation here, people might mistake you for a fascist. Back in America, you can be a frontrunner in a major political party.

“Around 13,000 people entered Austria on Saturday, according to the Red Cross, after being forced away from to Croatia, Hungary and Slovenia”

• Thousands Of Refugees Pour Into Austria As European Crisis Intensifies (AFP)

Thousands of refugees have streamed into Austria after being shunted through Croatia, Hungary and Slovenia as Europe’s divided nations stepped up efforts to push the migrants into neighbouring countries. The continent’s biggest migratory flow since 1945 has opened a deep rift between western and eastern members of the European Union over how to distribute the refugees fairly, and raised questions over the fate of the Schengen agreement allowing borderless travel within the 28-nation bloc. Several countries have imposed border controls, as recent figures have shown nearly half a million people have braved perilous trips across the Mediterranean to reach Europe so far this year, while the EU has received almost a quarter of a million asylum requests in the three months to June.

In Austria, up to 13,000 people entered the country over the course of Saturday alone, the head of the Austrian Red Cross told the APA news agency. The figure was not immediately confirmed by local police, who had said earlier they were readying for an influx of around 10,000 refugees and migrants. Austrian police said Hungary had shipped at least 6,700 people to the border, with more expected in the Burgenland border region by the end of Saturday. Hungary’s rightwing government has faced international criticism over violent clashes with migrants and a hastily-erected fence along its frontier with Serbia, but in a shift late Friday, Hungarian authorities began transporting thousands of migrants straight to the border with Austria, an apparent bid to move them through and out of their territory as quickly as possible.

There was no let-up in the stream of people making the gruelling journey across the Balkans into western Europe, with Croatia saying 20,700 had entered the country since Wednesday. Zagreb, which initially said it would allow migrants to pass through freely, announced it was swamped on Friday and began transporting hundreds to the Hungarian border by bus and train – sparking a furious reaction from Budapest. Despite the row, Croatian and Hungarian authorities appeared to be coordinating on the ground. An AFP journalist along the frontier between the two countries saw migrants board Croatian buses that took them to the border, before disembarking and crossing on foot then boarding Hungarian buses that quickly departed.

Shifting disasters.

• Exhausted Migrants Left With Few Options on Slovenian Border (WSJ)

In this small Croatian village, an army tent has been set up to cater for the hundreds of migrants stranded at the border crossing with Slovenia. Volunteers with the local Red Cross and Caritas are sorting through donated clothes and pouring hot ratatouille into plastic bowls. A sturdy, tattooed man is piling the fresh meals onto a large tray. “We delivered 600 meals yesterday and today we’re prepared for 2,000,” says Joakim Nilsson, a student from Sweden who traveled to the Balkans to help out wherever he could. “This is a world crisis,” he says about the thousands of migrants and refugees who have streamed daily from Serbia into Croatia after Hungary sealed its border.

At the border crossing, where a two-lane bridge is sealed off and guarded by a dozen of Slovenian riot police, the crowd is exhausted and angry. Many refuse Mr. Nilsson’s meals or prefer instead to walk back into the village where there is shade and stretchers for them to rest. Eventually, however, his tray is empty. “Good luck,” he tells one of the refugees. “And see you in Sweden.” The migrants, a mix of Syrians, Iraqis, Afghans and Africans, have been waiting for three days, and only on Saturday morning did two buses arrive to take some of them to a registration center in Slovenia. “When is a bus coming—when?” they repeatedly ask police officers wearing helmets, shields, batons and cans with pepper spray. But the officers remain silent.

At least one of those cans was used the night before, around midnight, when tensions flared as a group of migrants started pelting the police cordon with plastic bottles and sticks. A spokeswoman from the Slovenian Interior Ministry, Vesna Drole, maintained that only one officer used pepper spray against “a single protester” who was part of a larger group trying to break through the police cordon. “Pepper spray is one of the milder means of coercion that police may use to maintain public order and ensure people’s safety,” she added.

Time for UN to act, not talk.

