Leonardo da Vinci Head of a Woman 1470s

Panahi

Rita Panahi bursts out laughing at "dimwitted lefties". This woman @RitaPanahi may be the funniest person on the net right now! pic.twitter.com/aVRKdoWCPQ

— Robert W Malone, MD (@RWMaloneMD) September 22, 2023

Pelosi Jan 6

https://twitter.com/i/status/1704806237630501284

Maui

WHAT

ARE THEY

H I D I N G

FROM US ? pic.twitter.com/9EYuQ6mEpS— DR. Kek (@Thekeksociety) September 21, 2023

Russell

So… pic.twitter.com/UXxQqQukDb

— Russell Brand (@rustyrockets) September 22, 2023

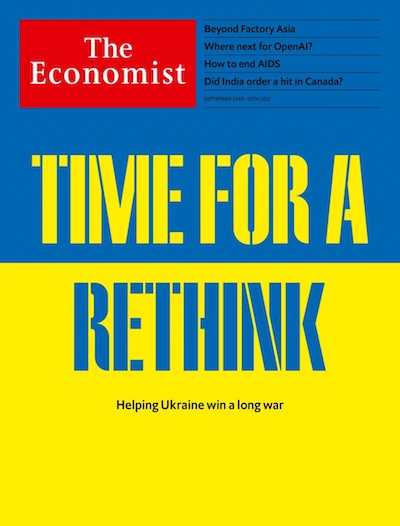

“There’s no money in the House right now for Ukraine.”

• Roadblocks: Zelensky Fails to Achieve Goals on US Visit (Sp.)

Ukrainian President Volodymyr Zelensky’s visit to the US, which wrapped up this week, proved to be a failure rather than a success.[..] The visit had a rocky start after [the NYT] published the results of its own investigation into the September 6 missile strike on Konstantinovka in eastern Ukraine, which killed 15 civilians. Kiev had blamed the attack on Moscow, however, the newspaper reported that the Ukrainian side was to blame. “Evidence, […] including missile fragments, satellite imagery, witness accounts and social media posts, strongly suggests the catastrophic strike was the result of an errant Ukrainian air defense missile fired by a Buk launch system,” the news outlet pointed out.Another US media outlet reported about “Zelensky’s frosty welcome to D.C.”, referencing six Republican senators and 22 House members’ letter to the White House, which opposed President Joe Biden’s request for $24 billion in additional funding for Ukraine.

As a result, POTUS finally announced the $325 million military assistance package for Kiev during a White House meeting with Zelensky. Notably, the Biden administration opted not to provide Ukraine with the long-range ATACMS missiles that would allow Kiev to launch strikes well behind Russian lines. House Speaker Kevin McCarthy, for his part, denied Zelensky’s request to address a joint meeting of Congress, telling reporters that Congressmen “just didn’t have time.” McCarthy was echoed by Republican Byron Donalds, who said that “There’s no money in the House right now for Ukraine.” According to Donalds, “It’s not a good time for [Zelensky] to be here, quite frankly.”The US media outlet noted in this vein that “the effectiveness of Zelensky’s personal appeals has […] been challenged, as dozens of Republicans used his visit as an occasion to snub Ukraine’s requests and mock its wartime leader.”

On September 19, the Ukrainian president addressed a UN General Assembly (UNGA) session in New York. US television channels at the time showed many empty seats in the premises where Zelensky delivered the speech. Ukrainian broadcasters, therefore, had to edit the footage so as to create an illusion of a full audience, where one could see Zelensky himself among the viewers. His visit came amid the Ukrainian Armed Forces (UAF)’s futile attempts to break through Russian defensive lines, a counteroffensive that President Vladimir Putin called a “failure rather than a standstill”. According to him, the UAF has lost more 71,000 soldiers and over 500 tanks since the beginning of the counteroffensive on June 4.

Ukrainian media edited Zelensky's UN speech to make it look like he had a bigger audience

They forgot to edit out Zelensky himself sitting in the audience. pic.twitter.com/bKU9E9DsVs

— Russian Market (@runews) September 21, 2023

“Clearly, the Patriots have failed in their mission. And it’s not like the United States has a better air defense system than the Patriot batteries – that’s the best we have to offer..”

• Zelensky’s US Trip Revealed Deepening Fractures in NATO Support (Sp.)

