Fidel Castro and Che Guevara ca. 1957

How many people remember it was the US that drove Castro into Russian arms? He visited the US shortly after becoming president. Eisenhower refused to talk. Everything after that is propaganda and fake news.

• Cuban Revolutionary Fidel Castro Dies At 90 (AFP)

Guerrilla revolutionary and communist idol, Fidel Castro was a holdout against history who turned tiny Cuba into a thorn in the paw of the mighty capitalist United States. The former Cuban president, who died aged 90 on Friday, said he would never retire from politics. But emergency intestinal surgery in July 2006 drove him to hand power to Raul Castro, who ended his brother’s antagonistic approach to Washington, shocking the world in December 2014 in announcing a rapprochement with US President Barack Obama. Famed for his rumpled olive fatigues, straggly beard and the cigars he reluctantly gave up for health reasons, Fidel Castro kept a tight clamp on dissent at home while defining himself abroad with his defiance of Washington.

In the end, he essentially won the political staring game, even if the Cuban people do continue to live in poverty and the once-touted revolution he led has lost its shine. As he renewed diplomatic ties, Obama acknowledged that decades of US sanctions had failed to bring down the regime – a drive designed to introduce democracy and foster western-style economic reforms – and it was time to try another way to help the Cuban people. A great survivor and a firebrand, if windy orator, Castro dodged all his enemies could throw at him in nearly half a century in power, including assassination plots, a US-backed invasion bid, and tough US economic sanctions.

Born August 13, 1926 to a prosperous Spanish immigrant landowner and a Cuban mother who was the family housekeeper, young Castro was a quick study and a baseball fanatic who dreamed of a golden future playing in the US big leagues. But his young man’s dreams evolved not in sports but politics. He went on to form the guerrilla opposition to the US-backed government of Fulgencio Batista, who seized power in a 1952 coup. That involvement netted the young Fidel Castro two years in jail, and he subsequently went into exile to sow the seeds of a revolt, launched in earnest on December 2, 1956 when he and his band of followers landed in southeastern Cuba on the ship Granma. Twenty-five months later, against great odds, they ousted Batista and Castro was named prime minister.

Once in undisputed power, Castro, a Jesuit-schooled lawyer, aligned himself with the Soviet Union. And the Cold War Eastern Bloc bankrolled his tropi-communism until the Soviet bloc’s own collapse in 1989. Fidel Castro held onto power as 11 US presidents took office and each after the other sought to pressure his regime over the decades following his 1959 revolution, which closed a long era of Washington’s dominance over Cuba dating to the 1898 Spanish-American War.

How much of the $5 million so far was furnished by Soros?

• Wisconsin Agrees To Statewide Recount In Presidential Race (R.)

Wisconsin’s election board agreed on Friday to conduct a statewide recount of votes cast in the presidential race, as requested by a Green Party candidate seeking similar reviews in two other states where Donald Trump scored narrow wins. The recount process, including an examination by hand of the nearly 3 million ballots tabulated in Wisconsin, is expected to begin late next week after Green Party candidate Jill Stein’s campaign has paid the required fee, the Elections Commission said. The state faces a Dec. 13 federal deadline to complete the recount, which may require canvassers in Wisconsin’s 72 counties to work evenings and weekends to finish the job in time, according to the commission. The recount fee has yet to be determined, the agency said in a statement on its website.

Stein said in a Facebook message on Friday that the sum was expected to run to about $1.1 million. She said she has raised at least $5 million from donors since launching her drive on Wednesday for recounts in Wisconsin, Michigan and Pennsylvania – three battleground states where Republican Trump edged out Democratic nominee Hillary Clinton by relatively thin margins. Stein has said her goal is to raise $7 million to cover all fees and legal costs. Her effort may have given a ray of hope to dispirited Clinton supporters, but the chance of overturning the overall result of the Nov. 8 election is considered very slim, even if all three states go along with the recount. The Green Party candidate, who garnered little more than 1 percent of the nationwide popular vote herself, said on Friday that she was seeking to verify the integrity of the U.S. voting system, not to undo Trump’s victory.