• UN Warns European Unity At Risk As Borders Close To Refugees (Guardian)

Europe’s biggest refugee crisis in 70 years atomised into a chaotic series of border confrontations and diplomatic disputes this weekend, as crowds of refugees were blocked from passing through a number of crossings in central Europe, prompting the UN to warn that the concept of European unity was at risk. Hungary sent armoured vehicles to its border with Croatia, while Slovenian police sealed several crossings after Croatia attempted to offload tens of thousands of refugees who are using it as an alternative entry point to the European Union.

Croatian policemen accompanying hundreds of migrants into Hungary were disarmed by their Hungarian counterparts and turned away, while Slovenian police used pepper spray to ward off hundreds, mostly Syrians and Afghans, trying to cross to reach the countries of northern Europe. The chaos had been sparked by Hungary’s decision to shut off its southern border with Serbia, blocking a well-trodden refugee railroad that has brought more than 170,000 refugees into the EU since the start of the year. In response, refugees flooded instead into Croatia, which immediately tried to move them back into Hungary and Slovenia, prompting quasi-military manoeuvres from its neighbours.

Croatia’s prime minister, Zoran Milanovic, called Hungary’s actions “incomprehensible”, given that no refugee wanted to stay in Hungary, and said the situation was “the ugliest thing I have seen in Croatia since the [Balkans] war”. He also refused to seal Croatia’s border, because “even if that were possible under the constitution – and it is not – it means killing people”. In response, Hungary’s foreign minister, Péter Szijjártó, said Croatia had “lied in the face” of Hungary. He argued that Croatia had failed to show adequate solidarity with Hungary by sending refugees across their border, just days after the same refugees had rushed into Croatia after being blocked from crossing the Hungarian-Serbian border.

The UN warned that failure to agree on a united response to the crisis endangered the concept of European unity. Peter Sutherland, the UN’s special representative on international migration, said: “If there is no agreement to share refugees between the countries of the European Union, it risks undermining the very essence of the European project.” Sutherland was also surprised at how central and eastern European countries were undermining some of the EU’s key values so soon after joining its membership. “It’s amazing that this is the reaction of central and eastern Europe to the whole concept of solidarity, having only just joined,” Sutherland said.

“..as new workers would help finance a generous set of welfare benefits..” Sure.

• Bank of Finland Governor Supports Opening Door to Migrants (WSJ)

An influx of migrants into Finland could give the small Nordic nation’s shrinking economy a shot in the arm, as new workers would help finance a generous set of welfare benefits, Bank of Finland Governor Erkki Liikanen said Saturday. “More foreign workers would support our economic growth,” the central banker told Finnish television. Mr. Liikanen’s recommendation to open Finland’s doors to foreigners echo comments heard in Germany—where government and business leaders have said the large migrant stream into Europe represents an opportunity to rejuvenate a fast-aging population and boost the economy Finland has experienced three years of stagnation and is expecting gross domestic product growth of only 0.3% this year.

Although Mr. Liikanen cautioned the process of integrating refugees could be “difficult,” the central banker’s view contrasts sharply with the anti-immigration sentiment prevailing among Finns and the government they elected in June. Earlier on Saturday, the Finnish government introduced rules on processing asylum seekers in a bid to tighten Finland’s borders following an increasing number of refugees entering the country from Sweden through a northern checkpoint. The Finnish Interior Ministry said the new rules would see all refugees registered at the country’s border upon arrival. The Finnish Police and Immigration Service have tightened family reunification criteria, saying they aimed to make swift decisions on applications deemed unfounded.

Inside the government, the anti-immigrant camp is led by Timo Soini, leader of the populist Finns Party, who was named deputy prime minister and foreign minister in June. He serves in the government of Prime Minister Juha Sipilä, who has pledged to repair the country’s recession-choked economy through deep spending cuts.

Bigger priority than stocks?! “A full 39% of individual wealth in China is kept in housing, and, according to Nomura, 21% of China’s urban households possess more than one home.”