As Ukrainian President Volodymyr Zelensky wrapped up his trip to the United States on Friday, where he spoke at the United Nations and visited the White House, he is preparing to return to Ukraine with far less than he expected. An expert noted the US and Ukraine are struggling to make a bad situation look better than it is. Retired CIA intelligence officer and former US State Department official Larry Johnson told Sputnik that “nothing of substance” had come from Zelensky’s trip to Washington, DC, but that careful study of the demeanor of Zelensky and several American officials revealed “they’ve had some very uncomfortable conversations behind the scenes.”

“He’s not going to get the ATACMS that he claimed he wanted,” Johnson said, referring to the ground strike missile that is launched from a HIMARS rocket system.He noted “they are sending some M1 Abrams tanks next week – that was already on the table.” “What was clear is that you’ve got a disconnect between the rhetorical position, what the Biden administration is saying publicly to support Zelensky, and what it’s actually doing,” he pointed out. “On the one hand, they are stridently insisting that they’re going to support Ukraine to the end, that Zelensky is on their team, etc. But when it comes to the actual assistance, they didn’t increase – they’re going to continue to provide aid, but they’re not providing any kind of advanced weapons system. I don’t think they do have a weapon system that would make a difference. But, you know, for example, they talked about: ‘Oh, we have to provide Ukraine with their defense.’ I thought that was what the Patriot batteries were for.

Clearly, the Patriots have failed in their mission. And it’s not like the United States has a better air defense system than the Patriot batteries – that’s the best we have to offer. That didn’t work. But they’re talking about providing some more air defense capabilities. I think it’s a meaningless gesture,” he said. “The problem is, it doesn’t matter what equipment or money the United States supplies. The problem Ukraine faces is the lack of manpower, that they’ve suffered such enormous casualties during this failed counteroffensive that their ability to replace those is a challenge.” Johnson noted that during Zelensky’s visit, there were “subtle gestures” but nothing like the hero’s welcome he was given before.

“During his previous trip, he was celebrated with a joint session of Congress and got to kiss [then-House Speaker] Nancy Pelosi, and yet this time he didn’t get that. He did meet with some members of Congress and he heard some challenges to his position. I think there’s still a majority in the Congress, in both the House and Senate, that are saying that they really strongly support Ukraine, but there’s a growing number of voices that are saying: ‘no, we need to spend that money that’s been going to Kiev here in the United States, in Maui, Philadelphia, New York, San Francisco.’ There’s growing pressure to spend those funds in the states as opposed to selling it overseas.”

“He didn’t get a joint press conference. They did put out some sort of controlled video of both Biden and Zelensky reading prepared remarks and setting it in a controlled environment, where the press were spectators but not able to ask questions. But they didn’t have a side-by-side press-conference. So, it was a much more tepid response this time compared to previous ones. And he didn’t go back with a greater economic package than he anticipated prior to arriving. Plus, on top of it, he did have Poland and the relationship to Poland and Ukraine was sort of a backdrop to all of this,” he said.

“Do you think that Poland is putting pressure on poor Ukraine today for no reason? No, they have been given the go-ahead from overseas: We need to dump this Zelensky, we’re tired of him..”

• West Preparing To ‘Dump’ Zelensky – Lukashenko (RT)

Washington has given the go-ahead to its partners to “dump” Ukrainian President Vladimir Zelensky as he has become a nuisance, Belarusian leader Alexander Lukashenko claimed during a government meeting on Friday. Lukashenko pointed to the ongoing grain dispute between Poland and Ukraine as an example of this new policy, noting that Warsaw had been one of Zelensky’s staunchest supporters but is now sharply critical of its partner. This shift occurred after Poland, along with Hungary and Slovakia, unilaterally banned the import of Ukrainian grain despite the EU having chosen to lift its bloc-wide embargo. In turn, Kiev filed disputes against the three countries with the World Trade Organization.

“Do you think that Poland is putting pressure on poor Ukraine today for no reason? No, they have been given the go-ahead from overseas: We need to dump this Zelensky, we’re tired of him,” Lukashenko said. He noted that the US has an upcoming presidential election and suggested that no one will care about Zelensky at that point. At the same time, US President Joe Biden stressed on Friday that Washington will stick with Zelensky throughout the Russia-Ukraine conflict and announced that US-made Abrams tanks will start arriving in Ukraine next week. Meanwhile, Zelensky, who is on his second wartime visit to Washington, insisted that Kiev’s continued fight against Russia relied on sustained US military assistance and reportedly said that if it doesn’t get the aid, it “will lose the war.”