In the same way that life imitates art, UK and US imitate each other.

• Bid To Challenge Brexit Gathers Pace Among Pro-Remain Politicians (G.)

A series of informal but concerted efforts by pro-remain politicians to reshape or even derail the Brexit process is under way and gaining momentum, according to people involved. MPs from across the parties had discussed how to push the government into revealing its Brexit plans and to ensure continued single market access, sources said, as a series of senior political figures made public interventions suggesting the result of the EU referendum could be reversed. Tony Blair and John Major both suggested this week that the public should be allowed to vote on or even veto any deal for leaving the EU. However, those connected to efforts by serving pro-remain MPs say the former prime ministers’ views had little support in the Commons.

More significant, they argued, were strategy discussions involving MPs from all parties “caught between their own views and those expressed at the ballot box” in the referendum. “It’s a long process of gradually bringing people round to our way of thinking, on all sides,” said someone who works closely with pro-remain figures. “A lot of people are a bit unsure what to do – they’re caught between their own views and those expressed at the ballot box, often by their own constituents. “There’s a growing realisation that this is a long game. There’s actually very little information out there, and very little substance to get into. It’s hard to coalesce people around particular policy positions when the government has no policy to speak of. That’s quite a challenge.”

Major told a private dinner that there was a “perfectly credible case” for holding a second referendum on the terms of a Brexit deal. He said the views of the 48% of people who voted to remain should be taken into account and warned against the “tyranny of the majority”. Blair, in particular, is known to be sounding out opinion on Brexit as part of his re-emergence into political life. The former Labour prime minister’s office said he had discussed the issue with the former chancellor George Osborne, among “many people”.

Be careful out there.

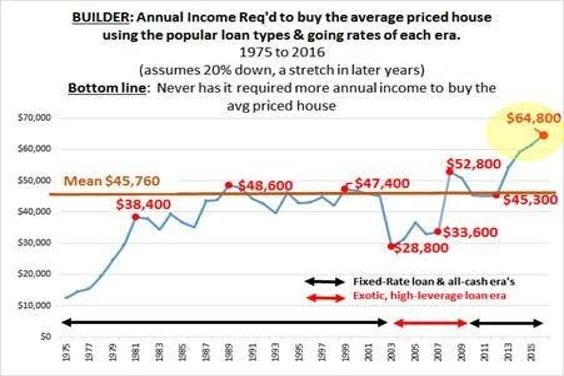

• Houses Have Never Been More Expensive To Buyers Who Need A Mortgage (Hanson)

Houses have NEVER BEEN MORE EXPENSIVE to end-user, mortgage-needing shelter buyers. The recent rate surge crushed what little affordability remained in US housing. It now it requires 45% more income to buy the average-priced house than just four years ago, as incomes have not kept pace it goes without saying. The spike in rates has taken “UNAFFORDABILITY” to such extremes that prices, rates, and/or credit are now radically out of scope. At these interest rate levels house prices are simply not sustainable even in the lower-end price bands, which were far more stable than the middle-to-higher end bands (have been under significant pressure since spring). [..] The Data (note, for simplicity my models assume best-case 20% down and A-grade credit, which is the “minority” of lower-to-middle end buyers).

1) The average $361k builder house requires nearly $65k in income assuming a 4.5% rate, 20% down, and A-grade credit. Problem is, 20% + A-credit are hard to come by. For buyers with less down or worse credit, far more than $65k is needed. For the past 30-YEARS income required to buy the average priced house has remained relatively consistent, as mortgage rate credit manipulation made houses cheaper. Bottom line: Reversion to the mean will occur through house price declines, credit easing, a mortgage rate plunge to the high 2%’s, or a combination of all three. However, because rates are still historically low and mortgage guidelines historically easy, the path of least resistance is lower house prices.

