Henri Matisse Music 1910

We don’t want to know how harmful this is. Because it’s so popular. We have no answer because it’s going so fast. And our governments don’t want the answer because it’s the mightiest spy tool ever.

• People Spend Most Of Their Waking Hours Staring At Screens (MW)

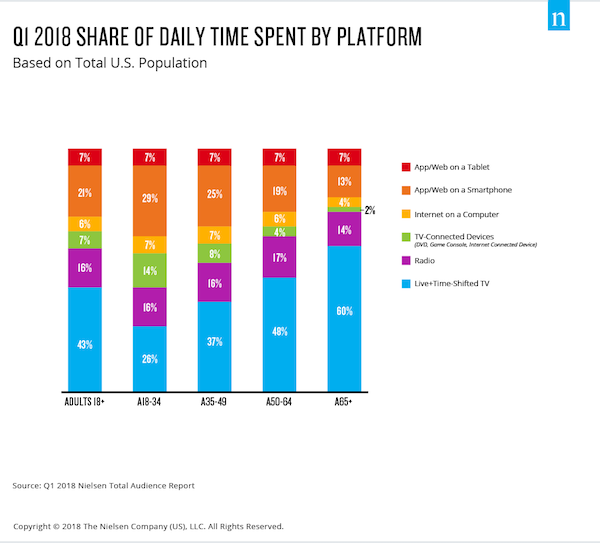

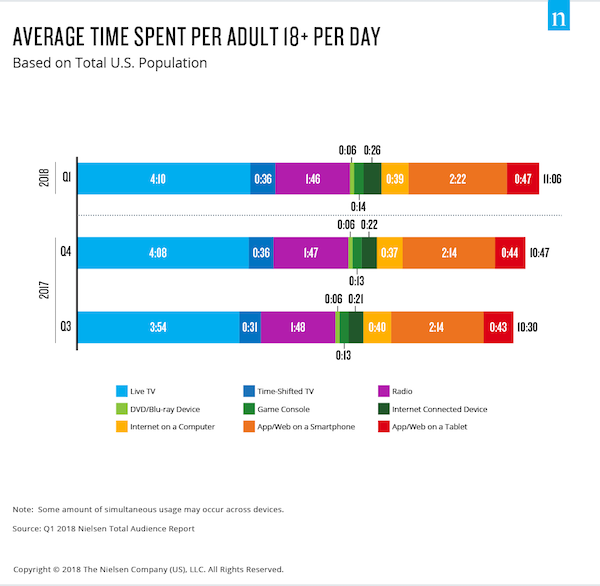

Swipe. Click. Binge. Repeat. Americans spend more time than ever watching videos, browsing social media and swiping their lives away on their tablets and smartphones. American adults spend more than 11 hours per day watching, reading, listening to or simply interacting with media, according to a new study by market-research group Nielsen. That’s up from nine hours, 32 minutes just four years ago. In the first quarter of the year, U.S. adults spent three hours and 48 minutes a day on computers, tablets and smartphones. This is a 13-minute increase from the previous quarter, and 62% of that time is attributed to app/web browsing on smartphones. Television still accounts for most media usage, with four hours and 46 minutes spent watching TV every day in the first quarter of this year.

[..] Media use is reaching new levels of intensity. Parents with children aged eight to 18 years of age spend over nine hours with screen media each day, according to a 2016 survey of 1,700 such parents by Common Sense Media, a San Francisco-based organization that examines the impact of technology and media on families. That compares to the more than 4.5 hours tweens spend on screen media on average every day and 6.5 hours spent by teenagers every day, according to a separate 2015 survey of more than 2,650 children by the same organization. Based on Nielsen’s latest report, however, the time people spend online has increased significantly, even over the last four years.

I see so many people doing so many weird things with their phones. Walking the street, getting out of transport, cycling, all glued to these things. And it’s all just to check Facebook etc. At some point, this will turn into a full-blown crisis.

• Fifth of Britons Feel Stressed If They Can’t Access Internet (G.)