So far, the Biden administration has spent $115 billion on military and financial aid to Kiev, recently requesting an additional $24 billion to be approved by the end of the month. However, a growing number of lawmakers, predominantly from the Republican Party, have started to oppose the financing of the Zelensky government with US taxpayer money. Republican Senator Josh Hawley from Missouri stressed on Wednesday that the US should stop endlessly pouring money into Ukraine, especially since Kiev has “nothing to show for it.” The Senator was apparently referring to Kiev’s much-touted summer counteroffensive, which has failed to yield any significant territorial gains. Hawley insisted that the US should not spend “a dime more on Ukraine” and instead conduct an audit of the billions that have already been paid. The senator also suggested that Germany and other European allies should “step up to the plate” to aid Kiev.

Cornered by Marjorie Taylor Greene.

• McCarthy Vows To Strip Ukraine Money From Pentagon Bill (Hill)

Speaker Kevin McCarthy (R-Calif.) announced Friday that he will strip funding for Ukraine out of a Pentagon spending bill after Rep. Marjorie Taylor Greene (R-Ga.) joined conservatives in blocking the legislation from advancing earlier this week. McCarthy said he would remove the $300 million for Ukraine currently in the Pentagon appropriations bill and hold a separate vote on the funding. “It would be out and voted on by itself,” McCarthy said when asked about the Ukraine aid in the Pentagon appropriations bill. The Speaker’s announcement comes one day after a band of five conservatives opposed a procedural vote for the Pentagon appropriations bill, sinking the effort and preventing the legislation from moving forward.

It was the second time this week that hard-liners blocked the funding bill from advancing. Votes on rules — which govern debate for legislation — are normally partisan and predictable matters, with the majority supporting voting “yes” and the minority party voting “no.” It is very rare for rules to fail on the floor. Greene, who has emerged as a close ally of McCarthy, was one of the Republicans who voted against the rule Thursday “because it funds the war in Ukraine.” It was a shift from her vote Tuesday, when the congresswoman supported the procedural vote to advance the Defense measure. The rule failed for a second time on the same day that Ukrainian President Volodymyr Zelensky met with lawmakers in the Capitol.

The Pentagon funding bill includes $300 million “to provide assistance, including training; equipment; lethal assistance; logistics support, supplies and services; salaries and stipends; sustainment; and intelligence support to the military and national security forces of Ukraine, and to other forces or groups recognized by and under the authority of the Government of Ukraine, including governmental entities within Ukraine, engaged in resisting Russian aggression against Ukraine, for replacement of any weapons or articles provided to the Government of Ukraine from the inventory of the United States.” Greene has come out against sending additional money to Ukraine. On Friday morning, she went live on X, the platform formerly known as Twitter, and said she would support the measure if the Ukraine aid is taken out.

Lindsey Graham returns: “..pulling the plug on Ukraine while they’re winning on the battlefield and letting Putin get away with this is far worse than Afghanistan.”

• White House Issues Ukraine Aid Warning (RT)

The White House has urged American lawmakers to approve President Joe Biden’s request for an additional $24 billion for Ukraine by the end of the month in order to ensure an uninterrupted flow of aid to the country. The US government has appropriated funds for the current fiscal year, which ends on September 30, US National Security Advisor Jake Sullivan told the media on Thursday. He said additional resources were now required from Congress by October 1 to avoid disruption to the supply of aid to Ukraine. Continued assistance to Kiev in its fight against Russia is facing a growing pushback from Republican lawmakers, particularly in the House of Representatives, where the party has a majority. Critics argue that Washington has more important priorities and should have stronger safeguards against the misappropriation of the aid it sends to Kiev.

Ukrainian President Vladimir Zelensky met members of Congress on Thursday to make his case in person. Senate Majority Leader Chuck Schumer said one phrase summed up the visiting leader’s message. “Mr. Zelensky said: ‘If we don’t get the aid, we will lose the war,’” he remarked after hosting the Ukrainian president. White House officials held a classified briefing for lawmakers on Wednesday evening. Senator Josh Hawley indicated he had been cemented in the conviction that the Biden administration’s Ukraine policy was failing. “If there’s some path to victory in Ukraine, I didn’t hear it today. And I also heard that there’s going to be no end to the funding requests,”the Republican said. Senator Lindsey Graham, a fellow GOP member with an opposing view on the conflict, argued that “pulling the plug on Ukraine while they’re winning on the battlefield and letting [Russian President Vladimir] Putin get away with this is far worse than Afghanistan.”