• Do China’s Ghost Cities Offer A Solution To Europe’s Migrant Crisis? (Reuters)

Nearly 150,000 Syrian refugees have already claimed asylum in Europe and tens of thousands more are flooding the borders in search of places to live. Meanwhile, in China, there are millions of new apartments sitting completely empty and entire sections of freshly constructed cities that are virtually uninhabited. This disparity between unmet housing need and oversupply has not been lost on many around the world, and after writing a book about China’s ghost cities, I’ve recently found my email inbox getting flooded with suggestions such as this: Do you think the Ghost Cities could be used, even as a temporary situation, to accommodate those displaced from Syria? It seems that many of the cities are just waiting for a community and here is a community that needs a city.

This sentiment is widespread across popular social media platforms, and on Twitter alone roughly 7 out of 10 results for searches pertaining to China’s ghost cities reveal tweets recommending the mass movement of Syrian refugees to these under-populated urban terrains. Realistically speaking, this suggestion isn’t worth analyzing with much depth. The political quagmire of relocating masses of people across the planet — not to mention the fact that refugees need more than just housing — means that this is a far greater ordeal than simply assuaging demand with supply. It does shed light, though, on the gulf that exists between the predominant international opinion on China’s so-called ghost cities and their present reality.

Even though there are between 20 and 45 million unoccupied homes across China, which account for roughly 600 million square meters of uninhabited floor space — enough to completely cover Madrid — these places are not the urban wastelands they are often posited to be. While many of China’s new cities and urban districts are deficient in people they are not deficient in owners. Nearly every apartment that goes on the market in China is quickly purchased, often at exorbitant prices that commonly range into the hundreds of thousands of dollars. Far from being unwanted infrastructure that could seamlessly be doled out to refugees, those arrays of vacant high-rises are actually the proud possessions of people who paid a lot of money for them.

So why would anyone spend incredible amounts of cash on houses they do not intent to use? All over the world, the value of property extends beyond the utilitarian function of being a place to live. Real estate is also a vital economic entity that presents an avenue for investment as well as a way of storing wealth — a use of property that is taken to the extreme in China. “Many Chinese investors are buying property based on expectations of appreciation, and that it is a solid, safe investment that they can easily understand,” said Mark Tanner, the founding director of China Skinny, a Shanghai based marketing research firm.

A full 39% of individual wealth in China is kept in housing, and, according to Nomura, 21% of China’s urban households possess more than one home. The reasons for this desire to invest in housing often results from a lack of better options. China’s banks pay negative interest and are becoming even more unattractive with the recent wave of currency devaluation. Wealth management products are not fully developed and are highly regulated by the government, and the stock market is viewed to be about as secure as a casino.

Curious travel itinerary. Pope and XI are in US at the same time. Xi is due in Washington on Thursday, just two days after the Pope?!

• Xi Jinping: Does China Truly Love ‘Big Daddy Xi’ – Or Fear Him? (Guardian)

[..] spin doctors have set about building a cult of personality around their leader with books, cartoons, pop songs and even dance routines celebrating Xi Dada’s rule. Earlier this month, thousands of troops goose-stepped through Tiananmen Square as part of a massive military parade proclaiming Xi’s unassailable position at the party’s helm. “There is this aristocratic flair which has now become more apparent, particularly after the military parade,” said Lam. “The word demi-god would be an exaggeration but after the military parade he looked like an emperor.” Many ordinary Chinese appear enamoured with their 21st century emperor. “He has the backing of the whole country,” claimed Zhang Jingchuan, the songwriter from Sichuan province, describing his leader as an approachable man of ideas.

Human rights activists, liberals and dissidents – some of whom will gather in the United States this week to protest the Chinese president’s visit – have been less impressed. Since Xi came to power, there has been a concerted effort to obliterate civil society in China, with moderate and once-tolerated critics including human rights lawyers, feminists, religious leaders and social activists harassed or thrown in prison. More than 200 lawyers have been detained or interrogated as part of a sweeping crackdown on their trade that began in July. At least 20 remain in detention or are missing, prompting calls for Barack Obama to cancel Xi’s visit to the US. “We had hoped for something different,” said Sophie Richardson, the China director of Human Rights Watch. “We are surprised by just how bad it is.”