The average Briton now checks a mobile phone every 12 minutes and is online for 24 hours a week, finds an Ofcom study revealing the extent to which people now rely on the internet. Ofcom also found that, for the first time, the time spent making phone calls from mobile phones fell, as users instead used messaging services such as WhatsApp and Facebook Messenger. The media regulator’s annual Communications Market Report found that a fifth of British adults felt stressed if they could not access the internet, while for the first time ever women were spending more time online than men. The report also showed the rapid growth of addiction to technology. According to Ofcom, just 12% of British adults said they never used the internet.

The total amount of time spent online by Britons has also doubled over the last 10 years, with a quarter of adults saying they spent more than 40 hours a week on the internet – a move driven by the uptake of smartphones. The internet has seeped into many aspects of our lives; two in five British adults – rising to 65% of those aged under 35 – said they looked at their phone within five minutes of waking up35. A third of adults checked their phones up until the moment they went to sleep, a figure which rose to 60% for the under-35s. The prevalence of mobile phones has also meant that attitudes to their use in public had changed. While 83% of Britons aged over 55 said they thought it unacceptable to check a phone during a meal, this figure almost halved among people aged 18-34 who were more comfortable with looking at notifications while eating with other people.

Or is it a mentality crisis? We never shook off Greed is Good, did we?

• Jeff Bezos’s $150 Billion Fortune Is a Policy Failure (Atlantic)

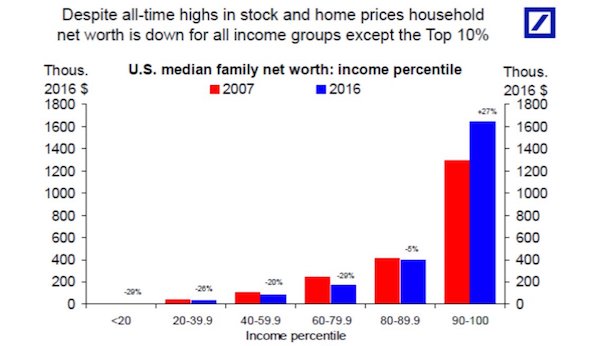

Last month, Bloomberg reported that Jeff Bezos, the founder of Amazon and owner of the Washington Post, has accumulated a fortune worth $150 billion. That is the biggest nominal amount in modern history, and extraordinary any way you slice it. Bezos is the world’s lone hectobillionaire. He is worth what the average American family is, nearly two million times over. He has about 50 percent more money than Bill Gates, twice as much as Mark Zuckerberg, 50 times as much as Oprah, and perhaps 100 times as much as President Trump. (Who knows!) He has gotten $50 billion richer in less than a year. He needs to spend roughly $28 million a day just to keep from accumulating more wealth. This is a credit to Bezos’s ingenuity and his business acumen.

Amazon is a marvel that has changed everything from how we read, to how we shop, to how we structure our neighborhoods, to how our postal system works. But his fortune is also a policy failure, an indictment of a tax and transfer system and a business and regulatory environment designed to supercharging the earnings of and encouraging wealth accumulation among the few. Bezos did not just make his $150 billion. In some ways, we gave it to him, perhaps to the detriment of all of us. Bezos and Amazon are in many ways ideal exemplars of the triumph of capital over labor, like the Waltons and Walmart and Rockefeller and Standard Oil before them. That the gap between executives at top companies and employees around the country is so large is in and of itself shocking.

Bezos has argued that there is not enough philanthropic need on earth for him to spend his billions on. (The Amazon founder, unlike Gates or Zuckerberg, has given away only a tiny fraction of his fortune.) “The only way that I can see to deploy this much financial resource is by converting my Amazon winnings into space travel,” he said this spring. “I am going to use my financial lottery winnings from Amazon to fund that.” In contrast, half of Amazon’s domestic employees make less than $28,446 a year, per the company’s legal filings. Some workers have complained of getting timed six-minute bathroom breaks. Warehouse workers need to pick goods and pack boxes at closely monitored speeds, handling up to 1,000 items and walking as many as 15 miles per shift.

