Unknown Paris 1900

Sell everything!

• This Is The Greatest Suckers’ Rally Of All Time: David Stockman (CNBC)

The Trump rally raged on this week with all major U.S. indexes hitting record highs, but despite the historic run, David Stockman is doubling down on his call for investors to sell everything. “This 5% eruption is meaningless. It’s some robo machine trying to tag new highs,” Stockman said Tuesday on CNBC’s “Fast Money,” in a dismissal of the S&P 500 rally. “I see a recession coming down the pike in 2017. The stock market is going to go down and it’s going to stay down long and hard because, for the first time in 25 years, there’s nothing to bail it out.” This echoed the initial call Stockman made Nov. 3, when he urged investors to sell stocks and bonds before the presidential election. However, since the Nov. 8 election, the Dow Jones industrial average has gained 4% en route to surpassing 19,000.

Additionally, the S&P 500 and Nasdaq also hit record highs in the same time period, gaining 3% and 4%, respectively. Yet Stockman, who was director of the Office of Management and Budget under President Ronald Reagan, reaffirmed that markets are heading for disaster. “My call stands. Sell the stocks, sell the bonds, get out of the casino,” Stockman explained to CNBC in an off-camera interview. “Bonds have already cratered by nearly $2 trillion worldwide and have miles to go. This isn’t a rotation into stocks, either. It’s the greatest sucker’s rally ever.” Stockman, author of “Trumped: A Nation on the Brink of Ruin… And How to Bring It Back,” lamented that there will be no Trump stimulus or Reagan-style boom.

He further added that he expects “an unprecedented fiscal bloodbath” resulting from the $20 trillion worth of debt that the U.S. currently has on the books. “This isn’t Ronald Reagan with a clean $1 trillion balance sheet and with a fluke GOP and a Southern Democratic coalition that only materialized because he got shot,” Stockman said in reference to John Hinkley Jr. attempting to assassinate Reagan in Washington, D.C., in 1981. “Nor is it LBJ in 1965 with a thundering electoral mandate and a massive congressional majority for the Great Society.” On the contrary, Stockman, who initially predicted that Trump would win the election, added that Washington will be in chaos by June. This is because he anticipates ongoing disruptions from the tea party, which Stockman doesn’t foresee as allowing additional deficit increases.

“..landlords are increasingly claiming “chronic rent delinquency” after just a single late payment..”

• More Than Half Of New Yorkers One Paycheck Away From Homelessness (Gothamist)

More than half of all New Yorkers don’t have enough money saved to cover them in the event of a lost job, medical emergency, or other disaster, according to a new report by the Association for Neighborhood & Housing Development. Nearly 60% of New Yorkers lack the emergency savings necessary to cover at least three months’ worth of household expenses including food, housing, and rent, but that statistic isn’t spread evenly across the five boroughs. The Bronx has the highest rate of families without adequate emergency savings: in Mott Haven, Melrose, Hunts Point, Longwood, Highbridge, South Concourse, University Heights, Fordham, Belmont, and East Tremont, 75% of families have inadequate emergency savings.

The Staten Island neighborhoods of Tottenville and Great Kills have the lowest rate, with just 41% of families lacking the funds necessary to cover three months’ worth of expenses. Without these savings, families who face emergencies could be at risk of eviction, foreclosure, damaged credit, and even homelessness. In Brooklyn, families in Brownsville (70%), Bed-Stuy (67%), Bushwick (68%), East New York (67%), and South Crown Heights/Prospect Heights (67%) are the most at-risk—in Manhattan, an average of 67% of families in Harlem, Washington Heights, and Inwood lack necessary savings. In Queens, the neighborhoods with the highest%age of these households were Elmhurst/Corona (64%), Rockaway/Broad Channel (60%), Sunnyside/Woodside (59%), and Jackson Heights (59%).

As DNAinfo notes, advocates say that rental assistance is crucial in preventing homelessness citywide, especially in neighborhoods where rents rise faster than incomes—many of which overlap with the neighborhoods where families lack adequate savings. And although an increase in rental assistance services like the one proposed by Queens Assemblyman Andrew Hevesi could cost the cost $450 million in state and federal funding, it would be more cost-effective than allowing more families to enter the chronically underfunded shelter system. Many tenants don’t know where to get emergency rental assistance, which can prevent them from falling behind on their rent. And landlords are increasingly claiming “chronic rent delinquency” after just a single late payment, which allows them to begin eviction proceedings earlier on than they would otherwise.