2) The average $274k builder house requires nearly $53k in income assuming a 4.5% rate, 20% down, and A-grade credit. Problem is, 20% + A-credit are hard to come by. For buyers with less down or worse credit, far more than $53k is needed. For the past 30-YEARS income required to buy the average priced house has remained relatively consistent, as mortgage rate credit manipulation made houses cheaper. Bottom line: Reversion to the mean will occur through house price declines, credit easing, a mortgage rate plunge to the high 2%s, or a combination of all three. However, because rates are still historically low and mortgage guidelines historically easy, the path of least resistance is lower house prices.

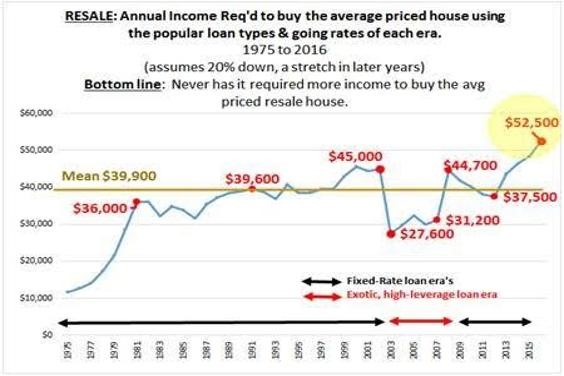

3) Bonus Chart … Case-Shiller Coast-to-Coast Bubbles Bottom line: IT’S NEVER DIFFERENT THIS TIME. Easy/cheap/deep credit & liquidity has found its way to real estate yet again. Bubbles are bubbles are bubbles. And as these core housing markets hit a wall they will take the rest of the nation with them; bubbles and busts don’t happen in “isolation.”

What does this mean for the future of human interaction?

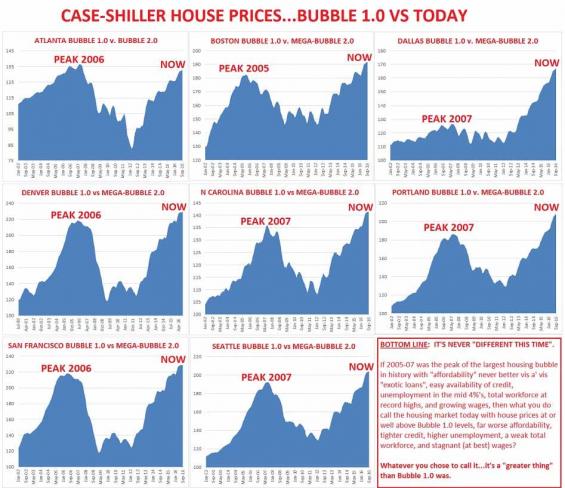

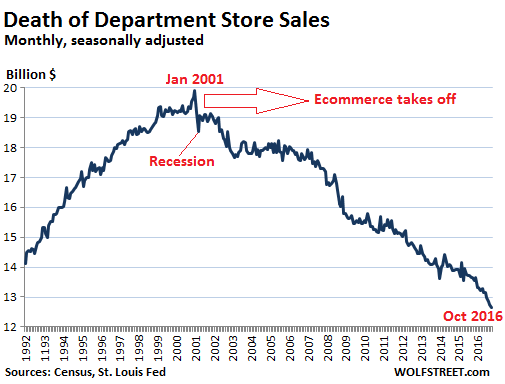

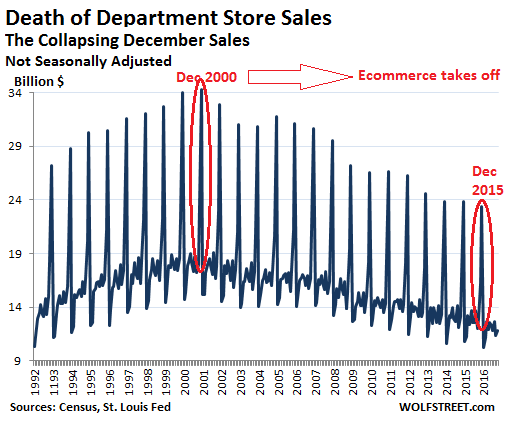

• Black Friday: The Death of Department Stores (WS)