He was referring to Biden’s 2021 decision to withdraw the US military from the Middle Eastern country, after two decades of costly counterinsurgency action and state-building experiments. Senator John Fetterman, a Democrat, promised an unorthodox concession to Republicans in the other chamber to secure money for Kiev. “If those jagoffs in the House stop trying to shut our government down, and fully support Ukraine, then I will save democracy by wearing a suit on the Senate floor next week,” he pledged on social media on Wednesday. Fetterman famously has an aversion to formal dress. Last Sunday, Schumer ditched the Senate dress code for elected officials – but not staff members – much to the chagrin of US conservatives.

If the government shuts down US citizens won’t get paid but Ukrainians will.

• Pentagon Exempts Ukraine Operations From Potential Government Shutdown (Pol.)

The Pentagon will exempt its Ukraine operations from a potential shutdown if lawmakers can’t agree on a deal to fund the government by the end of the month, allowing key training and other activities in support of Kyiv’s forces to move ahead uninterrupted, according to a Defense Department spokesperson. Washington is more resigned to the looming government shutdown every day. As the Sept. 30 deadline approaches, congressional leaders showed little progress this week in moving a stopgap funding bill to avert that scenario. The House was in chaos on Thursday as a group of GOP hardliners tanked a vote that could have offered a path to fund the government.

But if lawmakers fail to reach an agreement and government appropriations lapse, DOD has decided to continue activities supporting Ukraine, DOD spokesperson Chris Sherwood told POLITICO Thursday — just hours after Ukrainian President Volodymyr Zelenskyy met with Defense Secretary Lloyd Austin, Joint Chiefs Chair Gen. Mark Milley and other senior leaders at the Pentagon. “Operation Atlantic Resolve is an excepted activity under a government lapse in appropriations,” Sherwood said, referring to the named operation for DOD’s activities in response to the Russian invasion. The move means that the U.S. military’s activities related to the war, such as training of Ukrainian soldiers on American tactics and equipment, as well as shipments of weapons to Kyiv, will continue despite any potential shutdown. As recently as Tuesday, Sherwood had said the shutdown could halt those activities, as POLITICO first reported.

It’s good news for Zelenskyy, as U.S. and European officials worry that international support for continuing to aid Ukraine could be waning. Zelenskyy also pleaded his case with lawmakers on Capitol Hill on Thursday morning before heading to the White House to meet with President Joe Biden. The Biden administration is also expected to announce a new package of military aid for Ukraine later on Thursday, including additional air defenses and artillery. During the White House meeting, Biden announced a new $325 million package of aid for Ukraine, including more air defenses, artillery and additional cluster munitions. He also said that the first of the U.S. Army’s M1 Abrams tanks pledged to Kyiv are expected to arrive on the battlefield next week.

Mere days after the US said it wants to split Syria in two. That just got a lot harder.

• China and Syria Forge ‘Strategic Partnership’ (RT)

Beijing and Damascus announced a new “strategic partnership” during Syrian President Bashar Assad’s ongoing visit to China. President Xi Jinping met him in the city of Hangzhou before this week’s launch of the Asian Games, a high-profile international sports event. Assad is visiting China for the first time since 2004, when he met then-President Hu Jintao. Xi announced the new agreement as he welcomed his guest in the capital of Zhejiang Province on Friday. The Chinese leader stated that the relationship between the two nations has “withstood the test of international changes” and pledged to maintain them in the face of international “instability and uncertainty.” The US and its allies have been seeking to oust Assad for over a decade, accusing him of various transgressions during an armed conflict in the country.

The bloodshed started in 2011 as mass protests surged against the Syrian government but were soon hijacked by international jihadist organizations. These elements sidelined other anti-government forces, which Western nations touted as “moderate rebels,” as the main threat to Damascus. Russian intervention in 2015 turned the tide and helped the Syrian Army oust Islamist militants from most of the country. Some portions, where Turkish and American troops or their local allies are present, remain outside Damascus’ control. The US has imposed crippling unilateral sanctions on Syria, which hamper its ability to reconstruct after this brutal conflict. Xi expressed support for Assad’s efforts to rebuild the nation, keep terrorists in check, and seek a political settlement for the Syrian people.