Contractors have repeatedly complained of wage-and-hour violations and argued that the company retaliates against whistleblowers. An Amazon temp died on the floor just a few years ago. The impoverishment of the latter and the wealth of the former are linked by policy. Take taxes. The idea of America’s progressive income-tax system is that rich workers should pay higher tax rates than poor workers, with the top rate of 37% hitting earnings over $500,000. (The top marginal tax rate was 92% as recently as 1953.) But Bezos takes a paltry salary, in relative terms, given the number of shares he owns. That means his gains are subject to capital-gains taxes, which top out at just 20%; like Warren Buffett, it is possible he pays effective tax rates lower than his secretary does.

His health may be worse than we know. They’d love for him to ‘voluntarily’ leave.

• Assange May Finally Leave Ecuadorian Embassy In London As Health Worsens (RT)

Julian Assange, who has spent more than 2,230 days in the Ecuadorian embassy in London, is expected to leave the building soon with his health deteriorating, sources say. This latest information about the WikiLeaks founder, who was already expected to leave the embassy “in the coming weeks,” was broken Wednesday by Bloomberg which cited “two people with knowledge of the matter.” The news agency reported that the whistleblower’s health “has declined recently.” The news comes days after Ecuadorian President Lenin Moreno announced that Assange must “eventually” leave the embassy. “Yes, indeed yes, but his departure should come about through dialogue,” the Ecuadorian president said in answer to a reporter’s question on whether he will eventually have to leave.

“For a person to stay confined like that for so long is tantamount to a human rights violation,” Moreno said, stressing that Ecuador wants to make sure that nothing “poses a danger” to the whistleblower’s life. The whistleblower’s health is deteriorating, according to the Courage Foundation, a group that fundraises for the legal defense of whistleblowers. Assange is in “a small space” and has “no access to sunlight,” the group says, adding that this has a serious impact “on his physical and mental health.” [..] Washington simply “wants revenge” for the “embarrassment” WikiLeaks caused it, and wants it to serve “as a deterrent to others,” human rights activist Peter Tatchell told RT earlier in July. “Someone who’s published that information in the same way that the New York Times or the Guardian publish information, I don’t think they should face risk 30 or 40 years in jail in the United States,” Tatchell added.

25% is a lot in one go.

• Trump Threatens To Raise Tariffs On Chinese Goods To 25%, Up From 10% (AFP)

The United States may jack up the tariff rate on the next $200 billion in Chinese imports it plans to target as it pressures Beijing to reform its trade practices, US officials said Wednesday. President Donald Trump asked the US Trade Representative to consider increasing the proposed tariffs to 25 percent from the planned 10 percent, USTR Robert Lighthizer said. “We have been very clear about the specific changes China should undertake. Regrettably, instead of changing its harmful behavior, China has illegally retaliated against US workers, farmers, ranchers and businesses,” Lighthizer said in a statement.

Officials however downplayed suggestions the move was intended to compensate for the recent decline in the value of the Chinese currency, which has threatened to take much of the sting out of Trump’s tariffs by making imports cheaper. The US dollar has been strengthening since April as the central bank has been raising lending rates, which draws investors looking for higher returns. “It’s important that countries refrain from devaluing currencies for competitive purposes,” a senior administration official told reporters. “But I wouldn’t draw the conclusion that the announcement we’re making today is directly linked to any one practice.”

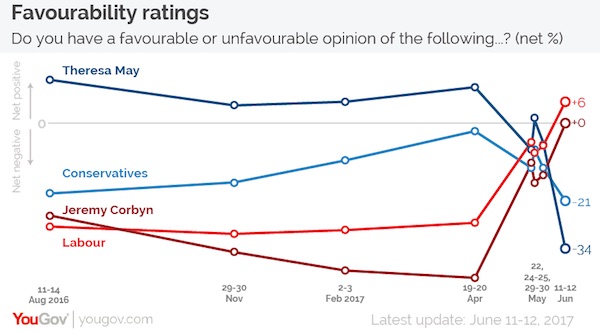

Brussels thinks they’ll be dealing with Boris Johnson soon. Their strategy is geared toward that,

• German Sources Deny Brexit Deal Offer Amid Panic In Remain Campaign (G.)