There are still four weeks left to pull out the year. And hopes persists that this year will be decent. But online sales are hot, according to Adobe Digital Index, cited by Reuters. Online shoppers blew $1.15 billion on Thanksgiving Day, between midnight and 5 pm ET, according to Adobe Digital Index, up nearly 14% from a year ago. Sales by ecommerce retailers have been sizzling for years, growing consistently between 14% and 16% year-over-year and eating with voracious appetite the stale lunch of brick-and-mortar stores, particularly department stores. The lunch-eating process began in 2001. The chart below shows monthly department store sales, seasonally adjusted, since 1992. Note the surge in sales in the 1990s, driven by population growth, an improving economy, and inflation (retail sales are mercifully not adjusted for inflation). But sales began to flatten out in 1999. The spike in January 2001 (on a seasonally adjusted basis!) marked the end of the great American department store boom.

Even as the US fell into a recession in March 2001, ecommerce took off. But department store sales began their long decline, from nearly $20 billion in January 2001 to just $12.7 billion in October 2016, despite 14% population growth and 36% inflation! The decline of department stores is finding no respite during the holiday season. Not-seasonally-adjusted data spikes in October, November, and December. But these spikes have been shrinking, from their peak in December 2000 of $34.3 billion to $23.4 billion in December 2015, a 32% plunge, despite, once again, 14% population growth and 36% inflation!

In other words: the brick-and-mortar operations of department stores are becoming irrelevant. Ecommerce sales include all kinds of merchandise, not just the merchandise available in department stores. So it’s a broader measure. They have skyrocketed from $4.5 billion in Q4 1999 ($1.5 billion a month on average) to $101 billion in Q3 2016 ($33.7 billion a month on average).

From the “It’s Just Not Fair!” department.

• US Payday Lenders Seek Emergency Court Help Against Regulators (R.)

Payday lenders asked a federal judge in Washington, D.C., for emergency relief to stop what they called a coordinated effort by U.S. regulators to stop banks from doing business with them, threatening their survival. In Wednesday night filings, the Community Financial Services Association of America (CFSA) and payday lender Advance America, Cash Advance Centers Inc said a preliminary injunction was needed to end the “back-room campaign” of coercion by the Federal Reserve, the Federal Deposit Insurance Corp and the Office of the Comptroller of the Currency. Advance America said its own situation became dire after five banks decided in the last month to cut ties, including a 14-year relationship with U.S. Bancorp, putting it “on the verge” of being unable even to hold a bank account.

Payday lenders make small short-term loans that can help tide over cash-strapped borrowers. But critics say fees can drive effective interest rates well into three digits, and trap borrowers into an endless debt cycle in which they use new payday loans to repay older loans. The CFSA said other payday lenders are also losing banking relationships as a result of “Operation Choke Point,” a 2013 Department of Justice initiative meant to block access to payment systems by companies deemed at greater risk of fraud. “Protecting consumers from credit fraud is, of course, a commendable goal,” Charles Cooper, a lawyer for the CFSA, wrote. “But the manner in which the defendant agencies have chosen to pursue that ostensible goal betrays that their true intent has always been to eradicate a disfavored industry.”

I don’t know to what extent Modi is the psychopath he’s made out to be here, but I do like the decentralization described (fits in with my end of centralization themes). “What a crazy idea it is to have a State monopoly on money..” [..] “In a tribalistic and irrational society, decentralization makes life much safer and makes the market more free, as complex decisions will be taken on the local level, where they belong”

Most people — particularly the salaried middle class – still seem to have a favorable opinion of Mr. Modi. They have been indoctrinated – in India’s extremely irrational and superstitious society – to believe that this demonetization will somehow alleviate corruption and that anything but support of Modi’s actions is anti-national and unpatriotic. This gives me pause to reflect. What a crazy idea it is to have a State monopoly on money, particularly a money that carries no inherent value and depends on regulatory edicts. On a deeper level, it makes me reflect on why for the culture of India – which is tribalistic, nativistic, superstitious and irrational – “India” is actually an unnatural entity. Such a society should consist of hundreds of tribes and countries, which is what “India” was before the British consolidated it.