The Arab League readmitted Syria in May as Damascus seeks to normalize relations with its neighbors. Beijing had facilitated the restoration of diplomatic relations between regional rivals, Iran and Saudi Arabia, in June. Both nations played significant roles in the Syrian crisis, the former supporting Assad’s government and the latter initially vying for his ouster. The Syrian president and First Lady Asma Assad arrived in Hangzhou on Thursday. On Saturday, the visiting dignitaries are set to attend the opening ceremony of the 19th Asian Games alongside a dozen other foreign guests.

https://twitter.com/i/status/1705317278290731396

Jim posted this piece without a title. Update: Jim sent me an email. Something about an iPad and a 3-day getaway. The article now has a title.

Did you catch Attorney General Merrick Garland’s performance Wednesday before the House Judiciary Committee? The absurdity ran pretty rank in the chamber as the AG artfully evaded explaining how it is he doesn’t know a darn thing about the consequential cases in process at his DOJ — and if he did happen to know, he wouldn’t be able to say because… reasons. For instance, the strange inability of one US attorney David Weiss to generate charges after five whole years of investigation in the sundry matters involving the president’s son, Hunter Biden, until the statute of limitations on tax evasion dribbled away. And then, after concocting a booby trapped plea deal on a Mickey Mouse gun rap that blew up under a judge’s scrutiny, the selfsame Mr. Weiss is appointed Special Counsel (i.e. prosecutor) over those very cases. Say, whu…? Not to mention that it’s against the regulations to appoint anyone special counsel from within the DOJ.

Well, you see, Mr. Weiss is a splendid fellow, Mr. Garland explained. When asked if he could give a working definition of professional incompetence, the AG affected to be stumped. In the course of all this play-acting, Mr. Garland maybe perjured himself several times, and he seemed painfully aware of his own possible looming legal difficulties. One suspects through all this mummery and confabulation that Merrick Garland is not actually in charge of the US DOJ. Then who is? My guess would be the ultra low profile Deputy AG Lisa Monaco, a mitochondria of the DC blob, one of its energy cells. Ms. Monaco was up to her eyeballs in the Obama regime’s prep work for the Russia Collusion Hoax of 2016, and since her appointment as DAG in April, 2021, is a behind the scenes architect of the new American police state.

The Washington Post pretends that she doesn’t exist. One also wonders when a House committee will become interested in deposing her, especially on the subject of her involvement with J-6 prosecutions. So far, the blob has gotten away with its many depredations because the DC federal district court is one of its pseudopods, able to reach out, engulf, and dissolve anyone who poses a threat. But a turning point in America’s struggle against blobbery may have been crossed far away from there. Down in Texas, which is lately afflicted with blobitis, the state Attorney General Ken Paxton escaped an impeachment trap laid by Party of Chaos state legislators and blob allies revolving around Karl Rove and the next-gen Bush family, losing its legacy as owners of the Texas GOP.

Mr. Paxton must be royally pissed off by these shenanigans and maybe ready to rumble with blob agent Homeland Security Sec’y Alejandro Mayorkas and his putative boss, “Joe Biden.” As it happens, with Autumn here and temperatures along the border moderating, crossings of illegal aliens are at 10,000 a day. A few days after Mr. Paxton’s acquittal in the Texas Senate, Governor Greg Abbott officially declared “an invasion.” Under the US Constitution, federal failure to defend the border allows the states to repel the invaders with force. It also pretty explicitly spells out an impeachable offense against “Joe Biden” — failure to defend our country. The blob quivers and throbs.

It was a major hit. CNN reports dozens of dead and wounded. Waiting for confirmation.

• Expert: NATO Helped Ukraine Strike Black Sea Fleet HQ in Sevastopol (Sp.)

The headquarters of Russia’s Black Sea Fleet in the Crimean port city of Sevastopol came under a Ukrainian missile strike on Friday, as per the Russian Ministry of Defense. The Ukrainian military attacked a historic building of the Black Sea headquarters in Sevastopol this September 22, with one Russian military serviceman going missing, according to the Russian Ministry of Defense (Mod). The MoD specified that during the Kiev regime’s attack on Sevastopol, five enemy missiles had been shot down by Russia’s air defenses. “[The Ukrainians] mostly attack with Storm Shadows, they are British-made, it is quite likely that they are also French, they are basically identical and almost identical among the French SCALPs,” Vasily Dandykin, a captain 1st rank reserve and military expert, told Sputnik.