MacFarquhar blamed the dramatic tightening on Xi’s obsession with the collapse of the Soviet Union, which followed Mikhail Gorbachev’s attempts at reform. “When he first came in he exhibited how much the Gorbachev phenomenon had spooked him. He is very conscious of long-term threats – and maybe he doesn’t see it as long-term. If he is only thinking in terms of 10 years, now is the time to solidify the country and he thinks he knows how to do it.” Yet for all Xi’s apparent muscle – one academic has dubbed him the Chairman of Everything – not everyone is convinced by the growing legend of Xi Dada. “I never bought the powerful leader narrative at all. But now it’s publicly displayed to be a fiction,” said Anne Stevenson-Yang, a respected observer of the Chinese economy and politics, who believes the recent stock market debacle and deadly Tianjin explosions exposed a president far weaker than many had thought.

AIIB.

• How China Decided To Redraw The Global Financial Map (Reuters)

Plans for China’s new development bank, one of Beijing’s biggest global policy successes, were almost shelved two years ago due to doubts among senior Chinese policymakers. From worries it wouldn’t raise enough funds to concerns other nations wouldn’t back it, Beijing was plagued by self-doubt when it first considered setting up the Asian Infrastructure Investment Bank (AIIB) in early 2013, two sources with knowledge of internal discussions said. But promises by some Middle East governments to stump up cash and the support of key European nations – to Beijing’s surprise and despite U.S. opposition – became a turning point in China’s plans to alter the global financial architecture.

The overseas affirmation, combined with the endorsement of stalwart supporters, including a former Chinese vice premier and incoming AIIB President Jin Liqun, a former head of sovereign wealth fund China Investment Corp, enabled China to bring the bank from an idea to its imminent inception. The bank’s successful establishment is likely to bolster Beijing’s confidence that it can play a leading role in supranational financial institutions, despite the economic headwinds it is facing at home. “At the start, China wasn’t very confident,” one of the sources said in reference to Beijing’s AIIB plans. “The worry was that there was no money for this.”

A Finance Ministry delegation that called on Southeast Asian nations to gauge interest in the AIIB was not encouraging, the source said. Governments backed the idea, but were too poor to contribute heavily to the bank’s funding. But subsequent visits to the Middle East helped to win the day as regional governments informed China they needed new infrastructure and, crucially, were able to pay for it, a source said. “They are all oil-producing countries, they have foreign currencies, they were very enthusiastic, and they could shell out the cash,” he said. “That was when we thought ‘Ah, this can be done.'”

“The key debate then should be around the pace and extent of this rise, not whether it should take place at all.”

• The US Federal Reserve Has Got It Wrong (Andrew Sentance)

The US Federal Reserve decided not to raise the key policy rate in the US this week. That would be an understandable decision if rates were at or close to a normal level. But they are not. Interest rates of 0.5% in the UK and 0-0.25% in the US are the lowest recorded levels in history. Seven years into a recovery, central bankers need to explain why the interest rate playing field is still so heavily tilted to borrowers. Continuing with such low interest rates in the UK and the US, when unemployment rates are back to 5-5.5% and our economies are growing well, raises some more profound questions about monetary policy in the west. First, how independent are central banks? Since the 1990s, the Fed and the Bank of England have pursued policies similar to the ones any well-meaning government official would have chosen.

They have cut interest rates very readily, but when they have raised them (in 1994-5 and 2005-7) they have been behind the curve. Independent central banks were established precisely to avoid this “behind the curve” interest rate policy. But it has not worked. Once again, they are at serious risk of lagging behind in their interest rate decisions as the major western economies climb out of the post-crisis recession. Second, if interest rates cannot rise now, when will they increase? In the case of the US, growth has averaged over 2% for more than six years since the recovery started in mid-2009. Unemployment has halved from around 10% to 5% over roughly the same period. Yet interest rates remain stuck — close to zero. A similar position prevails in the UK.