In a tribalistic and irrational society, decentralization makes life much safer and makes the market more free, as complex decisions will be taken on the local level, where they belong . India’s institutions – not just organizations, but larger socio-political beliefs – have begun to decay and crumble after the British left, losing their underlying essence, the reason for which they had been institutionalized in the first place. This degradation is now picking up pace. They must eventually fall apart – including the nation-state of India – to adjust to the underlying culture. Let us consider some of these institutions. Western education implanted in India has mutated. It is making individuals cogs in a big machine, all for the service of one great leader. Public education and the mass-media have become instruments of propaganda.

Complexity and the diversity of options that technology brings make an irrational thinker extremely confused, forcing him to seek sanity in ritualistic religion —hence the increase in religiosity in India and elsewhere in the region. This has happened despite the explosion in information technology. The concept of the nation-state, when it took hold in Europe, was about the values the emergent rational and enlightened societies of Europe shared and had collectively come to believe in, at least among their elites. In India, the idea of the nation-state has morphed into a valueless thread, which binds people together through nothing but a flag and an anthem, symbols completely devoid of any values. It has collectivized tribalistic and irrational people (an irrationality that is amply epitomized by the negative force Islam has become in the last two decades).

In India and many similarly constituted countries, institutions that are not natural to their culture – the nation state, education, monetary system, etc. must eventually face entropy, slowly at first, and then rapidly. India has now entered the rapid phase. The death of money – amid a lack of respect for property rights (which again are a purely European concept that emerged from the intellectual revolutions of the last 800 years) – has been sudden and will very likely be catastrophic. It is a man-made disaster of gargantuan proportions. It will fundamentally change India in a very negative way, particularly if the demonetization effort succeeds, as it will have created the foundations enabling the rapid emergence of a police state.

Yeah, expecting peaceful transitions is perhaps a bit much.

• Here’s What Happened When Ancient Romans Tried To ‘Drain The Swamp’ (Black)

In late January of the year 98 AD, after decades of turmoil, instability, inflation, and war, Romans welcomed a prominent solider named Trajan as their new Emperor. Prior to Trajan, Romans had suffered immeasurably, from the madness of Nero to the ruthless autocracy of Domitian, to the chaos of 68-69 AD when, in the span of twelve months, Rome saw four separate emperors. Trajan was welcome relief and was generally considered by his contemporaries to be among the finest emperors in Roman history. Trajan’s successors included Hadrian and Marcus Aurelius, both of whom were also were also reputed as highly effective rulers.

But that was pretty much the end of Rome’s good luck. The Roman Empire’s enlightened rulers may have been able to make some positive changes and delay the inevitable, but they could not prevent it. Rome still had far too many systemic problems. The cost of administering such a vast empire was simply too great. There were so many different layers of governments—imperial, provincial, local—and the upkeep was debilitating. Rome had also installed costly infrastructure and created expensive social welfare programs like the alimenta, which provided free grain to the poor. Not to mention, endless wars had taken their toll on public finances. Romans were no longer fighting conventional enemies like Carthage, and its famed General Hannibal bringing elephants across the Alps.

Instead, Rome’s greatest threat had become the Germanic barbarian tribes, peoples viewed as violent and uncivilized who would stop at nothing to destroy Roman way of life. Corruption and destructive bureaucracy were increasingly rampant. And the worse imperial finances became, the more the government tried to “fix” everything by passing debilitating regulation and debasing the currency. In his seminal work The History of the Decline and Fall of the Roman Empire, Edward Gibbon wrote: “The story of its ruin is simple and obvious; and instead of inquiring why the Roman empire was destroyed, we should rather be surprised that it had subsisted so long.”

Progress as a blind faith. “Critics wondered if Nixon was wise to point to modern appliances such as blenders and dishwashers as the emblems of American superiority.”