Reports that Germany is willing to offer Theresa May a vague Brexit deal so as to prevent the UK crashing out of the EU with no deal have set alarm bells ringing in the Remain campaign in the UK and prompted denials from German sources. The Remain campaign, now called People’s Vote, is focused on calling for a second referendum on leaving the EU. It warned against what it described as a “blind Brexit”, and in a rare criticism of the European commission said the EU should not offer May a face-saving deal in which many of the major issues were deferred for negotiation during the transition after the UK has legally left the bloc.

There are concerns amongst some Remain backers that the chief EU Brexit negotiator, Michel Barnier, is prepared to make the offer if it has the endorsement of Germany and France, on the basis that the majority of EU leaders fear the possibility of no-deal scenario. There is also a concern that details of the future relationship cannot be negotiated in the short time available. Until now it had been assumed that France and Germany would insist that any political declaration on future relations would include details of the planned future trading relationship after Brexit. A relatively brief declaration on future ties will not be a formal treaty, unlike the withdrawal agreement, which will give details of future UK payments, the Irish border and citizens’ rights. A vague deal on future relations is more likely to be acceptable to May’s MPs, and harder for the Labour party to oppose.

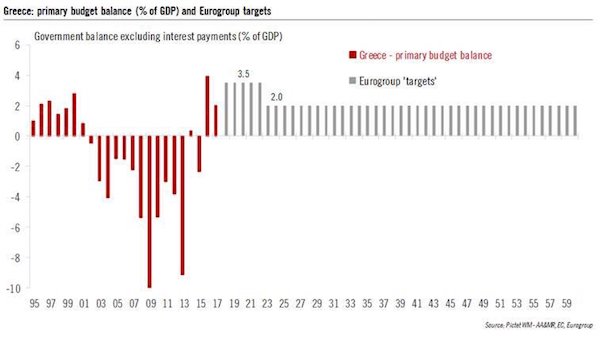

Taxed to death. People close their businesses because taxes are higher than income. That leads to less tax revenue, so taxes must be raised again. Greece cannot recover.

• German Parliament Approves Last Loan Installment To Greece (K.)

The German Parliament’s budget committee rubber-stamped on Wednesday the disbursement of the last loan installment of Greece’s adjustment program, totalling 15 billion euros. Germany had blocked the release of the last tranche in July, after the Greek government announced it would postpone the increase of value-added tax on five islands of the Aegean hit by the influx of migrants, a measure that had been agreed on with the country’s creditors. The European Stability Mechanism (ESM) had approved the disbursement in principle, while it awaited German lawmakers to sign-off the deal. The revenue losses from the lower VAT amount to 28 million euros, which the Greek government will compensate by savings in the defense budget, the German Parliament’s press release said. After Wednesday’s vote, Germany can consent to the payment of the last instalment by the ESM.

They’ll re-examine the issue in 2032. That’s minimum 14 more years of strangulation. IMF/EU is classic good cop bad cop.

• Brussels Defends Greek Debt Relief (K.)

The European Commission on Wednesday defended the Greek debt relief measures that the Eurogroup decided in June, in a manner of response to the IMF, which had deemed the debt easing inadequate to render the debt sustainable in the long term. In a regular press update, Commission spokeswoman Mina Andreeva stressed that the IMF forecasts on Greece are permanently pessimistic and that the Fund has in the past been forced to revise them. “The European Commission, the European Stability Mechanism and the ECB have made their own assessment and we, as Europeans, are funding the program and our conclusion is that the debt relief is sufficient,” the Bulgarian official stated.

She went on to highlight the eurozone’s commitment to re-examine the Greek debt in the future should further easing measures be required: “We have also said we will examine the issue again in 2032,” Andreeva said. The IMF said in its Debt Sustainability Analysis on Tuesday that the eurozone’s optimistic scenarios on the Greek growth and primary surpluses make the debt’s long-term sustainability uncertain, particularly after 2038.

Yeah, define ‘normal’.