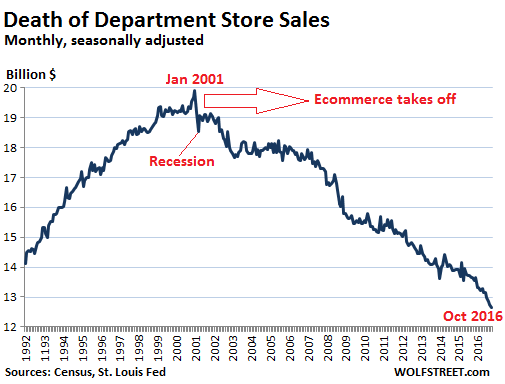

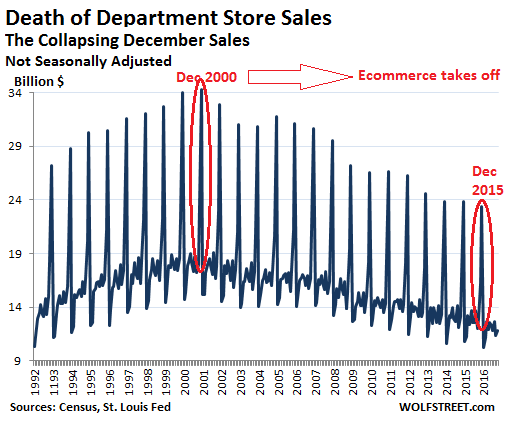

“Net sales on Black Friday slid 10.4% for brick-and-mortar chains..”

• US Thanksgiving, Black Friday Store Sales Fall 10.4%, Online Rises (R.)

Sales and traffic at U.S. brick-and-mortar stores on Thanksgiving Day and Black Friday declined from last year, as stores offered discounts well beyond the weekend and more customers shopped online. Internet sales rose in the double digits on both days, surpassing $3 billion for the first time on Black Friday, according to data released on Saturday. Data from analytics firm RetailNext showed net sales at brick-and-mortar stores fell 5.0% over the two days, while the number of transactions fell 7.9%. Preliminary data from retail research firm ShopperTrak showed that shopper visits to such stores fell a combined 1% during Thanksgiving and Black Friday when compared with the same days in 2015.

The data highlights the waning importance of Black Friday, which until a few years ago kicked off the holiday shopping season, as more retailers start discounting earlier in the month and opened their doors on Thanksgiving Day. “We knew it (holiday season) was going to be off to a slow start,” Shelley Kohan, vice president of retail consulting at RetailNext, said. “The first couple of weeks with the election were a complete distracter from the normal course of business and…a warmer climate in November may have made the sales more stubborn,” she said, adding that she saw sales picking up in December.

Net sales on Black Friday slid 10.4% for brick-and-mortar chains, according to RetailNext. “Stores that opened on Thursday were not very busy on Black Friday,… and while the Thanksgiving Day opt-outs were busier on Black Friday, they didn’t see the crowds they saw in previous years,” NPD group’s Chief Industry analyst Marshal Cohen said. Still, total holiday season sales are expected to jump 3.6% to $655.8 billion this year, according to the National Retail Federation, due to a tightening job market.

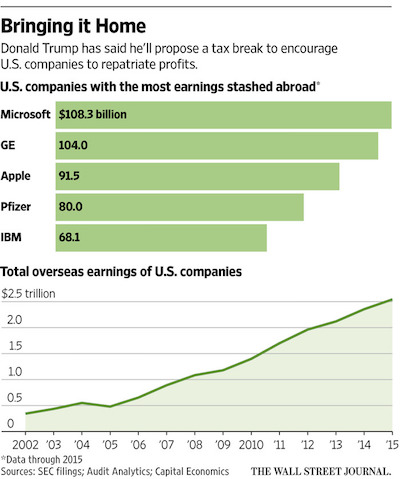

Only if buybacks are banned.