• Innovation Is Overvalued. Maintenance Matters More (Aeon)

Innovation is a dominant ideology of our era, embraced in America by Silicon Valley, Wall Street, and the Washington DC political elite. As the pursuit of innovation has inspired technologists and capitalists, it has also provoked critics who suspect that the peddlers of innovation radically overvalue innovation. What happens after innovation, they argue, is more important. Maintenance and repair, the building of infrastructures, the mundane labour that goes into sustaining functioning and efficient infrastructures, simply has more impact on people’s daily lives than the vast majority of technological innovations. The fates of nations on opposing sides of the Iron Curtain illustrate good reasons that led to the rise of innovation as a buzzword and organising concept.

Over the course of the 20th century, open societies that celebrated diversity, novelty, and progress performed better than closed societies that defended uniformity and order. In the late 1960s in the face of the Vietnam War, environmental degradation, the Kennedy and King assassinations, and other social and technological disappointments, it grew more difficult for many to have faith in moral and social progress. To take the place of progress, ‘innovation’, a smaller, and morally neutral, concept arose. Innovation provided a way to celebrate the accomplishments of a high-tech age without expecting too much from them in the way of moral and social improvement.

Before the dreams of the New Left had been dashed by massacres at My Lai and Altamont, economists had already turned to technology to explain the economic growth and high standards of living in capitalist democracies. Beginning in the late 1950s, the prominent economists Robert Solow and Kenneth Arrow found that traditional explanations – changes in education and capital, for example – could not account for significant portions of growth. They hypothesised that technological change was the hidden X factor. Their finding fit hand-in-glove with all of the technical marvels that had come out of the Second World War, the Cold War, the post-Sputnik craze for science and technology, and the post-war vision of a material abundance.

Robert Gordon’s important new book, The Rise and Fall of American Growth, offers the most comprehensive history of this golden age in the US economy. As Gordon explains, between 1870 and 1940, the United States experienced an unprecedented – and probably unrepeatable – period of economic growth. That century saw a host of new technologies and new industries produced, including the electrical, chemical, telephone, automobile, radio, television, petroleum, gas and electronics. Demand for a wealth of new home equipment and kitchen appliances, that typically made life easier and more bearable, drove the growth. After the Second World War, Americans treated new consumer technologies as proxies for societal progress – most famously, in the ‘Kitchen Debate’ of 1959 between the US vice-president Richard Nixon and the Soviet premier Nikita Kruschev. Critics wondered if Nixon was wise to point to modern appliances such as blenders and dishwashers as the emblems of American superiority.

Just wow. No lessons learned from Vancouver, keep digging while in that hole.

• Australia Eases Limits On Foreign Buyers As Apartment Glut Looms (AFR)

The federal government has announced it will make it easier for foreigners to buy new apartments amid concerns of a looming glut that will drive down prices. Treasurer Scott Morrison said the government will make changes to the foreign investment framework to allow foreign buyers to buy an off-the-plan dwelling that another foreign buyer has failed to settle as a new dwelling. Previously, on-sale of a purchased off the plan apartment was regarded as a second hand sale, which is not open to foreign buyers. Foreign buyers can only buy new dwellings. The move effectively opens up the pool of buyers who can soak a potential flood of apartments hitting the residential markets due to failed settlements.

“This change addresses industry concerns, and means property developers won’t be left in the lurch when a foreign buyer pulls out of an off-the-plan purchase,” Mr Morrison said in an announcement. “It is common sense that an apartment or house that has just been built, or is still under construction and for which the title has never changed hands, is not considered an established dwelling.” The policy change comes after Mirvac said it experienced a rise in the default rate for the settlement of off-the-plan residential sales, above its historic average of 1%. The changes will apply immediately and regulation change will be made soon to enable developers to acquire “New Dwelling Exemption Certificates” for foreign buyers of these recycled off-the-plan homes.