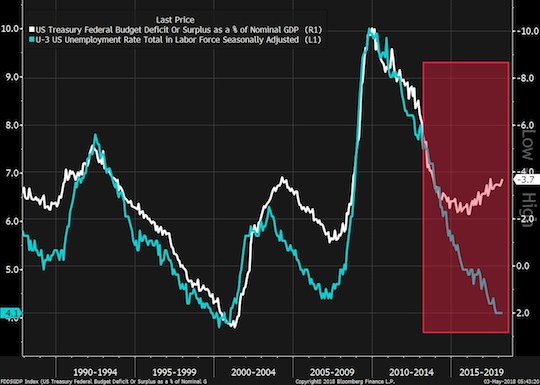

• Should The Bank Of England Raise Interest Rates? (Coppola)

It’s a momentous week for the Bank of England. On Thursday, August 2, 2018, the Monetary Policy Committee (MPC) could decide to raise interest rates by a quarter percent. This would mark the end of the post-Lehman crisis era in the UK and the start of the return to “normal.” But ten years on from Lehman, what is “normal”? The British central bank, like the Fed, is not at all sure what a “normal” level of interest rates would look like, nor how big a “normal” balance sheet should be. The consensus appears to be that the long-term neutral rate of interest is lower than pre-crisis estimates, perhaps somewhere between 2-3%, and that the Bank’s balance sheet will need to remain permanently larger than it was before the crisis.

Given that, one has to ask what the imperative is to start raising rates right now, when the U.K. is careering headlong towards a potentially disastrous no-deal Brexit. The rational reason why the MPC might start raising rates now starts with inflation. Currently, CPI inflation is running at 2.3%, slightly above the Bank’s target of 2%. It has been above 2% for over a year now – indeed in the fall of 2017 it was approaching 3%. In November, the Bank raised interest rates by 0.25%, which removed the additional rate cut imposed after the Brexit vote in 2016. But apart from that, it has so far preferred not to act to dampen inflation. Will it do so this time?

A tiny circle of close friends.

• Nomi Prins Exposes The Power Grab Of Central Bankers (Salon)

Three of the last four books that I’ve written, including this new one “Collusion,” all examine the juxtaposing of power and money. In all of them, I explore how elected leaders or those in positions of great unelected economic or political influence, use both of them to create or enforce policy. There is a time component as well, “It Takes a Pillage” examined the financial crisis and causes within the framework of a relatively tight temporal lens and I had a very short time to write it as well. “All the Presidents’ Bankers” was a much more expansive book from a historical sense, going back over a century to examine the relationships of key bankers and presidents, and the institutions with which they collaborated to fashion domestic and foreign policy.

“Collusion” is really a book about the future, though it spans the decade since the financial crisis from multiple geographical locations (traveling to which I amassed lots of air miles, and exploring which, I worked with a crack team of internal researchers). It delves into the global connectivity of a body of central banks that provide varying amounts of money to their respective local systems and by extension to the world, and examines how not all central banks are created equal.

In “Collusion,” neither the Fed, nor the U.S. has its own chapter like the other countries or regions. This is by design. The Fed acts as the global influencer, directly and indirectly, as does the U.S. through all of what I call the “pivot regions” in the book that unfold in each chapter. I wanted to show how deeply co-dependent the entire world is on the US monetary policy decisions made since the financial crisis, in various ways, that we are still finding out about. All of my books though, are ultimately, about the people behind their roles of power, and the decisions they make out of ideology, necessity, ego or fear.

“It’s a little hard to picture old horse-face popping a third beer at the clambake..”

If one word defines the preoccupying affairs of the USA these days it’s tiresome. The entire population seems to be enacting the old myth of Sisyphus, every, man, woman, child, swamp-creature, and non-binary child-of-God in the land, legal and undocumented, pushing that boulder uphill to the tippy top, only to have it roll back down to the bottom… repeat ad infinitum. Take Mr. Robert Mueller, for example, the sphinx-like figure looming over the political landscape with his lawyer’s attaché case full of radioactive secrets. He has already done yeoman’s service in his mission by indicting two dozen Russian Facebook trolls and Internet hackers — who will never be extradited or set foot in a US courtroom, sparing taxpayers the expense of trying them (and testing the theory of “collusion” with the current POTUS).