• Dollar to Benefit if $2.5 Trillion in Cash Stashed Abroad Is Repatriated (WSJ)

Part of $2.5 trillion in profits held overseas by companies such as Apple and Microsoft could be heading back to the U.S., a move analysts say could further fuel the U.S. dollar’s powerful rally. U.S. corporations have been holding billions in earnings and cash abroad to avoid paying a 35% tax that would be levied whenever the money is brought home. President-elect Donald Trump has said he would propose a one-time cut of the repatriation tax to 10% to lure money back to the U.S. that can be spent on hiring, business development and funding Mr. Trump’s fiscal stimulus proposals. Market optimism that the stimulus plan can generate U.S. economic growth and push the Federal Reserve to raise interest rates has buoyed the dollar against a basket of major trading partners toward 14-year-highs since the Nov. 8 presidential election.

Now, some say the prospect of companies repatriating perhaps hundreds of billions of dollars could offer more impetus to the U.S. currency’s rally. “However small, however big this flow of money will be, it will be positive for the case of dollar strength,” said Daragh Maher at HSBC. “There will most likely be an inflow into dollars.” When a company repatriates earnings from abroad, it may have to exchange the local currency for the U.S. dollar. The $2.5 trillion hoard of overseas earnings is highly concentrated in the technology and pharmaceutical sectors, according to Capital Economics. Microsoft held about $108 billion in earnings overseas as of 2015, while pharmaceutical giant Pfizer had $80 billion. General Electric had $104 billion overseas, according to Capital Economics. Analysts note that many companies already hold their overseas earnings in U.S. dollar assets, which would mute the demand for dollars.

Famous last words: “The notion that Chinese people do not like to borrow is clearly outdated..”

• China’s Property Frenzy And Surging Debt Raises Red Flag For Economy (AFP)

Chinese household debt has risen at an “alarming” pace as property values have soared, analysts have said, raising the risk that a real estate downturn could wreak havoc on the world’s second largest economy. Loose credit and changing habits have rapidly transformed the country’s famously loan-averse consumers into enthusiastic borrowers. Rocketing real estate prices in major Chinese cities in recent years have seen families’ wealth surge. But at the same time they have fuelled a historic boom in mortgage lending, as buyers race to get on the property ladder, or invest to profit from the phenomenon. Now the debt owed by households in the world’s second largest economy has surged from 28% of GDP to more than 40% in the past five years.

“The notion that Chinese people do not like to borrow is clearly outdated,” said Chen Long of Gavekal Dragonomics. The share of household loans to overall lending hit 67.5% in the third quarter of 2016, more than twice the share of the year before. But this surge has raised fears that a sharp drop in property prices would cause many new loans to go bad, causing a domino effect on interest rates, exchange rates and commodity prices that “could turn out to be a global macro event”, ANZ analysts said in a note. While China’s household debt ratio is still lower than advanced countries such as the US (nearly 80% of GDP) and Japan (more than 60%), it has already exceeded that of emerging markets Brazil and India, and if it keeps growing at its current pace will hit 70% of GDP in a few years.

It still has some way to go before it outstrips Australia, however, which has the world’s most indebted households at 125% of GDP. The ruling Communist party has set a target of 6.5-7% economic growth for 2017, and the country is on track to hit it thanks partly to a property frenzy in major cities and a flood of easy credit. But keeping loans flowing at such a pace creates such “substantial risks” that it could be a “self-defeating strategy”, Chen said. China’s total debt – including housing, financial and government sector debt – hit 168.48 trillion yuan ($25 trillion) at the end of last year, equivalent to 249% of national GDP, according to estimates by the Chinese Academy of Social Sciences, a top government think tank.

“..the informal sector accounts for [..] 80% of employment..”

• India’s Rural Economy Hit Hard As Informal Lending Breaks Down (R.)

Life was good for Mitharam Patil, a wealthy money lender from a small village in the Indian state of Maharashtra. Small-time financiers like Patil would typically lend cash to farmers and traders every day, providing a vital source of funding for a rural economy largely shut out of the banking sector, albeit at interest rates of about 24%. All that came crashing down on Nov. 8, when Prime Minister Narendra Modi banned 500 and 1,000 rupee ($7.30-$14.60) banknotes, which accounted for 86% of currency in circulation. The action was intended to target wealthy tax evaders and end India’s “shadow economy”, but it has also exposed the dependency of poor farmers and small businesses on informal credit systems in a country where half the population has no access to formal banking.

Patil was stuck with 700,000 rupees ($10,144) of worthless cash. He can also only withdraw up to 24,000 rupees from his account every week, barely enough for his own personal needs given he also works as a farmer. That is bad news for farmers and traders who had come to depend on Patil, despite his high interest rates, given that bank branches are located far from the village, while the process to obtain loans is long and cumbersome. It may also hurt India’s economy, as the informal sector accounts for 20% of GDP and 80% of employment. The country is due to report July-September GDP on Wednesday. “Sowing of winter crops has been started and farmers badly need money. But I couldn’t lend (to) them due to restrictions on withdrawal,” Patil said.