On top of defaults, the Australian apartment markets – which boomed in the last four years – are facing other fresh risks. On Friday, HSBC said an oversupply of apartments in Melbourne and Brisbane could send unit prices down by as much as 6% in 2017. The apartment building boom, an ongoing concern for the Reserve Bank of Australia, especially in inner city Melbourne is likely to “start showing through” in price drops of between 2% and 6% in that city next year, HSBC chief economist Paul Bloxham said in a note. It’s a similar story in Brisbane where apartment prices are forecast to fall by as much as 4%. “A national apartment building boom, which has been part of the rebalancing act, is likely to deliver some oversupply in the Melbourne and Brisbane apartment markets, which is expected to see apartment price falls in these markets,” Mr Bloxham said.

No play no pay.

• Australia Ceases Multimillion-Dollar Donations To Clinton Foundation (News)

The Clinton Foundation has a rocky past. It was described as “a slush fund”, is still at the centre of an FBI investigation and was revealed to have spent more than $50 million on travel. Despite that, the official website for the charity shows contributions from both AUSAID and the Commonwealth of Australia, each worth between $10 million and $25 million. News.com.au approached the Department of Foreign Affairs and Trade for comment about how much was donated and why the Clinton Foundation was chosen as a recipient. A DFAT spokeswoman said all funding is used “solely for agreed development projects” and Clinton charities have “a proven track record” in helping developing countries. Australia jumping ship is part of a post-US election trend away from the former Secretary of State and presidential candidate’s fundraising ventures.

Norway, one of the Clinton Foundation’s most prolific donors, is reducing its contribution from $20 million annually to almost a quarter of that, Observer reported. One reason for the drop-off could be increased scrutiny on international donors. The International Business Times reported in 2015 on curious links between donors and State Department approval. IBT wrote that the State Department approved massive commercial arms sales for countries which had donated to the Clinton charity. More than $165 billion worth of arms sales were approved by the State Department to 20 nations whose governments gave money to the Clinton Foundation, data shows. The countries buying weapons from the US were the same countries previously condemned for human rights abuses. They included Algeria, Saudi Arabia and Kuwait.

But what does Australia gain from topping up the Clinton coffers? The Australian reported in February that Australia was “the single biggest foreign government source of funds for the Clinton Foundation” but questions remain unanswered about the agreement between the two parties. “It’s not clear why Canberra had to go through an American foundation to deliver aid to Asian countries (including Indonesia, Papua New Guinea and Vietnam). There is now every chance the payments will become embroiled in presidential politics.” The Daily Telegraph wrote in October that “Lo and behold, (Julia Gillard) became chairman (of the Clinton-affiliated Global Partnership for Education) in 2014”, one year after being defeated in a leadership ballot by Kevin Rudd.

“After contributing $88mm to the Clinton Foundation over the past 10 years, making them one of the Foundation’s largest contributors, Australia has decided to pull all future donations.

But why would they stop funding now that Hillary has so much more free time to focus on her charity work?”

• Australia Joins Norway, Cuts Clinton Foundation Donations To $0 (ZH)

For months we’ve been told that the Clinton Foundation, and it’s various subsidiaries, were simple, innocent “charitable” organizations, despite the mountain of WikiLeaks evidence suggesting rampant pay-to-play scandals surrounding a uranium deal with Russia and earthquake recovery efforts in Haiti, among others. Well, if that is, in fact, true perhaps the Clintons could explain why wealthy foreign governments, like Australia and Norway, are suddenly slashing their contributions just as Hillary’s schedule has been freed up to focus exclusively on her charity work. Surely, these foreign governments weren’t just contributing to the Clinton Foundation in hopes of currying favor with the future President of the United States, were they? Can’t be, only an useless, “alt-right,” Putin-progranda-pushing, fake news source could possibly draw such a conclusion.

Alas, no matter the cause, according to news.com.au, the fact is that after contributing $88mm to the Clinton Foundation, and its various affiliates, over the past 10 years the country of Australia has decided to cease future donations to the foundation just weeks after Hillary’s stunning loss on November 4th. And just like that, 2 out of the 3 largest foreign contributors to the Clinton Foundation are gone with Saudia Arabia being the last remaining $10-$25mm donor that hasn’t explicitly cut ties or massively scaled by contributions. [..]