It’s a little hard to picture old horse-face popping a third beer at the clambake, let alone the stories he might tell around the fire (with necessary redactions). When he awakes hung over in the sand the next morning to the shrieking gulls, next to someone not-his-wife, will he be overwhelmed with regret for a year spent chasing gremlins from the Kremlin? The public appears to be good and goddamn sick of him. Even The New York Times has stopped squealing about Russia. Standing by for September histrionics….

Good and evil. And profits.

• Google ‘Working On Censored Search Engine’ For China (G.)

Google is working on a mobile search app that would block certain search terms and allow it to reenter China after exiting eight years ago due to censorship and hacking, according to US media reports. The California-based internet company has engineers designing search software that would leave out content blacklisted by the Chinese government, according to a New York Times report citing two unnamed people familiar with the effort. News website The Intercept first reported the story, saying the Chinese search app was being tailored for Google-backed Android operating system for mobile devices. The service was said to have been shown to Chinese officials. [..] The state-owned China Securities Daily, citing information from “relevant departments”, denied the report.

There was no guarantee the project would result in Google search returning to China. However, the Chinese human rights community said Google acquiescing to China’s censorship would be a “dark day for internet freedom”. “It is impossible to see how such a move is compatible with Google’s ‘Do the right thing’ motto, and we are calling on the company to change course,” said Patrick Poon, China Researcher at Amnesty International. “For the world’s biggest search engine to adopt such extreme measures would be a gross attack on freedom of information and internet freedom. In putting profits before human rights, Google would be setting a chilling precedent and handing the Chinese government a victory.”

Always too little, always too late. By design. Brussels keeps saying: look at all the money we gave! While conditions in the camps remain abysmal.

• European Commission Boosts Migration Aid To Greece (K.)

The European Commission said Wednesday that an additional 37.5 million euros in emergency assistance would be disbursed to improve reception conditions for migrants in Greece as arrivals from Turkey continue by both sea and land. In a statement, the EU’s executive branch said Greek authorities will receive 31.1 million euros to support the “provisional services” offered to migrants, including healthcare, interpretation and food, as well as to improve the infrastructure of the Fylakio reception center in Evros, northern Greece, which has seen an increase in arrivals from Turkey in recent months.

The extra funding will also go toward the creation of additional accommodation within facilities on the Greek mainland, the Commission said. It said a further 6.4 million euros has been awarded to the International Organization for Migration (IOM) to improve conditions at reception conditions on the Aegean islands and mainland. Commenting on the decision, European Migration Commissioner Dimitris Avramopoulos said the Commission was “doing everything in its power to support all member-states facing migratory pressures.” “Migration is a European challenge and we need a European solution, where no member-state is left alone,” he said.

“Greece has been on the frontline since 2015 and while the situation has greatly improved since the EU-Turkey statement, we continue to assist the country with the challenges it is still facing,” he added, noting that the EC’s “political, operational and financial support for Greece remains tangible and uninterrupted.”

For Christ’s sake.

• 95% Of World’s Lemur Population Facing Extinction (AFP)

Ninety-five percent of the world’s lemur population is “on the brink of extinction,” making them the most endangered primates on Earth, a leading conservation group said Wednesday. The arboreal primates with pointed snouts and typically long tails are found only in Madagascar, where rainforest destruction, unregulated agriculture, logging and mining have been ruinous for lemurs, the International Union for the Conservation of Nature (IUCN) said. “This is, without a doubt, the highest percentage of threat for any large group of mammals and for any large group of vertebrates,” Russ Mittermeier of IUCN’s species survival commission said in a statement.

Out of a total of 111 lemur species and subspecies, 105 are under threat, IUCN said, as it released its first update on the lemur population since 2012. Among the most concerning trends is an “increase in the level of hunting of lemurs taking place, including larger-scale commercial hunting,” Christoph Schwitzer, director of conservation at the Bristol Zoological Society, said in the statement. He described the hunting as “unlike anything we have seen before in Madagascar.” One of the species identified as “critically endangered” is the northern sportive lemur, of which there are thought to be only 50 individuals left, IUCN said. “Lemurs are to Madagascar what giant pandas are to China — they are the goose that laid the golden egg, attracting tourists and nature lovers,” said Jonah Ratsimbazafy of the domestic primate research group GERP.