Some farmers and small businesses say India’s informal credit system has ground to a virtual halt, despite government measures to steer more funds to them, including 230 billion rupees in crop loans. Not only are money lenders struggling to lend, they are also struggling to get paid. Saumya Roy, CEO of Vandana Foundation, a micro finance firm, said it has encountered difficulties in collecting payments from borrowers, which will have a knock-on effect on how much they can lend to others. “We can’t go on lending and suffer losses,” she said. “How can we force people to pay back when they don’t have money to buy food. How will they pay us?”

That should be fun.

• UK MPs Launch New Attempt To Interrogate Tony Blair Over Iraq (G.)

A cross-party group of MPs will make a fresh effort to hold Tony Blair to account for allegedly misleading parliament and the public over the Iraq war. The move, which could see Blair stripped of membership of the privy council, comes as the former prime minister tries to re-enter the political fray, promising to champion the “politically homeless” who are alienated from Jeremy Corbyn’s Labour and the Brexit-promoting government of Theresa May. The group, which includes MPs from six parties, will put down a Commons motion on Monday calling for a parliamentary committee to investigate the difference between what Blair said publicly to the Chilcot inquiry into the war and privately, including assurances to then US president George W Bush.

Backing the motion are Alex Salmond, the SNP MP and former first minister of Scotland; Hywel Williams, Westminster leader of Plaid Cymru; and Green party co-leader Caroline Lucas. Senior Tory and Labour MPs are also backing the move, which reflects widespread frustration that the publication of the Chilcot report in July, after a seven-year inquiry, did not result in any government action or accountability for Blair. Salmond said some MPs believe that senior civil servants were “preoccupied with preventing previous and future prime ministers being held accountable”. He said: “An example should be set, not just of improving government but holding people to account.”

He pointed to last week’s Observer story revealing that, according to documents released under the Freedom of Information Act, the inquiry was designed by senior civil servants to “avoid blame” and reduce the risk that individuals and the government could face legal proceedings. Salmond also noted that documents show many officials involved in planning the inquiry, including current cabinet secretary Sir Jeremy Heywood, were involved in the events that led to war. The new motion will be debated on Wednesday in Commons time allotted to the SNP.

What Renzi’s Dec. 4 constitutional referendum tries to achieve: “They’re sealing the system off so it can’t be changed in the future.”

• First Brexit then Trump. Is Italy Next For The West’s Populist Wave? (G.)

On a bitterly cold evening, MPs and senators representing the Five Star Movement (M5S), launched by Beppe Grillo, the comedian-turned-political rabble rouser, implored a packed piazza to use a referendum on the constitution on Sunday 4 December to send the prime minister, Matteo Renzi, packing. Renzi, the telegenic, youthful leader of the centre-left Democratic party (PD), has placed his authority behind proposals to limit the powers of the senate, Italy’s second chamber. His plan involves cutting the number of senators from 315 to 100, all of whom would be appointed – rather than elected, as at present – and restricting their power to influence legislation.

Since 1948 the Italian constitution has preserved a perfect balance of powers between the two houses of parliament, frequently leading to legislative gridlock in Rome. Renzi claims that slimming down the role of the senate will, along with other reforms to strengthen executive power, finally free governments to govern. Crucially, he has indicated he will step down if the vote goes against him. In other eras, a dry and technical debate might have preoccupied a few constitutional cognoscenti. But these are not ordinary times in western democracies. In Ferrara’s Piazza Trento e Trieste, Alessandro Di Battista, a rising star of Grillo’s movement, issued a populist call to arms. Renzi’s referendum, he told the crowd, was just the latest gambit by a political class determined to insulate itself from the people it should serve.

“This unelected senate will be constituted by the arselickers of the various parties”, said Di Battista, “and by those who are in trouble with the courts and need parliamentary immunity. They’re sealing the system off so it can’t be changed in the future.” Such a devious manoeuvre should, he said, come as no surprise: “There are two Italys: on the one side the very wealthy few who look after themselves, and on the other the masses who live every day with problems of transport and public health.” As his audience launched into a favourite Five Star chant, “A casa! A casa!” (“Send them home”), Di Battista referenced the political earthquake that was in everyone’s mind. “The election of Donald Trump is the American people’s business,” he said. “But what that election does show is that so many citizens are simply not taking the establishment’s bait any more.”