News.com.au confirmed Australia’s decision to cut future donations to the Clinton Foundation earlier today. When asked why donations were being cut off now, a Department of Foreign Affairs and Trade official simply said that the Clinton Foundation has “a proven track record” in helping developing countries. While that sounds nice, doesn’t it seem counterintuitive that these countries would pull their funding just as Hillary has been freed up to spend 100% of her time helping people in developing countries?“Australia has finally ceased pouring millions of dollars into accounts linked to Hillary Clinton’s charities. Which begs the question: Why were we donating to them in the first place? The federal government confirmed to news.com.au it has not renewed any of its partnerships with the scandal-plagued Clinton Foundation, effectively ending 10 years of taxpayer-funded contributions worth more than $88 million. News.com.au approached the Department of Foreign Affairs and Trade for comment about how much was donated and why the Clinton Foundation was chosen as a recipient. A DFAT spokeswoman said all funding is used “solely for agreed development projects” and Clinton charities have “a proven track record” in helping developing countries.”

Fake News Inc.

• New Zealand Media Merger Risks Growth Of ‘Glib, Click-Bait’ Coverage (G.)

A group of distinguished former newspaper editors has launched a scathing attack on plans for New Zealand’s largest print media companies to merge, calling it a threat to democracy which could see a concentration of power exceeded “only in China”. The merger of NZME and Fairfax Media, which was proposed in May, would not be healthy in a country that “already suffers from a dearth of serious content and analysis”, the editors say in a submission to the commerce commission. The group, which includes Suzanne Chetwin, former Dominion chief Richard Long and ex-New Zealand Herald editor Gavin Ellis, also criticise the trend towards “click-bait stories” at a time when television has “all but abandoned current affairs and our public discourse is increasingly glib”.

“The merger would see one organisation controlling nearly 90% of the country’s print media market (and associated websites), the greatest level of concentration in the OECD and one that is exceeded only by China. “That cannot be healthy, particularly in a society like New Zealand’s that has so few checks and balances in its constitutional arrangements.” The submission went on to state the greatest threat to New Zealand media came from off-shore publishers who had “no feel for New Zealand’s social fabric”, and urged the commerce commission to decline the merger. The merger was sold as an attempt by both companies to stem revenue losses and drastic staff and budget cuts, particularly to rural and regional newsrooms.

Dunedin’s The Otago Daily Times would be the only newspaper in the country to remain independent, although it too could be affected as they have content sharing agreements with NZME’s The New Zealand Herald. Radio stations and magazines owned by both companies would also be affected.

That’s not debt relief, it’s Schauble-friendly creative accounting.

• Greek Debt Relief Plan Said to Entail $35 Billion Bank Bond Swap (BBG)

Greece’s battered banks are being asked to swap about 33 billion ($35 billion) euros in floating-rate bonds for 30-year, fixed-rate securities under a euro-area plan to shield Athens from future interest rate increases, three people with knowledge of the matter said. The swap is part of a package of debt-relief proposals for Greece to be presented at a Dec. 5 meeting of euro-area finance ministers, according to the people, who asked not to be named because they weren’t authorized to speak publicly about the matter. The notes were issued by the European Financial Stability Facility, the region’s crisis-fighting fund, to re-capitalize Greek lenders in 2013.

While the current EFSF holdings of Greek banks fall due between 2034 and 2046, the fixed-rate notes will expire in 2047, the people said. That will reduce Greece’s interest rate risk, but it may come at a cost for its four systemically important lenders, which could be left with securities that are more difficult to trade. The technical aspects of the operation are still being hashed out. “There are discussions going on as to proposals which will improve the sustainability of the Greek debt,” Piraeus Bank Chairman George Handjinicolaou said in an interview Thursday. “Part of this proposal is a change in the EFSF bonds for something else, some form of fixed-rate debt, which would improve the predictability of the sustainability of the Greek debt profile.”