A multitude of reasons have been advanced for delaying the first rate rise: sluggish growth in all the major western economies in 2011-12; the euro crisis in 2013-14; and now the Fed is citing weak economic growth in China and the impact this has on financial markets. If you look around hard enough, there can always be a reason for not raising interest rates. But that highlights the key problem. Monetary policymakers are very timid at the moment. They are lions who have lost their roar. The third problem is that central bankers appear to lack a clear strategy for monetary policy. Their implicit strategy is that interest rates will remain at current excessively low levels — until sufficient evidence accumulates to raise them. But a more realistic approach to keeping monetary policy on a steady and neutral course would involve a gradual rise in interest rates over the next few years. The key debate then should be around the pace and extent of this rise, not whether it should take place at all.

Liar, liar, economy on fire.

• A Divided Fed Pits World’s Woes Against Domestic Growth (Reuters)

Federal Reserve policymakers appeared deeply divided on Saturday over how seriously problems in the world economy will effect the U.S., a fracture that may be difficult for Fed Chair Janet Yellen to mend as she guides the central bank’s debate over whether to hike interest rates. Though last week’s decision to again delay an interest rate increase was near-unanimous, drawing only one dissent, St. Louis Fed President James Bullard called the session “pressure-packed” as members debated whether global uncertainty or the continued strength of the U.S. economy deserved more attention. In the end the committee felt that tepid global demand, a possible weakening of inflation measures, and recent market volatility warranted waiting to see how that might impact the U.S.

Bullard, who does not have a vote this year on the Fed’s main policy-setting committee, said he would have joined Richmond Fed President Jeffrey Lacker’s dissent, and worried the central bank had paid too much attention to recent financial market gyrations. Markets sold off sharply this summer over concerns about a slowdown in China and weak world growth, leaving Fed officials to vet whether that reflected a short-term correction or more fundamental problems on the horizon. “Financial markets tend to wax and wane, sometimes suddenly. Monetary policy needs to be more stable,” said Bullard, who in prepared remarks here to the Community Bankers Association of Illinois said he did not think the Fed “provided a satisfactory answer” to why rates should stay near zero.

The economy is near full employment, and inflation will almost certainly rise, Bullard said, leaving the Fed’s near seven-year stay at near zero rates out of line with the broad economic picture. In a statement Lacker said he felt the current low rates “are unlikely to be appropriate for an economy with persistently strong consumption growth and tightening labor markets.”

“Some people call this stealing economic activity from the future..”

• Stuck At Zero: Global Risks Have Tied The Fed’s Hands (Forbes)

On the seventh anniversary of the implosion of Lehman Brothers, an event that rocked the global economy, it’s more than ironic that the main topic of global financial discussion has been a rate hike by the Federal Reserve, which just announced that it would leave rates unchanged yet again. Behind the scenes, more interesting is the growing list of risks which may be tying the FOMC’s hands behind their back. The Fed should have hiked rates in 2012, but every day they put off the rate raise, Lehman-like systemic risk is lurking and rising. It’s a Colossal Failure of Common Sense all over again. With all the debate about what exactly the Federal Reserve should do with short-term interest rates, historical perspective is something that’s being left behind.

The U.S. has had near zero short-term interest rates before. The period of 1932 to 1953 was defined by rates that were between zero and 2.1%. The last time we hit the zero bound, we stayed very close to it for upwards of 21 years. This is not something you hear often from economists these days. The main reason central banks raise and lower rates is to shift consumption around and smooth out periods of stagnation. The Fed’s dual mandate of non-accelerating inflation and full employment defines the characteristics of the smoothing that society wants to see. Low rates pull consumption and investment forward and allow projects to be undertaken that otherwise would have to wait. Some people call this stealing economic activity from the future, but we must keep our eye on the incentives created by Fed policy.

On the other hand, higher rates make debt more expensive and push consumption and investment out. This year, most economist have felt the Fed is looking to “tap the brakes” on the improving U.S. economy. The other pressing issue is high debt levels. The Fed is in no hurry to hike rates with debt levels so high in the post-Lehman era. The U.S. hit its debt ceiling in March, at $18.1 trillion, but the devil is in the details, or what’s called interest costs as a%age of federal spending. As you can see below, net interest outlays are on course to more than double by 2017 from 2005 levels. Interest costs on the staggering U.S. debt load, added together with government entitlement spending, is nearing 71% of Federal spending, compared to 26% in the early 1960s. Is this sustainable?