Did Stein really raise more money for this than for her entire 2016 campaign?

• Clinton Camp Splits From White House On Jill Stein Recount Push (G.)

Hillary Clinton’s presidential campaign said on Saturday it would help with efforts to secure recounts in several states, even as the White House defended the declared results as “the will of the American people”. The campaign’s general counsel, Marc Elias, said in an online post that while it had found no evidence of sabotage, the campaign felt “an obligation to the more than 64 million Americans who cast ballots for Hillary Clinton”. “We certainly understand the heartbreak felt by so many who worked so hard to elect Hillary Clinton,” Elias wrote, “and it is a fundamental principle of our democracy to ensure that every vote is properly counted.”

In response, President-elect Donald Trump said in a statement: “The people have spoken and the election is over, and as Hillary Clinton herself said on election night, in addition to her conceding by congratulating me, ‘We must accept this result and then look to the future.’” Wisconsin began recount proceedings late on Friday after receiving a petition from Jill Stein, the Green party candidate. Stein claims there are irregularities in results reported by Wisconsin as well as Michigan and Pennsylvania, where she plans to request recounts next week, having raised millions of dollars from supporters. Trump called Stein’s effort a “scam” and said it was “just a way … to fill her coffers with money, most of which she will never even spend on this ridiculous recount”. “The results of this election should be respected instead of being challenged and abused,” he added, “which is exactly what Jill Stein is doing.”

I bet you there’s hardly a single American -or European- who knows Cuba has been one of Canada’s most popular holiday destinations for many years.

• Justin Trudeau Ridiculed Over Praise Of ‘Remarkable’ Fidel Castro (G.)

Justin Trudeau, the Canadian prime minister, has been mocked and criticised over his praise of the late Cuban leader Fidel Castro. Following the death of Castro, Trudeau, whose father had a close relationship with the revolutionary, released a statement mourning the loss of a “remarkable leader”. Castro, who died on Friday aged 90, won support for bringing schools and hospitals to the poor but also created legions of enemies for his ruthless suppression of dissent. Trudeau’s comments were markedly more positive than most western leaders, who either condemned Castro’s human rights record or tip-toed around the subject. Instead, Trudeau warmly recalled his late father’s friendship with Castro and his own meeting with Castro’s three sons and brother – Raul, Cuba’s current president – during a visit to the island nation earlier this month.

“While a controversial figure, both Mr Castro’s supporters and detractors recognized his tremendous dedication and love for the Cuban people who had a deep and lasting affection for ‘el Comandante’,” Trudeau said in the statement. He called Castro “larger than life” and “a legendary revolutionary and orator”. Fidel Castro was an honorary pall bearer at the 2000 funeral of Trudeau’s father, former prime minister Pierre Trudeau. In 1976, the senior Trudeau became the first Nato leader to visit Cuba under Castro’s rule, at one point exhorting “Viva Castro!”. “I know my father was very proud to call him a friend and I had the opportunity to meet Fidel when my father passed away,” Trudeau said.

Better be careful with private armies getting involved.

• Military Veterans Seek New Role In South Africa Poaching War (AFP)

In another life, Lynn was a sniper in Afghanistan, Damien trained paramilitary forces in Iraq, and John worked undercover infiltrating drug cartels in central America. Now all three are back in action, this time fighting what they describe as a “war” against poachers in southern Africa as the killing of rhinos escalates into a crisis that threatens the survival of the species. In 2008, less than 100 rhinos were poached in South Africa, but in recent years numbers have rocketed with nearly 1,200 killed in 2015 alone. Faced with such slaughter, conservationists and government authorities have been desperately searching for ways to protect the animals.

Many ideas have been tried, including drones, tracking dogs, satellite imagery, DNA analysis, hidden cameras and even cutting horns off live animals before poachers can get to them. But the killing has continued, and now military veterans from the United States, Australia and elsewhere have been drafted to bring their expertise to the uphill battle to save the rhinos. “You have animals who are targeted by people using automatic weapons,” Damien Mander, a former Australian Navy special forces officer, told AFP. “You can not go to the communities and ask them nicely to stop. This is a war. We are fighting a war out there.”