“The Americans have not yet delivered their ballistic missiles with a firing range of 300 kilometers. These missiles [Storm Shadow – Sputnik] are quite insidious, they hit the Chongarsky Bridge with them twice; they hit our plant in Sevastopol. Seven were shot down, three penetrated.” “All this is orchestrated with the help of curators and patrons [from the West]. Even though they criticize Ukrainians for such behavior and that it’s not what they are taught. They provide [Kiev] with intelligence data – US strategic surface drones are constantly hovering there – they provide data from strategic aviation, which is in the neutral waters of the Black Sea, they also provide, accordingly, space reconnaissance, especially from satellites that hang in low orbits.”

A missile warning sound was heard in the Crimean city of Sevastopol, home to the Russian Black Sea Fleet, in the morning of September 22. According to Governor Mikhail Razvozhaev, the fleet’s headquarters were subjected to a rocket strike by the Ukrainian Armed Forces. Heavy smoke was seen emerging from the city center. “The enemy launched a missile attack on the fleet headquarters. A fragment fell near the Lunacharsky Theater… All operational services went to the incident scene. Information about the victims is being clarified. Please remain calm. And do not post photos and videos,” Razvozhaev said on Telegram. He warned of a possible new attack on the Black Sea Fleet’s headquarters. The news came after the Russian MoD earlier announced that the peninsular air defenses destroyed a Ukrainian guided missile and two aircraft-type drones off the west coast of Crimea.

[..] Dandykin noted that the Russian military is due to analyze where the strikes came from and take a closer look at the remaining Ukrainian military forces in Odessa. “They attack, as I understand it, mainly from the south of Ukraine, from Odessa,” the expert suggested. “We must take into account that this is probably the only thing they are now capable of in the situation when their counteroffensive failed. This means hitting our territories, shelling the Bryansk region, Belgorod, Kursk. This means to hit the Kherson region, the Zaporozhye region, including the nuclear power plant, and, accordingly, to attack long-suffering Donetsk and Gorlovka. Here they don’t spare shells, although they always complain that they don’t have enough. “[US President Joe] Biden also gave them cluster munitions. It’s pure slaughtering, as [Ukrainians] are shooting at civilians. We need to be even more vigilant and more effective,” Dandykin concluded.

10,000 young men land on Lampedusa, and Borrell says: “If we want to survive from a labor point of view, we need migrants..”

• Borrell Warns Migration Might ‘Dissolve’ EU (RT)

The European Union’s foreign policy chief Josep Borrell has warned that immigration could become a “dissolving force” for the international bloc, arguing that some member states simply “don’t want to accept people from outside.” Speaking to the Guardian for an interview published on Friday, Borrell pointed to rising nationalist sentiment across Europe, noting that “we have not been able until now to agree on a common migration policy.” “Migration is a bigger divide for the European Union. And it could be a dissolving force for the European Union,” he said, adding “There are some members of the European Union that are Japanese-style – we don’t want to mix. We don’t want migrants. We don’t want to accept people from outside. We want our purity.”

However, Borrell argued that Europe’s current “low demographic growth” meant that some states required an influx of immigration, calling the situation a “paradox.” “If we want to survive from a labor point of view, we need migrants,” the official continued. Borrell’s comments come just days after German President Frank-Walter Steinmeier declared that his country could no longer take in migrants and refugees, telling an Italian newspaper that “Germany, like Italy, is at the limit of its capacity.” The president cited “strong immigration from the eastern borders, from Syria, Afghanistan,” as well as the arrival of “over a million refugees from Ukraine” in the last year, and called for a “permanent solidarity mechanism” to ensure a “fair distribution” of migrants in Europe

According to newspaper Die Welt, Rome is also re-evaluating its border policies amid a spike in migration, with officials reportedly notifying other EU members that Italy would be halting migrant transfers “for a limited period of time” last December. They said the move was linked to “suddenly arising” technical issues related to the country’s intake capacity, though the suspension has continued into 2023, the German outlet reported. While Borrell warned that dissent over immigration could eventually threaten the integrity of the EU, he suggested that, for now, the bloc would remain intact. Britain’s decision to leave the EU had served as a “vaccine” for other members, he argued, stating that “No one wants to follow the British leaving the European Union.”