There’s a price to pay for six years of a zero interest rate policy, it’s not free. As the world’s most influential central bank has kept interest rates so low for so long, debt has piled up in all kinds of global pockets, especially in emerging markets. According to the Bank of International Settlements, emerging markets’ total debt to GDP ratio has surged to nearly 170%, up from 100% just before Lehman’s failure. Even more disturbing, according to Bloomberg data: there’s a strong correlation between the surge in emerging market debt levels and the cost of credit default protection. Investors wanting to insure themselves against the risk of EM defaults are paying up for the privilege these days.

U.S. Government Net Interest Outlays

2005: $150 billion

2009: $190 billion

2017: $335 billion

*Data from CBO

The lower the price, the more producers will pump.

• US Oil Tumbles 4.7% To Settle At $44.68 A Barrel (Reuters)

U.S. oil prices fell about 5% on Friday after U.S. energy firms cut oil rigs for a third week in a row this week, data showed on Friday, a sign the latest crude price weakness was causing drillers to put on hold plans announced several months ago to return to the well pad. The drop comes amid increased concerns about the outlook for energy demand. The U.S. central bank warned of the health of the global economy and bearish signs persisted that the world’s biggest crude producers would keep pumping at high levels. Drillers removed eight rigs in the week ended Sept. 18, bringing the total rig count down to 644, after cutting 23 rigs over the prior two weeks, oil services company Baker Hughes said in its closely followed report. Those reductions cut into the 47 oil rigs energy firms added in July and August after some drillers followed through on plans to add rigs announced in May and June when U.S. crude futures averaged $60 a barrel.

“Can you imagine what would happen in the U.S. if you cut spending by 20 or 30% and cut Social Security? You’d have riots in the streets, more so than we ever saw in Greece.”

• Jim Chanos on What Lies Ahead for Greece (Lynn Parramore)

Jim Chanos, the well-known hedge fund manager and president and founder of Kynikos Associates, is half Greek on his father’s side. He has been traveling to the country since 1970 and has also been active in the Greek community in the United States. A long-time observer of Greece, he became more involved in 2010 when he was part of a group that met with then-prime minister Papandreou to offer some pro bono advice. Since then, he has been watching closely from the sidelines with increasing levels of concern. In the following interview, he discusses how Greece reached this point of crisis, the upcoming elections, and what lies ahead.

LP: You’ve recently returned from a trip to Greece to visit family and friends. How did you find the mood in the country?

JC: It was grim — away from the vacation spots, of course, which are more international than domestic locations. I’d gotten there just after they’d finally agreed to sign the third memorandum. There was a general sense of resignation and not knowing what else they can do. The feeling of the people I spoke to — whether high level or people in restaurants and tavernas — was that they [the Troika] have them by the short hairs because of the banking system. And I think that was pretty clear. Really, there was no sense of any chance of this working out with an alternative currency. To this day we’re really not quite sure whether they had that planned — various reports differed as to whether they could have even done it — but I think that there’s just this general level of resignation coupled with despair amongst people worried about the long-term growth of the country and its well-being. People are worried about their kids, as they should be.

LP: I think pretty much everybody agrees that the negotiations with the Troika have been a fiasco. How do you assess what’s happened? Who is to blame?

JC: It’s important to understand that while Syriza may have botched the negotiations —and I do I think there’s a general consensus that they did or at least didn’t play it as well for their country as they could have — they didn’t cause this mess. When the first memorandum was signed and then agreed to by PASOK and Papandreou, and then the follow-on was agreed to by Samaras and New Democracy to the right, in effect they were the same types of understandings. But they couldn’t work from the get-go because, as we now know, there was no net new money in any meaningful way coming into Greece. Whatever new capital was coming in was just a way to keep the banks current. It was going in the front door and out the back door.

Greece really did a decent job from an austerity point of view. They brought down spending, they raised taxes. I know there’s this belief that the Greeks are just world-class tax evaders, but in fact, in terms of taxes collected as a%age of GDP, they’re now quite a bit higher than a number of European countries because a lot of the taxes are indirect: the Greeks couldn’t evade them if they wanted to. They also cut spending dramatically. Can you imagine what would happen in the U.S. if you cut spending by 20 or 30% and cut Social Security? You’d have riots in the streets, more so than we ever saw in Greece.

This weekend Greece, next weekend Catalunya.

• Catalonia Separatists: Spanish State Has Failed. We Can Change This (Guardian)

At the port of Tarragona recently, with the sun shining on the harbour, it became clear that Junts pel Sí (Together for Yes), the Catalan independence coalition which hopes to score a significant victory next weekend, is a pretty big tent. Asked about a controversial megacomplex of hotels, casinos and theme parks in the works, candidate Germà Bel was confident that the project would create wealth and jobs for the area. But Raül Romeva, charismatic leader of the Together for Yes list, doubted whether the project would actually go ahead. “It’s not a done deal,” he hedged. Spanish media seized on the moment as evidence of the uneasy bedfellows that had joined together for Catalonia’s forthcoming regional elections.

But Romeva, who leads the Junts pel Sí ticket, sees the unwieldy coalition backed by the conservative Democratic Convergence party, the leftwing Catalan Republican Left and grassroots independence activists, as a sign of the extraordinary moment Catalonia is experiencing. “This is a movement that goes from left to right, spanning conservatives, liberals, ecologists, sociologists and many others,” he told the Observer. “It’s a consequence of necessity.” For the past decade, he argued, the Spanish state has failed to represent the plurality of the country: “What we have is the opportunity to change all this.” His coalition seeks to turn the 27 September ballot into a de facto referendum on independence, segregating parties by their stance on the question and launching the region’s most ambitious move in recent years in the push to break away from Spain.

“If there is a majority, we will have to manage that result. If there is not a majority, we will have to accept that and move on.” Polls suggest that pro-independence parties could win a slim majority in the 135-seat regional parliament. If so, Catalan leader Artur Mas has pledged to lead a transitional government, lasting no longer than 18 months, which will begin drafting a Catalan constitution and work towards negotiating secession with the central government in Madrid. A leftist who dresses in jeans and wears bright yellow glasses, Romeva comes across as a bridge between the diverse groups that make up Junts pel Sí. Born in Madrid and raised in Catalonia, he said his position on independence was cemented in 2010, when Spain’s constitutional court ruled that Catalonia’s status and powers could not be considered tantamount to nationhood.

Channel Greece: “The system will crash. Elderly people won’t get the care they need, and it will be people with mental ill health who suffer most, because that is where the squeeze always comes.”

• UK’s NHS To Collapse Within Two Years, Warns Former Health Minister (Guardian)

The National Health Service will crash within two years with catastrophic consequences unless the government orders an immediate multibillion pound cash injection, the former minister in charge of care services says. The stark assessment from Norman Lamb, minister of state at the Department of Health until May’s general election, comes as fears mount among senior NHS officials, care providers and local authorities that NHS and care services are approaching breaking point. In an interview with the Observer, Lamb, a Liberal Democrat who was at the heart of policymaking during the Tory-Lib Dem coalition, accuses the government of dishonesty in failing to admit the scale of the problems.

He says that an increasing number of private companies and other organisations contracted to provide care by local authorities are refusing to tender again because cash-starved councils, already hit by budget cuts of more than 40% since 2010, cannot pay enough to let them run adequate services. Lamb says the result is that more elderly people in particular will end up in already overstretched hospitals, compounding the crisis. Pre-election promises by the Tories to provide an additional £8bn for the health service by 2020, on top of £2bn extra pledged at the end of last year, are insufficient and too vague to reassure anyone, he argues.

“If the investment is not made upfront and in the early period of this parliament, you could see serious failures in the system,” he said. “The system will crash. Elderly people won’t get the care they need, and it will be people with mental ill health who suffer most, because that is where the squeeze always comes.” While the promised extra money would help, it was nowhere near enough. “I don’t think anyone in the NHS believes that is enough. The government talks very vaguely about an extra £8bn by 2020, but it is needed now. If it comes in 2019-20, the system will have crashed by then. I think the next two years will make or break the NHS and the care system.”