Migration has remained a highly contentious issue within the bloc since 2015, when the EU was hit by an influx of refugees, as well as economic migrants, driven by poverty and wars in Africa and the Middle East. sSome countries, including Hungary and Poland, strongly opposed attempts by Brussels to force them to accept and settle migrants, which initially arrived in other member states. The Italian government, meanwhile, has closed its ports to ships transporting migrants from North Africa, insisting that other member states should share the burden of accepting them. The demand for tighter border controls was also one of the drivers behind the ‘Leave’ campaign during the 2016 Brexit referendum in the UK.

Censorship as a religion, high priests and all.

• The Defunct Disinformation Governance Board Exposed (Turley)

We previously discussed the defunct Disinformation Governance Board and its controversial head Nina Jankowicz. After the outcry over the program, Homeland Security Secretary Alejandro Mayorkas finally relented and disbanded the board while insisting that it was never about censoring opposing views. Jankowicz has sued over the portrayal of her views. Now, Americans for Prosperity Foundation (AFPF) has exposed just how broad the scope of the censorship efforts were under the board in combatting “misinformation, disinformation, and malinformation (MDM). This range of authority in what the agency called the “MDM space,” included targeting views on racial justice and the disastrous withdrawal from Afghanistan.

New documents obtained under the Freedom of Information Act (FOIA) requests show that the Department of Homeland Security (DHS) argued that the agency could regulate speech related to “the origins of the COVID-19 pandemic and the efficacy of COVID-19 vaccines, racial justice, U.S. withdrawal from Afghanistan, and the nature of U.S. support to Ukraine” as well as “irregular immigration.” Those subjects stretch across much of the “space” used for political speech in the last few years. Notably, within DHS, Jen Easterly, who heads the Cybersecurity and Infrastructure Security Agency, extended her agency’s mandate over critical infrastructure to include “our cognitive infrastructure.” The resulting censorship efforts included combating “malinformation” – described as information “based on fact, but used out of context to mislead, harm, or manipulate.” I testified earlier on this effort.

So DHS asserted the authority to target viewpoints on racial justice, Ukraine, and other political subjects, including views based on fact but viewed as misleading in context. What is also troubling is the continued effort to conceal these censorship activities. Homeland redacted much of this information on a now defunct board under FOIA Exemption 7(E), which protects “techniques and procedures for law enforcement investigations or prosecutions, or would disclose guidelines for law enforcement investigations.” That claim is itself chilling. After the demise of the board, National Public Radio ran an interview entitled “How DHS’s disinformation board fell victim to misinformation.”

As the title suggests, NPR just repeated the view of Jankowicz despite the objections of many of us in the free speech community. Jankowicz insisted “we weren’t going to be doing anything related to policing speech. It was an internal coordinating mechanism to make sure that we were doing that work efficiently.” Yet, what were the criminal investigations, prosecutions, and enforcement efforts now being claimed as connected to this work? Recently, a court found that the Biden Administration’s censorship efforts constituted “the most massive attack against free speech in United States history.” Those words by Chief U.S. District Judge Terry A. Doughty are part of a 155-page opinion granting a temporary injunction, requested by Louisiana and Missouri, to prevent White House officials from meeting with tech companies about social media censorship.

Yet, Democrats have gone all in on censorship, blacklisting, and even red-baiting efforts. The July 4 decision came six months after I testified before Congress that the Biden administration used social media companies for “censorship by surrogate.” Despite furious attacks by congressional Democrats in that and later hearings, a court found that the evidence overwhelmingly shows systematic violation of the First Amendment by the Biden administration. Now we have a glimpse into the chilling scope of the Homeland Security’s efforts to target opposing viewpoints. From racial justice to Covid to Ukraine, these subjects involve core political speech. Yet, the Biden Administration felt that it had the right to monitor and combat opposing views in these areas.

Octoberfest

The strength of Oktoberfest waitresses is truly remarkable! pic.twitter.com/d7ktnYaPyx

— Tansu YEĞEN (@TansuYegen) September 21, 2023

Protect

https://twitter.com/i/status/1705183877499682879

Cassowary

Cassowaries emit vibratory sounds and some biologists suggest that the casque on their head amplifies very low-frequency sounds, which may aid in communication in dense rainforestspic.twitter.com/hsvjPYx3vN

— Massimo (@Rainmaker1973) September 22, 2023

Son of the earth

The "Son of the Earth" is a sculpture standing in the vast Gobi Desert, located approximately 10 kilometers southeast of Guazhou, in north west China's Gansu,. The artwork depicts a gigantic baby lying on the ground, peacefully asleeppic.twitter.com/r8yImp7R7f

— Massimo (@Rainmaker1973) September 22, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.